Schedule 1

Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Division of Accounting and Finance (Slemkewicz) Division of Engineering (Graves) Office of Industry Development and Market Analysis (Breman) Division of Economics (Hudson) Office of the General Counsel (Barrera) |

||

|

RE: |

Docket No. 120244-EI Ė Petition for approval for base rate increase for Extended Power Uprate systems placed in commercial service by Florida Power & Light Company. |

||

|

AGENDA: |

11/27/12 Ė Regular Agenda Ė Proposed Agency Action Ė Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

|||

|

FILE NAME AND LOCATION: |

S:\PSC\AFD\WP\120244.RCM.DOC |

||

In 2006, the Florida Legislature enacted Section 366.93, Florida Statutes (F.S.), encouraging the development of nuclear energy in the state.† In that section, the Legislature directed the Commission to adopt rules providing for alternative cost recovery mechanisms that would encourage investor-owned electric utilities to invest in nuclear power plants.† The Commission adopted Rule 25-6.0423, Florida Administrative Code (F.A.C.), which provides for an annual clause recovery proceeding to consider investor-owned utilitiesí requests for cost recovery for nuclear plants.

By Order No. PSC-08-0021-FOF-EI,[1] the Commission made an affirmative determination of need for Florida Power & Light Companyís (FPL) Extended Power Uprate (EPU) project.† The EPU project will be accomplished at FPL's four nuclear units located at two nuclear generating plant sites in Florida: Turkey Point Units 3 and 4, and St. Lucie Units 1 and 2. †The EPU projects have gone into commercial service at various points in time, with the majority of the costs anticipated to go into plant in service when the modifications are completed in 2012 and 2013.

On October 1, 2012, FPL filed a petition to increase its base rates by the $243,978,281 revenue requirements associated with the uprates of St. Lucie Unit 1, St. Lucie Unit 2, and Turkey Point Unit 3 pursuant to Rule 25-6.0423(7), F.A.C.† Further, FPL has requested an additional $1,794,540 base rate increase for the 5-year amortization of existing assets that are being retired during 2012 pursuant to Rule 25-6.0423(7)(e), F.A.C.† FPL has also included a $280,473 true-up of the 2011 base rate revenue requirement for the 2011 modifications made at the St. Lucie and Turkey Point nuclear units. †In total, FPL has requested a base rate increase of $246,053,294.† This represents a base rate increase of $2.59 per month on a typical 1,000 kWh residential bill.

The Commission has jurisdiction over this subject matter pursuant to the provisions of Section 366.93, F.S., and other provisions of Chapter 366, F.S.

Issue 1:

Should FPL's request to increase its base rates by $243,978,281 for the EPU systems placed in commercial service during 2012 be approved?

Recommendation:

Yes.† FPL's request to increase its base rates by $243,978,281 for the 2012 EPU project modifications at the St. Lucie and Turkey Point nuclear units should be approved.† This approval should be subject to true-up and revision based on the final review of the 2012 modification expenditures in the Nuclear Cost Recovery Clause (NCRC).† (Slemkewicz, Graves, Breman)

Staff Analysis:

FPL has requested approval to increase its base rates by $243,978,281 for the EPU project modifications at the St. Lucie and Turkey Point units that went into service during 2012.

Rule 25-6.0423(7), F.A.C., states the following:

(7) Commercial Service. As operating units or systems associated with the power plant and the power plant itself are placed in commercial service:

(a) The utility shall file a petition for Commission approval of the base rate increase pursuant to Section 366.93(4), F.S., separate from any cost recovery clause petitions, that includes any and all costs reflected in such increase, whether or not those costs have been previously reviewed by the Commission; provided, however, that any actual costs previously reviewed and determined to be prudent in the Capacity Cost Recovery Clause shall not be subject to disallowance or further prudence review except for fraud, perjury, or intentional withholding of key information.

(b) The utility shall calculate the increase in base rates resulting from the jurisdictional annual base revenue requirements for the power plant in conjunction with the Capacity Cost Recovery Clause projection filing for the year the power plant is projected to achieve commercial operation. The increase in base rates will be based on the annualized base revenue requirements for the power plant for the first 12 months of operations consistent with the cost projections filed in conjunction with the Capacity Cost Recovery Clause projection filing.

(c) At such time as the power plant is included in base rates, recovery through the Capacity Cost Recovery Clause will cease, except for the difference between actual and projected construction costs as provided in subparagraph (5)(c)4. above.

(d) The rate of return on capital investments shall be calculated using the utilityís most recent actual Commission adjusted basis overall weighted average rate of return as reported by the utility in its most recent Earnings Surveillance Report prior to the filing of a petition as provided in paragraph (7)(a). The return on equity cost rate used shall be the midpoint of the last Commission approved range for return on equity or the last Commission approved return on equity cost rate established for use for all other regulatory purposes, as appropriate.

(e) The jurisdictional net book value of any existing generating plant that is retired as a result of operation of the power plant shall be recovered through an increase in base rate charges over a period not to exceed 5 years. At the end of the recovery period, base rates shall be reduced by an amount equal to the increase associated with the recovery of the retired generating plant.

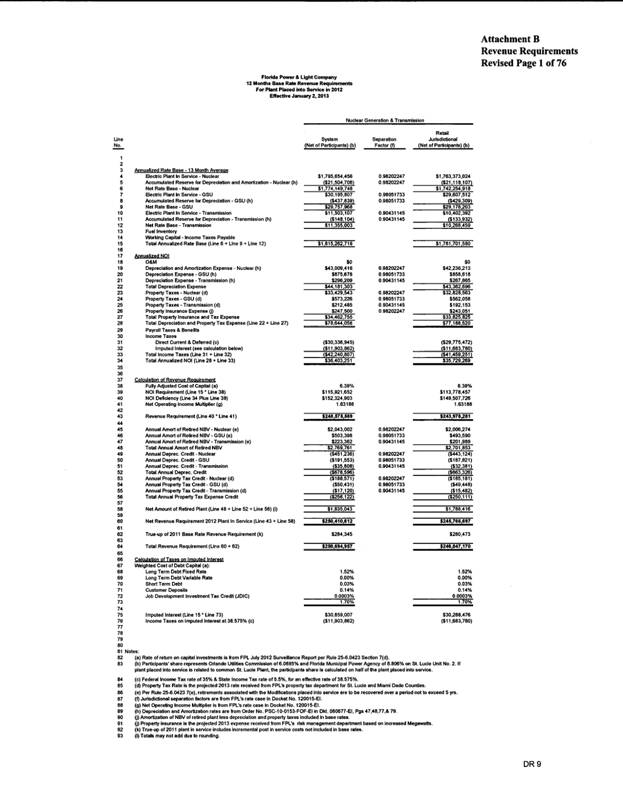

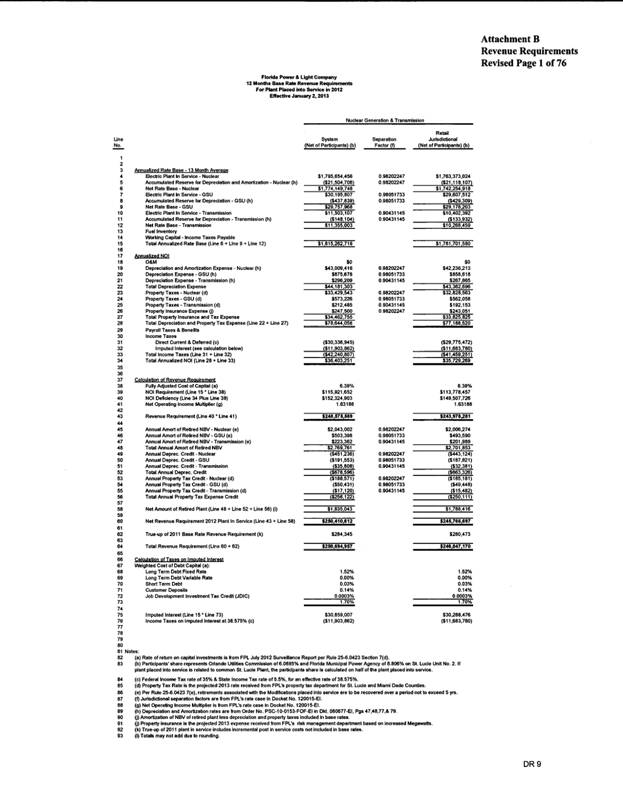

In compliance with Rule 25-6.0423(7), F.A.C., FPL submitted its calculation of the annualized base rate revenue requirements for the EPU project modifications for the first 12 months of operations.† This calculation is shown on Attachment B, Page 1 of 76, attached to FPLís petition.† Staff has reviewed the calculation of the $243,978,281 jurisdictional annual revenue requirement.† Staff believes the annual revenue requirement calculation has been calculated in compliance with Rule 25-6.0423(7), F.A.C.

The 2012 expenditures related to the EPU project modifications are still under review in the NCRC.† A final determination of the reasonableness and prudence of the 2012 expenditures will be made during 2013.† Per Attachment B, Page 1 of 76, to FPLís petition, the increase in Electric Plant in Service included in the calculation is $1,837,353,370 ($1,803,382,928 jurisdictional), net of joint owners.† If the $1,837,353,370 amount is revised based on a final audit and review of the 2012 expenditures, the annual revenue requirement will have to be recalculated.† This would require a true-up of the revenues already collected and a revision of the related tariffs.† Therefore, staff further recommends that the approval of the $243,978,281 base rate increase be made subject to true-up and revision based on the final review of the 2012 EPU project modification expenditures at the St. Lucie and Turkey Point units in the NCRC.

Issue 2:

Should FPLís request to increase its base rates by $1,794,540 for the 5-year amortization of existing assets that are being retired during 2012 as a result of the EPU project be approved?

Recommendation:

No.† The appropriate base rate increase is $1,788,416 for the 5-year amortization of the existing assets that are being retired during 2012.† At the end of the recovery period, base rates should be reduced by an amount equal to the increase associated with the recovery of the retired generating plant.† (Slemkewicz)

Staff Analysis:

FPL has requested approval to increase its base rates by $1,794,540 for the 5-year amortization of existing assets that are being retired during 2012 pursuant to Rule 25-6.0423(7)(e), F.A.C., which states:

The jurisdictional net book value of any existing generating plant that is retired as a result of operation of the power plant shall be recovered through an increase in base rate charges over a period not to exceed 5 years. At the end of the recovery period, base rates shall be reduced by an amount equal to the increase associated with the recovery of the retired generating plant.

As a direct result of the EPU project modifications, certain existing assets have been replaced or are no longer necessary for the operation of the plant.† Therefore, these assets are being retired pursuant to Rule 25-6.0423(7)(e), F.A.C.† Per Attachment B to FPLís petition, the net book value of the asset retirements will be $13,850,155 at December 31, 2012.† This results in an annual amortization of $2,775,997 ($2,707,976 jurisdictional) over the 5-year period.† In addition, FPL has proposed to decrease the annual amortization by annual depreciation expense and property tax expense credits of $934,718 ($913,436 jurisdictional), resulting in a net annual amortization of $1,841,279 ($1,794,540 jurisdictional).

During its review, staff noted several apparent errors that were made in the calculation involving the net book value of the assets.† In the Companyís response to Staffís First Data Request,[2] FPL filed a revision of the calculation of the 5-year amortization of the existing assets that are being retired during 2012 (Schedule 1).† The revision reflects the appropriate net book value amount in the calculation. †As shown on Schedule 1, line 58, the net amortization of the asset retirements decreased from $1,841,279 ($1,794,540 jurisdictional) to $1,835,043 ($1,788,416 jurisdictional), a reduction of $6,236 ($6,123 jurisdictional).

Staff agrees with FPLís revised calculation of the 5-year amortization amount for the assets that are being retired during 2012.† Therefore, staff recommends that the Commission approve $1,788,416 as the appropriate base rate increase for the 5-year amortization of the assets that are being retired during 2012.† In addition, base rates should be reduced by an amount equal to the increase associated with the recovery of the retired generating plant at the end of the recovery period.

Issue 3:

Should FPL's request to increase its base rates by $280,473 for the true-up of the 2011 base rate adjustment be approved?

Recommendation:

Yes.† The appropriate base rate increase is $280,473 for the true-up of the 2011 base rate adjustment.† (Slemkewicz, Graves, Breman)

Staff Analysis:

Per Order No. PSC-11-0575-PAA-EI,[3] FPL was authorized to increase its base rates by $20,068,628 for the 2011 modifications made at the St. Lucie and Turkey Point nuclear units.† This approval was subject to true-up and revision based on the final review of the 2011 expenditures in the NCRC in Docket No. 120009-EI.

As shown on page 76 of Attachment B to FPLís Petition, the Company is requesting a true-up to increase base rates by $280,473.† The primary reasons for the true-up are (1) a $2,027,920 Electric Plant in Service - Nuclear increase between the estimated $130,347,450 used in the previous calculation and the final amount of $132,375,370 used in the current calculation, and (2) a $36,186 Electric Plant in Service - Transmission increase between the estimated $18,496,957 used in the previous calculation and the final amount of $18,533,143 used in the current calculation.

Staff has reviewed the true-up calculation and recommends that the $280,473 base rate increase be approved.

Issue 4:

What is the appropriate effective date of FPLís revised base rates?

Recommendation:

If the Commission approves the staff recommendations in Issues 1, 2, and 3, the revised base rates should be implemented with the first billing cycle for 2013, which falls on January 2, 2013.† Staffís recommended total increase should be allocated among the various rate classes consistent with the Cost of Service study in place at the time the rates go into effect.† Furthermore, FPL should file revised tariff sheets to implement the Commission vote in Issues 1, 2, and 3 for administrative approval by staff prior to their effective date. †(Hudson)

Staff Analysis:

FPL proposed to revise base rates by increasing the energy charge for all rate classes.† In response to Staffís Second Set of Data Requests,[4] FPL explained that the fuel savings associated with the increased nuclear generation is better matched with costs by recovering the EPU base rate increase through the energy charge only.† Further, in order to ensure all customers in a rate class realize the same net cost per kWh after fuel savings, FPL explained that the EPU increase should be recovered through the energy charge.† The Commission has approved energy-only rate increases in other nuclear uprate projects.[5]

Staffís recommended total increase of $246,047,170 should be allocated among the various rate classes consistent with the Cost of Service study in place at the time the rates go into effect.† The total base rate increase recommended in Issues 1, 2, and 3 results in an approximate increase of $2.59 to the 1,000 kilowatt-hour residential bill.

If the Commission approves the staff recommendations in Issues 1, 2, and 3, the revised base rates should be implemented with the first billing cycle for 2013, which falls on January 2, 2013.† Furthermore, FPL should file revised tariff sheets to implement the Commission vote in Issues 1, 2, and 3 for administrative approval by staff prior to their effective date.

Issue 5:

Should this docket be closed?

Recommendation:

If no person whose substantial interests are affected by the proposed agency action files a protest within 21 days of the issuance of the order, this docket should be closed upon the issuance of a consummating order. †(Barrera)

Staff Analysis:

If no person whose substantial interests are affected by the proposed agency action files a protest within 21 days of the issuance of the order, this docket should be closed upon the issuance of a consummating order.

Schedule 1

[1]See Order No. PSC-08-0021-FOF-EI, issued January 7, 2008, in Docket No. 070602-EI, In re: Petition for determination of need for expansion of Turkey Point and St. Lucie nuclear power plants, for exemption from Bid Rule 25-22.082, F.A.C., and for cost recovery through the Commission's Nuclear Power Plant Cost Recovery Rule, Rule 25-6.0423, F.A.C.

[2] Document No. 07058-12, filed October 16, 2012.

[3]See Order No. PSC-11-0575-PAA-EI, issued December 14, 2011, in Docket No. 110270-EI, In re: Petition for approval of base rate increase for extended power uprate systems placed in commercial service, pursuant to Section 366.93(4), F.S., and Rules 25-6.0423(7) and 28-106.201, F.A.C., by Florida Power & Light Company.

[4] Document No. 07137-12, filed October 19, 2012

[5] See Order Nos. PSC-11-0575-PAA-EI, issued December 14, 2011, in Docket No. 110270-EI, In re:† Petition for approval of base rate increase for extended power uprate systems placed in commercial service, pursuant to Section 366.93(4), F.S., and Rules 25-6.0423(7) and 28-106.201, F.A.C., by Florida Power & Light Company and PSC-11-0078-PAA-EI, issued January 31, 2011, in Docket No. 100419-EI, In re:† Petition for approval of base rate increase for extended power uprate systems placed in commercial service, pursuant to Section 366.93(4), F.S., and Rules 25-6.0423(7) and 28-106.201, F.A.C., by Florida Power & Light Company.