Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Division of Economic Regulation (Slemkewicz, Cicchetti, Draper, P. Lee, Lester) Office of the General Counsel (Kiser, Helton, Bennett) |

||

|

RE: |

Docket No. 080677-EI – Petition for increase in rates by Florida Power & Light Company.

Docket No. 090130-EI – 2009 depreciation and dismantlem ent study by Florida Power & Light Company. |

||

|

AGENDA: |

10/12/10 – Regular Agenda – Decision on Stipulation and Settlement – Interested Parties May Participate |

||

|

COMMISSIONERS ASSIGNED: |

Argenziano, Edgar, Skop |

||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

Take up before Docket No. 100410-EI |

||

|

FILE NAME AND LOCATION: |

S:\PSC\ECR\WP\080677-090130 .RCM.DOC |

||

On March 17, 2010, the Commission issued Order No. PSC-10-0153-FOF Granting in Part and Denying in Part, Florida Power and Light Company’s Request for a Permanent Rate Increase and Setting Depreciation and Dismantlement Rates and Schedules (Final Order) in Docket Nos. 080677-EI and 090130-EI. The Final Order was issued as a result of the Commission’s vote on Florida Power & Light Company’s (FPL or Company) revenue requirements and rates at the Commission’s January 13 and January 29, 2010, Special Agenda Conferences. The Final Order was a culmination of the rate case proceedings which commenced on March 18, 2009, with the filing of a petition for a permanent rate increase by FPL. While the Office of Public Counsel (OPC), the Office of the Attorney General (AG), the Florida Industrial Power Users Group (FIPUG), The Florida Retail Federation (FRF), the Florida Association for Fairness in Rate Making (AFFIRM), the Federal Executive Agencies (FEA), South Florida Hospital and Healthcare Association (SFHHA), the Associated Industries of Florida (AIF), the City of South Daytona, Florida (South Daytona), the I.B.E.W. System Council U-4 (SCU-4), the FPL Employees Intervenors (Employee Intervenors), Thomas Saporito (Saporito), and Richard Unger (Unger) intervened in this proceeding, only FPL, OPC, FIPUG, SFHHA, and Saporito filed post-decision motions.

On April 1, 2010, both FPL and FIPUG filed Motions for Reconsideration. FPL included in its motion a Motion for Clarification. On April 8, 2010, OPC, SFHHA, and FIPUG filed responses to FPL’s Motion for Reconsideration and for Clarification. On that same date, FPL filed a response to FIPUG’s Motion for Reconsideration. On April 15, 2010, FPL filed a Motion for Leave to File Response to SFHHA’s Response to FPL’s Motion for Reconsideration and Clarification. On July 22, 2010, staff filed its recommendation on the Motions for Reconsideration. At the August 17, 2010 Agenda Conference, the Commission voted to deny staff’s recommendation on one issue of the recommendation on Motions for Reconsideration (Issue 2 regarding fuel clause over-recoveries). Consideration of the remaining issues was deferred to the August 31, 2010 Agenda Conference.

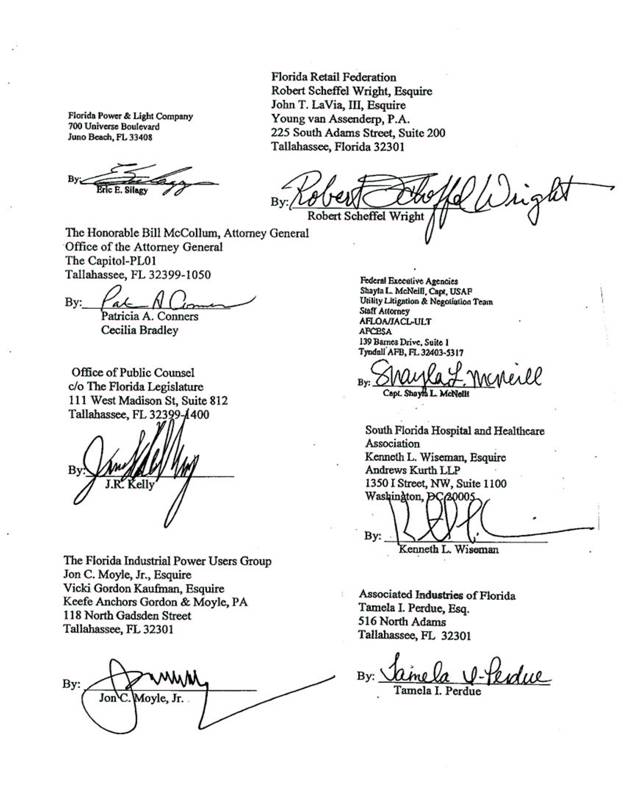

On August 20, 2010, FPL filed an Agreed Motion for Approval of Settlement Agreement to resolve all of the outstanding matters in Docket Nos. 080677-EI and 090130-EI. The signatories to the Stipulation and Settlement (Stipulation) are FPL, OPC, AG, FIPUG, FRF, SFHHA, FEA, and AIF (Joint Movants). Staff withdrew its recommendation on the reconsideration requests upon receipt of the Stipulation. The Stipulation will not affect the Commission’s vote on Issue 2. On August 26, 2010, staff sent data requests to all parties seeking clarification of certain aspects of the Stipulation. The responses were filed in the docket file on September 7 and 8, 2010, and are available for review.

On January 19, 2010, Saporito, who withdrew from the docket three days prior to the Prehearing Conference, filed a petition for a base rate proceeding, asking that the Commission use the evidentiary record from this docket to reach a different decision. Since Saporito’s petition was filed after the Commission’s decision setting forth the revenue requirements, his petition is addressed in this recommendation. With respect to Saporito’s petition, a petition such as Saporito’s must comply with Rule 28-106.201, Florida Administrative Code (F.A.C.) Failure to comply with the rule should result in dismissal of the petition, without prejudice.

This recommendation addresses the Stipulation and Saporito’s petition. The Commission has jurisdiction over this matter pursuant to Chapter 366, Florida Statutes, (F.S.), including Sections 366.041, 366.06, 366.07, and 366.076, F.S.

Issue A:

Should the Commission grant the Joint Petition to Assign Settlement Agreement to the Full Commission for Decision?

Recommendation:

Yes. Pursuant to Section 350.01(6), Florida Statutes (F.S.), the full Commission should consider whether to approve the Stipulation and Settlement Agreement. The full Commission should also consider whether to approve Mr. Saporito’s base rate petition. (Kiser, Helton, Bennett)

Staff Analysis:

On October 8, 2010, the Commission staff filed its recommendation regarding the proposed Stipulation and Settlement Agreement and Mr. Saporito’s base rate petition. The recommendation cover page shows that a panel consisting of Commissioners Argenziano, Edgar, and Skop are to decide these two issues.

The Motion

On October 5, 2010, the Office of Public Counsel (OPC), the Attorney General (AG), the Florida Industrial Power Users Group (FIPUG), the Florida Retail Federation (FRF), the Federal Executive Agencies (FEA), and the South Florida Hospital and Healthcare Association (SFHHA) (referred to herein collectively as Intervenors) filed a Joint Petition to Assign Settlement Agreement to the Full Commission for Decision. In their petition, the Intervenors state that on August 20, 2010, Florida Power & Light Company (FPL) and the Intervenors requested the Commission to approve a Stipulation and Settlement, approval of which would resolve all issues in Docket Nos. 080677-EI and 090130-EI. The Intervenors state that their motion requesting the full Commission to decide whether to approve the Settlement Agreement is guided by section 350.01(6), F.S., which provides:

A majority of the commissioners may determine that the full commission shall sit in any proceeding. The public counsel or a person regulated by the Public Service Commission and substantially affected by a proceeding may file a petition that the proceeding be assigned to the full commission. Within 15 days of receipt by the commission of any petition or application, the full commission shall dispose of such petition by majority vote and render a written decision thereon prior to assignment of less than the full commission to a proceeding. In disposing of such petition, the commission shall consider the overall general public interest and impact of the pending proceeding, including but not limited to the following criteria: the magnitude of a rate filing, including the number of customers affected and the total revenues requested; the services rendered to the affected public; the urgency of the requested action; the needs of the consuming public and the utility; value of service involved; the effect on consumer relations, regulatory policies, conservation, economy, competition, public health, and safety of the area involved. If the petition is denied, the commission shall set forth the grounds for denial.

The Intervenors contend that the Stipulation and Settlement Agreement provides assurance to customers that through the end of 2012 they will continue to receive important benefits provided by Commission Order No PSC-10-0153-FOF-EI, issued March 17, 2010 (the Commission’s decision in FPL’s last rate case). According to the Intervenors, one of the benefits from the last case was that the Commission set FPL’s authorized return on equity at a range of 9% to 11% in recognition of the cost to FPL of acquiring capital that prevails under current economic conditions. The Intervenors believe that these same difficult economic conditions, as well as the related low risks currently faced by FPL, persist today with no near term end in sight. The Intervenors contend that the Stipulation and Settlement Agreement will ensure that FPL’s actual earnings remain within the range set by the Commission. The Intervenors assert that similarly, the base rates approved by the Commission will continue through the end of 2012 if the Commission approves the Stipulation and Settlement Agreement. The Intervenors contend that without the agreement, there is a significant possibility that FPL would seek to raise rates again before the end of 2012 by filing a new petition for an increase in base rates.

Intervenors believe that consideration of the Stipulation and Settlement Agreement will be among the most important decisions facing the Commission during the next two years. According to the Intervenors, the decision will affect all 4.5 million customers of FPL, and the monetary impact of the decision could easily amount to hundreds of millions of dollars. Intervenors assert that it is in the public interest to assign this matter to the full Commission because of the significance and impact of the Stipulation and Settlement Agreement. The Intervenors assert that it is fully appropriate that the two newest Commissioners be included in this important decision regarding the settlement because the impacts of the settlement will be realized during their terms.

The Intervenors report that recently the full Commission approved a joint motion for approval of a stipulation and settlement agreement concerning Tampa Electric Company (TECO). Intervenors state that stipulation and settlement agreement resolved all issues pending in Docket No. 090368-EI (In re: Review of the continuing need and costs associated with Tampa Electric Company’s 5 Combustion Turbines and Big Bend Rail Facility) and all issues in the appeal of the TECO rate case Final Order and Order on Reconsideration. According to the Intervenors, all Commissioners, including Commissioners Graham and Brisé, participated in that decision, even though Commissioners Graham and Brisé had not been appointed at the time of the TECO rate case Final Order or at the time of the Order on Reconsideration. The Intervenors argue that just as it was appropriate for Commissioners Graham and Brisé to participate in the decision regarding the TECO settlement, these two Commissioners should participate in the decision regarding the FPL settlement. The Intervenors conclude that the two new Commissioners’ participation in the decision on the FPL settlement agreement will be consistent with the manner in which the Commission handled the TECO settlement agreement.

The Intervenors point out that the Commission Staff have opened Docket No. 100410-EI for the purpose of addressing the issue of potential overearnings by FPL. The Intervenors state that this new docket has been assigned to the full Commission. Intervenors contend that the interrelationship of the settlement agreement to the potential overearnings issue provides an additional reason why the Settlement Agreement, like the new overearnings docket, Docket No. 100410-EI, should be decided by the full Commission.

Staff Analysis

Legal staff agrees with the Intervenors that the full Commission should consider the Stipulation and Settlement Agreement. Section 350.01(6), F.S., and Section 2.05(B)(3), Administrative Procedures Manual (APM), describe what is to be considered in determining whether the full Commission should sit in a proceeding. The Commission should consider:

[T]he overall general public interest and impact of the pending proceeding, including but not limited to the following criteria: the magnitude of a rate filing, including the number of customers affected and the total revenues requested; the services rendered to the affected public; the urgency of the requested action; the needs of the consuming public and the utility; value of service involved; the effect on consumer relations; regulatory policies, conservation, economy, competition, public health, and safety of the area involved.

Section 350.01(6), F.S.; Section 2.05(B)(4)(c), APM.

As stated by the Intervenors, the decision will affect 4.5 million FPL customers. Staff agrees with the Intervenors that the monetary impact of the decision could amount to hundreds of millions of dollars. The two newest Commissioners should be included in the decision because the policies that may be established by approval of the agreement will be realized during their terms.

Legal staff believes that the decision to approve or reject the Stipulation and Settlement agreement will have policy implications that the Commission will be applying over the next several years. For instance, if the Stipulation and Settlement agreement is approved, there is a limitation on the ability of the parties, including OPC, to seek a rate case until 2012. If the Stipulation and Settlement Agreement is rejected, the Commission may see a new rate case prior to 2012. If approved, the Stipulation and Settlement Agreement allows for the inclusion of an electric generation facility through the capacity cost recovery clause with rate impacts commencing with the 2011 fuel factor. This means that the Commission would deal with the effects of the Stipulation and Settlement Agreement in the current fuel cost recovery clause proceeding. If the Stipulation and Settlement Agreement is rejected, West County Unit 3 will be in service in 2011, and FPL may be in a position to seek recovery of those costs in a limited or full rate proceeding. The Stipulation and Settlement Agreement also has implications that may affect the overearnings recommendation also being considered by the Commission in Docket No. 100410-EI.

According to the Public Service Commission’s General Counsel the Stipulation and Settlement Agreement (and Mr. Saporito’s base rate petition) are the type of issues the Legislature intended the full Commission to handle. It is the opinion of the General Counsel that the Legislature designed the Commission to have a five-Commissioner panel as the appropriate resource to handle large-scale cases such as the docket at issue. As a state Senator, Mr. Kiser was instrumental in developing and passing Section 350.01, F.S., and, thus, has special insight as to the intent of this statute. Mr. Kiser states that the legislature intended the full Commission be involved in rate cases of the type that is currently before the Commission. Mr. Kiser’s opinion is that Commission panels were intended for dockets that involve smaller, less complex issues. In the opinion of the General Counsel, having more Commissioners with varied and contrasting areas of expertise are needed to reach the types of decisions posed by the questions raised in the Stipulation and Settlement Agreement, as well as the petition by Mr. Saporito.

In conclusion, legal staff recommends that the Commission grant the Intervenor’s Joint Petition to Assign Settlement Agreement to the Full Commission for Decision. Staff recommends that the full Commission also vote on Mr. Saporito’s Petition for Base Rate Proceeding.

Issue 1:

Should the Commission approve the proposed Stipulation and Settlement?

Recommendation:

Yes, the Commission should approve the proposed Stipulation and Settlement. (Slemkewicz, Draper, Lester, Cicchetti, P. Lee, Bennett)

Staff Analysis:

The Joint Movants have proffered the proposed Stipulation (Attachment 1) as a complete resolution of all matters pending in Docket Nos. 080677-EI and 090130-EI. The major elements contained in the Stipulation are:

· Current base rates frozen through the last billing cycle in December 2012 unless return on equity falls below 9.00 percent. (Paragraphs 1 and 6)

· Recovery of storm damage costs and storm damage reserve replenishment (not to exceed $4.00/1,000 kilowatt-hour (kWh) monthly for residential customers) will begin, on an interim basis, 60 days following the filing of a petition. (Paragraph 3)

· Recovery of the West County Unit 3 non-fuel revenue requirements equal to the projected fuel savings associated with the operation of the unit until the next base rate proceeding. The recovery will be accomplished through the capacity cost recovery clause. (Paragraph 5)

· Discretion to amortize the theoretical depreciation reserve surplus up to $267 million each calendar year in 2010, 2011, and 2012, not to exceed a total of $776 million. (Paragraph 7)

The proposed Stipulation consists of 11 paragraphs of agreement among the Joint Movants. Staff believes that several of the paragraphs merit comment or clarification. These are as follows:

Paragraph 3: Paragraph 3 addresses storm damage cost recovery. After 60 days following the filing of a petition seeking recovery of storm damage costs, the Joint Movants have agreed that FPL will be allowed to implement, on an interim basis, a monthly storm cost recovery surcharge of up to $4.00/1,000 kWh on residential customer bills based on a 12-month recovery period. If the storm costs exceed that level, any additional costs will be recovered in a subsequent year(s) as determined by the Commission. However, if FPL incurs storm damage in excess of $800 million, FPL reserves the right to petition the Commission to increase the initial 12-month recovery above the $4.00/1,000 kWh level. The Joint Movants have also agreed that FPL’s earnings level will not be an issue at the time any request for storm damage cost recovery is made.

As reflected in Order No. PSC-10-0153-FOF-EI, FPL is no longer authorized to make any accruals to the storm damage reserve. Paragraph 3 also allows FPL to use the surcharge to replenish its storm damage reserve to the level as of the implementation date of the Stipulation if it is totally depleted. It is estimated that the storm damage reserve level as of the implementation date will be approximately $201 million. Based on the $4.00/1,000 kWh monthly cap for residential customers, the annual amount of the surcharge would be $220 million for residential customers and a total of $377 million for all of FPL’s customers in the event of a major storm.

Paragraph 4: Paragraph 4 addresses recovery of the costs of capital projects or other costs not currently recovered in base rates through various cost recovery clauses. According to FPL and the intervenors, this paragraph does not preclude or prevent FPL from petitioning for cost recovery through a clause for capital projects not currently recovered in base rates. Staff notes that, while the stipulation “freezes” base rates, it allows flexibility for FPL to petition for recovery of base rate costs through various cost recovery clauses. Staff further notes that the Commission’s review of such petitions would be on a case-by-case basis and that intervenors can oppose any such petition.

Examples of costs for which FPL could request recovery through a cost recovery clause would be incremental cybersecurity costs (capacity clause), the cost of projects not included in base rates and which result in fuel savings (fuel clause), and the cost of environmental compliance equipment and qualifying solar projects (environmental clause). Further, new or atypical costs imposed by an authorized governmental entity could be considered for recovery through a cost recovery clause. An example of cost which FPL could not recover through a clause would be increases in typical capital costs such as investment in transmission assets.

Paragraph 5: Under Paragraph 5, FPL would be allowed to collect annually through the capacity cost recovery clause that portion

of the annual revenue requirement associated with West County Unit 3 (WEC 3) that equals the projected annual fuel savings. The annual revenue requirement

would be based on the projected costs in the need determination According to

the Stipulation, the fuel savings amount would be calculated by modeling FPL’s system with and without the addition of [1]

adjusted for the 10.00 percent ROE authorized in this docket.West County Unit 3 WEC 3. The

applicable fuel price forecast would be the same forecast that is used to

calculate FPL’s fuel factors in the fuel and purchased power cost recovery

proceeding. It should be noted that the amount of the West County Unit 3

WEC 3 revenue requirements recovered from the ratepayers will be

based solely on the projected amount of fuel savings. Regardless of the

subsequent actual amount of fuel savings, no adjustment would be made to the

revenue requirement recovered through the capacity cost recovery clause for any

difference between the projected and actual amounts of fuel savings. The

calculation of fuel savings can be reviewed and contested by the intervenors.

In addition, according to FPL, the revenue requirements for West County Unit

3 WEC 3 for 2011 and 2012 would exceed the fuel savings. However,

only the amount equal to the projected fuel savings would be passed through the

capacity cost recovery clause.

In Paragraph 5(b), the Stipulation specifies that the projected non-fuel annual revenue requirements associated with WEC 3 will reflect the costs upon which the cumulative present value revenue requirements were predicated, and pursuant to which a need determination was granted by the Commission in Order No. PSC-08-0591-FOF-EI,[2] as adjusted by the application of a 10.00 percent return on equity (ROE) in lieu of the ROE that was used in the determination of need proceeding. According to FPL, the application of a 10.00 percent ROE as specified by Paragraph 5(b) results in an overall cost of capital of 8.42 percent. In the Final Order, the Commission approved an overall cost of capital of 6.65 percent. The 2011 revenue requirements for WEC 3 based on the cost of capital prescribed in the Stipulation is approximately $14.3 million greater than the revenue requirements for WEC 3 based on the cost of capital approved in the Final Order.[3]

The fuel savings would be passed on to the ratepayers

through the fuel clause on an energy, or kWh basis, while the revenue requirement

would be collected through the capacity cost recovery clause, on a demand, or

kilowatt (kW) basis. While on a total retail basis there would be no impact

from including West County Unit 3 WEC 3, various rate

classes will see slightly different bill impacts depending on their energy

versus demand consumption. For example, the residential class typically places

more demand on the system when compared to their energy consumption. Thus, the

revenue requirement amount allocated to the residential class in the capacity cost

recovery clause would be greater than the corresponding fuel savings amount allocated

to the residential class in the fuel clause. In response to Staff’s Data

Request, FPL projects the 1,000 kWh residential bill to be $100.45 for the

period January through May 2011, prior to the inclusion of West County Unit

3 WEC 3 in rates. For the period June through December 2011,

after the inclusion of West County Unit 3 WEC 3, FPL projects the 1,000 kWh residential bill to be $100.61, or $0.16 higher (including gross

receipts tax). Conversely, industrial customers, who are typically large

energy users, are expected to see a slight reduction in their bills as a result

of the fuel savings attributable to West County Unit 3 WEC 3.

Paragraph 6:

Under Paragraph 6, FPL can petition the Commission to amend its base rates if

its actual, adjusted earned return on equity (ROE) falls

below 9 percent, per its monthly earnings surveillance report (ESR), during the

term of the Stipulation. The Company can petition the Commission to amend base

rates in a general rate proceeding or a limited proceeding. Likewise, any party

can petition the Commission to review FPL’s base rates if the Company’s actual,

adjusted earned ROE exceeds 11 percent, as reported on the Company’s monthly

ESR, during the term of the Stipulation. For May and June 2010, FPL reported achieved ROEs of 11.28 percent and 11.43 percent, respectively. The Company has

requested and received the automatic 31 day extension provided by Rule 25-6.1352,

F.A.C., for its July 2010 ESR. FPL has also received an extension for filing the

2010 Forecasted ESR.

Paragraph 6 does not bar FPL from recovery of costs otherwise contemplated by the Stipulation; does not apply to requests to change FPL’s base rates that would become effective after the Stipulation expires; and does not limit any party’s rights in proceedings to change base rates in proceedings allowed by Paragraph 6.

Paragraph 7: Paragraph 7 addresses the amortization of the $894 million depreciation reserve surplus (Total Depreciation Surplus) the Commission identified in the Final Order. By the terms of this paragraph, FPL would be given flexibility in the amount of reserve surplus amortization it would record in each year of the 3-year settlement period. The Joint Movants have agreed that FPL would amortize an amount of the Total Depreciation Surplus necessary for it to maintain an ROE, measured on an FPSC actual, adjusted basis, of at least 9 percent and no more than 11 percent in each 12-month period of the settlement term. The maximum annual amortization amount is $267 million and the maximum 3-year total amortization amount is $776 million, unless a greater amortization amount is needed to avoid a surveillance report showing earnings of less than 9 percent in any given year. Additionally, FPL is required to use the remaining available Total Depreciation Surplus for the purpose of increasing its earned ROE to at least 9 percent before initiating a petition to increase base rates.

If FPL records less than $267 million in a given year, it is permitted to carry forward and increase the maximum yearly amortization that may be recorded in a subsequent year of the settlement term. For example, if FPL records an amortization of $200 million in 2010 so that its ROE is in the 9 percent to 11 percent range, it would be permitted to carry forward and record in 2011 or 2012 the $67 million difference between the amount booked and the yearly cap of $267 million, in addition to the $267 million capped amount for 2011. To the extent there exists any remaining unamortized reserve surplus at the end of the 3-year settlement period, FPL would amortize it in 2013 in accord with the 4-year amortization period approved in the Final Order unless the Commission requires a different result pursuant to a final rate order effective on or after January 1, 2013.

Paragraph 9: Paragraph 9 provides that the cost of service and rate design issues remain as set forth in the Final Order. This paragraph also allows FPL to request approval of new or revised rate schedules or tariff provisions, provided that such request does not increase any base rates during the term of the Stipulation unless the new or revised tariff is optional.

Staff has reviewed the terms of the Stipulation, and believes that the Stipulation provides a reasonable resolution of the outstanding issues in Docket Nos. 080677-EI and 090130-EI and is in the public interest. Therefore, staff recommends approval of the Stipulation.

Issue 2: Should the Commission grant Thomas Saporito’s Petition for Base Rate Proceeding?

Recommendation:

No. The Commission should not grant the Petition for Base Rate Proceeding. The petition does not meet the requirements of Rule 28-106.201, F.A.C., because it fails to allege any material issue of disputed facts. (Bennett)

Staff Analysis:

SAPORITO’S PETITION

On January 19, 2010, six days after the Commission voted on FPL’s petition for a general rate case, Thomas Saporito filed a Petition for the Conduct of a General Rate Case and Request for Hearing and Leave to Intervene. Saporito asks that the Commission conduct a general investigation and/or a general rate case of FPL’s rates as approved at the January 13, 2010, Agenda Conference. Saporito asks that the Commission determine whether FPL’s rates effective as of that date should be reduced and/or refunded.

Saporito states that he intends to rely upon the evidence and testimony filed in Docket No. 080677-EI. He states that the disputed issues of material fact will include but will not be limited to, whether FPL’s current electric rates should be decreased. Saporito states he reserves the right to identify and develop additional issues as the docket progresses.

STAFF ANALYSIS

Staff recommends the Commission deny Saporito’s petition for base rate proceeding because it fails to meet the criteria established in Rule 28-106.201, F.A.C. Staff believes the petition fails to allege any disputed issues of material fact, which the Commission has not already resolved by the issuance of Order No. PSC-10-0153-FOF-EI.

It is staff’s opinion that this petition would be nothing more than a rehearing of the prior proceeding. The Commission heard, considered, and rendered its decision based on the evidence in the record. Included in the record is testimony filed by Saporito, OPC, and other intervenors, arguing for a rate decrease. Mr. Saporito states he will rely on that same evidentiary record in the new proceeding for a rate decrease. Therefore, the Commission has already resolved all issues of disputed fact which were before it regarding the rates that FPL would charge.

Furthermore, Saporito’s interests were represented in this docket. Saporito participated as a party in the FPL rate case docket. Saporito was granted intervenor status by Order No. PSC-09-0280-PCO -EI, issued April 29, 2010 in this docket. Saporito filed testimony and evidence in the docket, conducted discovery, and filed a prehearing statement. On August 13, 2009, 4 days prior to the Prehearing Conference, Saporito withdrew from the docket citing health reasons, and the withdrawal was accepted by the Prehearing Officer. The hearing was conducted over several weeks in August, September and October. On October 2, 2009, Saporito filed a Withdrawal of his Motion to Withdraw which was denied by the presiding officer as an untimely new petition to intervene. See Order No. PSC-09-0687-PCO -EI, issued October 14, 2009.

While Saporito was not physically present at the technical hearings in the proceeding, his and all other consumers’ interests were represented by both OPC and AG. By statute, OPC provides “legal representation for the people of the state [of Florida] in proceedings before the [Public Service] commission . . . ,” Section 367.0611, F.S. The AG, as chief legal officer of the state of Florida, was granted intervention on behalf of the state of Florida. As part of his position in the request to intervene, the AG cited State ex. Rel. Shevin v. Yarborough, 257 So. 2d 891 (Fla. 1972) for the proposition that “there is no statute which prohibits the Attorney General from representing the State of Florida as a consumer, and offering such evidence and argument as will benefit its citizens.” See Order No. PSC-09-0289-PCO -EI, issued May 1, 2009, in this docket.

CONCLUSION

The petition for a new base rate proceeding seeks a different decision, a reduction of base rates on the same factual record as was used by the Commission to reach its decision in the Final Order. Saporito participated in the issues that were ultimately decided by the Commission in the Final Order. Therefore, Saporito’s petition fails to state any material issue of disputed fact and should be dismissed as failing to meet the requirements of Rule 28-106.201, F.A.C.

Issue 3:

Should these dockets be closed?

Recommendation:

Yes. These dockets should be closed upon the expiration of the time for appeal. (Bennett)

Staff Analysis:

These dockets should be closed upon the expiration of the time for appeal.

[1]

Order No. PSC-08-0591-FOF-EI, issued September 12, 2008, in Docket No. 080203-EI, In re: Petition to determine need for West County Energy Center Unit 3

electrical power plant, by Florida Power & Light Company.

[2] Issued September 12, 2008, in Docket No. 080203-EI, In re: Petition to determine need for West County Energy Center Unit 3 electrical power plant, by Florida Power & Light Company.

[3] Based on the projected revenue requirements for the period June 2011 – December 2011, or the 7 months WEC 3 is expected to be in commercial service in 2011.