|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Division of Regulatory Analysis (Casey, Kennedy, Salak) Office of the General Counsel (Harris, Teitzman) |

||

|

RE: |

Docket No. 100340-TP – Investigation of Associated Telecommunications Management Services, LLC (ATMS) companies for compliance with Chapter 25-24, F.A.C., and applicable lifeline, eligible telecommunication carrier, and universal service requirements.

Docket No. 110082-TP – Initiation of show cause proceedings against American Dial Tone, Inc., All American Telecom, Inc., Bellerud Communications, LLC, BLC Management LLC d/b/a Angles Communication Solutions, and LifeConnex Telecom, LLC for apparent violations of Chapter 364, F.S., Chapters 25-4 and 25-24, F.A.C., and FPSC Orders. |

||

|

AGENDA: |

04/05/11 – Regular Agenda – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

Graham (100340-TP) Administrative (110082-TP) |

||

|

SPECIAL INSTRUCTIONS: |

Issue Nos. 1,2,3, and 10 apply to both dockets; Issue Nos. 4 through 9 apply only to Docket No. 110082-TP. |

||

|

FILE NAME AND LOCATION: |

S:\PSC\RAD\WP\100340.RCM.110082.RCM.DOC |

||

Table of Contents

Issue 9: Should the following ATMS companies be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why they should not be fined collectively $16,448,000 for apparent willful violations of Florida Statutes, the Florida Administrative Code, and Florida PSC orders as follows:

Issue 10: Should this docket be closed?

In 2009, as in past years, Florida was the number one net contributor to the Federal universal service fund (USF), contributing $495,839,000 into the USF while receiving only $221,903,000 from the fund. Florida consumer contributions account for approximately seven percent of the USF monies contributed nationally.[1] In accordance with this Florida Public Service Commission’s (FPSC or Commission) desire for accountability in the federal universal service program, and elimination of fraud, waste, and abuse in the USF, staff monitors all eligible telecommunications carriers (ETCs) in Florida. This investigation was commenced to determine whether ATMS companies are compliant with federal and state regulations regarding universal service. On June 28, 2010, staff opened Docket No. 100340-TP to evaluate ATMS companies’ compliance with Chapter 25-24, Florida Administrative Code, and applicable Lifeline, ETC, and universal service requirements applicable to ATMS companies doing business in Florida.

Florida Lifeline and Link Up

Lifeline was originally implemented in 1985 to ensure that the increase in local rates that

occurred in the aftermath of the breakup of AT&T would not put local phone service out of reach for low-income households. Support for low-income households has long been a partnership between the states and the federal government, and the universal service program historically was administered in cooperation with states.[2] Under authority of Chapter 364.10, Florida Statutes, the Florida PSC adopted the requirements of the federal Lifeline and Link Up programs for Florida’s Lifeline and Link Up programs.

The Florida Lifeline and Link-Up programs enable low-income households to obtain and maintain basic local telephone service. Under the Federal Communications Commission’s (FCC) rules, there are four tiers of monthly federal Lifeline support.

· The first tier of federal support is a $6.50 monthly credit for the federal subscriber line charge (SLC), which is available to all eligible subscribers. All 50 states have approved this tier of support.

· The second tier of federal support is a $1.75 monthly credit that is available to subscribers in those states that have approved the credit. All 50 states have also approved this tier of support.

· The third tier of federal support is one-half the amount of additional state support up to a maximum of $1.75 in federal support. Because Florida carriers provide an additional $3.50 credit to Lifeline customers’ bills,[3] Florida Lifeline subscribers currently receive a total monthly credit of at least $13.50, consisting of $10.00 ($6.50, $1.75, and $1.75) in federal support and $3.50 in state support.[4] The telephone subscriber may receive a credit less than $13.50 if the subscriber’s bill for basic local telephone service is less than the maximum available credit.

· The fourth tier of support, available only to eligible subscribers living on tribal lands, provides an additional credit up to $25.00 per month. This amount is limited so that the credit does not bring the basic local residential rate below $1.00 per month.

Link-Up provides a 50 percent reduction in the telephone service initial installation charge for a traditional landline phone or activation fee for a wireless phone, up to a maximum $30 reduction. Eligible residents of tribal lands may receive up to $100 in discounts on initial connection charges. The $100 maximum is based on the sum of the federally financed 50 percent discount (up to the $30 maximum) available to all qualified low-income individuals, plus a dollar-for-dollar match (up to $70) for connection charges above $60.

Toll Limitation Service (TLS) is an optional service which includes toll blocking (allows subscribers to block outgoing toll calls) and toll control (allows subscribers to limit in advance their toll usage per month or billing cycle). An ETC may not collect a service deposit in order to initiate Lifeline service if the qualifying low-income consumer voluntarily elects toll blocking. If the qualifying low-income consumer elects not to place toll blocking on the line, an ETC may charge a service deposit. Section 364.10(2)(b), Florida Statutes, provides:

An eligible telecommunications carrier shall offer a consumer who applies for or receives Lifeline service the option of blocking all toll calls or, if technically capable, placing a limit on the number of toll calls a consumer can make. The eligible telecommunications carrier may not charge the consumer an administrative charge or other additional fee for blocking the service.

ETCs are allowed to receive reimbursement from the Federal USF for the incremental costs of providing TLS. By definition, incremental costs include the costs that carriers otherwise would not incur if they did not provide toll-limitation service to a given customer. ETCs are not allowed to receive support for their lost revenues in providing toll-limitation services (defined as the amount customers normally would pay for the service).[5] Incremental costs do not include overhead and costs for services or equipment used for non-toll limitation purposes.

The Lifeline, Link-Up, and TLS programs allow an ETC providing services to qualifying low-income consumers to seek and receive reimbursement through the Universal Service Administrative Company (USAC)[6] for revenues it forgoes each month for providing these services. The program was never intended to provide a profit for service providers.[7] In order for a carrier to receive low-income support from USAC, the carrier must first be designated as an ETC. Currently, the Commission has the authority to approve or deny ETC designation for all telecommunications companies, including wireless in Florida.

Investigation Background and Overview

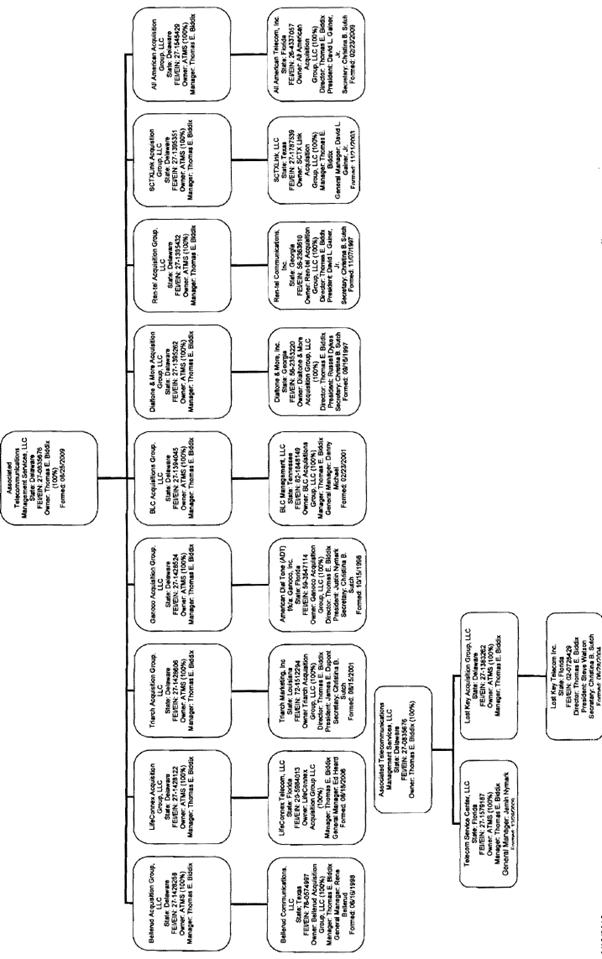

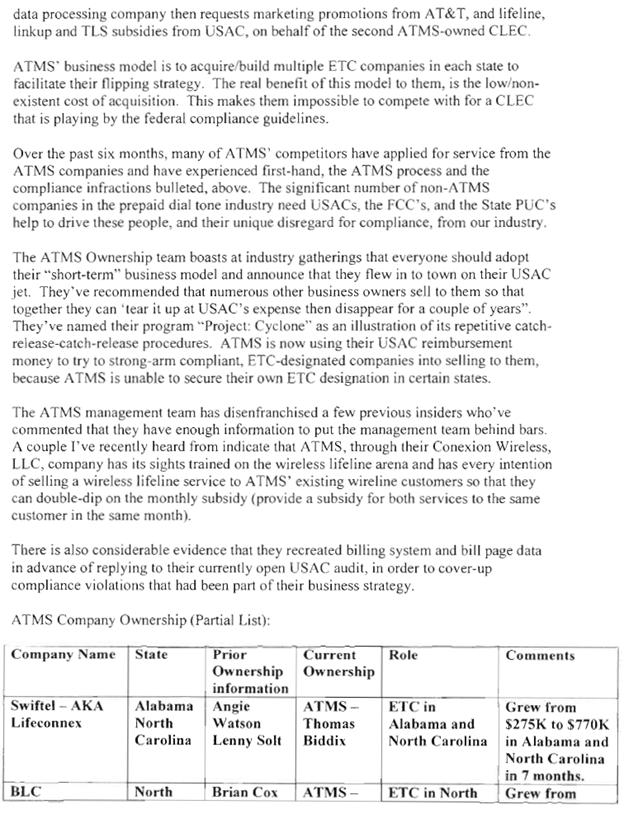

Associated Telecommunications Management Services (ATMS) is a Delaware limited liability company (LLC). On April 26, 2010, in answer to a staff data request, ATMS provided its organizational structure showing ATMS-owned companies (See Attachment A). ATMS companies received approximately $37 million in universal service low-income program monies from the USF on a national basis for the year 2010. Staff noticed the atypical growth in federal universal service low-income program disbursements for some companies under this ownership and management structure, and also received information from multiple anonymous sources that ATMS’ business practices may not be in compliance with state and federal Lifeline and Link-Up regulations. The Commission had received the following allegations against ATMS companies:

· ATMS using multiple companies so that it can claim duplicate subsidies resulting in overpayments from USAC;

· ATMS sharing customer information and forms among ATMS companies;

· USA Freephone (an ATMS marketing company) placing lifeline applicants with any ATMS company it chooses;

· ATMS not providing written disconnect notices to customers;

· ATMS violating Customer Propriety Network Information (CPNI)[8] requirements by sharing wholesale customer information with sister companies;

· ATMS receives Link Up reimbursement from USAC even though ATMS companies do not charge new applicants a hook up fee (resulting in possible over collection from USAC);

· Lifeline subscriber numbers submitted to USAC by ATMS are inaccurate and result in possible over payment of Universal Service funds;

· resold Lifeline lines claimed at USAC by the underlying carrier may be claimed by ATMS companies resulting in possible overpayment of Universal Service funds;

· ATMS companies providing Lifeline service and collecting Universal Service funds prior to customer completion of Lifeline eligibility certification resulting in possible overpayment of Universal Service funds;

· ATMS companies designated as ETCs may provide the required services using 100 percent resale in violation of law;

· All ATMS-associated companies may not have been disclosed to the Commission;

· All ATMS owners and officers may not have been disclosed to the Commission; and,

· ATMS companies may be operating as a single entity in contradiction of ATMS data request response that each of the ATMS companies is independent.

The following nine ATMS companies were the subject of staff’s investigation in Docket No. 100340-TP.[9]

|

Company |

CLEC Certificate Number |

IXC Registration Number |

|

Bellerud Communications, LLC |

TX 464 |

TK 293 |

|

LifeConnex Telecom, LLC, f/k/a Swiftel LLC |

TX 922 |

TK 290 |

|

TriArch Marketing, Inc. |

N/A (Withdrew application 9/14/10) |

N/A (Withdrew application 9/14/10) |

|

American Dial Tone Inc., f/k/a Ganoco, Inc. |

TX 274 |

TK 292 |

|

BLC Management, LLC, d/b/a Angles Communications Solutions |

TX 840 (Cancelled by PSC) TX997(Withdrew application 9/27/10) |

TK 070 (Cancelled by PSC) TK 251 (Withdrew application 9/27/10) |

|

DialTone & More, Inc. |

TX 939 (Cancelled by PSC) |

TK 155 (Cancelled by PSC)

|

|

Ren-Tel Communications, Inc. |

N/A |

N/A |

|

SCTXLink, LLC |

N/A |

N/A |

|

All American Telecom, Inc. |

TX 996 |

N/A |

Bellerud Communications, LLC (Bellerud), LifeConnex Telecom, LLC f/k/a Swiftel LLC (LifeConnex), BLC Management, LLC d/b/a Angles Communications Solutions (BLC), and All American Telecom Inc. (All American Telecom) have all previously applied for ETC status in Florida.[10] The Bellerud and All American Telecom petitions for ETC designation were withdrawn by the companies after staff sent data requests to them. The BLC docket was closed administratively by staff because BLC’s competitive local exchange certificate (CLEC) was cancelled;[11] and CLEC certification in Florida is a condition for receiving landline ETC designation in Florida. LifeConnex withdrew its petition for ETC designation after staff filed a recommendation to deny ETC status to LifeConnex and prior to consideration by Commissioners.[12] American Dial Tone had already received its ETC designation at the time it was purchased by ATMS on September 30, 2009. ATMS’ call center is located in Melbourne, Florida[13] (Telecom Service Center, LLC).

The following chart reflects low-income USF monies received nationally by five ATMS companies from January 2009 through May 2010: LifeConnex; American Dial Tone Inc. (American Dial Tone); Bellerud; TriArch Marketing, Inc. (Triarch); and BLC. ATMS purchased these companies between September 1, 2009, and November 30, 2009. Each of these five companies received ETC designation in at least one state which allows each to file for reimbursement from the USF for revenues it forgoes providing service to Lifeline customers in states where such companies have been designated as an ETC. American Dial Tone is the only ATMS company which presently has ETC designation in Florida.

Staff met with CGM L.L.C. (CGM), a vendor of ATMS, on May 21, 2010, regarding its concerns (See Attachment B) about ATMS’ business practices regarding Lifeline and Link-Up. CGM is a software firm which identifies competitive local exchange company billing disputes with incumbent local exchange companies and produces electronic forms for claims processing including requests for promotional credits. CGM also assists its clients in participating in, and compliance with, federal and state Lifeline reimbursement programs.[14] CGM and ATMS terminated their business relationship in 2009. On December 2, 2010, counsel for ATMS forwarded a letter (Attachment C) signed by Chuck Campbell, Founder and Partner of CGM, describing the discussions Mr. Campbell had with staff and stated that Mr. Campbell did not have any personal knowledge of what he described to staff on May 21, 2010.

On September 7, 2010, staff met with ATMS to discuss staff’s specific concerns related to ATMS companies appearing to provide inaccurate information to regulators and engage in questionable activities; staff also discussed allegations which the Commission had received from other third parties about ATMS companies. Among the additional concerns staff expressed to ATMS were the following:

· the ATMS chief operating officer appeared to have provided false testimony in a regulatory proceeding in South Carolina;

· despite problems with a United States Administrative Company (“USAC”) audit of an ATMS company (LifeConnex), the ATMS owner represented to staff that LifeConnex had “passed” the USAC audit;

· refusal by ATMS to provide Commission staff with a copy of a USAC audit of an ATMS company in Alabama (that also provided service in Florida);

· concerns raised by the USAC audit of an ATMS company in Alabama (obtained from the FCC pursuant to a Freedom of Information Act request);

· ATMS companies may be understating revenue information to the PSC for purposes of calculating the regulatory assessment fee (“RAF”);

· an inaccurate statement was included in an ATMS motion that, “BLC does not have any Florida Lifeline customers;”

· BLC continuing to do business in Florida after its certification had been cancelled for failure to pay RAFs;

· consumer complaints alleging improper disconnects, slamming, and improper bills by ATMS companies.

On January 31, 2011, staff again met with ATMS and presented concerns raised by the investigation. ATMS declined the opportunity to review each staff concern and instead chose to focus on how the matter might be settled. While initially agreeing to submit a proposed settlement by Friday, February 3, 2011, ATMS sought additional time and clarification of what was needed. Staff agreed to additional time and to ATMS providing a framework for a possible settlement. On February 8, 2011, ATMS timely filed a framework for settlement. On that date, pursuant to Section 120.573, Florida Statutes, ATMS companies also filed a Request for Settlement Discussions, Mediation and to Hold Docket in Abeyance. Staff met with ATMS to discuss a possible settlement on February 18, 2011, February 28, 2011, March 7, 2011, March 16, 2011, and March 23, 2011, and conducted a telephone conference with ATMS on March 9, 2011.

The company insisted that any negotiation discussions during these meetings with staff remain confidential and anything discussed during the negotiations could not be used against the company in possible future prosecutory proceedings. On February 21, 2011, after the first meeting, ATMS withdrew, without prejudice, its Request for Settlement Discussions, Mediation and to Hold Docket in Abeyance, noting that settlement discussions were currently on-going. Although ATMS representatives and staff had a total of seven meetings and a conference call, discussions failed to produce a workable resolution of these issues. On March 25, 2011, ATMS filed a “Petition for Mediation and to Hold Docket in Abeyance,” along with a “Request for Oral Argument.” These Petitions are discussed in Issue Nos. 1-3 of this recommendation.

Jurisdiction

Pursuant to Section 364.285(1), F.S., the Commission is authorized to impose upon any entity subject to its jurisdiction a penalty of not more than $25,000 for each day a violation continues, if such entity is found to have refused to comply with or to have willfully violated any lawful rule or order of the Commission, or any provision of Chapter 364, F.S.

A willful violation of a statute, rule or order is one done with an intentional disregard of, or a plain indifference to, the applicable statute or regulation. See, L. R. Willson & Sons, Inc. v. Donovan, 685 F.2d 664, 667 n.1 (D.C. Cir. 1982). Utilities are charged with knowledge of the Commission’s orders, rules, and statutes, and the intent of Section 364.285(1) is to penalize those who affirmatively act in opposition to those orders, rules, or statutes. See, Florida State Racing Commission v. Ponce de Leon Trotting Association, 151 So.2d 633, 634 (Fla. 1963), and. Commercial Ventures, Inc. v. Beard, 595 So.2d 47, 48 (Fla. 1992) (utilities are subject to the rules published in the Florida Administrative Code).

In Order No. 24306, issued April 1, 1991, in Docket No. 890216-TL, In Re: Investigation Into The Proper Application of Rule 25-14.003, F.A.C., Relating To Tax Savings Refund for 1988 and 1989 For GTE Florida, Inc., the Commission, having found that the company had not intended to violate the rule, nevertheless found it appropriate to order it to show cause why it should not be fined, stating that “‘willful’ implies an intent to do an act, and this is distinct from an intent to violate a statute or rule.” Additionally, “[i]t is a common maxim, familiar to all minds that ‘ignorance of the law’ will not excuse any person, either civilly or criminally.” Barlow v. United States, 32 U.S. 404, 411 (1833); see also, Perez v. Marti, 770 So.2d 284, 289 (Fla. 3rd DCA 2000) (ignorance of the law is never a defense). Thus, any intentional act, such as the acts described in this docket, would meet the standard for a “willful violation.”

Staff believes that the regulated ATMS companies have willfully violated applicable rules, statutes, and orders. Willfulness is evident from their alleged indifference to, disregard of, and failure to comply with, such rules, statutes, and orders.

Federal law recognizes that individual states and territories play an important role in accomplishing universal service goals. The FCC also has recognized the important role of the states. Courts have also previously determined that the Telecom Act “plainly contemplates a partnership between the federal and state governments to support universal service,”[15] and that “it is appropriate—even necessary—for the FCC to rely on state action.”[16] The Commission has Florida jurisdiction and authority to impose penalties on the ATMS companies pursuant to the following: Chapter 364, Florida Statutes; Sections 120.80(13)(d) and 364.285, Florida Statutes; Rules 25-24.820 and 25-24.474, Florida Administrative Code.

Should the Commission grant ATMS’ Request for Oral Argument on its Petition for Mediation and to Hold Docket in Abeyance?

Yes. The Commission should grant ATMS’ Request for Oral Argument on its Petition for Mediation and to Hold Docket in Abeyance. Staff recommends allowing ATMS 10 minutes to address this matter. (Harris)

Pursuant to Rule 25-22.0022(1), F.A.C., ATMS filed its Request for Oral Argument concurrently with its Petition for Mediation and to Hold Docket in Abeyance. ATMS is requesting 15 minutes to address the Commission.

The Commission has traditionally granted oral argument upon a finding that oral argument would aid the Commission in its understanding and disposition of the underlying matter. Rule 25-22.0022(3), F.A.C., provides that granting or denying a request for oral argument is within the sole discretion of the Commission.

Staff believes that the Commissioners would benefit from oral argument on ATMS’ Petition for Mediation and to Hold Docket in Abeyance. Accordingly, staff recommends that the Commission grant ATMS’ Request for Oral Argument. Staff further recommends that if the Commission decides to hear oral argument, ATMS should be allowed 10 minutes to address the Commission on this matter. Staff notes that the Commission has discretion to allow ATMS additional time to address the Show Cause issues in this recommendation.

Should the Commission order mediation by an independent mediator?

No. The Commission should not order mediation by an independent mediator. (Harris, Teitzman)

Staff Analysis: While its February 8, 2011, First Request was filed pursuant to Section 120.573, Florida Statutes, in its March 25, 2011, Petition, ATMS cites no legal authority for filing its pleading. ATMS does, however, quote a Florida 5th DCA case describing the benefits of mediation, and two orders issued by the Commission encouraging settlement of contested proceedings. The second of these Commission quotes is actually a quote from the introductory language of a settlement agreement among parties that was approved by the Commission.[17] ATMS also references a third Commission order involving a settlement but does not quote that Order. See Petition at 5-6.

ATMS’ Argument

In support of its Petition, ATMS asserts the following. ATMS purchased nine telephone companies a little over a year ago. Four were doing business in Florida providing service to nearly 9,000 customers. ATMS employs nearly 600 people in Florida providing nationwide services. ATMS does not deny regulatory issues that it failed to discover. Since discovering such issues, it has decided “to bring all activities on site.” This has been done, effective June 2010. In this process there has been “some data corruption” and litigation with third party vendors. ATMS is diligently working to make changes to ensure regulatory requirements are met but this takes time to implement.

ATMS asserts that the Investigation Docket was opened on June 28, 2010, with no information regarding what staff’s investigation concerned. Subpoenas were issued to each ATMS company seeking voluminous and non-jurisdictional information. After filing a Motion to Quash, ATMS worked with staff to narrow the scope of the subpoenas and provided all information. ATMS pledged cooperation with staff to timely resolve issues. ATMS has diligently worked with staff. Numerous meetings were held and ATMS believed that substantial progress had been made. ATMS is ready, willing and able to implement reasonable measures necessary to address issues staff has. It appeared to ATMS that only one issue remained open for resolution. However, at the March 23, 2011, meeting between staff and ATMS, staff “raised new and highly questionable demands that had not been discussed before.” Staff had made up its mind and “no agreement could be reached despite the many hours of work and meetings invested in the settlement process.” Believing that they were close to settlement, ATMS was “surprised by the tenor of the last meeting.”

ATMS argues that “the assistance of an unbiased mediator who can objectively evaluate the law and facts would be extremely helpful in this case.”[18] ATMS asserts that a mediator might bring an efficient, effective and quick resolution to the matter. ATMS recognizes that the Commission is the ultimate decision maker and suggests that the mediation order be treated as a recommended order. This would mitigate costs of litigation as well as staff and Commission resources. An evidentiary hearing could take several weeks and prior to hearing there would be extensive depositions including depositions of staff. Some staff members have been involved in this matter including settlement talks. It would be helpful “to have an objective mediator, who has no connection to or knowledge about these talks, critically evaluate the positions of the parties.” Use of a mediator would require parties “to rely only on documented, verifiable information.” ATMS quotes case law describing the mediation process, a Commission Order favoring settlement of contested proceedings, and an approved settlement agreement. Another Commission settlement order is also cited. ATMS asserts “that mediation would be similarly useful to resolve issues rather than proceed to a full scale evidentiary hearing, with the attendant time and resource commitments of [ATMS], [s]taff, and the Commission.”

ATMS asks the Commission to “order mediation of this matter by an independent mediator and that while such mediation is on-going this docket be held in abeyance pending the results of the mediation.”

Staff Analysis

The following legal standards govern mediation in Commission proceedings. Section 120.573, Florida Statutes, provides that “each announcement of an agency action that affects substantial interests shall advise whether mediation of the administrative dispute for the type of agency action announced is available.” The statute also establishes a timeframe for requesting mediation after such a notice is issued. Id. Rule 28-106.401, Florida Administrative Code, tracks the statutory language. Rule 28-106.402, Florida Administrative Code, provides that a request for mediation must include a “statement of the preliminary agency action.” The block quote from an approved settlement agreement that is relied upon by ATMS and attributed to the Commission is from consolidated show cause and lifeline dockets,[19] each of which would affect the substantial interests of the parties.

In contrast, staff notes the following: 1) No Order Initiating Show Cause has been issued; 2) more generally, no order affecting ATMS’ substantial interests has been issued; 3) consistent with no order being issued, no notice of mediation rights has been issued; 4) no timeframe to request mediation has been triggered; and, 5) while ATMS has expressed concerns, the Petition does not appear to include a “statement of the preliminary agency action” as required by Rule 28-106.402(2), Florida Administrative Code. Staff believes that the Commission has not yet taken preliminary action and thus, the matter is not ripe for mediation under the applicable mediation statute and rules.

Staff has presented regulatory concerns to ATMS and offered ATMS an opportunity to clarify staff’s understanding of facts and events. Staff has also worked with ATMS to attempt to settle the matter. While much progress was made, this process was ultimately unsuccessful and staff is now prepared to recommend that the Commission issue an order requiring ATMS to show cause why it should not be subjected to penalties for violations of applicable statutes, rules and orders.

In essence, by its Petition, ATMS is attempting to shape any show cause recommendation (which is essentially a recommended charging document) that staff might make to the Commission regarding apparent violations by ATMS companies. Staff believes that this is inappropriate and that it would be a bad precedent for parties to mediate Commission show cause charges. Staff believes that an independent mediator simply has no place 1) in the Commission’s determination of whether to issue a show cause order or 2) in determining what violations might be charged in such an order.

Staff believes that there is still an opportunity for settlement of this matter at any point up to the issuance of a final order in a show cause proceeding. To reiterate, in its Petition, ATMS quotes settlement language that was approved by the Commission more than ten months after an order establishing procedure was issued in the Verizon show cause docket.[20] That is not the same as mediating whether a show cause order is issued by the Commission. Finally, ATMS has an opportunity to appear and be heard by the Commission before any show cause order is issued.

Based on the foregoing, staff recommends that the Commission should not order mediation by an independent mediator.

Should the Commission hold these dockets in abeyance pending results of mediation?

No. If the Commission approves staff’s recommendation in Issue 2, the issue of holding the docket in abeyance pending the results of mediation will be moot. (Harris)

If the Commission approves staff’s recommendation in Issue 2, the issue of holding the docket in abeyance pending the results of mediation will be moot. However, if the Commission denies staff’s recommendation in Issue 2, and grants mediation, it should hold the dockets in abeyance pending the results of mediation.

Should American Dial Tone, Inc. be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its Eligible Telecommunications Carrier status in Florida should not be revoked because it is no longer in the public interest based on its apparent willful violation of one or more of the following statutes, rules and orders: Section 364.10(2)(a), Florida Statutes, Section 364.10(2)(e)1, Florida Statutes, Section 364.10(2)(f), Florida Statutes, Section 364.107(3)(a), Florida Statutes, Section 364.24(2), Florida Statutes, Section 364.183(1), Florida Statutes, Rule 25-4.0665(1), Florida Administrative Code, Rule 25-4.118, Florida Administrative Code, Rule 25-24.825(1), Florida Administrative Code, Order No. PSC-06-0298-PAA-TX, Order No. PSC-06-0680-PAA-TL, and Order No. PSC-07-0417-PAA-TL?

Yes, American Dial Tone, Inc. should be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its Eligible Telecommunications Carrier status in Florida should not be revoked because it is no longer in the public interest based on its apparent willful violation of one or more of the following statutes, rules and orders: Section 364.10(2)(a), Florida Statutes, Section 364.10(2)(e)1, Florida Statutes, Section 364.10(2)(f), Florida Statutes, Section 364.107(3)(a), Florida Statutes, Section 364.24(2), Florida Statutes, Section 364.183(1), Florida Statutes, Rule 25-4.0665(1), Florida Administrative Code, Rule 25-4.118, Florida Administrative Code, Rule 25-24.825(1), Florida Administrative Code, Order No. PSC-06-0298-PAA-TX, Order No. PSC-06-0680-PAA-TL, and Order No. PSC-07-0417-PAA-TL. (Casey, Kennedy, Harris)

American Dial Tone was granted ETC status by the FPSC on April 14, 2006.[21] The company was subsequently purchased by ATMS on September 30, 2009. By receiving ETC status in Florida, American Dial Tone is able to receive low-income support from the USF via USAC.

Having been designated an ETC by the Commission, American Dial Tone has used that designation as a platform to overstate Lifeline reimbursement requests it has filed with the federal government. Staff calculates that between January 1, 2010 through May 31, 2010, American Dial Tone has received $1,945,866 more from USAC than it was entitled to receive under the program. This was accomplished by an alleged disregard of applicable state and federal rules, statutes, and orders. Staff believes it may not be in the public interest for this alleged abuse to continue and, consistent with the Commission’s decision in Order No. PSC-08-0090-PAA-TX, in Docket No. 080065-TX,[22] recommends that American Dial Tone should be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its ETC designation in Florida should not be revoked.

The following graph reflects the monies received by American Dial Tone for Florida from the USF since July 2008, and shows the atypical growth after ATMS purchased American Dial Tone on September 30, 2009.

The following table shows the dollar amounts received by American Dial Tone from USAC for Lifeline, Link-Up, and TLS in Florida since becoming an ETC in Florida.[23] The shaded areas reflect the period of time under ATMS ownership.

|

Month/Year |

Lifeline |

Link-Up |

TLS |

Total |

|

January 2011 |

$53,400 |

$17,970 |

$31,720 |

$103,090 |

|

December 2010 |

$97,040 |

$20,220 |

$54,132 |

$171,392 |

|

November 2010 |

$134,901 |

$16,950 |

$72,101 |

$223,952 |

|

October 2010 |

$192,291 |

$143,940 |

$136,592 |

$472,823 |

|

September 2010 |

$243,310 |

$218,370 |

$183,283 |

$644,963 |

|

August 2010 |

$184,501 |

$176,850 |

$142,173 |

$503,524 |

|

July 2010 |

$173,270 |

$72,450 |

$106,989 |

$352,709 |

|

June 2010 |

$209,801 |

$147,210 |

$146,400 |

$503,411 |

|

May 2010 |

$242,260 |

$179,010 |

$171,607 |

$592,877 |

|

April 2010 |

$255,881 |

$199,200 |

$184,124 |

$639,205 |

|

March 2010 |

$164,270 |

$161,820 |

$127,820 |

$453,910 |

|

February 2010 |

$143,350 |

$204,390 |

$129,442 |

$477,182 |

|

January 2010 |

$82,800 |

$83,010 |

$64,837 |

$230,647 |

|

December 2009 |

$62,400 |

$69,600 |

$50,858 |

$182,858 |

|

November 2009 |

$41,821 |

$69,390 |

$40,529 |

$151,740 |

|

October 2009 |

$19,000 |

$11,910 |

$12,856 |

$43,766 |

|

September 2009 |

$15,030 |

$6,690 |

$9,395 |

$31,115 |

|

August 2009 |

$13,732 |

$12,840 |

$8,976 |

$35,548 |

|

July 2009 |

$13,551 |

$13,020 |

$8,966 |

$35,537 |

|

June 2009 |

$12,294 |

$8,880 |

$7,470 |

$28,644 |

|

May 2009 |

$12,678 |

$8,070 |

$7,557 |

$28,305 |

|

April 2009 |

$13,156 |

$4,890 |

$17,428 |

$35,474 |

|

March 2009 |

$13,973 |

$10,770 |

$9,944 |

$34,687 |

|

February 2009 |

$14,495 |

$6,750 |

$15,747 |

$36,992 |

|

January 2009 |

$12,955 |

$13,410 |

$10,698 |

$37,063 |

|

December 2008 |

$11,866 |

$13,830 |

$10,241 |

$35,937 |

|

November 2008 |

$9,345 |

$12,390 |

$9,449 |

$31,184 |

|

October 2008 |

$7,880 |

$10,800 |

$8,082 |

$26,762 |

|

September 2008 |

$6,421 |

$11,670 |

$7,474 |

$25,565 |

|

August 2008 |

$4,253 |

$16,500 |

$7,645 |

$28,398 |

|

July 2008 |

$1,764 |

$10,680 |

$2,227 |

$14,671 |

|

Total |

$2,463,689 |

$1,953,480 |

$1,796,762 |

$6,213,931 |

A) Apparent violations of Florida Statutes

a. Section 364.10(2)(a), Florida Statutes

American Dial Tone failed to file or maintain a Commission-approved tariff or price list price list with the Commission describing its respective Lifeline, Link-Up, and TLS services. American Dial Tone is in apparent violation of Section 364.10(2)(a), Florida Statutes provides that:

…an eligible telecommunications carrier shall provide a Lifeline Assistance Plan to qualified residential subscribers, as defined in a commission-approved tariff or price list, and a preferential rate to eligible facilities as provided for in part II. For the purposes of this section, the term “eligible telecommunications carrier” means a telecommunications company, as defined by s. 364.02, which is designated as an eligible telecommunications carrier by the commission pursuant to 47 C.F.R. s. 54.201.

b. Section 364.10(2)(e)1, Florida Statutes[24]

The USAC disbursement database shows that American Dial Tone received $888,561 from the USF for Florida Lifeline reimbursement during the five-month period of January 2010, through May 2010. Staff’s analysis shows that American Dial Tone had certified Lifeline customer applications[25] for only 22.09 percent of the Florida Lifeline reimbursements received by it during this period. Staff’s review shows that American Dial Tone was overpaid $692,311 from the USF for Florida Lifeline customers from January 2010, through May 2010, because of inaccurate Florida information provided to USAC by American Dial Tone.

The USAC disbursement database shows that American Dial Tone received $827,430 from the USF for Florida Link-Up reimbursement during the period of January 2010, through May 2010. Staff’s analysis shows that American Dial Tone had certified customer applications for only 11.38 percent of the Florida Link-Up reimbursements received by it during this period. Staff’s review shows that American Dial Tone was overpaid $733,290 from the USF for Link-Up customers from January 2010, through May 2010, based on inaccurate Florida information provided to USAC by American Dial Tone.

The USAC disbursement database shows that American Dial Tone received $677,830 from the USF for Florida TLS reimbursement during the period of January 2010, through May 2010. Staff’s analysis shows that American Dial Tone had certified customer applications for only 23.08 percent of the Florida TLS reimbursements received by it during this period. Staff’s review shows that American Dial Tone was overpaid $520,265 from the USF for TLS customers from January 2010, through May 2010, because of inaccurate Florida information provided to USAC by American Dial Tone.

In Question No. 13 of staff’s February 1, 2010 data request to American Dial Tone, staff asked American Dial Tone to provide its procedures regarding preservation of Lifeline customer records. In its February 15, 2010 response, American Dial Tone stated that it retains Lifeline eligibility forms for the life of the account plus 3 years. However, ATMS could not produce a substantial majority of the required Florida Lifeline signed certification forms.

Staff’s review indicates that American Dial Tone was overpaid a total of $1,945,866 from the USF for reimbursement of Florida Lifeline, Link-Up, and TLS customers from January 2010, through May 2010, because it misrepresented the number of certified Florida Lifeline, Link-Up, and TLS customers it was serving when filing its Forms 497 with USAC.[26] These misrepresentations are apparent violations of 364.10(2)(e)1, Florida Statutes, which states:

An eligible telecommunications carrier must notify a Lifeline subscriber of impending termination of Lifeline service if the company has a reasonable basis for believing that the subscriber no longer qualifies. Notification of pending termination must be in the form of a letter that is separate from the subscriber’s bill.

American Dial Tone apparently signs up Lifeline customers over the phone without receiving a signed Lifeline certification form with the idea that the customer will send in a signed Lifeline certification form later. Staff’s review shows American Dial Tone does not have signed Florida Lifeline certifications for the majority of its customers. American Dial Tone apparently was applying for reimbursement at USAC for customers that it did not have signed Lifeline certifications on file as proof of eligibility, and American Dial Tone had a reasonable basis for believing that the uncertified subscribers did not qualify for Lifeline, but failed to notify or terminate those Lifeline customers. Conversely, American Dial Tone had no reasonable basis to believe that such Florida customers were qualified to receive Lifeline service.

c. Section 364.107(3)(a), Florida Statutes

Staff attempted to determine whether Florida Lifeline customers were moved from American Dial Tone to another ATMS company, and if so, whether proper authorization and procedures were followed in accordance with Section 364.107(3)(a), Florida Statutes. By question No. 8 in staff’s June 30, 2010 subpoena to American Dial Tone, staff asked:

If a Florida Lifeline subscriber has been moved from American Dial Tone, Inc. to another Associated Telecommunications Management Service (ATMS) company during the period of January 2010 through May 2010, provide the name of the company each customer was moved to and provide a copy of each customer's authorization to do so.

On October 12, 2010, American Dial Tone responded to question No. 8 of the subpoena by stating, “During the period in question, American Dial Tone did not move any customers from American Dial Tone to another ATMS company.” Staff discovered that this statement was apparently not true; records from American Dial Tone’s underlying carrier show that 90 customers were transferred from American Dial Tone to BLC, and 11 customers were transferred from American Dial Tone to LifeConnex. Both BLC and LifeConnex are ATMS companies.

American Dial Tone apparently moved Lifeline customers from American Dial Tone to another ATMS company without authorization of the customer. In order to accomplish these unauthorized moves between ATMS companies, personal identifying information of the Lifeline customers was apparently shared between the companies in violation of Section 364.107(3)(a), Florida Statutes, which states:

(3)(a) An officer or employee of a telecommunications carrier shall not intentionally disclose information made confidential and exempt under subsection (1),[27] except as:

1. Authorized by the customer;

2. Necessary for billing purposes;

3. Required by subpoena, court order, or other process of court;

4. Necessary to disclose to an agency as defined in s. 119.011 or a governmental entity for purposes directly connected with implementing service for, or verifying eligibility of, a participant in a Lifeline Assistance Plan or auditing a Lifeline Assistance Plan; or

5. Otherwise authorized by law.

d. Section 364.24(2), Florida Statutes

As discussed above, records from American Dial Tone’s underlying carrier show that 90 customers were moved from American Dial Tone to BLC, and 11 customers were moved from American Dial Tone to LifeConnex. In addition, staff conducted an analysis to determine if more than one ATMS company was providing Lifeline service to a consumer at the same time. In a May 18, 2010 data request to LifeConnex, staff asked ATMS to describe what safeguards are in place to insure that no two ATMS companies are receiving Lifeline reimbursement or credits for the same customer. Staff also asked the company to describe what safeguards are in place to prevent ATMS companies from receiving Link-Up reimbursement or credit for the same customer at the same address if that customer moves to another ATMS company. On June 4, 2010, ATMS replied to the data request, stating:

A match-comparison is done based on first name, last name, address, unit number and zip code. Only one entry across all ATMS is allowable per each unique reference. If there already exists a reference, then a new submission is not approved.

This response demonstrates ATMS’ apparent violation of Section 364.24(2), Florida Statutes - Florida Customer Propriety Network Information (CPNI). In addition, based on information provided by ATMS and sorted by staff, staff discovered that 225 Florida Lifeline customers had American Dial Tone and LifeConnex listed as providing them Lifeline service at the same time, at the same address, using the same telephone number, 215 Florida Lifeline customers had American Dial Tone and BLC listed as providing them Lifeline service at the same time, at the same address, using the same telephone number, and 2 Florida Lifeline customers had American Dial Tone and Bellerud listed as providing them Lifeline service at the same time, at the same address, using the same telephone number. In addition, one Florida Lifeline customer had American Dial Tone, LifeConnex, and BLC listed as providing him/her Lifeline service at the same time, at the same address, using the same telephone number.[28]

American Dial Tone could not provide proper customer authorization for any transfers between ATMS companies which constitutes an apparent violation of Section 364.24(2), Florida Statutes. That Section provides:

Any officer or person in the employ of any telecommunications company shall not intentionally disclose customer account records except as authorized by the customer or as necessary for billing purposes, or required by subpoena, court order, other process of court, or as otherwise allowed by law.

In order to accomplish these unauthorized moves between ATMS companies, personal identifying information of the Lifeline customers was apparently shared between the companies in violation of Section 364.107(3)(a), Florida Statutes.

e. Section 364.10(2)(f), Florida Statutes

Staff’s review indicates that American Dial Tone was overpaid a total of $1,945,866 from the USF for reimbursement of Florida Lifeline, Link-Up, and TLS customers from January 2010, through May 2010, because staff believes it misrepresented the number of Florida certified Lifeline, Link-Up, and TLS customers it was serving when filing its Forms 497 with USAC. These misrepresentations are apparent violations of Section 364.10(2)(f), Florida Statutes, which provides:

An eligible telecommunications carrier shall timely credit a consumer’s bill with the Lifeline Assistance credit as soon as practicable, but no later than 60 days following receipt of notice of eligibility from the Office of Public Counsel or proof of eligibility from the consumer. (Emphasis added).

American Dial Tone apparently signs up Lifeline customers over the phone with the idea that the customer will send in a signed Lifeline certification form. Staff’s review shows such forms are not on file for the majority of American Dial Tone Lifeline customers. American Dial Tone apparently was applying for reimbursement at USAC for customers that it did not have signed Lifeline certifications on file as proof of eligibility as required by Section 364.10(2)(f), Florida Statutes. Having failed to receive an eligibility form, the Lifeline credit is untimely, per se, and is impermissibly claimed.

f. Section 364.183(1), Florida Statutes[29]

In responding to staff data requests, it appears American Dial Tone provided the following false or inaccurate information:

1) Staff’s review showed that American Dial Tone’s Lifeline self-certification application had no logo or company indentifying information on the application. Staff’s March 11, 2010 data request No. 15 asked American Dial Tone to explain why there is no company identifying information on its application. Its March 31, 2010 response was “This information has been added to the Lifeline form.” American Dial Tone did not provide a reason why the applications contained no company identifying information. A review of the applications provided by American Dial Tone during this investigation, dated as late as July 2010, showed that American Dial Tone failed to add company identifying information to its applications as it stated it would.

Only 1.6 percent of all American Dial Tone Lifeline applications provided by ATMS and reviewed by staff included a company logo or company identification. This would enable ATMS to place a Lifeline customer with the ATMS company of ATMS’ choice, not the customer’s choice, or claim duplicate USAC reimbursement for the same Lifeline customer by placing the application with more than one ATMS company. Thus, a customer signing up for service with one ATMS company may end up being served by another ATMS company, or customer records may show that it is being served by two or three ATMS companies, as is the case in this docket. Staff’s investigation concludes that ATMS “served” the same customer with one or more ATMS companies.

2) The American Dial Tone Lifeline self-certification application included a listing of qualifying Lifeline programs which the applicant has to check to show he/she participates in a qualifying program. One of the Lifeline qualifying programs listed was “Senior Citizen Low-Income Discount Plan.” The Florida Lifeline program does not have a qualifying program named “Senior Citizen Low-Income Discount Plan.” Staff’s March 11, 2010 data request No. 16 asked American Dial Tone why this program was listed on its Florida Lifeline application. Its March 31, 2010 response was “This option has been removed.” American Dial Tone did not provide a reason why the program was listed on the application. A review of the applications provided by American Dial Tone during this investigation, dated as late as July 2010, showed that American Dial Tone failed to remove the “Senior Citizen Low-Income Discount Plan” from its list of qualifying programs on its Florida Lifeline application as it stated it had. Lifeline certification applications submitted by American Dial Tone show that it did use “Senior Citizen Low-Income Discount Plan” to qualify Lifeline customers in Florida in apparent violation of Rule 25-4.0665(1), Florida Administrative Code.

3) The American Dial Tone Lifeline self-certification application included the statement “I understand that completion of the application does not constitute immediate enrollment in the Lifeline and Link-up programs.” Staff had an issue with this statement based on Rule 25-4.0665, Florida Administrative Code, which provides that an ETC must not impose additional verification requirements on subscribers beyond those which are required in the rule. By staff’s March 11, 2010 data request No. 17, staff asked American Dial Tone why an applicant with a signed Lifeline self-certification application would not be immediately enrolled in the Lifeline and Link-Up program. American Dial Tone’s March 31, 2010 response was “This statement has been removed.” American Dial Tone did not provide a reason why the statement was on the application as requested. A review of the applications provided by American Dial Tone during this investigation dated as late as July 2010, showed that American Dial Tone failed to remove the statement “I understand that completion of the application does not constitute immediate enrollment in the Lifeline and Link-up programs” on its Florida Lifeline application. Requiring additional criteria from Lifeline applicants who self-certify that they participate in a qualifying program is an apparent violation of Order PSC-06-0680-PAA-TL[30] which required all Florida ETCs to adopt Florida’s self-certification process for Lifeline applicants.

4) American Dial Tone’s Lifeline self-certification application includes the statement “I authorize my local telephone company to take all actions possible to keep my service active including providing my personal confidential information to third party companies and/or carriers who may be able to assist in locating alternate telephone service.” Staff advised American Dial Tone that it appears that American Dial Tone is asking the customer for this authorization to be able to switch the customer to other ATMS companies at will. By staff’s March 11, 2010 data request No. 18, staff asked American Dial Tone to explain the reasoning for inclusion of this language. American Dial Tone’s March 31, 2010 response stated “This language has been removed.” American Dial Tone did not provide any reasoning for inclusion of this language on the application as requested. A review of the applications provided by American Dial Tone during this investigation, dated as late as July 2010, showed that American Dial Tone failed to remove this language from its Florida Lifeline application.

Section 364.183(1), Florida Statutes, provides that:

The commission shall have access to all records of a telecommunications company that are reasonably necessary for the disposition of matters within the commission’s jurisdiction. The commission shall also have access to those records of a local exchange telecommunications company’s affiliated companies, including its parent company, that are reasonably necessary for the disposition of any matter concerning an affiliated transaction or a claim of anticompetitive behavior including claims of cross-subsidization and predatory pricing. The commission may require a telecommunications company to file records, reports or other data directly related to matters within the commission’s jurisdiction in the form specified by the commission and may require such company to retain such information for a designated period of time.

By providing allegedly false or inaccurate information, American Dial Tone has failed to comply with the requirements of Section 364.183(1) that it file records, reports, and other data. The Commission has previously addressed a company which made false or inaccurate statements to the Commission when the Commission was seeking information in accordance with Section 364.183(1), Florida Statutes.[31] By Order No PSC-00-1605-AS-TX, issued September 7, 2000, the Commission accepted a settlement offer of $25,000 from Alternative Telecommunications Services, Inc. d/b/a Second Chance Phone for providing false or inaccurate statements to the Commission in responses provided in accordance with Section 364.183(1), Florida Statutes. The customer base of Second Chance Phone was subsequently purchased by Ganoco, Inc. d/b/a American Dial Tone in 2004.

B) Apparent violations of the Florida Administrative Code

- Rule 25-4.0665(1), Florida Administrative Code

Based on information from the company, staff’s review indicates that American Dial Tone was overpaid a total of $1,945,866 from the USF for reimbursement of Florida Lifeline, Link-Up, and TLS customers from January 2010, through May 2010, because staff believes it misrepresented the number of certified Florida Lifeline, Link-Up, and TLS customers it was serving when filing its Forms 497 with USAC. These misrepresentations are apparent violations of Rule 25-4.0665(1), Florida Administrative Code, which states:

(1) A subscriber is eligible for Lifeline service if:

(a) The subscriber is a participant in one of the following federal assistance programs:

1. Medicaid;

2. Food Stamps;

3. Supplemental Security Income (SSI);

4. Temporary Assistance for Needy Families/Temporary Cash Assistance;

5. “Section 8” Federal Public Housing Assistance;

6. Low-Income Home Energy Assistance Program; or

7. The National School Lunch Program – Free Lunch; or

(b) The subscriber’s eligible telecommunications carrier has more than one million access lines and the subscriber’s household income is at or below 150 percent of the federal poverty income guidelines.

American Dial Tone apparently signs up Lifeline customers over the phone with the idea that the customer will send in a signed Lifeline certification form. Staff’s review shows that American Dial Tone does not have certifications for the majority of its customers. Without these forms, ATMS cannot know if the customer is qualified to receive Lifeline service, and nonetheless treats those customers as qualified for Lifeline service and submits claims to the federal government for the Lifeline reimbursement.[32]

As part of the investigation of American Dial Tone’s Lifeline and Link-Up practices, staff reviewed each monthly Form 497 submitted to the USAC by American Dial Tone for Florida. Staff also obtained information from American Dial Tone’s underlying carriers (AT&T and Verizon) in order to compare the number of access lines provided to American Dial Tone by AT&T and Verizon in Florida, and the number of Florida Lifeline, Link-Up, and TLS access lines actually claimed on American Dial Tone’s Forms 497 submitted to the USAC. Staff’s examination indicates that American Dial Tone improperly completed the Forms 497 by claiming multiple thousands of access lines for which no Lifeline customer certification appears to exist, and similarly claimed more Lifeline customers than for which it bought wholesale service.

Staff completed a review to determine how the number of Lifeline lines claimed on Form 497 for reimbursement compares with the number of access lines actually purchased from American Dial Tone’s underlying carriers during the period of the investigation. Staff discovered that American Dial Tone claimed approximately 27.29 percent more lines for Lifeline reimbursement, 21.14 percent more lines for Link-Up reimbursement, and 24.02 percent more lines for TLS reimbursement than it actually purchased from its underlying carriers.[33]

American Dial Tone apparently was applying for reimbursement at USAC for customers that it did not have signed Lifeline certifications on file as proof of eligibility as required by Rule 25-4.0665(1), Florida Administrative Code. More to the point, given the lines claimed versus lines purchased, the customers may not have existed at all.

A review of American Dial Tone’s subscriber list and the certified Lifeline applications which were provided by American Dial Tone show that American Dial Tone furnished Lifeline service to 27 accounts which had a person other than the subscriber at the same address qualify for the Lifeline service. For example, a family member such as a wife, brother, sister, or child may be the one who qualifies for Lifeline in the household, but the telephone subscriber who is the customer of record is the husband. This is an apparent violation of Rule 25-4.0665(1), Florida Administrative Code, which provides that the subscriber is the one who must qualify for Lifeline.

The American Dial Tone Lifeline self-certification application included a listing of qualifying Lifeline programs which the applicant has to check to show he/she participates in a qualifying program. One of the Lifeline qualifying programs listed was “Senior Citizen Low-Income Discount Plan.” The Florida Lifeline program does not have a qualifying program named “Senior Citizen Low-Income Discount Plan.” Lifeline certification applications submitted by American Dial Tone show that it did use “Senior Citizen Low-Income Discount Plan” to qualify Lifeline customers in Florida in apparent violation of Rule 25-4.0665(1), Florida Administrative Code.

- Rule 25-4.118, Florida Administrative Code

Staff attempted to determine whether Lifeline customers were moved from American Dial Tone to another ATMS company, and if so, whether proper authorization and procedures were followed in accordance with Rule 25-4.118(1), Florida Administrative Code. By question No. 8 in staff’s June 30, 2010 subpoena to American Dial Tone, staff asked:

If a Florida Lifeline subscriber has been moved from American Dial Tone, Inc. to another Associated Telecommunications Management Service (ATMS) company during the period of January 2010 through May 2010, provide the name of the company each customer was moved to and provide a copy of each customer's authorization to do so.

On October 12, 2010, American Dial Tone responded to question No. 8 of the subpoena by stating, “During the period in question, American Dial Tone did not move any customers from American Dial Tone to another ATMS company.” Staff discovered that this statement was apparently not true; records from American Dial Tone’s underlying carrier show that 90 customers were transferred from American Dial Tone to BLC, and 11 customers were transferred from American Dial Tone to LifeConnex. Both BLC and LifeConnex are ATMS companies.

American Dial Tone apparently moved Lifeline customers from American Dial Tone to another ATMS company without approval of the customer in apparent violation of Rule 25-4.118(1), Florida Administrative Code, which provides that “The provider of a customer shall not be changed without the customer’s authorization.”[34] American Dial Tone has not produced records, e.g., letters-of-authorization or third-party tape recordings authorizing these transfers, required by Rule 25-4.118, Florida Administrative Code.

- Rule 25-24.825(1), Florida Administrative Code

American Dial Tone failed to file or maintain a price list with the Commission describing its respective Lifeline, Link-Up, and TLS services. American Dial Tone is in apparent violation of Rule 25-24.825(1), Florida Administrative Code, which provides that:

Prior to providing service, each company subject to these rules shall file and maintain with the Commission a current price list which clearly sets forth the following information for the provision of residential dial tone, single-line business dial tone, and dial tone with any combination of the services included as part of basic local telecommunications services, as defined in Section 364.02(2), F.S.

C) Apparent violations of the Florida Public Service Commission Orders

- Order PSC-06-0298-PAA-TX, issued April 14, 2006[35]

By Order PSC-06-0298-PAA-TX, issued April 14, 2006, the Commission granted American Dial Tone ETC designation. The Order states that “American Dial Tone has acknowledged the requirements of the Florida Lifeline program and has agreed to adhere to the program…” (Page 8). The Order also states that “American Dial Tone has indicated that it will abide by all Florida Statutes, Rules, and Commission Orders regarding ETCs.” Based on staff’s review, American Dial Tone apparently is not abiding by all Florida Statutes, Rules, and Commission Orders regarding ETCs, which is a violation of a condition of the Commission granting ETC status.

- Order PSC-06-0680-PAA-TL, issued August 7, 2006[36]

By Order No. PSC-05-0153-AS-TL, issued February 8, 2005, the Commission approved settlement proposals filed by BellSouth, Embarq Florida, Inc., and Verizon to implement a simplified Florida Lifeline and Link-Up certification process. The settlement proposal explained that all a Florida Lifeline applicant would have to do is request the form from the company and it would be sent to the applicant within three business days. In describing the approved self-certification process, the Order states that “Once the form is received by BellSouth, the customer would be enrolled in the Lifeline program and receive a $13.50 Lifeline credit each month” (Page 2). (Emphasis added). By Order PSC-06-0680-PAA-TL, issued August 7, 2006, the FPSC expanded this process by requiring all ETCs to adopt this method of enrollment for the Lifeline and Link-Up programs.

American Dial Tone apparently signs up Lifeline customers for Lifeline Benefits over the phone with the idea that the customer will send in a signed Florida Lifeline certification form. This is an apparent violation of Order PSC-06-0680-PAA-TL, which states that once the form was received by the company, the customer would be enrolled in the Lifeline program.

- Order PSC-07-0417-PAA-TL, issued May 11, 2007[37]

By PSC-07-0417-PAA-TL, issued May 11, 2007, the Commission addressed a petition by the Office of Public Counsel and AARP which was jointly filed with the FPSC requesting that it order local exchange telecommunications companies in Florida to implement practices and procedures with the Department of Children and Families (DCF) to automatically enroll eligible customers in the Lifeline telephone program. In that Order, the Commission explained the Simplified-Certification process as follows:

Simplified-Certification Form --- By Order No. PSC-05-0153-AS-TL, issued February 8, 2005, in Docket No. 040604-TL, we approved a proposal which allows Lifeline eligible customers to simply sign a document certifying “under penalty of perjury” that the customer participates in one of the Florida Lifeline eligible programs and identifying the qualifying program. This process replaced the previous procedure whereby Lifeline applicants had to provide proof that they are enrolled in one of the qualifying programs. Once completed, the simplified-certification form is submitted via mail or fax to the appropriate ETC to be enrolled in Lifeline. On August 7, 2006, we ordered all ETCs to adopt the simplified-certification enrollment process. (Emphasis added).

American Dial Tone apparently signs up customers for Lifeline Benefits over the phone with the idea that the customer will send in a signed Lifeline certification form at a later time. This is an apparent violation of Order PSC-07-0417-PAA-TL, which extends the requirements of Order No. PSC-05-0153-AS-TL to all Florida ETCs (including American Dial Tone) that once the simplified-certification form is completed, the ETC can enroll the customer in Lifeline and receive benefits.

D) Designation and Revocation of ETC Status

State commissions have the primary responsibility for performing ETC designations. 47 C.F.R. Section 54.201(c), provides that:

Upon request and consistent with the public interest, convenience, and necessity, the state commission may, in the case of an area served by a rural telephone company, and shall, in the case of all other areas, designate more than one common carrier as an eligible telecommunications carrier for a service area designated by the state commission, so long as each additional requesting carrier meets the requirements of paragraph (d) of this section. Before designating an additional eligible telecommunications carrier for an area served by a rural telephone company, the state commission shall find that the designation is in the public interest.

47 C.F.R.§54.201(d), provides that carriers designated as ETCs must, throughout the designated service area: (1) offer the services that are supported by federal universal support mechanisms either using their own facilities or a combination of their own facilities and the resale of another carrier’s services, and (2) advertise the availability of such services and the related charges therefore using media of general distribution.

In addition to state commissions having the primary responsibility for granting ETC designations, they also possess the authority to rescind ETC designations for failure of an ETC to comply with the requirements of section 214(e) of the Telecommunications Act or any other conditions imposed by the state.[38] The FCC found that individual state commissions are uniquely qualified to determine what information is necessary to ensure that ETCs are complying with all applicable requirements, including state-specific ETC eligibility requirements.[39] The FCC expounded on state authority to revoke ETC designations in Order FCC 00-248, which states:

In addition, we note that ETC designation only allows the carrier to become eligible for federal universal service support. Support will be provided to the carrier only upon the provision of the supported services to consumers. We note that ETC designation prior to the provision of service does not mean that a carrier will receive support without providing service. We also note that the state commission may revoke a carrier’s ETC designation if the carrier fails to comply with the ETC eligibility criteria. (Id. At ¶15) (Emphasis added). (Internal citations omitted).

Pursuant to Section 214 of the Telecom Act of 1996, the FCC and state commissions must determine that an ETC designation is consistent with the public interest, convenience and necessity for rural areas. Congress did not establish specific criteria to be applied under the public interest tests in Sections 214 or 254. The public interest benefits of a particular ETC designation must be analyzed in a manner that is consistent with the purposes of the Act itself, including the fundamental goals of preserving and advancing universal service; ensuring the availability of quality telecommunications services at just, reasonable, and affordable rates; and promoting the deployment of advanced telecommunications and information services to all regions of the nation, including rural and high-cost areas.[40] The FPSC has found that an affirmative determination that an ETC designation is in the public interest must be made, regardless of whether the applicant seeks designation in an area served by a rural or non-rural carrier.[41]

The FPSC has previously exercised its authority to revoke an ETC designation. In Docket No. 080065-TX, the FPSC found it was no longer in the public interest to allow Vilaire Communications, Inc. to retain ETC designation in Florida and revoked its ETC designation for misuse of the Federal Universal Service Fund.

E) Conclusion

Staff’s analysis indicates that American Dial Tone had certified customer Lifeline applications for only 22.09 percent of the Florida Lifeline reimbursements, 11.38 percent of the Florida Link-Up reimbursements, and 23.08 percent of the Florida TLS reimbursements it received. Staff’s analysis also indicates that American Dial Tone misrepresented the number of certified Florida Lifeline, Link-Up, and TLS customers it was serving when it filed its Forms 497 with USAC. Staff believes American Dial Tone received an overpayment by USAC to American Dial Tone of $1,945,866 from the USF for January 2010, through May 2010. American Dial Tone failed to acknowledge transfers of Florida Lifeline customers between ATMS companies, and failed to maintain customer authorization for the transfers. American Dial Tone used a “Senior Citizen Low-Income Discount Plan” to qualify Lifeline customers in Florida. These actions represent apparent violations of the rules, statutes and orders discussed above.

In its petition for ETC designation, American Dial Tone indicated that it would abide by all Florida Statutes, Rules, and Commission Orders regarding ETCs.[42] ETC designation is a privilege which is granted to qualified companies by the FPSC, it is not a right. Staff believes that American Dial Tone may have forfeited that privilege based on its apparent violations of Florida statutes, FPSC rules, or FPSC orders. Thus, staff believes it may no longer be in the public interest to allow American Dial Tone to retain ETC designation in Florida. Therefore, staff recommends that American Dial Tone, Inc. should be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its Eligible Telecommunications Carrier status in Florida should not be revoked because it is no longer in the public interest based on its apparent willful violation of one or more of the following statutes, rules and orders: Section 364.10(2)(a), Florida Statutes, Section 364.10(2)(e)1, Florida Statutes, Section 364.10(2)(f), Florida Statutes, Section 364.107(3)(a), Florida Statutes, Section 364.24(2), Florida Statutes, Section 364.183(1), Florida Statutes, Rule 25-4.0665(1), Florida Administrative Code, Rule 25-4.118, Florida Administrative Code, Rule 25-24.825(1), Florida Administrative Code, Order No. PSC-06-0298-PAA-TX, Order No. PSC-06-0680-PAA-TL, and Order No. PSC-07-0417-PAA-TL.

Should Bellerud Communications, LLC be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its Competitive Local Exchange Company Certificate No. 7563 should not be cancelled pursuant to Rule 25-24.572(1), Florida Administrative Code, for apparent violation of the terms and conditions under which authority was originally granted, apparent violation of Commission rules or orders, or violation of Florida Statutes?

Yes. Staff recommends that Bellerud Communications, LLC be ordered to show cause, in writing within 21 days from the issuance of the Commission’s show cause order, why its Competitive Local Exchange Company Certificate No. 7563 should not be cancelled pursuant to Rule 25-24.572(1), Florida Administrative Code, for apparent violation of the terms and conditions under which authority was originally granted, apparent violation of Commission rules or orders, or violation of Florida Statutes. (Casey, Kennedy, Harris)

State Discount Telephone received Florida CLEC certificate No. 7563 on August 18, 2000.[43] In its Order granting the certificate, the Commission noted that it appeared that State Discount Telephone, LLC had sufficient technical, financial, and managerial capability to provide competitive local exchange service as required by Section 364.337(1), Florida Statutes. On January 13, 2003, the FPSC acknowledged a name change from State Discount Telephone, LLC to Bellerud Communications, LLC (Bellerud).[44] On September 5, 2009, ATMS purchased Bellerud. On September 23, 2009, Bellerud filed a petition requesting ETC designation in the state of Florida.[45] On March 3, 2010, Bellerud withdrew its ETC application after receiving staff’s second data request dated March 1, 2010. Staff conducted a review of Bellerud’s technical, financial, and managerial capability to operate a telecommunications company in Florida.

A) Managerial Capability

Section 364.337(1), Florida Statutes provides that:

The commission shall grant a certificate of authority to provide competitive local exchange service upon a showing that the applicant has sufficient technical, financial, and managerial capability to provide such service in the geographic area proposed to be served.

- ATMS Owner

A May 18, 2010 staff data request to LifeConnex requested additional information on a statement made by the owner of ATMS that LifeConnex passed a USAC low-income program audit in Alabama. Staff asked for a copy of all correspondence between USAC and LifeConnex pertaining to the audit including the draft audit results provided by USAC. In a August 20, 2010 letter to the PSC Director of the Regulatory Analysis Division, ATMS responded that “at no time before or after the purchase of LifeConnex on September 1, 2009, was the ATMS owner led to believe by USAC staff that there were any issues or problems regarding the audit.” It appears that this statement is not true. The USAC audit result findings[46] were e-mailed to the ATMS owner on February 12, 2010. E-mail correspondence provided to the PSC by ATMS shows that the ATMS owner forwarded the audit results to three other people on February 13, 2010. The USAC LifeConnex audit findings are similar to staff’s conclusions in its investigation.

- ATMS Chief Operating Officer

The ATMS Chief Operating Officer provided Direct Testimony at the South Carolina PSC dated February 8, 2010, in which he testified that LifeConnex had not been audited by USAC or any other entity pertaining to Lifeline and Link-Up. In a subsequent June 23, 2010 meeting with the South Carolina PSC, ATMS admitted that a USAC audit of LifeConnex had been going on for approximately three years. The South Carolina PSC Office of Regulatory staff, in its July 7, 2010 Motion to Dismiss LifeConnex’s ETC application stated:

Mr. Watson states in his February 8, 2010 prefiled testimony that LifeConnex has not been audited by USAC, or any other entity, with regard to Lifeline and Link-Up. (Test. p. 19, lines 2-4). ORS representatives have reviewed the filings of LifeConnex in other jurisdictions as well as at the FCC and have spoken to individuals at the Universal Service Administration Company (“USAC”). Thus, ORS was made aware through those conversations that the Company is currently being audited by USAC. During the June 23, 2010 meeting, ORS was informed that the USAC audit had been going on for approximately three (3) years, which is inconsistent with the prefiled testimony. ORS was also informed by the Company at the June 23, 2010 meeting that the results of USAC’s audit will be released in July/August of 2010. ORS is concerned that the Company stated in its prefiled testimony that it was not subject to an audit by USAC when in fact it had been subject to an audit for three years.[47]

LifeConnex subsequently withdrew its Application for Designation as an Eligible Telecommunications Carrier in South Carolina.

B) Apparent violations of the Florida Statutes

- Section 364.107(3)(a), Florida Statutes

Staff attempted to determine whether Florida Lifeline customers were moved from Bellerud to another ATMS company, and if so, whether proper authorization and procedures were followed in accordance with Section 364.107(3)(a), Florida Statutes. By question No. 4 in staff’s July 1, 2010 subpoena to Bellerud, staff asked:

If a Florida Lifeline subscriber has been moved from Bellerud, Inc. to another Associated Telecommunications Management Service (ATMS) company during the period of January 2010 through May 2010, provide the name of the company each customer was moved to and provide a copy of each customer's authorization to do so.

On October 12, 2010, Bellerud responded to question No. 4 of the subpoena by stating, “During the period in question, Bellerud did not move any customers from Bellerud to another ATMS company.” Staff discovered that this statement was apparently not true; records from Bellerud’s underlying carrier show that two Florida Lifeline customers were moved from Bellerud to BLC, and two Florida Lifeline customers were moved from Bellerud to American Dial Tone. Both BLC and American Dial Tone are ATMS companies.

Bellerud apparently moved Lifeline customers from Bellerud to another ATMS company without authorization of the customer. In order to accomplish these unauthorized moves between ATMS companies, personal identifying information of the Lifeline customers was apparently shared between the companies in violation of Section 364.107(3)(a), Florida Statutes, which states:

(3)(a) An officer or employee of a telecommunications carrier shall not intentionally disclose information made confidential and exempt under subsection (1),[48] except as:

1. Authorized by the customer;

2. Necessary for billing purposes;

3. Required by subpoena, court order, or other process of court;

4. Necessary to disclose to an agency as defined in s. 119.011 or a governmental entity for purposes directly connected with implementing service for, or verifying eligibility of, a participant in a Lifeline Assistance Plan or auditing a Lifeline Assistance Plan; or

5. Otherwise authorized by law.

- Section 364.24(2), Florida Statutes