The FPL Petition

seeks three things: first to reduce the respective 2018 fuel cost recovery

factors approved in Order No. PSC-2018-0028-AS-EI;[1] second, to approve the capacity factors;

and third, to approve the revisions to FPLís generating performance incentive

factor (GPIF) performance metrics. The requested approvals reflect the impact

of the Commission-approved St. Johnís River Power Park (SJRPP) transaction,

pursuant to Order No. PSC-2017-0415-AS-EI.[2]

Mid-course

corrections are part of the fuel and purchased power cost recovery clause (fuel

clause) proceeding, and such corrections are used by the Commission between

fuel clause hearings whenever costs deviate from revenues by a significant

margin. Petitions for mid-course corrections to fuel factors are addressed by

Rule 25-6.0424, Florida Administrative Code (F.A.C.). Under this rule, a

utility must notify the Commission whenever it expects to experience an

under-recovery or over-recovery greater than 10 percent. Pursuant to Rule

25-6.0424, F.A.C., the mid-course percentage is the estimated end-of-period

total net true-up amount divided by the current periodís total actual and

estimated jurisdictional fuel revenue applicable to period amount.

Mid-course

corrections are considered preliminary procedural decisions, and any

over-recoveries or under-recoveries caused by or resulting from the Commission-approved

adjusted fuel factors may be included in the following yearís fuel factors.

If approved by

the Commission, this mid-course correction will result in lower cost recovery

factors for FPLís customers. This mid-course correction was filed by FPL with

the intention of the proposed decrease in rates becoming effective March 1,

2018. Typically, effective dates are set a minimum of 30 days after a

Commission vote modifying the charges as the result of a mid-course correction.[3] This time limit is imposed in order to not

have new rates applied to energy consumed before the effective date of the

Commissionís action, i.e., the date of the vote. However, the Commission has

also implemented charges in less than 30 days when circumstances warrant.[4] In this instance, the interval between the

Commissionís vote on this matter (February 6, 2018) and the proposed

implementation date (expected to be March 1, 2018) is 22 days. Since this

filing, if approved, results in a decrease to rates, staff believes the 22 day

interval is sufficient.†

The Commissionís

jurisdiction to consider fuel clause proceedings derives from the Commissionís

authority to set fair and reasonable rates, found in Section 366.05, Florida

Statutes.

Discussion

of Issues

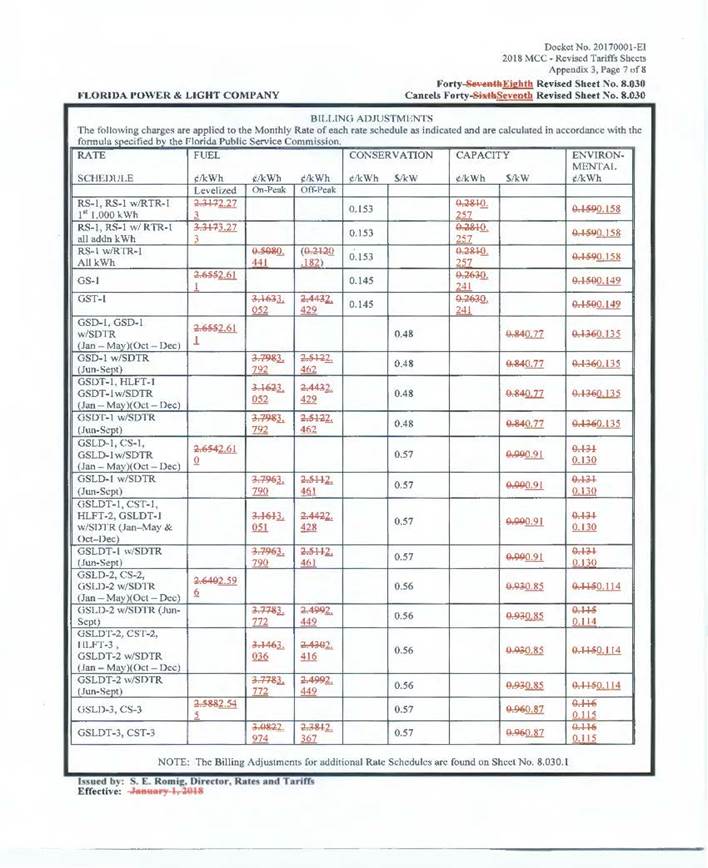

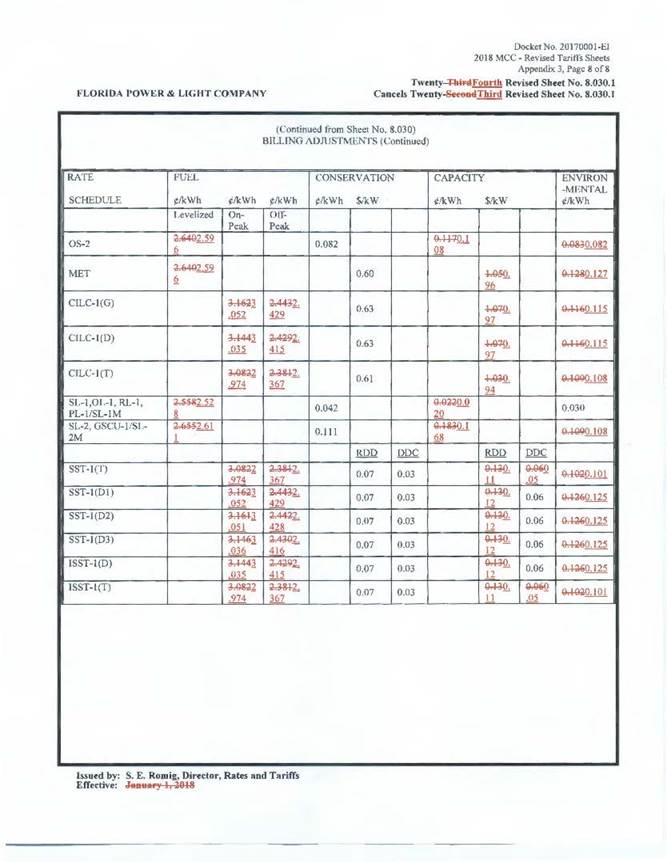

Issue 1:

Should the Commission approve FPL's Petition for

mid-course correction to its fuel and capacity cost recover factors, associated

tariff sheets, and revised GPIF Targets and Ranges?

Recommendation:

Yes. FPLís

request for mid-course correction to its 2018 fuel and capacity cost recovery

factors, associated tariff sheets, and revised 2018 GPIF Target and Ranges

should be approved. The recommended fuel and capacity cost recovery factors are

presented in Attachments A and B, respectively, and the revised 2018 GPIF

Targets and Ranges are presented in Attachment C. The associated tariff sheets are

presented in Attachment D. The revised fuel and cost recovery factors, the

associated tariff sheets, and the revised GPIF Target and Ranges should become

effective with the March 2018 billing cycle, which begins on March 1, 2018.

(Barrett, Galloway, Lee, Draper, Guffey)

Staff Analysis:

FPLís projection testimony and schedules for 2018

were filed on August 24, 2017, which came before the Commission had considered

a separately-docketed matter to approve an arrangement to mitigate unfavorable

impacts stemming from its partial ownership of the St. Johns River Power Park

(SJRPP Transaction). The impact of the SJRPP Transaction was not reflected in

FPLís calculations included in its projection testimony and schedules filed on

August 24, 2017. On September 25, 2017, the Commission approved FPLís and OPCís

stipulation and settlement resolving all issues concerning the SJRPP Transaction. Order

No. PSC-2018-FOF-EI,

approved the stipulation requiring FPL to file a mid-course correction to

reflect the impacts of the SJRPP Transaction no later than November 17, 2017,

and FPL did so.

Midcourse

Adjustment for Fuel Cost Recovery (FCR) Factors

FPLís

currently authorized 2018 fuel factors were set by the Commission following the

October 25, 2017 fuel hearing, and codified in the 2017 Order. These factors

are based on FPLís projected fuel costs for 2018, plus the true-up amounts from

2017. Given the timing of the Commissionís approval of the SJRPP Transaction, FPL

is requesting the current mid-course correction to reflect its 2018 cost

recovery factors. The Company notes, however, that its mid-course correction is

limited to only the impact of the SJRPP Transaction. The accounting treatment

approved in the SJRPP Order authorizes FPL to recover fuel-related costs

associated with the SJRPP Transaction through the fuel cost recovery (FCR)

clause.

The SJRPP Transaction closed and the plant was retired on

January 5, 2018. As a

result, purchased power payments and coal inventory balances will reflect

decreases. FPL states in its mid-course correction filing that ďthese decreases

are partially offset by an increase in natural gas consumption.Ē (FPL Petition,

page 4, paragraph 9)

The accounting changes result in a total variance from the

original 2018 projection filing of $22,933,601, or 7.99 percent. If FPLís

Petition is granted, this amount would be recovered through reduced fuel and

capacity cost recovery factors for MarchĖDecember 2018. The March-December 2018

FCR factor decreased from 2.630 cents per kWh to 2.606 cents per kWh, and

results in a reduction of $0.24 for a residential customer using 1,000 kWh of

electricity. The revised fuel cost recovery factors are reflected on Attachment

A.†

Midcourse

Adjustment for Capacity Cost Recovery (CCR) Factors

Revision

of the GPIF Targets and Ranges for 2018

Consistent

with the discussion on the revised fuel cost projection, appropriate adjustments to FPLís GPIF targets/ranges

for heat rate are needed due to the effects of the SJRPP transaction. The

revised GPIF targets and ranges for the 12 GPIF units provided in Appendix 4 of

FPLís petition show a slightly lower average heat rate value, reflecting a

higher performance target. Availabilities of the GPIF units are not changed by

the SJRPP transaction, thus no revisions are needed for the GPIF targets/ranges

for equivalent availabilities. The revised 2018 GPIF Targets and Ranges are

reflected on Attachment C.

Bill

Impact and Customer Notifications

Consistent

with the 2017 Fuel Order, the bill for a residential customer using 1,000

kilowatt hours (kWh) of electricity for the period March-December, 2018, was

projected to be $99.75 per month, with a fuel cost recovery component of $22.97

per month, and a capacity cost recovery component of $2.81 per month. As

proposed, the fuel cost recovery component will be reduced by $0.24 per month,

and a similar reduction will be applicable to capacity cost recovery factors as

well. Both reductions are reflected in the typical bill comparison that is

presented in Table 1 of Attachment E.

Staff

believes implementing reduced fuel cost recovery factors is in the best

interests of FPLís customers because the factors would be decreasing, and

customers would receive the benefit of reduced rates as quickly as

administratively possible.

At a noticed informal conference

between staff and interested parties held January 4, 2018, FPL stated that it

initially notified customers with bill inserts regarding this matter about the

time its Petition was filed. In the January 2018 bill, the Company sent

customers a quarterly newsletter that addressed the pending action in this

matter. Beginning in February, FPLís website will include links to show the

proposed rate schedules for residential and business rate classes that are

proposed to become effective March 1, 2018. The Company stated that physical

restrictions on bill inserts limit the amount of detail that can be included in

such notifications, but noted its customers can access detailed billing

information from links on the Companyís website.

Conclusion

Staff recommends the Commission approve FPLís request for mid-course correction to its 2018

fuel and capacity cost recovery factors, associated tariff sheets, and a revised

2018 GPIF Target and Ranges. The revised fuel and capacity cost recovery

factors and associated tariffs should become effective March 1, 2018. The

recommended fuel cost recovery factors are presented in Attachment A, the

capacity cost recovery factors are presented in Attachment B, the GPIF Targets

and Ranges are presented in Attachment C, the associated tariff sheets are

shown as Attachment D, and, finally, a typical bill comparison is presented in

Attachment E.

Issue 2:

Should this docket be closed?

Recommendation:

The fuel docket is on-going and should remain open.

(Brownless)

Staff Analysis:

The fuel docket is on-going and should remain open.