Discussion

of Issues

Issue 1:

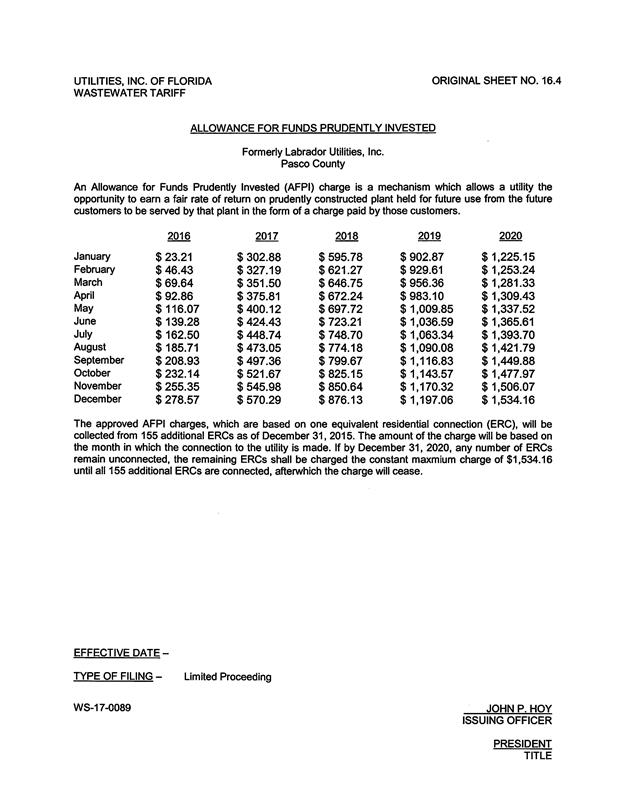

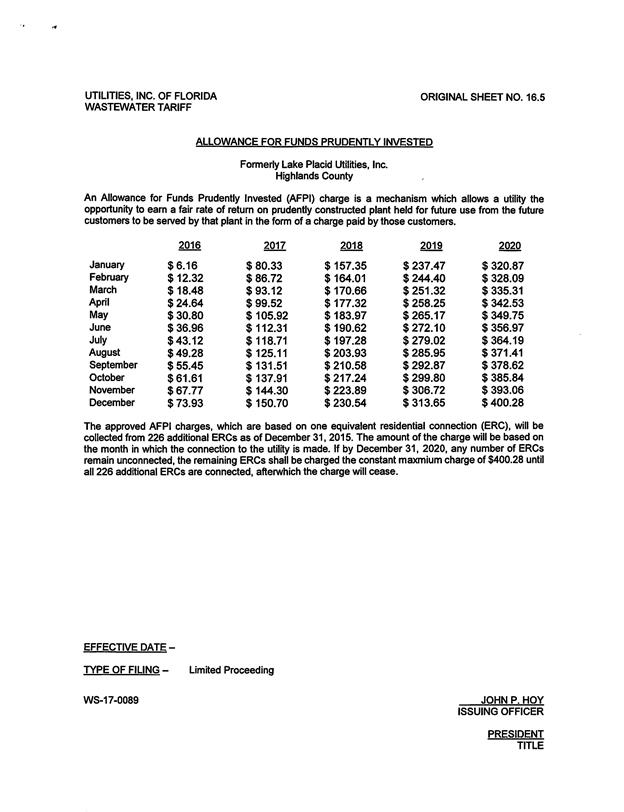

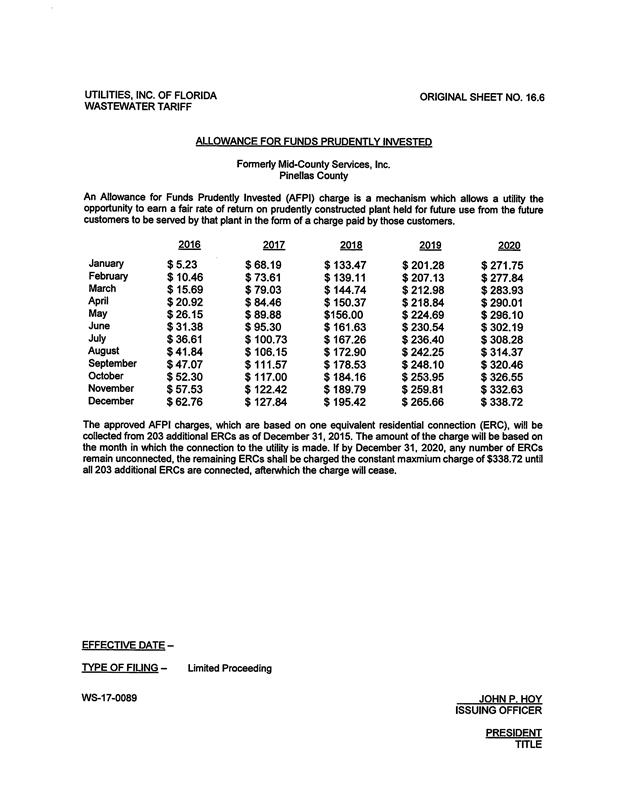

Should UIF be authorized to collect the proposed AFPI

charges for its Labrador, Lake Placid, Mid-County, and UIF-Marion wastewater systems?

Recommendation:

Yes. UIF should be

authorized to collect the proposed AFPI charges, shown on Attachment A, from

future wastewater customers in its Labrador, Lake Placid, Mid-County, and

UIF-Marion systems. After December 31, 2020, the utility should be allowed to

collect the constant charge until the projected ERCs included in the

calculation of the charge have been added, upon which the charges should be

discontinued. The AFPI charges should apply to future connections of 155 ERCs

for Labrador, 226 ERCs for Lake Placid, 203 ERCs for Mid-County, and 45 ERCs

for the UIF-Marion system.

UIF should provide notice to property owners who have

requested service during the 12

months prior to the month the request for AFPI charges was filed. The approved

charges should be effective for connections made on or after the stamped

approval date on the tariff sheets. The Utility should provide proof of noticing

within 10 days of providing its approved notice. (Bruce)

Staff Analysis:

Pursuant to Rule 25-30.434, Florida Administrative

Code (F.A.C.), an AFPI charge is a mechanism designed to allow a utility the

opportunity to earn a fair rate of return on prudently constructed plant held

for future use from the customers that will be served by that plant. This

one-time charge is assessed based on the date the future customer connects to

the utility’s system.

The utility’s proposed AFPI charges for the Labrador, Lake

Placid, Mid-County, and UIF-Marion wastewater systems (Attachment A) are based

on the non-U&U adjustments associated with those wastewater treatment plants

(WWTP) in Order No. PSC-2017-0361-FOF-WS. The Labrador WWTP was determined to

be 79.94 percent U&U, the Lake Placid WWTP was 29.79 percent U&U, the

Mid-County WWTP was 93.67 percent

U&U, and the UIF-Marion WWTP was 68.65 percent U&U. The U&U adjustments

in that rate case excluded a return on the non U&U portion of the

investments and the associated depreciation, property taxes, and regulatory

assessment fees from the approved revenue requirement. The proposed tariffs

filed on February 8, 12, and 15, 2018, reflect the new corporate federal tax

rate that became effective on January 1, 2018.

Pursuant to Rule 25-30.434(4), F.A.C., the beginning date

for accruing the AFPI charges should agree with the month following the end of

the test year that was used to establish the amount of non-U&U plant. The

test year used in Docket No. 201610101-WS for establishing the amount of

non-U&U plant was the year ended December 31, 2015; therefore, the

beginning date for accruing the AFPI in this case is January 1, 2016. The proposed

AFPI charges were calculated for a five-year period consistent with Rule

25-30.434(5), F.A.C. After December 31, 2020, the utility should be allowed to

collect the constant charge (reflecting the costs accrued through the fifth

year) until the projected equivalent residential connections (ERCs) included in

the calculation of the charge have been added, upon which the charges should be

discontinued. The AFPI charges

should apply to future connections of 155 ERCs for Labrador, 226 ERCs for Lake Placid, 203 ERCs for Mid-County, and 45 ERCs for the UIF-Marion system.

UIF should provide notice to property owners who have

requested service during the 12 months prior to the month the request for AFPI

charges was filed. The approved charges should be effective for connections

made on or after the stamped approval date on the tariff sheets. In accordance

with Rule 25-30.434(4), F.A.C., no charge may be collected for connections made

prior to the effective date of the AFPI charges. The Utility should provide proof

of noticing within 10 days of providing its approved notice. The charges

reflect the costs associated with one ERC based on 280 gallons per day (gpd)

per ERC. If a future customer is expected to place more demand on the system

than one ERC, the charge should be multiplied by the number of ERCs of demand

which are needed to provide service to the customer.

Conclusion

Based on the above, UIF

should be authorized to collect the proposed AFPI charges from future wastewater

customers in its Labrador, Lake Placid, Mid-County, and UIF-Marion systems.

After December 31, 2020, the utility should be allowed to collect the constant

charge until the projected ERCs included in the calculation of the charge have

been added, upon which the charges should be discontinued. The AFPI charges

should apply to future connections of 155 ERCs for Labrador, 226 ERCs for Lake

Placid, 203 ERCs for Mid-County, and 45 ERCs for the UIF-Marion system.

UIF should provide

notice to property owners who have requested service during the 12 months prior

to the month the request for AFPI charges was filed. The approved charges

should be effective for connections made on or after the stamped approval date

on the tariff sheets. The Utility should provide proof of noticing within 10

days of providing its approved notice.

Issue 2:

Should UIF be authorized to collect the

proposed AFPI charges for its LUSI wastewater system?

Recommendation:

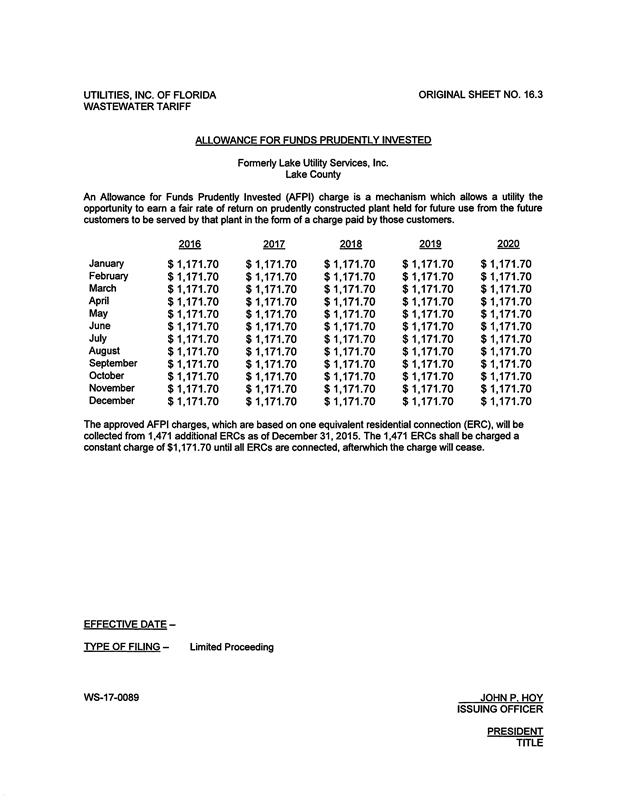

No. UIF’s proposed tariff as filed should be

denied. UIF should be given the option

to file a revised tariff within 10 days of the Commission’s vote, for

administrative approval by staff, that reflects the non U&U costs

associated with the LUSI WWTP, pursuant to Order No. PSC-2017-0361-FOF-WS, and

accrued beginning January 1, 2016.

Upon staff’s administrative approval, UIF should be

authorized to collect the proposed AFPI charges from future wastewater

customers in its LUSI system. After December 31, 2020, the utility should be

allowed to collect the constant charge until the projected ERCs included in the

calculation of the charge have been added, upon which the charges should be

discontinued. The AFPI charges should apply to 1,471 future ERCs.

UIF should provide

notice to property owners who have requested service during the 12 months prior to the month the request for AFPI

charges was filed. The approved charges should be effective for connections

made on or after the stamped approval date on the tariff sheets. The Utility

should provide proof of noticing within 10 days of providing its approved

notice. (Bruce)

Staff Analysis:

The utility’s proposed AFPI charges for the LUSI WWTP

(Attachment B) are based on the non-U&U adjustments determined in Order No.

PSC-2017-0361-FOF-WS. The proposed tariff filed on February 8, 2018, reflects

the new corporate federal tax rate that became effective on January 1, 2018. However,

staff believes that, because the utility’s proposed tariff reflects costs

accrued beginning in 2010, the proposed tariff is inconsistent with Rule

25-30.434(4), F.A.C. As discussed in Issue 1, the rule provides that the

beginning date for accruing the AFPI charges should agree with the month

following the end of the test year that was used to establish the amount of

non-U&U plant which, in this case, is January 1, 2016. The utility contends

that the AFPI charges should not be reset (accrued beginning January 1, 2016),

but should continue from the prior U&U adjustments.

AFPI charges applicable to the LUSI WWTP (formerly known

as Lake Groves) were previously approved in 1991 in the utility’s original

certificate case. At that

time, the capacity of the system was 160,000 gpd and the AFPI charges were

based on the 545 ERCs which the system was originally designed to serve. UIF

purchased the Lake Groves system in 1998 and increased the capacity to 500,000

gpd in 2000. In 2007,

the treatment capacity was expanded to 1,000,000 gpd and in a subsequent rate

case, Docket No. 20070693-WS, the Commission found the wastewater treatment

plant to be approximately 53 percent U&U. The

utility was serving approximately 2,860 wastewater customers at that time. In the

utility’s next rate case, Docket No. 20100426-WS, the Commission again found the

1,000,000 gpd WWTP to be 53 percent U&U based on the U&U percentage

from the prior order.

Pursuant to Order No. PSC-2017-0361-FOF-WS, the utility’s

most recent rate case, the Commission found the LUSI WWTP to be 58.78 percent

U&U (including prepaid commitments). However,

because the LUSI WWTP was serving in excess of the original 545 ERCs the system

was designed to serve, the LUSI WWTP AFPI charges were discontinued and an

investigation was opened to determine whether there was an over collection of

AFPI charges. The

investigation addresses AFPI collections prior to 2018, while the proposed charges

in this docket will be collected from future connections.

Although it was determined that the utility had

non-U&U plant in prior dockets, the AFPI charges were not re-evaluated by

staff and the utility did not request that the LUSI AFPI charges be revised

following the addition of the original 545 ERCs and the plant expansion that

occurred in 2007. Because it is incumbent upon the utility to request

consideration of AFPI charges for non-U&U capacity, staff does not believe it

is appropriate to accrue AFPI charges prior to January 1, 2016. However, the

utility should be given the option to file a revised tariff within 10 days of

the Commission’s vote, for administrative approval by staff, that reflects the

non U&U costs associated with the LUSI WWTP, pursuant to Order No.

PSC-2017-0361-FOF-WS, and accrued beginning January 1, 2016.

Upon staff’s administrative approval, UIF should be

authorized to collect the proposed AFPI charges from future wastewater

customers in its LUSI system. After December 31, 2020, the utility should be

allowed to collect the constant charge until the projected ERCs included in the

calculation of the charge have been added, upon which the charges should be discontinued.

The AFPI charges should apply to 1,471 future ERCs.

UIF should provide

notice to property owners who have requested service during the 12 months prior to the month the request for AFPI

charges was filed. The approved charges should be effective for connections

made on or after the stamped approval date on the tariff sheets. The Utility

should provide proof of noticing within 10 days of providing its approved

notice.

Issue 3:

Should this docket be closed?

Recommendation:

If the Commission approves

staff’s recommendation in Issue 1, the docket should remain open pending

staff’s verification that the revised tariff sheets and notice have been filed

by the utility and approved by staff. If a protest is filed within 21 days of

the issuance date of the Order, the approved tariff should remain in effect

with the charge held subject to refund pending resolution of the protest. If no

timely protest is filed, a consummating order should be issued.

If the Commission approves staff’s

recommendation in Issue 2, UIF timely files a revised AFPI tariff for its LUSI

wastewater system, and a protest is filed within 21 days of the issuance of the

order, the revised tariffs should remain in effect, with any revenues held

subject to refund, pending staff’s verification that the revised tariff sheets

and notice have been filed by the utility and approved by staff; the docket

should remain open pending resolution of the protest. If UIF timely files a revised AFPI tariff for

its LUSI wastewater system and no timely protest is filed with respect to that

issue, the docket should remain open pending staff’s verification that the

revised tariff sheets and notice have been filed by the utility and approved by

staff, a consummating order should be issued, and the docket should be closed

administratively.

If the Commission approves staff’s recommendation in Issue

2, UIF does not timely file a revised AFPI tariff meeting the conditions of the

order, and a protest is filed within 21 days of the issuance of the order, the

tariffed charges originally requested by UIF could be placed into effect, with

any revenues held subject to refund, pending staff’s verification that the

revised tariff sheets and notice have been filed by the utility and approved by

staff; the docket should remain open pending resolution of the protest. If UIF does

not timely file a revised AFPI tariff with respect to its LUSI wastewater

system and no timely protest is filed, a consummating order should be issued,

and the docket closed administratively. (Crawford)

Staff Analysis:

If the Commission approves

staff’s recommendation in Issue 1, the docket should remain open pending

staff’s verification that the revised tariff sheets and notice have been filed

by the utility and approved by staff. If a protest is filed within 21 days of

the issuance date of the Order, the approved tariff should remain in effect

with the charge held subject to refund pending resolution of the protest. If no

timely protest is filed, a consummating order should be issued.

If the Commission approves staff’s

recommendation in Issue 2, UIF timely files a revised AFPI tariff for its LUSI

wastewater system, and a protest is filed within 21 days of the issuance of the

order, the revised tariffs should remain in effect, with any revenues held

subject to refund, pending staff’s verification that the revised tariff sheets

and notice have been filed by the utility and approved by staff; the docket

should remain open pending resolution of the protest. If UIF timely files a revised AFPI tariff for

its LUSI wastewater system and no timely protest is filed with respect to that

issue, the docket should remain open pending staff’s verification that the

revised tariff sheets and notice have been filed by the utility and approved by

staff, a consummating order should be issued, and the docket should be closed administratively.

If the Commission approves staff’s recommendation in Issue

2, UIF does not timely file a revised AFPI tariff meeting the conditions of the

order, and a protest is filed within 21 days of the issuance of the order, the

tariffed charges originally requested by UIF could be placed into effect, with

any revenues held subject to refund, pending staff’s verification that the

revised tariff sheets and notice have been filed by the utility and approved by

staff; the docket should remain open pending resolution of the protest. If UIF does

not timely file a revised AFPI tariff with respect to its LUSI wastewater

system and no timely protest is filed, a consummating order should be issued,

and the docket closed administratively.