Issue Description Page

2 Agreed upon Audit Adjustments (VanEsselstine, Fletcher)

3 Contested Audit Findings (VanEsselstine, Fletcher)

4 Pro Forma Plant (McRoy, VanEsselstine)

5 Used and Useful (McRoy, VanEsselstine)

6 Working Capital Allowance (VanEsselstine, Fletcher)

7 Appropriate Rate Base (VanEsselstine, Fletcher)

8 Appropriate Return on Equity (VanEsselstine, Fletcher)

9 Overall Cost of Capital (VanEsselstine, Fletcher)

10 Test Year Revenues (Thompson)

11 Allocated Expenses (VanEsselstine, Fletcher)

12 Appropriate Rate Case Expense (VanEsselstine, Fletcher)

13 Pro Forma Expense Items (VanEsselstine, Fletcher)

14 Income Tax Expense (VanEsslestine, Fletcher)

15 Appropriate Revenue Requirement (VanEsselstine, Fletcher)

16 Appropriate Rate Structure (Thompson, Hudson)

17 Repression Adjustment (Thompson, Hudson)

18 Appropriate Rates (Thompson, Hudson)

19 Interim Refund (VanEsselstine, Fletcher)

20 Four-Year Rate Reduction (Thompson, Hudson)

21 Proof of Adjustments (VanEsselstine, Fletcher)

22 Close of Docket (Lawson, VanEsselstine, Fletcher)

Schedule 1-A – Water Rate Base

Schedule 1-B – Wastewater Rate Base

Schedule 1-C – Adjustments to Rate Base

Schedule 2 – Capital Structure

Schedule 3-A – Water Operating Income

Schedule 3-B – Wastewater Operating Income

Schedule 3-C – Adjustments to Operating Income

Schedule 4-B – Wastewater Rates

Pluris Wedgefield, Inc. (Wedgefield or Utility) is a Class B utility providing service to approximately 1,598 water and 1,567 wastewater customers in Orange County. For the year ended December 31, 2011, the Utility reported operating revenues of $985,446 for water and $731,559 for wastewater. Additionally, the Utility reported an operating income of $158,969 for water and an operating loss of $127,780 for wastewater.

The Utility’s last rate case was in 2008 for water and 1988 for wastewater.[1] On September 8, 2009, Wedgefield was transferred from Wedgefield Utilities, Inc. to Pluris Wedgefield, LLC.[2] The Utility became Pluris Wedgefield, Inc. by Order No. PSC-09-0739-FOF-WS, issued November 9, 2009.[3]

On July 19, 2012, Wedgefield filed its application for the rate increase at issue in the instant docket. The Utility requested that the application be processed using the Proposed Agency Action (PAA) procedure and requested interim rates. The test year established for interim and final rates is the simple average period ended December 31, 2011.

The Utility was granted interim rates designed to generate annual revenues of $1,350,198 for water and $907,479 for wastewater. This represented an annual revenue increase of $362,443 (36.69 percent) for water and $175,476 (23.97 percent) for wastewater.[4]

Pluris requested final rates designed to generate annual revenues of $1,379,982 for water and $913,888 for wastewater. This represents a revenue increase of $394,536 (40.04 percent) for water and $182,329 (24.92 percent) for wastewater. Subsequent to filing its Minimum Filing Requirements (MFRs), Pluris submitted a request for additional pro forma plant in the amount of $92,209 for repairs made to its water plant and a new bio filter for its water treatment facilities. The Utility also requested additional pro forma expenses in the amount of $110,069 relating to the addition of call center staff, the addition of a Controller, and an increase in the Utility’s property taxes. However, the Utility did not officially change its requested revenue requirement.

This recommendation addresses the Utility’s requested final rates. The Commission has jurisdiction pursuant to Sections 367.081 and 367.082, Florida Statutes (F.S.).

Is the quality of service provided by Pluris Wedgefield, Inc. satisfactory?

Recommendation:

Yes. The quality of service provided by Pluris Wedgefield, Inc. is satisfactory. (McRoy)

Staff Analysis:

Pursuant to Rule 25-30.433(1), Florida Administrative Code (F.A.C), the Commission determines the quality of service provided by a utility by evaluating three separate components of water and wastewater operations. These components include the quality of the utility’s product, the operating condition of the utility’s plants and facilities, and the utility’s attempt to address customer satisfaction. Comments or complaints received by the Commission from the utility’s customers and the utility complaint files are reviewed. The utility’s current compliance with the regulations of the Department of Environmental Protection (DEP) and the Water Management District are also considered.

Quality of Utility’s Product and Operational Condition of Plants and Facilities

In Orange County, the water and wastewater programs are regulated by the St. Johns River Water Management District (SJRWMD) and DEP. On November 12, 2011, DEP conducted a Sanitary Survey of the Wedgefield water treatment plant (WTP) with no deficiencies noted during the inspection.

On July 19, 2012, DEP conducted a Compliance Evaluation Inspection of the Wedgefield wastewater treatment plant (WWTP). The WWTP was found to be in substantial compliance. However, the report indicated the effluent quality was out of compliance due to a high Total Suspended Solids value reported on the Utility’s April 2012 Discharge Monitoring Report. DEP indicated the exceedence was properly reported and no further action was required by the Utility.

Wedgefield is currently in compliance with all of the required chemical analyses and has met all required standards for both water and wastewater operations. The Utility has no outstanding consent orders or warning letters. A staff field inspection of Wedgefield was conducted on December 5, 2012. Staff found no apparent problems with the operations of either the water or wastewater facilities. On the morning of December 6, 2012, staff observed the Utility conducting its annual sewer line inspections and the installation of two new isolation valves at the WTP. The new isolation values should allow the Utility to isolate affected areas of the service territory when a line break occurs. Based on a review of the maintenance records and a physical inspection, the general condition of the facilities appeared to be adequate. Therefore, staff recommends that the quality of drinking water delivered to the customers, the wastewater effluent quality, and the operating condition of the Utility’s water and wastewater plants and facilities are satisfactory.

The Utility’s Attempt to Address Customer Satisfaction

A customer meeting was held on December 5, 2012, at the Wedgefield Country Club in Orlando, Florida. Over 200 customers attended the meeting with 24 customers providing verbal comments. Citing affordability concerns, the attendees were generally against the proposed rate increases for water and wastewater. Water quality in particular was cited as a reason for not justifying the rate increases. Although it was acknowledged that the water provided by the Utility met DEP health and safety standards, general consensus among the attendees was that the water was considered unfit to consume and not worth the rate increase because of frequent taste, odor, and discoloration problems. Several customers indicated the quality had not improved since the last rate case, while other customers made comments about public noticing concerning Precautionary Boil Water Notices (PBWNs). The Utility met with and responded to 23 of the 24 customers who spoke at the customer meeting. The Utility was unable to meet with one Wedgefield Home Owner Association representative, stating that several attempts to meet with him had failed. The Utility attempted to address each the of customer’s concerns raised at the customer meeting. After meeting with the Utility, several customers submitted letters acknowledging that the Utility had met with them and addressed their concerns. A report titled “Customer Comments Follow-up” and the customer letters were submitted to the Commission by the Utility and placed in the docket file.[5]

The collection and distribution system for the Wedgefield community was built in the early 1960’s. Recently, a significant number of water line breaks have occurred. Several customers expressed concern relating to frequent water outages due to water line breakage. One particular area of the distribution system where a lot of the current outages have occurred is located at the area of the intersection of Majestic Street and Archer Boulevard. After further discussion with Wedgefield, it was noted that this line is constructed with Asphalt Concrete (AC) pipe. AC pipe was used in the 60’s and 70’s and as it ages, it becomes very difficult to repair if a leak develops. Wedgefield estimates there is approximately 19,200 linear feet of AC pipe ranging in sizes of 4, 6, and 8 inches within the distribution system. To help reduce the number of customers impacted by line breaks, the Utility has installed two new isolation valves at the WTP. The isolation values should allow the Utility to better isolate affected areas of the service territory.

Staff questioned the Utility on its PBWN procedures. The Utility informed staff that when PBWNs are required, customers are notified by multiple methods of communication consisting of robo calls, notifying the Wedgefield Country Club office, door hangers and signs. For all PBWNs, no matter how many customers are affected, an outbound telephone message is made to all affected customers who have an active phone number posted on their account. Once the PBWN is rescinded, another reverse robo call is issued to the same customers notifying them that the PBWN is no longer in effect. Depending on what time the disruption of service or water outage occurs, Wedgefield's field staff notifies the Wedgefield Country Club office. This method is most commonly used when a PBWN is issued during normal business hours. Once the PBWN is rescinded, Wedgefield staff notifies the office that the PBWN is no longer in effect. If the PBWN affects a small number of customer connections, the PBWN is attached to door hangers and left on the door of the affected customers’ homes. Historically, water outages are typically limited to specific streets or portions of the distribution system. Once the PBWN is rescinded, notices are hung on the same doors with the news that the PBWN is no longer in effect. The Utility further indicates that in the case of a PBWN that requires notifying the whole community, signs are placed at both entrances to the Wedgefield development. Once the PBWN is rescinded, the signs are updated to reflect the rescission date.

Pursuant to Rule 25-30.251(2), F.A.C, the Utility shall notify the Commission of any interruptions in service which affect ten percent or more of its customers. Notification to the Commission shall be made within one work day of notification by the Utility that such an interruption has occurred, and within one work week after service has been restored. The Utility shall file a complete report of the interruption to the Commission. During the past outages, the Utility notified DEP and its customers, but did not notify the Commission. Since Wedgefield’s purchase of the system in 2009, this was the first time that the Utility did not notify the Commission per the rule. During staff’s field inspection, staff addressed the oversight with the Utility, and the Utility verbally agreed to notify the Commission per the rule on future outages.

Several customers also expressed considerable interest in having Orlando Utilities Commission (OUC) provide service to the community based on a perceived superior water quality. Staff reviewed the latest DEP Consumer Confidence Reports (CCR) for both OUC and Wedgefield and did a comparison for five of the most commonly recognized categories for drinking water analysis: Copper, Lead, Chlorine, Haloacetic Acids (HAA5) and Total Trihalomethanes (TTHM). The results are listed in the table below.

Table 1-1

|

Wedgefield vs. OUC Commonly recognized categories for drinking water analysis |

||||

|

Item |

Wedgefield |

Level Exceeded (Y/N) |

OUC |

Level Exceeded (Y/N) |

|

Copper (ppm) |

0.07 |

N |

0.48 |

N |

|

Lead (ppb) |

0.005 |

N |

0.48 |

N |

|

Chlorine (ppm) |

1.75 |

N |

2.09* (annual average 1.04) |

N |

|

Haloacetic Acid (HAA5) (ppb) |

38.2 |

N |

31* (annual average 18) |

N |

|

Total Trihalomethanes (TTHM) (ppb) |

55.2 |

N |

88* (annual average 49) |

N |

* OUC note – Compliance levels are based on running annual averages.

Based on the published CCR reports, both utilities produced water similar in chemical content and both were in compliance for all five of the categories.

There are currently two active water complaints on file at the Commission, and there were no complaints indicated for wastewater. The Utility’s complaint log for the test year (2011) indicated that approximately six customer complaints were received. The majority of the water complaints during this time dealt with billing while one complaint was regarding discolored water. The Commission did receive approximately 60 letters. The letters were generally against the proposed rate increases. Water quality, in particular, was cited as a reason for not justifying the rate increase.

Staff believes the Utility’s efforts to respond to customer concerns demonstrates its willingness to address customer satisfaction. Treating the water used for all purposes by all customers to the highest customer expectation can come at significant cost to customers. For most systems, point-of-use treatment systems are often the most cost effective mechanism to achieve individual customer quality objectives. Although there have been water line breaks that have inconvenienced customers, staff believes that the Utility has notified its customers and reestablished service as required by rule. Therefore, staff recommends that Wedgefield’s attempt to address customer satisfaction is satisfactory.

Conclusion

Staff recommends that, pursuant to Rule 25-30.433(1), F.A.C., Wedgefield’s quality of product, operating condition of its plants and facilities, and its attempt to address customer satisfaction are satisfactory.

Should the audit adjustments to rate base and net operating income to which the Utility and staff agree be made?

Recommendation:

Yes. The following adjustments should be made to rate base and net operating income as set forth in Table 2-2 below. (VanEsselstine, Fletcher)

Staff Analysis:

The Utility was afforded an opportunity to address all of the findings issued by the auditing staff and provide additional support documentation for those areas it felt were unjustified. On December 7, 2012, the Utility provided its response to Audit Finding No. 2 that included information pertaining to unsupported plant additions (discussed in Issue 3). As the Utility did not respond to the other audit findings contained in the report, staff believes these adjustments should be considered agreed upon audit adjustments.

Table 2-1

|

Audit Findings |

Description of Audit Adjustments |

|

Finding No. 1 |

To correctly reflect the appropriate adjustments to plant, deprecation expense and accumulated depreciation from the prior order. |

|

Finding No. 3 |

To correctly reflect the appropriate balance of the land associated with the Utility’s water plant. |

Based on the above, staff believes that the following adjustments should be made:

Table 2-2

|

Water |

||||

|

|

|

|

Accum. |

Depreciation |

|

Audit Adjustments |

Plant |

Land |

Depreciation |

Expense |

|

Finding No. 1 |

$95,740 |

|

($51,596) |

$5,597 |

|

Finding No. 3 |

|

($3,964) |

|

|

|

Adjustment Totals |

$95,740 |

($3,964) |

($51,596) |

$5,597 |

|

|

||||

|

Wastewater |

||||

|

|

|

|

Accum. |

Depreciation |

|

Audit Adjustments |

Plant |

Land |

Depreciation |

Expense |

|

Finding No. 1 |

($118,384) |

|

$51,596 |

($4,976) |

|

Finding No. 3 |

|

|

|

|

|

Adjustment Totals |

($118,384) |

|

$51,596 |

($4,976) |

Should the contested audit adjustments to rate base be made?

Recommendation:

Yes. The Utility’s wastewater plant should be reduced by $135,285. Accordingly, corresponding adjustments should be made to decrease accumulated depreciation and depreciation expense by $17,184 and $4,318, respectively. (VanEsselstine, Fletcher)

Staff Analysis:

The Utility provided partial responses to requests for support documentation relating to Audit Finding No. 2, reduction to the Utility’s wastewater plant for unsupported additions. Based on the audit, audit staff recommended a reduction of the Utility’s wastewater plant in the amount of $161,862, with corresponding reductions in accumulated depreciation of $20,982 and depreciation expense of $5,150.

In its response to the audit report, Wedgefield provided additional support documentation in the amount of $26,577. As a result, plant, accumulated depreciation, and depreciation expense were recalculated. Staff notes that the Utility should not be precluded from receiving a return on its investment in plant in a subsequent rate case if more information becomes available to the Utility. Based on the above, staff believes the Utility’s wastewater plant should be reduced by $135,285 ($161,862 - $26,577). Accordingly, corresponding adjustments should be made to decrease accumulated depreciation and depreciation expense by $17,184 and $4,318, respectively.

Issue 4: Should the Commission approve any pro forma plant additions?

Recommendation:

Yes. The appropriate pro forma plant additions are $86,203 for water and $3,103 for wastewater. This results in an incremental increase of $41,358 for water and decrease of $7,979 for wastewater from the Utility’s initial filing. Corresponding adjustments should also be made to decrease accumulated depreciation by $44,863 for water and $9,235 for wastewater and decrease depreciation expense by $2,028 for water and $391 for wastewater. Additionally, pro forma property taxes should be increased by $2,243 for water and $207 for wastewater. (McRoy, VanEsselstine)

Staff Analysis:

The Utility requested in its MFR filing several pro forma plant improvements to be included in the instant docket in the amount of $44,665 for water and $11,082 for wastewater. These pro forma plant items included Variable Frequency Drives (VFD), weir replacements, and work on the Utility’s Supervisory Control and Data Acquisition (SCADA) system. Staff believes that the pro forma additions are reasonable and prudent because they will help extend the life of the water and wastewater facilities and address several other maintenance issues.

As a part of staff’s review relating to the prudency of these additions, staff requested a statement of why each addition is necessary and a copy of all invoices and support documentation for the additions. In response to a staff request, Wedgefield provided invoices from E&R Mechanical totaling $50,893 for water and $12,412 for wastewater, as well as the necessary permit from DEP for the addition of the VFD. Therefore, staff recommends a $6,228 ($50,893 - $44,665) increase for water and a $1,330 ($12,412 - $11,082) increase for wastewater. However, the Utility did not include a pro forma retirement adjustment for the replacement of the weirs at its wastewater facilities. When the original cost is not known, or the year that retired plant was placed in service, it is Commission practice to determine the retirement cost by using 75 percent of the replacement cost.[6] In accordance with Commission practice, staff recommends wastewater plant and accumulated depreciation both be reduced by $9,309 ($12,412 x 75 percent). This results in a net plant reduction of $7,979 ($1,330 - $9,309) for wastewater.

Further, the Utility requested additional pro forma plant subsequent to its MFR filing in the amount of $92,209 for repairs made to its water plant and a new bio filter for its water treatment facilities. Staff reviewed the support documentation provided by the Utility and believes these adjustments are warranted. Staff recommends that $550 for employee time be removed as non-recurring, and $11,440 be removed as duplicative with the pro forma amount that was initially requested in the Utility’s MFRs. However, staff recommends disallowance of employee time related to work on the Utility’s SCADA system that staff believes could have taken place during normal business hours. Staff’s recommended pro forma plant increase does include employee time that was incurred outside normal business hours in connection to the Utility’s pipe breakages. Based on the above, staff recommends an increase of $80,219 ($92,209 - $550 - $11,440) associated with these pro forma items. However, the Utility did not include a pro forma retirement adjustment for the additional pro forma plant. In accordance with Commission practice, staff recommends that the recommended amount for plant and accumulated depreciation each be netted against $45,089 ($80,219 x 75 percent) to reflect the associated plant retirements.

Based on the above, staff recommends that the appropriate pro forma plant additions are $86,203 for water and $3,103 for wastewater. This results in an incremental increase of $41,358 ($6,228 + $80,219 - $45,089) for water and decrease of $7,979 ($1,330 - $9,309) for wastewater from the amounts requested in the Utility’s initial filing. Using the depreciable life pursuant to Rule 25-30.140, F.A.C., corresponding adjustments should be made to decrease accumulated depreciation by $44,863 for water and $9,235 for wastewater. In addition, depreciation expense should be decreased by $2,028 for water and $391 for wastewater. Finally, pro forma property taxes should be increased by $2,243 for water and $207 for wastewater.

What are the Used and Useful percentages of the Utility's water and wastewater systems?

Recommendation:

Staff recommends that the Utility’s WTP and storage be considered 100 percent used and useful (U&U). The Utility's water distribution system should be considered 85.1 percent U&U. As a result, corresponding adjustments are necessary for the non-U&U water distribution plant. Accordingly, water rate base should be reduced by $9,787. Corresponding adjustments should be made to increase depreciation expense by $302 and reduce property taxes by $894. The Utility's WWTP should be considered 72.1 percent U&U. The Utility's wastewater collection system should be considered 85.1 percent U&U. Accordingly, wastewater rate base should be reduced by $14,186. Corresponding adjustments should be made to increase depreciation expense by $163 and reduce property taxes by $2,465. (McRoy, VanEsselstine)

Staff Analysis:

In its application, the Utility asserts that the WTP is 100 percent, WWTP is 72.1 percent, and the water distribution and wastewater collection systems are 85.1 percent U&U. Below is a discussion for each facility.

Water Treatment Plant

Pursuant to Rule 25-30.4325, F.A.C., the U&U calculation for a WTP is determined by dividing the peak demand by the firm reliable capacity (FRC) of the WTP. Because the system has storage facilities, the calculation is in gallons per day (gpd). Consideration of growth, fire flow requirements, unaccounted for water, and other factors may also be included.

The WTP has two wells, rated at 400 and 600 gallon per minute (gpm). Pursuant to Rule 25-30.4325(6)(b), F.A.C., the FRC of a water treatment system with storage, excluding the largest well, is 384,000 (400 x 60 x 16) gpd. During the test year, the single maximum day peak demand was 567,000 gallons, and it occurred on May 2, 2011, based on the Utility’s Monthly Operating Reports. Fire hydrants are located throughout the service area. It does not appear that there was a fire, line break, or other unusual occurrence on that day. Therefore, pursuant to Rule 25-30.4325(1)(d), F.A.C., a fire flow allowance of 500 gpm for 2 hours (60,000 gpd) should be included in the U&U analysis. The Utility did not request any allowance for growth.

The Utility’s F-1 schedule in the MFRs indicates the unaccounted for water was 7.64 percent of the amount produced, which is not excessive. Pursuant to Rule 25-30.4325, F.A.C., Excessive Unaccounted for Water (EUW) is unaccounted for water in excess of 10 percent of the amount pumped.

Pursuant to Rule 25-30.4325(5), F.A.C., staff recommends that the WTP is 100 percent U&U based on a peak day of 567,000 gpd, a fire flow allowance of 60,000 gpd, EUW of 0 gpd, and FRC of 384,000 gpd.

Ground Storage Tank

Rules 25-30.4325(8) and (9), F.A.C., provide that the U&U percentage for a storage tank is determined by dividing the peak demand by the usable capacity of the tank. The Utility has a 350,000-gallon ground storage tank with the bottom of the tank below the centerline of the pumping unit. Therefore, pursuant to Rule 25-30.4325(9)(b), F.A.C., the usable capacity of the tank is 90 percent of the capacity or 315,000 gpd. Because the usable storage capacity is less than the peak day demand (567,000 gpd), the storage tank should be considered 100 percent U&U, pursuant to Rule 25-30.4325(8), F.A.C.

Wastewater Treatment Plant

Pursuant to Rule 25-30.432, F.A.C., the U&U percentage for a WWTP is determined by dividing the customer demand, less excessive infiltration and inflow, plus a growth allowance. The rule also contains a provision for consideration of other factors, such as whether the service area is built out, whether the permitted capacity differs from design capacity, and whether flows have decreased due to conservation or reduction in the number of customers.

The current DEP permitted capacity is 330,000 gpd for the WWTP based on Annual Average Daily Flows (AADF). The AADF during the test year was 238,000 gpd. Staff did not identify any excessive infiltration and inflow in the collection system. The Utility did not request any allowance for growth. Staff agrees with the Utility’s position that, pursuant to Rule 25-30.432, F.A.C., and using the AADF during the test year, the WWTP should be considered 72.1 percent U&U.

Water Distribution and Wastewater Collection Systems

The U&U calculations for the water distribution and wastewater collection systems are determined by dividing the number of customers connected to the systems by the number of lots available for service. The average number of connections during the test year was 1,594 Equivalent Residential Connection (ERCs). An annual customer growth rate of 6.5 ERCs was estimated with a statutory growth period of 5 years which equates to a total of 33 additional ERCs. The distribution and collection systems were designed to serve a total of 1,911 ERCs. Therefore, staff agrees with the Utility’s position that, pursuant to Rule 25-30.432, F.A.C., the water distribution and wastewater collection systems should be considered 85.1 (1,594 + 33 / 1,911) percent U&U.

Conclusion

Staff recommends that the Utility’s WTP and storage be considered 100 percent used and useful (U&U). The Utility's water distribution system should be considered 85.1 percent U&U. As a result, corresponding adjustments are necessary for the non-U&U water distribution plant. Accordingly, water rate base should be reduced by $9,787. Corresponding adjustments should be made to increase depreciation expense by $302 and reduce property taxes by $894. The Utility's WWTP should be considered 72.1 percent U&U. The Utility's wastewater collection system should be considered 85.1 percent U&U. Accordingly, wastewater rate base should be reduced by $14,186. Corresponding adjustments should be made to increase depreciation expense by $163 and reduce property taxes by $2,465.

What is the appropriate working capital allowance?

Recommendation:

The appropriate working capital allowance is $70,969 for water and $72,121 for wastewater. This represents a reduction of $3,370 for water and $3,361 for wastewater. (VanEsselstine, Fletcher)

Staff Analysis:

In its MFRs, the Utility reflected a working capital allowance of $74,339 for water and $75,482 for wastewater. Rule 25-30.433(2), F.A.C., requires that Class B utilities use the formula method, whereby the working capital allowance is based on one-eighth of operations and maintenance (O&M) expense. The Utility has properly filed its allowance for working capital using the formula method. However, based on staff’s recommended level of O&M expenses and adjustments in other issues, staff recommends that a working capital allowance of $70,969 for water and $72,121 for wastewater be approved. This represents a reduction of $3,370 for water and $3,361 for wastewater.

What is the appropriate rate base for the test year ended December 31, 2011?

Recommendation:

Consistent with other recommended adjustments, the appropriate rate base for the test year ended December 31, 2011, is $4,439,796 for water and $885,369 for wastewater. (VanEsselstine, Fletcher)

Staff Analysis:

In its MFRs, the Utility recorded rate

base of $4,334,962 for water and $1,086,549 for wastewater. Staff calculated Wedgefield’s

water and wastewater rate bases using the Utility’s MFRs with adjustments as

recommended in the preceding issues. Accordingly, staff recommends that the

appropriate simple average rate base for the test year ended December 31, 2011,

is $4,439,796 for water and $885,369 for wastewater. Staff’s recommended water

and wastewater rate bases are shown on Schedule Nos. 1-A and 1-B, respectively.

The adjustments are shown on Schedule No. 1-C.

COST OF CAPITAL

Issue 8: What is the appropriate return on equity?

Recommendation:

Based on the Commission leverage formula currently in effect, the appropriate Return on Equity (ROE) is 10.88 percent. Staff recommends an allowed range of plus or minus 100 basis points be recognized for ratemaking purposes. (VanEsselstine, Fletcher)

Staff Analysis:

The Utility requested an ROE of 11.16 percent. Although the Utility correctly utilized the current leverage formula, staff recommends certain adjustments to the Utility’s capital structure as discussed in Issue 9. These adjustments resulted in a higher equity ratio for the test year and thus a lower recommended ROE. Based on the current leverage formula and an equity ratio of 42.97 percent, the appropriate ROE is 10.88 percent.[7] Staff recommends an allowed range of plus or minus 100 basis points be recognized for ratemaking purposes.

What is the appropriate weighted average cost of capital including the proper components, amounts, and cost rates associated with the capital structure?

Recommendation:

The appropriate weighted average cost of capital, including the proper components, amounts, and cost rates associated with the capital structure, is 8.36 percent. (VanEsselstine, Fletcher)

Staff Analysis:

As shown on MFR Schedule D-1, Wedgefield requested an overall cost of capital of 8.33 percent. However, staff believes there are adjustments that should be made to the Utility’s capital structure.

First, on Schedule A-19 of its filing, the Utility included “Advances from Associated Companies” in its long-term debt balance. In response to a staff data request, the Utility noted that the advance has a zero percent cost rate. The Commission has previously held that debt from “associated companies” with no interest payments made should be treated as common equity.[8] In accordance with Rule 25-30.433(4), F.A.C., staff recommends that $252,431 of the Utility’s long-term debt be reclassified as common equity.

Second, on Schedule D-1 of its filing, the Utility did not include “Deferred Income Tax” in its capital structure. However, the Utility recorded a deferred income tax asset of $3,179 for 2010 and a deferred income tax liability of $23,221 in 2011. In response to a staff data request, the Utility noted that Wedgefield does not record deferred income taxes because the Utility has historically operated in a net loss position and does not expect to pay these taxes; therefore, any calculated deferred income taxes have been fully reserved. However, in accordance with Rule 25-30.433(3), F.A.C., staff calculated the simple average of U&U debit deferred tax offsetting the net U&U credit deferred income tax. Therefore, staff recommends the inclusion of $9,444 of deferred income tax credit be included in the Utility’s capital structure.

Based on the above, staff’s recommended capital structure yields an overall cost of capital of 8.36 percent.[9] Schedule No. 2 contains staff’s recommended capital structure.

What is the appropriate amount of test year revenues?

Recommendation:

The appropriate test year revenues for Wedgefield are $983,812 for water and $732,003 for wastewater. CIAC for water should be increased by $8,410. (Thompson)

Staff Analysis:

Wedgefield recorded total test year revenues of $985,446 for water and $731,559 for wastewater. The water revenues included $945,414 of service revenues and $40,032 of miscellaneous revenues. The Utility did not include any miscellaneous revenues for the wastewater system.

Based on staff’s review of the Utility’s billing determinants and the rates that were in effect during the test year, staff recommends adjustments to the test year water service revenues. The Utility incorrectly billed residential irrigation customers $5.02 per 1,000 gallons which was the general service gallonage charge. The Commission-approved rate structure for residential irrigation customers was an inclining block rate structure. Staff adjusted the water test year revenues by $452 to correct this error. The Utility has corrected its billing for residential irrigation to reflect the Commission-approved tariff rates. In addition, the test year service revenues were adjusted by $2,307 to reflect the Utility’s billing determinants and the rates in effect during the test year. Therefore, staff recommends that the test year water service revenues be increased by $2,759 to reflect total test year water service revenues of $948,173.

Staff also made several adjustments to test year miscellaneous revenues. The Utility recorded $330 of meter installation charges as miscellaneous revenues. Staff reduced miscellaneous revenues and increased CIAC for water by $330 to properly record the meter installation charges.

Further, in 2010, Wedgefield began offering customers the ability to make online payments through a third party vendor. Wedgefield collected $2 per online payment transaction, a portion of which was recorded as miscellaneous revenues, and the remainder was remitted to a third party vendor. The Utility’s Commission-approved tariff does not authorize the collection of an online payment fee. As of August 2012, the Utility discontinued the online payment fee. The Utility indicated it may seek to establish a tariff rate at a later date for an online payment fee.

Wedgefield indicated that from October 2010 to August 2012 it collected $18,544 of online payment fees and retained $8,080 of that amount. During the test year, the Utility recorded miscellaneous revenues of $7,906 related to the collection of the online payment fees. Staff contacted the Utility to determine if it could make customer-specific refunds to those customers who paid the online payment fees. Wedgefield indicated it does not have a method readily available to determine which customers would be entitled to a refund and cannot quantify the work that would be required to make the customer-specific refund determination. As result, staff recommends that the net amount the Utility retained as online payments fees from October 2010 to August 2012, $8,080, be recorded as CIAC in lieu of a refund. By recording the online payment fees to CIAC, it will benefit the general body of rate payers by decreasing rate base. In addition, test year miscellaneous revenues should be reduced by $7,906 to remove the online payment fees recorded during the test year.

The Utility decreased miscellaneous revenues by $12,595 when it reversed a prior year accrual. Wedgefield’s reversal understates test year miscellaneous revenues. Staff increased miscellaneous revenues to remove the reversal adjustment. Also, the Utility recorded an accrual in the amount of $968. Wedgefield was unable to provide supporting documentation for the accrual; therefore, staff removed the accrual from the test year.

Lastly, Wedgefield’s miscellaneous revenues included late payment fees of $29,056. The Utility’s late payment fee was implemented during the test year ended December 31, 2011. Staff questioned the Utility in regard to whether it experienced the same level of late fee payments for calendar year 2012. The Utility indicated the late payment fees collected in 2012 averaged $21,271, which was a decreased of $7,784 or 27 percent. The test year level of late payment fees are reflective of the customers responsiveness to the initial implementation of the late payment fee. The level of late payment fees may decrease as the customers adjust to Pluris’ enforcement for late payments, whereas the previous owners did not have a late payment fee. Staff recommends that miscellaneous revenues be decreased by $7,784 to reflect the amount of late payment fees the Utility is expected to collect prospectively.

The Utility recorded $731,559 for wastewater service revenues during the test year. Based on staff’s review of the Utility’s billing determinants and the rates that were in effect during the test year, staff calculated test year revenue of $732,003. The Utility incorrectly billed a gallonage charge of $4.59 instead of $4.56 for its general service wastewater customers. The Utility has corrected its billing to reflect the Commission-approved rate. Staff recommended increasing wastewater service revenues by $444 to reflect the appropriate test year revenue.

Table 10-1

|

Test year revenues WATER - adjustments |

|

|

Billing Determinant Correction |

$2,759 |

|

Meter Installation |

($330) |

|

Online Payment Fees |

($7,906) |

|

Prior Year Accrual |

$12,595 |

|

Undocumented Accrual |

($968) |

|

Late Payment Fees |

($7,784) |

|

NET increase (decrease) |

($1,634) |

Based on the above, staff recommends test year revenues of $983,812 for the water system and $732,003 for the wastewater system. Test year revenues for the water system should be decreased by $1,634 (as reflected in Table 10-1 above) and CIAC for water should be increased by $8,410 ($8,080 + $330). Wastewater test year revenues should be increased by $444. Test year revenues are shown on Schedule Nos. 3-A and 3-B.

Issue 11: Should any adjustments be made to Contractual Services – Management Fees?

Recommendation:

Yes. The appropriate amount of allocated expenses from Pluris Holdings, LLC to Pluris Wedgefield, Inc. in Contractual Services – Management Fees should be reduced by a total of $69,419 or by $34,710 each for water and wastewater. (VanEsselstine, Fletcher)

Staff Analysis:

In MFR Schedule B-9, the Utility included $193,938 (split equally between water and wastewater) for Contractual Services – Management Fees for utility management. With information supplied by the Utility, through data requests, the staff audit, technical staff’s review, and input from the Office of Public Counsel (OPC), staff believes there are several adjustments necessary to Contractual Services – Management Fees.

Before covering the Utility’s post-filing adjustments and staff’s recommended adjustments, staff believes it would be appropriate to first discuss the Utility’s allocation methodology, the required analysis of affiliate charges, and staff’s audit.

Allocation Methodology

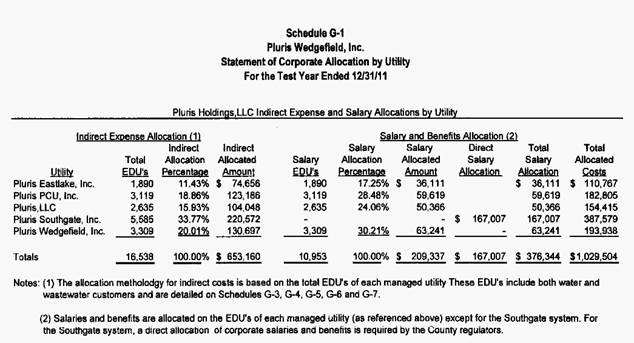

Pluris Holdings, LLC (Pluris) is the parent company to five utilities.[10] The parent costs are allocated for the most part based on number of customers. This allocation method involves dividing the total number of Equivalent Dwelling Units (EDUs) of each utility, by the total number of EDUs of all the utilities to determine the percentages, and then applying the prorated allocation of expenses to the individual utilities.[11]

Payroll-related costs are allocated using the same methodology with the exception of Pluris Southgate, Inc. (Southgate) which reports its direct labor costs to Sarasota County. Southgate is a regulated franchised utility subject to the jurisdiction of Sarasota County. Sarasota County ordinance (Resolution No. 2003-12) requires timesheets to be completed by corporate management and actual hours for services billed to Southgate in lieu of allocation by EDUs. The following table is MFR Schedule G-1 which outlines the Utility’s allocated indirect costs and labor costs.[12]

Required Analyses of Affiliate Charges

It is the utility’s burden to prove that its costs are reasonable. This burden is even greater when the transaction is between related parties for two reasons: (1) affiliate transactions raise the concern of self-dealing where market forces do not necessarily drive prices, and (2) utilities have a natural business incentive to shift costs from non-regulated operations to regulated monopoly operations since recovery is more certain with captive ratepayers. Accordingly, although a transaction between related parties is not per se unreasonable, related party transactions require closer scrutiny. The legislature has recognized the need to scrutinize affiliate transactions by specifically granting the Commission access to non-regulated affiliate records. Specifically, Section 367.156(1), F.S., states:

The commission shall continue to have reasonable access to all utility records and records of affiliated companies, including its parent company, regarding transactions or cost allocations among the utility and such affiliated companies, and such records necessary to ensure that a utility’s ratepayers do not subsidize nonutility activities. Upon request of the utility or any other person, any records received by the commission which are shown and found by the commission to be proprietary confidential business information shall be kept confidential and shall be exempt from s. 119.07(1).

(Emphasis added). In overturning a prior Commission decision, Florida’s Supreme Court enunciated the standard for which the Commission should review affiliate transactions stating, “(w)e believe the standard must be whether the transactions exceed the going market rate or are otherwise inherently unfair.” [13]

Staff Audit

Staff auditors performed an analytical review of Pluris’ costs to determine whether selected costs could be traced back to supporting source documentation. An audit of the gross costs at the parent level was performed which included an examination of costs for proper timing, amount, and classification. The auditors also examined the costs to determine whether any costs were non-utility related, non-recurring, unreasonable or imprudent.

Post-Filing Utility Adjustments

The first set of adjustments pertain to the Utility’s allocated operating expenses as outlined in MFR Schedule G-2, which reflects total parent operating expenses of $529,393 with Wedgefield’s allocation of $105,930. In response to numerous staff data requests, including concerns raised by OPC, the Utility withdrew in part, or total, certain expenses it determined should not have been included in the allocated overhead.

Table 11-1

|

|

Utility Adjusted Expenses |

||||

|

Expense Description |

Jan - Dec 11 Pluris |

Jan - Dec 11 Wedgefield |

Adjusted Pluris Expense |

Adjusted Wedgefield Allocation |

|

|

Travel |

$98,238 |

$19,657 |

$77,152 |

$15,438 |

|

|

Meals and Entertainments |

10,356 |

2,072 |

0 |

0 |

|

|

Dues and Subscriptions |

17,187 |

3,439 |

1,863 |

373 |

|

|

Education and Seminars |

3,959 |

792 |

450 |

90 |

|

|

Relocation Cost |

43,047 |

8,614 |

26,442 |

5,291 |

|

|

Total Expense |

$529,393 |

$105,930 |

$462,513 |

$92,548 |

|

|

Other Income |

($2,386) |

($477) |

0 |

$0 |

|

|

Interest Expense |

121,267 |

24,266 |

0 |

0 |

|

|

Income Taxes |

116 |

23 |

0 |

0 |

|

|

Total Other Income/Expense |

$118,997 |

$23,812 |

$0 |

$0 |

|

The above table includes the original MFR filing and Utility-made adjustments resulting in a reduction of $13,382 ($105,930 - $92,548) from the allocated parent expenses. Additionally, Wedgefield removed ‘Other Income’ from a vehicle sold in North Carolina in the allocated amount of $477, ‘Interest Expense’ in the allocated amount of $24,266, and ‘Corporate Income Tax Expense’ of $23. This represents a total reduction of O&M expense allocated to Wedgefield of $38,149 ($24,266 + $23 + $477 + $13,382).

Technical Staff Review

Staff issued several data requests to Wedgefield seeking additional and clarifying information for Pluris’ proposed cost allocations. Although the Utility withdrew some of its requested allocated costs, staff believes further reductions on these items and additional items are necessary. During its review, staff identified several expenses that it recommends be adjusted to reflect the proper amount of costs to be allocated from Pluris to Wedgefield.

Automobile Expense

In its MFRs, the Utility recorded $47,305 at the parent-level with $9,466 ($47,305 x 20.01 percent) allocated to Wedgefield for various vehicle expenses. This amount includes the annual lease expense for two company vehicles in the amount of $28,436 at the parent-level and $5,690 ($28,436 x 20.01 percent) allocated to Wedgefield. In response to a staff data request, the Utility submitted that company vehicles supplied to the executive staff were part of their compensation package. Although staff believes it is important for utility companies to offer attractive compensation packages to hire and retain qualified management, staff believes the magnitude of this expense exceeds the benefit to the ratepayers.

Further, the Utility provided in response to a staff data request its company travel policy, which states that employees are limited to rent mid-sized vehicles. The Utility also provided annual lease estimates for vehicles typically rented while on travel by Wedgefield employees, including an annual lease amount of $5,920 for a Chevrolet Impala (same size as rental policy). Staff believes that it is reasonable to include the annual lease amount in line with the company’s stated rental policy for vehicles. This equates to parent-level and allocated vehicle lease expense for executive staff of $11,840 and $2,369, respectively. Thus, staff recommends a reduction in annual expense of $16,596 ($28,436 - $11,840) at the parent-level and $3,321 ($5,690 - $2,369) allocated to Wedgefield.

Travel

In its MFRs, the Utility recorded $98,238 at the parent-level with $19,657 ($98,238 x 20.01 percent) allocated to Wedgefield for travel incurred in the test year. In response to a staff data request, the Utility removed $21,086 that it believed was recorded incorrectly resulting in a total travel expense at the parent-level of $77,152 ($98,238 - $21,086). The Utility provided a spreadsheet with all of the test year travel expenses as support documentation of the expense. Staff reviewed the revised travel expenses and identified additional charges that it believes should be removed from the test year amount.

First, staff identified costs it believes to be for travel for potential acquisitions, non-utility costs, and/or items that can be directly identified as a cost to be booked by a subsidiary other than Wedgefield. Staff believes that $20,725 is the appropriate amount of travel expenses at the parent-level to be allocated down, of which $4,147 ($20,725 x 20.01 percent) should be allocated to Wedgefield. The net result of this adjustment is a reduction of $11,291 to travel expenses.

The second part of the adjustment to travel expense relates to expenses that were non-recurring outside the test year. In accordance with Rule 25-30.433, F.A.C., non-recurring test year expenses should be amortized over five years. Several of the travel costs incurred in the test year were directly identified as relocation expenses. As such, staff believes $11,129 should be amortized over five years or $2,226 annually with $445 ($2,226 x 20.01 percent) allocated to Wedgefield. Based on the above, staff recommends a reduction in travel expenses of $11,736 ($11,291 + $445) allocated to Wedgefield.

Dues and Subscriptions

In its MFRs, the Utility recorded $17,187 in dues and subscriptions at the parent-level with $3,439 ($17,187 x 20.01 percent) allocated to Wedgefield. In response to a staff data request, the Utility removed $15,324 of this amount, resulting in a total dues and subscriptions expense at the parent-level of $1,863 ($17,187 - $15,324). Staff reviewed the revised dues and subscriptions expenses and identified an additional charge it believes should be removed from the test year. Staff believes that $325 for dues to the Georgia Rural Water association should be removed from management fees as a non-utility related expense. Staff believes that $1,538 is the appropriate amount of dues and subscriptions at the parent-level to be allocated down, of which $308 ($1,538 x 20.01 percent) should be allocated to Wedgefield.

Wages

In its MFRs, the Utility recorded $376,344 in labor costs at the parent-level. As discussed above, payroll-related costs are allocated using the same methodology as its expenses. However, the Utility’s Southgate unit is required to report its direct labor costs to Sarasota County. The removal of the Southgate system increases the relative allocation percentage for salaries and benefits allocated to Wedgefield to 30.21 percent. However, this higher factor is applied to a lower base cost of $209,337 reflecting the removal of the Southgate-specific payroll costs. The allocated labor costs to Wedgefield are $63,241.

In response to a staff data request, the Utility provided job descriptions for the three employees included in the wages expense: Managing Member and Principal Engineer, Manager, and Administrative Assistant. The management job duties are described below:

Maurice W. Gallarda, PE, serves as the Managing Member and Principal Engineer. He is a licensed Civil Engineer in multiple states. His duties include oversight responsibilities of corporate matters including banking and finance, engineering operations, regulatory compliance and developer relations.

Kenneth Pratt serves as a Manager and his duties include human resources, accounting and finance, IT and customer relations.

Tina Odisho provides reception, clerical and accounts' payables' duties at the Pluris corporate office in Dallas, Texas.[14]

Staff determined the appropriateness of the management’s compensation by comparing the salaries with the appropriate average salary levels found in the 2008 Water Utility Compensation Survey (WUCS) published by the American Water Works Association (AWWA). Staff reviewed the job descriptions provided by the Utility and matched them to job categories outlined by AWWA. The Commission has previously utilized the AWWA’s WUCS to determine appropriate compensation levels.[15]

The total wages for these three positions amounted to $245,912 ($112,155 + $80,995 + $52,762). Staff used a gross-up factor that included the Commission approved index amounts from 2009, 2010, and 2011, or an increase of 4.43 percent to the 2008 salary-level. As a result, staff recommends a reduction in the Utility’s requested wages in the amount of $80,900 ($376,344 - $245,912). Corresponding adjustments should also be made to payroll expense, payroll tax expense, and employee benefits in the amount of $820 ($3,314 - $2,494), $5,017 ($20,267 - $15,250), and $6,424 ($25,950- $19,526), respectively. The table below shows staff’s calculation of the appropriate compensation levels adjusted to the test year:

Table 11-2

|

|

|

AWWA Compensation Survey |

|

|

||

|

Work Performed |

Parent Compensation per Utility |

Top Executive |

Top Admin Executive |

Office/Adm Mgmr |

Staff Adjustment to Parent |

Staff Recommended Wages |

|

Salary |

$326,812 |

$112,155 |

$80,995 |

$52,762 |

($80,900) |

$245,912 |

|

Payroll Expense |

3,314 |

1,137 |

821 |

535 |

(820) |

$2,494 |

|

Payroll Tax Expense |

20,267 |

6,955 |

5,023 |

3,272 |

(5,017) |

$15,250 |

|

Employee Benefits |

25,950 |

8,906 |

6,431 |

4,189 |

(6,424) |

$19,526 |

|

Total |

$376,343 |

|

|

|

($93,161) |

$283,183 |

Thus, staff recommends the appropriate labor costs at the parent-level is $283,183 ($376,343 - $93,161) of which $157,517 is the available amount for allocation to Wedgefield. As discussed above, the Utility’s Southgate unit is required to report its direct labor costs to Sarasota County. Therefore, staff calculated the relative decrease in its recommended salaries at the parent-level associated with the Southgate, which equates to approximately 44 percent or $125,666 ($283,183 x 44 percent). Based on the above, utilizing the Utility’s allocation factor of 30.21 percent, staff believes $47,586 ($157,517 x 30.21 percent) should be allocated to Wedgefield.

However, staff recommends an adjustment related to the allocation percentage for salaries and benefits. Upon reviewing the Utility’s filing, staff noted that Pluris did not allocate any of its parent-level costs or salaries and benefits to Pluris Alabama, LLC (PAL). In response to a staff data request, the Utility provided an organization chart consisting of one parent company and six subsidiaries. The Utility also noted that it was responsible for the costs associated with three miles of Polyvinyl Chloride (PVC) main water lines booked directly to PAL. A review of the Utility’s travel logs revealed that Mr. Gallarada spent time traveling to Alabama during the test year. Staff believes that since there is management time associated with PAL, the corresponding ERCs associated with PAL should be included in the allocation of the salary and benefit expense. Staff determined the appropriate ERCs to allocate for PAL utilizing the AWWA meter equivalent factors for an eight inch meter. As a result, staff believes the appropriate amount of ERCs associated with the PAL system is 115 (8 x 14.38).

Table 11-2

|

Adjusted Salary Allocation |

||

|

System |

EDUs |

Allocation % |

|

Pluris Eastlake, Inc. |

1,890 |

17.08% |

|

Pluris PCU, Inc. |

3,119 |

28.18% |

|

Pluris, LLC |

2,635 |

23.81% |

|

Pluris Southgate, Inc. |

0 |

0.00% |

|

Pluris Wedgefield, Inc. |

3,309 |

29.90% |

|

Pluris Alabama, LLC |

115 |

1.04% |

|

|

11,068 |

100.00% |

Staff’s recommended adjustments to the allocated amount of salaries at the parent-level require a corresponding adjustment to reduce the base payroll cost, reflecting the removal of the Southgate-specific payroll costs, to $157,517. Based on the above, staff recommends lowering the allocation factor for Wedgefield to 29.90 percent resulting in an allocated salary amount of $47,093 ($157,517 x 29.90 percent) to Wedgefield. This equates to a reduction in allocated salary of $16,148 ($63,241 - $47,093).

Comparison of Pluris’ Allocated Costs to Other Florida Water and Wastewater Utilities

For comparative purposes only, staff notes in the recent Aqua Utilities of Florida, Inc. 2010 rate case, staff compiled the total average O&M expense per customer of all utilities under the Commission’s jurisdiction.[16] Based on all 2009 regulated utilities’ annual reports on file with the Commission, the total average O&M expense per customer of all utilities is approximately $399. On a total O&M basis, including management fees, the current cost per customer for Wedgefield is $370, which staff believes is comparable to the average amount for all utilities under the Commission’s jurisdiction.

Conclusion

Based on staff’s recommendations above, the appropriate amount of allocated expenses from Pluris Holdings, LLC to Wedgefield in Contractual Services – Management Fees is $124,519, which represents a decrease of $69,419 ($193,938 - $124,519). This equates to a reduction of $34,710 for both water and wastewater.