Case Background

On March 8, 2017,

the Florida Division of Chesapeake Utilities Corporation (Chesapeake or

Company) filed a petition to amend the 2017 gas reliability infrastructure

program (GRIP) factor for commercial customers in rate class FTS-9 and to allow

the Company to issue refunds to the affected customers. The GRIP program allows

Chesapeake to recover the cost of accelerating the replacement of cast iron and

bare steel distribution mains through a surcharge on customers’ bills. The 2017

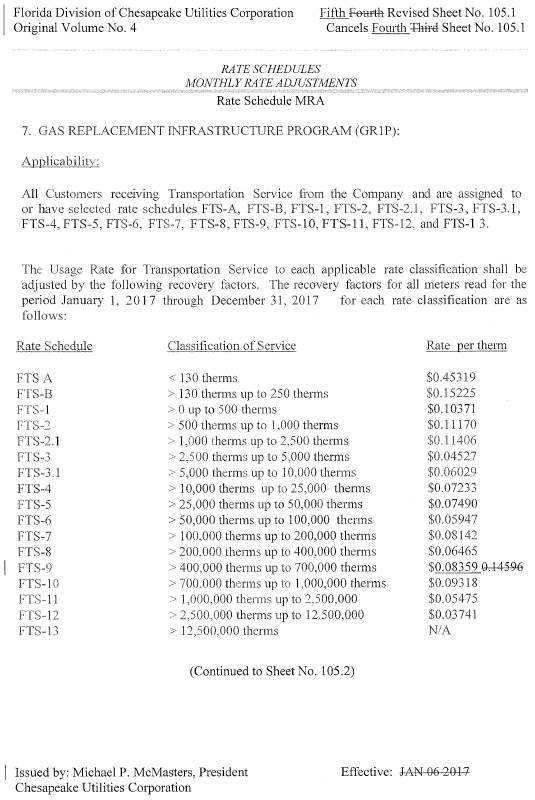

GRIP factors were approved in Order No. PSC-16-0567-TRF-GU. Rate class FTS-9, which currently has six

customers, is for customers whose annual therm usage is between 400,000 and

700,000 therms (compared to about 240 therms per year for residential

customers).

Chesapeake

responded to staff’s first data request on March 28, 2017 and filed revised

responses on March 30, 2017. The proposed (legislative) tariff page is

contained in Attachment 1 to the recommendation. The Commission has

jurisdiction over this matter pursuant to Sections 366.03, 366.04, 366.05, and

366.06, Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission approve Chesapeake's petition

to amend the 2017 GRIP factor for rate class FTS-9 customers and issue refunds

to FTS-9 customers?

Recommendation:

Yes, the Commission should approve Chesapeake’s

petition to amend the 2017 GRIP factor for rate class FTS-9 customers effective

on the date of the Commission’s decision and issue refunds in the form of bill

credits to the FTS-9 customers. Within 30 days of the issuance of the bill

credits, Chesapeake should notify staff that the refunds have been completed.

(Ollila)

Staff Analysis:

After a customer questioned Chesapeake about the

$0.14596 per therm GRIP factor for the FTS-9 rate class, the Company determined

that the GRIP factor was incorrect and should have been $0.08359 per therm.

Chesapeake proposes to amend the GRIP factor to $0.08359 per therm and provide

refunds using a bill credit to FTS-9 customers. Chesapeake estimated that the refunds

will total approximately $71,500.

GRIP Factor

The 2017 GRIP factor was developed by forecasting the 2017

GRIP revenue requirement and allocating the revenue requirement to each rate

class using the same methodology used for the allocation of mains and services

in the cost of service study used in Chesapeake’s most recent rate case.

The revenue requirement allocated to each rate class is then divided by

Chesapeake’s forecast of therms for that rate class, resulting in the per therm

GRIP factor for each rate class.

Chesapeake explained that the projected therm usage used

to calculate the 2017 factor for FTS-9 was understated compared to historical

therms and previous projections, resulting in the higher GRIP factor. Chesapeake

revised its 2017 FTS-9 therm forecast and used that forecast to develop the

amended GRIP factor of $0.08359 per therm. Chesapeake has since reviewed all

GRIP factors for Chesapeake, Florida Public Utilities Company (FPUC), and FPUC

– Fort Meade and concluded that there were no significant therm over- or

understatements used in calculating the 2017 GRIP factors.

In response to staff’s data request, Chesapeake explained

that in future proceedings, it plans to thoroughly review the projected annual

therms and GRIP factors for reasonableness for each rate class. This review,

according to the Company, will enable it to identify and investigate any

anomalies in the therm forecast as well as the GRIP factors.

Corrected Billing and Refunds

In its petition, Chesapeake proposed that the corrected

GRIP factor for the FTS-9 rate class be effective upon Commission approval. The

Company explained to staff that the May billing cycle will begin after May 4,

the date of the Commission’s decision; therefore, all FTS-9 customers will be

billed the corrected FTS-9 GRIP factor beginning with the May billing cycle.

Chesapeake stated it believes that it is prudent to

address the over-recovery of dollars through a correction to the FTS-9 GRIP factor

and the issuance of refunds rather than to use the true-up process contained in

the annual GRIP filing. The true-up process would have served to reduce

Chesapeake’s 2018 GRIP factors for all rate classes; however, FTS-9 customers

would not have received the benefit of a refund nor would the lower 2018 GRIP

factor have offset the amounts FTS-9 customers overpaid in 2017. Chesapeake

proposes to refund the difference between the approved 2017 GRIP factor for

FTS-9 customers ($0.14596 per therm) and the amended GRIP factor ($0.08359 per

therm), resulting in a refund of $0.06237 per therm for January through April,

2017.

Since all FTS-9 customers are current Chesapeake

customers, refunds will be processed using bill credits. The credits will

include refunds for any applicable taxes/fees, which will be computed when the

refunds are processed through the billing system. Rule 25-7.091, Florida

Administrative Code (F.A.C.), requires that interest be paid on all refunds,

excluding deposit refunds and refunds associated with adjustment factors. FCG

explained in its revised response to staff’s first data request that its

interpretation is that Rule 25-7.091, F.A.C., does not apply to the GRIP

factor, which it considers an adjustment factor; however, the Company intends

to include interest in the calculation of the refund. The refunds will be

included with the June billing cycle and the Company informed staff that it

plans to notify the affected customers by separate letter once refunds are

processed. The Company agreed to notify staff when the refunds are complete.

Conclusion

Staff believes it is reasonable to amend the FTS-9 GRIP

factor and to issue refunds to the FTS-9 customers who have been billed the

incorrect 2017 GRIP factor.

Staff recommends

that the Commission approve Chesapeake’s petition to amend the 2017 GRIP factor

for rate class FTS-9 customers effective on the date of the Commission’s

decision and issue refunds in the form of bill credits to the FTS-9 customers.

Within 30 days of the issuance of the bill credits, Chesapeake should notify

staff that the refunds have been completed.

Issue 2:

Should this docket be closed?

Recommendation:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariff should remain in effect,

pending resolution of the protest. If no timely protest is filed, this docket

should be closed administratively after Chesapeake notifies staff that the

refunds are complete. (Janjic)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariff should remain in effect,

pending resolution of the protest. If no timely protest is filed, this docket

should be closed administratively after Chesapeake notifies staff that the

refunds are complete.