Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Division of Economic Regulation (McNulty, Draper, Kummer, Bulecza-Banks, Gardner, Ollila) Office of the General Counsel (Brown) |

||

|

RE: |

Docket No. 090539-GU – Petition for approval of Special Gas Transportation Service agreement with Florida City Gas by Miami-Dade County through Miami-Dade Water and Sewer Department. |

||

|

AGENDA: |

03/13/12 – Regular Agenda – Settlement Agreement - Parties May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

|||

|

FILE NAME AND LOCATION: |

S:\PSC\ECR\WP\090539.RCM.DOC |

||

Florida City Gas (FCG or utility), formerly City Gas Company of Florida, executed a Natural Gas Transportation Services Agreement with Miami-Dade County on behalf of the Miami-Dade Water and Sewer Department (MDWASD) in 1998 (1998 Agreement).[1] MDWASD owns and operates several water and wastewater treatment plants in Miami-Dade County, Florida. As part of its water treatment operations, MDWASD operates lime kilns at the Alexander Orr Plant in South Miami and at the Hialeah-Preston Plant in Hialeah, as well as a cogeneration facility (Blackpoint) at the South Dade Wastewater Treatment Plant (South Dade). MDWASD uses natural gas to heat the lime kilns for the water treatment process that produces and distributes water to MDWASD’s customers.

Pursuant to the 1998 Agreement, FCG received natural gas for MDWASD and transported the gas on FCG’s distribution system to MDWASD’s facilities. MDWASD purchases its own natural gas. The 1998 Agreement had a ten-year term, expiring July 1, 2008, with no automatic renewal. It appears that FCG’s predecessor never submitted the 1998 Agreement to the Commission for approval.

Before the 1998 Agreement expired, FCG and MDWASD agreed to an amendment dated August 28, 2008 (2008 Amendment), which temporarily extended the term of the 1998 Agreement on a month-to-month basis as of July 1, 2008. Pursuant to the terms of the 2008 Amendment, either party could terminate with 30 days’ notice.[2]

While negotiating the 2008 Amendment, FCG and MDWASD also negotiated a successor agreement to the 1998 Agreement, dated August 28, 2008 (2008 Agreement). The 2008 Agreement contained the same rates and other provisions as the 1998 Agreement. Like its predecessor, the 2008 Agreement provided that FCG would transport natural gas to Miami-Dade’s facilities at rates below the otherwise applicable tariff rate. In the 2008 Agreement, specific reference was made to the qualification of MDWASD under the Contract Demand Service (KDS) Rate Schedule, a schedule which allows negotiated rates set not lower than the incremental costs the utility incurs to serve the customer. The most significant distinction between the 1998 and 2008 Agreements was that the 2008 Agreement was expressly subject to Commission approval. Further, the 2008 Agreement states that if the Commission did not approve the 2008 Agreement within 180 days, or by February 24, 2009, the 2008 Agreement would not become effective.

By petition dated November 13, 2008, FCG requested that the Commission approve the 2008 Agreement.[3] Thereafter, prior to the Commission considering the 2008 Agreement, FCG concluded that the rates in the proposed 2008 Agreement did not recover its cost of service to MDWASD and voluntarily withdrew its petition on February 17, 2009, and the Commission administratively closed the docket. MDWASD did not intervene in Docket No. 080672-GU.

On June 22, 2009, FCG advised MDWASD that it was invoking the 30-day termination notice provided in the 2008 Amendment and began charging MDWASD the applicable GS 1,250k tariff rate on August 1, 2009. MDWASD remitted payment of the full tariff rates to FCG until October 2009, at which time MDWASD began withholding the difference between the 2008 Agreement rates and the higher tariff rate. According to MDWASD, it has been placing the difference between the 2008 Agreement rates and the tariff rate in a private, separate account since that time.

On December 14, 2009, MDWASD filed a petition for approval of the 2008 Agreement that initiated the instant docket. In its petition, MDWASD requested that the Commission either recognize that the 2008 Agreement is not subject to the Commission’s regulatory jurisdiction or, in the alternative, approve the terms of the 2008 Agreement. In addition, MDWASD requested that the Commission order FCG to refund the difference between the 2008 Agreement rates and the tariff rates FCG has been charging MDWASD if it approves the 2008 Agreement. On March 5, 2010, FCG filed a petition for leave to intervene in this docket, which was granted by Order No. PSC-10-0261-PCO-GU, issued on April 26, 2010. FCG objected to the relief sought by MDWASD.

By Order No. PSC-10-0671-PCO-GU,[4] the Commission determined that it has jurisdiction to consider the 2008 Agreement. The matter was scheduled for a formal administrative hearing on June 1-3, 2011.

At the beginning of the June 1, 2011, hearing before the full Commission, FCG and MDWASD (the Parties) announced that they had reached a settlement regarding the issues in the case. The Parties jointly requested that the hearing be suspended to afford the Parties the opportunity to prepare the necessary documents to submit to the Commission. On August 19, 2011, FCG provided staff with draft settlement documents. The Parties and staff met to discuss the draft settlement documents in noticed meetings on September 13 and September 21, 2011.

On November 8, 2011, FCG filed a Joint Petition to accept Settlement between FCG and MDWASD, new Load Enhancement Service Rate Schedule, amendment to Competitive Rate Adjustment Rider “C,” and New Natural Gas Transportation Service Agreement (Settlement). The proposed New Natural Gas Transportation Service Agreement would be effective August 1, 2009 until December 31, 2013. In the joint petition (Settlement Petition), the Parties state the entire package contained in Settlement needs to be approved by the Commission in order for the Settlement to be fully and completely resolved, settled, and concluded. The Parties further state that if the Settlement Petition and its supporting attachments are not accepted in their entirety, the Parties and Commission staff will need to meet to immediately reschedule this docket for the evidentiary hearing that was abated on June 1, 2011.

This recommendation addresses the proposed Settlement and associated Load Enhancement Service Rate Schedule, amendment to Competitive Rate Adjustment Rider “C,” and New Natural Gas Transportation Service Agreement. The Commission has jurisdiction over this matter pursuant to Sections 366.04, 366.05, and 366.06, Florida Statutes.

Issue 1:

Should the Commission approve the joint petition to accept Settlement between FCG and MDWASD, and associated new 2011 Natural Gas Transportation Service Agreement (TSA), new Load Enhancement Service (LES) Rate Schedule, and amendment to Competitive Rate Adjustment (CRA) Rider “C”?

Primary Recommendation:

No. Primary Staff recommends that the Commission deny the Settlement because (1) 2011 TSA rates for 2012 and 2013 are insufficient to cover the cost of service to MDWASD; (2) the 2012-2013 proposed TSA rates to MDWASD can be expected to result in unacceptable cross-subsidies of MDWASD by FCG’s general body of ratepayers; and (3) FCG’s January 17, 2012, CRA filing would result in additional cross-subsidies since it is based on understated 2009 through 2011 costs of service for MDWASD’s Alexander Orr plant. Staff further recommends that the Commission encourage the Parties to continue their negotiations so that they might propose for the Commission’s approval a cost-based resolution to this matter at the earliest possible time rather than proceed to a potentially lengthy and costly evidentiary hearing. (McNulty, Ollila, Kummer)

Alternative Recommendation: Yes. Consistent with its longstanding policy supporting negotiated settlement of disputes, the Commission should approve the Settlement between FCG and MDWASD. The Settlement resolves complex, highly controversial, and expensive litigation, avoids further controversy, litigation, and expense, provides certainty going forward, and is in the public interest overall. Furthermore, the 2011 TSA expires in December 2013 and the impact on the general body of ratepayers is minimal. (Brown, Draper)

Staff Analysis:

Overview of Settlement Petition

The Settlement Petition includes three documents for Commission consideration: (1) the new 2011 Natural Gas Transportation Service Agreement, (2) the new Load Enhancement Service Rate Schedule, and (3) an amendment to Competitive Rate Adjustment Rider “C”. Each document is discussed below.

New 2011 Natural Gas Transportation Service Agreement (2011 Agreement or TSA)

The proposed 2011 Agreement would be deemed effective on August 1, 2009, and terminate on December 31, 2013. For the period August 1, 2009 through December 31, 2011, as part of the Settlement, the Parties agree that the rates, terms, and conditions of service provided under the 2008 Amendment should apply. The applicable gas transportation rates for the period August 1, 2009 through December 31, 2011 are $0.01 per therm for the Orr plant, and $0.03 per therm for the Hialeah plant. The 2011 Agreement does not include the Blackpoint plant, which had been included in the prior agreements. The Settlement Petition explains that the recovery for the period August 1, 2009 through December 31, 2011 is important because MSWASD would continue to be considered a Contract Demand Service (KDS) customer, thus providing stability to MDWASD, a utility which passes its energy cost along to its customers, during the time this dispute has been litigated before the Commission.

Beginning January 1, 2012 and continuing through December 31, 2013, the Parties negotiated the following new gas transportation rates:

|

Table 1 Contract Rates Proposed by Parties for 2012 and 2013 |

||||

|

Plant |

Orr |

Hialeah |

||

|

|

Volume (in million therms) |

Rate |

Volume (in million therms) |

Rate |

|

Tier 1 |

Less than 3.2 |

$0.0284 |

Less than 1.8 |

$0.0350 |

|

Tier 2 |

3.2 to less than 3.7 |

$0.0227 |

1.8 to less than 2.3 |

$0.0281 |

|

Tier 3 |

3.7 and higher |

$0.0185 |

2.3 and higher |

$0.0245 |

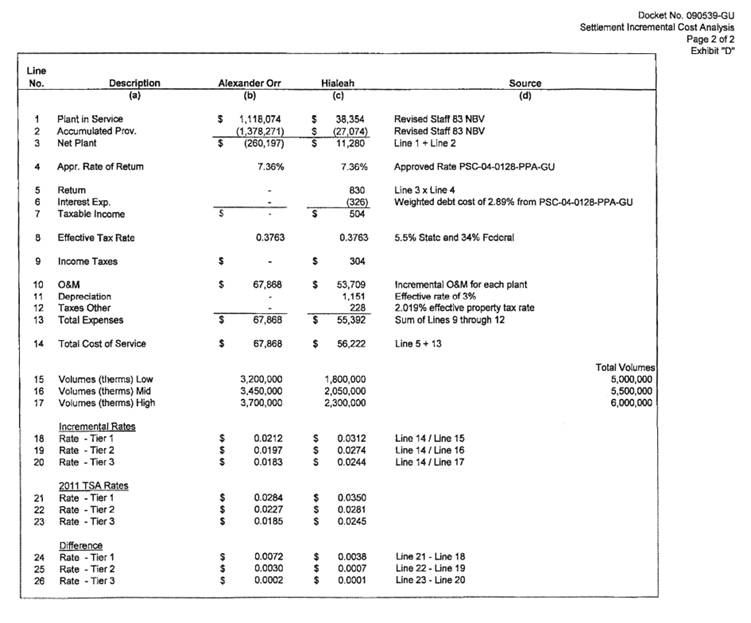

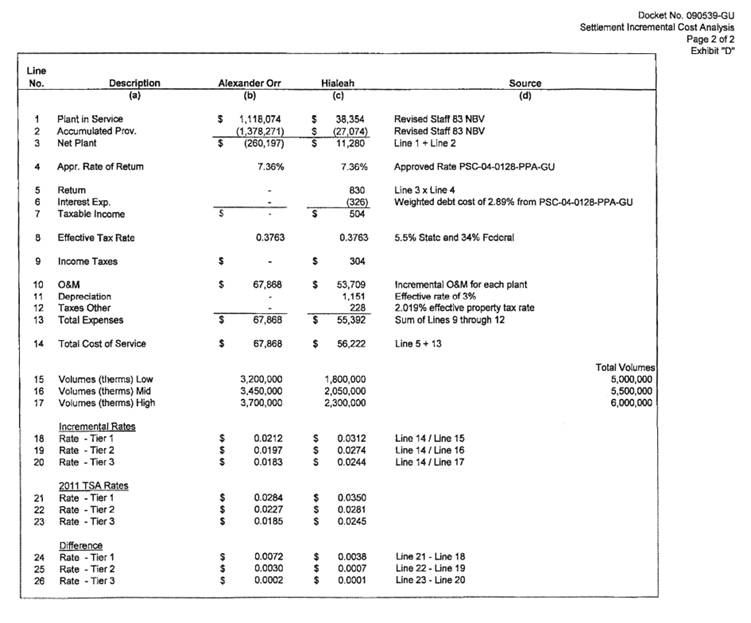

Although the rates appear to be tiered, under the contract, all usage will be charged at the lowest rate achievable based on the total volume of usage. For example, if the volume consumed for the Orr Plan was 3.2 million therms, consumption of 0 to 3.2 would all be assessed at $0.0227 per therm. The Settlement Petition states that the new rates (shown in the table above) are based on FCG’s calculated incremental cost to serve the Orr and Hialeah plants, plus an additional amount to recover FCG’s common costs. Exhibit D to the Settlement Petition provides FCG’s incremental cost analysis and calculation of the new rates. The incremental cost of service for the Orr and Hialeah plants was determined by FCG to be $67,868 and $56,222, respectively.[5]

New Load Enhancement Service (LES) Rate Schedule

One of the issues identified in this docket is whether FCG’s tariff allows it to offer MDWASD a negotiated rate.[6] The Settlement Petition states that while the Parties had different positions on this issue, the Parties agree that going forward, service to MDWASD would be facilitated by the new LES tariff that specifically addresses the retention of large commercial customers such as MDWASD. The proposed tariff provides FCG the flexibility to negotiate service agreements with existing or new commercial customers taking into account competitive and economic market conditions and overall system benefits.

Specifically, the proposed LES tariff is available at FCG’s sole discretion to customers who meet the following applicability standards:

· The customer must provide FCG verifiable documentation of either a viable alternative fuel or of the opportunity to economically bypass FCG’s system;

· FCG must demonstrate that a customer served under the LES tariff will not cause any additional cost to FCG’s other rate classes, including, at a minimum, that the rate shall not be set lower than the incremental cost plus some additional amount as a reasonable return on the investment FCG incurs to serve the customer; and

· The customer and FCG must enter into a service agreement under the LES rate schedule.

The tariff further provides that any service agreement under the LES shall be subject to Commission approval before any contract rate is implemented and before the agreement can be executed by the Parties. Finally, the LES tariff includes a provision that the difference between the otherwise applicable tariff rate and the approved contract rate may be subject to recovery through the CRA tariff.

Amendment to Competitive Rate Adjustment (CRA) tariff

The Settlement includes a proposed amendment to the CRA tariff to specifically include the proposed new LES rate schedule as one of the rate schedules for which FCG may receive CRA recovery. The CRA tariff allows FCG to recover from its customers any revenue shortfall or credit any revenue surplus it incurs by offering a discount to large volume customers that have alternative fuel capabilities, but the CRA does not allow specifically for shortfalls arising from other types of load retention contracts. The CRA became effective in July 1991 and FCG’s current version of the CRA was approved in FCG’s 2003 rate case. FCG calculates the shortfall or surplus by comparing actual revenues received from customers receiving a discount to revenues FCG would have received in the absence of a discount. FCG collects the shortfall from its customers through the CRA charge, on a cents per therm basis.

The current CRA tariff is applicable to all customers except those taking service under certain rate schedules, such as Flexible Gas Service (FGS), KDS, or receiving a discount under the Alternate Fuel Discount (AFD) Rider.

Primary Staff Analysis

Primary staff does not take issue with the proposed LES tariff or the CRA tariff modification. Primary staff believes that the proposed 2011 Agreement, however, is not in the best interest of the general body of ratepayers. Because the proposed rates are not compensatory at all usage levels, FCG’s general body of ratepayers will be inappropriately subsidizing MDWASD if the usage falls outside the range assumed by the Parties. In addition, the purpose of a load retention contract is to ensure that some benefits above the marginal cost accrue to the general body of ratepayers. Even if usage occurred at levels such that the proposed rates are compensatory, simply covering the marginal cost of service does not provide any benefits to other ratepayers who are paying the subsidy through the CRA. FCG and MDWASD may agree to the terms of the 2011 Agreement; however, the ratepayers subsidizing the contract are not signatories to the Agreement and are not represented in this proceeding.

The proposed LES would require two fundamental cost evaluations for special contracts: (1) The customer must provide verifiable documentation of alternative fuel or economic bypass, and (2) FCG must demonstrate that the contract will not result in additional costs to its general body of ratepayers. If either of these conditions is not met, FCG’s general body of ratepayers is harmed because of the operation of the CRA factor.

Bypass. For a load retention contract, such as contemplated here, the cost of bypassing FCG’s system will constitute the maximum rate that MDWASD should be willing to pay to remain on FCG’s system. It should be the obligation of the utility to negotiate a rate just below that bypass level in order to minimize the impact of the contract on its general body of ratepayers. Primary staff believes that the cost of bypass to MDWASD is likely lower than the otherwise applicable GS-1250 rate. However, as discussed below, it is not possible to determine exactly what the bypass cost is and whether FCG has maximized the negotiated rate sufficiently to protect its other ratepayers.

Additional costs to other ratepayers. This analysis goes to the heart of the rate calculation and whether the proposed rates recover the incremental costs to serve the customer and provide some benefit to the general body of ratepayers. If the rate is below incremental costs, the general body of ratepayers would be better off if MDWASD left FCG’s system. Primary staff has concerns with the volume of therms and the accuracy of the costs used by the Parties to prove that the proposed rates are compensatory. Making sure the rates are cost compensatory is critical because the contract allows recovery from FCG’s general body of ratepayers, on an annual basis, of any difference between revenues received under the contract and the otherwise applicable rate. Neither MDWASD nor the utility bears any risk if the projected costs and revenues are misstated.

Analysis of Bypass Alternatives Available to MDWASD

The Commission has historically approved various load retention tariff schedules for gas transportation utilities which are designed to allow utilities to retain customers who have demonstrated the ability and intention to bypass utility facilities at costs below the normal tariff rates.[7] In instances of demonstrated bypass, load retention tariffs typically encourage negotiated rates which allow the utility to cover its cost of providing service to the customer plus provide some amount of contribution to the common costs of the utility. FCG’s proposed LES Rate Schedule’s section titled “Applicability” includes the requirement that “the Customer must provide the Company verifiable documentation of either a viable alternative fuel or a Customer’s opportunity to economically bypass the Company’s system.” In the Settlement, the Parties state that service to MDWASD at its Orr and Hialeah plants complies with the LES Rate Schedule in part because there is a verifiable and documented bypass alternative for the Orr and Hialeah plants. The Parties provided a document titled “MDWASD Bypass Analysis” as backup documentation to the proposed 2011 TSA (Exhibit D).

The Parties provided three different estimates of bypass cost of service for the Alexander Orr and Hialeah plants as part of Exhibit D of their Settlement Petition, including “FGT Construction Estimates,” “TNT Estimates,” and “Standalone Bypass Estimates,” all based on a 40 year cost recovery period. Each of these estimates must be compared to the GS-1250 tariff rate, the applicable rate which would apply to MDWASD’s Orr and Hialeah plants absent a showing of a viable bypass alternative. The GS-1250K rate is approximately $0.134 per therm, exclusive of the CRA.[8] Staff notes that the bypass cost estimates provided by the Parties are much lower than the GS-1250K rate. For instance, the FGT and TNT bypass cost estimates for the Alexander Orr plant are $0.01217 per therm and $0.01269 per therm, respectively. Also, the FGT and TNT bypass cost estimates for the Hialeah plant are $0.07244 per therm and $0.02932 per therm, respectively. Again, these bypass cost estimates are well below the GS-1250 rate of $0.134.

Primary staff believes some costs may not be reflected in the FGT and TNT bypass estimates provided, reducing the perceived cost effectiveness of the bypass option. For the FGT Construction Estimates, staff believes certain regulatory costs and maintenance costs are additional potential costs which should have been included in the estimates. For the TNT Estimates, staff believes certain regulatory and maintenance costs, as well as a greater level of construction costs associated with main taps, should have been considered.[9] While these potential costs have not been quantified with precision, based on the staff analysis presented in Attachment 1, staff believes it is highly unlikely that the potential unaccounted costs would be equal to or greater than the difference between the tariff rate and the bypass estimates provided by the Parties. As a result, staff believes the Parties have shown that MDWASD has verifiable and documented bypass alternatives to the FCG gas transportation facilities at the Alexander Orr and Hialeah plants.

More accurate bypass cost estimates would provide the Commission with a better understanding of the rates FCG should have been able to negotiate in contracting for gas transportation service with MDWASD. Lacking a greater level of accuracy of bypass costs may be problematic for purposes of determining whether the Settlement reflects a reasonable level of contribution to the common costs of the utility. Typically, the higher the cost of the bypass alternative to utility facilities, the more leverage the utility would be expected to exercise to negotiate higher prices for its gas transportation services, thereby reducing the amount which would otherwise have to be collected via the CRA (see “Cost Compensatory Rates” section).

Cost Compensatory Rates

In Paragraph 10 of the Settlement, the Parties state that the rates in their proposed 2011 TSA recover the cost of service as well as provide a contribution to FCG’s common costs. In Paragraph 19, the Parties represent that FCG would continue to serve MDWASD’s Alexander Orr and Hialeah plants under the 2011 TSA without adversely impacting FCG’s other customers. The Settlement’s 2011 TSA includes two periods for purposes of evaluating rates for cost compensation: January 1, 2012 through December 31, 2013, and August 1, 2009 through December 31, 2011.

Rates for 2012 and 2013. For the period of January 1, 2012 through December 31, 2013, the rates proposed for MDWASD are specified in the 2011 TSA and considered in conjunction with the proposed Load Enhancement Service (LES) tariff. For this period, the Parties evaluated whether rates were compensatory by simply comparing the proposed rates to FCG’s estimated unit cost of service. The basis for the Parties’ 2012 and 2013 cost compensation argument is contained in Exhibit D, Page 2 of 2, of the Settlement Petition (Attachment 2). Exhibit D includes a netting of the costs (lines 18-20) and the 2011 TSA rates (lines 21-23) to yield the margin (lines 24-26). Under the Parties’ estimates, the margins are all shown to be positive at the specified volume of therms for both the Alexander Orr and Hialeah plants for 2012-2013.

Staff identified two significant problems with the Parties’ cost analysis. First, Exhibit D shows how the 2011 TSA rates cover unit costs at the highest number of therms for Tier 1 and at the mid-range number of therms for Tier 2. Primary staff believes that compensatory rates can be confirmed only if the rates exceed the costs to serve at all reasonable therm volumes for each plant. Staff believes the Parties should have used the lowest number of therms for all tier levels as the indicator of whether rates cover the cost of service. For this analysis, the unit cost of service is highest at the lowest level of therm volumes within any tier. This is true because the cost of gas transportation service is not volume sensitive.[10] For Tiers 2 and 3, staff used the lowest number of therms in the tier level to determine whether rates were sufficient to cover the cost of service. For Tier 1, staff used the lowest annual number of therms actually consumed at each plant since 2003 to determine whether rates were sufficient to cover the cost of service.[11]

Table 2 shows how Parties and staff used different therm amounts to determine cost compensation for the Hialeah plant, which results in different unit costs. For example, staff’s unit cost for Tier 2, based on a volume of 1.8 million therms (the lowest number of therms at that tier), is 3.12 cents per therm, which is higher than the Parties’ unit cost of 2.74 cents per therm, based on a volume of 2.05 million therms.

|

Table 2

Staff’s versus Parties’ 2012 Unit Cost of Service , Hialeah Plant

|

||||||

|

A Volume/Rate |

B 2011 TSA Volume (in millions of therms) |

C Parties’ Volume (in millions of therms) |

D Staff’s Volume (in millions of therms) |

E Cost of Service (Parties/ Staff) (1)

|

F Parties’ Unit Cost (cents/ therm) (E/C) |

G Staff’s Unit Cost (cents/ therm) (E/D) |

|

Tier 1 |

Less than 1.8 |

1.80 |

1.74 |

$56,222/ $56,083 |

3.12 |

3.23 |

|

Tier 2 |

1.8 to less than 2.3 |

2.05 |

1.80 |

$56,222/ $56,083 |

2.74 |

3.12 |

|

Tier 3 |

2.3 and higher |

2.30 |

2.30 |

$56,222/ $56,083 |

2.44 |

2.44 |

|

(1) Minor difference in cost of service between Parties and Staff are due to accounting differences in net plant, depreciation. See Attachment 3, Page 2 and Settlement, Exhibit D, p. 2. |

||||||

Table 3 shows the associated revenue shortfall of $5,503 for Hialeah at the Tier 2 rate based on the cost of service analysis in Table 2. If MDWASD’s demand for gas pipeline transportation were 1.8 million therms in 2012, FCG’s general body of ratepayers would inappropriately subsidize the contract by $5,503 through the CRA factor for gas transportation costs attributable to MDWASD’s Hialeah plant. Staff’s analysis indicates that the 2011 TSA Hialeah Tier 1 rate is not cost compensatory between 1.80 million and 1.93 million therms. Staff notes that Hialeah posted an annual volume of 1.85 million therms in 2009, so it is quite plausible that a volume of therms resulting in unit costs exceeding the proposed Hialeah rate could occur in either 2012 or 2013 if the proposed Hialeah rates are approved. A similar analysis reveals a 2013 revenue shortfall of $5,318 for Hialeah at the Tier 2 rate. (Attachment 3, Page 1a and 1b)

|

Table 3

Staff’s versus Parties’ 2012 Revenue Surplus / Shortfall, Hialeah Plant

|

|||||||

|

A Volume/Rate

|

B Parties’ Volume (in millions of therms) (1) |

C Staff’s Volume (in millions of therms) (2) |

D Parties’ Unit Cost (cents/ therm) (1)

|

E Staff’s Unit Cost (cents/ therm) (2)

|

F 2011 TSA Rate (cents/ therm) (1)

|

G Parties’ Revenue (Shortfall) ((F-D)*B) |

H Staff’s Revenue Surplus/ (Shortfall) ((F-E)*C) |

|

Tier 1 |

1.80 |

1.74 |

3.12 |

3.23 |

3.50 |

$6,840 |

$3,417 |

|

Tier 2

|

2.05 |

1.80 |

2.74 |

3.12 |

2.81 |

$1,435 |

($5,503) |

|

Tier 3 |

2.30 |

2.30 |

2.44 |

2.44 |

2.45 |

$267 |

$267 |

|

(1) Exhibit D of Settlement Petition (2) Attachment 3, page 2 |

|||||||

MDWASD’s rate analysis is the same as staff’s for Tier 3 for the Hialeah plant. Tier 3 rates for Hialeah yield a contribution to common costs of $267, which is a margin of only 0.5 percent ($267/$56,083). If actual costs are slightly higher than represented by the Parties at the Tier 3 level, FCG’s general body of ratepayers would inappropriately subsidize MDWASD via the CRA for some of the gas transportation costs attributable to FCG’s service to MDWASD’s Hialeah plant. Staff’s concern regarding cross-subsidy is heightened in this instance because identifying the true cost of service in this proceeding has been a source of considerable difficulty for both the Parties and staff. In the proposed Settlement, the Parties provided a cost of service analysis which is not specific to any particular year.[12] Staff believes when costs have not or cannot be determined with precision, the rates should be set such that a reasonable level of contribution to the common costs of the utility is included to allow for a greater margin of error. While selecting a margin to accomplish that objective may be a somewhat subjective exercise, to staff, a margin of 0.5 percent is too low.

The second problem with the Parties 2012-2013 cost analysis, specific to the Alexander Orr plant, is the omission of a depreciation expense adjustment to take into account the effect of negative net salvage.[13] A company recovers the cost of its investment (including any net salvage) through depreciation rates.[14] The net book dollar amount provided by FCG does not take into account Alexander Orr’s negative net salvage, which is negative 30.6 percent overall. In order for FCG to fully recover its original investment of $1,118,074 in the Alexander Orr plant, it must recover an additional $342,229, for a total of $1,460,303. As long as Alexander Orr’s investment is not fully recovered, then the net book investment is still positive and depreciation rates apply. As of December 31, 2011, $33,460 remains to be recovered in 2012.

When the necessary depreciation expense adjustments are included in the analysis, the 2011 TSA rates are not compensatory for the Alexander Orr plant in 2012 at any reasonable therm volume, as high as levels up to 5.4 million therms. The Alexander Orr plant’s typical annual volume of therms is more than 2.6 million therms and less than 3.7 million therms. Staff calculated a revenue shortfall based on marginal cost ranging from $26,984 at 2.6 million therms up to $32,878 at 3.7 million therms when the depreciation adjustment is included. Table 4 shows staff’s revenue surplus/shortfall analysis for the Alexander Orr plant for 2012 including the depreciation expense adjustment. The combined effect of using the minimum therm level within each tier and including the depreciation expense adjustment shows the 2011 TSA rates for the Alexander Orr plant do not cover the plant’s cost of service.

|

Table 4

Staff’s versus Parties’ 2012 Revenue Surplus / Shortfall, Alexander Orr Plant (including a depreciation expense adjustment to account for negative net salvage value)

|

|||||||

|

A Volume/Rate

|

B Parties’ Volume (in millions of therms) (1) |

C Staff’s Volume (in millions of therms) (2) |

D Parties’ Unit Cost (cents/ therm) (1)

|

E Staff’s Unit Cost (cents/ therm) (2)

|

F 2011 TSA Rate (cents/ therm) (1)

|

G Parties’ Revenue Surplus/ (Shortfall) ((F-D)*B) |

H Staff’s Revenue Surplus/ (Shortfall) ((F-E)*C) |

|

Tier 1 |

3.20 |

2.62 |

2.12 |

3.87 |

2.84 |

$23,040 |

($26,984) |

|

Tier 2

|

3.45 |

3.20 |

1.97 |

3.17 |

2.27 |

$10,350 |

($28,688) |

|

Tier 3 |

3.70 |

3.70 |

1.83 |

2.74 |

1.85 |

$740 |

($32,878) |

|

(1) Exhibit D of Settlement Petition (2) Attachment 3, page 3 |

|||||||

Rates for 2009 through 2011. At paragraph 25 of the Settlement, the Parties indicate that FCG intends to seek CRA recovery for the difference between the incremental cost of service to the Alexander Orr and Hialeah plants and the GS-1250 tariff rate since August 2009. However, FCG will not seek recovery of the difference between the incremental cost of service calculated as part of this proceeding for service to MDWASD at the Orr and Hialeah plants and actual rates paid by MDWASD from 2009 to 2011, which have been determined to be below incremental costs. FCG is seeking recovery of the difference between the GS-1250 tariff rate and the incremental cost of service through the CRA. Under the provisions of the Settlement, correctly identifying the 2009 through 2011 costs of service to the Alexander Orr and Hialeah plants ensures that the general body of ratepayers are protected against cross-subsidy via the operation of the CRA.

The Settlement did not identify the costs of service to the plants for 2009 through 2011. However, on November 9, 2011, FCG submitted to staff a CRA filing seeking recovery of costs to service MDWASD’s Orr and Hialeah plants for the period August 1, 2009 through September 30, 2011. On January 17, 2012, FCG submitted a corrected CRA filing. FCG has not yet implemented the 2012 CRA factor, pending the Commission’s decision on the Settlement Petition. In its CRA revised filing, FCG identifies the cost of service of the plants for the 2009 through 2011 period as the Tier 1 incremental costs for 2012-2013 appearing in Exhibit D of the Settlement. Staff analyzed FCG’s 2009 through 2011 costs to serve MDWASD’s plants as shown in its January 17, 2012 CRA filing to determine whether it shifted any portion of the 2009 through 2011 cost of gas transportation service to serve MDWASD to FCG’s general body of ratepayers.

Staff identified two problems with the way FCG evaluated the cost of service for 2009 through 2011 for both the Alexander Orr and Hialeah plants. First, FCG equated 2009 through 2011 unit costs with the Settlement’s 2012-2013 Tier 1 unit costs, which is calculated using the highest volume of therms in Tier 1. Staff believes actual therm usage, whenever available, should be used to calculate the unit cost of service in order to improve the accuracy of the estimate. Staff calculated the unit costs to serve the Alexander Orr and Hialeah plants based on the actual number of therms used by the plants in August 2009 through September 2011. Additionally, staff estimated therm usage for the 3 month period of October 2011 to December 2011 based on the average therm usage of the prior 9 month period (January through September 2011). Thus, staff’s unit cost calculations are based mainly on actual therm usage, whereas FCG’s unit cost calculations are based entirely on estimated therm usage. Staff believes actual data provides more accurate calculations of unit cost.

The second problem with FCG’s method of calculating 2009 through 2011 cost of service to the Alexander Orr plant is the omission of a depreciation expense adjustment to take into account the effect of negative net salvage value. This problem is described above in the section titled “Rates for 2012 and 2013.” With this adjustment, the cost of service includes positive amounts for net plant for all years, so costs other than operations and maintenance expense are included, such as depreciation expense, interest expense, and taxes.

FCG’s cost of service to the Alexander Orr plant for 2009 through 2011, which would be used to determine the CRA recovery from the general body of ratepayers, appears in Table 5, Column C. In Column D, staff provides its estimate of the unit cost of service which is based on actual therm volumes and includes the depreciation expense adjustment. Under the provisions of the Settlement and the CRA filing, the excess cost recovery via the CRA for the Alexander Orr plant for the entire period would be $148,125, as shown in Column G.

Table 5

Staff’s versus FCG’s 2009-2011 Revenue Surplus / Shortfall, Alexander Orr Plant (including a depreciation expense adjustment to account for negative net salvage value)

|

||||||

|

A Volume/ Rate

|

B Volume (in therms) (1)

|

C FCG’s Unit Cost (cents/ therm) (1)

|

D Staff’s Unit Cost (cents/ therm) (2)

|

E FCG’s CRA Cost (B*C) |

F Staff’s CRA Cost (B*D) |

G CRA

Excess/ (Shortfall) (E-F) |

|

2009 |

852,547 |

2.12 |

4.90 |

$18,074

|

$41,873 |

($23,799) |

|

2010

|

3,015,673 |

2.12 |

4.10 |

$63,932 |

$122,693 |

($58,761) |

|

2011 |

2,403,000 |

2.12 |

4.85 |

$50,944 |

$116,508 |

($65,565) |

|

TOTAL |

8,641,929 |

|

|

$132,950 |

$281,074 |

($148,125) |

|

(1) January 17, 2012 CRA Filing and Settlement, Exhibit D, page 2, Attachment 3, page 5 (2) Attachment 3, page 5 |

||||||

Cost Summary. Staff’s analysis indicates several instances where the 2011 TSA’s proposed gas transportation rates for 2012 and 2013 for the Hialeah and Alexander Orr plants cover the cost of service but do so inadequately. The 2011 TSA rates fail to recover the cost of service for 2012 and 2013 for the Hialeah plant at lower volume of therms in Tier 2. The revenue shortfalls are $5,503 and $5,318 for 2012 and 2013, respectively. In addition, the 2011 TSA rates provide inadequate contribution to the common costs of the utility even at the Tier 3 level, given the uncertainty of the cost estimates provided. The 2011 TSA rates fail to recover the cost of service at all tier levels for 2012 for the Alexander Orr plant taking into account a depreciation expense adjustment and lower volumes of therms at each tier. The revenue shortfalls range from $26,984 (Tier 1) to $32,878 (Tier 3).

Staff’s analysis of the 2009 through 2011 costs of service for the Alexander Orr plant based on the Settlement Petition and the January 17, 2012 CRA filing indicates that FCG’s estimated costs of service are too low and would result in inappropriate cross-subsidies through the CRA if accepted. Staff’s method of calculating 2009 through 2011 costs of service to the Alexander Orr plant, including actual therm volumes and a depreciation expense adjustment, results in significantly higher costs than the costs identified by the utility. FCG’s Tier 1 unit cost assumption for 2009 through 2011 would yield $148,125 in cross-subsidies from FCG’s general body of ratepayers for service provided to MDWASD.

Table 6 provides the cross-subsidy data identified above in combined format for the Alexander Orr and Hialeah plants. The expected annual cross-subsidy via the CRA for both plants combined for 2009 through 2011 ranges from $23,275 (2009) up to $48,663 (2011) based on actual therm usage. For 2012 rates under the 2011 TSA, if actual therm usage is equivalent to the bottom of the lower levels within each tier, the cross-subsidy for both plants combined is expected to range from $23,567 to $34,191. Similarly, the potential for cross-subsidy in 2013 is $546 at the Tier 2 level for both plants combined. At the Tier 3 level for 2013, FCG’s cross-subsidy potential for both plants combined is barely avoided. The margin for both plants combined in 2013 for therm usage at the lower end of the Tier 3 is expected to be $1,034, or 0.8 percent. Allowing slim margins such as this sends the signal that a utility may negotiate load retention contracts at the bare marginal cost of service with very little if any contribution to the fixed costs assessed to other ratepayers, thereby providing little or no benefits to the other ratepayers paying the subsidy. This is contrary to prior Commission practice and detrimental to the general body of ratepayers because they are deriving little or no benefit from retaining the customer. The cross-subsidy question is discussed more fully in the next section.

|

Table 6

Potential Cross-Subsidy of the MDWASD Plants

|

||||

|

A Year

|

B Tier |

C Alexander Orr Potential Cross-Subsidy |

D Hialeah Cross-subsidy (1) |

E Total Potential Cross-subsidy, Alex. Orr and Hialeah (C +D) |

|

2009 |

N/A |

$23,799 |

-$524 |

$23,275 |

|

2010 |

N/A |

$58,761 |

-$10,581 |

$48,180 |

|

2011 |

N/A |

$65,565 |

-$16,902 |

$48,663 |

|

2009-2011 |

N/A |

$148,125 |

-$19,230 |

$120,118 |

|

|

|

|

|

|

|

2012 |

1 |

$26,984 |

-$3,417 |

$23,567 |

|

|

2 |

$28,688 |

$5,503 |

$34,191 |

|

|

3 |

$32,878 |

-$267 |

$32,611 |

|

2013 |

1 |

-$6,476 |

-$4,935 |

-$11,411 |

|

|

2 |

-4,772 |

$5,318 |

$546 |

|

|

3 |

-$582 |

-$452 |

-$1,034 |

|

Source: Tables 3-5 |

||||

Cross-subsidies through the CRA

The CRA mechanism was originally designed to allow utilities to reduce rates to those large customers who had alternative fuel capability in order to retain load on its system with some contribution to fixed cost. For example, if a customer could burn both oil and gas, when oil was cheaper than gas, the cost of gas would be discounted to the price of oil. When the differential switched, the cost of gas would return to a higher level. The difference in the revenue between the otherwise applicable rate and the discounted rate was passed through to other ratepayers, on the premise that it was better for the general body of ratepayers to retain the load long term, even at a short term cost. The CRA has since been expanded to include shortfalls associated with any load retention contract. The floor to any negotiated load retention contract from the utility’s perspective should be the cost of bypass to the customer. At anything above that, the customer would be better off leaving the local distribution company. The level of the CRA cost recovery to other customers is determined by how well the utility negotiates with the customer looking at alternatives.

CRA factors are adjusted annually and assessed as a cents per therm charge to all non-contract customers. The shortfall from negotiated contracts is recovered dollar for dollar. Under the CRA option, neither the customer seeking the discount nor the utility is harmed, no matter how low the negotiated rate. In this case, MDWASD is paying a rate significantly below what staff believes is its correctly calculated bypass costs, and FCG will incur a revenue shortfall arising from the lower rate charged to MDWASD. A significant portion of this revenue shortfall will be recovered from FCG’s other customers. The customers who will be paying for the shortfall in revenues are not represented in this proceeding.

The Settlement Petition states “it is important to note that by seeking this amendment to the CRA that FCG is not making the specific CRA recovery request that would be associated with rates and service to MDWASD under the proposed 2011 Agreement as a part of this settlement package, nor the CRA recovery under the continuation of the 2008 Amendment.” However, the Settlement Petition further states that if the Commission approves the Stipulation, FCG will seek recovery of the CRA shortfall as provided for in its tariff. Therefore, staff believes that for completeness of the recommendation, a discussion of the CRA and its impact on the general body of ratepayers will be helpful.

On January 17, 2012, FCG provided staff with its CRA filing for the period of August 2009 through September 2011, which indicated that its incremental costs of service to the plants used for purposes of calculating the CRA for the period is FCG’s Tier 1 cost of service referenced in Exhibit D of the Settlement.[15] FCG’s proposed 2011 TSA rates for service to MDWASD are lower than its estimated Tier 1 cost of service,[16] but FCG has agreed as part of its Settlement to restrict its request for CRA recovery from its general body of ratepayers to only the difference between its incremental costs of service to the plants and the GS-1250 tariff rates for August 2009 through December 2011. FCG has also not included any CRA recovery for the Blackpoint plant for any service received August 1, 2009 forward.

The CRA filing shows a total under-recovery of $1,189,161, which consists of a $1,236,580 shortfall resulting from the 2011 TSA, and a $47,418 over-recovery from prior period CRA collections. The resulting CRA factor for the period January through December 2012 is $0.01336 per therm, or $0.27 for a residential customer who uses 20 therms per month. The bill for an FCG residential customer who used 20 therms per month in 2011 was $29.79, so the CRA factor would constitute a 0.91 percent bill increase. FCG has not yet implemented the CRA factor, pending the Commission’s decision on the Settlement Petition. The Parties justified recovery through the CRA for the period 2009 through 2011 based on the length of time between the filing of the 2009 contract and the anticipated effective date of the stipulation. Staff has concerns about this retroactive recovery.

The Parties were both aware that the 1998 Agreement was expiring in 2008, yet FCG did not request approval of a successor agreement until November 13, 2008. FCG unilaterally withdrew the 2008 Agreement on February 17, 2009, as not being cost compensatory. It was almost a year later on December 14, 2009, that MDWASD filed a petition to enforce the 2008 Agreement. The Parties stated at the June 1, 2011 hearing that they had reached a stipulation in principle, but the formal petition for approval of a stipulation was not filed until November 2011. FCG’s general body of ratepayers should not be penalized for the Parties’ delay in reaching agreement.

If CRA recovery for the period 2009 through 2011 is disallowed, FCG’s CRA factor would be zero since FCG currently has no other customers on a below-tariff rate. If recovery for the period 2009 through 2011 is allowed, but adjusted to remove the excess costs identified by staff in the prior section for both plants ($120,118), staff estimates the CRA factor for 2012 would be $0.012, or $0.24 for a residential customer who uses 20 therms per month. One of the arguments MDWASD made was that it was a governmental entity and any increase in rates would be passed along to its customers, therefore the FCG customers who were also MDWASD customers should not be negatively impacted by the cross-subsidy. FCG has approximately 101,000 customers who would pay the CRA,[17] but FCG’s service territory covers much of the east coast of Florida, including Brevard, St. Lucie, and Broward Counties, in addition to Dade County, so many of FCG’s customers do not receive water from MDWASD. Primary staff believes the proposed excess CRA recovery provided by these customers would be a cross-subsidy of MDWASD by FCG’s general body of ratepayers, not just by those who are also MDWASD customers.

Summary of Primary Recommendation on Settlement

Based on the discussions above, primary staff recommends that the Commission deny the Settlement because the Parties have not demonstrated that the 2011 TSA rates for 2012 and 2013 are sufficient to cover the cost of service to MDWASD and provide a reasonable contribution to fixed costs. The 2012-2013 proposed TSA rates to MDWASD can be expected to result in inappropriate cross-subsidies of MDWASD by FCG’s general body of ratepayers. FCG’s January 17, 2012, CRA filing would result in additional cross-subsidies since it is based on understated 2009 through 2011 costs of service for MDWASD’s Alexander Orr plant. Staff further recommends that the Commission encourage the Parties to continue their negotiations so that they might propose for the Commission’s approval a cost-based resolution to this matter at the earliest possible time rather than proceed to a potentially lengthy and costly evidentiary hearing.

Alternative Staff Analysis

Alternative staff’s recommendation to approve the proposed Settlement is based upon staff’s assessment of the Settlement as a whole, not isolated parts of it. We do believe that on balance the benefits of the Settlement to FCG’s ratepayers, as well as to MDWASD’s ratepayers and to the public interest, outweigh the flaws identified in the primary recommendation.

Alternative staff does not disagree with the cost effectiveness analysis of the 2011 TSA rates presented in the primary staff recommendation, but notes that the 2011 TSA will expire in December 2013, and the impact on the general body of ratepayers of the 2011 TSA is minimal. FCG’s 2012 CRA filing for the period July 2009 through September 2011 results in a $0.01336 per therm CRA factor or a $0.27 impact on a residential customer who uses 20 therms. The CRA factor in subsequent years should be lower because of the higher 2011 TSA rates for 2012 and 2013 (as shown in Table 1). Furthermore, FCG will be able to revert back to the usual 12-month CRA recovery period in 2013.

The primary recommendation raises concerns about the 2-year recovery period of the CRA. While a 2-year recovery period is unusual, alternative staff believes that this is reflective of the lengthy litigation between the Parties. We also note that the revenue shortfall resulting from the 1998 Agreement and the 2008 Amendment was reflected in FCG’s annual CRA filings.

The primary recommendation concludes that the 2011 TSA Hialeah rate is not compensatory between 1.8 million and 1.93 million therms and that Hialeah posted an annual volume of 1.85 million in 2009. That is correct; however, we note that Hialeah’s average therm consumption for the years 2005 through 2010 has been 2.3 million therms.[18] FCG’s amended CRA filing shows the therm volumes for Hialeah for the period October 2010 through September 2011 at 2.5 million. Alternative staff, therefore, believes that based on Hialeah’s past therm consumption, it appears unlikely that Hialeah will consume only between 1.8 and 1.93 million therms in 2012 and 2013.

Finally, the primary recommendation calculates potential cross-subsidies from FCG's general body of ratepayers for service provided to MDWASD. Alternative staff agrees that if the negotiated 2011 TSA rates had been set higher to be compensatory at all usage levels and provide a larger contribution above marginal costs, variations in cost estimates would not eliminate the benefits to the general body of ratepayers of retaining the load. However, staff notes that the impact on the general body of ratepayers of any potential cross-subsidies is negligible and not unduly discriminatory pursuant to section 366.07, F.S., given the overall benefits of the Settlement, the economies of scale benefitting customers by retaining MDWASD on FCG’s system, and the fact that the 2011 TSA presented in the Settlement will expire in December 2013, less than two years from the date of the Agenda Conference.

Alternative staff recommends that a decision to approve the proposed Settlement is legally supportable, and is more consistent with the Commission’s practice in addressing settlements. As the Commission expressly affirmed in its recent approval of the Progress Energy Florida, Inc. comprehensive settlement agreement in Docket No. 120022-EI,[19] the Commission has a longstanding commitment to the support and encouragement of negotiated settlements.[20] That commitment is supported in the law. See, for example: Utilities Commission of New Smyrna Beach v. Florida Public Service Commission, 469 So. 2d 731, 732 (Fla. 1985). In reversing the Commission’s disapproval of a territorial agreement, the Supreme Court said:

The legal system favors the settlement of disagreements between the contending parties. . . . The PSC has the responsibility to ensure that the territorial agreement works no detriment to the public interest. . . . The agreement as a whole contained no detriment to the public and should have been approved.

See, also, J. Allen, Inc. v. Castle Floor Covering, Inc., 543 So. 2d 249, 251 (Fla. 2d DCA 1989), where the Court said: “It is clear that parties may enter into such a compromise and settlement of disputed claims so as to avoid litigation, a sound public policy.”

Numerous Commission orders spanning several decades have supported this sound public policy and approved settlement agreements as in the public interest. See, for example Order No. PSC-04-1115-FOF-EI,[21] at page 14, where the Commission declined to vacate its approval of an agreement settling complex litigation, saying:

Allied has not alleged sufficient material facts to show misrepresentation, detrimental reliance, harm, or any significant changed circumstances that would warrant vacation of a Commission order in abrogation of the doctrine of administrative finality or the Commission’s longstanding commitment to the support and encouragement of negotiated settlements.

In Order No. 22094[22] approving an offer of settlement of its rate increase request by South Seas Utility Company, at page 1, the Commission stated: “This Commission encourages settlements as they reduce the time and cost of proceedings, which ultimately benefit the ratepayers.” In Order No. PSC-04-0934-PAA-EU[23] the Commission determined that the settlement agreement was in the public interest and “consistent with the Commission’s longstanding policy of encouraging agreements.” And again, in Order No. PSC-07-0912-AS-WS,[24] at page 2, the Commission said:

[I]t is in the public interest to approve the Settlement Agreement because it promotes administrative efficiency and avoids the time and expense of a hearing. In keeping with our long-standing practice of encouraging Parties to settle contested proceedings whenever possible, we approve the Parties’ Settlement Agreement.

In fact, staff’s research into the many Commission decisions addressing settlement agreements over the years indicates that the vast majority of decisions have approved settlements to complex, contested litigation. Most of the decisions staff has identified that denied settlement proposals involved show cause procedures or other penalty cases for failure to comply with statutes, rules or Commission orders, and most of those involved the disapproval of a party’s proposed fine amount. This is not to say that the Commission cannot deny a proposed settlement. The Commission has the discretion to approve a settlement in the public interest, and concomitantly, it has the discretion to disapprove a settlement not in the public interest. It is only to say that the Commission’s practice has consistently favored settlements, and staff would suggest that the Commission should favor the settlement in this case as well, unless it can be demonstrably, if not conclusively, shown that the settlement creates a detriment to the public interest. Staff does not believe, on balance, considering the settlement as a whole, that such a case has been made here.

Conclusion. The agreement that the Parties have submitted to the Commission for approval resolves nearly 4 years of controversy and litigation. It ensures that FCG will retain MDWASD, its largest gas transportation customer, on its system. It provides certainty to the Parties in the near term. It prevents further costly litigation expense harmful to both Parties and their ratepayers, and it limits further costly administrative expense for the Commission that ultimately translates into increased expense for regulatory assessment fees for all gas utilities and ratepayers. Furthermore, the TSA expires in December 2013, and the impact on the general body of ratepayers is minimal. For these reasons, the Settlement is in the public interest and the Commission should approve it in its entirety.

Issue 2:

Should this docket be closed?

Recommendation:

If the Commission accepts Primary Staff recommendation in Issue 1, the docket should remain open to proceed to hearing on the proposed contract. If the Commission accepts Alternative Staff recommendation, the docket may be closed.

Staff Analysis:

If the Commission accepts Primary Staff’s recommendation to deny the stipulation, the docket should remain open to continue the hearing process established by Commission Order PSC-11-0219-PHO-GU. The stipulation was proposed as a settlement of all issues identified in that prehearing order. If the stipulation is denied, the Parties have requested that an expedited hearing track be established to hold a full evidentiary hearing on MDWASD’s petition to enforce the original contract filed by FCG on November 13, 2008.

If the Commission accepts Alternative Staff recommendation, the docket may be closed.

MDWASD Bypass Alternatives Analysis

Alexander Orr Bypass Alternative 1: “FGT Construction Estimate”

The “FGT Construction Estimate” for the Alexander Orr plant according to Exhibit D to the Settlement petition indicates the bypass cost of service for Alexander Orr is $0.01215 per therm. The parties’ bypass cost of service for the Orr plant, $914,252, is based on detailed information provided in discovery, including an October 1, 2009, e-mail to FCG’s witness Langer from Dan Swanson, an FGT employee.[25] This cost estimate provided to FCG did not result in an official reimbursement agreement between FCG and FGT.

FGT’s estimated cost for the Orr plant bypass was based on a misunderstanding regarding the existence of a FERC Blanket Certificate for bypass of FCG facilities at the Orr and Hialeah plants. At the time of his e-mailed cost estimate to witness Langer, Mr. Swanson believed a blanket certificate approved in 1998 was still effective, but it was later revealed to have expired on April 11, 1999.[26] Mr. Swanson indicated in a January 24, 2011, e-mail to FCG’s witness Langer that winning approval of the required certificate would be costly if FCG were to intervene in the FERC hearing to approve MDWASD’s request for a blanket certificate.[27] The FGT Construction Estimate of $0.01215 does not include FERC blanket certificate regulatory costs, which could be significant but is not known with precision.

No maintenance costs are included in the “FGT Construction Estimate”. It is not known whether additional costs would apply for maintenance of the bypass pipeline for any portion of the 40 year term considered in the parties’ analysis.

Despite the “FGT Construction Estimate” for Alexander Orr plant not accounting for these potential costs, the estimate does offer valuable insight into the ability of MDWASD to bypass FCG facilities. Staff believes it is highly unlikely that the potential unaccounted costs would be equal to or greater than the difference between the tariff rate and the “FGT Construction Estimate” ($0.134 per therm GS-1250 tariff rate less the $0.01215 per therm “FGT Construction Estimate”). Thus, staff believes MDWASD has shown it could bypass FCG gas transportation facilities at the Alexander Orr plant with the FGT alternative.

Alexander Orr Bypass Alternative 2: “TNT Estimates”

The TNT bypass estimate calculated by the parties for the Orr plant is $0.01269 per therm. This estimate is based on a TNT Pipeline’s construction cost estimate of $610,000 for primary construction costs and $32,000 for the tap cost (the cost to tap into the FCG transmission main).[28] However, the estimated tap cost is contingent upon FGT’s approval of TNT tapping into its main, and MDWASD was unable to provide evidence that such approval was ever provided. Without FGT approval, MDWASD doesn’t know what TNT’s cost would be to tap into FGT’s main.[29] There is a significant difference in the parties’ Standalone Bypass Estimate for tapping into the line for the Orr plant and the TNT tap cost estimate.

Another part of the TNT bypass estimate for the Alexander Orr plant is the maintenance cost estimate, which is $500,000. The only estimated maintenance cost information provided by MDWASD which might apply to the Orr plant is $25,000 per year[30] which, if provided over the 40 year horizon used in the parties’ analysis, would equal $1,000,000, or double the amount estimated by the parties. MDWASD estimate of $25,000 per year was based on an informal estimate received by Utility Services of North America, and MDWASD witness Langer stated his opinion that the estimate is on the “high side” of what he anticipated would be received when bids were solicited.

Finally, the TNT estimate includes zero cost for receiving a required FERC blanket certificate, yet the certification process could be costly.

In sum, the parties indicate that the TNT bypass estimate is $0.01269 per therm, but staff believes this estimate is too low because it does not account for potentially higher tap, maintenance, and regulatory costs. Nonetheless, the TNT bypass estimate does offer valuable insight into the ability of MDWASD to bypass FCG facilities. Staff believes it is highly unlikely that the potential unaccounted costs would be equal to or greater than the difference between the tariff rate and the TNT bypass estimate ($0.134 per therm GS-1250 tariff rate less the $0.01269 per therm TNT bypass estimate). Thus, staff believes MDWASD has shown it could bypass FCG gas transportation facilities at the Alexander Orr plant with the TNT alternative.

Hialeah Bypass Alternative 1: “FGT Construction Estimates”

The “FGT Construction Estimates” detail appearing in Exhibit D to the Settlement petition indicates the bypass cost of service for the Hialeah plant (FGT bypass estimate) is $0.07244 per therm. The parties’ bypass cost of service for the Hialeah plant, $3,680,042, was provided in a November 3, 2009, FGT e-mail to MDWASD.[31] As with the FGT bypass estimate for the Orr plant, Staff believes the FGT bypass estimate of $0.07244 per therm for the Hialeah plant does not include the regulatory costs associated with acquiring approval of a FERC Blanket Certificate, and it doesn’t account for possible maintenance cost. However, the FGT bypass estimate does offer valuable insight into the ability of MDWASD to bypass FCG facilities. Staff believes it is highly unlikely that the potential unaccounted costs would be equal to or greater than the difference between the tariff rate and the FGT bypass estimate for the Hialeah plant ($0.134 per therm GS-1250 tariff rate less the $0.07244 per therm FGT bypass estimate). Thus, staff believes MDWASD has shown it could bypass FCG gas transportation facilities at the Alexander Orr plant with the FCG alternative.

Hialeah Bypass Alternative 2: “TNT Estimate”

The TNT bypass estimate calculated by the parties for the Hialeah plant is $0.02932 per therm. The TNT Pipeline construction estimate for bypass of the Hialeah plant received by FCG is $1,145,000 for the primary construction cost and $32,000 for the tap cost (the cost to tap into the FCG transmission main).[32] Staff believes the TNT estimate for the Hialeah plant is too low because it does not factor in the potential for higher tap, maintenance, and regulatory costs. Nonetheless, the TNT Estimate of the Orr plant bypass cost of service does offer valuable insight into the ability of MDWASD to bypass FCG facilities. Staff believes it is highly unlikely that the potential unaccounted costs would be equal to or greater than the difference between the tariff rate and the “TNT Estimates” for the Hialeah plant ($0.134 per therm GS-1250 tariff rate less the $0.02932 per therm “TNT Estimates”). Thus, staff believes MDWASD has shown it could bypass FCG gas transportation facilities at the Alexander Orr plant with the TNT pipeline alternative.

Alexander Orr and Hialeah Bypass Alternative: “Standalone Bypass Estimate”

The Standalone Bypass Estimates, along with most of the inputs, for the Orr and Hialeah plants were filed with a request for confidential treatment.[33] Staff believes the Standalone Bypass Estimates were designed to reflect the cost of service to FCG to construct and operate replacement pipelines at today’s costs. The Standalone Bypass Estimates may be considered valuable tools for gauging the reasonableness of the FGT and TNT bypass alternatives. Staff notes that the Standalone Bypass Estimates are substantially lower than the GS-1250 tariff rates. In that regard, the Standalone Bypass Estimates provided by the parties lend support to their claim that MDWASD has verifiable and documented bypass alternatives to FCG’s facilities.

[1] The 1998 Agreement was signed on October 29, 1999; however, it became effective as of July 1, 1998.

[2] Paragraph 2, 2008 Amendment.

[3] See Docket No. 080672-GU, In re: Petition for approval of Special Gas Transportation Service agreement with MDWASD by Florida City Gas.

[4] Issued on November 5, 2010, in Docket No. 090539-GU, In re: Petition for approval of Special Gas Transportation Service agreement with Florida City Gas by Miami-Dade County through Miami-Dade Water and Sewer Department.

[5] FCG Response to Staff’s 6th Set of Interrogatories, No. 89.

[6] The 1998 Agreement stated that MDWASD qualifies for the Contract Interruptible Large Volume Transportation Service (CI-LVT) rate schedule. In FCG’s 2003 rate case, the Commission approved numerous revisions to FCG’s rate schedules, including the elimination of the CI-LVT rate. Thus, in the 2008 Agreement FCG changed the tariff reference from CI-LVT to the Contract Demand Service (KDS) tariff. One of the issues identified was whether the KDS tariff addresses service to MDWASD.

[7] Order No. PSC-00-1592-TRF-GU, issued September 5, 2000, in Docket No. 000717-GU, In re: Petition for authority to implement contract transportation service by City Gas Company of Florida; Order No. PSC-96-1218-FOF-GU, issued September 24, 1996, in Docket No. 960920-GU, In Re: Petition for approval of flexible service tariff by City Gas Company of Florida; Order No. PSC-98-1485-FOF-GU, issued November 5, 1998, in Docket No. 980895-GU, In re: Petition by Florida Division of Chesapeake Utilities Corporation for authority to implement proposed flexible gas service tariff and to revise certain tariff sheets

[8] MDWASD response to Staff’s 1st Set of Interrogatories, No. 3.

[9] These potential costs are discussed in greater detail in Attachment 1 for each plant and each bypass estimate provided.

[10] FCG Response to Staff’s 6th Set of Interrogatories, No. 89 and Settlement, Exhibit D.

[11] Direct Testimony of FCG Witness Carolyn Bermudez, Exhibit CB-4, pages 4 and 7, indicating volume of therms for the Hialeah plant were 1,738,090 in 2004, and annual therms for the Alexander Orr plant in 200 were 2,617,741.

[12] FCG Response to Staff’s 6th Set of Interrogatories, No. 89 and Exhibit D of Settlement, Page 2 of 2, line 10.

[13] The Hialeah plant’s net book remains positive through the term of the contract; thus, its negative net salvage is not an issue for this contract.

[14] Net salvage is gross salvage minus cost of removal. For example, if the original investment is $100 and a company receives $10 when the investment is removed from service, the net salvage is 10 percent. Therefore, in order to be made whole, the company needs to recover $90 through depreciation rates, not the original $100, because it is receiving $10 in net salvage. If, overall, it costs the company $10 to remove the investment, then the net salvage is negative 10 percent and, in order for the company to be made whole, it must recover $110 through depreciation rates.

[15] FCG clarified in its CRA submission of January 17, 2012, that the costs of service pertaining to August 2009 through December 2011 are the Tier 1 costs of service appearing in the Settlement petition Schedule D, page 2 of 2, Line 18, Columns B and C, for the Alexander Orr and Hialeah plants, respectively.

[16] For August 2009 through December 2011, the 2011 TSA rate for Alexander Orr Plant is $0.01 per therm, while its estimate of its cost of service for the plant is $0.0212. For the same period, the 2011 TSA rate for Hialeah is $0.0300 per therm, while its estimated cost of service to the plant is $0.0312.

[17] Direct Testimony of Melvin Williams, page 2, filed December 29, 2010.

[18] See the Direct Testimony of Carolyn Bermudez filed on December 29, 2010, Exhibit CB-4, page 7 of 7.

[19] In re: Petition for limited proceeding to approve stipulation and settlement agreement by Progress Energy Florida, Inc.

[20] As one Commissioner remarked during the Commission’s deliberations; “I note that the Public Service Commission has a long-standing history precedent of favoring settlements, and also that any settlement does not establish precedent.” Transcript of February 22, 2012 Limited Proceeding Hearing, page 9.

[21] Issued November 9, 2004, in Docket No. 040046-EI, In re: Petition to vacate Order No. PSC-01-1003-AS-EI approving, as modified and clarified, the settlement agreement between Allied Universal Corporation and Chemical Formulators, Inc. and Tampa Electric Company and request for additional relief, by Allied Universal Corporation and Chemical Formulators, Inc.

[22] Issued October 26, 1989, in Docket No. 881518-SU, In re: Application of South Seas Utility Company for a rate increase in Lee County.

[23] Issued September 21, 2005, in Docket No. 050500-EU, In re: Joint petition for approval of territorial settlement agreement by Tampa Electric Company, Progress Energy Florida, Inc., and The Mosaic Company.

[24] Issued November 9, 2007, in Docket No. 060257-WS, In re: Application for Increase in water and wastewater rates in Polk County by Cypress Lakes Utilities, Inc.

[25] MDWASD response to FCG’s 1st Request for Production of Documents, Item 11, pp 7-9.

[26] MDWASD response to Staff’s 2nd Request for Production of Documents, Item No. 8, p 23.

[27] MDWASD response to Staff’s 5th Request for Production of Documents, Item No. 15, p 35.

[28] Witness Langer Rebuttal Testimony, Exhibit 12, p 4.

[29] MDWASD response to Staff’s 4th Set of Interrogatories, No. 62(f).

[30] MDWASD’s response to Staff’s 3rd Set of Interrogatories, No. 35.

[31] MDWASD response to FCG’s 1st Request for Production of Documents, Item 11, pp 11.

[32] Witness Langer Rebuttal Testimony, Exhibit 12, p 4.

[33] Settlement Petition, Exhibit D, p. 1.