Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

|

|

DATE: |

||

|

TO: |

Office of Commission Clerk (Cole) |

|

|

FROM: |

Division of Regulatory Analysis (Ma, Graves) Division of Economic Regulation (Franklin) Office of the General Counsel (Tan, Brown) |

|

|

RE: |

Docket No. 100346-EQ – Petition for approval of the second negotiated purchase power contract with Hathaway Renewable Energy, Inc. by Progress Energy Florida, Inc. |

|

|

AGENDA: |

12/14/10 – Regular Agenda – Proposed Agency Action – Interested Persons May Participate |

|

|

COMMISSIONERS ASSIGNED: |

||

|

PREHEARING OFFICER: |

||

|

SPECIAL INSTRUCTIONS: |

Take up dockets 100345-EQ, 100346-EQ, 100347-EQ together |

|

|

FILE NAME AND LOCATION: |

S:\PSC\RAD\WP\100346.RCM.DOC |

|

On July 6, 2010, Progress Energy Florida, Inc., (PEF) filed three Petitions[1] requesting approval of three separate negotiated contracts for the purchase of firm capacity and energy between Hathaway Renewable Energy, LLC (Hathaway) and PEF, dated June 22, 2010. The negotiated contracts are based on Hathaway constructing, owning, and operating three identical self-sustained biomass electric generating facilities (Hathaway Facility) at varying locations in Florida and with varying in-service dates. In this docket, Hathaway proposes to sell 16 MW of firm capacity and associated energy from the Hathaway Facility to PEF for a term of 25 years beginning in September 1, 2013. PEF has requested confidential classification for certain information contained in the negotiated contracts and also for some of its responses to staff’s data requests. The confidentiality requests will be addressed through a separate order.

On November 5, 2010, PEF filed revised negotiated contracts in each docket. The changes include correcting inconsistent contract terms, deferring the in-service date, and revising the contract payment streams from an early levelized to a normal value of deferral payment structure.

Hathaway is a start-up company and has no previous experience with constructing, managing, or operating an electric generating facility. The specific type of technology being utilized is relatively experimental and commercially untested. In response to staff’s data request, Hathaway noted two facilities of similar technology currently in construction in Asia and California, but those facilities will be primarily using natural gas, unlike Hathaway’s proposed facilities that are fueled by gasified biomass.

The three Hathaway Facilities will use a gasified biomass product as the primary fuel and a new gasifier fuel cell technology supplemented by a biomass gas combustion turbine. Each facility is anticipated to have an open-loop fuel source, relying on woody biomass waste from its individual surrounding area. Each will operate as a Qualifying Facility as defined by Federal Energy Regulatory Commission Rules 292.101 through 292.207 and Rule 25-17.080, Florida Administrative Code (F.A.C.). Hathaway intends to qualify for a US Treasury Section 1603 Grant provided under the 2009 American Reinvestment and Renewal Act.

This recommendation addresses PEF’s petition for approval of the second of the three negotiated contracts with Hathaway. The Commission has jurisdiction over this matter pursuant to Sections 366.051, 366.81, and 366.91, Florida Statutes (F.S.).

Issue 1:

Should the Commission approve the petition submitted by PEF requesting approval for cost recovery of the second negotiated contract with a qualifying facility, Hathaway Renewable Energy, LLC.?

Recommendation:

No. Based on the most recent available information, the contracted payments are expected to be approximately $13.3 million above PEF’s current avoided costs, and therefore not eligible for cost recovery pursuant to Sections 366.051 and 366.91, F.S., and Rule 25-17.0832(2), F.A.C. (Ma, Graves)

Staff Analysis:

Hathaway proposes to sell 16 megawatts (MW) of firm capacity and energy from the Hathaway Facility to PEF for a term from November 1, 2013, through November 1, 2038. Rule 25-17.0832(3), F.A.C., states that in reviewing a negotiated firm capacity and energy contract for the purpose of cost recovery, the Commission shall consider factors relating to the contract that would affect the utility’s general body of retail and wholesale customers, including; need for power, the cost-effectiveness of the contract, security provisions for early capacity payments, and performance guarantees associated with the generating facility. Each of these factors is evaluated below.

A. Need for Power

Based on PEF’s 2010 Ten-Year Site Plan, the company does not have a reliability need for additional capacity in 2013, the proposed in-service date of the Hathaway Facility. Although renewable resources are beneficial in contributing to fuel diversity, and it has been the Commission’s policy to approve cost-effective contracts that use renewable resources as the primary fuel, this contract is not cost-effective when compared to PEF’s current avoided costs as discussed below.

B. Cost-Effectiveness

Section 366.051, F.S., defines a utility’s full avoided cost as “the incremental costs to the utility of the electric energy or capacity, or both, which, but for the purchase from cogenerators or small power producers, such utility would generate itself or purchase from another source.” Section 366.91(3), F.S., requires investor-owned utilities to continuously offer to purchase power from renewable generators based upon the utility’s full avoided costs, as defined in Section 366.051, F.S. The Commission has implemented these statutes pursuant to Rules 25-17.080 through 25-17.310, F.A.C. Rule 25-17.0832(2), F.A.C., states in part that negotiated contracts will be considered prudent for cost recovery purposes if payments do not exceed full avoided costs. Therefore, cost recovery is limited to a utility’s full avoided cost, which is reflected in a utility’s Standard Offer Contract.

PEF and Hathaway have agreed upon payments divided into two parts, energy and capacity. PEF’s energy payments to Hathaway are calculated as the lesser of system as-available energy or firm energy from the avoided unit used to develop the 2009 Standard Offer, a 178 MW natural gas-fired combustion turbine that would come into service on June 1, 2014. While this pricing methodology is unaffected by the fuel forecast and mimics the economic dispatch of the avoided unit, the avoided unit upon which PEF’s 2009 Standard Offer was based is no longer being planned by PEF. PEF’s energy payments should reflect the most current avoided unit pricing, which is PEF’s 2010 Standard Offer that is based on a 178 MW natural gas-fired combustion turbine that would come into service on June 1, 2018.

PEF’s negotiations with Hathaway began on January 5, 2010, at which time PEF’s 2009 Standard Offer was representative of PEF’s avoided costs and available to all renewable generators. The capacity payment of the Hathaway Facility was originally filed as an early levelized fixed rate of $12.20/kW-month for the 25-year duration and justified minimal savings against the 2009 Standard Offer. On April 1, 2010, PEF filed its Ten-Year Site Plan, which did not include the 2014 combustion turbine. PEF filed a petition to approve the 2010 Standard Offer on April 1, 2010. On July 21, 2010, the Commission approved PEF’s petition.[2]

Rule 25-17.250(3), F.A.C., states that:

Each standard offer contract shall remain open until the generating unit upon which the standard offer contract was based is no longer part of the utility’s generation plan, as evidenced by a petition to that effect filed with the Commission or by the utility’s most recent Ten-Year Site Plan.

PEF’s 2010 Ten-Year Site Plan and the petition filed confirm that the 2014 combustion turbine was no longer part of the utility’s generation plan. Therefore, by April 1, 2010, the 2009 Standard Offer was closed, and PEF’s avoided costs were changed. Staff would note that the original contract was signed on June 22, 2010, and filed with the Commission on July 6, 2010. Staff identified incomplete and inconsistent information within the contract through staff’s data requests. PEF chose to submit a revised contract, which corrected these inconsistencies, but also materially altered the terms of the contract by deferring the in-service date of the Hathaway Facility and changing the payment stream from an early levelized fixed rate to the normal value of deferral payment of PEF’s 2009 Standard Offer. The change in capacity payments would increase the Net Present Value (NPV) of payments to Hathaway by $8,000. The revised contract was signed on October 27, 2010, and filed with the Commission on November 5, 2010. The table below summarizes the timeline of events that occurred throughout the development process of the proposed negotiated contract:

|

Negotiated Contract Timeline |

|

|

Date |

Event |

|

1/05/2010 |

Negotiations between Hathaway Renewable, Inc. and PEF commence |

|

4/01/2010 |

PEF’s 2010 Ten-Year Site Plan and petition for a new Standard Offer Contract filed with the Commission |

|

6/22/2010 |

Original negotiated contract signed |

|

7/06/2010 |

Original negotiated contract filed with the Commission |

|

7/21/2010 |

Petition for a new Standard Offer Contract Approved by the Commission |

|

10/27/2010 |

Revised negotiated contract signed |

|

11/05/2010 |

Revised negotiated contract filed with the Commission |

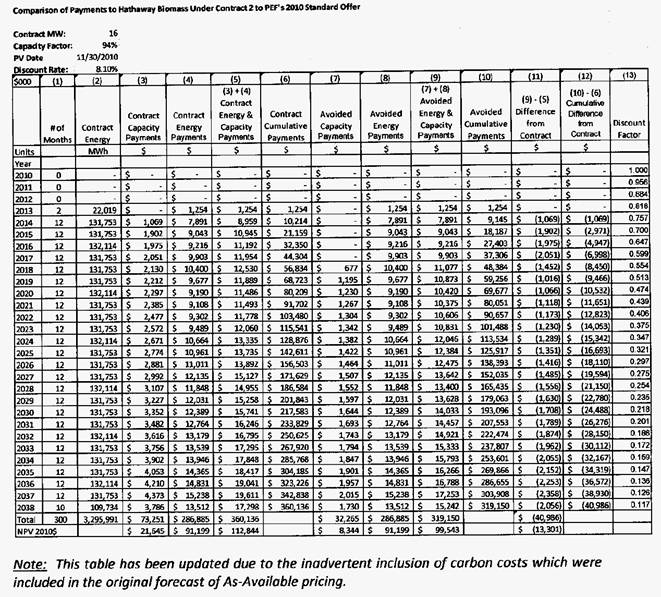

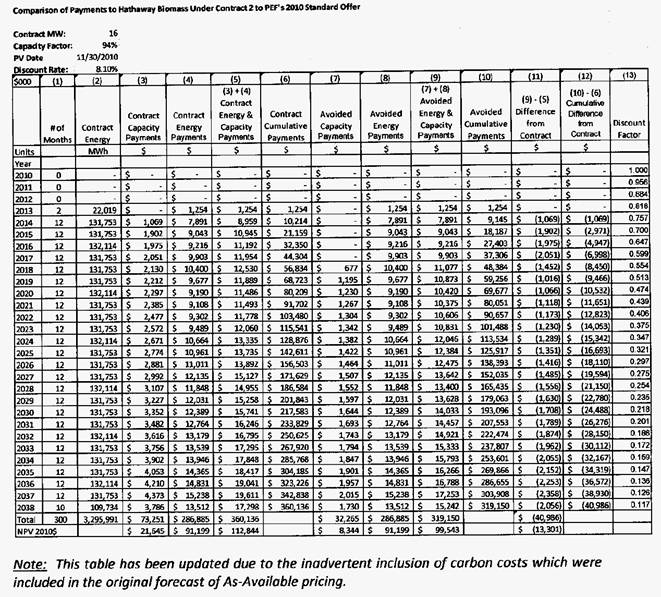

At staff’s request, PEF compared the projected payments to Hathaway against what payments would be under PEF’s 2010 Standard Offer. When compared to PEF’s 2010 Standard Offer, the revised negotiated contract results in payments higher than PEF’s current avoided costs by a NPV of approximately $13.3 million. When compared to PEF’s 2009 Standard Offer, the original negotiated contract projected a NPV savings of $8,000. The complete cost analyses provided by PEF are contained in Attachments A and B. The table below summarizes a comparison of savings to ratepayers of the original and revised negotiated contract against what payments would have been under PEF’s 2009 and 2010 avoided costs:

|

Comparison of Projected NPV Savings from Negotiated Contract |

|||

|

|

In-Service Date |

Savings/Costs when compared to: |

|

|

2009 Standard Offer |

2010 Standard Offer |

||

|

Original Contract |

1-Jun-13 |

$ 8,000 |

$ (12,577,000) |

|

Revised Contract |

1-Nov-13 |

$ -0 - |

$ (13,301,000) |

One of the factors that affected the disparity between the two Standard Offer comparisons is the in-service date of the avoided unit. The four year delay of the avoided unit will reduce the NPV of PEF’s avoided costs making the baseline value on which to compare the negotiated contract much less. Additionally, PEF reported that as a result of current economic conditions, the cost of major materials and labor has decreased, which will reduce the cost of the new Ten-Year Site Plan avoided unit.

In the past, where the negotiation period extended through the submittal of a new Standard Offer, the Commission has considered both Standard Offer avoided units when evaluating negotiated contracts for cost recovery purposes.[3] Using the most recent avoided cost data for an accurate evaluation of a negotiated contract is consistent with the Commission’s actions in the past. However, all previous negotiated contracts were found to be below the utility’s most current avoided costs; whereas in this case the Hathaway negotiated contract payments are above the most recent avoided cost projections.

As mentioned above, PEF revised the contract with Hathaway on October 27, 2010, which increased the NPV payments to Hathaway. Since the Commission approved PEF’s 2010 Standard Offer Contract in July 21, 2010, both parties were clearly aware of changed circumstances and should have reacted accordingly. Staff questions the rationale of PEF’s decision to renegotiate the contract, as the renegotiated contract continues to disregard the most recent available avoided cost information. Based on today’s avoided costs, the negotiated contract is not projected to be cost-effective.

C. Early Termination Security

The Commission has recognized early termination security as a protection for contracts in which the renewable provider receives capacity payments prior to the in-service date of the avoidable unit (early capacity payments). Early capacity payments incur an early cost to rate-payers that is gradually recovered over the term of the contract. An early termination fee is designed to ensure repayment of early costs that are incurred but may not be fully recovered as a result of a default during the term of the contract.

PEF has agreed to pay Hathaway normal value of deferral capacity payments based on the 2009 Standard Offer, and when compared to the 2009 Standard Offer, the negotiated contract is not projected to exceed PEF’s avoided cost in any year. Because PEF believes that the 2009 Standard Offer is the appropriate baseline for evaluating the payments to Hathaway, no provisions for termination security were included in the negotiated contract. However, as discussed above, the negotiated contract is not cost-effective when compared to PEF’s 2010 Standard Offer, which staff believes is the appropriate baseline for evaluating the negotiated contract.

D. Performance Guarantees

November 1, 2013, is the estimated in-service date for the Hathaway Facility. As security for meeting the committed in-service date and satisfactory performance of the facility, Hathaway is required to maintain a letter of credit for the term of the contract. If Hathaway is unable to meet the committed in-service date, or the contract is terminated due to a Seller default, PEF will be able to draw upon the letter of credit security deposit to pay for replacement power. The amount of the letter of credit required by the contract is adequate when compared with the security amounts contained in PEF’s 2009 and 2010 Standard Offers.

When the Hathaway Facility is operational, the expected annual energy produced will be 131,753 MWh, based upon a 94 percent capacity factor. In the event that the Annual Capacity Billing Factor[4] (ACBF) of the Hathaway Facility is below 94 percent but above 74 percent, the total capacity payment rate will be reduced on a sliding scale. If the ACBF is less than or equal to 74 percent no monthly capacity payment is due. The method for calculating monthly capacity payments contained in the contract is consistent with those found in PEF’s 2009 and 2010 Standard Offers. However, as discussed above, the negotiated contract is not cost-effective when compared to PEF’s 2010 Standard Offer.

Staff would note that the negotiated contract allows PEF to terminate the contract if PEF is not fully reimbursed for all payments to Hathaway through the Fuel Adjustment Clause and the Capacity Cost Recovery Clause. If the Commission allows cost recovery of capacity payments up to the 2010 avoided costs figures, any amounts above avoided costs would be borne by PEF’s stockholders. Therefore, it would be unlikely that PEF would continue the contract since the incremental costs would be borne by PEF’s stockholders.

Conclusion

Staff recognizes the difficulty involved with negotiations when the avoided unit upon which negotiations are based may change annually. However, staff believes that it is important for the Parties and the Commission to use the most recent data available to evaluate the cost-effectiveness of negotiated contracts. This ensures the most accurate analysis of cost-effectiveness, and ensures that the utility’s ratepayers will not be charged above avoided cost for renewable generation. Based on the most recent available data, the contracted payments are expected to be approximately $13.3 million above PEF’s current avoided costs, and are not eligible for cost recovery pursuant to Section 366.051, F.S., and Rule 25-17.0832(2), F.A.C. Therefore, staff recommends that the Commission deny PEF’s petition for cost recovery of the negotiated contract between Hathaway and PEF. If the Commission permits cost recovery up to the most current avoided costs, it is likely that PEF will terminate the contract.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. This docket should be closed upon issuance of a Consummating Order unless a person whose substantial interests are affected by the Commission's decision files a protest within 21 days of the issuance of the proposed agency action. (Tan, Brown)

Staff Analysis:

This docket should be closed upon issuance of a Consummating Order unless a person whose substantial interests are affected by the Commission's decision files a protest within 21 days of the issuance of the proposed agency action.

[1] See Docket No. 100345-EQ - In re: Petition for approval of a negotiated purchase power contract with Hathaway Renewable Energy, Inc. by Progress Energy Florida, Inc., Docket No. 100346-EQ - In re: Petition for approval of a second negotiated purchase power contract with Hathaway Renewable Energy, Inc. by Progress Energy Florida, Inc., and Docket No. 100347-EQ - In re: Petition for approval of a third negotiated purchase power contract with Hathaway Renewable Energy, Inc. by Progress Energy Florida, Inc.

[2] See Order No. PSC-10-0464-TRF-EI, issued July 21, 2010, in Docket No. 100168-EI - In re: Petition for approval of amended standard offer contract, by Progress Energy Florida.

[3] See Order No. PSC-09-0562-PAA-EQ, issued August 14, 2009, in Docket No. 090150-EQ - In re: Petition for approval of a modification to existing negotiated renewable energy contract with Solid Waste Authority of Palm Beach County, by Florida Power & Light Company, and Order No. PSC-09-0851-PAA-EQ, issued December 30, 2009, in Docket No. 090371-EQ - In re: Petition for approval of amended negotiated purchase power contract with Vision / FL, LLC by Progress Energy Florida.

[4] The Annual Billing Capacity Factor is defined as the total amount of energy received divided by the product of committed capacity and the number of hours of the elapsed time period. This calculation shall be performed at the end of each Monthly Billing Period until enough Monthly Billing Periods have elapsed to calculate a 12-month rolling average.