Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Division of Economics (Guffey, Draper) Office of the General Counsel (Janjic) |

||

|

RE: |

|||

|

AGENDA: |

12/03/15 – Regular Agenda – Tariff Filing – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

8-Month Effective Date: 05/01/16 (60-day suspension date waived by the utility) |

|||

|

SPECIAL INSTRUCTIONS: |

|||

On September 1, 2015, Florida Public Utilities Company (FPUC), FPUC-Fort Meade (Fort Meade), and the Florida Division of Chesapeake Utilities Corporation (Chesapeake), collectively the Company, filed a petition seeking approval to implement a new gas reliability infrastructure program (GRIP) for Fort Meade and for approval of GRIP cost recovery factors for FPUC, Fort Meade, and Chesapeake.

The GRIP program for FPUC and Chesapeake was originally approved in Order No. PSC-12-0490-TRF-GU[1] (2012 order) to recover the cost of accelerating the replacement of cast iron and bare steel distribution mains and services through a surcharge on customers’ bills. FPUC and Chesapeake’s currently effective surcharges were approved in Order No. PSC-14-0693-TRF-GU.[2] FPUC’s and Chesapeake’s proposed 2016 GRIP surcharges are discussed in Issue 1 of the recommendation.

Fort Meade currently does not have a GRIP program and is requesting Commission approval to implement a GRIP program in the instant petition. On October 27, 2015, the Company filed an amended petition for approval to implement GRIP for Fort Meade. Fort Meade’s proposed implementation of a GRIP program is discussed in Issue 2 of the recommendation.

The 2012 order for FPUC and Chesapeake addressed the reliability and safety rationale for pipeline replacement, the scope of the program, similar actions in other states, and the procedure for annually setting the GRIP surcharge to recover the costs of the program. The procedure requires an annual filing with three components:

1. A final true-up showing the actual replacement costs, actual surcharge revenues, and over- or under-recovery amount for the 12-month historical period from January 1 through December 31 of the year prior to FPUC’s/Chesapeake’s annual GRIP petition.

2. An actual/estimated true-up showing seven months of actual and five months of projected replacement costs, surcharge revenues, and over- or under-recovery amount.

3. A revenue requirement projection showing 12 months of projected GRIP revenue requirement for the period beginning January 1 following FPUC’s/Chesapeake/s annual GRIP petition filing.

The Commission concluded the 2012 order by stating:

Replacement of bare steel pipelines is in the public interest to improve the safety of Florida’s natural gas infrastructure, thereby reducing the risk to life and property. Given the length of time these pipelines have been installed and the leak history due to corrosion, we find that it is appropriate to approve the proposed replacement program. Without the GRIP surcharge, it is reasonable to expect that FPUC/Chesapeake will have to file for more frequent base rate proceedings to recover the expenses of an accelerated replacement program. The annual filings will provide us with the oversight to ensure that projected expenses are trued-up and only actual costs are recovered. FPUC’s/Chesapeake’s GRIP and its associated surcharges will terminate when all replacements have been made and the revenue requirement rolled into rate base.

On October 22, 2015, the Company filed responses to Staff’s First Data Request. The Commission has jurisdiction over this matter pursuant to Sections 366.03, 366.04, 366.05, and 366.06, Florida Statutes (F.S.).

Issue 1:

Should the Commission approve FPUC's and Chesapeake's proposed GRIP surcharge factors for 2016?

Recommendation:

Yes. The Commission should approve FPUC’s and Chesapeake’s proposed GRIP surcharges for each rate class commencing with bills rendered for meter readings taken on or after January 1, 2016. (Guffey, Draper)

Staff Analysis:

The FPUC and Chesapeake surcharges have been in effect since January 2013. FPUC and Chesapeake state that they continue to replace eligible infrastructure aggressively. Both companies prioritize the potential replacement projects in areas of high consequence and areas susceptible to corrosion. These areas are dictated by the Distribution Integrity Management Program, which uses a risk-based prioritization designed to determine the replacement order for cast iron and bare steel pipelines. Attachment 1 provides an update of mains and services replaced and the replacement forecast through the end of the term of the GRIP program in 2022 for FPUC and Chesapeake. The companies appear to be on track to complete the replacements on time.

FPUC’s True-ups by Year

FPUC’s calculations for the 2016 GRIP revenue requirement and surcharges include a final true-up for 2014, an actual/estimated true-up for 2015, and projected costs for 2016. Attachment 2 contains tables showing the calculation for each year. Staff notes that FPUC recovers $747,727 of annual GRIP expenses in base rates. The amount included in base rates is excluded from the GRIP surcharge calculation.

Final True-up for 2014

FPUC stated that the GRIP revenues for 2014 were $674,601, compared to a revenue requirement of $2,381,424. The resulting under-recovery is $1,706,823. After adding interest of $139 and the end of 2013 over-recovery ($414,542), the final 2014 true-up is an under-recovery of $1,292,420.

Actual/Estimated 2015 True-Up

FPUC provided actual GRIP revenues for January through July and estimated revenues for August through December, which total $4,283,483. The actual/estimated revenue requirement for 2015 is $5,770,685 and includes a return on investment, depreciation expense, and property tax expense. The forecast under-recovery for 2015 is $1,487,202. After adding interest of $1,388, and the final 2014 under-recovery of $1,292,420, the total 2015 under-recovery is $2,781,010.

Projected 2016 Costs

FPUC projects capital expenditures of $12,237,715 for the replacement of cast iron/bare steel infrastructure in 2016. This compares with final 2014 expenditures of $19,128,274 and actual/estimated 2015 expenditures of $25,207,005. The return on investment, net depreciation expense, customer notification, and property tax expenses associated with that investment are $8,920,386. Subtracting the revenue requirement for bare steel replacement investment included in base rates results in a 2016 revenue requirement of $8,172,659. After adding the total 2015 under-recovery of $2,781,010, the 2016 revenue requirement is $10,953,669.

Chesapeake’s True-ups by Year

Chesapeake does not have a replacement recovery amount embedded in base rates. Chesapeake’s calculations for the 2016 GRIP revenue requirement and surcharges include a final true-up for 2014, an actual/estimated true-up for 2015, and projected costs for 2016. Attachment 3 contains tables showing the calculation for each year.

Final True-Up for 2014

Chesapeake’s stated that the GRIP revenues for 2014 were $666,121, compared to total replacement costs of $967,391. The resulting under-recovery is $301,270. After adding interest of $12 and the end of 2013 over-recovery amount ($90,107), the final 2014 under-recovery is $211,175.

Actual/Estimated 2015 True-Up

Chesapeake provided actual GRIP revenues for January through July and forecast revenues for August through December, which total $1,800,824. The actual/estimated GRIP revenue requirement for 2015 is $1,717,692 and includes a return on investment, depreciation expense, and property tax expense. The forecast over-recovery for 2015 is $83,132. After adding interest of $81 and the 2014 over-recovery amount ($211,175), the total 2015 under-recovery is $127,962.

Projected 2016 Costs

Chesapeake projects capital expenditures of $4,447,860 for the replacement of cast iron/bare steel infrastructure in 2016. This compares with final 2014 expenditures of $5,196,099 and actual/estimated 2015 expenditures of 5,815,969. The return on investment, depreciation expense, and property tax expense to be recovered in 2016 totals $2,432,850. After adding the total 2015 under-recovery of $127,962, the total 2016 revenue requirement is $2,560,812.

Proposed Surcharges for FPUC and Chesapeake

As established in the 2012 order approving the GRIP, the total 2016 revenue requirement is allocated to the rate classes using the same methodology that was used for the allocation of mains and services in the cost of service study used in the companies’ most recent rate case. After calculating the percentage of total plant costs attributed to each rate class, the respective percentages were multiplied by the 2016 revenue requirement, resulting in the revenue requirement by rate class. Dividing each rate class’ revenue requirement by projected therm sales provides the GRIP surcharge for each rate class.

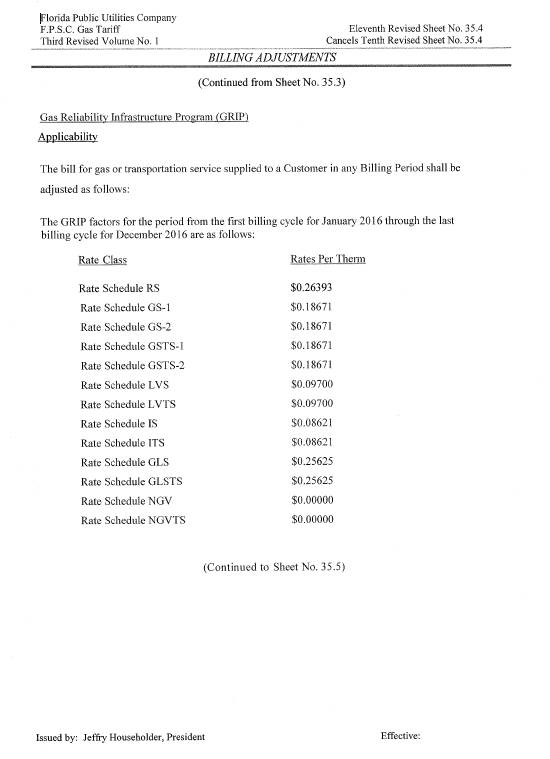

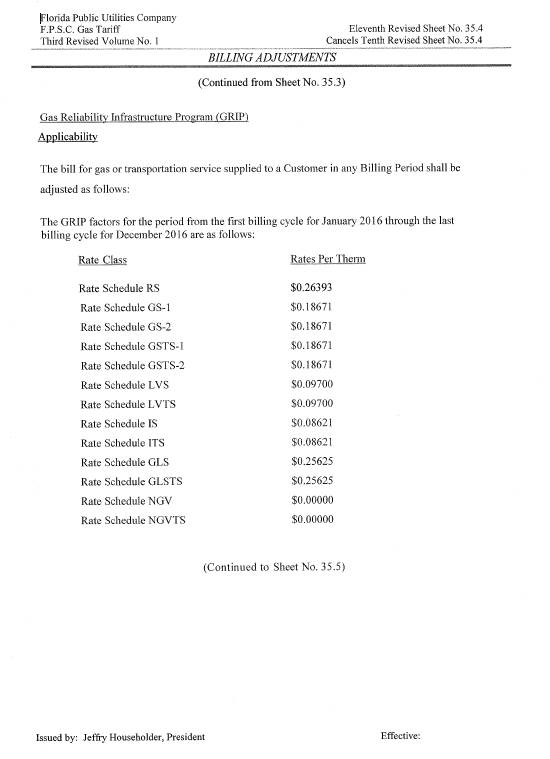

The proposed 2016 GRIP surcharge for residential FPUC customers is $0.26393 per therm (compared to the current surcharge of $0.10516 per therm). The monthly bill impact is $5.50 beginning January 2016 for a residential customer who uses 20 therms per month. The proposed FPUC tariff page is provided in Attachment 4.

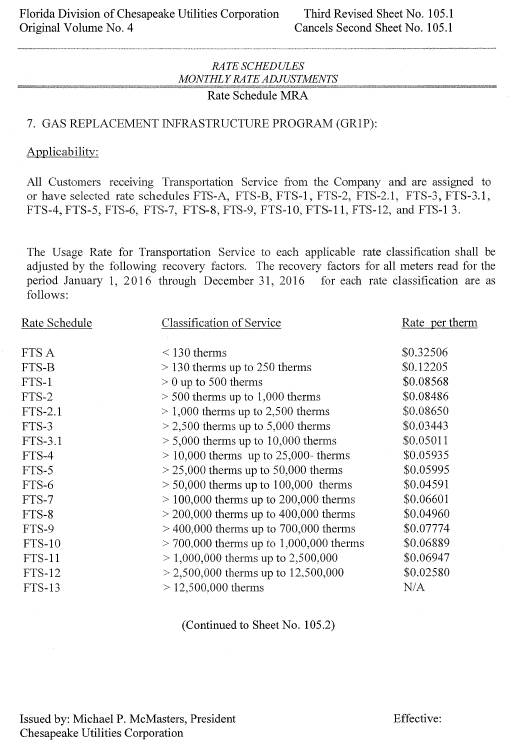

The proposed 2016 GRIP surcharge for residential Chesapeake customers on the FTS-1 rate is $0.08568 per therm (compared to the current surcharge of $0.05713 per therm). The monthly bill impact is $1.71 beginning January 2016 for a residential Chesapeake customer who uses 20 therms per month. The proposed tariff page is provided in Attachment 5.

Conclusion

Staff believes the calculation of the 2016 GRIP surcharge revenue requirement and the proposed GRIP surcharges for FPUC and Chesapeake are reasonable and accurate. Therefore, staff recommends approval of FPUC’s and Chesapeake’s proposed 2016 GRIP surcharge for each rate class commencing with bills rendered for meter readings taken on and after January 1, 2016.

Issue 2:

Should the Commission approve the proposed GRIP program for Fort Meade?

Recommendation:

Yes, the Commission should approve the proposed GRIP program for Fort Meade effective January 1, 2016. Fort Meade should file a petition to implement 2017 GRIP surcharges no later than September 1, 2016. (Guffey, Draper)

Staff Analysis:

Fort Meade currently does not have a GRIP program. Fort Meade is located in Polk County and Fort Meade serves approximately 650 natural gas residential and commercial customers. FPUC and the City of Fort Meade executed a purchase agreement in 2013 for the sale of the City of Fort Meade’s natural gas system and FPUC acquired the system in December 2013. The Commission approved Fort Meade’s initial tariff sheets in Order No. PSC-13-0676-TRF-GU.[3] At that point Fort Meade started operating as a new investor-owned natural gas utility in Florida as a division of FPUC.

The Company explained that after the acquisition of the Fort Meade system, it found during a routine maintenance survey approximately 250 steel tubing services in the Fort Meade system. Steel services are subject to corrosion and are typically replaced with plastic services. In the petition filed on September 1, 2015, Fort Meade requested Commission approval to implement a GRIP program to replace the steel tubing services and associated GRIP surcharges effective January 2016 consistent with the purpose of the FPUC and Chesapeake GRIP programs the Commission approved in the 2012 order.

After filing the September 1, 2015 petition, the Company determined that the implementation of the GRIP surcharge for Fort Meade prior to October 2016 would be in violation of a term in the purchase agreement for the Fort Meade system. Therefore, the Company submitted an amended petition on October 27, 2015 as it relates to Fort Meade. Specifically, the amended petition requests that Fort Meade be allowed to implement a new GRIP program to be able to start the replacement of the Fort Meade steel services effective January 2016, however, defer collecting GRIP surcharges from customers until January 2017. If the Commission approves Fort Meade’s proposed GRIP program in this issue, the Company anticipates making a GRIP filing in the fall of 2016 concurrent with the annual FPUC and Chesapeake GRIP filing, which will include actual/estimated replacement cost for 2016, projected replacement cost for 2017, and GRIP surcharges effective January 2017.

The Company states that using the same average replacement cost of services for FPUC and Chesapeake of $1,900 per service, the total projected investment for Fort Meade is $475,000 to replace 250 services. The Company anticipates if it acts aggressively that it will take approximately two years to replace the Fort Meade steel services. The estimated annual revenue requirement associated with half of the investment ($237,500) is $15,086. As with the approved FPUC and Chesapeake GRIP programs, the revenue requirement for Fort Meade includes depreciation expenses, return on investment, and property taxes. In response to staff’s data request, the Company explained that it will notify the Fort Meade customers of the GRIP surcharge in December 2016 through a message on the customer’s bill, separate mailing, and a message on the FPUC-Fort Meade website.

While the 2017 Fort Meade GRIP surcharge won’t be determined until Fort Meade files a petition for a surcharge by September 1, 2017, Fort Meade currently estimates the 2017 residential GRIP surcharge to be $0.24155 per therm, or $4.83 for a customer who uses 20 therms per month. This estimated residential GRIP surcharge includes the revenue requirement for 2016 and 2017. If Fort Meade had implemented a surcharge in 2016, as contemplated in the petition filed September 1, 2016, based on only the 2016 projected revenue requirement, the surcharge would be $0.12065 per therm, or $2.41 for a customer who uses 20 therms per month. Delaying the implementation of the surcharge by a year therefore increases the surcharge to customers. However, staff notes that replacement cost may vary from current estimates and staff discussed with the Company to consider options such as spreading the recovery of the GRIP revenue requirement over two years to mitigate the initial impact on customers, if necessary. Staff believes that, as the Commission stated in the 2012 order, the replacement of bare steel pipelines is in the public interest and Fort Meade should start replacing the steel services in January 2016 and not delay implementation until January 2017.

Staff recommends that the Commission approve the proposed

GRIP program for Fort Meade effective January 1, 2016. Fort Meade should file a

petition to implement 2017 GRIP surcharges no later than September 1, 2016.

Approval of a GRIP program for Fort Meade is consistent with the GRIP programs

the Commission approved for FPUC, Chesapeake and Peoples Gas System.[4]

Issue 3:

Should this docket be closed?

Recommendation:

If Issues 1 and 2 are approved and a protest is filed within 21 days of the issuance of the order, the tariffs should remain in effect, with any revenues held subject to refund, pending resolution of the protest. If no timely protest is filed, this docket should be closed upon the issuance of a consummating order. (Janjic)

Staff Analysis:

If Issue 1 and 2 are approved and a protest is filed within 21 days of the issuance of the order, the tariffs should remain in effect, with any revenues held subject to refund, pending resolution of the protest. If no timely protest is filed, this docket should be closed upon the issuance of a consummating order.

Table 1-1

FPUC Pipe Replacement Program Progress

|

|

Main Replacements |

Service Replacements |

|||||

|

|

Replaced Cast Iron (miles) |

Replaced Bare Steel (miles) |

Remaining Cast Iron at Year End (miles) |

Remaining Bare Steel at Year End (miles) |

Total Miles Remaining |

Replaced Number of Steel Services |

Total Number of Remaining Steel Services |

|

|

|||||||

|

|

|||||||

|

Year |

|||||||

|

July 2012 |

0.9 |

197.10 |

198.00 |

|

7980 |

||

|

2012 |

|

6.00 |

0.9 |

191.10 |

192.00 |

91 |

7889 |

|

2013 |

0.6 |

26.40 |

0.3 |

164.70 |

165.00 |

2071 |

5818 |

|

2014 |

|

38.00 |

0.3 |

126.70 |

127.00 |

1275 |

4543 |

|

2015 |

|

41.00 |

0.3 |

85.70 |

86.00 |

905 |

3638 |

|

2016 |

|

20.00 |

0.3 |

65.70 |

66.00 |

815 |

2823 |

|

2017 |

0.3 |

13.70 |

0 |

52.00 |

52.00 |

595 |

2228 |

|

2018 |

|

14.00 |

0 |

38.00 |

38.00 |

595 |

1633 |

|

2019 |

|

14.00 |

0 |

24.00 |

24.00 |

595 |

1038 |

|

2020 |

|

14.00 |

0 |

10.00 |

10.00 |

595 |

443 |

|

2021 |

|

8.00 |

0 |

2.00 |

2.00 |

385 |

58 |

|

2022 |

|

2.00 |

0 |

0.00 |

0.00 |

58 |

0 |

Source: FPUC’s response to staff’s first data request

Table 1-2

Chesapeake Pipe Replacement Program Progress

|

|

Main Replacements |

Service Replacements |

|||||

|

|

Replaced Cast Iron (miles) |

Replaced Bare Steel (miles) |

Remaining Cast Iron at Year End (miles) |

Remaining Bare Steel at Year End (miles) |

Total Miles Remaining |

Replaced Number of Steel Services |

Total Number of Remaining Steel Services |

|

|

|||||||

|

|

|||||||

|

Year |

|||||||

|

July 2012 |

|

|

|

152 |

152 |

|

762 |

|

2012 |

|

5 |

0 |

147 |

147 |

34 |

728 |

|

2013 |

|

3 |

0 |

144 |

144 |

139 |

589 |

|

2014 |

|

19 |

0 |

125 |

125 |

47 |

542 |

|

2015 |

|

40 |

0 |

85 |

85 |

280 |

262 |

|

2016 |

|

14 |

0 |

71 |

71 |

42 |

220 |

|

2017 |

|

14 |

0 |

57 |

57 |

42 |

178 |

|

2018 |

|

14 |

0 |

43 |

43 |

42 |

136 |

|

2019 |

|

14 |

0 |

29 |

29 |

42 |

94 |

|

2020 |

|

14 |

0 |

15 |

15 |

42 |

52 |

|

2021 |

|

12 |

0 |

3 |

3 |

40 |

12 |

|

2022 |

|

3 |

0 |

0 |

0 |

12 |

0 |

Source: Chesapeake’s response to staff’s first data request

Table 2-1

FPUC Final True-up for 2014

|

2014 GRIP Revenues |

$674,601 |

|

2014 Net Revenue Requirement |

$2,381,424 |

|

2014 Under-recovery |

$1,706,823 |

|

Interest |

$139 |

|

2013 Final True-up (over-recovery) |

$414,542 |

|

2014 Final True-Up (under-recovery) |

$1,292,420 |

Source: Schedule B-1 of the petition

Table 2-2

FPUC Actual/Estimated True-up for 2015

|

2015 GRIP Revenues |

$4,283,483 |

|

2015 Net Revenue Requirement |

$5,770,685 |

|

2015 Under-recovery |

$1,487,202 |

|

Interest |

$1,388 |

|

2014 Final True-up (under-recovery) |

$1,292,420 |

|

2015 Total True-Up (under-recovery) |

$2,781,010 |

Source: Schedule B-2 of the petition

Table 2-3

FPUC Projected 2016 Costs

|

2016 Projected Expenditures |

$12,237,715 |

|

Return on Investment |

$6,195,036 |

|

Depreciation Expense |

$1,535,625 |

|

Tax and Customer Notice Expenses |

$1,189,725 |

|

2016 Revenue Requirement |

$8,920,386 |

|

Less Revenue Requirement in Base Rates |

$747,727 |

|

2016 GRIP Revenue Requirement |

$8,172,659 |

|

Plus Prior Period Under-Recovery |

($2,781,010) |

|

Total 2016 Revenue Requirement |

$10,953,669 |

Source: Schedule C-1 of the petition

Table 3-1

|

2014 GRIP Revenues |

$666,121 |

|

2014 Net Revenue Requirement |

$967,391 |

|

2014 Under-recovery |

$301,270 |

|

Interest |

$12 |

|

2013 Final True-Up (over-recovery) |

$90,107 |

|

2014 Final True-up (under-recovery) |

$211,175 |

Chesapeake Final True-up for 2014

Source: Schedule B-1 of the petition

Table 3-2

Chesapeake Actual/Estimated True-up for 2015

|

2015 GRIP Revenues |

$1,800,824 |

|

2015 Net Revenue Requirement |

$1,717,692 |

|

2015 Over-Recovery |

$83,132 |

|

Interest |

$81 |

|

2014 Final True-Up (under-recovery) |

$211,175 |

|

2015 Total True-Up (under-recovery) |

$127,962 |

Source: Schedule B-2 of the petition

Table 3-3

Chesapeake Projected 2016 Costs

|

2016 Projected Expenditures |

$4,447,860 |

|

Return on Investment |

$1,669,415 |

|

Depreciation Expense |

$427,963 |

|

Tax and Customer Notice Expenses |

$335,472 |

|

2016 Revenue Requirement |

$2,432,850 |

|

Plus Prior Period Under-recovery |

$127,962 |

|

Total 2016 Revenue Requirement |

$2,560,812 |

Source: Schedule C-1 of the petition

[1] Order No. PSC-12-0490-TRF-GU, issued September 24, 2012, in Docket No. 120036-GU, In re: Joint petition for approval of Gas Reliability Infrastructure Program (GRIP) by Florida Public Utilities Company and the Florida Division of Chesapeake Utilities Corporation.

[2] Order No. PSC-14-0693-TRF-GU, issued December 15, 2014, in Docket No. 140166-GU, In re: Joint petition for approval of Gas Reliability Infrastructure Program (GRIP) by Florida Public Utilities Company and the Florida Division of Chesapeake Utilities Corporation.

[3] Order No. PSC-13-0676-TRF-GU, issued December 20, 2013, Docket No. 130258-GU, In re: Petition for approval of tariff sheets reflecting gas service to customers in the City of Ft. Meade, by Florida Public Utilities Company.

[4] Order No. PSC-12-0476-TRF-GU, issued September 18, 2012, in Docket No. 110320-GU, In re: Petition for approval of Cast Iron/Bare Steel Pipe Replacement Rider (Rider CI/BSR), by Peoples Gas System.