ATTACHMENT A

Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Office of the General Counsel (Robinson) Division of Economic Regulation (Draper) Division of Safety, Reliability & Consumer Assistance (Forsman, Hicks) |

||

|

RE: |

Docket No. 110305-EI – Initiation of formal proceedings of Complaint No. 1006767E of Edward McDonald against Tampa Electric Company, for alleged improper billing. |

||

|

AGENDA: |

01/24/12 – Regular Agenda – Proposed Agency Action – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

|||

|

FILE NAME AND LOCATION: |

S:\PSC\GCL\WP\110305.RCM.DOC |

||

On May 3, 2011, Mr. Edward McDonald (Mr. McDonald) filed an informal complaint against Tampa Electric Company (TECO) alleging improper billing of $915.94 and requesting a $3,500 refund for allegedly overpayments made in 2004. In accordance with Rule 25-22.032, Florida Administrative Code (F.A.C.), the complaint was forwarded to TECO for resolution.

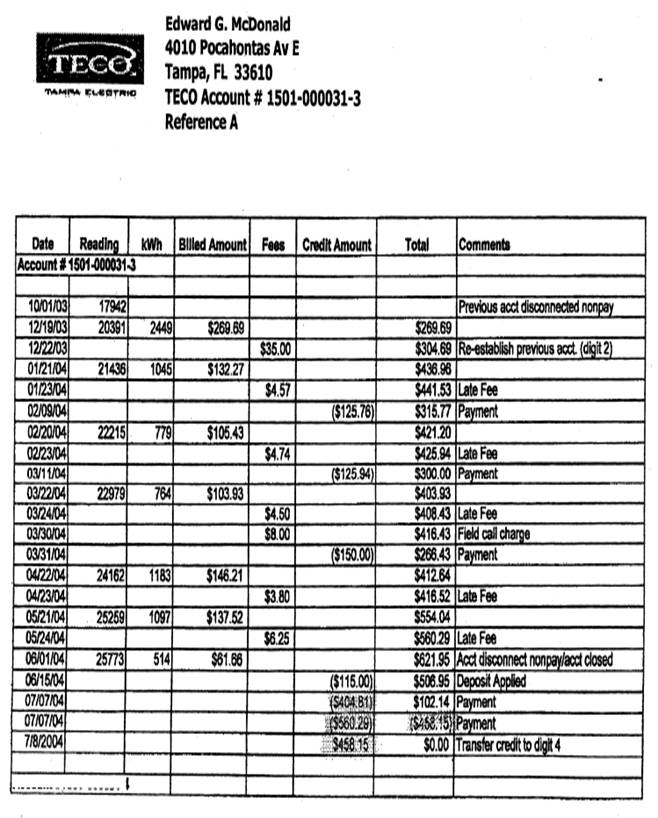

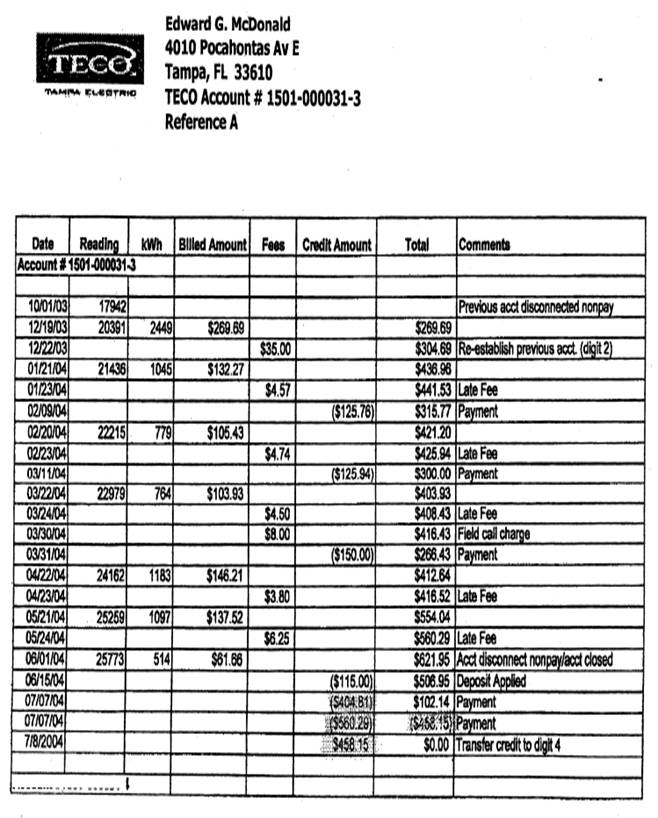

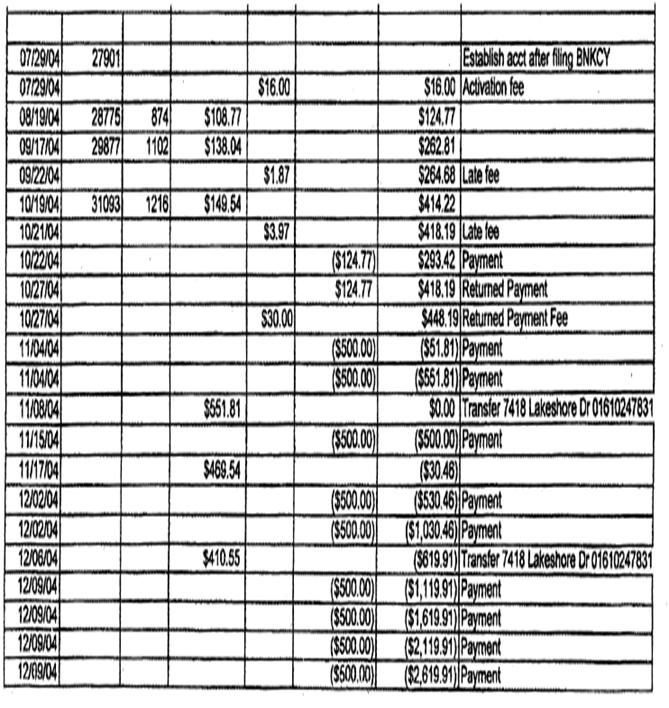

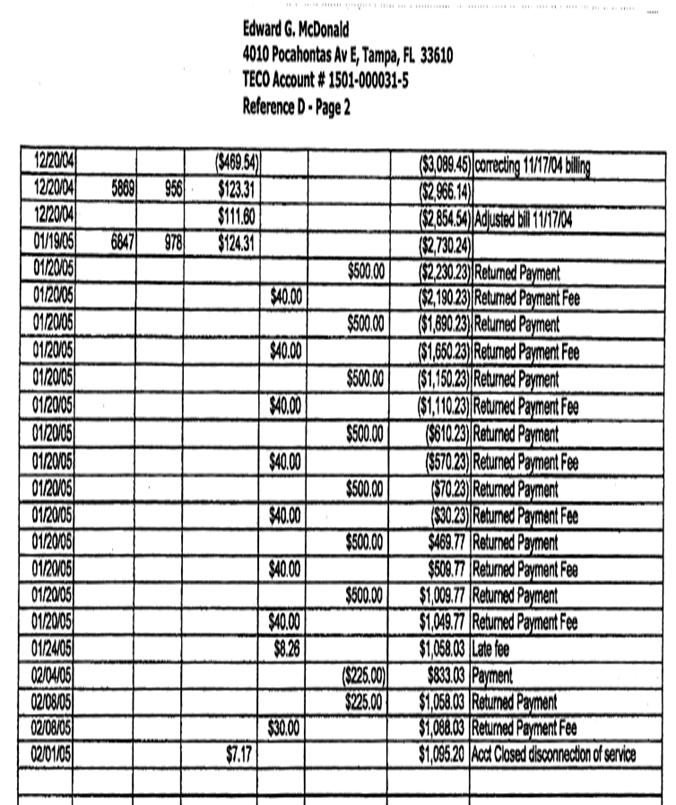

On May 25, 2011, TECO advised Mr. McDonald by letter that: (1) the $915.94 represented an outstanding balance that TECO delayed collecting because Mr. McDonald made bankruptcy filings which were later dismissed; (2) the bank recalled the $3,500 payment because Mr. McDonald accessed the funds from his mother’s account without proper authorization; and (3) Mr. McDonald had an additional $307.49 outstanding balance in other fees that was different from the $915.94 balance. TECO applied his deposit and interest to the outstanding balances and credited Mr. McDonald’s account for the $307.49. TECO also offered Mr. McDonald a payment arrangement to resolve the remaining $914.95. Mr. McDonald rejected TECO’s offer. TECO submitted Attachments A-D as supporting documentation.

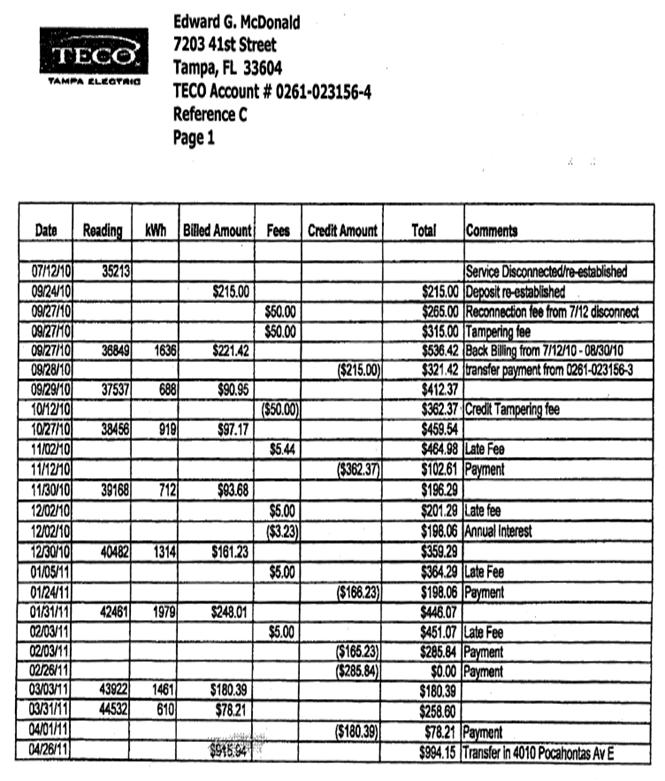

On May 31, 2011, Mr. McDonald filed his response to TECO’s letter adding that TECO owed him $5,000 in legal fees. Staff sent several data requests to TECO regarding Mr. McDonald’s complaint and discovered that Mr. McDonald had three account numbers at the same address, and two accounts had outstanding balances at closing of $914.95 and $1,095.20 as seen in Attachments A-C.

On July 25, 2011, staff sent Mr. McDonald a letter advising that the $915.94 represented an outstanding balance for which TECO postponed collection pending his bankruptcy filings. Mr. McDonald made bankruptcy filings in 2003, 2004, and 2005. TECO had written off the outstanding balance of $914.95 as bad debt; however, an upgrade to its computer system permitted TECO to match the outstanding balance to Mr. McDonald’s new account.

Staff also advised Mr. McDonald that the bank recalled payments totaling $3,500 in 2005 as the bank determined the funds were accessed without authorization from Mr. McDonald mother’s account. Staff provided Mr. McDonald with information demonstrating that the bank recalled the $3,500 payment. The alleged $3,500 overpayment resulted from Mr. McDonald making numerous payments in the amount of $500 each from his mother’s account to TECO. Between November 2004 and December 2004, Mr. McDonald made nine payments of $500 each from his mother’s account as seen in Attachment C. In January 2005, payments totaling $3,500 were recalled by the bank after it was determined that Mr. McDonald was not authorized to access his mother’s account.

On October 3, 2011, after numerous telephone and written contacts with Mr. McDonald, staff prepared and mailed its proposed resolution letter to Mr. McDonald stating that: (1) Mr. McDonald was billed correctly for the $915.94; (2) the $3,500 payment was addressed in complaint number 648071E filed on May 24, 2005, which was closed; (3) Mr. McDonald may send any proof that he has paid the $915.94 in full; and (3) the informal complaint process would close on October 12, 2011.

On November 4, 2011, Mr. McDonald filed a formal complaint rejecting staff’s proposed resolution, and the instant docket was opened. On November 21, 2011, TECO filed its answer denying Mr. McDonald’s assertions. Although not contemplated by Commission rules, on December 6, 2011, Mr. McDonald filed his reply asserting that (1) he paid the $915.94 in full; (2) TECO returned the $3,500 back to the bank and is thus liable; (3) his 2005 complaint was never investigated; and (4) Chapter 95, Florida Statutes (F.S.) prohibits TECO from collecting the $915.94.

On December 9, 2011, TECO offered Mr. McDonald a credit adjustment resolution, and he rejected it. On December 11, 2011, Mr. McDonald filed his reply rejecting TECO’s proposed settlement offer. On December 15, 2011, TECO filed a letter confirming receipt of Mr. McDonald’s refusal.

This recommendation addresses Mr. McDonald’s formal complaint filed on November 4, 2011. The Commission has jurisdiction over this matter pursuant to Chapter 366, F.S.

Issue 1:

Should the Commission grant Mr. McDonald the relief sought in his petition?

Recommendation:

No. Staff recommends that the Commission deny Mr. McDonald’s petition as it does not demonstrate that (1) TECO’s attempt to collect the $915.94 violates any statutes, rules, or Orders; (2) TECO’s calculation of the $915.94 is incorrect; and (3) TECO is liable for the $3,500 that the bank recalled because Mr. McDonald made the payments from his mother’s account without proper authorization. (Robinson, Draper, Forsman)

Staff Analysis:

Pursuant to Rule 25-22.036(2), F.S., a complaint is appropriate when a person complains of an act or omission by a person subject to Commission jurisdiction which affects the complainant’s substantial interests and which is in violation of a statute enforced by the Commission, or of any Commission rule or order. In accordance with Rule 25-22.032(9), F.S., the parties may agree to settle their dispute at any time. Likewise, Rule 25-6.033, F.A.C., states that a utility should include provisions relating to disconnecting and reconnecting services and billing periods in its tariff. Rule 25-6.100, F.A.C., outlines bill requirements, and Rule 25-6.101, F.A.C., states that a bill is delinquent after 20 days from the bill mail or delivery date.

The Commission considers any pleading filed that is not contemplated by its rules as an inappropriate pleading. See Order No. PSC-03-0525-FOF-TP, issued on April 21, 2003.[1] Mr. McDonald’s reply to TECO’s answer is not contemplated by the Commission’s rules and is therefore an inappropriate pleading. Thus, staff did not consider the arguments raised in his reply.

Mr. McDonald’s petition fails to show that TECO’s attempt to collect the outstanding $914.95 violates a statute, rule, or order as required by Rule 25-22.036(2), F.S. Staff believes that TECO’s tariff complies with Rules 25-6.033, F.A.C., and 25-6.100, F.A.C., and that TECO complied with its tariff in attempting to collect the $915.94. Therefore, the Commission should deny Mr. McDonald’s petition for relief.

Mr. McDonald asserts that his wife’s payment of $1,095.20 proves that he does not owe the $915.94. TECO stated that Mr. McDonald had outstanding balances on two different accounts as seen follows:

|

ACCOUNTS |

CLOSING DATES |

BALANCES |

|

1501-000031-4 |

July 27, 2004 |

$915.94 |

|

1501-000031-5 |

February 1, 2005 |

$1,095.20 |

As seen above and on Attachments A-C, the $1,095.20 represents the balance on a separate account. Therefore, Mr. McDonald still owes the $915.94.

Mr. McDonald also failed to demonstrate that TECO owes him $3,500. According to the Commission’s Consumer Activity Tracking System (CATS), in 2005, staff advised Mr. McDonald that the bank recalled the $3,500 and closed the informal complaint process. Mr. McDonald has provided no new information or documentation to demonstrate that TECO owes him $3,500. As mentioned above, in accordance with Rule 25-22.032(9), F.S., which authorizes the parties to settle the dispute at any time, TECO proposed a settlement to Mr. McDonald on December 9, 2011, which he rejected. Therefore, staff recommends that the Commission deny Mr. McDonald’s request for reimbursement of the alleged $3,500 overpayment.

Mr. McDonald’s request for a reimbursement of $5,000 in attorney fees incurred in a 2005 circuit court proceeding exceeds the Commission’s jurisdiction. The Commission has consistently held that as an administrative body, it lacks statutory authority to assess costs and attorney’s fees. See Order No. PSC-09-0799-PAA-TP, issued on December 2, 2009.[2] Additionally, Mr. McDonald seeks reimbursement of $5,000 in attorney’s fees he allegedly incurred in the circuit court, and the circuit court is the forum in which Mr. McDonald should seek the reimbursement. Therefore, staff recommends that the Commission also deny Mr. McDonald’s request for $5,000 in attorney fees.

Conclusion

Staff recommends that the Commission deny Mr. McDonald’s petition as it does not demonstrate that (1) TECO’s attempt to collect the $915.94 violates any statutes, rules, or Orders; (2) TECO’s calculation of the $915.94 is incorrect; and (3) TECO is liable for the $3,500 that the bank recalled because Mr. McDonald made the payments from his mother’s account without proper authorization.

Issue 2:

Should the docket be closed?

Recommendation:

Yes. If no person whose substantial interests are affected files a protest to the Commission’s proposed agency action order within 21 days, the docket should be closed upon issuance of a consummating order. (Robinson, Draper, Forsman)

Staff Analysis:

If no person whose substantial interests are affected files a protest to the Commission’s proposed agency action order within 21 days, the docket may be closed upon issuance of a consummating order.

ATTACHMENT A

ATTACHMENT B

ATTACHMENT C – page 1 of 2

ATTACHMENT C – page 2 of 2

ATTACHMENT D – page 1 of 2

ATTACHMENT D – page 2 of 2

[1] See Order No. PSC-03-0525-FOF-TP, issued on April 21, 2003, in Docket No. 020919-TP, In re: Request for arbitration concerning complaint of AT&T Communications of the Southern States, LLC, Teleport Communications Group, Inc., and TCG South Florida for enforcement of interconnection agreements with BellSouth Telecommunications, Inc. (finding that AT&T's Response to BellSouth's Response was an inappropriate pleading not contemplated by our rules or the uniform rules, and thus the Commission shall not consider the arguments raised in AT&T's Response to BellSouth's Response).

[2] See Order No. PSC-09-0799-PAA-TP, issued on December 2, 2009, in Docket No. 090430-TP, In re: Amended petition for verified emergency injunctive relief and request to restrict or prohibit AT&T from implementing its CLEC OSS-related releases, by Saturn Telecommunication Services, Inc. Section 120.595, F.S., which authorizes administrative law judges to award attorney fees for improper purpose participation, is inapplicable here. Section 120.595(1)(b), F.S., states that the final order in a proceeding pursuant to Section 120.57(1), F.S., shall award reasonable costs and a reasonable attorney’s fee to the prevailing party only where the nonprevailing adverse party has been determined by the administrative law judge to have participated in the proceeding for an improper purpose. Section 120.595(1)(e)1., F.S., defines improper purpose as “participation in a proceeding pursuant to Section 120.57(1), F.S., primarily to harass or to cause unnecessary delay or for frivolous purpose or to needlessly increase the cost of litigation, licensing, or securing the approval of an activity.”