†Case Background

On April 28,

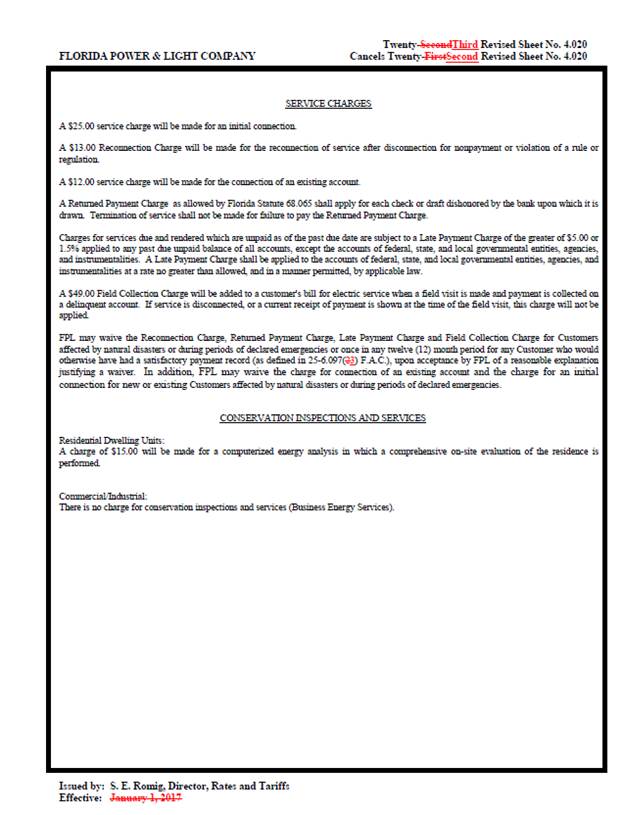

2017, Florida Power & Light Company (FPL or Company) filed a petition

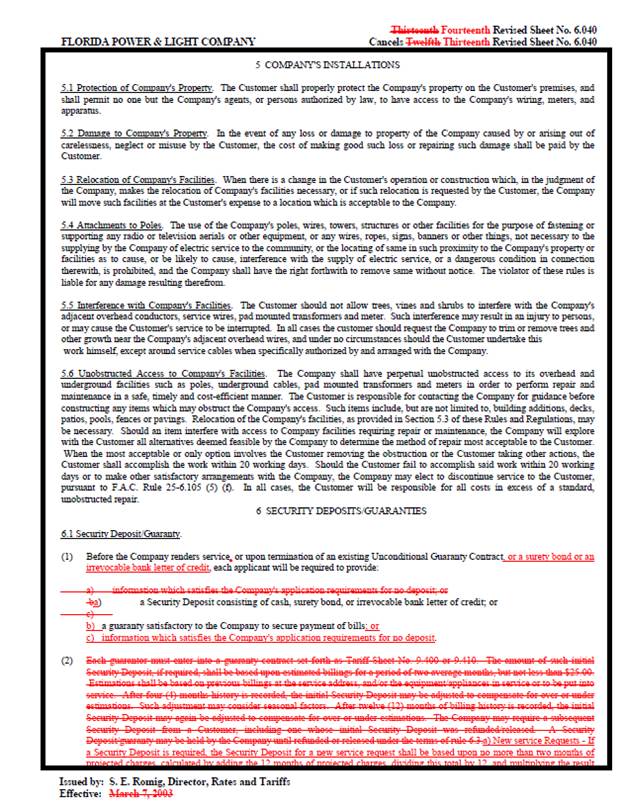

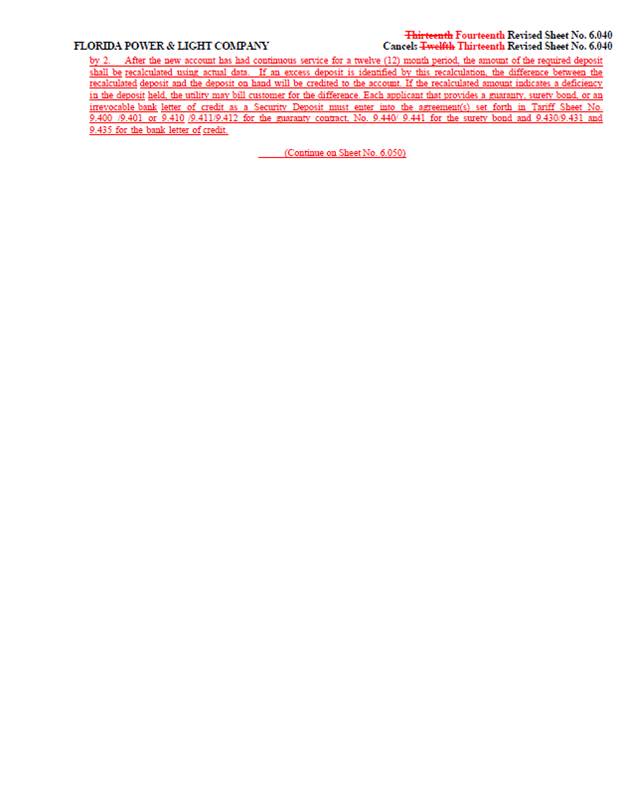

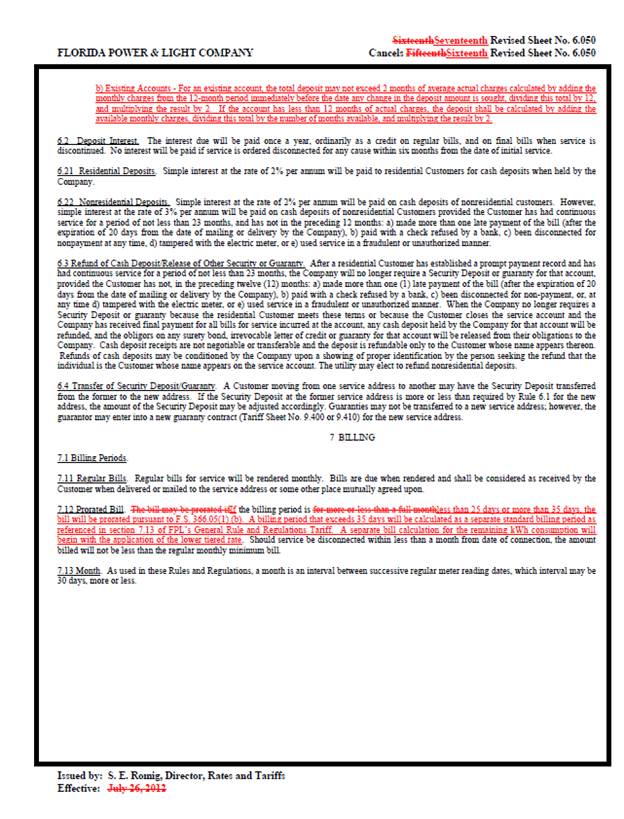

requesting Commission approval of amendments to Tariff Sheet Nos. 4.020, 6.040,

6.050, 9.400, and 9.410 regarding customer deposits. During the 2015 session,

the Florida Legislature enacted House Bill 7109 which was incorporated into

Chapter 2015-129, Laws of Florida. Among other things, the legislation created

Section 366.05(1)(b) and (c), Florida Statutes (F.S.). Paragraph (1)(b)

addresses billing periods and Paragraph (1)(c) addresses customer deposits.

These laws became effective on July 1, 2015. The Commission adopted amendments

to Rules 25-6.100 (Customer Billings) and 25-6.097 (Customer Deposits), Florida

Administrative Code (F.A.C.), respectively, to implement the laws enacted in

July 2015.

FPL is

requesting tariff modifications at this time to ensure that the Companyís

tariff language continues to conform to the applicable statutes and Commission

rules. On May 18, 2017, FPL filed an amended version of Tariff Sheet No. 6.050 that

was inadvertently not included with the original petition. The Commission has

jurisdiction in this matter pursuant to Sections 366.03, 366.05, and 366.06, F.S.

Discussion

of Issues

Issue 1:

Should the Commission approve FPL's proposed tariff modifications?

Recommendation:

Yes, the Commission should approve FPLís requested

modifications to Tariff Sheet Nos. 4.020, 6.040, 6.050, 9.400, and 9.410, as

reflected in Attachment A, effective June 5, 2017. (Rome, Draper)

Staff Analysis:

FPLís proposed tariff modifications are designed to

conform FPLís tariff to the applicable statutes and Commission rules. The two

tariff modifications are discussed below.

Billing Period

Section 366.05(1)(b), F.S., provides that if the

Commission authorizes a public utility to charge tiered rates based upon levels

of usage and to vary its regular billing period, the utility may not charge a

customer a higher rate because of an increase in usage attributable to an

extension of the billing period; however, the regular meter reading date may

not be advanced or postponed more than five days for routine operating reasons

without prorating the billing for the period. The Commission amended Rule

25-6.100, F.A.C., to implement the statutory changes.

The prior rule specified that the regular meter reading date may be advanced or

postponed not more than 5 days without a proration of the billing for the

period, but did not address the application of tiered rates to extended billing

periods. Tiered rates, such as FPLís residential energy charges, apply a higher

energy charge to usage above 1,000 kilowatt-hours.

FPL has proposed to add language to Tariff Sheet No. 6.050

to reflect the statutory requirements and to include the Companyís current

billing practices in its tariff. The revised tariff sheet addresses both the

proration of charges when billing periods are varied by more than five days, as

well as the prohibition against charging higher tiered rates if the extension

of a billing period of more than five days causes a customerís energy

consumption to exceed the Companyís tier threshold of 1,000 kilowatt-hours. FPL

has represented to staff that its current business practices regarding bill

proration and administration of tiered rates are in compliance with Section

366.05(1)(b), F.S.

Customer Deposits

Section 366.05(1)(c), F.S., provides that for an existing

account, the total deposit may not exceed two months of average actual charges.

For a new service request, the total deposit may not exceed two months of

projected charges. Once a new customer has had continuous service for a

12-month period, the amount of the deposit shall be recalculated using actual

data. Any difference between the projected and actual amounts must be resolved

by the customer paying the additional amount that may be billed by the utility

or the utility returning any overcharge.

The Commission amended Rule 25-6.097(1), F.A.C., to state

that the utilityís methodology for determining customer deposits for existing

and new accounts shall conform to Section 366.05(1)(c), F.S.

The prior rule language already required that the total amount of a deposit not

exceed twice the average monthly bill.

FPLís proposed amendments to Tariff Sheet Nos. 6.040 and

6.050 conform to the new statutory language regarding the recalculation of the

deposit after 12-months. FPLís proposed amendments to Tariff Sheet Nos. 6.040

and 6.050 comport with this language by providing that: (a) if the recalculated

deposit amount based on the previous 12-months billing history is less than the

customerís current deposit amount, the difference between the deposit amounts

will be applied as a credit to the customer account; and (b) if the

recalculated deposit amount exceeds the customerís current deposit amount, the

Company may request an additional deposit amount. FPL also proposed some

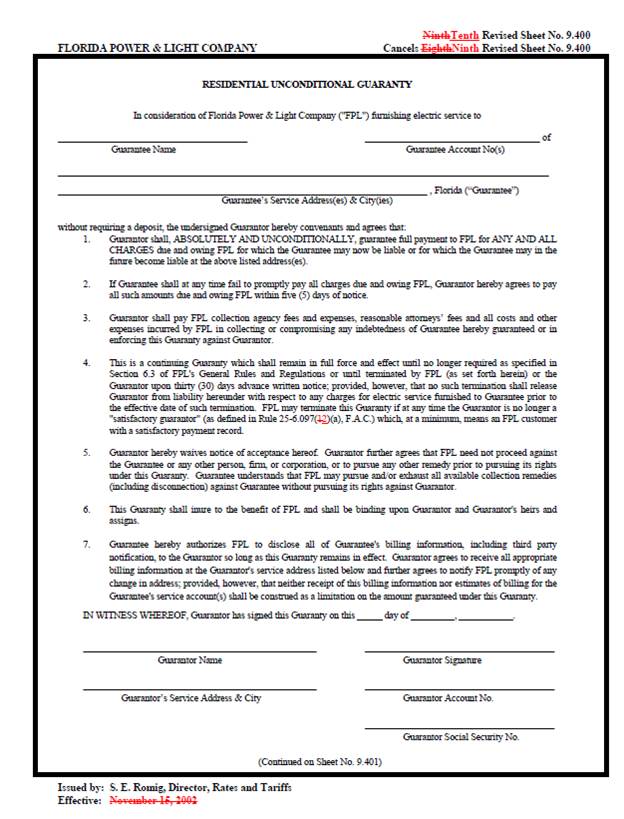

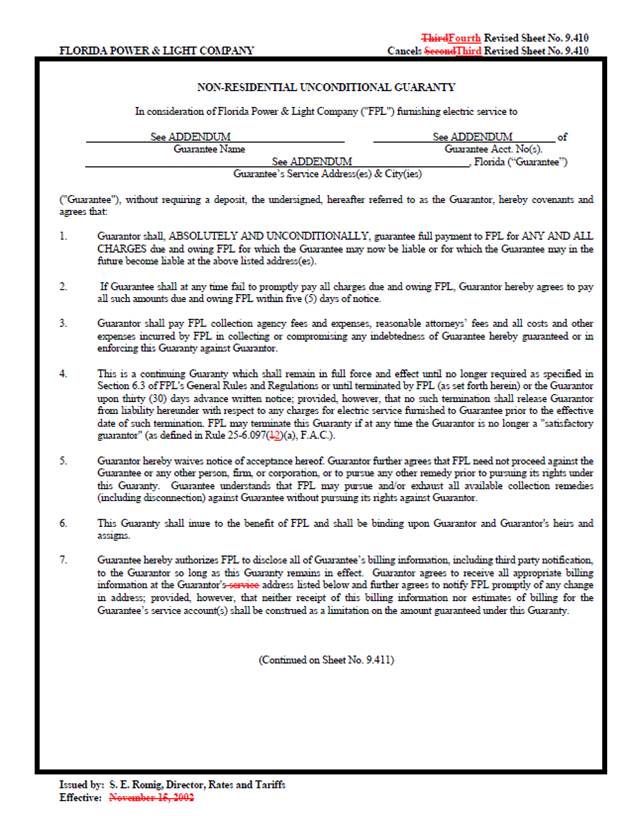

administrative revisions to Tariff Sheet Nos. 4.020, 9.400, and 9.410 to

conform to Rule 25-6.097, F.A.C.

Pursuant to Rule 25-6.097(3), F.A.C., utility customers

receive refunds of their deposits with interest after a period of 23 months of

continuous service, assuming their payment record is satisfactory. Therefore,

for the majority of utility customers, the deposit amount recalculation after a

12-month period of continuous service occurs only once.

Conclusion

Based on a review of the applicable statutes, Commission

rules, and proposed tariffs filed by FPL, staff believes that the tariff sheet

revisions conform to the applicable statutes and Commission rules. Therefore,

staff recommends that the Commission approve FPLís requested modifications to

Tariff Sheet Nos. 4.020, 6.040, 6.050, 9.400, and 9.410, as reflected in

Attachment A, effective June 5, 2017.

Issue 2:

Should this docket be closed?

Recommendation:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order. (Brownless)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order.