†Case Background

On April 16, 2018,

Florida Power & Light Company (FPL)

filed a Petition for Mid-Course Corrections to its 2018 Capacity and

Environmental Cost Recovery Factors that reflect the impact of the Tax Cuts and

Jobs Act of 2017 (FPL Mid-Course Petition). The FPL Mid-Course Petition seeks

to reduce the respective 2018 capacity cost recovery factors that were approved

in Order No. PSC-2018-0105-PCO-EI,[1] and the environmental cost recovery

factors that were approved in Order No. PSC-2018-0100-FOF-EI.[2] Staff notes that the capacity cost

recovery† portion of FPLís Mid-Course

Petition will be addressed in Docket No. 20180001-EI, and environmental cost

recovery clause reduction will be addressed in Docket No. 20180007-EI.

Mid-course

corrections are part of the fuel and purchased power cost recovery clause (fuel

clause) proceeding, and such corrections are used by the Commission between

fuel clause hearings whenever costs deviate from revenues by a significant

margin. Petitions for mid-course corrections to fuel factors are addressed in

Rule 25-6.0424, Florida Administrative Code (F.A.C.). Under this rule, a

utility must notify the Commission whenever it expects to experience an

under-recovery or over-recovery greater than 10 percent. Pursuant to Rule

25-6.0424, F.A.C., the mid-course percentage is the estimated end-of-period

total net true-up amount divided by the current periodís total actual and

estimated jurisdictional fuel revenue applicable to period amount.

Mid-course

corrections are considered preliminary procedural decisions, and any

over-recoveries or under-recoveries caused by or resulting from the Commission-approved

adjusted fuel or capacity factors may be included in the following yearís fuel or

capacity factors.†

The Commissionís

jurisdiction to consider fuel clause proceedings derives from the Commissionís

authority to set fair and reasonable rates, found in Section 366.05, Florida

Statutes.

Discussion

of Issues

Issue 1:

Should the Commission approve FPL's Mid-Course Petition

to correct its capacity cost recover factors and the associated tariff sheets?

Recommendation:

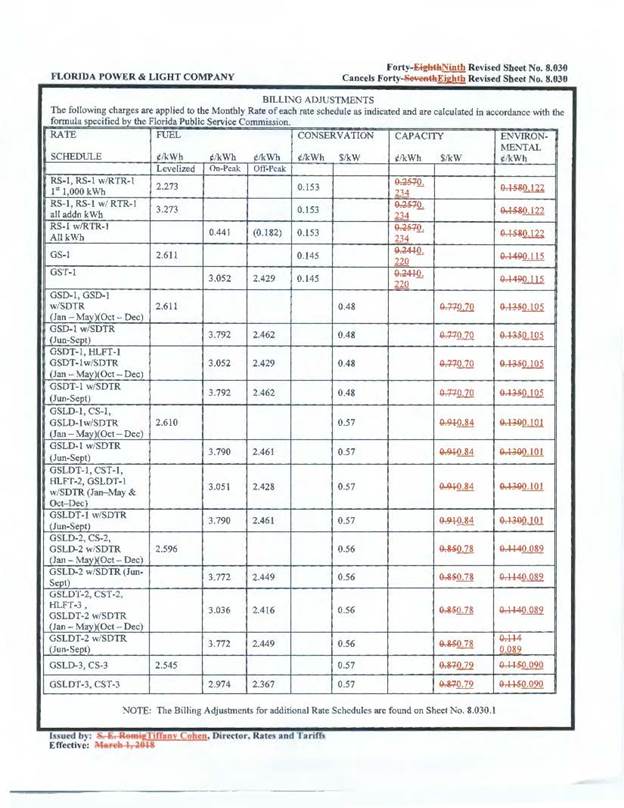

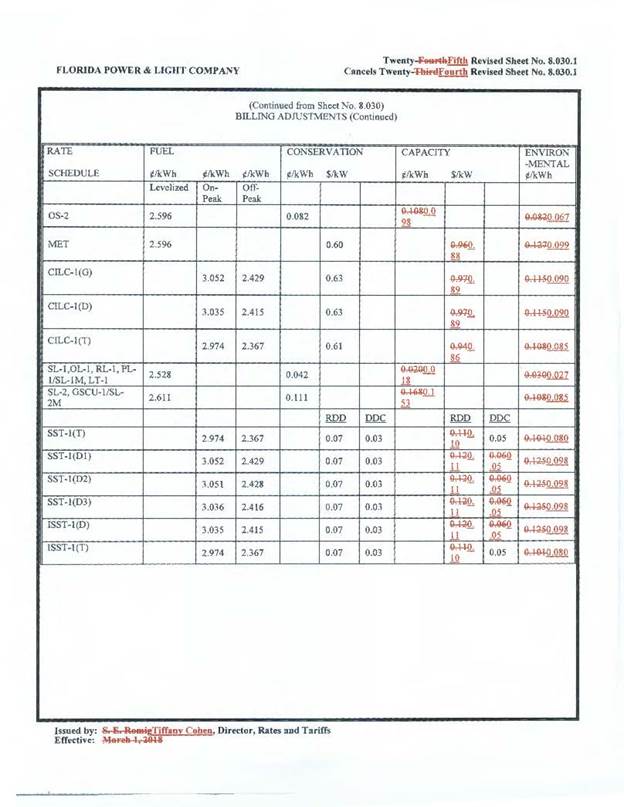

Yes. FPLís

request for mid-course correction to its 2018 capacity cost recovery factors

and the associated tariff sheets should be approved. The recommended capacity cost

recovery factors are presented in Attachment A and the associated tariff sheets

are presented in Attachment B. The revised capacity cost recovery factors and

the associated tariff sheets should become effective with the July 2018 billing

cycle, which begins on July 1, 2018. The Commission should give staff

administrative authority to approve the tariff sheets implementing the approved

rate adjustments. (Barrett, Galloway, Draper, Guffey)

Staff Analysis:

Midcourse

Adjustment for Capacity Cost Recovery (CCR) Factors

FPLís

currently authorized 2018 fuel and capacity amounts and factors are codified in

the First Mid-Course Order, which projected total capacity costs of

$282,109,414 for 2018. Because this projection of total capacity-related costs

was developed before the Tax Cuts and Jobs Act of 2017 lowered the federal

income tax rate for corporations from 35 percent to 21 percent, many of the

costs embedded in that total are now overstated. Federal income tax rate

amounts are included in the calculation of the capacity costs that have a

capital component, such as the Cedar Bay, Indiantown, and St. John River Power

Park Transactions, or the capital-related costs for Incremental Power Plant

Security, as shown in Schedule E12A/B of FPLís Mid-Course Petition. When the

lower federal income tax amount is incorporated into the projected costs, the

revised total capacity costs for 2018 are $261,614,030. When the true-up

provision amounts are applied and final calculations are performed, the total

end-of-period balance reflects that FPL would over-recover its capacity costs

for 2018 by $12,071,089, or 4.61 percent.

If FPLís Mid-Course Petition is granted, this amount would

be recovered through reduced capacity cost recovery factors for JulyĖDecember

2018. For a residential customer using 1,000 kilowatt hours (kWh) of

electricity, the capacity portion of their bill will be reduced by $0.23. The

revised capacity cost recovery factors are reflected on Attachment A.

As noted previously, the FPL Mid-Course Petition also

seeks to reduce the respective 2018 environmental cost recovery factors, as

addressed in a recommendation filed in Docket No. 20180007-EI. A typical bill

comparison for a residential customer using 1,000 kWh of electricity is

presented in Attachment C showing all of the changes that would be implemented

in the July billing cycle, pending Commission approval.†

Bill

Impact and Customer Notifications

Consistent

with the First Mid-Course Order, the current bill for a residential customer

using 1,000 kWh of electricity for the period March-December, 2018, is $99.37

per month, with a capacity cost recovery component of $2.57 per month. As

proposed, the capacity cost recovery component will be reduced by $0.23 per

month, to $2.34 per month. In addition, an environmental cost recovery clause

reduction of $0.36 per month is being addressed in Docket No. 20180007-EI, and

a small change is proposed for the storm bond charge.

The sum of those three changes results in a slight reduction to the Gross

Receipts Tax, as well. Pending the Commissionís approval in this matter and the

similar consideration in Docket No. 20180007-EI, the proposed bill for a

residential customer using 1,000 kWh of electricity for July-August, 2018, is

projected to be $98.87 per month, as shown and presented in Column 3 from Table

1 of Attachment C.

Staff believes

implementing reduced capacity cost recovery factors is in the best interests of

FPLís customers because the factors would be decreasing, and customers would receive

the benefit of reduced rates as quickly as administratively possible.

In its May 30 2018, response to Commission

staffís Second Data Request, Question No. 5, FPL stated that it will notify

customers with bill inserts 30 days in advance of the rates taking effect. In

addition, FPL stated the billing changes identified in the instant petition

will be addressed in the Companyís next quarterly newsletter (to be published

in July 2018). FPLís website will include links to show the proposed rate

schedules for residential and business rate classes that are proposed to become

effective July 1, 2018. The Company stated that physical restrictions on bill

inserts limit the amount of detail that can be included in such notifications,

but noted its customers can access detailed billing information from links on

the Companyís website.

If approved

by the Commission, this mid-course correction will result in lower capacity

cost recovery factors for FPLís customers. This mid-course correction was filed

by FPL with the intention of the proposed decrease in rates becoming effective

July 1, 2018. Typically, effective dates are set a minimum of 30 days after a

Commission vote modifying the charges as the result of a mid-course correction.[8] This time

limit is imposed in order to not have new rates applied to energy consumed

before the effective date of the Commissionís action, i.e., the date of the

vote. However, the Commission has also implemented charges in less than 30 days

when circumstances warrant.[9] In this

instance, the interval between the Commissionís vote on this matter (June 5,

2018) and the proposed implementation date (expected to be July 1, 2018) is 25

days. Because this filing, if approved, results in a decrease to cost recovery

factors, staff believes the 25 day interval is sufficient.

Conclusion

Staff recommends the Commission approve FPLís request for mid-course correction to its 2018

capacity cost recovery factors and the associated tariff sheets. The

recommended capacity cost recovery factors are presented in Attachment A and the

associated tariff sheets are presented in Attachment B. The revised capacity

cost recovery factors and the associated tariff sheets should become effective with

the July 2018 billing cycle, which begins on July 1, 2018. The Commission

should give staff administrative authority to approve the tariff sheets implementing

the approved rate adjustments.

Issue 2:

Should this docket be closed?

Recommendation:

The fuel docket is on-going and should remain open.

(Brownless)

Staff Analysis:

The fuel docket is on-going and should remain open.