Discussion

of Issues

Issue 1:

Should the Commission authorize FPL to implement a

2017 Interim Storm Restoration Recovery Charge?

Recommendation:

Yes. The Commission should authorize FPL to

implement a 2017 Interim Storm Restoration Recovery Charge, subject to refund. Once

the total actual storm costs are known, FPL should be required to file

documentation of the storm costs for Commission review and true up of any

excess or shortfall. (Slemkewicz)

Staff Analysis:

As stated in the case background, FPL filed a

petition for a limited proceeding seeking authority to implement an interim

storm restoration recovery charge to recover a total of $318.5 million for the

incremental restoration costs related to Hurricane Matthew and to replenish its

storm reserve. The requested recovery of $318.5 million

represents net retail recoverable costs of approximately $200.7 million, plus

an additional $117.1 million to replenish the storm reserve to the balance that

existed on January 2, 2013. In addition, the $318.5 million includes interest

of $0.4 million and regulatory assessment fee expense of $0.2 million. The

petition was filed pursuant to the provisions of the RSSA approved by the

Commission in Order No. PSC-13-0023-S-EI.

Pursuant to Paragraph 5 of the RSSA, FPL can begin to recover storm costs, not

exceeding $4.00/1,000 kWh on monthly residential customer bills, on an interim

basis beginning sixty days following the filing of a petition for recovery. FPL

has requested an interim storm restoration recovery charge of $3.36 on a

monthly 1,000 kWh residential bill, effective for a 12-month period beginning

March 1, 2017.

In its petition, FPL asserts that it incurred total retail

recoverable costs of approximately $293.8 million as a result of Hurricane

Matthew. This amount was calculated in accordance with the Incremental Cost and

Capitalization Approach (ICCA) methodology prescribed in Rule 25-6.0143,

Florida Administrative Code (F.A.C.). The net retail recoverable costs of

$200.1 million were determined by reducing the $293.8 million total costs by

the pre-storm storm reserve balance of $93.1 million. Paragraph 5 of the RSSA

also allows FPL to request the replenishment of its storm reserve to the $117.1

million balance that existed on January 2, 2013, the implementation date of the

RSSA.

The approval of an interim storm restoration recovery

charge is preliminary in nature and is subject to refund pending a further

review once the total actual storm restoration costs are known. After the

actual costs are reviewed for prudence and reasonableness, and are compared to

the actual amount recovered through the interim storm restoration recovery

charge, a determination will be made whether any over/under recovery has

occurred. The disposition of any over/under recovery, and associated interest, would

be considered by the Commission at a later date.

Based on a review of the information provided by FPL in

its petition, staff recommends that the Commission authorize FPL to implement a

2017 Interim Storm Restoration Recovery Charge, subject to refund. Once the

total actual storm costs are known, FPL should be required to file

documentation of the storm costs for Commission review and true up of any

excess or shortfall.

Issue 2:

Should the Commission approve FPL's request to

establish a regulatory asset for the debit balance in Account 228.1,

Accumulated Provision for Property Insurance?

Recommendation:

No. The Commission should not approve FPL's request

to establish a regulatory asset for the debit balance in Account 228.1,

Accumulated Provision for Property Insurance? (Slemkewicz)

Staff Analysis:

In its petition, FPL asserts that it has maintained

the amount of eligible restoration costs that exceed the pre-storm balance of

the storm reserve as a debit in Account 228.1 as required by Rule

25-6.0143(1)(i), F.A.C. However, FPL has requested approval to establish a

regulatory asset to be recorded in Account 182.1, Extraordinary Property

Losses, and transfer the debit balance in Account 228.1 to Account 182.1,

effective March 1, 2017. FPL contends that this treatment would be consistent

with the storm cost recovery for the 2004 storm season approved by the

Commission in Order No. PSC-05-0937-FOF-EI.

When Order No. PSC-05-0937-FOF-EI was issued in 2005, Rule

25-6.0143, F.A.C., stated the following concerning Account 228.1:

(1) Account No. 228.1 Accumulated Provision for

Property Insurance.

(a) This account may be established to provide for

losses through accident, fire, flood, storms, nuclear accidents and similar

type hazards to the utility’s own property or property leased from others,

which is not covered by insurance. This account would also include provisions

for the deductible amounts contained in property loss insurance policies held

by the utility as well as retrospective premium assessments stemming from

nuclear accidents under various insurance programs covering nuclear generating

plants. A schedule of risks covered shall be maintained, giving a description

of the property involved, the character of risks covered and the accrual rates

used.

(b) Charges to this account shall be made for all

occurrences in accordance with the schedule of risks to be covered which are

not covered by insurance. Recoveries or reimbursements for losses charged to

this account shall be credited to the account.

Because the rule at that time did not specifically address

the treatment of debit balances in Account 228.1, it was necessary to establish

a regulatory asset to allow the deferral and subsequent amortization of the

storm reserve debit balance in Account 228.1.

In 2007, however, Rule 25-6.0143, F.A.C., was expanded

regarding Account 228.1. The extensive rule revisions included the

establishment of the ICCA methodology for determining the types of costs

eligible to be charged to the reserve. Rule 25-6.0143(1)(i), F.A.C., was also

established and states that:

If the charges to Account No. 228.1 exceed the account

balance, the excess shall be carried as a debit balance in Account No. 228.1

and no request for a deferral of the excess or for the establishment of a

regulatory asset is necessary.

The rule was specifically amended so that any debit

balance in Account 228.1 was automatically deferred for accounting purposes.

Therefore, a request for a deferral or the establishment of a regulatory asset was

no longer required or necessary.

Based on the specific provision in Rule 25-6.0143, F.A.C.,

regarding debit balances in Account 228.1, staff recommends that FPL’s request

to establish a regulatory asset for the debit balance in Account 228.1 be

denied.

Issue 3:

Should the Commission approve FPL’s proposed

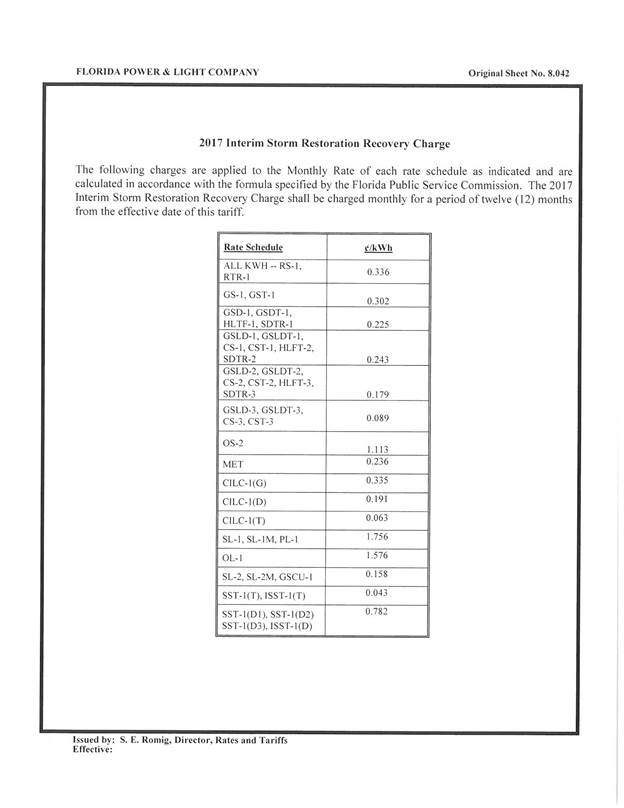

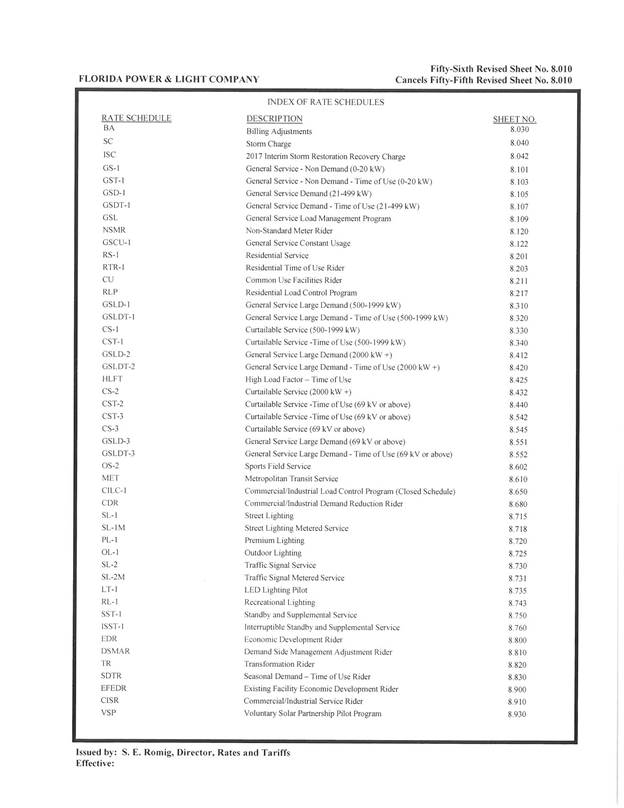

Original Tariff Sheet No. 8.042 and Fifty-Sixth Revised Tariff Sheet No. 8.010

with an effective date of March 1, 2017?

Recommendation:

Yes, the Commission should approve FPL’s proposed

Original Tariff Sheet No. 8.042 and Fifty-Sixth Revised Tariff Sheet No. 8.010

as shown in Attachment A with an effective date of March 1, 2017. (Rome,

Draper)

Staff Analysis:

FPL proposed to commence the 12-month recovery period

for its interim storm restoration recovery charge on March 1, 2017 and to

include the charge in the non-fuel energy charge on customer bills. In support

of its proposed rate calculations, FPL provided Appendices C and D to the

petition.

Appendix C illustrated the computation of the proposed

interim storm restoration recovery charges for each rate class. FPL represented

that it followed the methodology for allocation of storm costs among rate

classes consistent with the method set forth in FPL’s storm financing order.

Specifically, FPL developed its proposed charges by rate class using the

following steps:

(1) Multiplying

the percent allocation of plant share by rate class as shown in the Cost of

Service MFR Schedule E-3a approved in Docket No. 120015-EI by

the percentage share of plant assets projected to be damaged,

(2) Multiplying

the allocation factors for each rate class as determined in Step (1) above by

the total amount of storm losses associated with Hurricane Matthew

($318,456,000), and

(3) Dividing

the results obtained in Step (2) above for each rate class by the projected

sales for each rate class during the 12-month recovery period to arrive at the

charges by rate class.

Staff replicated FPL’s calculations and believes the

allocation methodology to be reasonable. Most of the storm-related costs are

weighted to reflect damage to distribution and transmission assets (71 percent

and 20 percent, respectively) with a lesser proportion related to generation

and other plant assets.

Application of the allocation methodology for the

residential customer rate class results in a proposed interim storm restoration

recovery charge of 0.336 cents per kWh, which equates to $3.36 on a 1,000 kWh

residential bill. The proposed interim charges for all rate classes are

presented on Original Tariff Sheet No. 8.042 included in Appendix D to FPL’s

petition. Appendix D also includes Fifty-Sixth Revised Tariff Sheet No. 8.010

which reflects the appropriate addition of Sheet No. 8.042 to FPL’s Index of

Rate Schedules. Both tariff sheets are included in Attachment A.

Based on its review of the information provided by FPL,

staff recommends that the Commission approve FPL’s proposed Original Tariff

Sheet No. 8.042 and Fifty-Sixth Revised Tariff Sheet No. 8.010 as shown in

Attachment A with an effective date of March 1, 2017.

Issue 4:

What is the appropriate security to guarantee the

amount collected subject to refund through the 2017 Interim Storm Restoration

Recovery Charge?

Recommendation:

The appropriate security to guarantee the funds

collected subject to refund is a corporate undertaking. (Archer, D. Buys)

Staff Analysis:

Staff recommends that all funds collected subject to

refund be secured by a corporate undertaking. The criteria for a corporate

undertaking include sufficient liquidity, ownership equity, profitability, and

interest coverage to guarantee any potential refund. Staff reviewed the

financial statements to determine if FPL can support a corporate undertaking

for recovery of incremental storm restoration costs related to Hurricane

Matthew. FPL’s 2015, 2014 and 2013 financial statements were used to determine

the financial condition of the Company. FPL’s financial performance

demonstrates adequate levels of liquidity, ownership equity, profitability, and

interest coverage to guarantee the potential refund.

Staff believes FPL has adequate resources to support a

corporate undertaking in the amount requested. Based on this analysis, staff

recommends that a corporate undertaking of $318.5 million is acceptable. This

brief financial analysis is only appropriate for deciding if the Company can

support a corporate undertaking in the amount proposed and should not be

considered a finding regarding staff's position on other issues in this

proceeding.

Issue 5:

Should this docket be closed?

Recommendation:

No, this docket should remain open pending final

reconciliation of actual recoverable Hurricane Matthew storm costs with the

amount collected pursuant to the 2017 Interim Storm Restoration Recovery

Charge, and the calculation of a refund or additional charge if warranted. (Brownless)

Staff Analysis:

No, this docket should remain open pending final

reconciliation of actual recoverable Hurricane Matthew storm costs with the

amount collected pursuant to the 2017 Interim Storm Restoration Recovery

Charge, and the calculation of a refund or additional charge if warranted.