Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Division of Engineering (Matthews, Mtenga) Office of the General Counsel (Murphy) |

||

|

RE: |

|||

|

AGENDA: |

07/10/14 – Regular Agenda – Proposed Agency Action – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

SPECIAL INSTRUCTIONS: |

|||

Section 366.91(3), Florida Statutes (F.S.) requires that each investor-owned utility (IOU) continuously offers to purchase capacity and energy from renewable energy generators. Commission Rules 25-17.200 through 25-17.310, Florida Administrative Code (F.A.C.), implement the statute and require each IOU to file with the Commission by April 1 of each year a standard offer contract to purchase the capacity and energy from such renewable generators, with estimated payments based on the next avoidable fossil fueled generating unit of each technology type identified in the utility’s current Ten-Year Site Plan. On April 1, 2014, Duke Energy Florida (DEF or Utility) filed a petition for approval of its revised standard offer contract and associated rate schedule based on a combined cycle (CC) avoided unit.

In its 2013 filings, DEF also included a new standard offer contract for an avoided unit of the combustion turbine (CT) technology type. However, because no CT unit appears in DEF’s 2014 Ten-Year Site Plan, the Utility is suspending sheets 9.500 through 9.575 of its rate schedule, which include the standard offer and associated payment schedule for a CT unit, approved by Order No. PSC-13-0313-PAA-EI, issued July 11, 2013, in Docket No. 130069-EI.[1]

The Commission has jurisdiction over this standard offer contract pursuant to Sections 366.04 through 366.06 and 366.91, F.S.

Issue 1:

Should the Commission approve the revised standard offer contract filed by Duke Energy Florida?

Recommendation:

Yes. The provisions of the revised standard offer contract and associated rate schedule conform to all requirements of Rules 25-17.200 through 25-17.310, F.A.C. The revised standard offer contract provides flexibility in the arrangements for payments so that a developer of renewable generation may select the payment stream best suited to its financial needs. Staff recommends that the revised standard offer contract and rate schedule submitted by DEF be approved as filed. (Matthews)

Staff Analysis:

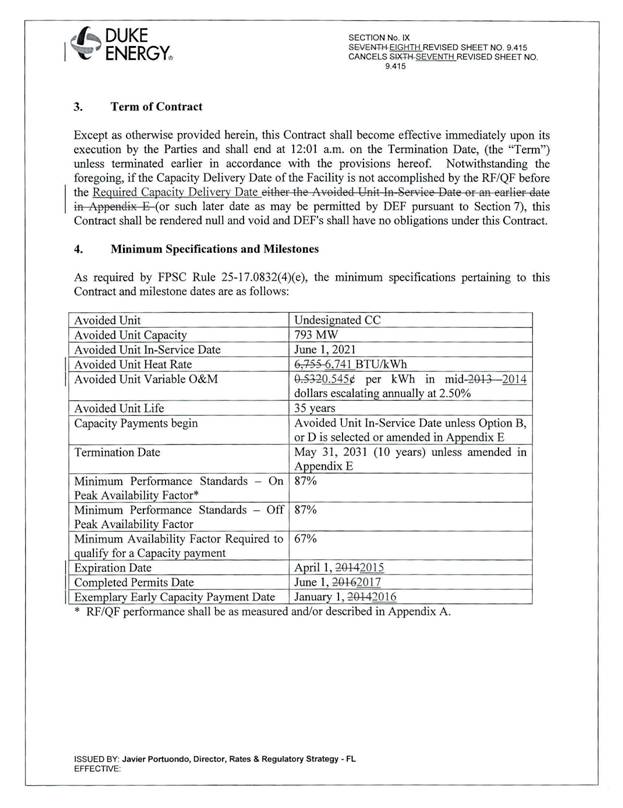

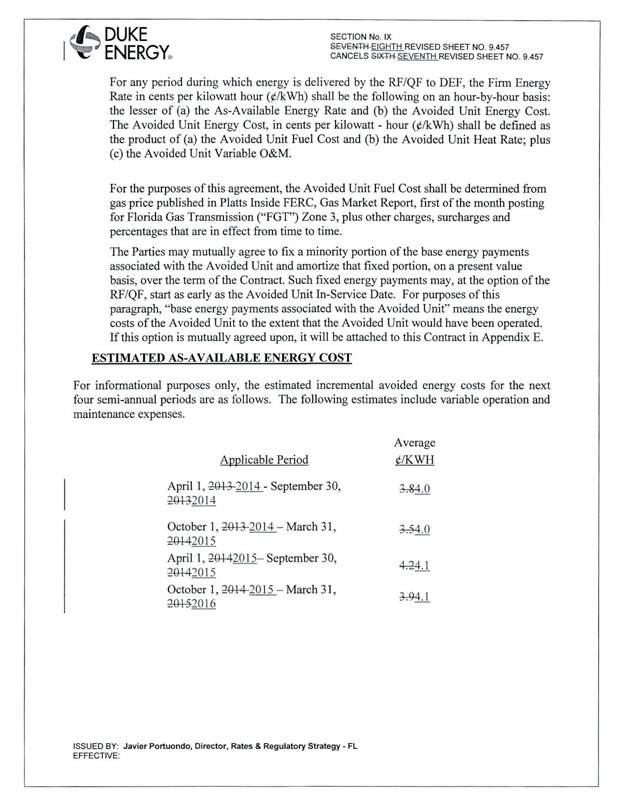

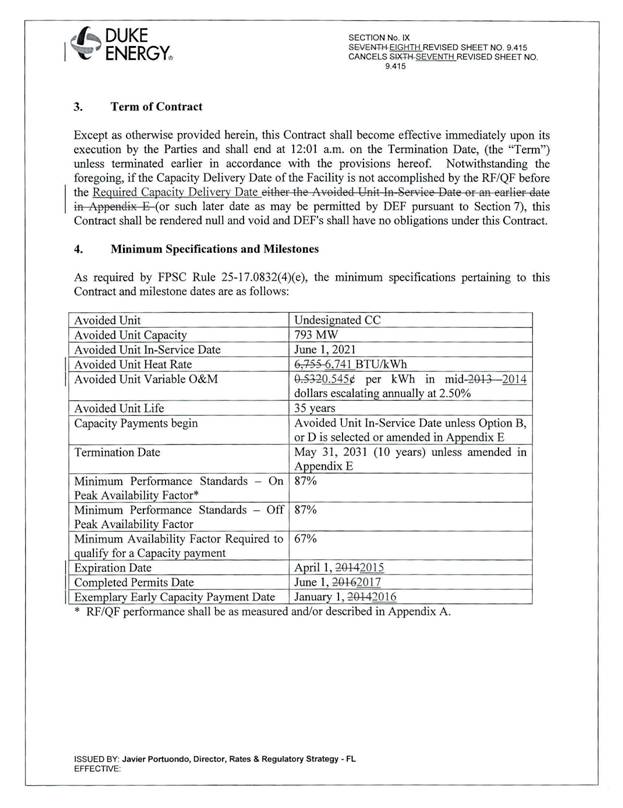

Rule 25-17.250, F.A.C., requires that DEF, an IOU, continuously makes available a standard offer contract for the purchase of firm capacity and energy from renewable generating facilities (RF) and small qualifying facilities (QF) with design capacities of 100 kilowatts (kW) or less. Pursuant to Rules 25-17.250(1) and (3), F.A.C., the standard offer contract must provide a term of at least ten years, and the payment terms must be based on the Utility’s next avoidable fossil-fueled generating unit identified in its most recent Ten-Year Site Plan or, if no avoided unit is identified, its next avoidable planned purchase. DEF has identified a 793 megawatt (MW) natural gas-fired combined cycle unit as the next fossil-fueled generating unit in its 2014 Ten-Year Site Plan. The projected in-service date of this unit is June 1, 2021.

The RF/QF operator may elect to make no commitment as to the quantity or timing of its deliveries to DEF, and to have a committed capacity of zero (0) MW. Under such a scenario, the energy is delivered on an as-available basis and the operator receives only an energy payment. Alternatively, the RF/QF operator may elect to commit to certain minimum performance requirements based on the identified avoided unit, such as being operational and delivering the agreed upon amount of capacity by the in-service date of the avoided unit, and thereby becomes eligible for capacity payments in addition to payments received for energy. The standard offer contract can also serve as a starting point for negotiation of contract terms by providing payment information to an RF/QF operator, in a situation where one or both parties desire particular contract terms other than those established in the standard offer.

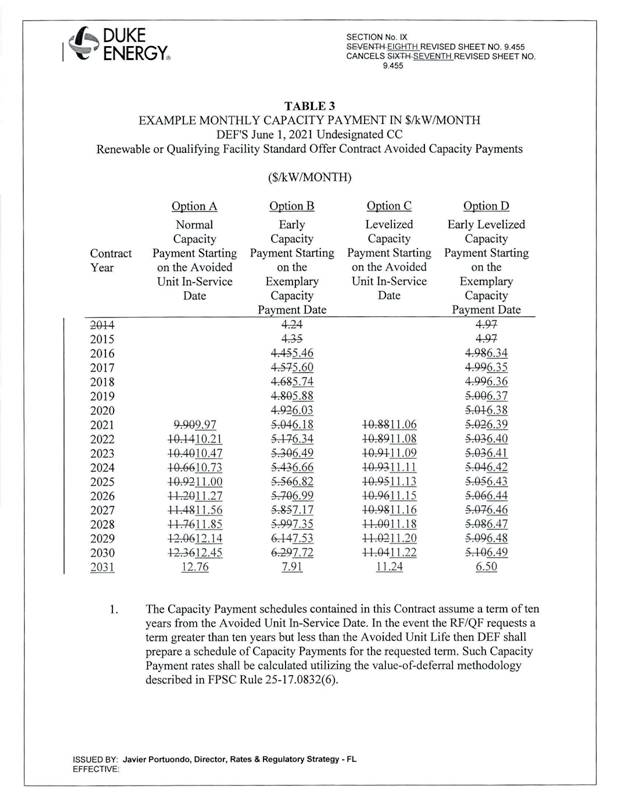

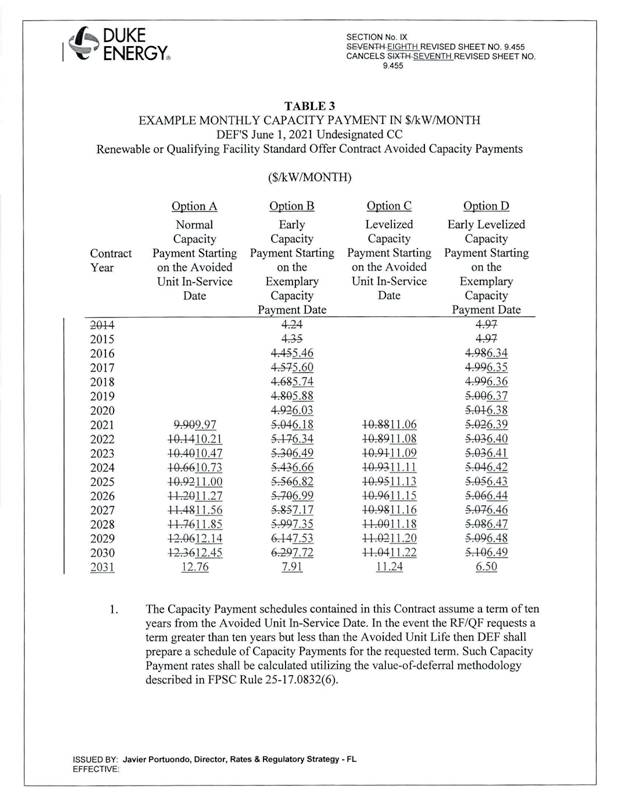

In order to promote renewable generation, the Commission requires the IOU to offer multiple options for capacity payments, including the options to receive early or levelized payments. If the RF/QF operator elects to receive capacity payments under the normal or levelized contract options, it will receive as-available energy payments only until the in-service date of the avoided unit (in this case June 1, 2021), and thereafter begin receiving capacity payments in addition to the energy payments. If either the early or early levelized option is selected, then the operator will begin receiving capacity payments earlier than the in-service date of the avoided unit. However, payments made under the early capacity payments options tend to be lower in the later years of the contract term because the net present value (NPV) of the total payments must remain equal for all contract options.

Table 1 below estimates the annual payments for each payment option available under the revised standard offer contract to an operator with a 50 MW CC facility operating at a capacity factor of 87 percent, which is the minimum capacity factor required to qualify for full capacity payments. Normal and levelized capacity payments begin in 2021, reflecting the in-service date of the avoided CC unit (June 1, 2021).

Table 1 – Estimated Annual Payments to a 50 MW Renewable Facility

(87% Capacity Factor)

|

Year |

Energy Payment |

Capacity Payment (By Type) |

|||

|

Normal |

Levelized |

Early |

Early Levelized |

||

|

$(000) |

($) |

($) |

($) |

($) |

|

|

15,732 |

- |

- |

- |

- |

|

|

2016 |

15,885 |

- |

- |

3,372 |

4,014 |

|

2017 |

16,259 |

- |

- |

3,456 |

4,020 |

|

2018 |

17,620 |

- |

- |

3,543 |

4,026 |

|

2019 |

18,760 |

- |

- |

3,631 |

4,031 |

|

2020 |

20,111 |

- |

- |

3,722 |

4,037 |

|

2021 |

20,427 |

3,488 |

4,002 |

3,815 |

4,044 |

|

2022 |

21,020 |

6,129 |

6,870 |

3,911 |

4,050 |

|

2023 |

22,912 |

6,282 |

6,880 |

4,008 |

4,056 |

|

2024 |

23,336 |

6,439 |

6,891 |

4,109 |

4,063 |

|

2025 |

22,398 |

6,600 |

6,901 |

4,211 |

4,070 |

|

2026 |

23,422 |

6,765 |

6,912 |

4,317 |

4,076 |

|

2027 |

23,335 |

6,934 |

6,923 |

4,424 |

4,084 |

|

2028 |

23,296 |

7,107 |

6,935 |

4,535 |

4,091 |

|

2029 |

23,383 |

7,285 |

6,947 |

4,648 |

4,098 |

|

2030 |

24,429 |

7,467 |

6,959 |

4,765 |

4,106 |

|

2031 |

26,192 |

7,654 |

6,971 |

4,884 |

4,114 |

|

2032 |

27,289 |

7,845 |

6,984 |

5,006 |

4,122 |

|

2033 |

27,271 |

8,041 |

6,997 |

5,131 |

4,130 |

|

2034 |

27,761 |

8,242 |

7,010 |

5,259 |

4,138 |

|

Total* |

440,838 |

96,279 |

94,182 |

80,748 |

77,369 |

|

NPV (2015$) |

237,241 |

42,457 |

42,457 |

42,457 |

42,457 |

*Figures in table may not add exactly to totals due to rounding.

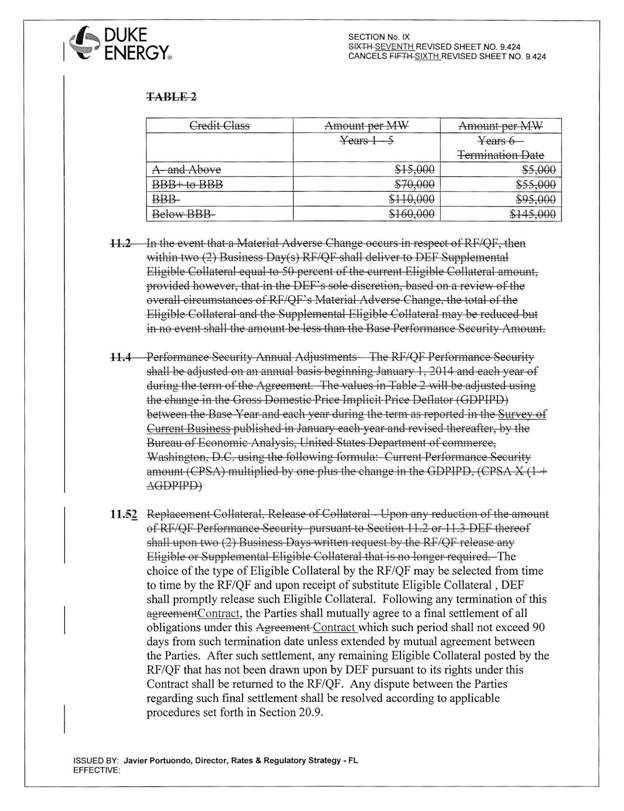

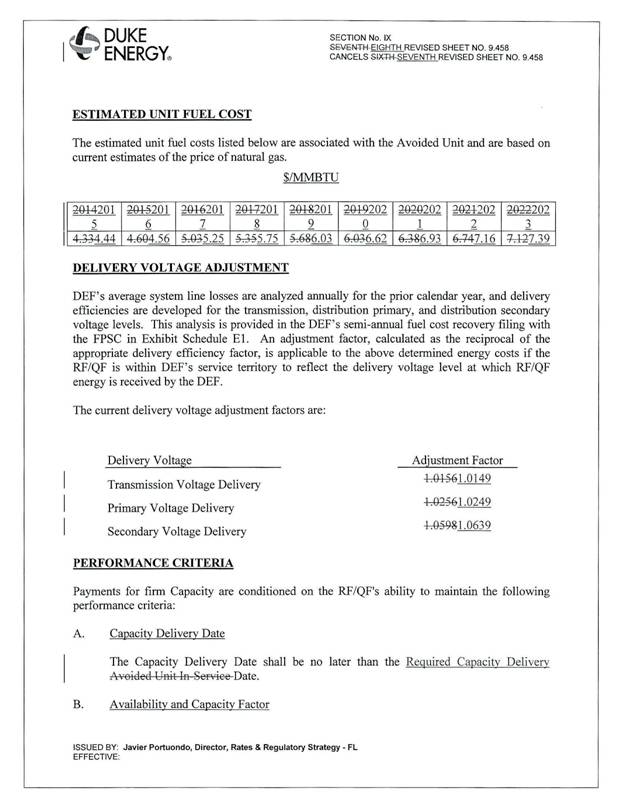

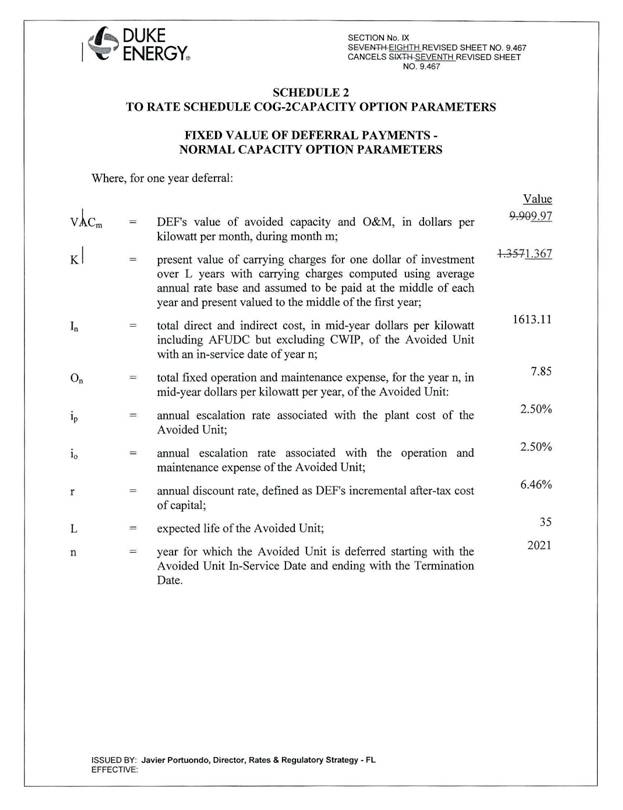

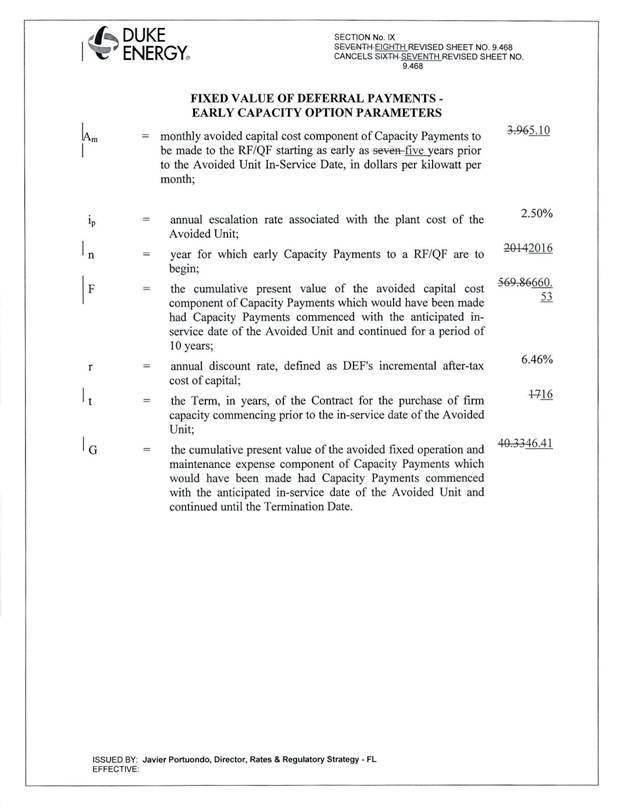

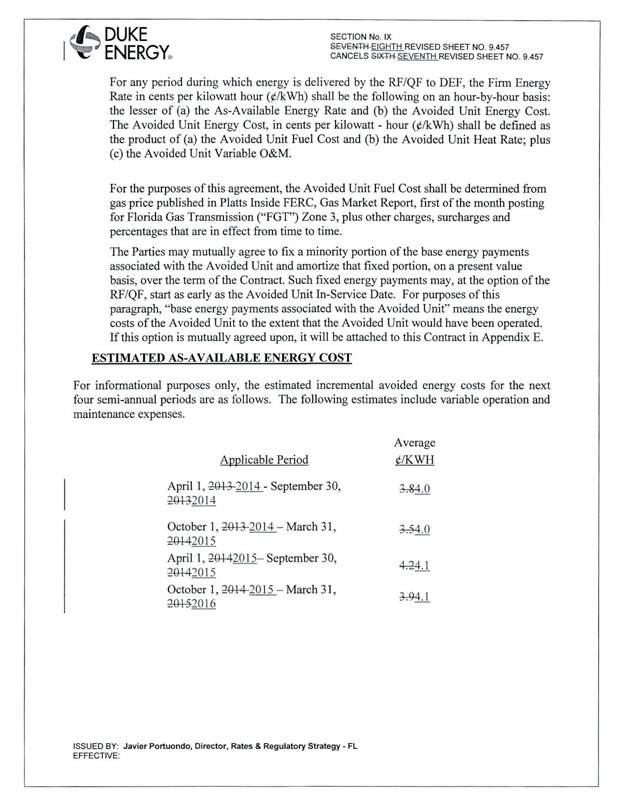

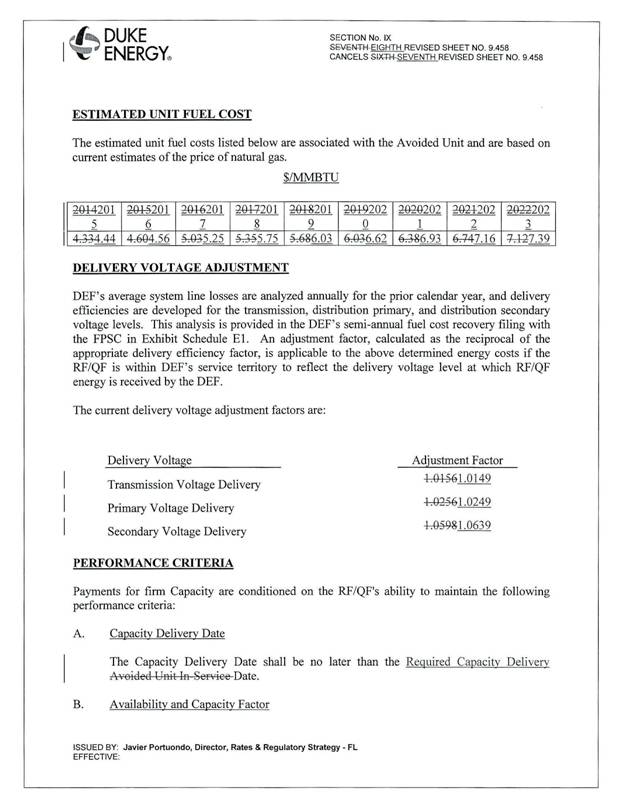

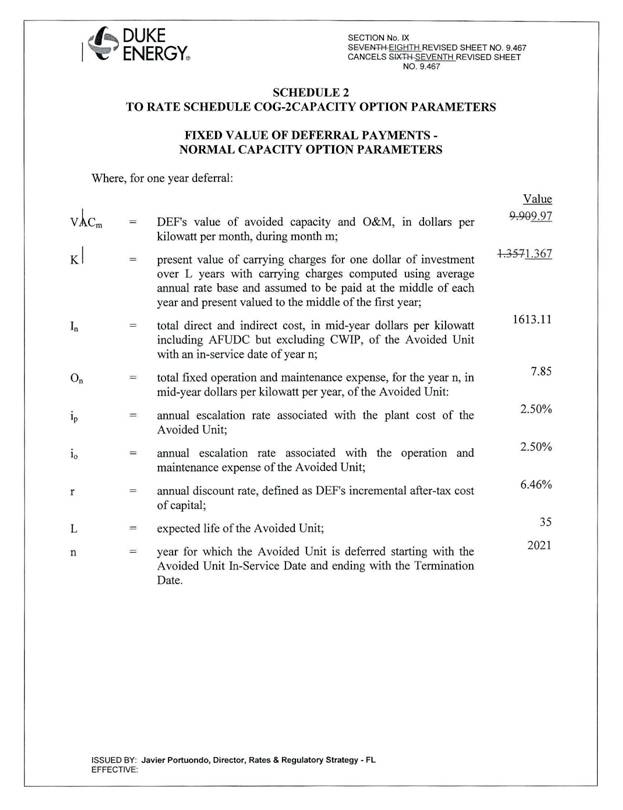

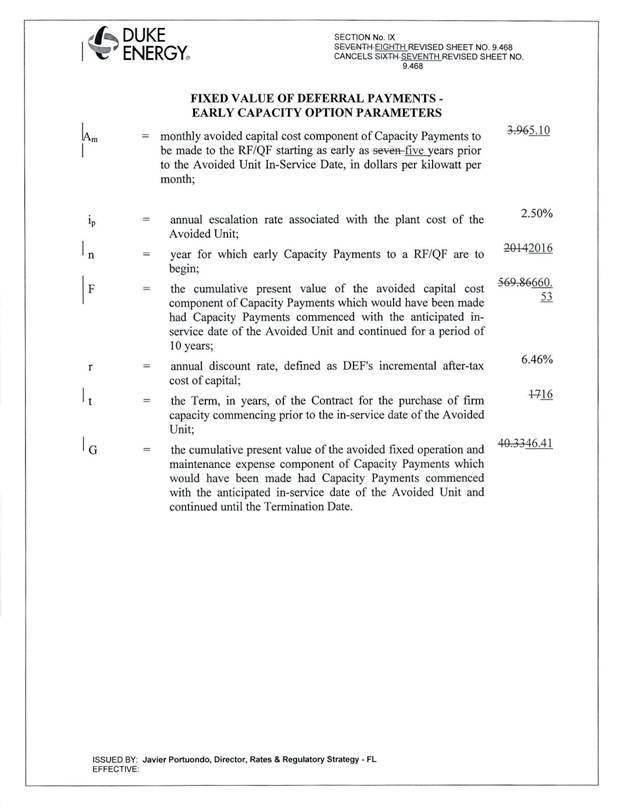

The type-and-strike format versions of the revised standard offer contract and associated rate schedule are included as Attachment A to this recommendation. All of the changes made to the tariff sheets are consistent with the updated avoided unit. Revisions include an updated example of monthly capacity payments, updates to calendar dates, as-available energy costs, and estimated unit fuel costs. In addition, the changes made to the amounts required for liability insurance and performance security are substantial. In its response to a staff data request, DEF explained its rationale for these revisions.

The requirement for performance security payments was changed from an amount based on the credit rating of the RF/QF operator to a standard amount of $30 per kW of the generating unit. This change was made because most of the projects that utilize the standard offer contract are owned by legal entities that do not issue public debt, and therefore have no credit rating. This lack of an independent credit rating causes the determination of performance security payments to be difficult and potentially contentious. Having a fixed performance security rate, which is consistent with other large utilities in Florida, makes the process easier and more transparent to the developers of the project and also protects DEF rate payers.

The liability insurance requirement for RF/QF project developers was increased from $1 million to $5 million. DEF explained that increased liability insurance was necessary to protect all parties involved in the project because litigation awards have increased while the liability insurance requirement had remained at $1 million since the early 1980s. Also, net metering rules have been established that require up to $2 million of liability insurance for facilities between 100 kW and 2 MW. QF projects have traditionally been larger than 5 MW, and in some cases much larger.

Conclusion

The provisions of the revised standard offer contract and associated schedule, as filed on April 1, 2014, conform to all requirements of Rules 25-17.200 through 25-17.310, F.A.C. The revised standard offer contract provides flexibility in the arrangements for payments so that a developer of renewable generation may select the payment stream best suited to its financial needs. Staff recommends that the revised standard offer contract and related schedule be approved as filed.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. This docket should be closed upon issuance of a consummating order, unless a person whose substantial interests are affected by the Commission’s decision files a protest within 21 days of the issuance of the Commission’s proposed agency action order. Potential signatories should be aware that, if a timely protest is filed, FPL’s standard offer contract may subsequently be revised. (Murphy)

Staff Analysis:

This docket should be closed upon the issuance of a consummating order, unless a person whose substantial interests are affected by the Commission’s decision files a protest within 21 days of the issuance of the Commission’s proposed agency action order. Potential signatories should be aware that, if a timely protest is filed, FPL’s standard offer contract may subsequently be revised.

[1] Docket No. 130069-EI – In re: Petition for approval of new standard offer contract (Schedule COG-2A), by Progress Energy Florida, Inc.