Discussion

of Issues

Issue 1:

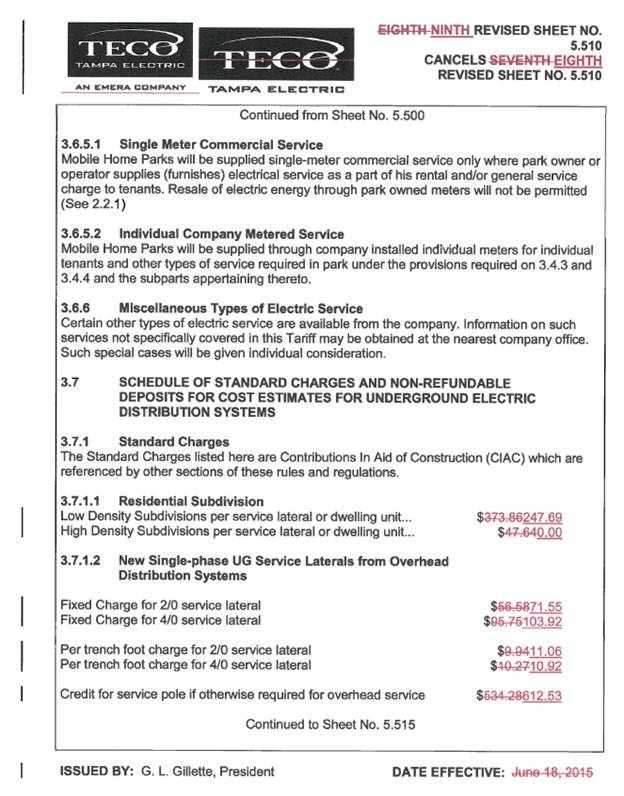

Should the Commission approve TECO's proposed URD

tariffs and associated charges?

Recommendation:

Yes, the Commission should approve TECO’s proposed

URD tariffs and other associated charges as shown in Attachment A, effective

July 13, 2017. (Draper, Rome)

Staff Analysis:

Rule 25-6.078 Florida Administrative Code (F.A.C.), defines

investor-owned utilities’ (IOU) responsibilities for filing updated URD

tariffs. TECO has filed the instant petition pursuant to subsection (3) of the

rule, which requires IOUs to seek Commission approval of updated URD tariff

charges if the utility’s per-lot cost differentials between overhead and

underground service based on current material and labor costs vary by more than

10 percent from the existing Commission-approved differentials. All IOUs are

required to file supporting data and analyses for URD tariffs at least once

every three years.

The URD tariffs provide standard charges for underground

service in new residential subdivisions and represent the additional costs the

utility incurs to provide underground service in place of overhead service. The

cost of standard overhead construction is recovered through base rates from all

ratepayers. In lieu of overhead construction, customers have the option of

requesting underground facilities. Costs for underground construction have

historically been higher than for standard overhead construction and the

additional cost is paid by the customer as a

contribution-in-aid-of-construction (CIAC). Typically, the URD customer is the

developer of the subdivision.

TECO’s URD charges are based on two standard model

subdivisions: (1) a 210-lot low density (LD) subdivision, and (2) a 176-lot

high density (HD) subdivision. While actual construction may differ from the

model subdivisions, the model subdivisions are designed to reflect average

overhead and underground subdivisions. TECO does not utilize a model HD

subdivision where dwelling units take service at ganged meter pedestals (groups

of meters at the same physical location).

In response to a staff data request, TECO stated that the

designs used for the LD and HD underground subdivisions in this docket were the

same as those used in the Company’s 2015 docket. However, TECO identified two

changes to the designs for the LD and HD overhead subdivisions: (a)

substitution of 35-foot Class 4 wooden poles for 30-foot Class 6 wooden poles

to meet wind-loading/clearance guidelines, and (b) addition of more lightning

arrester stations to address a deficiency in the prior design. The impacts of

these design changes are discussed later in this recommendation.

Table 1-1 presents a comparison between the currently

approved and proposed URD differentials for the LD and HD subdivisions. The

charges shown are per-lot charges.

Table 1-1

Comparison of URD

Differential per Lot

|

|

Current Differential

|

Proposed Differential

|

|

Low Density

|

$373.86

|

$247.69

|

|

High Density

|

$47.64

|

$0.00

|

Source:

Petition page 2; paragraphs 6 and 7

As shown in Table 1-1 above, the differentials per lot

have decreased for both subdivisions. Two primary factors impacted the calculation

of TECO’s proposed URD charges and are discussed in greater detail below: (1)

updated labor and material costs, and (2) calculation of operational costs.

Updated Labor and Material Costs

The installation costs of both underground and overhead facilities

include the labor and material costs to provide primary, secondary, and service

distribution lines as well as transformers. The costs of poles are specific to

overhead service while the costs of trenching and backfilling are specific to underground

service. TECO’s current URD charges are based on 2015 labor and material costs,

and the proposed charges are based on 2017 costs. Table 1-2 compares the

per-lot 2015 and 2017 underground and overhead labor and material costs

(rounded to whole dollars) for the two subdivisions.

Table 1-2

Labor and Material Costs per

Lot

|

|

2015 Costs

|

2017 Costs

|

Difference

|

|

Low Density

|

|

Underground labor/material costs

|

$2,127

|

$2,156

|

$29

|

|

Overhead labor/material costs

|

$1,269

|

$1,379

|

$110

|

|

Per lot differential

|

$858

|

$777

|

($81)

|

|

High Density

|

|

Underground labor/material costs

|

$1,638

|

$1,640

|

$2

|

|

Overhead labor/material costs

|

$979

|

$1,001

|

$22

|

|

Per lot differential

|

$659

|

$639

|

($20)

|

Source:

Petition Exhibit pages LD 1 and HD 1

As indicated in Table 1-2 above, the total labor and

material cost differentials decreased for both the LD and HD model subdivisions

because the costs of overhead construction increased at a greater rate than the

costs of underground construction. Documentation provided by TECO indicated

that the two design changes noted earlier in this recommendation pertaining to

the model subdivisions with overhead service affected the associated

construction costs for overhead service.

The materials cost for overhead construction increased due

to the substitution of more expensive 35-foot Class 4 wooden poles for 30-foot

Class 6 wooden poles in order to meet wind-loading/clearance guidelines. Materials

costs for overhead service also increased due to the addition of more lightning

arrester stations to address a deficiency in the design used in the 2015 docket.

The additional labor hours necessary to install the additional lightning

arrester stations and the larger poles also increased the associated labor cost

portion of overhead construction.

TECO provided other relevant documentation to show that

the Company decreased its material handling factor from 23.38 percent to 15.31

percent. The recalculation of the factor to reflect current material handling

practices had the effect of mitigating the increases to construction costs for

both the LD and HD model subdivisions.

TECO also provided information to show that contractor

overhead adder rates increased from 21.85 percent to 34.83 percent. TECO

represented that the increase in adder rates was based on prior year actual

costs associated with all projects using contract labor. Some of the more

common activities typically performed by contractors include trenching, transformer

pad site preparation, and splice box installation. These contractor services

are performed in association with underground construction; therefore, the

increase in contractor overhead adder rates had a greater effect on underground

construction costs than on the construction costs for overhead service.

However, increases in labor costs associated with underground construction were

mitigated by decreases in material costs.

Updated Operational Costs

Rule 25-6.078(4), F.A.C., provides that the differences in

Net Present Value (NPV) of operational costs between overhead and underground

systems, including average historical storm restoration costs over the life of

the facilities, be included in the URD charge. Operational costs include

operations and maintenance (O&M) costs and capital costs. The inclusion of

the operational costs is intended to capture longer term costs and benefits of

undergrounding.

TECO used its actual historical O&M and capital

expenses for the period 2014 through 2016 to calculate the operational cost difference

for overhead and underground facilities. Table 1-3 below compares the 2015 and

2017 NPV calculations of operational cost differentials (rounded to whole

dollars) between overhead and underground systems on a per-lot basis.

Table 1-3

NPV of Operational Costs

Differential per Lot

|

|

2015 Calculation

|

2017 Calculation

|

Difference

|

|

Low Density

|

|

Underground NPV - Operational Costs

|

$906

|

$1,025

|

$119

|

|

Overhead NPV - Operational Costs

|

$1,390

|

$1,554

|

$164

|

|

Per lot Differential

|

($484)

|

($529)

|

($45)

|

|

High Density

|

|

Underground NPV - Operational Costs

|

$432

|

$484

|

$52

|

|

Overhead NPV - Operational Costs

|

$1,044

|

$1,157

|

$113

|

|

Per lot Differential

|

($612)

|

($673)

|

($61)

|

Source: Petition Exhibit

pages LD 1 and HD 1

Table 1-3 shows that the NPV of operational costs for

overhead service is higher than the NPV for underground service. This reflects

the inclusion of storm restoration costs in the NPV calculations; storm

restoration costs are higher for overhead service than for underground service.

This has the effect of reducing the differential in the per-lot calculations.

The methodology used by TECO in its 2015 filing for

calculating the NPV of operational costs was approved in Order No.

PSC-09-0784-TRF-EI. In

response to a staff data request, TECO stated that it used the same approved

methodology in the instant docket with the exception of the period over which

storm restoration costs were averaged. The storm restoration costs in the

current filing are based on the previous three-year average of hurricane

recovery costs for the distribution system; the value used in the 2015 docket

was based on the average of hurricane recovery costs for the period 2004

through 2008 inclusive (five years).

TECO represented that the use of the most recent

three-year average is consistent with the methodology used in the NPV

calculations for non-storm operating costs. The Company also asserted that the

most recent three-year period is more representative of current and future

costs of restoration and better reflects storm activity in TECO’s service

territory than the older data used in the Company’s prior URD filing. Using the

most recent three-year period had the effect of mitigating the increase in the

NPV of operational costs associated with overhead construction.

TECO’s NPV calculation used a 35-year life of the

facilities and a 6.61 percent discount rate. Staff notes that operational costs

may vary among IOUs as a result of differences in size of service territory,

miles of coastline, regions subject to extreme winds, age of the distribution

system, or construction standards.

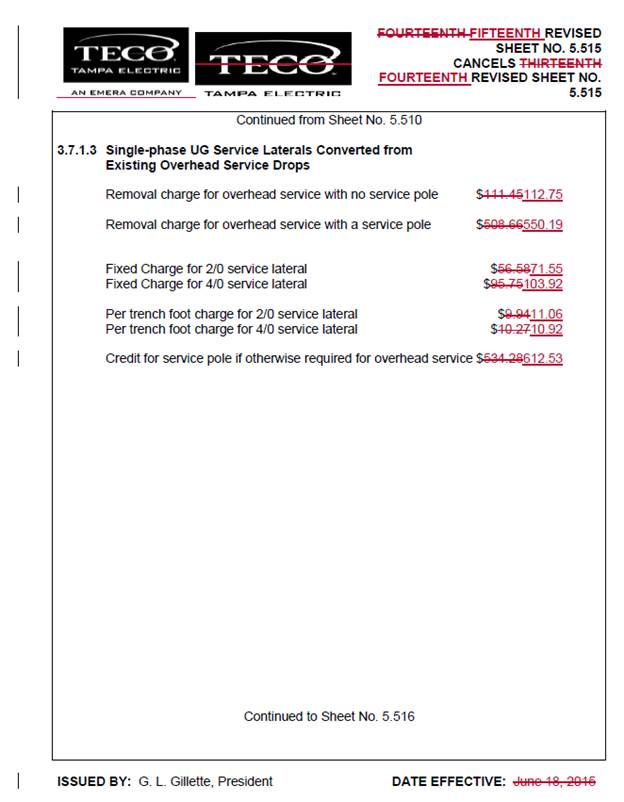

Other Proposed Tariff Changes

In addition to the proposed tariff changes discussed

above, TECO proposed to revise its non-refundable deposits for estimates of

CIAC for conversion of existing overhead distribution facilities to underground

facilities. To develop the proposed deposits, TECO adjusted its current deposit

amounts by the Consumer Price Index (CPI) factors published by the United

States Department of Labor Bureau of Labor Statistics in Table 24 of the CPI

Detailed Report.

TECO also proposed modifications to the charges and

credits for customers requesting new underground service laterals from overhead

distribution systems, and for the conversion of existing service laterals from

overhead to underground. Factors which contributed to the Company’s requested

modifications included the shift to using 35-foot poles for clearance reasons

and the increases in contractor labor costs associated with conversions to

underground service.

Conclusion

Documentation provided by TECO supports the Company’s

assertion that the per-lot cost differentials for the model LD and HD

subdivisions have decreased. A significant factor contributing to the decrease in

the differentials is that the costs of overhead construction increased at a

greater rate than the costs of underground construction. The increases in the

cost of overhead construction may be attributed in part to the Company’s design

changes to subdivisions with overhead service to better reflect actual

construction practices.

Staff has reviewed TECO’s proposed changes to its URD tariffs

and associated charges, the accompanying work papers, and responses to staff’s

data requests. Staff believes TECO’s proposed URD tariffs and other associated

charges are reasonable; staff recommends approval of the tariffs shown in

Attachment A, effective July 13, 2017.

Issue 2:

Should this docket be closed?

Recommendation:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order. (Mapp)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order.