In response to the Commission’s direction at the October 14, 2008 Agenda Conference and the December 3, 2008 Commission workshop, staff’s recommendation addresses two separate draft RPS strategies, within which are a number of interrelated policy issues. Figure 1 below illustrates the two RPS strategies and interrelated policy issues addressed by this recommendation.

Figure 1: Renewable Portfolio Standards – Strategies and Policy Issues

RPS Strategy A RPS Policy Issues RPS Strategy B

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

RPS %

|

|

|

|

|

|

|

|

||||||||||||||

|

|

14-Oct-08 |

|

|

|

|

|

|

|

|

|

3-Dec-08 |

||||||||||||||||

|

|

Agenda |

|

|

|

RPS Timing |

|

|

|

Commission Workshop |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

REC Market |

|

|

|

Rate Cap

|

|

|

|

Standard Offer |

||||||||||||||||||

|

|

with |

|

|

|

|

|

|

|

|

|

Contract |

||||||||||||||||

|

|

Negotiated |

|

|

|

|

|

|

|

|

|

Approach |

||||||||||||||||

|

|

Contracts |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

(Energy |

|||||||||||||||||||

|

|

|

|

|

Mandatory |

|

Frequency |

|

generated |

|||||||||||||||||||

|

|

|

|

|

vs. |

|

of |

|

used for |

|||||||||||||||||||

|

|

|

|

|

Aspirational |

|

Review |

|

compliance |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

with RPS |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

target) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Solar & Wind |

|

RFP |

|

|

|

||||||||||||||||||

|

|

|

|

|

Carve- |

|

Prior to |

|

|

|

||||||||||||||||||

|

|

|

|

|

Outs |

|

Self-Build |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

Cost |

|

Rewards |

|

|

|

||||||||||||||||||

|

|

|

|

|

Recovery |

|

& |

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

Penalties |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

Alternative Legislative Recommendation |

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

Clean Alternatives Included in RPS |

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

I. RPS Strategies

A. October 14, 2008 Draft Rules

In the draft rule strategy discussed at the October 14, 2008 Agenda Conference, compliance with the RPS is based on the production of, and the buying and selling of RECs. Defined in Section 366.92, F.S., a REC is a financial instrument that represents the unbundled, separable, renewable attribute of renewable energy or equivalent solar thermal energy produced in Florida and is equivalent to one megawatt-hour (MWh) or 1,000 kWhs of electricity generated by a source of renewable energy located in Florida. IOUs would be required to generate through self-build renewables, or purchase sufficient RECs from other utilities and non-utility renewable energy resources to meet the RPS standards. The use of RECs as the sole means of compliance with the RPS would facilitate the tracking and accounting of both kWh energy production by renewable energy resources and the additional costs of compliance with the RPS. Use of RECs would also allow for the inclusion of a wider range of renewable energy resources, including self-service generation used to offset customer load.

The price paid for purchased RECs would be established through negotiated contracts and spot market transactions, and would represent payment for the renewable attributes associated with each renewable energy resource. In order to minimize costs to ratepayers, the total costs paid for renewable attributes for both utility self-build renewables and non-utility renewable energy resources would be limited by an overall rate cap. The cost and payment for capacity and energy from a renewable energy resource would continue to be based on existing least-cost planning policies for utility self-build renewables and existing avoided cost pricing policies for purchases from non-utility renewable energy resources. (see Section 366.051, F.S., Attachment F)

The purchase of RECs from other utilities in Florida or from non-utility renewable energy resources would be facilitated through the development of a REC market. Both short-term spot market purchases and sales and long-term negotiated bilateral contracts would be supported. An independent third-party administrator would be selected, subject to Commission approval, to administer the Florida REC market. The structure, governance, and procedures for administering the REC market would also be subject to Commission approval.

Modifications to the October 14, 2008 Draft Rules

Based on comments and discussion subsequent to the filing of the October 14, 2008 draft RPS rule and the results of Navigant Consulting’s study, the following modifications to the draft rule have been made. In draft Rule 25-17.400(3)(a), F.A.C., the initial RPS requirement for 2017 has changed from 5 percent to 6 percent. This reflects an increase in existing renewable generation as determined by Navigant Consulting. In draft Rule 25-17.400(4), F.A.C., staff has clarified that initial utility RPS implementation plans are subject to Commission approval, and that implementation plans must be submitted for approval following future Commission review proceedings of the RPS. In draft Rule 25-17.400(5)(d), F.A.C., staff has clarified the RPS compliance costs eligible to be counted against the rate cap. These costs are: (1) the cost of RECs purchased from non-utility renewable resources in Florida; (2) the administrative cost of RECs from IOU self-build renewable projects; and (3) the incremental cost of an IOU self-build renewable project above the IOU’s avoided cost of generating electricity. In draft Rule 25-17.400(7)(a), F.A.C., staff has deleted “including a separately determined ROE on total capital costs.” This change clarifies that the Commission would not set a separate ROE for IOU self-build projects, but would utilize the IOU’s last established ROE in a base rate proceeding. Finally, staff has included the Renewable Energy Charge representing the incremental costs of IOU self-build renewables and purchases of RECs from non-utility renewables as a separate line-item on customer bills.

With these modifications, the staff recommends submitting the October 14, 2008 draft rule to the Legislature as an RPS option. (see Attachment A)

Pros and Cons of a REC Market with Negotiated Contracts

One advantage of using RECs for compliance with the RPS is the flexibility it provides for the marketing of renewable energy in Florida. RECs can be sold either together with their associated energy in a package or sold separately depending on what is most economic for both the buying utility and the selling renewable energy resource. This expands the range of opportunities for financing renewable energy projects. The use of RECs as the sole compliance mechanism would also facilitate the tracking and accounting for both kWh energy production by renewable energy resources and the additional costs of compliance with the RPS.

Another advantage is that the use of RECs as the sole means of compliance with the RPS would allow inclusion of a wider range of renewable energy resources, including self-service generation used to offset customer load. The October 14, 2008 draft rules include the following demand-side renewable energy resources:

- greater than 2 megawatts (MW) providing on-site generation to offset all or a part of the customer’s electrical needs;

- greater than 2 MW providing equivalent solar thermal energy to offset all or a part of the customer’s electrical needs; and

- 2 MW or less, that have not received incentives from a Commission-approved demand-side conservation program pursuant to Sections 366.80-.82, F.S., FEECA (see Attachment F).

Establishing an independent REC market, administered by a third-party administrator, would add to this flexibility by providing a central marketplace to facilitate the short-term sales of RECs through electronically posted buy-sell quotes and the long-term sale of RECs through negotiated contracts. Staff envisions that the REC market would not limit itself to only the sale of RECs, but would also provide coordinated opportunities to bundle energy and the associated RECs.

Staff also believes that negotiated contracts for the purchase and sale of long-term capacity, energy, and renewable attributes represent a more efficient, cost-effective, and fair means of marketing renewable energy in Florida. Negotiated contracts provide for the one-on-one interaction between the buying utility and selling renewable energy resource that is needed to structure an agreement that best meets the needs of both parties. To the extent that parties cannot agree and Commission involvement is required, a review of a specific renewable energy contract provides a more focused set of facts to be adjudicated.

One disadvantage of a REC-only approach is that it will take time to establish a comprehensive REC market in Florida. Under the October 14, 2008 draft rules, an independent third-party administrator would have to be selected and approved by the Commission. The structure, governance, and procedures for administering the REC market would also have to be established. The draft rules require the IOUs to solicit, select, and submit for Commission approval an independent REC market administrator within 90 days of the effective date of the rule. Within 180 days of Commission approval of the administrator, the proposed structure, governance, and procedures for administering the REC market are to be filed for Commission approval. Therefore, even with expedited review and approval by the Commission, the initial establishment of a REC market is likely to take one year or more.

B. December 3, 2008 Draft Rules

In the draft rule strategy discussed at the December 3, 2008 Commission workshop, compliance with the RPS is based primarily on renewable energy produced by investor-owned self-build renewables and purchases from non-utility renewable energy resources through standard offer contracts. Standard offer contract purchases would be priced at the IOUs’ avoided cost plus a “cost added” for renewable attributes. A separate standard offer contract would be established for each of the following classes of renewables: (1) solar PV; (2) solar thermal; (3) wind; (4) biomass, including municipal solid waste; and (5) industrial waste heat, including waste heat from sulfuric acid manufacturing operations. The “cost added” for renewable attributes for each class of renewables would be determined separately in evidentiary hearings based on the level of support required to make each technology financially feasible.

In addition to renewable energy generated or purchased by an IOU, the renewable attributes associated with certain demand-side renewable generation would also count toward compliance with the RPS. First, the renewable attributes associated with self-service renewable generation produced by large commercial and industrial customers, greater than 2 MW, would qualify to be sold pursuant to a standard offer contract with payment for renewable energy attributes only. Second, the renewable attributes associated with renewable energy produced by smaller customers, less than 2 MW, receiving the benefits of net-metering would also count toward compliance with the RPS. Because of the benefits already received from net-metering, these customers would not receive any additional payment for their renewable attributes. However, to further promote the development of solar renewables, an IOU rebate program for demand-side solar PV and solar thermal installations less than 2 MW in size would be established. The renewable attributes from customers receiving a solar rebate from an IOU would count toward compliance with the utility’s RPS.

While compliance with the RPS under this strategy would be met by the production or purchase of renewable energy or attributes, RECs would also be assigned for each MWh of renewable energy produced. The RECs would become the property of the utility and would be available for resale in voluntary out-of-state REC markets. The revenues from the sale of RECs would be shared between IOU ratepayers and stockholders in an 80/20 split.

Pros and Cons of Standard Offer Contract Approach

The advantage of establishing a renewable energy market using standard offer contracts to comply with the RPS is that it may lead to a more rapid implementation and deployment of the RPS. This will rely on an expedited hearing process where the Commission establishes separate standard offer contracts to be offered by each IOU for each designated class of renewable energy resources. Each standard offer for purchases from non-utility renewable energy resources and renewable attributes would be based on “avoided cost plus” pricing. The pricing for capacity and energy provided would by based on the Commission’s existing avoided cost pricing policies. The pricing of the renewable attributes provided would be separately determined for each renewable class based on the level of financial support required to make the technology financially feasible, subject to an overall rate cap.

One disadvantage of the December 3, 2008 RPS strategy is that it is heavily weighted toward a command-and-control type paradigm where the Commission must approve through hearings, aspects of each standard offer contract’s pricing, terms, and conditions. A further disadvantage is the difficulty of including all existing renewable resources in the state. For example, renewable resources for which the energy is currently under contract to a municipal or rural electric cooperative utility would be ineligible to participate until such a contract expires. Section 366.92, F.S., expresses the intent to protect existing renewable resources. Finally, Rule 25-6.065, F.A.C., Interconnection and Net Metering of Customer-Owned Renewable Generation, and Rule 25-17.280, F.A.C., Tradable Renewable Energy Credits (TRECs) would require amendments to assign RECs from the customer to the host utility.

Conclusion

Staff recommends that both the October 14, 2008 and the December 3, 2008 draft rule strategies be submitted to the Florida Legislature for consideration. However, staff recommends an RPS of 20 percent by 2041 and a 2 percent rate cap in both options. Both approaches appear to reasonably meet the Legislature’s intent. This complete recommendation should be sent as a package to the Legislature.

The Commission may want to consider further revisions to the draft rules which are presented as policy options below and in Section IV of Issue 1, and are based on the Commission’s direction at the October 14, 2008 Agenda Conference.

II. Alternative RPS Policy Issues

As shown in Figure 1, regardless of the overall RPS strategy adopted, there are a number of interrelated policy issues that must be decided. In the discussion that follows, staff has addressed a range of alternatives for consideration by the Commission for each major policy issue.

A. Magnitude and Timing of the RPS

A pivotal issue in the design of an RPS is the magnitude and timing of the standards to be met. Section 366.92, F.S., defines “Renewable Portfolio Standard” as the minimum percentage of total annual retail electricity sales by an IOU to consumers in Florida that shall be supplied by renewable energy produced in Florida. Over the course of the workshops held by the Commission, numerous RPS percentages and timings were discussed.

At the August 20, 2008 workshop, for discussion purposes, staff presented a draft strawman rule which proposed an overall RPS of 20 percent by 2050, with interim standards by 2017 and 2025, based on target dates for greenhouse gas emission reductions contained in the Governor’s Executive Order 07-127. In response, environmental advocates and renewable energy producers proposed an overall RPS of 20 percent by 2020. Florida Power & Light Company (FPL) contended that, with the inclusion of clean energy as part of the RPS, it could meet an RPS standard of 20 percent by 2030. Subsequently, at the October 14, 2008 Agenda Conference, staff proposed an RPS standard of 20 percent by 2041.

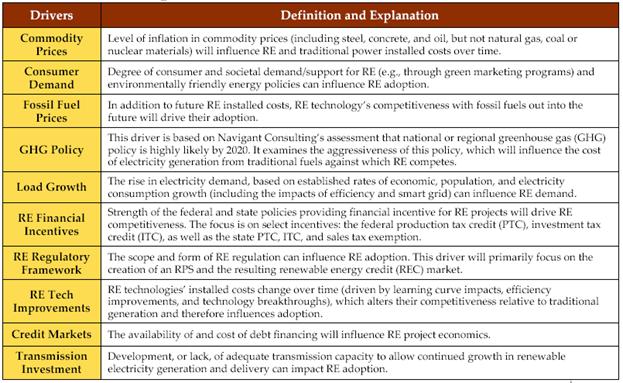

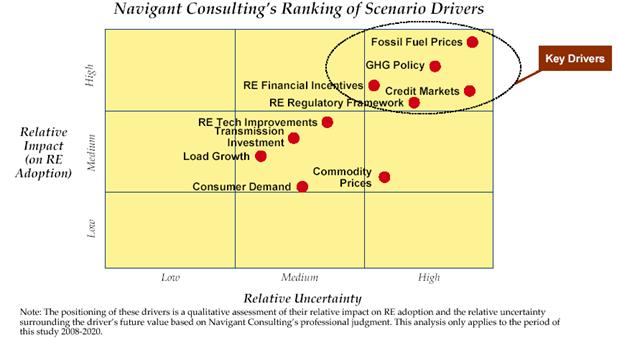

In August 2008, the Commission, in cooperation with the Governor’s Energy Office and the Lawrence Berkeley National Laboratory, engaged Navigant Consulting to perform an assessment of the technical and economic potential for renewable energy resources in Florida. The assessment provides estimates of the renewable energy resources that are currently operating in Florida and that could potentially be developed in Florida through the year 2020. The assessment also provides an estimate of the levelized life-cycle costs of existing and developing renewable technologies as well as estimates of the off-the-shelf costs of conventional utility central station generating plants. Finally, Navigant Consulting performed an economic screening analysis to model a range of estimates of the achievable potential of renewable energy that could be developed in Florida. Navigant Consulting presented the results of their draft final report at the December 3, 2008 Commission workshop and the final report was filed with the Commission on December 30, 2008.

In order to estimate the achievable potential for renewables in Florida, Navigant Consulting modeled three scenarios under different economic and policy conditions. The key assumptions driving the economic modeling were: (1) fossil fuel costs, (2) greenhouse gas policy, (3) financial incentives for renewables, (4) availability of and cost of debt and equity, and (5) renewable energy regulatory frameworks. The results of Navigant Consulting’s achievable potential analysis are shown in Figure 2.[2]

Figure 2

Renewable Energy as a Percentage of IOU Retail Sales

Navigant Consulting’s results conclude that the potential development of renewable energy is higher under each economic scenario if renewable energy resource providers receive a payment for their RECs. Navigant Consulting’s results are summarized below:

- Under the most favorable scenario for renewable development, which includes a 5 percent rate cap, renewable energy in Florida could be 24 percent of IOU retail sales by 2020;

- Under the mid-favorable scenario for renewable development, which includes a 2 percent rate cap, renewable energy in Florida could be 11 percent of IOU retail sales by 2020;

- Under the unfavorable scenario for renewable development, which includes a 1 percent rate cap, renewable energy in Florida could be 5 percent of IOU retail sales by 2020.

Navigant Consulting found that only under the most favorable circumstances for renewables would a 20 percent by 2020 RPS be achievable. The favorable scenario for renewables assumes: (1) high fossil fuel prices, (2) greenhouse gas emissions priced at $50/ton by 2020, (3) state and federal renewable energy incentive programs would not expire until 2020, (4) favorable access and cost for debt and equity, and (5) a 5 percent rate cap for RPS compliance costs. Navigant Consulting indicates that only one driver, the price of coal, is currently in the mid-favorable scenario. All other drivers for renewable development are currently represented in the unfavorable scenario. This indicates that an RPS of between 5 and 11 percent by 2020 is more reasonably achievable. Staff’s recommendation in Issue 1 is consistent with these findings.

The technical, economic, and achievable potential analyses performed by Navigant Consulting represents an initial screening of renewables compared to utility resources with similar operating characteristics. In other words, the analysis is a starting point only. The timeframe and budget for the study did not allow for a comprehensive integrated resource planning (IRP) exercise which would take into consideration all options for meeting future customer reliability and economic needs, including: (1) conservation; (2) demand-side efficiencies; (2) supply-side efficiencies; (3) existing generation resources; and (4) purchased power and alternative generating resources. The timing of the need for capacity was also not examined in the Navigant Consulting study. Much of the additional generating capacity needed to maintain reliability in the state for the next ten years has already been accounted for in utility Ten-Year Site Plans. Because Navigant Consulting’s study includes the capacity benefit from renewables that Florida’s ratepayers may not need, the estimates of the economic potential for renewables in Florida may be overstated.

Based on the above and as discussed in the analysis of Issue 1, staff recommends that the RPS standards for Florida be set at 20 percent of retail sales by 2041. This level represents a reasonable approach given the current limited capacity benefits that could be provided by additional renewables and the uncertainties associated with Navigant Consulting’s most favorable economic scenario. A 20 percent RPS by 2041 appears to be consistent with Navigant Consulting’s mid-favorable scenario which includes a 2 percent cap on RPS compliance costs. Given the numerous uncertainties associated with developing Florida’s market for renewable energy resources, staff believes that a long-term horizon for the RPS standards is warranted.

B. Rate Cap

Another pivotal issue in the design of an RPS is how much should rates to consumers be allowed to increase in order to promote the development of renewable energy resources in Florida. Section 366.92, F.S., expresses the intent to minimize the cost to consumers associated with the RPS.

During the Commission workshops, the Office of Public Counsel (OPC) and AARP took the position that additional costs associated with the RPS should be capped at 1 percent of IOU annual revenue requirements. Environmental advocates and renewable energy producers generally advocated a rate cap between 3 to 5 percent. Information provided by staff at the December 3, 2008 Commission workshop indicates that a rate cap of as much as 5 to 10 percent may be required to support aggressive RPS standards and meet the financial requirements of emerging renewable energy industries, such as solar. Increasing the rate cap may improve opportunities to more rapidly develop additional renewable resources in the state. This, however, must be balanced with the need to minimize ratepayer costs, given other cost pressures facing ratepayers in the form of volatile fuel costs and the escalating materials and labor costs associated with construction of generating facilities.

Staff recommends a 2 percent annual rate cap on RPS compliance costs coupled with an RPS of 20 percent by 2041. If, however, the Commission decides at this time to adopt a more aggressive RPS percentage and timing, according to the Navigant Consulting study, a 2 percent rate cap may not be sufficient to meet the RPS.

C. Mandatory Standards or Aspirational Goals

Staff interprets Section 366.92, F.S., as requiring mandatory RPS standards. The statute mandates that the Commission’s draft rule must require each IOU to supply a minimum level of renewable energy to its customers. Also, the statute requires the draft rule to include appropriate compliance measures and excusal provisions for non-attainment of the RPS requirements. Based on discussions at the rule development workshops, provisions were included in the October 14, 2008 draft rule allowing the Commission to assess penalties to an IOU that does not meet the RPS requirements. The Commission may assess a penalty of up to 50 basis points which will be paid from stockholder funds. However, as mandated by the statute, the draft rule provides that the Commission may excuse the IOU from compliance if sufficient RECs are not available, or if compliance is cost-prohibitive. These draft rule provisions would ensure that the RPS requirements of 20 percent by 2041 are mandatory. As such, the October 14, 2008 draft rule reflects an RPS strategy that is both realistic in its expected outcomes as it is demanding on the expected performance of the IOUs.

If, however, the Commission decides to establish a more aggressive RPS, such as 20 percent by 2020, the potential cost and difficulty of achieving such goals are significantly heightened. The Navigant Consulting study results show that an aggressive RPS is feasible only under the most favorable economic scenario for renewable energy which includes a 5 percent rate cap. As such, the penalty provisions of the draft rule may need to be relaxed, thus making the RPS requirements more aspirational in nature. The December 3, 2008 draft rule, which includes an RPS of 20 percent by 2020, does not include penalties due to the aggressive nature of these requirements.

D. Frequency of Review

The October 14, 2008 draft rule would require Commission review of the RPS at least once every five years. This frequency of review would allow the Commission the ability to examine each IOU’s progress in complying with the 2017 and 2025 standards and the ultimate standard of 20 percent by 2041. It is also consistent with the five-year cycle established in the Commission’s rules implementing FEECA conservation goals.

The December 3, 2008 draft rule would require Commission review of the RPS at least once every three years. This increased frequency of review is consistent with the more aggressive RPS standard of 20 percent by 2020 with annual incremental standards each year to reach that point.

During the Commission workshops, environmental advocates and renewable energy producers called for more frequent review of the RPS every two to three years. They contend that more frequent review of the RPS is needed to ensure the continued development of a market for renewables in Florida.

Staff continues to believe that a five-year review cycle is appropriate because of the administrative complexity of such proceedings. Care must be taken to allow sufficient time on the front end and throughout the process for the IOUs to establish their plans and procedures to implement compliance with the RPS. If, however, the Commission adopts the more aggressive RPS requirement of 20 percent by 2020, a more frequent review every three years may be appropriate.

E. Solar and Wind Carve-Out

Section 366.92(3), F.S., provides the Commission with the authority to give greater weight to solar and wind in the formulation of the draft RPS rule. In the October 14, 2008 draft rule, this is accomplished by establishing a 25 percent carve-out for solar and wind and by allocating 75 percent of the annual revenue cap to be used to promote solar and wind. A carve-out is necessary in order to further encourage renewable resources that would improve environmental conditions. Also, early emphasis on these currently higher-cost resources may result in downward pressure on resource costs over time as solar technologies mature.

In the December 3, 2008 rule draft, separate standard offer contracts would be established for solar PV, solar thermal, and wind projects. Preference would be given to solar and wind through the rates established by the Commission in the standard offer contracts for the renewable attributes for each resource. Also, funding would be provided to support rebates to IOU customers for demand-side solar energy systems.

Staff believes that carve-outs are necessary in order to promote the development of certain renewable energy resources such as solar and wind. If the Commission decides to adopt a market approach to implement an RPS in Florida, then the carve-outs contained in the October 14, 2008 draft rule would be appropriate. If, however, the Commission decides to adopt a more hands-on approach using standard offer contracts to implement an RPS in Florida, then the solar and wind-specific contract pricing provisions, combined with funding for solar rebates contained in the December 3, 2008 rule draft would be appropriate.

F. Renewable Energy Request for Proposals (RFP)

IOU self-build renewable energy resources are encouraged in both the October 14, 2008 and the December 3, 2008 draft rules. In the October 14, 2008 draft rule, an RFP is required every two years to ensure that IOUs select the most reliable and cost-effective renewable energy resources in a negotiated contract marketplace. In the December 3, 2008 draft rule, an RFP is required only prior to the construction of an IOU self-build option to avoid gaming in the standard offer contract market.

G. Cost Recovery

Section 366.92,(3)(b)(1), F.S., gives the Commission rulemaking authority to establish annual cost recovery provisions to incentivize the development of renewable resources. As described in both the October 14, 2008 and the December 3, 2008 draft rules, a separate Renewable Energy Cost Recovery (RECR) clause would be established to recover all costs associated with renewables, including utility self-build options and purchases from non-utility renewable energy sources.

During the December 3, 2008 Commission workshop, information was provided on alternative cost recovery mechanisms. These options include recovery through base rates of costs for IOU self-build renewable projects. Commission review of such costs could occur in either a full rate case or a limited proceeding. The purchase of capacity and energy from renewable facilities through negotiated or standard offer contracts could be recovered through the existing Fuel and Purchased Power Recovery clause (Fuel clause). Currently, there is no mechanism for the recovery of RECs or the associated administrative costs. These costs could be recovered through the Environmental Cost Recovery clause (ECRC).

A dedicated clause, such as the RECR, would act as an incentive for IOU self-build renewables as recovery of costs would not be subject to the potential delay of a base rate proceeding. Also, recovery in the RECR of all costs associated with renewables, including compliance with the RPS, would be fully transparent to the Commission and other stakeholders. Other provisions of the draft rules, such as requiring renewable RFPs, in addition to normal regulatory scrutiny during the cost recovery proceedings will provide adequate safeguards to ensure the prudence of IOU self-build options.

The December 3, 2008 draft rule includes a provision that would create a separate Renewable Energy Charge on customer bills that would show the total additional costs being paid for renewable energy attributes. Staff recommends that this provision be also added to the October 14, 2008 draft rule.

H. Rewards and Penalties

Section 366.92,(3)(b)(1), F.S., gives the Commission rulemaking authority to establish incentive-based adjustments to authorized rates of return on common equity to IOUs to incentivize the development of renewable resources. The October 14, 2008 draft rule establishes a reasonably achievable RPS of 20 percent by 2041. In order to provide incentives to achieve these standards, the draft rule provides for the following rewards and penalties:

· IOUs are allowed to earn an ROE for self-build renewables, including a return on the additional capital costs associated with building renewables, and recover these costs through a separate cost recovery clause;

· Any IOU failing to meet the RPS standards shall be subject to a penalty of up to 50 basis points of the utility’s approved ROE.

The December 3, 2008 draft rule provides for an ROE reward, not to exceed 25 basis points, to IOUs which meet or exceed the RPS requirements. The draft rule does not include penalties for non-compliance because of the aggressive nature of the 20 percent by 2020 RPS.

If a more aggressive RPS of 20 percent by 2020 is adopted, staff recommends that no penalty provision be included in either draft rule. This is due to the uncertainty of the ability of the IOU to comply with these standards under expected economic conditions.

III. Alternative Legislative Recommendation: Including Clean Energy in the RPS

Section 366.92, F.S., establishes that only Florida renewable energy resources are eligible for compliance with the RPS. Both the October 14, 2008 and the December 3, 2008 draft rules reflect the Legislature’s intent. If an aggressive RPS, such as 20 percent by 2020, is established, the Commission may wish to recommend to the Legislature that clean electric generating resources and supply-side and demand-side efficiency improvements be included as eligible resources for compliance with the RPS. As discussed in Issue 3, these resources could include: (1) Energy from new nuclear facilities or uprates approved by the Commission since 2006; (2) integrated gasification combined cycle (IGCC) with carbon capture and sequestration plans approved by DEP; (3) energy savings from efficiency improvements to existing utility generation; and (4) savings associated with customer energy efficiency programs.

In addition, electric customers can contribute towards achieving an energy efficient Florida through buying smaller homes, owning energy-efficient appliances including air conditioning systems, and making energy-efficiency improvements to their homes to reduce energy losses. Looking forward to the future, technological advances such as "smart meters" could provide a gateway to transform the nature of energy generation and usage. These devices can remotely meter customer usage and provide price signals to individual locations. Empowering the consumer with this information will spur the development of new industries to further assist the consumer in using energy wisely. At the same time, utilities and their ratepayers will benefit from the real-time dispatchability of the customer’s load.

If nuclear resources are included, staff recommends that it be limited to capacity associated with new facilities or uprates that have been approved by the Commissions since 2006. These clean energy resources are currently lower in cost and more technically feasible than some renewables, such as solar and wind. An amendment to include clean energy resources, therefore, would contribute toward the Legislature’s intent to diversify fuel supplies, promote economic development, improve environmental conditions, and minimize RPS costs to consumers.

IV. Rule 25-17.420, F.A.C. - Municipal and Rural Electric Cooperative Reporting

As part of the October 14, 2008 draft rule, staff included a separate rule that requires municipal and cooperative electric utilities to report annually to the Commission their efforts to develop standards for the promotion, encouragement, and expansion of the use of renewable energy resources, and energy conservation and efficiency measures, as required by Section 366.92(5), F.S. Also, these utilities are required to submit additional data to facilitate the Commission’s efforts to track the development of renewable energy in Florida. Staff recommends that draft Rule 25-17.420, F.A.C., be submitted to the Legislature for ratification.

Discussion of Issues

Issue 1:

Should the Commission submit to the Legislature the October 14, 2008 draft Rule 25-17.400, F.A.C., entitled Florida Renewable Portfolio Standard, and draft Rule 25-17.410, F.A.C., entitled Florida Renewable Energy Credit Market, as set forth in Attachment A?

Recommendation:

Yes. The Commission should submit to the Legislature the October 14, 2008 draft rules as one alternative for consideration. Staff would recommend, however, minor changes to these draft rules as follows:

(1) Modification to the 2017 RPS from 5 percent to 6 percent. (See Section 25-17.400(3)(a));

(2) Clarification that the implementation plans required by the IOUs will be approved by the Commission. (See Sections 25-17.400(4));

(3) Clarification of the types of costs that can be counted toward the rate cap. (See Section 25-17.400(5)(d));

(4) Removing the provision for a separately determined ROE for IOU self-build renewable projects in the RECR clause. Thus, the IOU’s last authorized ROE would be utilized. (See Section 25-17.400(7)(a)1);

(5) Three revisions to the RECR clause proceeding to change the projected period in one of the filing requirements; to remove an unnecessary filing requirement; and to include the Renewable Energy Charge as a line-item on customer bills. (See Section 25-17.400(7)(c)); and

(6) Inclusion of reference to the Commission’s complaint resolution process to address disputes between IOUs and renewable energy developers. (See Rule 25-17.410(11))

These modifications to the draft rule are discussed in the staff analysis and shown in Attachment A in type and strike format.

The Commission may also decide to consider further revisions to the draft rule which are presented as policy options in Section IV of the staff analysis and based on the Commission’s direction at the October 14, 2008 Agenda Conference. (Ballinger, Chase, Crawford, Futrell, Harlow)

Staff Analysis: The October 14, 2008 draft rules would set a reasonably achievable RPS of 20 percent by 2041 with a 2 percent rate cap and would establish a market-based approach to compliance through an inclusive REC-based system. Staff believes this market-based strategy can also be used to implement a more aggressive RPS, such as 20 percent by 2020. A 2 percent rate cap, however, may not be sufficient to meet such an aggressive RPS. Also, penalty provisions may need to be relaxed or removed, thus making the RPS requirements more aspirational in nature.

Draft Rule 25-17.400, F.A.C., Renewable Portfolio Standards, would establish a uniform mandatory RPS for the IOUs, and a procedure to review and, if appropriate, modify the RPS at least every five years. Rule 25-17.410, F.A.C., Florida Renewable Energy Credit Market, would require the establishment of a REC trading market to facilitate compliance with the RPS. A detailed analysis of the October 14, 2008 draft rules was provided in the staff recommendation filed on October 2, 2008. An overview of these rules and analysis of recommended modifications is provided below.

Modifications to Draft Rule 25-17.400, and .410, F.A.C.

Based on comments and discussion subsequent to the filing of the October 14, 2008 draft RPS rule and the results of Navigant Consulting’s study, the following modifications to the draft rule have been made:

(1) In draft Rule 25-17.400(3)(a), F.A.C., the initial RPS requirement for 2017 is changed from 5 percent to 6 percent. This modification is based on Navigant Consulting’s estimate that existing renewable energy resources meet approximately 4.4 percent of Florida’s energy needs. The initial 2017 RPS requirement of 5 percent was based on an estimate of existing renewable resources of 3.6 percent, which was derived from stakeholder data.

(2) In draft Rule 25-17.400(4), F.A.C., staff has clarified that initial utility RPS implementation plans are subject to Commission approval, and that implementation plans must be submitted for approval following initial adoption of the RPS rule and future Commission review proceedings of the RPS. The Commission’s review of these plans will provide a safeguard that a utility’s compliance strategy will meet or exceed the RPS in a manner that is not cost-prohibitive, and contains an appropriate mix of self-build and REC purchase options.

(3) In draft Rule 25-17.400(5)(d), F.A.C., staff has clarified the RPS compliance costs eligible to be counted against the rate cap. These costs are: (1) the cost of RECs purchased from non-utility renewable resources in Florida, (2) the administrative cost of RECs from IOU self-build renewable projects, and (3) the incremental cost of an IOU self-build renewable project above the IOU’s cost of generating electricity (avoided cost). Numerous stakeholders expressed uncertainty about the language in the October 14, 2008 version of the draft rule. This modification clarifies the intent that the costs appropriate for inclusion as RPS compliance costs are those costs which are greater than IOUs’ cost of generation.

(4) In draft Rule 25-17.400(7)(a), F.A.C., staff has deleted “including a separately determined ROE on total capital costs.” This change clarifies that the Commission would not set a separate ROE for IOU self-build projects, but would utilize the IOU’s last established ROE in a base rate proceeding.

(5) In draft Rule 25-17.400(7)(c), F.A.C., staff has made three changes to the reporting requirements for the RECR clause proceeding. First, the milestones for filing actual and projected true-up data would be adjusted to better reflect the availability of such data. Second, a requirement to file an unnecessary report is deleted. Finally, a Renewable Energy Charge representing the incremental costs of IOU self-build renewables and purchases of RECs from non-utility renewables as a separate line-item on customer bills.

(6) Finally, in draft Rule 25-17.410(11), F.A.C., staff has included a reference to the Commission’s existing rules which provide a means of resolving disputes among stakeholders in the REC market.

With these modifications, the October 14, 2008 draft RPS rule as shown in Attachment A should be submitted to the Legislature as a viable RPS option.

I. Overview of Draft Rule 25-17.400, F.A.C., Renewable Portfolio Standards

The following is an overview of the October 14, 2008 draft Rule 25-17.400, F.A.C., and includes the modifications discussed above.

Initial RPS - Section 25-17.400(3) - The draft rule establishes the following percentages of the prior year’s retail sales for each IOU to be provided by Florida renewable energy resources:

1. By January 1, 2017: 6 percent;

2. By January 1, 2025: 10 percent;

3. By January 1, 2033: 15 percent; and

4. By January 1, 2041: 20 percent.

These percentages represent a reasonably achievable RPS that meets the Legislature’s intent to protect and encourage renewables, and minimize cost to ratepayers, and is based on a 2 percent rate cap. Navigant Consulting estimated that currently available renewable energy resources meet approximately 4.4 percent of IOUs’ energy needs. This compares with the initial estimate of approximately 3.6 percent which was based on stakeholder data. The primary difference between these percentages appears to be Navigant Consulting’s identification and estimate of energy produced and used by pulp and paper manufacturers in their operations. The potential expansion of renewable energy as shown in the schedule above, represents an approximate doubling of the amount of renewable energy every eight years.

Navigant Consulting identified five key drivers that could have the most impact on renewable energy development. The key drivers were varied in three economic and policy scenarios. These are described in detail in the analysis of policy option A, the magnitude and timing of the RPS. Only under the most favorable scenario for renewable energy development which includes high fossil fuel prices, high greenhouse gas emission prices, and favorable access to and cost of debt and equity, would an aggressive RPS, such as 20 percent by 2020 be achievable. The recommended RPS of 20 percent by 2041, with a 2 percent rate cap, aligns with Navigant Consulting’s mid-favorable scenario for renewables. Current economic and policy conditions, however, are reflected in Navigant Consulting’s unfavorable scenario which indicates renewable energy potential of 5 percent by 2020.

If the Commission decides to establish an aggressive RPS, such as 20 percent by 2020, the market-based strategy of the October 14, 2008 draft rule can be utilized. A 2 percent rate cap, however, may not be sufficient to meet such an aggressive RPS. Also, penalty provisions may need to be relaxed or removed, thus making the RPS requirements more aspirational in nature.

Florida Renewable Energy Resources - Section 25-17.400(2)(a) – Only in-state renewables, as defined in Section 366.92(2), F.S., are eligible to be used for compliance under the rule. The statute promotes renewable energy resources that produce electrical, mechanical, and thermal energy from hydrogen, biomass, solar, geothermal, wind, ocean, waste heat or hydroelectric power.

Encouragement of Wind and Solar - Section 25-17.400(3)(b) – Staff believes it is appropriate to provide added weight to wind and solar resources, as provided for in Section 366.92(3)(b)3, F.S. Accordingly, the rule would require that at a minimum 25 percent of the RPS be provided from wind and solar resources, defined as Class I renewables. In addition, 75 percent of revenues available for RECs would be dedicated to solar and wind resources.

Renewable Portfolio Standards Proceeding - Section 25-17.400(3)(c) and (d) - The rule establishes that the Commission would hold a proceeding at least once every five years to review and, if appropriate, modify the RPS. In such a proceeding, an analysis of the technical and economic potential for Florida renewable energy resources would be provided.

Implementation Plans - Section 25-17.400(4) – Each IOU would be required to submit to the Commission within 180 days of the effective date of the rule, and following the periodic RPS review, its plan for meeting or exceeding the RPS. The implementation plans will provide the Commission with information on each IOU’s expected plans to meet the RPS as the market for renewable energy and RECs develops in Florida. The Commission’s review of these plans will provide a safeguard that a utility’s compliance strategy will meet or exceed the RPS in a manner that is not cost-prohibitive, and contains an appropriate mix of self-build and purchased power options. Staff suggests a minor change to Section (4) of the draft rule in order to clarify that the implementation plans submitted by the IOUs are subject to Commission approval.

Compliance – Section 25-17.400(5) – Section 366.92(3)(b)1, F.S., requires the Commission to include in the draft RPS rule methods of managing the cost of compliance with the RPS, “whether through direct supply or procurement of renewable power or through the purchase of renewable credits.” The statute appears to provide the Commission with the flexibility to choose one of three compliance mechanism options: (1) a REC market, (2) a contract path or energy only market, or (3) a combination of RECs and energy compliance. The draft rule requires RECs to be the sole means by which to comply with the RPS. Section 366.92(2), F.S., defines a REC as a product representing the renewable attribute of renewable energy produced in Florida and is equivalent to one MWh of electricity. IOUs may either purchase RECs from Florida renewable energy resources owned by third-parties, or use RECs from self-build renewable projects. Staff believes that requiring compliance through RECs will: (1) facilitate the ease of tracking compliance; (2) reduce the potential for double counting; (3) facilitate the inclusion of eligible customer-owned generation, including small systems, because RECs can be issued to account for the energy produced by these facilities, and (4) position the state for integration into any future federal or regional RPS.

Enforcement Mechanisms - Rewards/Penalties/Excusal – Section 25-17.400(5)(b)(c) – Staff believes that IOUs will be incented to construct renewables in two ways: (1) self-build renewable projects would add to rate base on which the IOU would have the opportunity to earn a return; and (2) the costs for these facilities would be recovered through a newly created dedicated cost recovery clause, the RECR clause. The rule also provides conditions under which an IOU may be excused for non-compliance as required by the statute. These conditions include insufficient supply of Florida renewable energy resources or prohibitive cost. If an IOU is not excused from compliance, the rule provides that an IOU which fails to meet the RPS shall be subject to a penalty up to 50 basis points of the IOU’s approved rate of return on equity. The penalty would be assessed as a reduction in the amount of recoverable costs in the RECR clause.

Rate Cap – Section 25-17.400(5)(e) - The draft rule recognizes the Legislature’s intent to minimize the cost of power supply to consumers by establishing a rate cap that would limit the total cost of compliance to 2 percent of each IOU’s total annual revenue from retail sales of electricity. To further encourage solar and wind resources, the costs of complying with the RPS are allocated with 1.5 percent going to wind and solar, and 0.5 percent going to all other Florida renewable energy resources for a total rate cap of 2 percent.

Cost of Compliance – Section 25-17.400(5)(d) – The draft rule defines the types of costs which may be counted toward the rate cap. Staff believes it is appropriate to count those costs associated with purchasing RECs, the associated costs from the REC market, and the utility’s costs of its self-build renewable resources which exceed the utility’s costs for generating or purchasing traditional resources.

Based on comments made in workshops and post-workshop comments, it is apparent that this section of the draft rule has created confusion among the stakeholders. Staff has made a minor change to this section of the draft rule in order to clarify the types of costs that can be counted toward the rate cap. These costs are: (1) the cost of RECs purchased from non-utility renewable resources in Florida, (2) the administrative cost of RECs from IOU self-build renewable projects, and (3) the incremental cost of an IOU self-build renewable project above the IOU’s cost of generating electricity (avoided cost).

Renewable Request for Proposals – Section 25-17.400(6) – Under the draft rule, each IOU would be required to biennially issue an RFP for Florida renewable energy resources. The IOUs would evaluate individual proposals in order to secure the most reliable and cost-effective portfolio of renewable resources. The results of the RFP would be included in each IOU’s Ten-Year Site Plan. Also, any renewable capacity and/or energy acquired as a result of the RFP process would be incorporated into the IOU’s IRP. Thus, the need for new power plants could be reduced by: (1) savings from energy efficiency programs, and (2) cost-effective renewable purchases. The RFP framework would utilize a market-based approach to encourage renewable developers to participate in the Florida market. Also, the Renewable RFP would provide the IOU and the Commission with information to evaluate the cost-effectiveness and need for a self-build renewable option. The Renewable RFP would be in addition to the opportunity for individual negotiations between renewable developers and the IOUs, as well as the renewable energy contracts required by Rule 25-17.200-.310, F.A.C.

Cost Recovery – Section 25-17.400(7) – The rule provides for cost recovery of reasonable and prudent costs associated with the purchase of RECs, including administrative costs, and costs associated with IOU-owned renewable facilities. The RECR clause would be created to allow for Commission review and approval of reasonable and prudent costs associated with RECs, IOU-owned renewable facilities, and capacity and energy purchased through tariffs or contracts with Florida renewable energy resources.

Staff is recommending a change to Subsection (7)(a) of the draft rule to remove the provision that a separately determined return on equity (ROE) will be established on utility investment in renewable facilities. Upon reflection, staff no longer believes it is appropriate to establish a separate ROE for each renewable facility in the RECR clause proceeding. A utility’s ROE is normally set in a rate case proceeding taking into account its total investment and the associated risk and market conditions at the time. This process can be costly and time-consuming, requiring expert witnesses and thorough analyses. It would be burdensome to require a separate analysis for each self-build renewable project and unrealistic to attempt to complete the analysis in the course of the RECR proceeding each year. Further, it would lead to confusion if a utility had different ROEs for its renewable projects than for other utility investments. Therefore, staff is recommending this provision be removed from the draft rule and that the IOU’s last established ROE be utilized for utility investment in renewable facilities.

Staff is recommending three additional changes to the RECR clause proceeding detailed in Subsection (7)(c) of the draft rule. First, Subsection (7)(c)2. of the draft rule requires the IOUs to submit an annual true-up filing showing eight months actual and four months projected costs. This true-up filing will be used in the RECR hearing held in November of each year to determine over- or under-recoveries. Since the true-up filings are usually submitted in September of each year, it is unreasonable to expect eight months of actual cost data to be available in September. Therefore, staff recommends that the draft rule be changed so that the true-up filings would reflect seven months actual and five months projected costs.

The second change is to eliminate Subsection (7)(c)5. of the draft rule, which requires a filing of the actual cost data within 90 days following the first six months of the annual reporting period. While this information might be somewhat useful in order to see how accurately the IOUs have estimated their annual projected costs associated with renewables, it is not necessary since the Commission will receive the actual cost data for seven months in the true-up filing discussed above. This requirement can be eliminated.

Finally, a Renewable Energy Charge representing the incremental costs of IOU self-build renewables and purchases of RECs from non-utility renewables as a separate line-item on customer bills. As part of this change, the total RECR charge would no longer be a separate line-item. Thus, only the incremental cost of compliance with the RPS would appear on customer bills.

Reporting Requirements – Section 25-17.400(8) – Each IOU would be required to provide an annual report to the Commission by April 1 concurrent with the filing of its Ten-Year Site Plan. The specific data to be provided by each IOU in these reports will facilitate the Commission’s evaluation of utility efforts and costs associated with the RPS, and efforts to track the development of renewable energy in Florida. Further, because these reports are filed concurrently with the Ten-Year Site Plans, the Commission will have a complete picture of how each utility’s RPS compliance strategy fits in with the utility’s integrated resource plan.

II. Overview of Draft Rule 25-17.410, F.A.C. - Renewable Energy Credit Market

The following is an overview of the October 14, 2008 draft rule 25-17.410, F.A.C., and includes the modification discussed above.

Establishment of a REC Market – Section 25-17.410(1), (2), (3)(a) and (b), and (4) – The REC market allows for the certification and accounting of RECs that may be used by the IOUs to meet the requirements of the RPS. The rule directs the IOUs to establish a REC market and select an independent third-party REC market administrator, subject to Commission approval. The administrative costs of the REC market will be collected through fees assessed to a REC. The REC market will allow the IOUs to generate their own, buy, sell, and trade the RECs needed to comply with the RPS and allow for owners of Florida renewable energy resources to benefit from the sale of RECs. The rule would require the establishment of a group to act as technical advisors to the REC market administrator in the areas of governance, fees and market rules. The IOUs, municipal electric utilities, rural electric cooperatives, and Florida renewable energy resource providers are to make up the advisory group. As part of the IOUs’ request for Commission approval of the REC market structure and governance, provisions shall be made to facilitate both short-term purchases of RECs, and long-term bilateral contracts for RECs between IOUs and Florida renewable energy providers.

Full Transparency – Section 25-17.410(1), (2), (3), (11) – The rule provides for full oversight of the REC market by the Commission in several ways: (1) the REC market administrator must be approved by the Commission, (2) the rule requires Commission approval of all of the practices and procedures of the REC market, and (3) all records of the REC market must be fully transparent and open to the Commission for inspection and audit. Also, staff has modified the October 14, 2008 draft rule to include references to the Commission’s dispute resolution process pursuant to Rule 25-22.032, F.A.C, Customer Complaints, and Rule 25-22.036, F.A.C., Initiation of Formal Proceedings. This will provide a forum and process for resolution of disputes among stakeholders in the REC market.

Eligible Facilities – Section 25-17.410(5) – Renewable facilities that are eligible to produce RECs must be certified by the REC market administrator. The rule lists eligible facilities, which include: (1) all utility-owned Florida renewable energy resources; (2) non-utility owned renewables for which the capacity or energy is under contract to a utility or pursuant to an approved tariff; (3) non-utility owned renewables greater than two megawatts, that offset all or part of the customer’s electrical needs; and (4) customer-owned renewables, two megawatts or less, that have not received an incentive from an IOU pursuant to a Commission-approved energy efficiency program.

Treatment of RECs – Section 25-17.410(6)-(10) – The rule would require that RECs are retained by the owner of the eligible Florida renewable energy resource, unless sold or transferred, and shall have a life of two years. The rule also would ensure, pursuant to statute, that RECs credited toward RPS compliance are not credited toward any other purpose. To prevent double counting, the rule requires that RECs produced by Florida renewable energy resources used to comply with Florida’s RPS or any other state’s RPS must be retired and not used for compliance with another state or regional RPS.

III. Summary of Draft Rules as Modified

In summary, staff recommends that the Commission submit to the Legislature the October 14, 2008 draft rules contained in Attachment A as one alternative for consideration. These draft rules contain changes to the drafts presented to the Commission at the October 14, 2008 Agenda Conference.

Draft Rule 25-17.400, F.A.C., Florida Renewable Portfolio Standard, is consistent with the requirements of Section 366.92, F.S., and offers a balanced approach to encouraging the development of renewable resources in Florida, while providing sufficient ratepayer safeguards. The rule establishes a reasonable initial uniform RPS for each IOU, and includes a procedure for the Commission to review and update these standards, as necessary, not less than every five years. Further, the rule contains two primary components to protect ratepayers from high rate impacts: (1) the procedure for the Commission to review and modify the standards, if appropriate; and (2) a rate cap based on 2 percent of each IOU’s retail electric sales.

Draft Rule 25-17.410, F.A.C., Florida Renewable Energy Credit Market, contains appropriate procedures for the establishment and administration of a Florida REC market. The REC market will allow the IOUs to self-generate, buy, sell and trade the RECs needed to comply with the RPS and allow for owners of Florida renewable energy resources to benefit from the sale of RECs. The draft rule requires that the IOUs use an RFP process to select a third-party market administrator. The selection of the market administrator and the governance and structure of the market will be subject to Commission approval. The draft rule sets forth minimum provisions that must be contained in the REC market filing, identifies eligible facilities, addresses the ownership and life of a REC, and clarifies the prohibition of double counting of a REC created in the Florida market. Further, the rule requires the establishment of a group of stakeholders to act as technical advisors to the REC market administrator in the areas of governance and market rules. The IOUs, municipal electric utilities, rural electric cooperatives, and Florida renewable energy resource providers are to make up the advisory group. Staff believes the draft rule provides for reasonable oversight by the Commission, and will ensure a REC market that is transparent, impartial and fair to all market participants.

IV. Alternative Policy Options

The Commission directed staff at the October 14, 2008 Agenda Conference to develop information on alternatives to certain provisions of the draft RPS rule. As discussed in the following subsections, alternative policy options may be incorporated into the Commission’s draft RPS rule. Each of these alternatives are interrelated and can impact the ultimate draft rule that is developed.

A. Magnitude and Timing of the Renewable Portfolio Standard

Section 366.92, F.S., defines “Renewable Portfolio Standard” as the minimum percentage of total annual retail electricity sales by an IOU to consumers in Florida that shall be supplied by renewable energy produced in Florida. The magnitude and timing of the RPS is a critical decision point in the formulation of an RPS rule, however, it does not exist in isolation. The ability for an RPS to meet legislative intent is also dependent on interrelated policy options that are discussed further, including: (1) penalty and excusal provisions, (2) rate cap, (3) eligible resources, and (4) carve-out for certain resources. To be consistent with legislative intent, an RPS should balance the need to protect existing and encourage new renewable energy resources with the need to minimize cost to ratepayers.

RPS Options

There appears to be general agreement among the stakeholders regarding a 20 percent ultimate goal, and this level was identified in the Governor’s Executive Order Number 07-127. A key question remains regarding the timing of the ultimate goal, however. Through the rule development process there have been discussions and information developed on the following options:

· 20 percent by 2050 – August 20, 2008 strawman draft rule

· 20 percent by 2041 – October 14, 2008 draft rule

· 20 percent by 2030 – FPL’s clean energy portfolio

· 20 percent by 2020 – Environmental and renewable energy advocates

Staff’s presentation at the December 3, 2008 Commission workshop showed that the potential ratepayer impact of the RPS was dependent on the timing of the ultimate goal, the mix of renewable resources used to meet the goal, and any rate cap established in the RPS rule. For example, the following table used at the workshop provides estimates of the relative cost of RPS rollout strategies using a mix of solar and biomass resources. These are currently the renewables with the most near-term potential in Florida.

|

Table 1 Comparison of RPS Requirements and Estimated Costs |

|||

|

25 % Solar/75% Biomass |

|||

|

|

20% by 2020 |

20% by 2030 |

20% by 2041 |

|

RPS Value Giga-watt hours (GWh) |

44,500[3] |

28,000 |

21,600 |

|

Required Solar Capacity (MW) |

5,770 |

3,630 |

2,800 |

|

Existing Solar Capacity (MW) |

3 |

3 |

3 |

|

# of Solar Installations by 2020 |

1.4 Million |

0.9 Million |

0.7 Million |

|

Required Biomass Capacity (MW) |

4,760 |

3,000 |

2,300 |

|

Existing Biomass Capacity (MW) |

1,069 |

1,069 |

1,069 |

|

# of Biomass Installations by 2020 |

46 |

24 |

15 |

|

Estimated Cost ($ Billion Net Present Value (NPV)) |

$24.5 |

$17.2 |

$14.3 |

The RPS percentages and timing should incorporate information on an assessment of the existing and potential renewable resources, RPS policy options, and the potential cost to ratepayers.

Navigant Consulting, Inc.’s Florida Renewable Energy Potential Study

As discussed in detail in Attachment D, Navigant Consulting’s renewables assessment includes an evaluation of the levelized cost, and current and projected availability of renewable energy through 2020. The study shows a range of RPS requirements of: (1) 5 percent by 2020 in the unfavorable scenario, (2) 11 percent by 2020 in the mid-favorable scenario, and (3) 24 percent by 2020 in the favorable scenario. The study results show that only under the most favorable circumstances for the development of renewable energy would a 20 percent goal be achievable by 2020. Current economic and policy conditions fall in the unfavorable scenario.

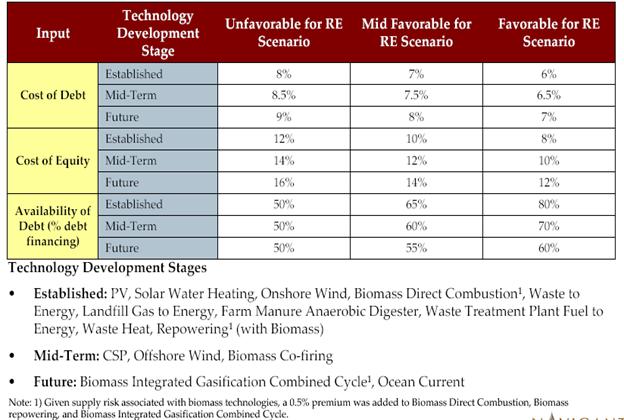

In order to project future renewable energy development, Navigant Consulting identified ten key drivers that could impact the renewable energy market. Scenarios of potential renewable development were analyzed around the five key drivers with the highest potential impacts and the most uncertainty. These drivers are: (1) fossil fuel prices, (2) cost of carbon under greenhouse gas emissions policies, (3) federal and state renewable energy tax credits and other incentives, (4) the availability and cost of debt and equity, and (5) the rate cap established for the purchase of RECs. According to Navigant Consulting, the purpose of the additional revenue stream to the renewable energy resource is to make up any difference between the cost of the renewable facility and the comparable utility generation facility in order to insure an adequate return on investment for the renewable developer.

Navigant Consulting then created three scenarios for potential renewable energy development in which the five key drivers were used. These key drivers were varied under three scenarios to determine the impact on the development of renewable energy by 2020. These scenarios are summarized as:

· Unfavorable – low fossil fuel prices, 1 percent rate cap, no extension of current government renewable incentives per current policies, tight financial markets, and carbon pricing of $10/ton by 2020;

· Mid-favorable – mid range fossil fuel prices, 2 percent rate cap, partial extension of government renewable incentives, moderate financial markets, and carbon pricing of $30/ton by 2020; and

· Favorable - high fossil fuel prices, 5 percent rate cap, government renewable incentives extended through 2020, widely available debt and equity, carbon pricing of $50/ton by 2020.

Navigant Consulting concluded that:

- Under the unfavorable scenario for renewable development, which includes a 1 percent rate cap, renewable energy in Florida could be 5 percent of IOU retail sales by 2020;

- Under the mid-favorable scenario for renewable development, which includes a 2 percent rate cap, renewable energy in Florida could be 11 percent of IOU retail sales by 2020; and

- Under the most favorable scenario for renewable development, which includes a 5 percent rate cap, renewable energy in Florida could be 24 percent of IOU retail sales by 2020.

Navigant Consulting found that renewable energy development would be expected to develop more extensively under a scenario with high fossil fuel prices, a 5 percent rate cap on RECs, government incentives extended through 2020, and widely available debt and equity at lower cost.

Current economic and policy conditions generally coincide with Navigant Consulting’s unfavorable scenario for future renewable development. Specifically, the unfavorable scenario for carbon pricing assumes $0/ton initially, then scaling to $10/ton by 2020. Currently, there is no federal or state policy establishing carbon pricing. As shown in Attachment D, Navigant Consulting assumes in its unfavorable scenario the cost of debt to be approximately 8.5 percent, the cost of equity approximately 14 percent and ready access to debt, which would make-up 50 percent of renewable project financing. Currently, credit markets are extremely tight and it is uncertain when conditions will improve. Navigant Consulting assumes natural gas costs to be $5-$6/MMBtu in the unfavorable scenario. Currently, natural gas is trading at $5.70/MMBtu. Most forecasts project natural gas prices to increase over the long-term. Navigant Consulting projects various federal and state renewable energy financial incentives under each scenario, as shown in Attachment D. For example, in the unfavorable scenario, Florida’s solar rebate program is projected to expire in 2010, with a $5 million annual funding level. The Governor’s Energy Office has budget authority to spend $5 million in the 2008/09 fiscal year. It is unknown if and to what level the Legislature will appropriate funds for the solar rebate program in future fiscal years.

It should be noted that Navigant Consulting performed their primary analysis with a solar and wind carve-out of 75 percent of RPS expenditures, identical to the October 14, 2008 draft rule. Based on comments in the rule development process, Navigant Consulting performed an alternate analysis that did not include a carve-out. This analysis shows that renewable energy could provide 4 percent under the unfavorable scenario, 9 percent under the mid-favorable scenario and 23 percent under the favorable scenario of the IOUs’ retail sales by 2020.

The timeframe and scope of Navigant Consulting’s study allowed only for an assessment of existing renewable resources, a comparison of the cost of renewables to comparable traditional generation options, and an assessment of the economic potential under the scenarios listed above. While the study provides useful information, a complete IRP exercise could not be performed. An IRP would have allowed for an analysis of the future need for electricity, existing resources and the associated costs, and the availability and cost of options to meet additional electrical needs. These options include energy efficiency, renewables, purchased power and traditional generation options.

Initial Magnitude and Timing of the RPS

The starting point for an RPS should be based on existing renewable resources. Staff’s most recent information indicates that renewable generation provides approximately 6,339 GWh or 3.6 percent of the IOUs’ energy needs. This estimate includes both energy that flows onto the grid and energy used to self-serve. Navigant Consulting’s assessment shows that renewables contribute the equivalent of 7,768 GWh or 4.4 percent of the IOUs’ energy needs. Navigant Consulting includes data from sources not reported to staff by the stakeholders. The primary difference between these percentages appears to be Navigant Consulting’s identification and estimate of energy produced and used by pulp and paper manufacturers in their operations. Staff believes that Navigant Consulting’s data provides a reasonable upper bound of the energy produced by existing renewable resources.

The information presented at the December 3, 2008 rule development workshop included three cases with an end-date and not a starting date. The October 14, 2008 draft rule would make 2017 the first year the IOUs are required to meet a standard. This date would allow for time to establish a rule and to establish the REC market. If the Commission decides to establish an alternative starting date for the RPS, care must taken to consider: (1) the potential for near-term development of renewables; (2) the rate cap established in the draft rule; and (3) the compliance provisions including penalties and excusal for non-compliance.

Ultimate Magnitude and Timing of the RPS

A key consideration in determining the ultimate magnitude and timing of the RPS is the potential to achieve the goal within the desired timeframe. The Navigant Consulting study provides insight on this issue. The study shows that renewable energy could account for 5, 11 or 24 percent of the IOUs’ retail sales by 2020, depending on the assumed economic and policy scenario. Navigant Consulting found that only under the most favorable scenario for the development of renewable energy could a 20 percent RPS be expected to be achieved by 2020. As discussed above, current economic and policy conditions would generally fall into Navigant Consulting’s unfavorable scenario for renewable energy development. Navigant Consulting’s conclusion must therefore be viewed only as the upper bound or maximum possible renewable development under the most favorable assumptions.

Staff notes that the ease of achieving 20 percent renewables will be affected if the resources eligible for compliance are altered. For example, if eligible resources are expanded to include clean energy resources, as discussed in Issue 3, it could be expected that the 20 percent goal would be more easily and quickly achieved by the IOUs. Therefore, the magnitude and timing of the ultimate standard should be revisited if the eligible resources change, such as by including all clean energy resources.

A second consideration involves the effect of the timing of the ultimate goal on the cost of achieving the goal. As shown in Table 1 from staff’s presentation at the December 3, 2008 workshop, a near-term RPS of 20 percent would significantly increase the cost of compliance. All else being equal, advancing the schedule from 2041 to 2020 would be expected to increase the costs of achieving a 20 percent goal by approximately $10 billion NPV. The cost impact to ratepayers could be ameliorated through adjustments to the rate cap. This, however, could impact the potential for IOUs to achieve the RPS requirements.

Conclusion

Staff recommends an RPS of 20 percent by 2041. If the Commission alters the RPS percentages and timing from the October 14, 2008 draft rule, consideration must be given to available and projected renewable resources, and the interrelated policy options. These policy options will affect the ability to achieve the goal and impact the compliance costs recoverable from the ratepayers.

B. Rate Cap

Since the cost of certain renewables is likely to be higher than conventional technologies, particularly in the early years of development, staff believes it is essential to include some form of cost containment measure in the RPS policy. In addition, Section 366.92(3)(b)2, F.S., provides that noncompliance with the RPS can be excused if the cost of compliance was “cost prohibitive.” The draft rule limits ratepayer cost exposure through a rate cap based on a percentage of retail sales. This cap performs the dual functions of: (1) minimizing RPS compliance costs to ratepayers, and (2) providing an excusal for the IOU in the event that compliance costs are excessive and prevent the IOU from meeting the RPS.

In this rulemaking process, OPC, other consumer advocates, and utilities suggested a rate cap of 1 percent of annual retail revenues. The environmental advocates and renewable energy producers commented that a 1 percent rate cap is too low to fully encourage the development of renewables in Florida. These parties recommended increasing the rate cap to as high as 5 percent, or removing the rate cap altogether. As an example of the various rate caps suggested by the parties, Table 2 displays 1 to 5 percent of each IOU’s annual 2007 revenues.

|

Table 2 Rate Caps Associated with 2007 IOU Revenues |

|||||

|

|

1% Retail Sales

|

2% Retail Sales (Draft Rule) |

3% Retail Sales |

4% Retail Sales |

5% Retail Sales |

|

FPL |

$112,648,020 |

$225,296,040 |

$337,944,060 |

$450,592,080 |

$563,240,100 |

|

FPUC |

$564,089 |

$1,128,178 |

$1,692,267 |

$2,256,356 |

$2,820,445 |

|

Gulf |

$10,282,092 |

$20,564,184 |

$30,846,276 |

$41,128,368 |

$51,410,460 |

|

PEF |

$41,383,779 |

$82,767,558 |

$124,151,337 |

$165,535,116 |

$206,918,895 |

|

TECO |

$20,410,858 |

$40,821,716 |

$61,232,574 |

$81,643,432 |

$102,054,290 |

|

Total: |

$185,288,838 |

$370,577,676 |

$555,866,514 |

$741,155,352 |

$926,444,190 |