|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

January 25, 2018

|

|

TO:

|

Office of Commission Clerk (Stauffer)

|

|

FROM:

|

Division of Engineering (Thompson, Ellis,

King, Wright)

Division of Economics

(Higgins)

Office of the General

Counsel (Cuello)

|

|

RE:

|

Docket No. 20170248-EI – Petition for

approval of fuel cost proxy substitution to qualifying facility contract

between Duke Energy Florida, LLC and CFR/Biogen (n/k/a Orange Cogeneration

Limited Partners), Ridge Generating Station Limited Partnership, Mulberry

Energy Company, Inc. (n/k/a Polk Power Partners), and Orlando Cogen Limited,

L.P.

|

|

AGENDA:

|

02/06/18 – Regular Agenda – Proposed Agency Action - Interested

Persons May Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Administrative

|

|

CRITICAL DATES:

|

Duke is requesting a Consummating Order be filed by

April 2018 because they are retiring Crystal River 1 and 2, the Avoided Unit Fuel

Reference Plant for the contracts being modified, on this date.

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

On July 1, 1991,

the Florida Public Service Commission (Commission) approved a petition by

Florida Power Corporation n/k/a Duke Energy Florida, LLC (Duke or Utility)

requesting approval for cost recovery of negotiated contracts for purchase of

firm capacity and energy with the following qualifying facilities: Ridge

Generating Station Limited Partnership (Ridge), Mulberry Energy Company, Inc.

n/k/a Polk Power Partners (Polk), and Orlando CoGen Limited, L.P. (Orlando),

among others. Similarly, on March 31, 1992, the

Commission approved a joint petition by another qualifying facility, CFR-Biogen

Corp. n/k/a Orange Cogeneration Limited Partners (Orange), and Duke requesting

approval for cost recovery of a negotiated contract for purchase of firm

capacity and energy. (These contracts, as amended to date, are

collectively referred to as the “QF PPAs”)

Pursuant to the

QF PPAs, Duke’s coal-fired units Crystal River 1 and 2 (CR 1 and 2) comprise

the avoided unit fuel reference plant that is used to calculate the energy

payments for these qualifying facilities. This calculation includes the

delivered price of coal burned at CR 1 and 2. However, Duke plans to retire

these coal units in April 2018. Upon retirement of these units, the energy

payments for these QF PPAs can no longer be calculated as previously called

for.

Duke and the

owners of the qualifying facilities have negotiated respective amendments to

the QF PPAs to agree to substitute the delivered price of coal burned at CR 1

and 2 with a substitute index to act as a fuel cost proxy (Substitute Index),

designed to approximate the delivered price of coal burned at CR 1 and 2. Each

of the amendments utilizes the Substitute Index, with the index’s development

methodology being identical among all amendments. On November 17, 2017, Duke

filed a petition for approval of the amendments to the QF PPAs.

The Commission

has jurisdiction over this matter pursuant to Sections 366.04 and 366.051,

Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission approve Duke Energy Florida,

LLC’s petition for approval of the amendments to the negotiated contracts for

purchase of firm capacity and energy between Ridge Generating Station Limited

Partnership, Mulberry Energy Company, Inc. n/k/a Polk Power Partners, Orlando

CoGen Limited, L.P., and CFR-Biogen Corp. n/k/a Orange Cogeneration Limited

Partners?

Recommendation:

Yes. Duke currently plans to retire CR 1 and 2 in

April 2018, coal units comprising the avoided unit fuel reference plant as

defined in the QF PPAs. The amendments to the QF PPAs seek to substitute the

delivered price of coal burned at CR 1 and 2 with the Substitute Index, a fuel

cost proxy expected to approximate the delivered price of coal to CR 1 and 2. The

remaining total annual payments under the modified QF PPAs are expected to remain

approximately equivalent to those estimated prior to modification.

The amendments to the QF PPAs do not modify any other part

of the respective contracts. Thus, the core provisions of the QF PPAs,

including total energy delivery amounts, contract duration, reliability,

security, and risk allocation remain unchanged. Therefore, staff recommends

that the Commission approve Duke’s petition for approval of the amendments to

the QF PPAs. (Wright)

Staff Analysis:

Duke’s petition requests approval of modifications

to four existing contracts. The Utility has provided the information required

in accordance with Rule 25-17.0836(1), Florida Administrative Code (F.A.C.). As

required by Rule 25-17.0836(6), F.A.C., staff evaluated modifications and

concessions of the Utility and developer against both the existing contract and

the current value of the purchasing Utility’s avoided cost.

Three of the four negotiated contracts for the purchase of

firm capacity and energy under consideration in this docket were originally

approved for cost recovery in 1991, with the fourth contract receiving approval

in 1992. Since the original approvals, the Mulberry Energy Company, Inc.

contract has been assigned to Polk Power Partners, with the agreement of Duke. Likewise,

Duke agreed to the assignment of the contract originally with CFR-Biogen Corp.

to Orange Cogeneration Limited Partners. The Ridge and Orlando QF PPAs expire

in December 2023. The Polk QF PPA expires in August 2024, while the Orange QF

PPA expires in December 2025. For all of the contracts, CR 1 and 2 comprise the

avoided unit fuel reference plant. That is, the delivered price of coal burned

at CR 1 and 2 is used as a fuel proxy for energy payment calculation purposes

of the avoided unit. Duke plans to retire CR 1 and 2 in April 2018. Thus, after

this date energy payment calculations could not be calculated pursuant to the

terms of the contracts. Duke and the parties to each QF PPA have negotiated

respective amendments to the contracts, attached as Attachment A, that seek to

substitute the delivered price of coal burned at CR 1 and 2 with the Substitute

Index, an index designed to approximate the delivered price of coal burned at

CR 1 and 2. Each of the amendments utilizes the Substitute Index, with the

index’s development methodology being identical among all amendments.

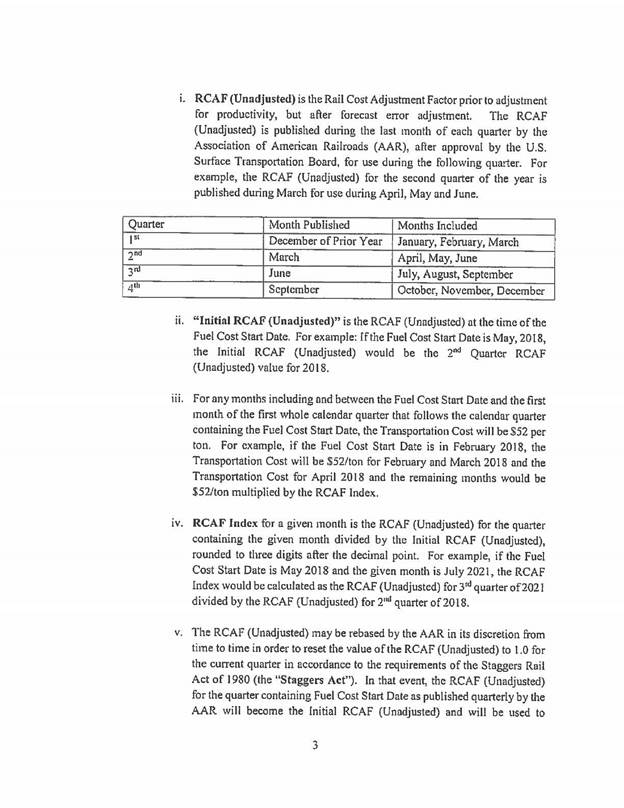

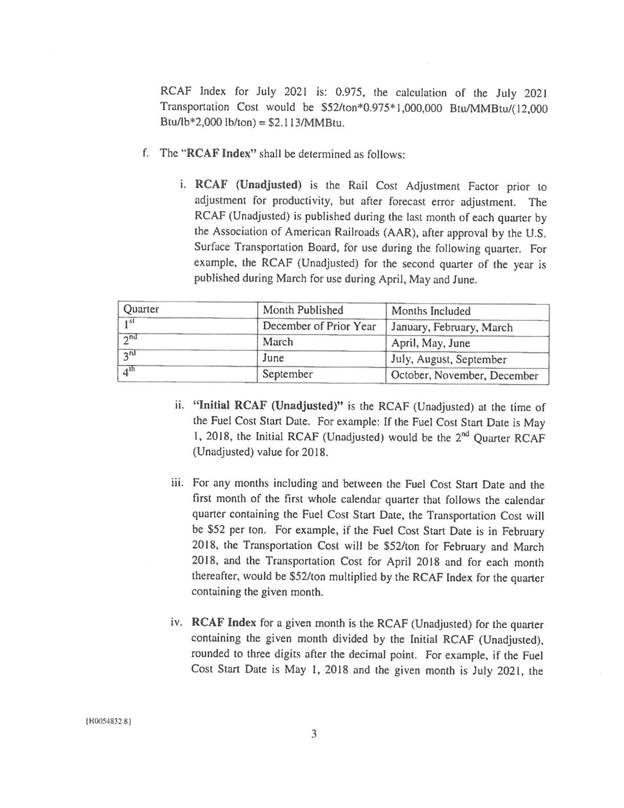

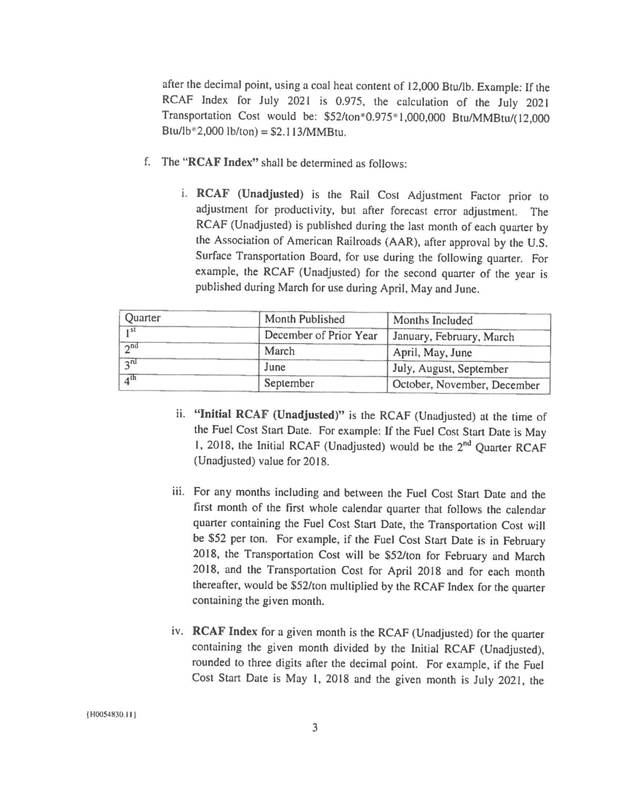

The Substitute Index is designed as a composite index,

calculated as the sum of a coal price index and a transportation cost index,

unitized in $/MMBtu. The coal price index is the unweighted monthly average of

the weekly SNL Physical Market Survey Prompt Year price for NYMEX Big Sandy

River Barge coal in $/ton published by SNL and converted to $/MMBtu. This index

was chosen by Duke and the qualifying facilities because the characteristics of

the coal, including heat rate and sulfur content, best matched that of the coal

burned at CR 1 and 2 and because the index was public, transparent, and had

historic values that were readily available. Following selection, the historic

values of the coal price index were compared to the actual comprehensive fuel

costs of CR 1 and 2 found on Duke’s A4 Schedule, System Net Generation and Fuel

Cost Report. A variable, yet persistent, difference was identified over the eight

years of data reviewed and was calculated to be approximately $52/ton. This

difference was used as the foundation for the transportation cost index used in

the Substitute Index. To account for future transportation cost variability,

and to arrive at the final transportation cost index, the $52/ton rate is

multiplied by a Rail Cost Adjustment Factor index, which sensitizes the

transportation cost to the rate of inflation in railroad inputs such as labor

and fuel. Staff finds the Substitute Index is designed in a logical, fair, and

robust manner and recognizes its use in the amendments to the QF PPAs as a good

faith effort to maintain the cost-effectiveness of the QF PPAs as originally

approved by the Commission.

Three years of historic monthly energy prices used to

calculate payments to each of the qualifying facilities under current

contractual obligations were compared to prices calculated utilizing the

Substitute Index as a fuel cost proxy in order to evaluate the potential for

future payment deviations. After removal of outliers, payments calculated

utilizing the Substitute Index were on average 0.058 $/MMBtu higher than

as-paid fuel prices, representing an average 1.49 percent increase. Duke

determined that a 1 percent increase in the value of the Substitute Index would

result in a $0.03/1000 kWh increase to customer bills. In light of this

information, the use of the Substitute Index to approximate the delivered price

of coal to CR 1 and 2 over the remaining durations of the contracts is expected

to result in energy payments that would remain approximately equivalent to

those that would have been made had CR 1 and 2 remained in-service. Furthermore,

any potential payment deviations from use of the Substitute Index that ultimately

reach the customer through cost recovery mechanisms were determined to have minimal

impact to ratepayer’s bills. Therefore, staff recommends that the amendments to

the QF PPAs are cost effective.

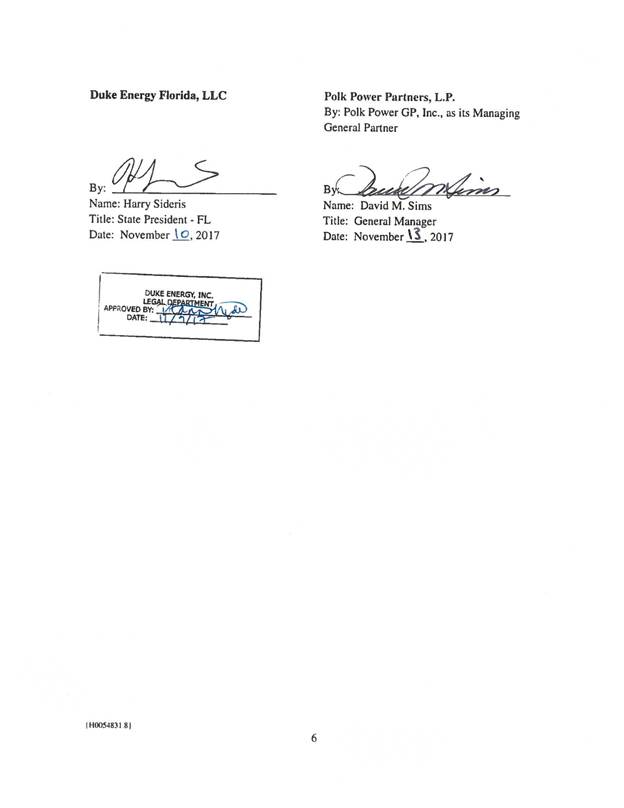

While each amendment seeks to modify its respective QF PPA

and implement use of the Substitute Index, the language used in each amendment

naturally differs as a consequence of the differences in language used in each

individual QF PPA. As a result of this, the amendments were also evaluated for

their ability to accurately incorporate the Substitute Index as a fuel cost

proxy in their respective QF PPA. Those amendments modifying the Orange, Polk,

and Orlando contracts were determined to contain appropriate language. The

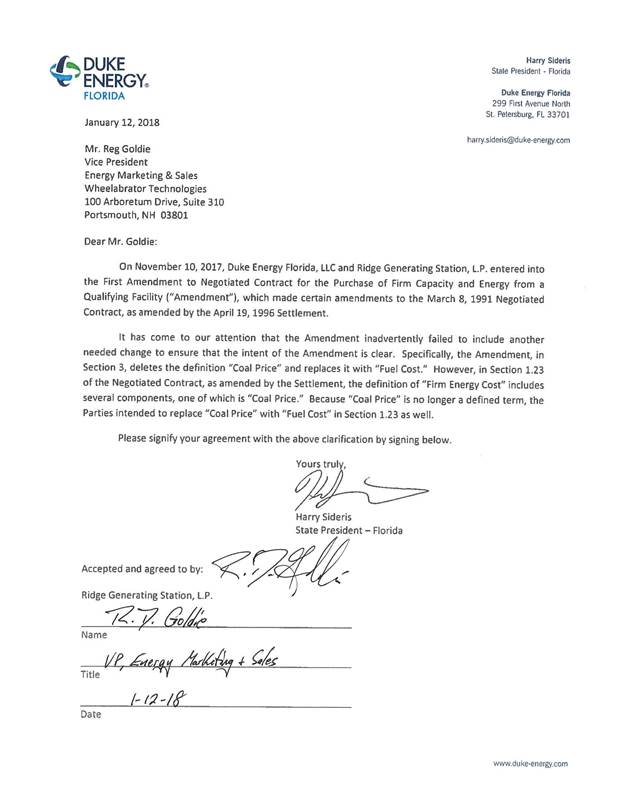

amendment modifying the Ridge contract was found to omit language necessary to

identify the use of the Substitute Index as a factor in the calculation of

energy payments while simultaneously replacing its predecessor. Duke was

notified of this omission and has filed a letter agreement between Duke and

Ridge detailing the necessary amendment modifications, attached as Attachment

B.

Conclusion

Duke currently plans to retire CR 1 and 2 in April 2018,

coal units comprising the avoided unit fuel reference plant as defined in the

QF PPAs. The amendments to the QF PPAs seek to substitute the delivered price

of coal burned at CR 1 and 2 with the Substitute Index, a fuel cost proxy

expected to approximate the delivered price of coal to CR 1 and 2. The

remaining total annual payments under the modified QF PPAs are expected to

remain approximately equivalent to those estimated prior to modification.

The amendments to the QF PPAs do not modify any other part

of their respective contracts. Thus, the core provisions of the QF PPAs,

including total energy delivery amounts, contract duration, reliability,

security, and risk allocation remain unchanged. Therefore, staff recommends

that the Commission approve Duke’s petition for approval of the amendments to

the QF PPAs.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no person whose substantial interests are

affected by the proposed agency action (PAA) files a protest within 21 days of

the issuance of the PAA Order, a Consummating Order should be issued and the

docket should be closed. (Cuello)

Staff Analysis:

If no person whose substantial interests are

affected by the proposed agency action files a protest within 21 days of the

issuance of the PAA Order, a Consummating Order should be issued and the docket

should be closed.