|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Cole) |

||

|

FROM: |

Office of the General Counsel (Lawson) |

||

|

RE: |

|||

|

AGENDA: |

10/24/13 Ė Regular Agenda Ė Tariff Filing Ė Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

60-Day Suspension Date: 10/30/13 |

|||

|

SPECIAL INSTRUCTIONS: |

|||

|

FILE NAME AND LOCATION: |

|||

On August 30, 2013, Florida Public Utilities Company (FPUC) and the Florida Division of Chesapeake Utilities Corporation (Chesapeake) filed a petition seeking approval of 2014 Gas Reliability Infrastructure Program (GRIP) surcharges for their cast iron and bare steel pipe replacement programs.† The GRIP program was approved in Order No. PSC-12-0490-TRF-GU[1] to recover the cost of accelerated replacement of cast iron and bare steel distribution mains and services through a surcharge on customersí bills.† According to quarterly reports FPUC and Chesapeake filed on the progress of the replacement programs, for the period August 2012 through June 2013, FPUC replaced 36 miles of pipes, and Chesapeake replaced 22 miles of pipes.

The order addressed the reliability and safety rationale for pipeline replacement, the scope of the program, similar actions in other states, and the procedure for annually setting the GRIP surcharge to recover the costs of the program.† The procedure requires an annual filing with three components:

1.†††††††† A final true-up showing the actual replacement costs, actual surcharge revenues, and over- or under-recovery amount for the 12-month historical period from January 1 through December 31 of the year prior to FPUCís/Chesapeakeís annual GRIP petition.

2.†††††††† An actual/estimated true-up showing seven months of actual and five months of projected replacement costs, surcharge revenues, and over- or under-recovery amount.

3.†††††††† A revenue requirement projection showing 12 months of projected GRIP revenue requirement for the period beginning January 1 following FPUCís/Chesapeakeís annual GRIP petition filing.

The Commission concluded the order by stating:

Replacement of bare steel pipelines is in the public interest to improve the safety of Floridaís natural gas infrastructure, thereby reducing the risk to life and property.† Given the length of time these pipelines have been installed and the leak history due to corrosion, we find that it is appropriate to approve the proposed replacement program.† Without the GRIP surcharge, it is reasonable to expect that FPUC/Chesapeake will have to file for more frequent base rate proceedings to recover the expenses of an accelerated replacement program.† The annual filings will provide us with the oversight to ensure that projected expenses are trued-up and only actual costs are recovered.† FPUCís/Chesapeakeís GRIP and its associated surcharges will terminate when all replacements have been made and the revenue requirement has been rolled into rate base.

Order No. PSC-12-0490-TRF-GU, at p. 19.

The Commission has jurisdiction over this matter pursuant to Sections 366.03, 366.04, 366.05, and 366.06, Florida Statutes (F.S.).

Issue 1:

Should the Commission approve FPUCís and Chesapeakeís proposed GRIP surcharge factors for 2014?

Recommendation:

Yes.† FPUCís and Chesapeakeís calculations of the GRIP surcharge factors are reasonable and accurate.† (Garl)

Staff Analysis:

FPUCíS GRIP SURCHARGE FACTORS FOR 2014

FPUC has had a bare steel replacement and recovery program in place since 2005.† In FPUCís 2008 rate case, the Commission approved an annual expense of $747,727 associated with the program, to be included in base rates.† The amount included in base rates is excluded from the GRIP surcharge calculation.†

The GRIP surcharges have been in effect since January 2013.† FPUCís calculations for the 2014 revenue requirement and surcharges include a final true-up amount for 2012, an actual/estimated true-up for 2013, and projected costs for 2014.† The order approving the GRIP program stated that both FPUC and Chesapeake shall include a final true-up for the period August 14, 2012 through December 31, 2012.

Final 2012 and Actual/Estimated 2013 true-up.† The final 2012 true-up is an over-recovery of $243,238.† To calculate the 2013 true-up, FPUC calculated the difference between the revenue requirement in base rates, $747,727, and the 2013 actual (January through July)/estimated (August through December) revenue requirement for 2013, $747,392, producing a surplus of $335.† The actual/estimated revenue requirement includes the return on investment, depreciation expense, customer notification, and ad valorem taxes associated with the investment.† FPUC reported actual/estimated revenues for 2013 of $259,154.† Adding the revenue requirements surplus, and the interest provision to the revenues, showed the over-recovery for 2013 is $259,794.† After including the over-recovery of 2012, the amount over-recovered applicable to the 2014 revenue requirement is $503,032 as shown below:

|

Annual Revenue Requirement in Base Rates |

$747,727 |

|

Less 2013 GRIP Revenue Requirement RerrrrrrrrrrrRRReRequiRequirement |

|

|

Net Revenue Requirement surplus |

$335 |

|

2013 GRIP Revenues |

|

|

Over-Recovery |

$259,489 |

|

Interest Provision |

$305 |

|

2013 Total Over-Recovery |

$259,794 |

|

2012 Over-Recovery |

$243,238 |

|

Total 2012 and 2013 Over-Recovery |

$503,032 |

Projected 2014 costs.† FPUC projects to spend $15,557,547 for the replacement of cast iron/bare steel infrastructure in 2014.† The return on investment, depreciation, customer notification, and ad valorem tax expenses associated with that investment are $1,891,864.†

†Subtracting the revenue requirement for bare steel replacement investment included in base rates provides the 2014 revenue requirement of $1,144,137.† Finally, the over-recovery from 2012 and 2013, $503,032, is subtracted to provide the total 2014 revenue requirement of $641,105.

|

2014 Projected Expenditures |

$15,557,547 |

|

Return on Investment |

$1,407,269 |

|

Depreciation Expense |

$272,128 |

|

Tax and Customer Notice Expenses |

|

|

Revenue Requirement |

$1,891,864 |

|

Less Revenue Requirement in Base Rates |

($747,272) |

|

2014 Revenue Requirement |

$1,144,137 |

|

Less Prior Period Over-Recovery |

($503,032) |

|

Total 2014 Revenue Requirement |

$641,105 |

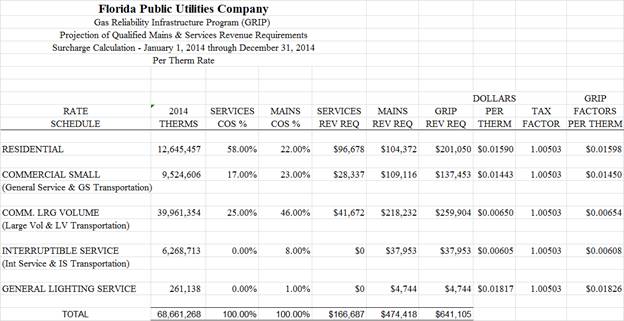

The calculation of the GRIP surcharges by rate class is shown in Attachment 1 to the recommendation.† As established in the order approving the GRIP, the total 2014 revenue requirement is allocated to the rate classes using the same methodology that was used for the allocation of mains and services in the cost of service study used in FPUCsí most recent rate case.† After calculating the percentage of total plant costs attributed to each rate class, the respective percentages were multiplied by the 2014 revenue requirement, resulting in the revenue requirement by rate class.† Dividing each rate classí revenue requirement by projected therm sales provides the GRIP surcharge for each rate class.† The GRIP surcharge for residential customers is $0.01598 per therm.† The monthly bill impact for a residential customer who uses 20 therms is $0.32.

CHESAPEAKEíS GRIP SURCHARGE FACTORS FOR 2014

Chesapeake does not have any replacement recovery amount embedded in base rates and has in the past replaced its infrastructure as conditions warranted.†††

Final 2012 and Actual/Estimated 2013 true-up.† The final 2012 true-up is an under-recovery of $16,886.† To calculate the 2013 true-up, Chesapeake provided actual revenues received (January through July) and estimated revenues (August through December) for 2013 of $594,014.† The actual/estimated revenue requirement for 2013 is $378,913 and the over-recovery for 2013 is $215,161.† After including the under-recovery of 2012, the amount over-recovered applicable to the 2014 revenue requirement is $198,275 as shown below:

|

2013 GRIP Revenues |

$594,014 |

|

2013 GRIP Revenue Requirement |

|

|

Over-Recovery |

$215,101 |

|

Interest Provision |

$60 |

|

2013 Total Over-Recovery |

$215,161 |

|

2012 Under-Recovery |

($16,886) |

|

Total 2012 and 2013 Over-Recovery |

$198,275 |

Projected 2014 costs.† Chesapeake projects to spend $6,837,772 in 2014.† The return on that amount plus investment expenses are $802,747.† Finally, the over-recovery from 2012 and 2013, $198,275, is subtracted to provide the total 2014 revenue requirement of $604,472.

|

2014 Projected Expenditures |

$6,837,772 |

|

Return on Investment |

$531,798 |

|

Depreciation Expense |

$180,909 |

|

Tax and Customer Notice Expenses |

$90,040 |

|

2014 Revenue Requirement |

$802,747 |

|

Less Prior Period Over-Recovery |

($198,275) |

|

Total 2014 Revenue Requirement |

$604,472 |

The calculation of Chesapeakeís GRIP surcharges by rate class is shown in Attachment 2 to the recommendation.† The GRIP surcharge for residential customers on the FTS-1 rate is $0.02198 per therm.† The monthly bill impact for a residential customer who uses 20 therms is $0.44.

CONCLUSION

Staff believes both FPUC and Chesapeake complied with the Commissionís order in filing for an annual adjustment of the GRIP cost recovery factors.† The data and results presented by both companies were reasonable and accurately calculated.† Staff recommends approval of FPUCís and Chesapeakeís proposed GRIP cost recovery factors for 2014.†

Issue 2:

Should this docket be closed?

Recommendation:

Yes.† If Issue 1 is approved, the tariffs should become effective on January 1, 2014.† If a protest is filed within 21 days of the issuance of the order, the tariffs should remain in effect, with any revenues held subject to refund, pending resolution of the protest.† If no timely protest is filed, this docket should be closed upon the issuance of a consummating order.† (Lawson)

Staff Analysis:

If Issue 1 is approved, the tariffs should become effective on January 1, 2014.† If a protest is filed within 21 days of the issuance of the order, the tariffs should remain in effect, with any revenues held subject to refund, pending resolution of the protest.† If no timely protest is filed, this docket should be closed upon the issuance of a consummating order.