Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rules

25-30.425 and 25-30.455, F.A.C.?

Recommendation:

Yes. The Commission should propose the amendment of

Rules 25-30.425 and 25-30.455, F.A.C., as set forth in Attachment A. (Harper, Golden,

Rome)

Staff Analysis:

The purpose of this rulemaking is to update,

clarify, and streamline Commission Rules 25-30.425 and 25-30.455, F.A.C.,

consistent with the Florida Legislature’s 2016 legislation. Staff is

recommending that the Commission propose the amendment of the rules, as set

forth in Attachment A. Below is a more detailed explanation of the rule

amendments staff is recommending.

Rule 25-30.425, F.A.C., Pass Though Rate

Adjustment

Rule 25-30.425, F.A.C., implements

Section 367.081(4)(b), F.S., which allows for water and wastewater utilities

regulated by the Commission to use pass-through provisions to obtain rate

increases or decreases without the requirements for a rate proceeding. Prior to the

2016 legislation, Section 367.081(4)(b), F.S., allowed a utility to use the pass-through provisions to

adjust its rates to reflect changes in the following specified expenses: (a)

purchased water or wastewater service, (b) costs of electric power, (c) ad

valorem taxes, (d) Commission Regulatory Assessment Fees, (e) Department of

Environmental Protection (DEP) fees for the National Pollutant Discharge

Elimination System (NPDES) Program, and (f) water quality or wastewater quality

testing required by DEP.

The 2016 legislation modified subsection 367.081(4)(b),

F.S., to expand the types of specified expenses that are eligible for a pass-through

adjustment to include: (a) fees charged for wastewater biosolids disposal, (b)

costs incurred for a tank inspection required by DEP or a local governmental

authority, (c) treatment plant operator and water distribution system license

fees required by DEP or a local governmental authority, (d) water or wastewater

operating permit fees charged by DEP or a local governmental authority, and (e)

consumptive or water use permit fees charged by a water management district.

Accordingly, staff is

recommending

language to amend sections (2), (3), and (4) of Rule 25-30.425, F.A.C., to

assist applicants by clarifying the documentation that the Commission requires

from utilities to evaluate the utilities’ submissions for recovery of

pass-through costs. Staff is also recommending additional amendments to subsection

25-30.425(2), F.A.C., to clarify how applicants may provide certain

documentation to allow for the filing of concurrent pass-through and price

index applications more efficiently.

In addition, the 2016

legislation allows the Commission to establish by rule additional expense items

that are outside the control of the utility and have been imposed upon the

utility by a federal, state, or local law, rule, order, or notice. Staff did

not receive any requests to add any additional specified expenses at this time.

Staff received comments from OPC requesting better access to the pass-through

petitions and filings, which are currently undocketed and processed

administratively. Staff is reviewing possible options for improving public

access to this information and will address this concern outside of the

rulemaking process.

Staff believes the amendments to Rule 25-30.425, F.A.C.,

are consistent with the 2016 legislation, address the interested persons’ comments, and will

reduce the number of data requests that would be necessary to acquire the

information from the utilities during the pass-through application process,

thereby streamlining the process for both staff and the applicants.

Rule 25-30.455, F.A.C., Staff Assistance in Rate

Cases

Rule 25-30.455, F.A.C.,

implements Section 367.0814(3), F.S., which was amended by the 2016 legislative

session to specify that the Commission may not award rate case

expenses to recover attorney fees or fees of other outside consultants who are

engaged for the purpose of preparing or filing the case if a utility receives

staff assistance in changing rates and charges pursuant to this section, unless

the Office of Public Counsel or interested parties have intervened. The statute

as amended provides that the Commission may award rate case expenses for

attorney fees or fees of other outside consultants if such fees are incurred

for the purpose of providing consulting or legal services to the utility after

the initial staff report is made available to customers and the utility. The

amended statute also provides that if there is a protest or appeal by a party

other than the utility, the Commission may award rate case expenses to the

utility for attorney fees or fees of other outside consultants for costs

incurred after the protest or appeal. Thus, Rule 25-30.455, F.A.C., was

amended to reflect the amendments to Section 367.0814(3), F.S., made in the

2016 legislation.

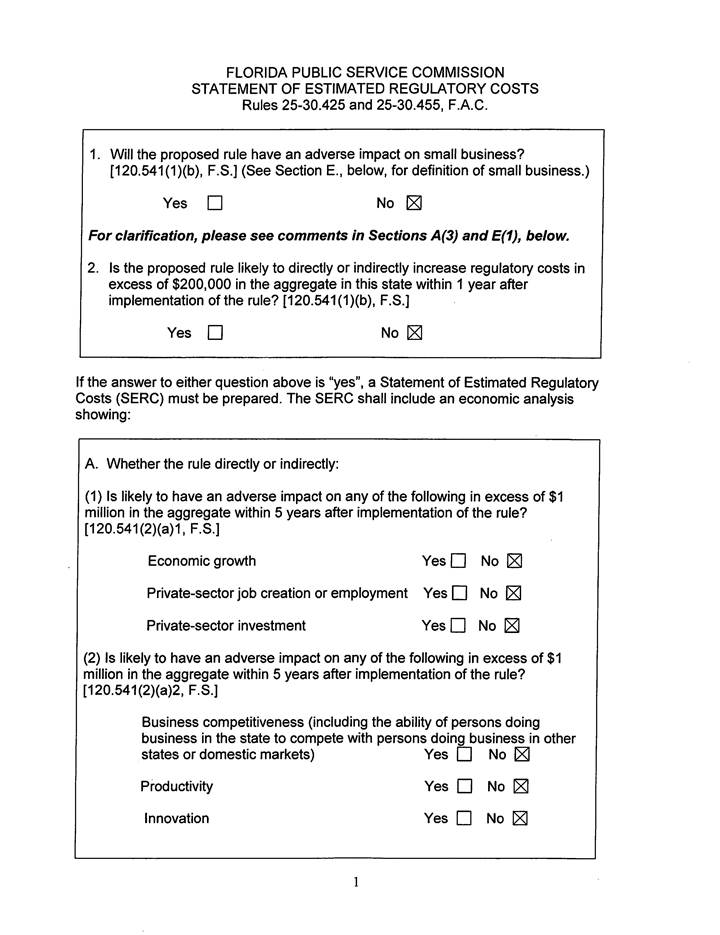

Statement of Estimated Regulatory Costs

Pursuant to Section 120.54, F.S., agencies are encouraged

to prepare a statement of estimated regulatory costs (SERC) before the

adoption, amendment, or repeal of any rule. The SERC is appended as Attachment

B to this recommendation. The SERC analysis also includes whether the rule

amendment is likely to have an adverse impact on growth, private sector job

creation or employment, or private sector investment in excess of $1 million in

the aggregate within five years after implementation.

The SERC concludes that any economic impacts that might be

incurred by affected entities would be a result of statutory changes to

Sections 367.081 and 367.0814, F.S., made by the 2016 legislation and will not

be the result of staff’s recommended amendments to the Commission rules. Staff

believes that the rule amendments will not likely directly or indirectly

increase regulatory costs in excess of $200,000 in the aggregate in Florida

within one year after implementation.

Further, the SERC concludes that the rule amendments will

not likely have an adverse impact on economic growth, private-sector job

creation or employment, private sector investment, business competitiveness,

productivity, or innovation in excess of $1 million in the aggregate within

five years of implementation. Thus, the rule amendments do not require

legislative ratification pursuant to Section 120.541(3), F.S.

In addition, the SERC states that the rule amendments will

not have an adverse impact on small business and will have no impact on small

cities or small counties. No regulatory alternatives were submitted pursuant to

paragraph 120.541(1)(a), F.S. None of the impact/cost criteria established in

paragraph 120.541(2)(a), F.S., will be exceeded as a result of the recommended

revisions.

Conclusion

Based on the

foregoing, staff recommends the amendment of Rules 25-30.425 and 25-30.455,

F.A.C.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no requests for hearing or comments are

filed, the rules may be filed with the Department of State, and this docket

should be closed. (Harper)

Staff Analysis:

If no requests for hearing or comments are filed,

the rules may be filed with the Department of State, and this docket should be

closed.

25-30.425 Pass Through Rate Adjustment.

The verified notice to the Commission

of an adjustment of rates under the provisions of Section 367.081(4)(b), F.S.,

shall be made in the following manner:

(1) This rule applies Prior

to any regulated water or wastewater utility that adjusts its an

adjustment in rates pursuant to Section 367.081(4)(b), F.S., to reflect

because of an increase or decrease in the rates, fees, or costs for

the following specified expenses purchased utility service, the utility

shall file:

(a) A certified copy of the order,

ordinance or other evidence whereby the rates for Water or wastewater

utility service purchased from a are increased or decreased by the

governmental authority agency or other by a water

or wastewater utility regulated by the Commission;, along with

evidence of the utility service rates of that governmental agency or water or

wastewater utility in effect on January 1 of each of the three preceding years.

(b) Purchased electric power; A

statement setting out by month the charges for utility services purchased from

the governmental agency or regulated utility for the most recent 12-month

period.

(c) Ad valorem taxes; 1. A

statement setting out by month the gallons of water or wastewater treatment

purchased from the governmental agency or regulated utility for the most recent

12-month period. If wastewater treatment service is not based on a metered

flow, the number of units by which the service is measured shall be stated.

2. A statement setting out by month

gallons of water and units of wastewater service sold by the utility for the

most recent 12-month period.

(d) National Pollutant Discharge

Elimination System (NPDES) Permit Program fees charged by the Florida

Department of Environmental Protection; A statement setting out by month

the gallons of water or wastewater treatment purchased from any other

government entity or utility company.

(e) Regulatory Assessment Fees imposed

A statement setting out by the Commission; month the gallons

of water pumped or wastewater treated by the utility filing the verified

notice.

(f) If the total Wwater

or wastewater quality testing required by the Department of Environmental

Protection (DEP); available for sale is in excess of 110% of the water

sold, a statement explaining the unaccounted for water.

(g) Wastewater biosolids disposal fees;

(h) Tank inspection required by the DEP

or a local governmental authority;

(i) Treatment plant operator and water

distribution system operator license fees required by the DEP or a local

governmental authority;

(j) Water or wastewater operating

permit fees charged by the DEP or a local governmental authority; or

(k) Consumptive or water use permit

fees charged by a water management district.

(2) Prior to an adjustment in rates pursuant

to Section 367.081(4)(b), F.S., because of an increase or decrease in

the charge for electric power the utility shall file its verified notice

and supporting documents with the Commission’s Division of Accounting

and Finance at least 45 days prior to the effective date of its pass through

rate adjustment, or at least 60 days prior to the effective date of its

combined or simultaneously filed price index and pass through rate adjustments

if the utility requests an exception to the 45 day effective date, as

referenced in paragraph (2)(h), to allow the price index and pass through rate

adjustments to be implemented as one rate adjustment pursuant to Section

367.081(4)(e), F.S. Each verified notice of a pass through rate adjustment

shall include the following supporting documents. If the same information or

supporting document is required for both the price index and pass through rate

adjustments, such as revised tariff sheets, annualized revenue calculations,

return on equity affirmations, and customer notices, the applicant may file a combined

supporting document to be used for both applications:

(a) Revised tariff sheets reflecting

the increased or decreased rates; A certified copy of the order,

ordinance or other evidence which establishes that the rates for electric power

have been increased or decreased by the supplier, along with evidence of the

electric power rates of the supplier in effect on January 1 of each of the

three preceding years.

(b) A schedule showing, by month,

the calculation of charges for electric power and consumption for

the proposed rates, including most recent 12 month period, the following

information. If the pass through rate adjustment is combined with a price index

rate adjustment, a combined schedule that shows the calculation of both the

price index and pass through rate adjustments may be provided: charges

that would have resulted had the new electric rates been applied, and

the difference between the charges under the old rates and the charges under

the new rates.

1. The calculation of the recurring

annual or amortized annual amount of the new expense or incremental change

calculated as referenced in subsection (3);

2. The utility’s actual annual revenue

or calculation of the annualized revenue for the most recent 12-month period,

or 12-month test year if combined or simultaneously filed with a price index

application. If there were any Commission-approved changes to the utility’s

rates during the 12-month period or test year, the revenue should be annualized

to reflect the revenue that would have resulted if the rate change had been in

effect the entire 12 months. The annualized revenue calculation should reflect

the annual number of bills broken down by customer class and meter size, and

the annual gallons of water or wastewater service sold broken down by customer

class. Annualized revenues should be calculated separately if the utility

provides both water and wastewater service;

3. If the pass through of an increase

or decrease in purchased water or wastewater utility service, purchased power, or

wastewater biosolids disposal is applied only to the gallonage charge in the

rate adjustment calculation, provide a schedule showing the gallons of water or

wastewater service sold during each month of the most recent 12-month period or

test year, broken down by customer class and meter size, if not shown in the

revenue calculation previously provided in subparagraph (2)(b)2. above; and

4. The calculation of the proposed

rates that shows the current rates, dollar amount of the pass through increase

or decrease, and proposed adjusted rates. The percentage increase or decrease

resulting from the pass through adjustment for any specified expense may be

applied to all rates equally or allocated between the base facility charge and

gallonage charge based on the following guidelines:

i. The percentage increase or decrease

in purchased water or wastewater utility service, purchased power, or

wastewater biosolids disposal may be applied solely to the gallonage charge;

ii. The percentage increase or decrease

in ad valorem taxes may be applied solely to the base facility charge;

iii. The percentage increase or

decrease in any specified expense that was adjusted using a specific allocation

methodology in the utility’s last rate proceeding or in a prior pass through

adjustment may be applied using that same methodology; and

iv. The percentage increase or decrease

in any specified expense that reflects a single assessment to the water and

wastewater systems combined may be allocated between the water and wastewater rates

based on the equivalent residential connection ratio of water and wastewater

customers;

(c) A copy of statement

outlining the current invoice, proof of payment, or other documentation

that demonstrates that measures taken by the specified expense has

been adjusted or is a new requirement.

If the specified expense is an existing expense that was not previously

included in the utility’s rates, also provide a statement confirming that the

specified expense has never been included in the utility’s rates; utility

to conserve electricity.

(d) A copy of the invoice(s) or other

documentation that supports the utility’s calculation of the recurring annual

or amortized annual increase or decrease in the specified expense referenced in

subparagraph (2)(b)1., as follows:

1. For a frequently recurring specified

expense, such as purchased power, provide a copy of all invoices received for

the most recent 12-month period or test year;

2. For a specified expense that occurs

on an annual basis, such as ad valorem taxes, provide a copy of the invoice

received for the prior year;

3. For a specified expense that occurs

less than annually, such as NPDES permit program fees, provide a copy of the

invoice received the last time the expense occurred; or

4. For the pass through of an

incremental increase or decrease in regulatory assessment fees that were

previously included in the utility’s rates by another governmental entity prior

to the Commission’s regulation of the utility, provide documentation that shows

the percentage or amount of regulatory assessment fees that were previously

included in the utility’s rates, such as a copy of an order, ordinance, rate

calculation, or other available information that can be used to determine and

verify the percentage of regulatory assessment fees that were previously

included in the utility’s rates.

(e) The utility’s DEP Public Water

System identification number and Wastewater Treatment Plant Operating Permit

number;

(f) The affirmation required by Section

367.081(4)(c), F.S., including the rate of return on equity that the utility is

affirming it will not exceed with this rate adjustment;

(g) A copy of the notice to customers

required by subsection (6); and,

(h) If applicable, a statement that the

utility requests an exception to the 45 day effective date provided by Section

367.081(4)(b), F.S., to allow combined or simultaneously filed price index and

pass through rate adjustments to be implemented together as one rate adjustment

pursuant to Section 367.081(4)(e), F.S., with an effective date 60 days after

the official filing date of the utility’s notice of intention to increase rates

through a price index rate adjustment filed pursuant to Section 367.081(4)(a)

and Rule 25-30.420(2), F.A.C.

(3) The recurring annual or amortized

annual amount Prior to an adjustment in rates because of an

increase or decrease in ad valorem taxes the new expense or incremental

change utility shall be calculated as follows file with

the Commission:

(a) The change in aA frequently

recurring specified expense, such as purchased power, copy of the ad

valorem tax bills which increased or decreased shall be calculated as an

annual and copies of the previous three years’ bills; if copies have

been submitted previously, a schedule showing the tax total, broken down

by month for the most recent 12-month period or for the 12-month test year if

combined or simultaneously filed with a price index rate adjustment. The

calculation shall reflect the following information: only is acceptable;

and

1. All charges or fees included in the

total specified expense, such as the purchased water or wastewater base

facility charge, gallonage charge, any applicable billing or service fees, and

taxes, even if some of the rates or fees did not change;

2. The actual or annualized charges for

the specified expense. If the rates or charges for the specified expense

changed during the 12-month period or test year, the actual charges should be

annualized to reflect the charges that would have resulted if the prior rates

or charges had been in effect the entire 12 months;

3. The annualized charges that would

have resulted if the new rates had been in effect the entire 12 months;

4. The difference between the charges

at the prior and new rates; and

5. If the utility’s most recent rate

proceeding included adjustments for excessive unaccounted for water (EUW) or

excessive inflow and infiltration (I&I), the calculation of an increase or

decrease in purchased water or wastewater utility service or purchased electric

power shall also include the same percentage EUW or I&I adjustments. If the

utility has taken steps to reduce EUW or I&I since its most recent rate

proceeding, the utility may, but is not required to, provide additional

information to demonstrate that the EUW or I&I percentages have been

reduced. Any proposed revision to the EUW or I&I percentages should be

calculated as referenced in subsection (4);

(b) The change in aA specified

expense calculation of the amount of the ad valorem taxes related to

that occurs on an annual basis, such as ad valorem taxes, shall be

calculated as an annual total based on a comparison of the prior expense and

new expense. If applicable, the calculation of the increase or decrease portion

of the water or wastewater plant not used and useful in ad valorem taxes

shall only include the following additional adjustments: in providing

utility service.

1. If any ad valorem tax bills reflect

a single assessment for combined water and wastewater property, the calculation

shall also include the utility’s calculation of the equivalent residential

connection ratio of water and wastewater customers used to allocate the

combined tax assessment between the utility’s water and wastewater rates; and

2. If the utility’s last rate proceeding

included adjustments for non-used and useful plant, the calculation shall also

include an adjustment to remove the portion of the ad valorem taxes related to

the water or wastewater plant that is not used and useful in providing utility

service;

(c) The change in a specified expense

that occurs less than annually, such as NPDES permit program fees, shall be

calculated as an annual amortized amount based on a comparison of the prior and

new expense. The expense shall be amortized as a non-recurring expense in

accordance with Rule 25-30.433(8), F.A.C., and the calculation shall include an

explanation if the expense that is amortized for a period other than five

years.

(4) Prior to an adjustment in rates

because of an increase or decrease in Tthe pass through

costs of changes water quality or wastewater quality testing

required by the Department of Environmental Protection (DEP), or because of an

increase or decrease in purchased water or wastewater utility service or

purchased electric power shall be adjusted for EUW or I&I consistent with

adjustments approved by the fees charged by DEP in connection with the

National Pollutant Discharge Elimination System Program, the utility shall file

with the Commission in the utility’s most recent rate proceeding, if

applicable. If the utility has taken steps to reduce the EUW and I&I

percentages since its most recent rate proceeding, the utility may, but is not

required, to provide the following information to demonstrate that the EUW and

I&I percentages have been reduced and that the previously approved EUW and

I&I percentages should either be reduced or eliminated from the pass

through rate adjustment calculation:

(a) A description copy of any

steps taken by the utility to reduce the EUW or I&I since the

utility’s last rate proceeding invoice for testing; and,

(b) A schedule showing the updated cCalculation

of EUW or I&I broken down by month for the most recent 12-month

period or test year including: amortized amount.

1. The gallons of water or wastewater

treatment purchased from the governmental authority or regulated utility that

has increased or decreased its rates. If wastewater treatment service is not

based on a metered flow, describe how the wastewater flows are determined and include the number of units by which the service is

measured;

2. If the utility purchases water or

wastewater service from more than one governmental authority or regulated

utility, include the gallons of water or

wastewater treatment purchased from any other governmental authority or

regulated utility not reflected in subparagraph (4)(b)1. above. If wastewater

treatment service is not based on a metered flow, describe how the wastewater

flows are determined and include the number of

units by which the service is measured;

3. The gallons of water pumped or

wastewater treated by the utility, if applicable;

4. The gallons of water or wastewater

service sold by the utility;

5. The total unaccounted for water or

inflow and infiltration; and

6. A statement explaining the EUW or

I&I if the total water available for sale or total wastewater treatment

purchased is still in excess of 110 percent of the water or wastewater service

sold.

(5) The amount administratively

approved for a pass through rate adjustment In addition to subsections

(1), (2), (3) and (4) above, the utility shall not exceed the actual

cost incurred. Foregone pass through decreases shall not be used to adjust a

pass through increase below the actual cost incurred. also file:

(a) A schedule of proposed rates which

will pass the increased or decreased costs on to the customers in a fair and

nondiscriminatory manner and on the basis of current customers, and a

calculation showing how the rates were determined;

(b) A statement, by class of customer

and meter size, setting out by month the gallons of water and units of

wastewater service sold by the utility for the most recent 12 month period.

This statement shall not be required in filings for the pass-through of

increased regulatory assessment fees or ad valorem taxes;

(c) The affirmation reflecting the

authorized rate of return on equity required by Section 367.081(4)(c), F.S.;

(d) A copy of the notice to customers

required by subsection (7) of this rule;

(e) Revised tariff sheets reflecting

the increased rates;

(f) The rate of return on equity that

the utility is affirming it will not exceed pursuant to Section 367.081(4)(c),

F.S.; and

(g) The utility’s DEP Public Water

System identification number and Wastewater Treatment Plant Operating Permit

number;

(6) The utility shall provide each

customer with written notice of the administratively approved rate adjustment,

including the effective date and an explanation of the reasons for the increase

or decrease, prior to the time each customer will begin consumption at the

adjusted rates. If the pass through rate adjustment is combined or

simultaneously filed with a price index rate adjustment, the utility may

provide the information for both rate adjustments in a combined customer notice

amount authorized for pass through rate adjustments shall not exceed the

actual cost incurred and shall not exceed the incremental increase or decrease

for the 12-month period. Foregone pass through decreases shall not be used to

adjust a pass through increase below the actual cost incurred.

(7) In order for the Commission to

determine whether a utility which had adjusted its rates pursuant to Section

367.081(4)(b), F.S., has thereby exceeded the range of its last authorized rate

of return, the Commission may require a utility to file the information

required in Rule 25-30.437, F.A.C., for the test year specified.

(8) Prior to the time a customer begins

consumption at the adjusted rates, the utility shall notify each customer of

the increase authorized and explain the reasons for the increase.

(9) The utility shall file an original

and five copies of the verified notice and supporting documents with the

Commission Clerk. The rates shall become effective 45 days after the official

date of filing. The official date of filing for the verified notice to the

Commission of adjustment in rates shall be at least 45 days before the new

rates are implemented.

Rulemaking Authority 350.127(2), 367.081, 367.121(1)(c),

(f) FS. Law Implemented 367.081(4), 367.121(1)(c), (g) FS. History–New 6-10-75,

Amended 4-5-79, 4-5-81, 10-21-82, Formerly 25-10.179, Amended 11-10-86, 6-5-91,

4-18-99, __________.

25-30.455

Staff Assistance in Rate Cases.

(1)

Water and wastewater utilities whose total gross annual operating revenues are

$275,000 or less for water service or $275,000 or less for wastewater service,

or $550,000 or less on a combined basis, may petition the Commission for staff

assistance in rate applications by submitting a completed staff assisted rate

case application. If a utility that chooses to utilize the staff assistance

option employs outside experts to assist in developing information for staff or

to assist in evaluating staff’s schedules and conclusions, the Rreasonable

and prudent rate case expense shall will be eligible

for recovery recoverable through the rates developed by staff. Recovery

of attorney fees and outside consultant fees related to the rate case shall be

determined based on the requirements set forth in Section 367.0814(3), F.S.

A utility that chooses not to exercise the option of staff assistance may file

for a rate increase under the provisions of Rule 25-30.443, F.A.C.

(2)

The appropriate application form, Commission Form PSC/AFD 2-W (11/86) (Rev.

06/14), entitled “Application for a Staff Assisted Rate Case,” is incorporated

into this rule by reference and is available at: http://www.flrules.org/Gateway/reference.asp?No=Ref-04415.

The form may also be obtained from the Commission’s Division of Accounting and

Finance, 2540 Shumard Oak Boulevard, Tallahassee, Florida 32399-0850.

(3)

Upon completion of the form, the applicant shall file it with the Office of

Commission Clerk, Florida Public Service Commission, 2540 Shumard Oak

Boulevard, Tallahassee, Florida 32399-0870.

(4)

Within 30 days of receipt of the completed application, the Committee will

evaluate the application and determine the applicant’s eligibility for staff

assistance.

(a)

If the Commission has received four or more applications in the previous 30

days; or, if the Commission has 20 or more docketed staff assisted rate cases

in active status on the date the application is received, the Commission will

deny initial evaluation of an application for staff assistance and close the

docket. When an application is denied under the provisions of this paragraph,

the Commission will notify the applicant of the date on which the application

may be resubmitted.

(b)

Initially, determinations of eligibility will be conditional, pending an

examination of the condition of the applicant’s books and records.

(5)

Upon making its final determination of eligibility, the Commission will notify

the applicant in writing as to whether the application is officially accepted

or denied. If the application is accepted, a staff assisted rate case will be

initiated. If the application is denied, the notification of application denial

will state the deficiencies in the application with reference to the criteria

set out in subsection (7) of this rule.

(6)

The official date of filing will be 30 days after the date of the written

notification to the applicant of the Commission’s official acceptance of the

application.

(7)

In determining whether to grant or deny the application, the Commission will

consider the following criteria:

(a)

Whether the applicant qualifies for staff assistance pursuant to subsection (1)

of this rule;

(b)

Whether the applicant’s books and records are organized consistent with Rule

25-30.110, F.A.C., so as to allow Commission personnel to verify costs and

other relevant factors within the 30-day time frame set out in this rule;

(c)

Whether the applicant has filed annual reports;

(d)

Whether the applicant has paid applicable regulatory assessment fees;

(e)

Whether the applicant has at least one year of experience in utility operation;

(f)

Whether the applicant has filed additional relevant information in support of

eligibility, together with reasons why the information should be considered;

and

(g)

Whether the utility was granted a rate case increase within the 2-year period

prior to the receipt of the application under review.

(8)

The Commission will deny the application if the utility does not remit the

filing fee, as provided by paragraph 25-30.020(2)(f), F.A.C., within 30 days

after official acceptance.

(9)

An aggrieved applicant may request reconsideration of the application denial,

which will be decided by the full Commission.

(10)

A substantially affected person may file a petition to protest the Commission’s

proposed agency action in a staff assisted rate case within 21 days of issuance

of the Notice of Proposed Agency Action Order, as set forth in Rule 28-106.111,

F.A.C.

(11)

A petition to protest the Commission’s proposed agency action shall conform to

Rule 28-106.201, F.A.C.

(12)

In the event of a protest of the Commission’s Notice of Proposed Agency Action

Order in a staff assisted rate case, the utility shall:

(a)

Provide prefiled direct testimony in accordance with the Order Establishing

Procedure issued in the case. At a minimum, that testimony shall adopt the

Commission’s Proposed Agency Action Order;

(b)

Sponsor a witness to support source documentation provided to the Commission

staff in its preparation of the staff audit, the staff engineering and

accounting report and the staff proposed agency action recommendation in the

case;

(c)

Include in its testimony the necessary factual information to support its

position on any issue that it chooses to take a position different than that

contained in the Commission’s Proposed Agency Action Order; and

(d)

Meet all other requirements of the Order Establishing Procedure.

(13)

Failure to comply with the dates established in the Order Establishing

Procedure, or to timely file a request for extension of time for good cause

shown, may result in dismissal of the staff assisted rate case and closure of

the docket.

(14)

In the event of a protest of the Commission’s Proposed Agency Action Order in a

staff assisted rate case, the Commission staff shall:

(a)

File prefiled direct testimony to explain its analysis in the staff proposed

agency action recommendation. In the event the staff wishes to alter its

position on any issue, it shall provide factual testimony to support its changed

position;

(b)

Meet all other requirements of the Order Establishing Procedure; and

(c)

Provide to the utility materials to assist the utility in the preparation of

its testimony and exhibits. This material shall consist of an example of

testimony filed by a utility in another case, an example of testimony that

would support the Proposed Agency Action Order in this case, an example of an

exhibit filed in another case, and examples of prehearing statements and briefs

filed in other cases.

Rulemaking

Authority 350.127(2), 367.0814, 367.121 FS. Law Implemented 367.0814 FS.

History–New 12-8-80, Formerly 25-10.180, Amended 11-10-86, 8-26-91, 11-30-93,

1-31-00, 12-16-08, 8-10-14, ______________.