Changes in appearance and in display of formulas, tables, and text may have occurred during translation of this document into an electronic medium. This HTML document may not be an accurate version of the official document and should not be relied on.

For an official paper copy, contact the Florida Public Service Commission at contact@psc.state.fl.us or call (850) 413-6770. There may be a charge for the copy.

|

|

|

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Division of Accounting and Finance (Barrett, Lester) Division of Economics (Draper, Guffey) Office of the General Counsel (Vilafrate, Janjic) |

||

|

RE: |

|||

|

AGENDA: |

|||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

None |

|||

|

SPECIAL INSTRUCTIONS: |

|||

On February 1, 2016, Duke Energy Florida, LLC (DEF) filed a Notice Of Intent to File a Petition for Mid-Course Correction, asserting that its Petition for Mid-Course Correction would be filed on or before February 8, 2016. On February 8, 2016, DEF filed its Petition for Mid-Course Correction to its 2016 Fuel Adjustment and Capacity Factors (DEF Petition).

On February 2, 2016, Florida Power & Light Company (FPL) filed a Petition for Mid-Course Correction to its 2016 Fuel Adjustment Factors (FPL Petition).

The DEF and FPL filings seek to reduce the respective 2016 fuel and purchased power cost recovery factors (fuel factors) approved in Order No. PSC-15-0586-FOF-EI.[1] FPL has requested that the revised fuel factors become effective with the in-service date of the Port Everglades Energy Center, which is expected to be April 1, 2016, and DEF has requested that its revised fuel factors become effective when the April 2016 billing cycle begins. The requested reductions for DEF and FPL are primarily due to decreases in projected 2016 natural gas prices.

This case is scheduled to be voted on at the March 1, 2016 Agenda Conference or 30 days before the April 2016 billing cycle begins. Typically, effective dates are set a minimum of 30 days after a Commission vote modifying charges as the result of a mid-course correction.[2] This time limit is imposed in order to not have new rates applied to energy consumed before the effective date of the Commissionís action, i.e., the date of the vote. However, the Commission has also implemented charges in less than 30 days when circumstances warrant.[3] In this instance, the interval between the Commissionís vote on this matter (March 1, 2016) and the proposed implementation date (expected to be April 1, 2016) is 30 days, which staff believes is sufficient.†

Mid-course corrections are part of the fuel and purchased power cost recovery clause (fuel clause) proceeding, and such corrections are used by the Commission between fuel clause hearings whenever costs deviate from revenues by a significant margin. Petitions for mid-course corrections to fuel factors are addressed by Rule 25-6.0424, Florida Administrative Code (F.A.C.). Under this rule, a utility must notify the Commission whenever it expects to experience an under-recovery or over-recovery greater than 10 percent. Pursuant to Rule 25-6.0424, F.A.C., the mid-course percentage is the estimated end-of-period total net true-up amount divided by the current periodís total actual and estimated jurisdictional fuel revenue applicable to period amount.

Mid-course corrections are considered preliminary procedural decisions, and any over-recoveries or under-recoveries caused by or resulting from the new fuel factors adopted by the mid-course correction may be included in the following yearís fuel factors.

The Commissionís jurisdiction to consider fuel clause proceedings derives from the Commissionís authority to set fair and reasonable rates, found in Section 366.05, Florida Statutes.

Issue 1:

Should the Commission approve FPLís petition for a mid-course revision to its 2016 fuel cost recovery factors and associated tariff sheets?

Recommendation:

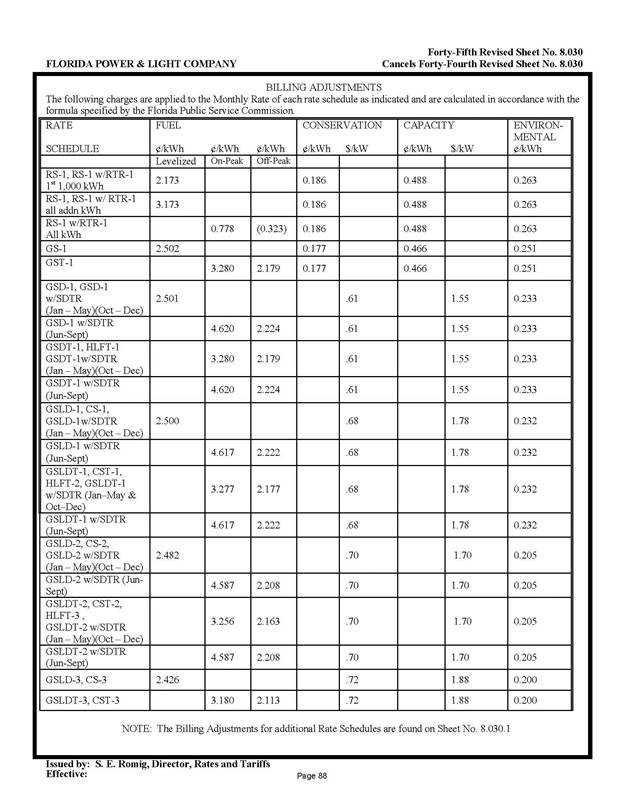

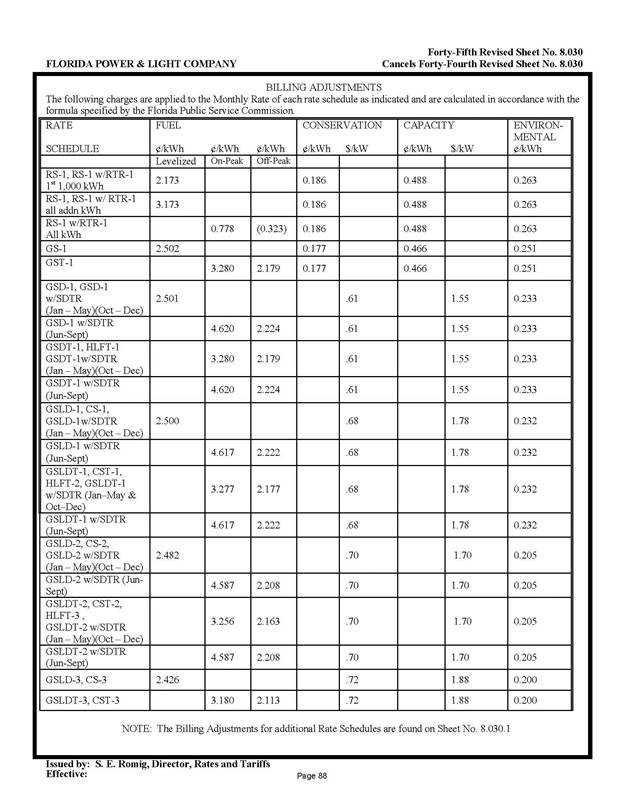

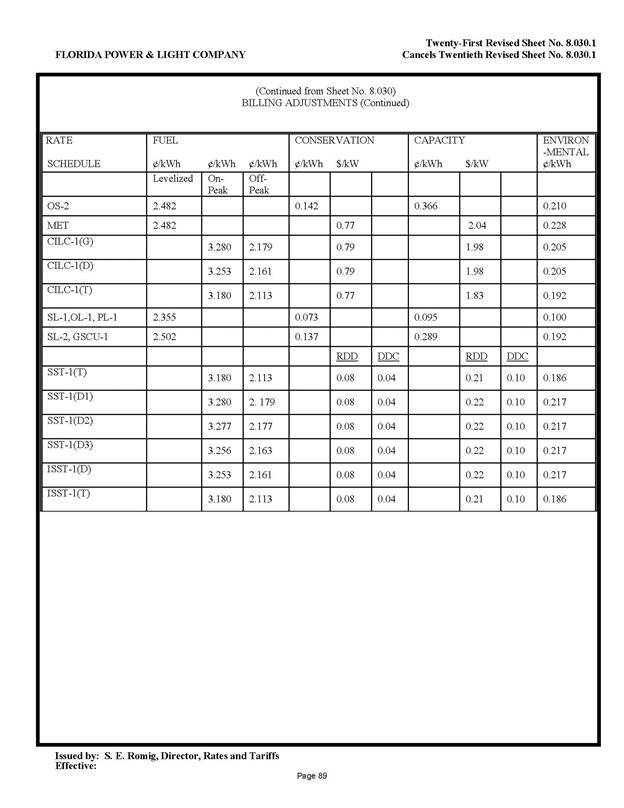

Yes. Staff recommends the Commission approve FPLís Petition for mid-course correction to its 2016 fuel cost recovery factors and the associated tariff sheets. The revised fuel cost recovery factors and associated tariffs should become effective with the in-service date of the Port Everglades Energy Center, which is expected to be April 1, 2016. The recommended fuel cost recovery factors are presented in Attachment A, and the associated tariff sheets are shown in Attachment C. (Barrett, Lester, Draper, Guffey)

Staff Analysis:

FPLís currently authorized 2016 fuel factors were set by the Commission following the November 2, 2015 fuel hearing, and codified in Order No. PSC-15-0586-FOF-EI.[4] These factors are based on FPLís projected fuel costs for 2016, plus the true-up amount from 2015.

FPL states that its original projected cost for natural gas used the New York Mercantile Exchange (NYMEX)[5] futures contract prices for each month of 2016, based on a forward curve as of July 27, 2015. Forward curve prices represent the price of gas for delivery in a particular month in the future. Futures contracts are actively traded and the prices can change hour-by-hour throughout a trading day.

In its Petition, FPL noted that projected natural gas commodity prices have declined substantially since its original projections were developed. For its mid-course calculations, FPL used NYMEX futures contract prices based on a forward curve as of January 4, 2016. According to FPL, the decrease in 2016 projected gas prices from the original projections to the mid-course projections is about 21 percent.[6]

In addition, FPL updated its 2015 true-up amount to reflect twelve months of actual data (January through December 2015). Originally, the actual/estimated true-up was an under-recovery of $66,818,243. FPLís mid-course filing shows the actual under-recovery for 2015 was $37,050,993 or a $29,767,250 reduction in the 2015 under-recovery amount. FPL projects that the current fuel factors for 2016 will produce an over-recovery of approximately $256 million, resulting in a net over-recovery of about $286 million, or 9.66 percent (rounded to 9.7 percent in the FPL Petition). FPL acknowledges that its projected over-recovery percentage of 9.66 percent is less than the threshold identified for notification under Rule 25-6.0424, F.A.C., but states that Section 2 of Rule 25-6.0424, F.A.C., does not preclude it from making a mid-course filing.

In its Petition and on Schedule E1-B, FPL projected its end of year net true up for 2016 would be an over-recovery of $285,525,014, based on revised estimated figures for January through December 2016. Additionally, FPL projects that Jurisdictional Fuel Revenues Applicable for this Period will be $2,956,151,664. Based on Rule 25-6.0424, F.A.C., the mid-course percentage is the estimated end-of-period total net true-up amount ($285,525,014) divided by the current periodís total actual and estimated jurisdictional fuel revenue applicable to period amount ($2,956,151,664), resulting in the mid-course calculation of 9.66 percent.

For 2016, FPL projects its generation mix will be approximately 71 percent natural gas. Therefore, a decrease in the projected cost of gas for FPL can significantly decrease its fuel factors.

FPLís current 1,000 kilowatt hour (kWh) residential bill is $93.38 per month with a fuel cost recovery component of $25.80 per month. In the March billing cycle, FPL will be implementing a $0.32 per month true up adjustment to the Storm Restoration Surcharge, and in Aprilís billing cycle, FPL plans to implement the fuel factor adjustments the Commission approved for the Port Everglades Energy Center Generation Base Rate Adjustment (GBRA) approved in Order No. PSC-15-0586-FOF-EI. In its Petition, FPL requests that its proposed mid-course correction to fuel factors be implemented concurrent with the GBRA adjustments in the April billing cycle. Assuming the Storm Restoration Surcharge adjustment (in March), the GBRA adjustments (in April), and the revised fuel cost recovery factors proposed in its mid-course correction (proposed to coincide with the GBRA adjustments), the total residential bill for 1,000 kWh of usage for April through December 2016 will be $91.73 per month, with a fuel cost recovery component of $21.73 per month. Upon approval, the total of all adjustments results in a net reduction of $1.65 per month for residential customers using 1,000 kWh of electricity, as shown in Attachment B. FPL believes implementing reduced fuel cost recovery factors is in the best interests of its customers since the factors would be decreasing, not increasing, and customers would get the benefit of reduced rates as quickly as administratively possible.

At an informal meeting between staff and interested parties, FPL stated that it intends to provide notice to customers in advance of the Commissionís vote regarding its mid-course correction request through bill inserts, and also via website links.[7]

Conclusion

Staff recommends the Commission approve FPLís Petition for mid-course correction to its 2016 fuel cost recovery factors and the associated tariff sheets. The revised fuel cost recovery factors and associated tariffs should become effective with the in-service date of the Port Everglades Energy Center, which is expected to be April 1, 2016. The recommended fuel cost recovery factors are presented in Attachment A, and the associated tariff sheets are shown in Attachment C.

Issue 2:

Should the Commission approve DEFís petition for a mid-course revision to its 2016 fuel and capacity cost recovery factors and †the associated tariff sheet?

Recommendation:

Yes. Staff recommends the Commission approve DEFís Petition for mid-course correction to its 2016 fuel and capacity cost recovery factors and the associated tariff sheet. The revised fuel and capacity cost recovery factors should become effective with the first billing cycle in April 2016. The recommended fuel and capacity cost recovery factors are presented in Attachment D, and the associated tariff sheet is shown in Attachment F. (Barrett, Lester, Draper, Guffey)

Staff Analysis:

There are two specific requests in DEFís Petition. First, DEF seeks a mid-course adjustment to its 2016 fuel cost recovery factors which were set by the Commission following the November 2, 2015 fuel hearing and codified in the 2015 Fuel Order. These factors are based on DEFís projected fuel costs for 2016, plus the true-up amount from 2015. Second, DEF seeks to adjust the capacity cost recovery factors for 2016, which were also set following the November 2, 2015 fuel hearing, and codified in the 2015 Fuel Order.

Midcourse Adjustment for Fuel Cost Recovery Factors

DEF states that its original projected cost for natural gas used NYMEX futures contract prices for each month of 2016, based on a forward curve as of June 11, 2015. Forward curve prices represent the price of gas for delivery in a particular month in the future. Futures contracts are actively traded and the prices can change hour-by-hour throughout a trading day.

In its Petition, DEF noted that projected natural gas commodity prices have declined substantially since its original projections were developed. For its mid-course calculations, DEF †used NYMEX futures contract prices based on a forward curve as of January 6, 2016. According to DEF, the decrease in 2016 projected natural gas prices from the original projections to the mid-course projections is about 30 percent.[8]

In addition to the revised fuel price projections, DEF updated its 2015 true-up amount to reflect twelve months of actual data (January through December 2015). Originally, the actual/estimated true-up was an over-recovery of $78,731,031. DEFís mid-course filing shows the actual over-recovery for 2015 was $116,588,895, a difference of $37,857,864. Based on the updated projections for 2016, DEF anticipates an end of period total true-up over-recovery of $161,726,581, resulting in a total end of period true-up of $199,584,445. †

Based on Rule 25-6.0424, F.A.C., the mid-course percentage is the estimated end-of-period total true-up amount ($199,584,445) divided by the current periodís total actual and estimated jurisdictional fuel revenue applicable to period amount. Schedule E1-B, attached to DEFís Petition, shows that DEFís total actual and estimated jurisdictional fuel revenue applicable to period amount is $1,544,204,763, resulting in the mid-course calculation of 12.93 percent.

For 2016, DEF projects its generation mix will include approximately 74 percent natural gas. Therefore, a decrease in the projected cost of gas for DEF can significantly decrease its fuel factors.

DEFís current 1,000 kilowatt hour (kWh) residential bill is $114.15 per month with a fuel component of $33.53 per month. Assuming that its mid-course correction is approved, the fuel portion of a residential bill for 1,000 kWh of usage for April through December 2016 will be reduced by $6.74 per month, to $26.79 per month. Staff notes that DEFís Petition also requests an adjustment to capacity cost recovery factors due to an error that understated actual costs. On a stand-alone basis, the understated capacity costs would have increased the bill for a residential customer using 1,000 kilowatt hours by $1.05 per month. However, when implemented concurrent with the reduction to fuel cost recovery factors pursuant to the mid-course correction, the net reduction in fuel cost recovery amounts more than offsets the understated capacity costs. Upon approval, the bill for a residential customer using 1,000 kilowatt hours falls to $108.32 per month, a net reduction of $5.83 per month from February bills, as shown in Attachment E.

DEF has requested that the revised fuel factors become effective with the first billing cycle of April 2016. This case is scheduled to be voted on at the March 1, 2016 agenda conference or 30 days before the April 2016 billing cycle begins. DEF has stated that it will provide notice of its mid-course correction request through on-bill notices in the March billing cycle, and inserts for the April cycle.[9]†

Midcourse Adjustment for Capacity Cost Recovery Factors

In its Petition, DEF stated that it discovered an error in the capacity cost recovery amounts that were used in calculating the factors for 2016, which were codified in Order No. PSC-15-0586-FOF-EI.[10] On DEFís revised Schedule E12-A, its projected capacity costs were understated by $29,153,914, when compared to the similar schedule from its projection filing.[11] In addition to revising its capacity cost projections, DEF updated its 2015 true-up amount to reflect twelve months of actual data (January through December 2015). Originally, the actual/estimated true-up was an under-recovery of $38,643,256. DEFís mid-course filing shows the actual under-recovery for 2015 was $35,762,070, a difference of $2,881,186. Based on these updated projections for 2016, the net additional capacity cost DEF seeks recovery for is $26,272,728. When the Revenue Tax Multiplier of 1.00072 is applied, the final adjustment DEF is proposing is $26,291,645, as reflected on Line 41 of Schedule E12-A. †

Staff notes that if the impact of the net changes for these capacity cost recovery amounts were calculated apart from the mid-course correction to fuel cost recovery factors, the result would increase the bill for a residential customer using 1,000 kilowatt hours by $1.05 per month, or 8.45 percent from currently-approved capacity cost recovery amounts. However, in the interest of providing its customers with a more accurate bill and avoiding inaccurate under-recovered amounts, DEF is petitioning for the capacity cost recovery changes to be implemented concurrent with the reduction to fuel cost recovery factors described above. Implementation in this manner more than offsets what would have been a net increase to residential customers using 1,000 kilowatt hours. Attachment E summarizes the bill impact for a residential customer using 1,000 kilowatt hours, showing that on a total basis, the currently-approved amount of $114.15 per month is reduced to $108.32 per month for April through December 2016, a net reduction of $5.83 per month.

†

Conclusion

Staff recommends the Commission approve DEFís Petition for mid-course correction to its 2016 fuel and capacity cost recovery factors and the associated tariff sheet. The revised fuel and capacity cost recovery factors should become effective with the first billing cycle in April 2016. The recommended fuel and capacity cost recovery factors are presented in Attachment D, and the associated tariff sheet is shown in Attachment F.

Issue 3:

Should this docket be closed?

Recommendation:

The fuel docket is on-going and should remain open. (Vilafrate)

Staff Analysis:

The fuel docket is on-going and should remain open.

|

FPLís Proposed Mid-Course Correction Fuel Cost Recovery Factors April 2016 Ė December 2016 |

||||

|

GROUP |

RATE SCHEDULE |

AVERAGE FACTOR |

FUEL RECOVERY LOSS MULTIPLIER |

FUEL RECOVERY FACTOR |

|

A |

RS-1 first 1,000kWh |

2.495 |

1.00267 |

2.173 |

|

RS-1 all additional kWh |

2.495 |

1.00267 |

3.173 |

|

|

A |

GS-1, SL-2, GSCU-1, WIES-1 |

2.495 |

1.00267 |

2.502 |

|

A-1 |

SL-1, OL-1, PL-1 |

2.349 |

1.00267 |

2.355 |

|

B |

GSD-1 |

2.495 |

1.00260 |

2.501 |

|

C |

GSLD-1, CS-1 |

2.495 |

1.00185 |

2.500 |

|

D |

GSLD-2, CS-2, OS-2, MET |

2.495 |

0.99490 |

2.482 |

|

E |

GSLD-3, CS-3 |

2.495 |

0.97228 |

2.426 |

|

A |

GST-1 On-Peak |

3.271 |

1.00267 |

3.280 |

|

Off-Peak |

2.173 |

1.00267 |

2.179 |

|

|

RTR-1 On-Peak |

|

|

0.778 |

|

|

Off-Peak |

(0.323) |

|||

|

B |

GSDT-1, CILC-1(G), HLFT-1 (21-499 kW)† On-Peak |

3.271 |

1.00260 |

3.280 |

|

Off-Peak |

2.173 |

1.00260 |

2.179 |

|

|

C |

GSLDT-1, CST-1, HLFT-2 (500-1,999 kW) On-Peak |

3.271 |

1.00185 |

3.277 |

|

Off-Peak |

2.173 |

1.00185 |

2.177 |

|

|

D |

GSLDT-2, CST-2, HLFT-3 (2,000+ kW) †On-Peak |

3.271 |

0.99545 |

3.256 |

|

Off-Peak |

2.173 |

0.99545 |

2.163 |

|

|

E |

GSLDT-3, CST-3, CILC-1(T), ISST-1(T) †On-Peak |

3.271 |

0.97228 |

3.180 |

|

Off-Peak |

2.173 |

0.97228 |

2.113 |

|

|

F |

CILC-1(D), ISST-1(D) On-Peak |

3.271 |

0.99459 |

3.253 |

|

Off-Peak |

2.173 |

0.99459 |

2.161 |

|

|

FPLís Proposed Mid-Course Correction Seasonal Demand Time of Use Rider (SDTR) Fuel Recovery Factors On-Peak: June 2016 through September 2016 Weekdays 3:00 pm to 6:00 pm Off-Peak: All Other Hours |

||||

|

GROUP |

OTHERWISE APPLICABLE RATE SCHEDULE |

AVERAGE FACTOR |

FUEL RECOVERY LOSS MULTIPLIER |

SDTR FUEL RECOVERY FACTOR |

|

B |

GSD(T)-1 On-Peak |

4.608 |

1.00260 |

4.620 |

|

Off-Peak |

2.218 |

1.00260 |

2.224 |

|

|

C |

GSLD(T)-1 On-Peak |

4.608 |

1.00185 |

4.617 |

|

Off-Peak |

2.218 |

1.00185 |

2.222 |

|

|

D |

GSLD(T)-2 On-Peak |

4.608 |

0.99545 |

4.587 |

|

Off-Peak |

2.218 |

0.99545 |

2.208 |

|

|

FPLís Proposed Mid-Course Correction Comparison of 1,000 kWh Residential Bill |

|||||

|

Component |

February 2016

(Current) |

March 2016

(Stand-alone Storm Charge Adjustment) |

April 2016

(Stand-alone GBRA Adjustment) |

April Ė Dec. 2016 (Storm Charge Adjustment and GBRA Adjustment Combined with Proposed Mid-Course Correction) |

Net Difference from Current |

|

Base Charge |

$54.86 |

$54.86 |

$57.00 |

$57.00 |

$2.14 |

|

Fuel Cost Recovery |

$25.80 |

$25.80 |

$25.19 |

$21.73 |

-$4.07 |

|

Conservation Cost Recovery |

$1.86 |

$1.86 |

$1.86 |

$1.86 |

$0 |

|

Capacity Payment |

$4.54 |

$4.54 |

$4.54 |

$4.54 |

$0 |

|

Nuclear Cost Recovery |

$0.34 |

$0.34 |

$0.34 |

$0.34 |

$0 |

|

Environmental Cost Recovery |

$2.63 |

$2.63 |

$2.63 |

$2.63 |

$0 |

|

Storm Restoration Surcharge |

$1.02 |

$1.34 |

$1.34 |

$1.34 |

$0.32 |

|

Subtotal |

$91.05 |

$91.37 |

$92.90 |

$89.44 |

-$1.61 |

|

Gross Receipts Tax |

$2.33 |

$2.34 |

$2.38 |

$2.29 |

-$0.04 |

|

Totals |

$93.38 |

$93.71 |

$95.28 |

$91.73 |

-$1.65 |

|

DEFís Proposed Mid-Course Correction Fuel and Capacity Cost Recovery Factors April 2016 Ė December 2016 |

||||||

|

Cost Recovery Factors |

||||||

|

Rate Schedule |

Delivery Voltage Level |

Fuel Cost Recovery |

Capacity Cost Recovery |

|||

|

Levelized (c/ kWh) |

On-Peak (c/ kWh) |

Off-Peak (c/ kWh) |

(c/ kWh) |

($/ kW) |

||

|

RS-1, RST-1, RSL-1, RSL-2, RSS-1 |

†Secondary |

|

3.854 |

2.537 |

1.523 |

|

|

< 1,000 |

2.679 |

|

||||

|

> 1,000 |

3.679 |

|||||

|

GS-1, GST-1 |

Secondary |

2.973 |

3.871 |

2.548 |

1.171 |

|

|

Primary |

2.943 |

3.832 |

2.522 |

1.159 |

||

|

Transmission |

2.914 |

3.793 |

2.497 |

1.148 |

||

|

GS-2 |

Secondary |

2.973 |

|

0.836 |

||

|

GSD-1, GSDT-1, SS-1 |

Secondary |

3.008 |

3.916 |

2.578 |

|

4.24 |

|

Primary |

2.978 |

3.877 |

2.552 |

4.20 |

||

|

Transmission |

2.948 |

3.838 |

2.526 |

4.15 |

||

|

CS-1, CST-1, CS-2, CST-2, CS-3, CST-3, SS-3 |

Secondary |

3.008 |

3.916 |

2.578 |

2.49 |

|

|

Primary |

2.978 |

3.877 |

2.552 |

2.47 |

||

|

Transmission |

2.948 |

3.838 |

2.526 |

2.44 |

||

|

IS-1, IST-1, IS-2, IST-2, SS-2 |

Secondary |

3.008 |

3.916 |

2.578 |

3.39 |

|

|

Primary |

2.978 |

3.877 |

2.552 |

3.36 |

||

|

Transmission |

2.948 |

3.838 |

2.526 |

3.33 |

||

|

LS-1 |

Secondary |

2.828 |

|

0.233 |

|

|

|

SS-1, SS-2, SS-3 Monthly |

Secondary |

|

0.412 |

|||

|

Primary |

0.408 |

|||||

|

Transmission |

0.404 |

|||||

|

SS-1, SS-2, SS-3 Daily |

Secondary |

0.196 |

||||

|

Primary |

0.194 |

|||||

|

Transmission |

0.192 |

|||||

†††††††††††

|

DEFís Proposed Mid-Course Correction Comparison of 1,000 kWh Residential Bill |

|||

|

Component |

February 2016 (Current) |

April Ė Dec. 2016[12] |

Difference from Current |

|

Base Charge |

$58.50 |

$58.50 |

$0 |

|

Fuel Cost Recovery |

$33.53 |

$26.79 |

($6.74) |

|

Capacity Cost Recovery |

$12.42 |

$13.47 |

$1.05 |

|

Energy Conservation Cost Recovery |

$3.25 |

$3.25 |

$0 |

|

Environmental Cost Recovery |

$1.84 |

$1.84 |

$0 |

|

Nuclear - CR3 Uprate |

$1.76 |

$1.76 |

$0 |

|

Nuclear - Levy |

$0 |

$0 |

$0 |

|

Subtotal |

$111.30 |

$105.61 |

($5.69) |

|

Gross Receipts Tax |

$2.85 |

$2.71 |

($0.14) |

|

Totals |

$114.15 |

$108.32 |

($5.83) |

[1]Order No. PSC-15-0586-FOF-EI, issued December 23, 2015, in Docket No: 150001-EI, In re: Fuel and Purchased Power Cost Recovery Clause with Generating Performance Incentive Factor.

[2]Gulf Power Co. v. Cresse, 410 So.2d 492 (Fla. 1982); Order No. PSC-96-0907-FOF-EI, issued on July 15, 1996, in Docket No. Docket No. 960001-EI, In re: Fuel and purchased power cost recovery clause and generating performance incentive factor; Order No. 96-0908-FOF-EI, issued July 15, 1996, in Docket No. 960001-EI, In re: Fuel and purchased power cost recovery clause and generating performance incentive factor; Order No. PSC-97-0021-FOF-EI, issued on January 6, 1997, in Docket No. 970001-EI, In re: Fuel and purchased power cost recovery clause and generating performance incentive factor.

[3]Order No. PSC-01-0963-PCO-EI, issued April 18, 2001, in Docket No. 010001-EI, In re: Fuel and purchased power cost recovery clause and generating performance incentive factor, (allowing recovery of increase in fuel factor in order to decrease the carrying costs and therefore the† total amount ratepayers were ultimately required to repay.); Order No. PSC-00-2383-FOF-GU, issued December 12, 2000, in Docket No. 000003-GU, In re: Purchased gas adjustment (PGA) true-up (allowing recovery of an increased gas fuel factor due to drastic increases in natural gas prices in winter of 2000-2001.); Order No. PSC-15-0161-PCO-EI, issued April 30, 2015, in Docket No. 150001-EI, In re: Fuel and Purchased Power Cost Recovery Clause with Generating Performance Incentive Factor. (approving FPLís petition for a mid-course correction, thereby reducing fuel factors with less than 30 days notice).

[4]Order No. PSC-15-0586-FOF-EI, issued December 23, 2015, in Docket No: 150001-EI, In re: Fuel and Purchased Power Cost Recovery Clause with Generating Performance Incentive Factor.

[5]The New York Mercantile Exchange (NYMEX) is a commodities futures exchange widely used by the electric industry for pricing natural gas.

[6]The FPL Petition states that the NYMEX average 2016 price of natural gas based on the July 27, 2015 forward curve was $3.14 per MMBtu. The comparative forward curve as of January 4, 2016 reflects the NYMEX average 2016 price of natural gas had declined to $2.48 per MMBtu, a reduction of $0.66 per MMBtu (21.02 percent).

[7]Staff reviewed drafts of notices FPL will use for residential and business customers.

[8]The Duke Petition included a matrix of Projected Market Price by Fuel Type showing the NYMEX average 2016 price of natural gas based on the June 11, 2015 forward curve was $3.20 per MMBtu. The comparative forward curve as of January 6, 2016 reflects the NYMEX average 2016 price of natural gas had declined to $2.47 per MMBtu, a reduction of $0.73 per MMBtu (29.55 percent).

[9]Staff reviewed drafts of notices DEF will use for residential and business customers.

[10]Order No. PSC-15-0586-FOF-EI, issued December 23, 2015, in Docket No: 150001-EI, In re: Fuel and Purchased Power Cost Recovery Clause with Generating Performance Incentive Factor.

[11]On September 1, 2015, DEF filed projection schedules for 2016, and Line 30 of Schedule E12-A reflects that DEF estimated its Total Capacity Costs for the period January-December, 2016 would be $358,842,970. The similar schedule in DEFís mid-course correction filing revises this amount to $387,996,884, which includes a January 2016 True-up balance adjustment of $14,191,494.†

[12]On Schedule E-10, DEF states that its Proposed Mid-Course Correction amounts do not include the impact of recovering the CR3 regulatory asset through issuance of low-cost bonds. The estimated bill impact for a residential customer using 1,000 kWh of electricity is $2.93 per month, resulting in total estimated bill of $111.32. Staff notes that as of the date of this memorandum, the bonds have not been issued, but are expected to be issued in March or April, 2016.†