Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

|

DATE:

|

May 12, 2011

|

|

TO:

|

Office of Commission Clerk (Cole)

|

|

FROM:

|

Office of the General Counsel (Harris,

Teitzman)

Division of Regulatory

Analysis (Kennedy, Salak)

|

|

RE:

|

Docket No. 100340-TP – Investigation of Associated Telecommunications

Management Services, LLC (ATMS)

companies for compliance with Chapter 25-24, F.A.C., and applicable lifeline,

eligible telecommunication carrier, and universal service requirements.

Docket No. 110082-TP – Initiation

of show cause proceedings against American Dial Tone, Inc., All American

Telecom, Inc., Bellerud Communications, LLC, BLC

Management LLC d/b/a Angles Communication Solutions, and LifeConnex Telecom,

LLC for apparent violations of Chapter 364, F.S., Chapters 25-4 and 25-24,

F.A.C., and FPSC Orders.

|

|

AGENDA:

|

05/24/11 – Regular Agenda – Decision on Offer of Settlement – Final

Agency Action - Interested Persons May Participate

|

|

COMMISSIONERS

ASSIGNED:

|

All Commissioners

|

|

PREHEARING

OFFICER:

|

Graham (100340-TP)

Administrative

(110082-TP)

|

|

CRITICAL DATES:

|

None

|

|

SPECIAL

INSTRUCTIONS:

|

None

|

|

FILE NAME AND LOCATION:

|

S:\PSC\GCL\WP\100340.RCM.DOC

|

|

|

|

Case Background

In

2009, as in past years, Florida

was the number one net contributor to the Federal universal service fund

(“USF”), contributing $495,839,000 into the USF while receiving only $221,903,000

from the fund. Florida

consumer contributions account for approximately seven percent of the USF

monies contributed nationally. In accordance with this Florida Public

Service Commission’s (FPSC or Commission) desire for accountability in the

federal universal service program, and elimination of fraud, waste, and abuse

in the USF, staff monitors all eligible telecommunications carriers (“ETC”) in Florida. On June 28, 2010, staff opened Docket No.

100340-TP to

evaluate Associated Telecommunications Management Services’ (“ATMS”) compliance with Chapter 25-24, Florida

Administrative Code, and applicable Lifeline, ETC,

and universal service requirements applicable to ATMS

companies doing business in Florida. As a result of its investigation, on March

24, 2011, staff opened Docket Number 110082-TP in order to recommend the initiation of a show

cause proceeding against ATMS.

Florida Lifeline and Link Up

Lifeline

was originally implemented in 1985 to ensure that the increase in local rates

that occurred in the aftermath of the breakup of AT&T would not put

local phone service out of reach for low-income households. Support for

low-income households has long been a partnership between the states and the

federal government, and the universal

service program historically was administered in cooperation with states.

Under authority of Chapter 364.10, Florida Statutes, the Florida PSC adopted the requirements of the federal

Lifeline and Link Up programs for Florida’s

Lifeline and Link Up programs.

The

Lifeline, Link-Up, and Toll Limitation Services (“TLS”)

programs allow an ETC providing

services to qualifying low-income consumers to seek and receive reimbursement

through the Universal Service Administrative Company (“USAC”) for revenues it forgoes each month for

providing these services. The program was never intended to provide a profit for

service providers. In order for a carrier to receive

low-income support from USAC, the carrier must first be designated as an ETC.

Currently, the Commission has the authority to approve or deny ETC designation for all telecommunications

companies, including wireless in Florida.

Investigation Background and

Overview

Associated Telecommunications Management

Services is a Delaware

limited liability company (“LLC”). On

April 26, 2010, in answer to a staff data request, ATMS

provided its organizational structure showing ATMS-owned

companies, including American Dial Tone, Inc. (“ADT”), All American Telecom,

Inc. (“All American Telecom”), Bellerud Communications, LLC (“Bellerud”), BLC Management LLC d/b/a Angles Communication

Solutions (“BLC”), and LifeConnex

Telecom, LLC (“LifeConnex”). ATMS companies received approximately $37 million

in universal service low-income program monies from the USF on a national basis

for the year 2010. Staff noticed the

atypical growth in federal universal service low-income program disbursements

for some companies under this ownership and management structure, and also

received information from multiple anonymous sources that ATMS’ business practices may not be in compliance

with state and federal Lifeline and Link-Up regulations. The Commission had received the following allegations against ATMS companies:

·

ATMS using multiple companies so that it can claim duplicate

subsidies resulting in overpayments from

USAC;

·

ATMS sharing customer information and forms among ATMS companies;

·

USA Freephone (an ATMS marketing company) placing lifeline applicants with any ATMS company it chooses;

·

ATMS not providing written disconnect notices to customers;

·

ATMS violating Customer Propriety Network Information (CPNI) requirements by sharing

wholesale customer information with sister companies;

·

ATMS receives Link Up reimbursement from USAC even though ATMS companies do not charge new applicants a hook

up fee (resulting in possible over collection from USAC);

·

Lifeline subscriber numbers

submitted to USAC by ATMS are inaccurate and result in possible over payment of

Universal Service funds;

·

resold Lifeline lines claimed at

USAC by the underlying carrier may be claimed by ATMS companies resulting in possible overpayment of Universal

Service funds;

·

ATMS companies providing Lifeline service and collecting

Universal Service funds prior to customer completion of Lifeline eligibility

certification resulting in possible overpayment of Universal Service funds;

·

ATMS companies designated as ETCs may provide the required

services using 100 percent resale in violation of law;

·

All ATMS-associated companies may not have been disclosed to the

Commission;

·

All ATMS owners and officers may not have been disclosed to the

Commission; and,

·

ATMS companies may be operating as a single entity in

contradiction of ATMS data request

response that each of the ATMS

companies is independent.

The following nine ATMS

companies were the initial subject of staff’s investigation in Docket No. 100340-TP.

|

Company

|

CLEC

Certificate Number

|

IXC

Registration Number

|

|

Bellerud Communications, LLC

|

TX 464

|

TK 293

|

|

LifeConnex Telecom, LLC, f/k/a Swiftel LLC

|

TX 922

|

TK 290

|

|

TriArch Marketing, Inc.

|

N/A (Withdrew application 9/14/10)

|

N/A (Withdrew application 9/14/10)

|

|

American Dial Tone Inc., f/k/a Ganoco, Inc.

|

TX 274

|

TK 292

|

|

BLC Management, LLC, d/b/a Angles Communications

Solutions

|

TX 840 (Cancelled by PSC)

TX997(Withdrew application 9/27/10)

|

TK 070 (Cancelled by PSC)

TK 251 (Withdrew application 9/27/10)

|

|

DialTone & More, Inc.

|

TX 939 (Cancelled by PSC)

|

TK 155 (Cancelled by PSC)

|

|

Ren-Tel Communications, Inc.

|

N/A

|

N/A

|

|

SCTXLink, LLC

|

N/A

|

N/A

|

|

All American Telecom, Inc.

|

TX 996

|

N/A

|

Bellerud,

LifeConnex, BLC, and All American

Telecom have all previously applied for ETC

status in Florida. The

Bellerud and All American Telecom petitions for ETC

designation were withdrawn by the companies after staff sent data requests to

them. The BLC

docket was closed administratively by staff because BLC’s

competitive local exchange certificate (CLEC)

was cancelled and CLEC

certification in Florida is a condition for

receiving landline ETC designation

in Florida. LifeConnex withdrew its petition for ETC designation after staff filed a recommendation

to deny ETC status to LifeConnex

and prior to consideration by Commissioners.

American Dial Tone had already received its ETC

designation at the time it was purchased by ATMS

on September 30, 2009.

The

following chart reflects low-income USF monies received nationally by five ATMS companies from January 2009 through May 2010:

LifeConnex; American Dial Tone; Bellerud; TriArch Marketing, Inc. (Triarch); and BLC. ATMS

purchased these companies between September 1, 2009, and November 30,

2009. Each of these five companies

received ETC designation in at

least one state which allows each to file for reimbursement from the USF for revenues it forgoes providing service to Lifeline

customers in states where such companies have been designated as an ETC.

American Dial Tone is the only ATMS

company which presently has ETC

designation in Florida.

On September 7, 2010, staff met with ATMS to discuss staff’s specific concerns related

to ATMS companies appearing to

provide inaccurate information to regulators and engaging in questionable

activities; staff also discussed allegations which the Commission had received

from other third parties about ATMS

companies. Among the additional concerns

staff expressed to ATMS

were the following:

·

the ATMS chief operating officer appeared to have provided false

testimony in a regulatory proceeding in South

Carolina;

·

despite problems with a United

States Administrative Company (“USAC”) audit of an ATMS company (LifeConnex), the ATMS

owner represented to staff that LifeConnex had “passed” the USAC audit;

·

refusal by ATMS to provide Commission staff with a copy of a USAC audit

of an ATMS company in Alabama (that also provided service in Florida);

·

concerns raised by the USAC

audit of an ATMS company in Alabama

(obtained from the FCC pursuant to a Freedom of Information Act request);

·

ATMS companies may be understating revenue information to the PSC for purposes of calculating the regulatory

assessment fee (“RAF”);

·

an inaccurate statement was

included in an ATMS motion that, “BLC

does not have any Florida Lifeline customers;”

·

BLC continuing to do business in Florida after its certification had been

cancelled for failure to pay RAFs;

·

consumer complaints alleging improper

disconnects, slamming, and improper bills by ATMS

companies.

On January 31, 2011, staff again met with ATMS and presented concerns raised by the

investigation. ATMS

declined the opportunity to review each staff concern and instead chose to

focus on how the matter might be settled.

While initially agreeing to submit a

proposed settlement by Friday, February 3, 2011, ATMS

sought additional time and clarification of what was needed. Staff agreed to additional time and to ATMS providing a framework for a possible

settlement. On February 8, 2011, ATMS timely filed a framework for settlement. On that date, pursuant to Section 120.573,

Florida Statutes, ATMS companies

also filed a Request for Settlement Discussions, Mediation and to Hold Docket

in Abeyance. Staff met with ATMS to discuss a possible settlement on February

18, 2011, February 28, 2011, March 7, 2011, March 16, 2011, and March 23, 2011,

and conducted a telephone conference with ATMS

on March 9, 2011.

The company

insisted that any negotiation discussions during these meetings with staff

remain confidential and anything discussed during the negotiations could not be

used against the company in possible future prosecutory proceedings. On February 21, 2011, after the first

meeting, ATMS withdrew,

without prejudice, its Request for Settlement Discussions, Mediation

and to Hold Docket in Abeyance, noting that settlement discussions were

currently on-going. Although ATMS representatives and staff had a total of seven

meetings and a conference call during February and March, those discussions

failed to produce a workable resolution of the issues, and on March 25, 2011, ATMS filed a “Petition for Mediation and to Hold

Docket in Abeyance,” along with a “Request for Oral Argument.”

On March 29, 2011, staff filed a combined

Recommendation in Dockets 100340-TP

and 110082-TP,

recommending the Commission deny ATMS’ Petition for Mediation and initiating show

cause proceedings against ADT, Bellerud, LifeConnex, BLC,

and All American Telecom.

Staff’s investigation concluded that American Dial Tone apparently

misrepresented the number of certified Florida Lifeline, Link-Up, and TLS customers it was serving when it filed its 497

forms with USAC. This appeared to result

in an

overpayment by USAC to American Dial Tone of $1,945,866 from the USF for

January 2010, through May 2010.

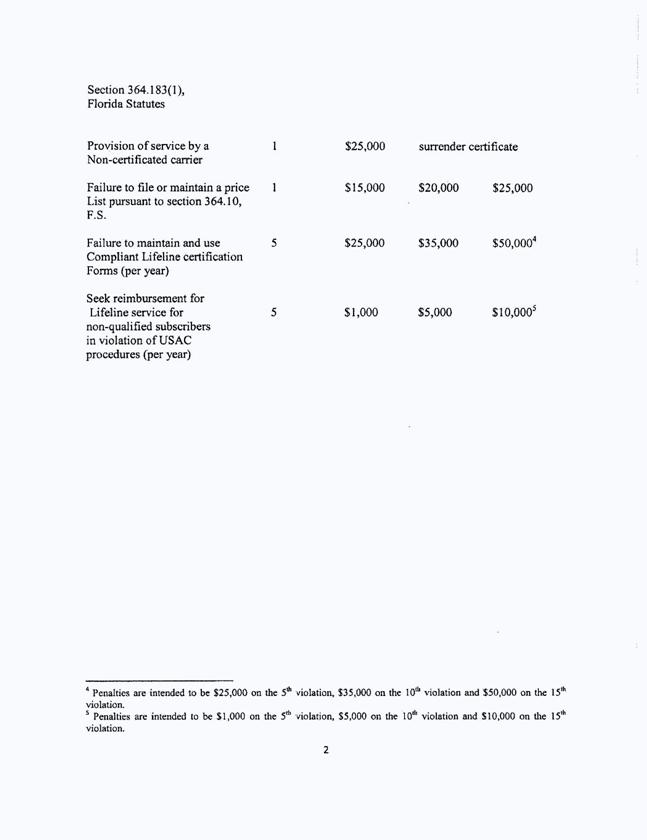

The March 29, 2011 staff recommendation

concluded that American Dial Tone, Bellerud, LifeConnex, All American Telecom, BLC Management, and American Dial Tone were each in

apparent willful violation of one or more of the following statutes, rules and

orders: Section 364.10(2)(a), Florida Statutes, Section 364.10(2)(e)1, Florida

Statutes, Section 364.10(2)(f), Florida Statutes, Section 364.107(3)(a),

Florida Statutes, Section 364.24(2), Florida Statutes, Section 364.183(1),

Florida Statutes, Rule 25-4.0161, Florida Administrative Code, Rule

25-4.0665(1), Florida Administrative Code, Rule 25-4.118, Florida

Administrative Code, Rule 25-24.825(1), Florida Administrative Code, Order No. PSC-06-0298-PAA-TX, Order No. PSC-06-0680-PAA-TL, and Order No. PSC-07-0417-PAA-TL. As a result, staff recommended the show

cause proceedings include the cancellation of all companies’ CLEC certificates; the revocation of ADT’s ETC designation; and the imposition of over $16.4

Million in fines. The

Recommendation was deferred from the April 5, 2011, Agenda Conference.

Following the filing of the Recommendation,

staff continued to work with ATMS

in an attempt to reach a settlement of this matter, including a conference call

on April 13, 2011, and an in-person meeting on April 27, 2011. As a result of both parties’ continued

efforts to reach a settlement, both staff and ATMS

were able to agree on a Framework for Settlement (“Settlement Agreement”) which

both parties believe meets the goal of a show cause, which is to ensure

compliance with Florida Statutes and Commission Rules. Following the agreement on the Framework, on

May 6, 2011, ATMS filed a Motion

for Approval of Offer of Settlement Agreement, included in its entirety as

Attachment One.

Jurisdiction

Pursuant to Section 364.285(1), F.S., the

Commission is authorized to impose upon any entity subject to its jurisdiction

a penalty of not more than $25,000 for each day a violation continues, if such

entity is found to have refused to

comply with or to have willfully

violated any lawful rule or order of the Commission, or any provision of

Chapter 364, F.S.

A willful violation of a statute, rule or

order is one done with an intentional disregard of, or a plain indifference to,

the applicable statute or regulation. See, L. R. Willson & Sons,

Inc. v. Donovan, 685 F.2d 664, 667 n.1 (D.C. Cir. 1982). Utilities are charged with knowledge of the

Commission’s orders, rules, and statutes, and the intent of Section 364.285(1)

is to penalize those who affirmatively act in opposition to those orders,

rules, or statutes. See, Florida

State Racing Commission v. Ponce de Leon Trotting Association, 151 So.2d

633, 634 (Fla.

1963), and. Commercial Ventures,

Inc. v. Beard, 595 So.2d 47, 48 (Fla.

1992) (utilities are subject to the rules published in the Florida

Administrative Code).

In Order No. 24306, issued April 1, 1991,

in Docket No. 890216-TL, In Re: Investigation Into The Proper Application of

Rule 25-14.003, F.A.C., Relating To Tax Savings Refund for 1988 and 1989 For

GTE Florida, Inc., the Commission, having found that the company had not

intended to violate the rule, nevertheless found it appropriate to order it to

show cause why it should not be fined, stating that “‘willful’ implies an

intent to do an act, and this is distinct from an intent to violate a statute

or rule.” Additionally, “[i]t is a

common maxim, familiar to all minds that ‘ignorance of the law’ will not excuse

any person, either civilly or criminally.”

Barlow v. United States, 32 U.S.

404, 411 (1833); see also, Perez v. Marti, 770 So.2d 284, 289 (Fla. 3rd DCA

2000) (ignorance of the law is never a defense). Thus, any intentional act, such as the acts

described in this docket, would meet the standard for a “willful violation.”

Federal

law recognizes that individual states and territories play an important role in

accomplishing universal service goals. The FCC also has recognized the important role of the

states. Courts have also previously

determined that the Telecom Act “plainly contemplates a partnership between the

federal and state governments to support universal service,” and that “it

is appropriate—even necessary—for the FCC to rely on state action.” The Commission has Florida jurisdiction and authority to impose

penalties on the ATMS companies pursuant

to the following: Chapter 364, Florida Statutes; Sections 120.80(13)(d) and 364.285, Florida Statutes; Rules 25-24.820 and

25-24.474, Florida Administrative Code.

Discussion

of Issues

Issue 1:

Should the Commission accept Associated Telephone

Management Services’ Offer of Settlement to resolve apparent violations of

Florida Statutes and Commission Rules?

Recommendation:

Yes, the Commission should accept Associated

Telephone Management Services Offer of Settlement to resolve apparent

violations of Florida Statutes and Commission Rules. (Harris,

Kennedy)

Staff Analysis:

As discussed in the case background, on May 6, 2011,

ATMS filed the attached Framework

for Settlement (Settlement Agreement) in an effort to fully resolve all

apparent violations identified by staff in both the investigation and show

cause dockets. Staff notes that from the

onset of this investigation, staff’s goal, as is the goal of any investigation

or show cause proceeding, was to ensure the companies’ compliance with Florida

law and the Commission’s rules and orders.

Staff believes the Settlement Offer accomplishes this goal, as well as

providing a remedy for apparent past violations. Highlights of specific provisions of the

settlement offer are as follows:

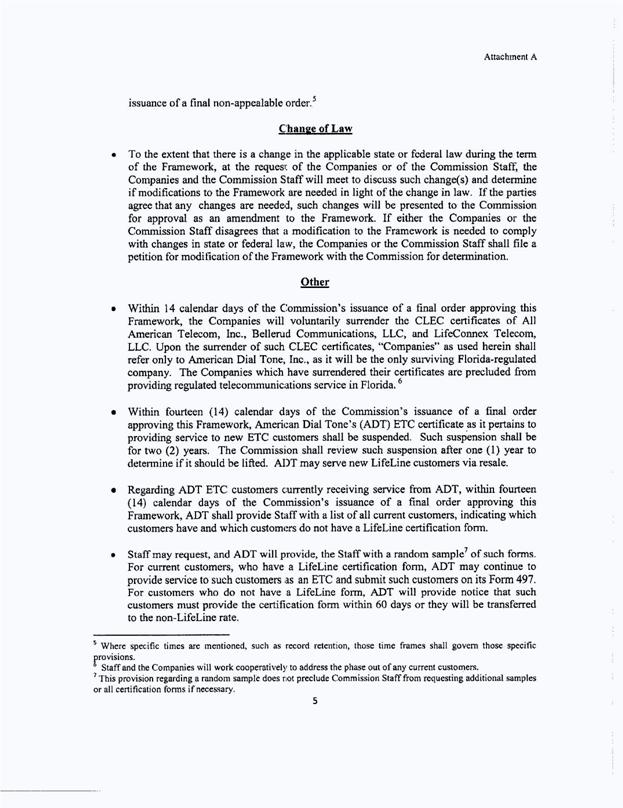

Surrender of CLEC

certificates. Within 14 days of the

final order, ATMS will surrender

the CLEC certificates of All

American Telecom, Inc., Bellerud Communications, LLC, and LifeConnex Telecom,

LLC. As a result, the only ATMS company which may

conduct regulated telecommunications service in Florida will be American Dial Tone, Inc.

Suspension of ETC

designation. ATMS agrees that within 14 days of the final order,

the ETC designation of American

Dial Tone will be suspended for a period of two years, subject to Commission

review after one year. At the one-year

review, based upon ATMS’

compliance with the terms of the Settlement, the Commission may determine that

ADT’s ETC suspension may be

lifted. During the suspension period,

ADT may continue to seek USF reimbursement for those existing customers for

which ADT has valid Lifeline certification/eligibility forms on file. ADT may serve new Lifeline customers through

resale.

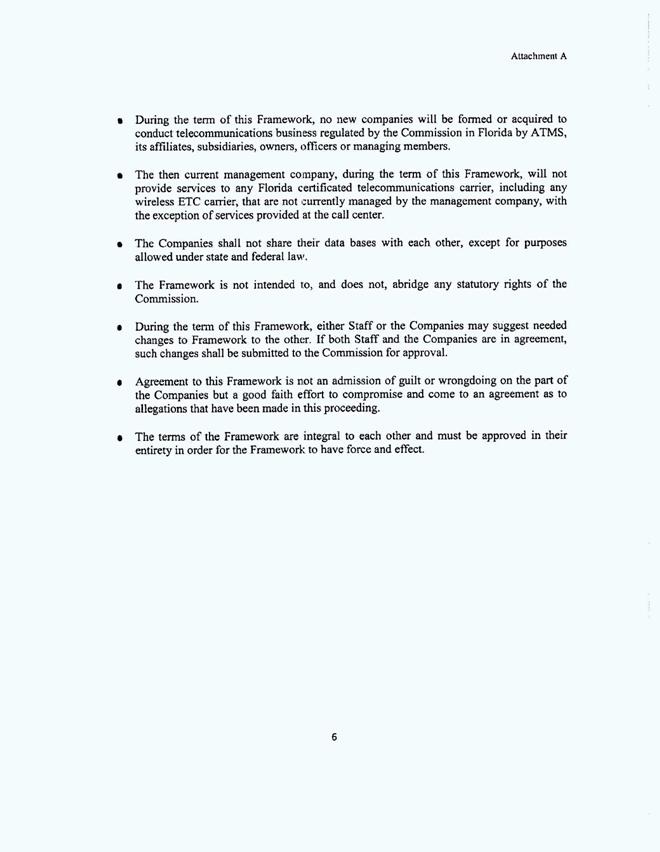

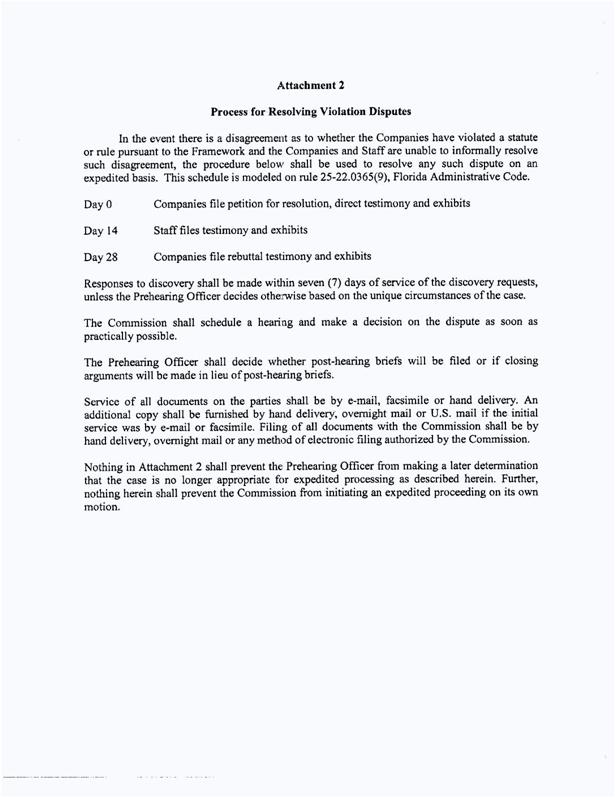

Length of Agreement. ATMS

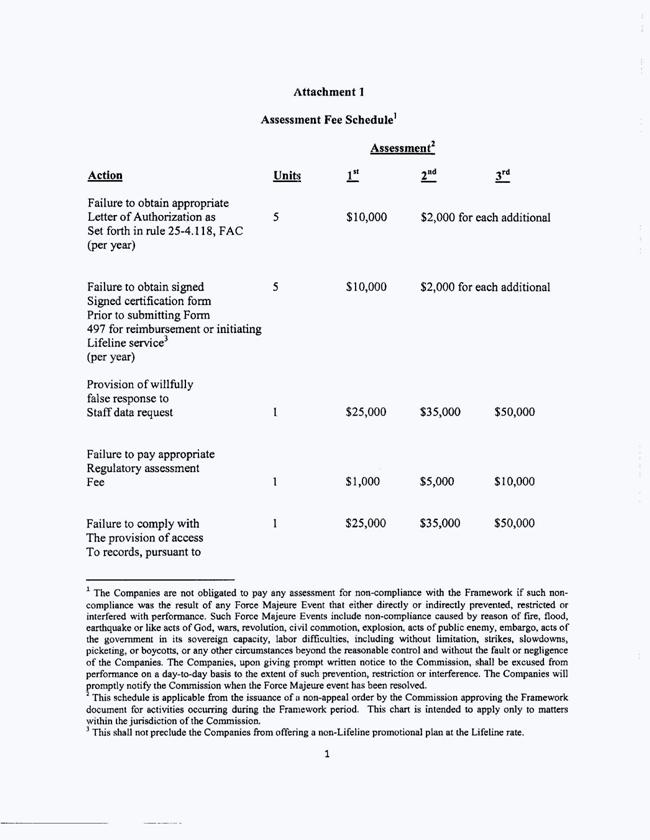

commits to a four year period of heightened monitoring and compliance. The Agreement contains numerous specific

provisions detailing compliance metrics and goals, and includes escalating

penalties for non-compliance with any of the measures during the four year term.

Compliance with Lifeline Rules. ATMS

commits that it will maintain all calls, requests, and forms regarding

potential lifeline customers for as long as the subscriber remains an ATMS customer, and then three years

thereafter. ATMS

commits that it will not seek reimbursement from USF without an accurate,

complete certification form. ATMS will provide all lifeline forms from the

previous month to staff on a CD, will maintain a regulatory compliance

department, and will provide the staff any proposed changes to its lifeline

certification forms in advance of changes being made.

Audits ATMS

agrees to audits, by independent, third party auditors selected by the staff

from a list proposed by ATMS,

no more than once per year. The cost of

the audits will be borne by ATMS,

and shall be for purposes of determining the company’s compliance with the

Settlement Agreement.

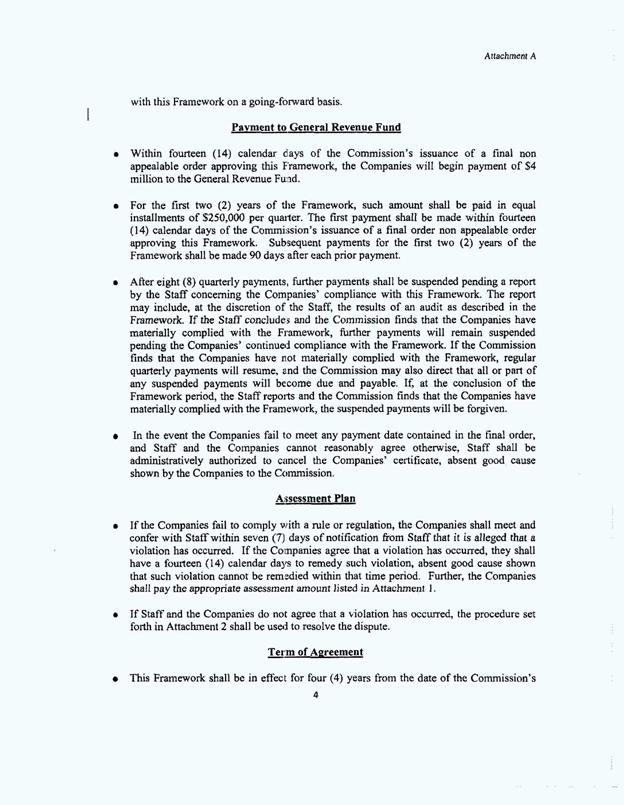

Payments to the General Revenue Fund. The Settlement Agreement specifies that ATMS will make a $4 Million payment to the State’s General Revenue Fund,

in quarterly increments of $250,000, with the first payment to be due 14 days

after the Commission’s final order becomes non-appealable. The Settlement Agreement further provides

that after the first 8 quarterly payments, further payments will be suspended

pending a review of the companies’ compliance with the terms of the Settlement

Agreement. If at any time the payments

are suspended, the Commission finds that the companies’ are not materially

complying with the terms of the Settlement Agreement, then the payments may be

resumed and any suspended payments may become due and payable.

Management Services. ATMS

commits that it will not provide any management services to any additional Florida certificated

telecommunications companies or new wireless Florida ETCs during the term of

the Settlement Agreement.

Abridgement of Rights. The Settlement Agreement clearly expresses

that the Settlement Agreement does not abridge any statutory rights of the

Commission.

Staff

believes that, taken in its entirety, the Settlement Agreement provides a

reasonable resolution of the outstanding issues in Docket Nos.100340-TP and 110082-TP. Staff further believes that the Commission’s

approval of the Settlement Agreement is in the public interest, as it provides

for future compliance with Florida Statutes and Commission Rules and provides a

voluntary contribution to the State’s General Revenue fund as a remedy for any

apparent past violations. Staff suggests

that Commission approval of the Settlement Agreement will promote

administrative efficiency and will avoid the time and expense of a hearing. Therefore, Staff recommends that the

Commission approve the Revised Settlement Agreement submitted by ATMS.

Issue 2:

Should these Dockets be closed?

Recommendation:

If the Commission approves staff’s recommendation on

Issue 1, Docket Number 100340-TP

should be closed, while Docket Number 110082-TP should remain open to process the quarterly

settlement payments as well as to monitor ongoing compliance with the

Settlement Agreement during the four year period of the agreement. (Harris)

Staff Analysis:

If the Commission approves staff’s recommendation on

Issue 1, Docket Number 100340-TP

should be closed, while Docket Number 110082-TP should remain open to process the quarterly

settlement payments as well as to monitor ongoing compliance with the

Settlement Agreement during the four year period of the agreement.