Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Office of the General Counsel (Page) Division of Economics (Rome, Draper) |

||

|

RE: |

150241-PU - Proposed amendments to Rules 25-6.093, Information to Customers; 25-6.097, Customer Deposits; 25-6.100, Customer Billings; 25-7.079, Information to Customers; 25-7.083, Customer Deposits; and 25-7.085, Customer Billing, F.A.C. |

||

|

AGENDA: |

12/03/15 – Regular Agenda – Rule Proposal - Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

Patronis |

||

|

SPECIAL INSTRUCTIONS: |

|||

Rules 25-6.093, Information to Customers, 25-6.097, Customer Deposits, 25-6.100, Customer Billings, 25-7.079, Information to Customers, 25-7.083, Customer Deposits, and 25-7.085, Customer Billing, Florida Administrative Code (F.A.C.), set forth the requirements for investor owned electric and gas utilities on billings, deposits, and information to customers. The rules implement Section 366.05 and Section 366.95, Florida Statutes (F.S.).

Paragraph 366.05(1)(b), F.S., addresses tiered utility rates based on levels of usage and varied billing periods. Paragraphs 366.05(1)(c) and (d), F.S., pertain to customer deposits and customer information for electric and gas utilities. Paragraphs 366.95(4)(a) and (b), F.S., require billing notices for electric utilities that have obtained a financing order for nuclear assets and caused nuclear asset recovery bonds to be issued.

Staff initiated this rulemaking to conform the rules to the recent amendments to Section 366.05 and Section 366.95, F.S., and to clarify and simplify the rules and delete unnecessary and redundant rule language. The Commission’s Notice of Development of Rulemaking was published in the Florida Administrative Register (F.A.R.) on September 25, 2015, in Volume 41, Number 187. There were no requests for a rule development workshop, so no workshop was held. However, comments were received from Gulf Power (Gulf), Tampa Electric Company (TECO), Duke Energy (Duke), the Office of Public Counsel (OPC), Florida Power & Light Company (FPL) and Peoples Gas System (Peoples).

This recommendation addresses whether the Commission should propose the amendment of Rules 25-6.093, 25-6.097, 25-6.100, 25-7.079, 25-7.083, and 25-7.085, F.A.C. The Commission has jurisdiction pursuant to Section 120.54, F.S., and Section 366.05, F.S.

Issue 1:

Should the Commission propose the amendment of Rules 25-6.093, 25-6.097, 25-6.100, 25-7.079, 25-7.083, and 25-7.085, F.A.C.?

Recommendation:

Yes. The Commission should propose the amendment of Rules 25-6.093, 25-6.097, 25-6.100, 25-7.079, 25-7.083, and 25-7.085, F.A.C., as set forth in Attachment A. (Page, Rome, Draper).

Statutory Amendments

In the 2015 session, the Legislature amended Section 366.05, and added Section 366.95, F.S., to impose new requirements on electric and gas utilities. These new requirements are summarized below.

Paragraph 366.05(1)(b), F.S. states that if the Commission authorizes a public utility to charge tiered rates based upon levels of usage and to vary its regular billing period, the utility may not charge a customer a higher rate because of an increase in usage attributable to an extension of the billing period. The regular meter reading date may not be advanced or postponed more than 5 days for routine operating reasons without prorating the billing for the period.

Subparagraph 366.05(1)(c)1., F.S., states that effective January 1, 2016, a utility may not charge or receive a deposit for existing accounts in excess of 2 months of average actual charges calculated by adding the monthly charges from the 12-month period immediately before the date any change in the deposit amount is sought, dividing this total by 12, and multiplying the result by 2. For a new service request, subparagraph 366.05(1)(c)2., F.S., provides that the total deposit shall not exceed 2 months of projected charges, calculated by adding the 12 months of projected charges, dividing this total by 12, and multiplying the result by 2.

Paragraph 366.05(1)(d), F.S., provides that if a utility has more than one rate for any customer class, it must notify each customer in that class of the available rates and explain how the rate is charged to the customer. If a customer contacts the utility seeking assistance in selecting the most advantageous rate, the utility must provide good faith assistance to the customer.

Paragraph 366.95(4)(a), F.S., states that customer billings must explicitly reflect that a portion of the charges on the bill represents nuclear-asset recovery charges if a financing order has been approved by the Commission and issued to the electric utility. Paragraph 366.95(4)(b), F.S., requires the electric utility to include the nuclear asset recovery charge on each customer’s bill as a separate line item titled “Asset Securitization Charge” and state both the rate and the amount of the charge on each bill.

Staff is recommending that the Commission propose the amendment of Rules 25-6.093, 25-6.097, 25-6.100, 25-7.079, 25-7.083, and 25-7.085, F.A.C., as set forth in Attachment A to implement these statutory changes. Staff is also recommending a number of amendments to update and clarify the rules.

Electric Utilities

Rule 25-6.093, F.A.C.

Rule 25-6.093(3)(a), F.A.C., Information to Customers, states that by bill insert or other appropriate means of communication, the utility shall give to each of its customers a summary of major rate schedules which are available to the class of which that customer is a member. Staff recommends amendments to Rule 25-6.093(3)(a), F.A.C., to conform the rule to paragraph 366.05(1)(d), F.S.

FPL commented that the information to customers may be provided in paper or electronic form and may consist of a summary of all available electrical rates that are available to the class of which that customer is a member. Staff believes that allowing the utility to designate the bill insert as paper or electronic will ensure that the term “bill insert” is up to date with current practices and processes. According to FPL, the use of the term “summary of major rate schedules” would result in a substantial expansion of the information that must be provided to customers via bill insert. FPL suggests that a summary of all available rates be provided to customers, but not all supporting schedules such as the tariffs. Staff agrees that the summary of available rates would be beneficial to both the utility and customers and recommends that this term be included in the amendments to Rule 25-6.093, F.A.C.

Staff recommends amendments to Rule 25-6.093, F.A.C., that by paper or electronic bill insert or other means agreed to by both the customer and the utility, the utility shall give to each of its customers a summary of all available electrical rates applicable to the customer’s class. Gulf commented that “means agreed to by both the customer and the utility” could create additional work to communicate with customers. Gulf suggested that the amendment state that by billing statement, website, electronic notification or other appropriate means of communication the utility shall give to each of its customers the rate schedules that are available to the customer. Staff does not recommend the phrase “appropriate means of communication” because it is vague and open to a wide range of possible interpretation. Staff believes that Gulf’s suggestion to add the terms “billing statement, website and electronic notification” to the list of means by which utilities can provide rate information to customers is a reasonable implementation of paragraph 366.05(1)(d), F.S. Therefore, staff recommends that this suggested language be included in the amendments to Rule 25-6.093(3)(a), F.A.C.

Paragraph 366.05(1)(d), F.S., states that if a utility has more than one rate for any customer class, it must notify each customer in that class of available rates and explain how the rate is charged to the customer. The statute states that if a customer contacts the utility seeking assistance in selecting the most advantageous rate, the utility must provide good faith assistance to the customer.

Staff believes that Rule 25-6.093, F.A.C., reiterates the provisions of paragraph 366.05(1)(d), F.S., regarding customer information and the obtainment of the most advantageous rate for the customer’s service requirements. Pursuant to paragraph 120.545(1)(c), F.S., the Joint Administrative Procedures Committee examines each proposed rule for the purpose of determining whether the rule reiterates or paraphrases statutory material. Staff believes that Rule 25-6.093, F.A.C., reiterates paragraph 366.05(1)(d), F.S., on information regarding available rates and assistance in selecting the most advantageous rate. Therefore, staff recommends that the specific provisions of Rule 25-6.093, F.A.C., which reiterate paragraph 366.05(1)(d), F.S. be deleted.

Staff is also recommending that the Commission propose amendments to sections (1), (2), and (4) of the rule to remove obsolete rule language and to clarify the rule.

Rule 25-6.097, F.A.C.

Rule 25-6.097, F.A.C., Customer Deposits, provides that each company’s tariff shall contain the specific criteria for determining the amount of initial deposit. This rule states that for new or additional deposits, the total amount of the deposit shall not exceed an amount equal to twice the average charges for actual usage of electric service for the twelve month period immediately prior to the date of notice.

Staff recommends amendments to Rule 25-6.097, F.A.C., stating that the methodology shall conform to paragraph 366.05(1)(c), F.S. The specific reference to paragraph 366.05(1)(c), F.S., clarifies that utilities must adhere to the statutory methodology for calculating the amount of the deposit.

Staff is also recommending that the Commission propose amendment to section (1) of the rule to move the requirements for the establishment of credit to section (2) of the rule. Staff believes that this amendment will make the rule clearer. Staff is also recommending amendments to sections (4), (6) and (7) of the rule to remove obsolete rule language and to clarify the rule provisions.

Rule 25-6.100, F.A.C.

Rule 25-6.100, F.A.C., Customer Billings, prescribes the information that electric utilities must provide to customers when rendering a bill. This information must be provided with the dollar amount of the bill, the customer charge, total electric cost, taxes, and past due balances.

Staff recommends amended language stating that the dollar amount of the bill must include the rate and amount of the “Asset Securitization Charge” as a separate line item pursuant to paragraph 366.95(4)(b), F.S., if applicable. This language reflects the requirements of paragraph 366.95(4)(b), F.S., that this charge be identified as a separate line item on the customer’s bill.

TECO submitted comments and represented that FPL and Duke Energy concurred with TECO’s comments. TECO suggested that Rule 25-6.100(2)(c)5., F.A.C., should state that the total electric cost reflected on the customer’s bill, should be at a minimum, the costs identified in Rule 25-6.100(2)(c)1.-4., F.A.C., but can include other line item charges, e.g., Asset Securitization Charge, Florida Gross Receipts Tax, etc. TECO asserted that the suggested language simplifies the description of what is included in the total electric cost, and provides flexibility for the utilities to include other line items as they exist now or may be developed and implemented in the future.

FPL suggested that Rule 25-6.100(4), F.A.C., be amended to state that the advancement or postponement of the regular meter reading date is governed by subsection 366.05(1)(b), F.S. FPL stated that FPL employees routinely refer to the rule with customers as authority when addressing any issue involving the advancement or postponement of the regular meter reading date. FPL states that this suggested revision of the rule will provide an adequate reference point to the Florida Statutes when communications take place between FPL and its customers.

TECO made a similar suggestion that Rule 25-6.100(4), F.A.C., should contain new language citing subsection 366.05(1)(b), F.S., so that utilities will be on notice that advancement or postponement of regular meter reading dates is addressed by reference to the statute, and not the rule. Staff recommends amendments to the provisions of Rule 25-6.100(4), F.A.C., regarding the advancement or postponement of the regular meter reading date as suggested by FPL, TECO, and Duke.

OPC commented that the reference in Rule 25-6.100, F.A.C., to the utility’s “local business office” should be amended to state contacting the utility. Staff recommends this amendment because many utilities no longer have numerous local business offices.

Gas Utilities

Rule 25-7.079, F.A.C.

Rule 25-7.079, F.A.C., Information to Customers, states that each utility shall, upon request, give its customers such information and assistance as is reasonable, in order that the customer may secure safe and efficient service. The rule also states that it is the duty of the utility to assist the customer in obtaining the rate which is most advantageous for the customer’s service requirements.

Paragraph 366.05(1)(d), F.S., states that if a utility has more than one rate for any customer class, it must notify each customer in that class of available rates and explain how the rate is charged to the customer. The statute states that if a customer contacts the utility seeking assistance in selecting the most advantageous rate, the utility must provide good faith assistance to the customer.

Staff believes that Rule 25-7.079, F.A.C., reiterates the provisions of paragraph 366.05(1)(d), F.S., regarding customer information and the obtainment of the most advantageous rate for the customer’s service requirements. Pursuant to paragraph 120.545(1)(c), F.S., the Joint Administrative Procedures Committee examines each proposed rule for the purpose of determining whether the rule reiterates or paraphrases statutory material. Staff believes that Rule 25-7.079, F.A.C., reiterates paragraph 366.05(1)(d), F.S., on information regarding available rates and assistance in selecting the most advantageous rate. Therefore, staff recommends that the specific provisions of Rule 25-7.079, F.A.C., which reiterate paragraph 366.05(1)(d), F.S. be deleted.

Rule 25-7.083, F.A.C.

Rule 25-7.083, F.A.C., Customer Deposits, states that each company’s tariff shall contain specific criteria for determining the amount of initial deposit. Paragraph 366.05(1)(c), F.S., contains specific methodologies for the calculation of deposits by utilities for existing accounts and new service requests.

Staff recommends amendments to Rule 25-7.083, F.A.C., to conform the rule to subparagraphs 366.05(1)(c)1.and 2., F.S. Staff recommends language stating that each company’s tariff shall identify the methodology for determining the amount of the deposit charged for existing accounts and new service requests. Staff recommends that the rule contain language similar to that in Rule 25-6.097, F.A.C., i.e., that the methodology shall conform to paragraph 366.05(1)(c), F.S. This reference to paragraph 366.05(1)(c), F.S., identifies the formulas for the calculation of deposits by gas utilities.

Rule 25-7.085, F.A.C.

Rule 25-7.085, F.A.C., Customer Billing, specifies the procedures that gas utilities must follow when billing customers for service. Rule 25-7.085(5), F.A.C, states that regular meter reading dates may be advanced or postponed not more than five days without a proration of the billing for the period.

Subsection 366.05(1)(b), F.S., provides that regular meter reading dates may not be advanced or postponed more than 5 days for routine operating reasons without prorating the bill. Staff recommends the deletion of this provision in Rule 25-7.085, F.S., because it reiterates subsection 366.05(1)(b), F.S.

Peoples suggested that Rule 25-7.085(5), F.A.C., be amended to provide a reference to subsection 366.05(1)(b), F.S., regarding the advancement or postponement of the regular meter reading date. Peoples suggests this language because billing employees at the utility utilize the Florida Administrative Code rather than the Florida Statutes to respond to billing questions that arise. Staff recommends the language suggested by Peoples that puts gas utilities on notice that the advancement or postponement of the regular meter reading date is addressed in the statute.

OPC commented that the reference to “local office” is no longer suitable because most gas utilities do not currently have numerous local offices. Peoples made similar comments as to the use of the term “local office.” Staff agrees with the comments and recommends amending this language to state “utility.”

OPC suggested that the term “utility” be substituted for the word “company” in Rule 25-7.085, F.A.C.[1] Staff recommends this amendment to so that the references to gas utilities use terminology that is consistent with the terms used in rules applicable to electric utilities.

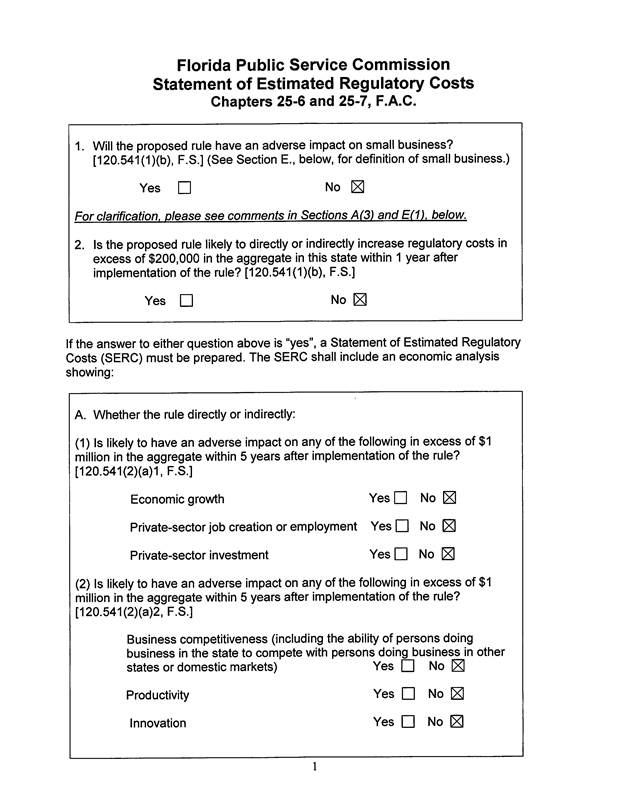

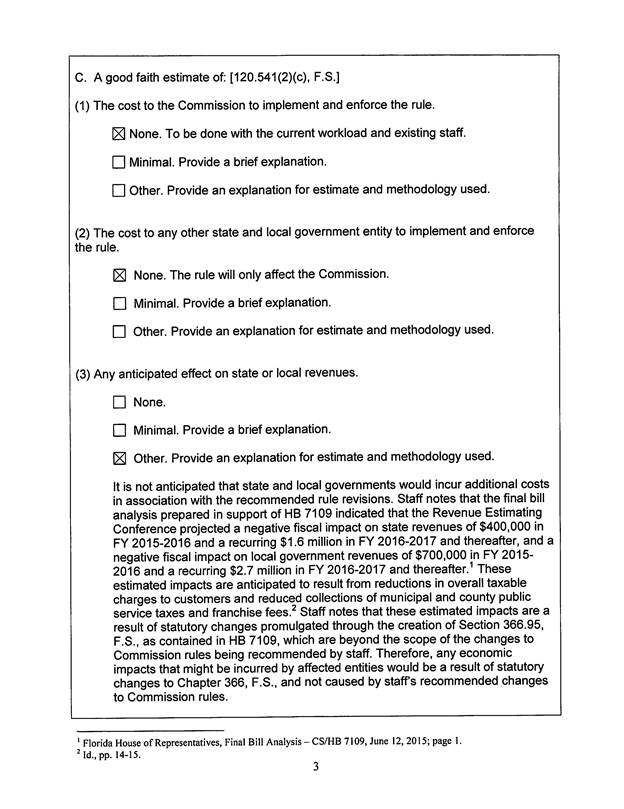

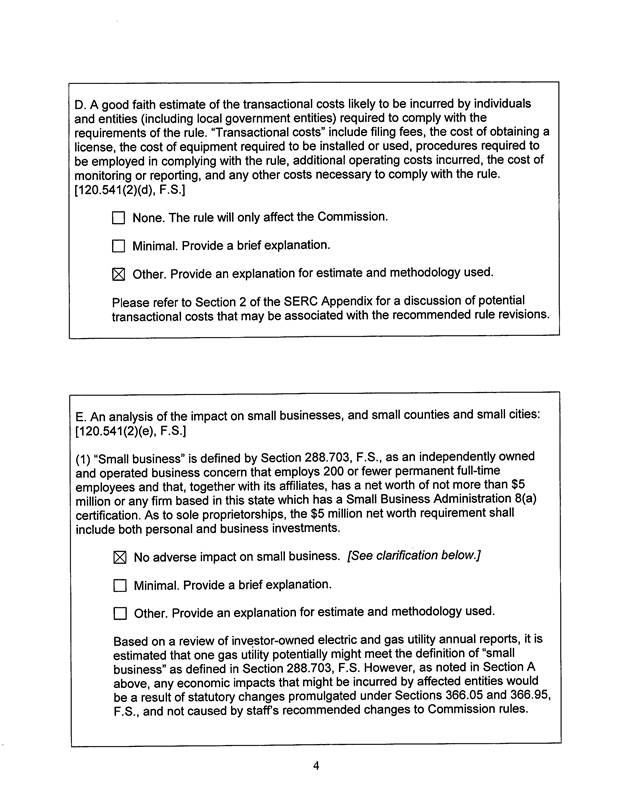

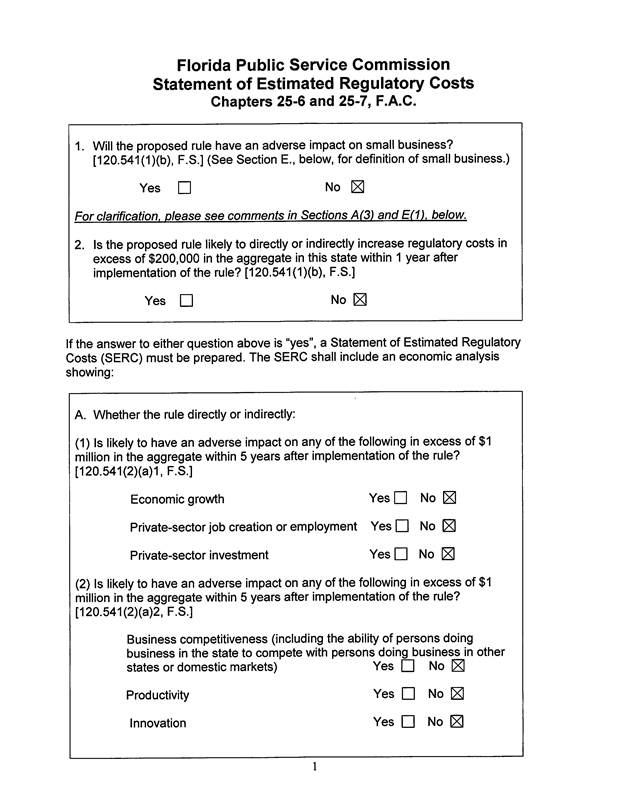

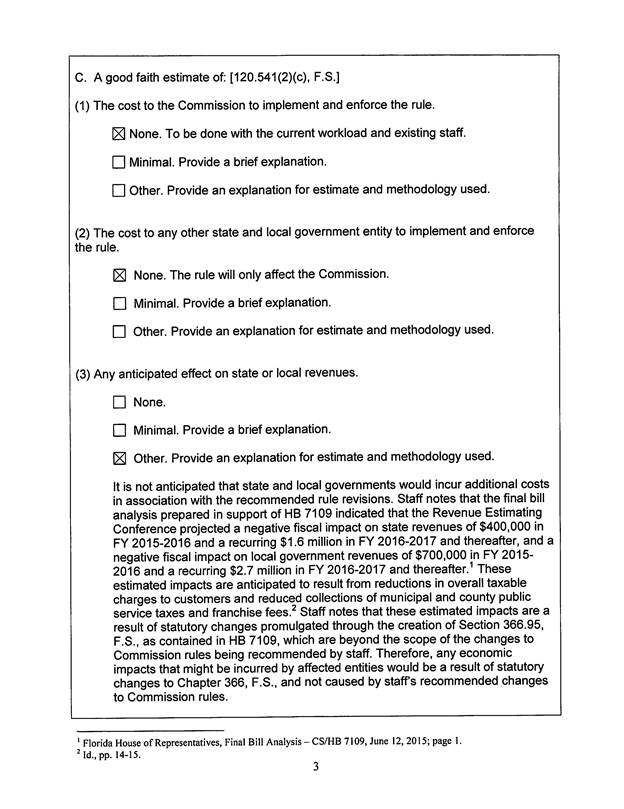

Statement of Estimated Regulatory Costs

Pursuant to Section 120.54, F.S., agencies are encouraged to prepare a statement of estimated regulatory costs (SERC) before the adoption, amendment, or repeal of any rule. The SERC is appended as Attachment B to this recommendation. The SERC analysis includes whether the rule amendment is likely to have an adverse impact on growth, private sector job creation or employment, or private sector investment in excess of $1 million in the aggregate within five years after implementation.[2]

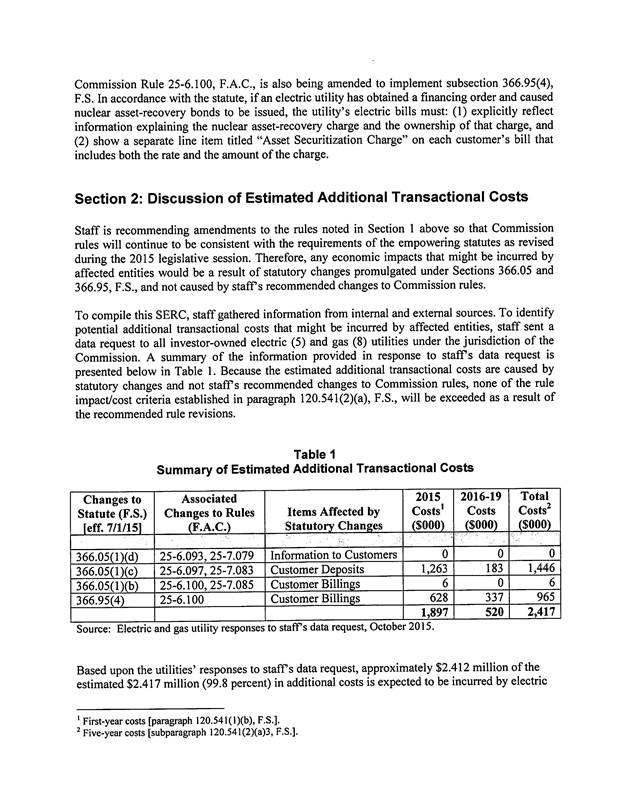

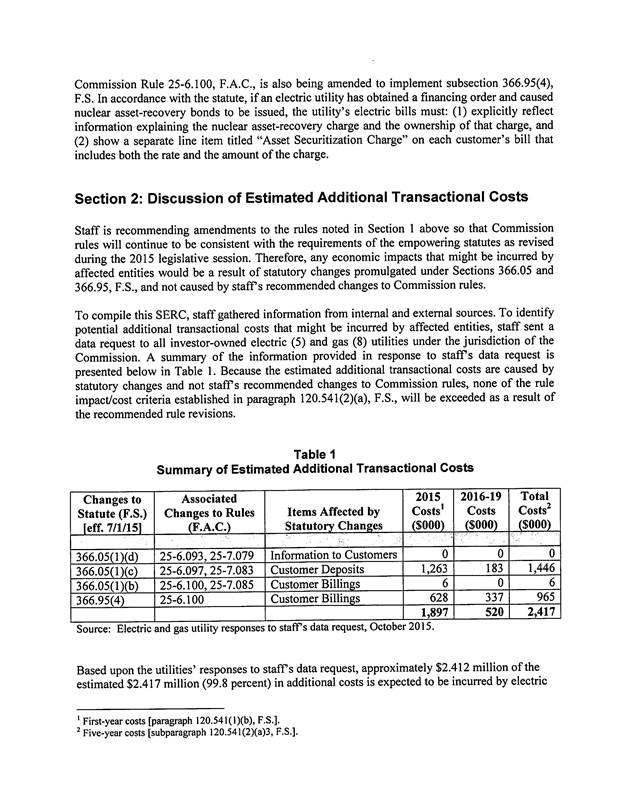

The SERC concludes that the rule amendments will not likely directly or indirectly increase regulatory costs in excess of $200,000 in the aggregate in Florida within one year after implementation. The SERC states that any economic impacts that might be incurred by affected entities would be a result of statutory changes promulgated under Sections 366.05 and 366.95, F.S., and not caused by staff’s recommended changes to Commission rules. The SERC states that several comments from interested parties were incorporated into the draft rules to provide additional clarification. No regulatory alternatives were submitted pursuant to paragraph 120.541(1)(a), F.S. The SERC concludes that because the estimated additional transactional costs are caused by statutory changes to Commission rules, none of the impact/cost criteria established in paragraph 120.541(2)(a), F.S., will be exceeded as a result of the recommended revisions.

Conclusion

Based on the foregoing, staff recommends the amendment of Rules 25-6.093, 25-6.097, 25-6.100, 25-7.079, 25-7.083, and 25-7.085, F.A.C.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no requests for hearing or comments are filed, the rules may be filed with the Department of State, and this docket should be closed. (Page)

Staff Analysis:

If no requests for hearing or comments are filed, the rules may be filed with the Department of State, and this docket should be closed.

25-6.093 Information to Customers.

(1) Each utility shall, upon request of any customer, give

such information and assistance as is reasonable, in order that the customer

may secure safe and efficient service. Upon the customer’s request,

the utility shall provide to the any customer information as to

the method of reading meters and the derivation of billing therefrom, the

billing cycle and approximate date of monthly meter reading.

(2) Upon request of the any customer, the utility shall

is required to provide to the customer a copy and explanation of the

utility’s rates and provisions applicable to the type or types of service

furnished or to be furnished such customer, and to assist the customer in

obtaining the rate schedule which is most advantageous to the customer’s

requirements.

(3)(a) By paper or electronic bill insert, billing

statement, website, electronic notification, or other means agreed to by

both the customer and the utility appropriate means of communication,

the utility shall give to each of its customers a summary of all available

electrical major rates schedules that which

are available to the class of which that customer is a member., and

(b) The utility shall provide the information contained in paragraph (a) to all its customers:

1. Not later than 60 days after the commencement of service, and

2. Not less frequently than once each year, and

3. Not later than 60 days after the utility has received approval of its new rate schedule applicable to such customer.

(c) In this subsection, “rate schedule” shall mean customer charge, energy charge, and demand charge, as set forth in Rule 25-6.100, F.A.C.

(d) By bill insert, or as a message on the customer bill, on a quarterly basis using the utility’s normal billing cycle, each utility shall provide its customers the sources of generation for the most recent 12-month period available prior to the billing cycle. The sources of generation shall be stated by fuel type for utility generation and as “purchased power” for off-system purchases. The sources of generation are to be set forth as kilowatt-hour percentages of the total utility generation and purchased power.

(4) Upon request of the any customer, but not more

frequently than once each calendar year, the utility shall provide to the

customer transmit a concise statement of the actual consumption of

electric energy by that customer for each billing period during the previous 12

months.

Rulemaking Authority 366.05(1), 350.127(2) FS. Law Implemented 366.03, 366.04(2)(f), (6), 366.041(1), 366.05(1), (3), 366.06(1) FS. History–New 7-29-69, Amended 11-26-80, 6-28-82, 10-15-84, Formerly 25-6.93, Amended 4-18-99,___________.

25-6.097 Customer Deposits.

(1) Deposit required; establishment of credit. Each utility’s

company’s tariff shall state the methodology contain their

specific criteria for determining the amount of the initial

deposit charged for existing accounts and new service requests. The

methodology shall conform to paragraph 366.05(1)(c), F.S. Each utility

may require an applicant for service to satisfactorily establish credit, but

such establishment of credit shall not relieve the customer from complying with

the utilities’ rules for prompt payment of bills. Credit will be deemed so

established if:

(a) The applicant for service furnishes a satisfactory

guarantor to secure payment of bills for the service requested. For residential

customers, a satisfactory guarantor shall, at the minimum, be a customer of the

utility with a satisfactory payment record. For non-residential customers, a

satisfactory guarantor need not be a customer of the utility. Each utility

shall develop minimum financial criteria that a proposed guarantor must meet to

qualify as a satisfactory guarantor. A copy of the criteria shall be made

available to each new non-residential customer upon request by the customer. A

guarantor’s liability shall be terminated when a residential customer whose

payment of bills is secured by the guarantor meets the requirements of

subsection (2) of this rule. Guarantors providing security for payment of

residential customers’ bills shall only be liable for bills contracted at the

service address contained in the contract of guaranty.

(b) The applicant pays a cash deposit.

(c) The applicant for service furnishes an irrevocable letter

of credit from a bank or a surety bond.

(2) Each utility may require an applicant for service to satisfactorily establish credit, but such establishment of credit shall not relieve the customer from complying with the utility’s rules for payment of bills. Credit will be deemed so established if:

(a) The applicant for service furnishes a satisfactory guarantor to secure payment of bills for the service requested. For residential customers, a satisfactory guarantor shall, at the minimum, be a customer of the utility with a satisfactory payment record. For non-residential customers, a satisfactory guarantor need not be a customer of the utility. Each utility shall develop minimum financial criteria that a proposed guarantor must meet to qualify as a satisfactory guarantor. A copy of the criteria shall be made available to each new non-residential customer upon request by the customer. A guarantor’s liability shall be terminated when a residential customer whose payment of bills is secured by the guarantor meets the requirements of subsection (3) of this rule. Guarantors providing security for payment of residential customers’ bills shall only be liable for bills contracted at the service address contained in the contract of guaranty.

(b) The applicant pays a cash deposit.

(c) The applicant for service furnishes an irrevocable letter of credit from a bank or a surety bond.

(32) Refund of deposits. After a customer has

established a satisfactory payment record and has had continuous service for a

period of 23 months, the utility shall refund the residential customer’s

deposits and shall, at the utility’s its option, either refund or

pay the higher rate of interest specified below for nonresidential deposits,

providing the customer has not, in the preceding 12 months:.

(a) Made more than one late payment of a bill (after the expiration of 20 days from the date of mailing or delivery by the utility).

(b) Paid with a check refused by a bank.

(c) Been disconnected for nonpayment, or at any time.

(d) Tampered with the electric meter, or

(e) Used service in a fraudulent or unauthorized manner.

(43) Deposits for existing accounts New

or additional deposits. A utility may charge require, upon reasonable

written notice to the customer of not less than thirty (30) days, a new

deposit, where previously waived or returned, or additional deposit on

an existing account, in order to secure payment of current

bills. Such request for a deposit shall be separate and apart from any

bill for service and shall explain the reason for the such new or

additional deposit, provided, however, that the total amount of the

required deposit shall not exceed an amount equal to twice the average charges

for actual usage of electric service for the twelve month period immediately

prior to the date of notice. In the event the customer has had service less

than twelve months, then the utility shall base its new or additional deposit

upon the average actual monthly usage available. The deposit charged

must conform to the requirements of Section 366.05(1)(c)1., F.S.

(54) Interest on deposits.

(a) Each electric utility which requires deposits to be made by

its customers shall pay a minimum interest on such deposits of 2 percent per

annum. The utility shall pay an interest rate of 3 percent per annum on

deposits of nonresidential customers qualifying under subsection (32)

when the utility elects not to refund such deposit after 23 months. Such

interest rates shall be applied within 45 days of the effective date of the

rule.

(b) The deposit interest shall be simple interest in all cases

and settlement shall be made annually, either in cash or by credit on the

current bill. This does not prohibit any utility paying a higher rate of

interest than required by this rule. No customer depositor shall be entitled to

receive interest on a his deposit until and unless a customer

relationship and the deposit have been in existence for a continuous period of

six months, then the customer he shall be entitled to receive

interest from the day of the commencement of the customer relationship and the

placement of deposit. Nothing in this rule shall prohibit a utility from

refunding at any time a deposit with any accrued interest.

(65) Record of deposits. Each utility having on

hand deposits from a customer or hereafter receiving deposits from them shall

keep records to show:

(a) The name of each customer making the deposit;

(b) The premises for which the deposit applies occupied

by the customer;

(c) The date and amount of deposit; and

(d) Each transaction concerning the deposits such as interest payments, interest credited or similar transactions.

(76) Receipt for deposit. The utility shall

provide a receipt to the customer for any deposit received from the customer

A non-transferable certificate of deposit shall be issued to each customer

and means provided so that the customer may claim the deposit if the

certificate is lost. Where a new or additional deposit is required under

subsection (3) of this rule, a customer’s cancelled check or validated bill

coupon may serve as a deposit receipt.

(87) Refund of deposit when service is

discontinued. Upon termination of service, the deposit and accrued interest may

be credited against the final account and the balance, if any, shall be

returned promptly to the customer but in no event later than fifteen (15) days

after service is discontinued.

Rulemaking Authority 366.05(1), 350.127(2) FS. Law Implemented 366.03, 366.041(1), 366.05(1), 366.06(1) FS. History–New 7-29-69, Amended 5-9-76, 7-8-79, 6-10-80, 10-17-83, 1-31-84, Formerly 25-6.97, Amended 10-13-88, 4-25-94, 3-14-99, 7-26-12, ___________.

25-6.100 Customer Billings.

(1) Bills shall be rendered monthly and as promptly as possible following the reading of meters.

(2) By January 1, 1983, Eeach customer’s

bill shall show at least the following information:

(a) The meter reading and the date the meter is read, in addition to the meter reading for the previous period. If the meter reading is estimated, the word “estimated” shall be prominently displayed on the bill.

(b)1. Kilowatt-hours (KWH) consumed including on and off peak if customer is time-of-day metered.

2. Kilowatt (KW) demand, if applicable, including on and off peak if customer is time-of-day metered.

(c) The dollar amount of the bill, including separately:

1. Customer, Base or Basic Service charge.

2. Energy (KWH) charges, exclusive of fuel, in cents per

KWH, including amounts for on and off peak if the customer is

time-of-day metered, and applicable cost recovery clause charges energy

conservation costs .

3. Demand (KW) charges, exclusive of fuel, in dollar cost

per KW, if applicable, for any demand charges included in the utility’s rate

structure and applicable cost recovery clause charges including amounts

for on and off peak if the customer is time-of-day metered.

4. Fuel (KWH) charges cost in cents per KWH

(no fuel costs shall be included in the Energy or Demand base charges

for demand or energy).

5. Total electric cost which, at a minimum, is the sum of the

customer charge, total fuel cost, total energy cost, and total demand

cost. charges 1 through 4 above but can include other line item charges

(e.g., Florida Gross Receipts Tax, etc.).

6. Franchise fees, if applicable.

7. Taxes, as applicable on purchases of electricity by the customer.

8. Any discount or penalty, if applicable.

9. Past due balances shown separately.

10. The gross and net billing, if applicable.

11. The rate and amount of the “Asset Securitization Charge,” pursuant to paragraph 366.95(4)(b), F.S., if applicable.

(d) Identification of the applicable rate schedule.

(e) The date by which payment must be made in order to benefit from any discount or avoid any penalty, if applicable.

(f) The average daily KWH consumption for the current period and for the same period in the previous year, for the same customer at the same location.

(g) The delinquent date or the date after which the bill becomes past due.

(h) Any conversion factors which can be used by customers to

convert from meter reading units to billing units. Where metering complexity

makes this requirement impractical, a statement must be on the bill advising where

and how that such information may be obtained from by

contacting the utility’s local business office.

(i) Where budget billing is used, the bill shall contain

the current month’s actual consumption and charges should be shown separately

from budgeted amounts.

(j) If applicable, the information required by subsection 366.8260(4), F.S., and subsection 366.95(4), F.S.

(kj) The name and address of the utility and

plus the telephone toll-free number(s) and web address where

customers can receive information about their bill as well as locations where

the customers can pay their utility bill. Such information must identify those

locations where no surcharge is incurred.

(3) When there is sufficient cause, estimated bills may be submitted provided that with the third consecutive estimated bill the company shall contact the customer explaining the reason for the estimated billing and who to contact in order to obtain an actual meter reading. An actual meter reading must be taken at least once every six months. If an estimated bill appears to be abnormal when a subsequent reading is obtained, the bill for the entire period shall be computed at a rate which contemplates the use of service during the entire period and the estimated bill shall be deducted. If there is reasonable evidence that such use occurred during only one billing period, the bill shall be computed.

(4) The advancement or postponement of tThe regular

meter reading date is governed by subsection 366.05(1)(b), F.S. may

be advanced or postponed not more than five days without a pro-ration of the

billing for the period.

(5) Whenever the period of service for which an initial or

opening bill is rendered is less than the normal billing period, the charges

applicable to such service, including minimum charges, shall be prorated

pro-rated except that initial or opening bills need not be rendered but

the energy used during such period may be carried over to and included in the

next regular monthly billing.

(6) The practices employed by each utility regarding customer billing shall have uniform application to all customers on the same rate schedule.

(7) Franchise Fees.

(a) When a municipality charges a utility any franchise fee, the utility may collect that fee only from its customers receiving service within that municipality. When a county charges a utility any franchise fee, the utility may collect that fee only from its customers receiving service within that county.

(b) A utility may not incorporate any franchise fee into its other rates for service.

(c) For the purposes of this subsection, the term “utility” shall mean any electric utility, rural electric cooperative, or municipal electric utility.

(d) This subsection shall not be construed as granting a municipality or county the authority to charge a franchise fee. This subsection only specifies the method of collection of a franchise fee, if a municipality or county, having authority to do so, charges a franchise fee.

Rulemaking Authority 366.05(1), 366.04(2) FS. Law Implemented 366.03, 366.04(2), 366.041(1), 366.05(1), 366.051, 366.06(1), 366.8260(4), 366.95(4) FS. History–New 2-25-76, Amended 4-13-80, 12-29-81, 6-28-82, 5-16-83, 2-4-13,___________.

25-7.079 Information to Customers.

(1) Each utility shall, upon request, give its customers such

information and assistance as is reasonable, in order that the customer may

secure safe and efficient service. The utility shall, when requested,

by the customer, provide to the any customer information

as to the method of reading meters and derivation of billing therefrom.

(2) Upon request of the any customer, it shall

be the duty of the utility shall to provide to the customer,

a copy and/or explanation of the utility’s rates applicable to the type or

types of service furnished or to be furnished to the such

customer, and to assist him in obtaining the rate which is most advantageous

for the customer’s his service requirements.

Rulemaking Authority 366.05(1) FS. Law Implemented 366.03, 366.05(1), 366.06 FS. History–New 1-8-75, Repromulgated 5-4-75, Formerly 25-7.79, Amended ___________.

25-7.083 Customer Deposits

(1) Deposit required;

establishment of credit. Each utility’s company’s tariff

shall state the methodology contain their specific criteria for

determining the amount of the initial deposit charged for

existing accounts and new service requests. The methodology shall conform to

Section 366.05(1)(c), F.S. Each utility may require an applicant for

service to satisfactorily establish credit, but such establishment of credit

shall not relieve the customer from complying with the utilities’ rules for

prompt payment of bills. Credit will be deemed so established if:

(a) The applicant for service

furnishes a satisfactory guarantor to secure payment of bills for the service

requested. For residential customers, a satisfactory guarantor shall, at the

minimum, be a customer of the utility with a satisfactory payment record. For

non-residential customers, a satisfactory guarantor need not be a customer of

the utility. Each utility shall develop minimum financial criteria that a

proposed guarantor must meet to qualify as a satisfactory guarantor. A copy of the

criteria shall be made available to each new non-residential customer upon

request by the customer. A guarantor’s liability shall be terminated when a

residential customer whose payment of bills is secured by the guarantor meets

the requirements of subsection (6) of this rule. Guarantors providing security

for payment of residential customers’ bills shall only be liable for bills

contracted at the service address contained in the contract of guaranty.

(b) The applicant pays a cash

deposit.

(c) The applicant for service

furnishes an irrevocable letter of credit from a bank or a surety bond.

(2) Each utility may require an applicant for service to satisfactorily establish credit, but such establishment of credit shall not relieve the customer from complying with the utility’s rules for payment of bills. Credit will be deemed so established if:

(a) The applicant for service furnishes a satisfactory guarantor to secure payment of bills for the service requested. For residential customers, a satisfactory guarantor shall, at the minimum, be a customer of the utility with a satisfactory payment record. For non-residential customers, a satisfactory guarantor need not be a customer of the utility. Each utility shall develop minimum financial criteria that a proposed guarantor must meet to qualify as a satisfactory guarantor. A copy of the criteria shall be made available to each new non-residential customer upon request by the customer. A guarantor’s liability shall be terminated when a residential customer whose payment of bills is secured by the guarantor meets the requirements of subsection (7) of this rule. Guarantors providing security for payment of residential customers’ bills shall only be liable for bills contracted at the service address contained in the contract of guaranty.

(b) The applicant pays a cash deposit.

(c) The applicant for service furnishes an irrevocable letter of credit from a bank or a surety bond.

(32) Receipt for

deposit. The utility shall provide a receipt to the customer for any deposit

received from the customer. A non-transferable certificate of deposit

shall be issued to each customer and means provided so that the customer may

claim the deposit if the certificate is lost. When a new or additional deposit

is required under subsection (3) of this rule a customer’s cancelled check or

validated bill coupon may serve as a deposit receipt.

(43) Deposits

for existing accounts New or additional deposits. A utility may charge

require, upon reasonable written notice to the customer of

not less than 30 days, such request or notice being separate and apart from

any bill for service, a new deposit, where previously waived or returned, or an

additional a deposit on an existing account, in order

to secure payment of current bills; provided, however, that the total

amount of the required deposit shall not exceed an amount equal to the average

actual charges for gas service for two billing periods for the 12-month period

immediately prior to the date of notice. In the event the customer has had

service less than 12 months, then the utility shall base its new or additional

deposit upon the average actual monthly billing available. Such request

for a deposit shall be separate and apart from any bill for service and shall

explain the reason for the deposit. The deposit charged must conform to the

requirements of Section 366.05(1)(c)1., F.S.

(54) Record of

deposit. Each utility having on hand deposits from customers or hereafter

receiving deposits from them shall keep records to show:

(a) The name of each customer making the deposit;

(b) The premises for which the

deposit applies occupied by the customer;

(c) The date and amount of deposit; and

(d) Each transaction concerning the deposit such as interest payments, interest credited or similar transactions.

(65) Interest on

deposits.

(a) Each gas utility which

requests deposits to be made by its customers shall pay a minimum interest on

such deposits of 2 percent per annum. The utility shall pay a minimum interest

rate of 3 percent per annum on deposits of nonresidential customers qualifying

under subsection (76) below when the utility elects not to refund

such a deposit after 23 months. Such interest rates shall be applied within

45 days of the effective date of the rule.

(b) The deposit interest shall be

simple interest in all cases and settlement shall be made annually, either in

cash or by credit on the current bill. This does not prohibit any utility

paying a higher rate of interest than required by this rule. No customer

depositor shall be entitled to receive interest on a his deposit

until and unless a customer relationship and the deposit have been in existence

for a continuous period of six months, then the customer he shall

be entitled to receive interest from the day of the commencement of the

customer relationship and the placement of deposit. Nothing in this rule

shall prohibit a utility from refunding at any time a deposit with any accrued

interest.

(76) Refund of deposit.

After a customer has established a satisfactory payment record and has had

continuous service for a period of 23 months, the utility shall refund the

residential customer’s deposits and shall, at the utility’s its

option, either refund or pay the higher rate of interest specified above for

nonresidential deposits, provided the customer has not, in the preceding 12

months:

(a) Made more than one late payment of a bill (after the expiration of 20 days from the date of mailing or delivery by the utility);

(b) Paid with check refused by a bank;

(c) Been disconnected for nonpayment, or at any time;

(d) Tampered with the gas meter; or

(e) Used service in a fraudulent

or unauthorized manner. Nothing in this rule shall prohibit the company from

refunding at any time a deposit with any accrued interest.

(87) Refund of deposit

when service is disconnected. Upon termination of service, the deposit and

accrued interest may be credited against the final account and the balance, if

any, shall be returned promptly to the customer but in no event later than

fifteen (15) days after service is discontinued.

Rulemaking Authority 366.05(1), 350.127(2) FS. Law Implemented 366.03, 366.05(1) FS. History–New 1-8-75, Amended 6-15-76, 6-10-80, 1-31-84, Formerly 25-7.83, Amended 10-13-88, 4-25-94, 3-14-99, 7-26-12,_____________.

25-7.085 Customer Billing.

(1) Bills shall be rendered monthly. With the exception of a duplicate bill, each customer’s bill shall show at least the following information:

(a) The meter reading and the date the meter was read plus the meter reading for the previous period. When an electronic meter is used, the gas volume consumed for the billing month may be shown. If the gas consumption is estimated, the word “estimated” shall prominently appear on the bill.

(b) Therms and cubic feet consumed.

(c) The total dollar amount of the bill, indicating separately:

1. Customer, Base or Basic Service charge.

2. Energy (therm) charges exclusive of fuel cost in cents per therm.

3. Fuel (therm) charges cost in cents per therm (no

fuel costs shall be included in the charge for energy).

4. Total gas cost which at a minimum is the sum of charges

1 through 3 above but can include other line item charges (e.g., Florida

Gross Receipts Tax) the customer charge, total fuel cost and total

energy cost.

5. Franchise fees, if applicable.

6. Taxes, as applicable on purchases of gas by the customer.

7. Any discount or penalty, if applicable.

8. Past due balances.

9. The gross and net billing, if applicable.

(d) Identification of the applicable rate schedule.

(e) The date by which payment must be made in order to benefit from any discount or avoid any penalty, if applicable.

(f) The average daily therm consumption for the current period and for the same period in the previous year, for the same customer at the same location.

(g) The delinquent date or the date after which the bill becomes past due.

(h) Any conversion factors which can be used by customers to convert from meter reading units to billing units.

(i) Where budget billing is used, the bill shall contain the current month’s consumption and charges separately from budgeted amounts.

(j) The name of the utility plus the address, and telephone

number(s) and web address of the local office where the

bill can be paid and questions concerning the bill can be answered.

(2) All gas utilities shall charge for gas service on a thermal basis instead of on a volume basis. The provisions governing customer billing on a thermal basis shall be as follows:

(a) The unit of service shall be the “Therm.”

(b) The number of therms which shall have been taken by consumer during a given period shall be determined by multiplying the difference in the meter readings in cubic feet at the beginning and end of the period by the conversion factors in paragraph (1)(h) including a heating-value factor which has been determined as prescribed in paragraph (c) below.

(c) The heating-value factor for gas utilities receiving and distributing natural gas shall be the average thermal value of the natural gas received and distributed during the preceding month. In case the average heating value during the calendar month has been below the standard, then the value to be used in determining the factor shall be the heating value standard minus a deduction of one percent (1%) for each one percent (1%) or fraction thereof that the average heating value has been below the standard.

(d) The consumer shall be billed to the nearest one-tenth of a therm.

(3) Whenever the period of service for which an initial or opening bill would be rendered is less than the normal billing period, no bill for that period need be rendered if the volume amount consumed is carried over and included in the next regular monthly billing. If, however, a bill for such period is rendered, the applicable charges, including minimum charges, shall be prorated.

(4) When there is sufficient cause, estimated billings may be used by a utility provided that with the customer’s third consecutive estimated billing the customer is informed of the reason for the estimation and whom to contact to obtain an actual meter reading if one is desired. An actual meter reading must be taken at least once every six months. If an estimated bill appears to be abnormal once an actual meter reading is obtained, the bill for the entire estimation period shall be computed at a rate based on use of service during the entire period and the estimated bill shall be deducted. If there is substantial evidence that such use occurred during only one billing period, the bill shall be computed.

(5) The advancement or postponement of rRegular

meter reading dates is governed by subsection 366.05(1)(b), F.S. may

be advanced or postponed not more than five days without a proration of the

billing for the period.

(6) The practices employed by each utility regarding customer billing shall have uniform application to all customers on the same rate schedule.

(7) Franchise Fees.

(a) When a municipality charges a utility any franchise fee, the utility may collect that fee only from its customers receiving service within that municipality. When a county charges a utility any franchise fee, the county may collect that fee only from its customers receiving service within that county.

(b) A utility company may not incorporate any

franchise fee into its other rates for service.

(c) This subsection shall not be construed as granting a municipality or county the authority to charge a franchise fee. This subsection only specifies the method of collection of a franchise fee, if a municipality or county, having authority to do so, charges a franchise fee.

Rulemaking Authority 366.05(1) FS. Law Implemented 366.05(1), 366.06(1) FS. History–New 12-15-73, Repromulgated 1-8-75, Amended 5-4-75, 11-21-82, 12-26-82, Formerly 25-7.85, Amended 10-10-95, 7-3-96,______________.