Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Office of the General Counsel (Corbari) Office of Telecommunications (Casey) Office of Consumer Assistance and Outreach (Hicks) |

||

|

RE: |

|||

|

AGENDA: |

01/08/15 – Regular Agenda – Interested Persons May Participate |

||

|

COMMISSIONERS

ASSIGNED: |

|||

|

PREHEARING

OFFICER: |

|||

|

SPECIAL

INSTRUCTIONS: |

|||

By Order PSC-01-1695-PAA-TC, issued August 21, 2001, Tri-County

Telephone, Inc. (Company) was granted Payphone Certificate Number 7903 to

provide pay telephone service in the State of Florida. The Order specified that pay telephone

providers are subject to Chapter 25‑24, Florida Administrative Code

(F.A.C.), and all applicable provisions of Chapter 364, Florida Statutes (F.S.),

and Chapter 25-4, Florida Administrative Code.

In 2014, the Company paid its 2013 Regulatory

Assessment Fees and indicated on its Regulatory Assessment Fee Return that it

had no payphones in operation at the end of 2013.

On July 28, 2014, the Florida Public Service Commission (Commission) Office of Consumer Assistance & Outreach received a complaint from a property manager that the payphone located at 1001 SW 2nd Avenue in Boca Raton, Florida operated by Tri-County Telephone, Inc. was not working (Complaint No. 1154120T). The property manager stated that the payphone was not in service, and requested it be removed from the property.

This recommendation addresses a payphone complaint forwarded to Tri-County Telephone, Inc. and Tri-County Telephone, Inc.’s apparent violation of Section 364.335(2), F.S., Section 364.3375(2), F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032(6)(b), F.A.C. The Commission has jurisdiction pursuant to Chapter 364, F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032, F.A.C.

Issue 1:

Should

the Commission order Tri-County Telephone, Inc., to show cause in writing

within 21 days of the date of the order why it should not be penalized $2,000 or

its Certificate No.7903 should not be cancelled for apparent violations of Section

364.335(2), F.S., Section 364.3375(2), F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032(6)(b), F.A.C.?

Recommendation:

Yes. The Commission should order Tri-County Telephone, Inc., to show cause in writing within 21 days of the issuance of the Commission Order why it should not be penalized $2,000 or its Certificate No. 7903 cancelled for apparent violations of Section 364.335(2), F.S., Section 364.3375(2), F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032(6)(b), F.A.C. Specifically, staff recommends that Tri-County Telephone, Inc., be directed to repair or remove the inoperable payphone, pay a penalty of $2,000, update company contact information with the Commission Clerk, and update the Company’s Corporate Registration with the Florida Secretary of State. Tri-County Telephone, Inc.=s response must contain specific allegations of fact or law. If Tri-County Telephone, Inc., fails to respond to the show cause order or request a hearing pursuant to Section 120.57, F.S., within 21 days and/or remit the penalty, the facts should be deemed admitted and the Company’s certificate No. 7903 should be cancelled. If a penalty is assessed and paid by the Company, the Commission will remit the penalty to the State of Florida General Revenue Fund pursuant to Section 364.285, F.S. (Corbari, Casey, Hicks)

Staff Analysis:

Factual Allegations

Pursuant to Section 364.335(2), F.S., certificated

companies are required to ensure continued compliance with applicable business

formation, registration, and taxation provisions of law.

Pursuant

to Section 364.3375(2), F.S.,

each pay telephone station shall:

·

Receive and permit

coin-free access to the universal emergency telephone number “911” where

operable or to a local exchange company toll operator;

·

Receive and provide

coin-free or coin-return access to local directory assistance and the telephone

number of the person responsible for repair service; and

·

Be eligible to

subscribe to flat-rate, single-line business local exchange services.

Rule 25-4.0051, F.A.C., (Current Certificate Holder Information) requires each certificated company to file updated information for the following items with the Office of Commission Clerk within 10 days after any changes to the following:

1) The address of the certificate holder’s main corporate and Florida offices (if any) including street name and address and post office box, city, state and zip code; or

2) Telephone number, name, and address of the individual who is to serve as primary liaison with the Commission in regard to the ongoing Florida operations of the certificated company.

Rule 25-22.032(6)(b), F.A.C., (Customer Complaints), requires a company to provide the Commission with a written response to a customer complaint, within 15 working days after the complaint is sent to the company by Commission staff.

Complaint No. 1154120T

On July 28, 2014, the Commission’s Office of Consumer Assistance & Outreach received a complaint that the payphone located at 1001 SW 2nd Avenue in Boca Raton, Florida was out of order. On August 27, 2014, the Office of Consumer Assistance & Outreach attempted to contact Tri-County Telephone, Inc. via telephone but the telephone number was disconnected.

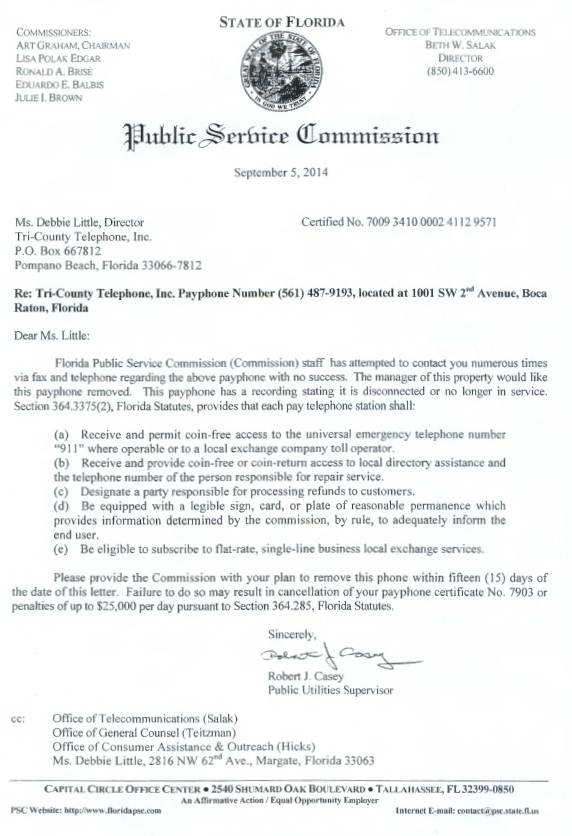

On September 4, 2014, the Office of Consumer Assistance & Outreach forwarded the complaint to the Commission’s Office of Telecommunications for further action. On September 4, 2014, the Office of Telecommunications also called the payphone number and received a recording that it was disconnected. On September 5, 2014, the Office of Telecommunications sent a certified letter to Tri-County Telephone, Inc. notifying it of the payphone complaint the Commission received regarding the payphone at 1001 SW 2nd Avenue in Boca Raton, Florida being out of order, and the property manager wanting the payphone removed. Commission staff requested that the company provide the Commission with its plan to repair or remove the phone within fifteen (15) days of the date of the letter. Staff also advised the company that failure to comply with staff’s request may result in cancellation of its payphone certificate or penalties of up to $25,000 per day, pursuant to Section 364.285, Florida Statutes. On September 30, 2014, the certified letter was returned by the United States Postal Service as “unclaimed, unable to forward.” (See, Attachment A – Copy of staff’s September 5, 2014, letter which was returned on September 30, 2014.)

Staff

Recommendation

Certificated companies are charged with the knowledge of the Commission's rules and statutes. Additionally, "[i]t is a common maxim, familiar to all minds that ‘ignorance of the law’ will not excuse any person, either civilly or criminally." Barlow v. United States, 32 U.S. 404, 411 (1833). In making similar decisions, the Commission has repeatedly held that certificated companies are charged with the knowledge of the Commission’s Rules and Statutes, and the intent of Section 364.285(1) is to penalize those who affirmatively act in opposition to those orders, rules, or statutes.[1]

The procedure followed by the Commission in dockets such as this is to consider the Commission staff’s recommendation and determine whether or not the facts warrant requiring the company to respond. If the Commission approves staff’s recommendation, the Commission issues an Order to Show Cause. A show cause order is considered an administrative complaint by the Commission against the company. If the Commission issues a show cause order, the company is required to file a written response. The response must contain specific allegations of disputed fact. If there are no disputed factual issues, the company’s response should so indicate. The response must be filed within 21 days of service of the show cause order on the respondent.

The company has

two options if a show cause order is issued.

The company may respond and request a hearing pursuant to Sections

120.569 and 120.57, F.S. If the company requests a hearing, a

hearing will be scheduled to take place before the Commission, after which a

final determination will be made. Alternatively,

the company may respond to the show cause order by remitting the penalty. If the company pays the penalty and resolves

the complaint, this show cause matter will be considered resolved, and the

docket closed.

In the event the company fails to timely respond to the show cause order, the company is deemed to have admitted the factual allegations contained in the show cause order. The company’s failure to timely respond is also a waiver of its right to a hearing. Additionally, a final order will be issued imposing the sanctions set out in the show cause order.

Pursuant to Section 364.285, F.S., the Commission is authorized to impose upon any entity subject to its jurisdiction a penalty of not more than $25,000 for each offense, if such entity is found to have refused to comply with or to have willfully violated any lawful rule or order of the Commission, or any provision of Chapter 364. Each day a violation continues is treated as a separate offense. Each penalty is a lien upon the real and personal property of the company and is enforceable by the Commission as a statutory lien.[2]

Willfulness is a question of fact.[3] Therefore, part of the determination the

Commission must make in evaluating whether to penalize a company is whether the

company willfully violated the rule, statute, or order. Section 364.285, F.S.,

does not define what it is to “willfully violate” a rule or order. In Commission Order No. 24306, issued April

1, 1991, in Docket No. 890216-TL titled In Re: Investigation Into The Proper

Application of Rule 25-14.003, F.A.C., Relating To Tax Savings Refund for 1988

and 1989 For GTE Florida, Inc., the Commission stated that “willful implies

an intent to do an act, and this is distinct from an intent to violate a

statute or rule." The plain meaning of "willful" typically

applied by the Courts in the

absence of a statutory definition, is an act or omission that is done

“voluntarily and intentionally” with specific intent and “purpose to violate or

disregard the requirements of the law.” Fugate v. Fla. Elections Comm’n,

924 So. at 76.

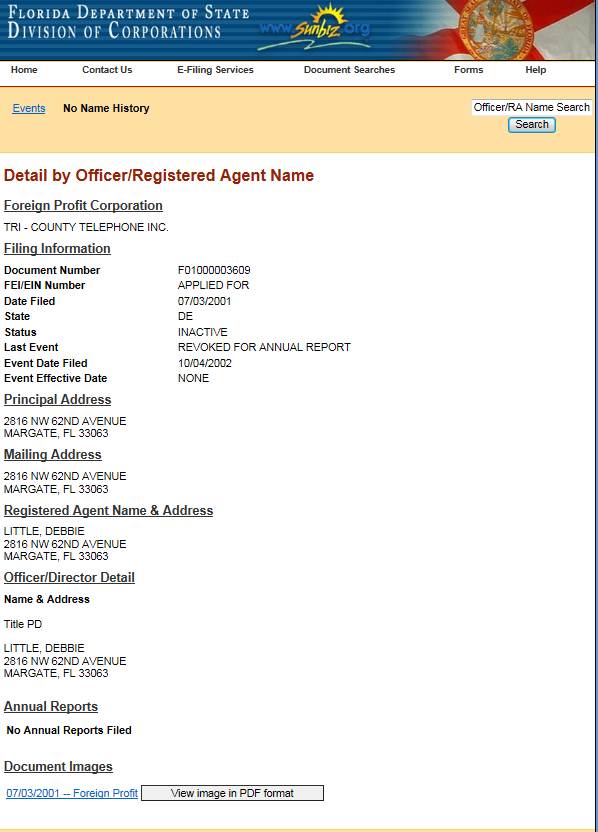

As

outlined above, staff has attempted to contact Tri-County Telephone,

Inc., numerous times via telephone, facsimile, and certified letter with no

success. Tri-County Telephone, Inc.’s

fax line and telephone line have been disconnected. Staff

also tried to call phone numbers listed on the Company’s 2013 Regulatory Assessment

Fee Return with no success. A certified

letter sent by staff has been returned as unclaimed,

unable to forward. In addition, staff reviewed the Florida Secretary

of State Corporation database (See, Attachment B – Copy of Florida Tri-County

Telephone, Inc. Expired Corporate

Registration) and found that the Company does not have a current Florida

Corporate Registration, in violation of Section 364.335, F.S.

Staff believes that Tri-County Telephone, Inc., has knowingly failed to comply with the provisions of Section 364.335(2), F.S., Section 364.3375(2), F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032(6)(b), F.A.C., and, as a result, Tri-County Telephone, Inc.’s acts were “willful” in the sense intended by Section 364.285, F.S., and Fugate. Staff therefore recommends that Tri-County Telephone, Inc. should be ordered to show cause in writing, within 21 days of the issuance of the Commission Order, why it should not be penalized $2,000 or its certificate No. 7903 cancelled for apparent violations of Section 364.335(2), F.S., Section 364.3375(2), F.S., Rule 25-4.0051, F.A.C., and Rule 25-22.032(6)(b), F.A.C. Staff asserts that the penalty amount recommended of $500 per violation is consistent with amounts imposed for similar violations.

Tri-County Telephone, Inc.=s response must contain specific allegations of fact or law. If Tri-County Telephone, Inc. fails to respond to the show cause order or request a hearing pursuant to Section 120.57, F.S., and/or the penalty is not paid within the 21-day response period, the facts should be deemed admitted and the Company’s certificate No. 5108 should be cancelled. If the Company pays the assessed penalty, the Commission will remit the penalty to the State of Florida General Revenue Fund pursuant to Section 364.285, F.S.

In addition, staff recommends that the show cause order incorporate the following conditions:

1. This show cause order is an administrative complaint by the Florida Public Service Commission, as petitioner, against Tri-County Telephone, Inc., as respondent.

2. The Company shall respond to the show cause order within 21 days of service on the Company, and the response shall reference Docket No. 140222-TC In re: Initiation of show cause proceedings against Tri-County Telephone, Inc. for apparent violation of Section 364.335(2), F.S., Application for Certificate of Authority, Section 364.3375(2), F.S., Pay Telephone Service Providers, Rule 25-4.0051, F.A.C., Current Certificate Holder Information, and Rule 25-22.032(6)(b), F.A.C., Customer Complaints.

3. The Company has the right to request a hearing to be conducted in accordance with Sections 120.569 and 120.57, F.S., and to be represented by counsel or other qualified representative.

4. Requests for hearing shall comply with Rule 28-106.2015, F.A.C.

5. The Company’s response to the show cause order shall identify those material facts that are in dispute. If there are none, the petition must so indicate.

6. If the Company files a timely written response and makes a request for a hearing pursuant to Sections 120.569 and 120.57, F.S., a further proceeding will be scheduled before a final determination of this matter is made.

7. A failure to file a timely written response to the show cause order will constitute an admission of the facts herein alleged and a waiver of the right to a hearing on this issue.

8. In the event that the Company fails to file a timely response to the show cause order, and the respective penalty is not received, Tri-County Telephone, Inc.’s Certificate No. 7903 should be cancelled and this docket closed administratively.

9. If the Company responds to the show cause order by remitting the penalty, resolving the complaints, updating company contact information with the Commission Clerk, and updating the Company’s Corporate Registration with the Florida Secretary of State, this show cause matter will be considered resolved, and the docket closed.

Issue 2:

Should this docket be closed?

Recommendation:

No. If Issue 1 is approved, then Tri-County Telephone, Inc., will have 21 days, from the issuance of the Order to Show Cause, to respond in writing why it should not be assessed a penalty or have its certificate canceled. If Tri-County Telephone, Inc. timely responds, in writing, to the Order to Show Cause, and repairs or removes the inoperable payphone, updates the company contact information with the Commission Clerk, updates the Company’s Corporate Registration with the Florida Secretary of State, and timely pays the assessed penalty of $2,000, the penalty should be deposited in the Florida General Revenue Fund pursuant to Section 364.285(1), Florida Statutes, and the docket closed administratively. If Issue 1 is approved and Tri-County Telephone, Inc. fails to timely respond to the Order to Show Cause or request a hearing, fails to repair or remove the inoperable payphone, fails to update the company contact information with the Commission Clerk, fails to update the Company’s Corporate Registration with the Florida Secretary of State, or fails to timely pay the assessed penalty of $2,000, then Tri-County Telephone, Inc.=s Certificate No. 7903 should be canceled and the docket closed administratively. (Corbari, Casey, Hicks)

Staff Analysis:

If Issue 1 is approved, then Tri-County Telephone, Inc., will have 21 days, from the issuance of the Order to Show Cause, to respond in writing why it should not be assessed a penalty or have its certificate canceled. If Tri-County Telephone, Inc. timely responds, in writing, to the Order to Show Cause, and repairs or removes the inoperable payphone, updates the company contact information with the Commission Clerk, updates the Company’s Corporate Registration with the Florida Secretary of State, and timely pays the assessed penalty of $2,000, the penalty should be deposited in the Florida General Revenue Fund pursuant to Section 364.285(1), Florida Statutes, and the docket closed administratively. If Issue 1 is approved and Tri-County Telephone, Inc. fails to timely respond to the Order to Show Cause or request a hearing, fails to repair or remove the inoperable payphone, fails to update the company contact information with the Commission Clerk, fails to update the Company’s Corporate Registration with the Florida Secretary of State, or fails to timely pay the assessed penalty of $2,000, then Tri-County Telephone, Inc.=s Certificate No. 7903 should be canceled and the docket closed administratively.

[1] See, Order No. PSC-11-0250-FOF-WU, issued June 13,

2011, in Docket No. 100104-WU, In re: Application for increase in water

rates in Franklin County by Water Management Services, Inc.; Order No.

PSC-07-0275-SC-SU, issued April 2, 2007, in Docket No. 060406-SU, In re: Application for staff-assisted rate

case in Polk County by Crooked Lake Park Sewerage Company; and Order No.

PSC-05-0104-SC-SU, issued January 26, 2005 in Docket Nos. 020439-SU and 020331-SU; In re: Application for

staff-assisted rate case in Lee County by Sanibel Bayous Utility Corporation;

In re: Investigation into alleged improper billing by Sanibel Bayous Utility

Corporation in Lee County in violation of Section 367.091(4), Florida Statutes.

See also, Florida State Racing

Commission v. Ponce de Leon Trotting Association, 151 So.2d 633, 634 (

[2] See, Section 364.285(1), F.S.

[3] Fugate v. Fla. Elections Comm’n, 924 So. 2d 74, 75 (Fla. 1st DCA 3006), citing, Metro. Dade County v. State Dep't of Envtl. Prot., 714 So. 2d 512, 517 (Fla. 3d DCA 1998).