†Case Background

On April 16, 2018,

Florida Power & Light Company (FPL or Company) filed a Petition for

Mid-Course Corrections to its 2018 Environmental Cost Recovery Clause (ECRC) factors that reflect the impact of the Tax

Cuts and Jobs Act of 2017 (Mid-Course Petition). By its Mid-Course Petition, FPL

seeks to reduce the 2018 ECRC factors that were approved in Order No. PSC-2018-0100-FOF-EI.[2]

Mid-course

corrections are rare in the ECRC docket and are more typical in the fuel

docket. Mid-course corrections are considered preliminary procedural decisions,

and any over-recoveries or under-recoveries resulting from the approval by the Florida

Public Service Commission (Commission) may be adjusted in the following year

proceeding. †

The Tax Cuts and

Jobs Act of 2017 (Tax Act) was signed into law on December 22, 2017, about four

months after FPL filed its projection testimony and cost recovery schedules for

2018. In addition to filing its Mid-Course Petition in Docket No. 20180007-EI,

FPL filed similar petitions in Docket No. 20180001-EI, the Fuel and Capacity

Cost Recovery Clause docket, and in Docket No. 20180046-EI, Consideration of

the tax impacts associated with Tax Cuts and Jobs Act of 2017 for FPL.

The Commission

has jurisdiction over this matter pursuant to Section 366.05 and 366.8255,

Florida Statutes. (F.S.)

Discussion

of Issues

Issue 1:

Should the Commission approve FPLís Mid-Course Petition

to correct its 2018 ECRC factors and associated tariff sheets?

Recommendation:

Yes. Staff recommends approval of FPLís Mid-Course Petition

which was filed to address a federal tax reduction. Approval will allow for a

reduction in the ECRC factors and will decrease customer bills. The revised

factors and associated tariffs should become effective July 1, 2018. (Mtenga) †

Staff Analysis:

The projected ECRC costs for 2018 were developed

before the Tax Act was signed into law. The Tax Act will have the effect of

lowering the federal income tax rate for corporations from 35 percent to 21 percent;

therefore, some of the costs embedded into the total projected ECRC costs for

2018 are overstated. Federal income tax amounts are included in the calculation

of the costs that have a capital component. Adjustments for tax impacts on revenue

requirements recovered through the ECRC will change the currently approved

factors. The impact of the Tax Act on FPLís ECRC cost projections result in an

over-recovery of approximately $19.1 million or 9.2 percent. Approval of FPLís Mid-Course

Petition will result in a reduction to the typical 1,000 kWh monthly

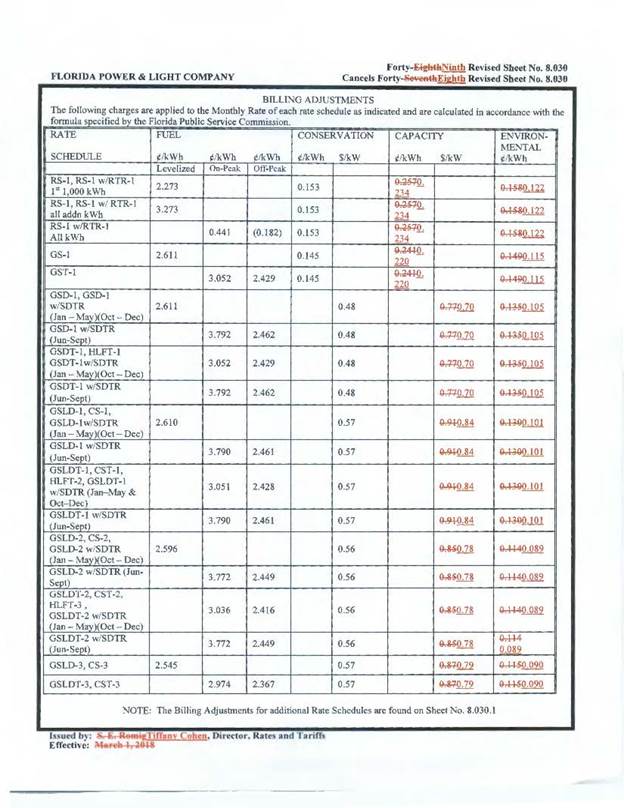

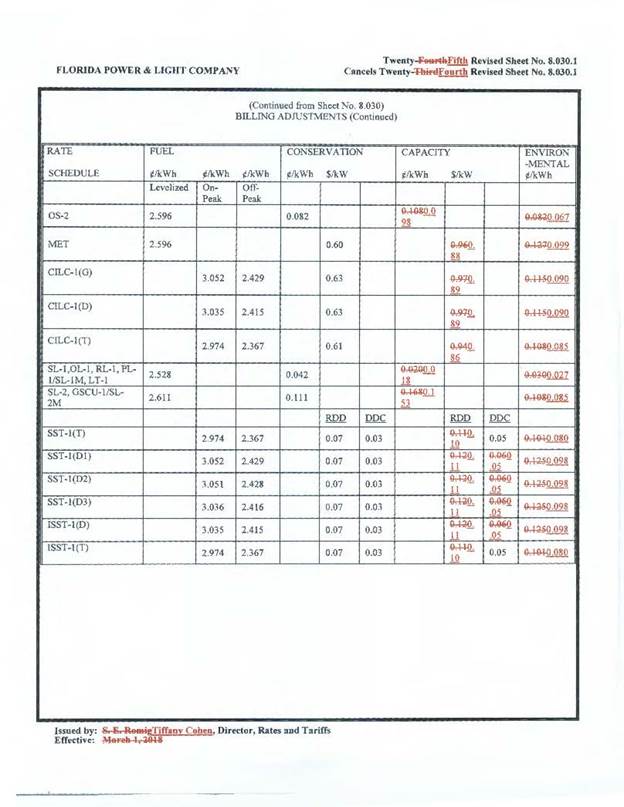

residential customer bill of $0.36. The revised tariffs are included as

Attachment A. In its May 10, 2018, response to staffís second set of

interrogatories No. 19, FPL indicated that the Company will include a short

bill insert on all customer bills 30 days in advance of the rates taking

effect, and will provide updated rate schedules on its website.

FPLís Mid-Course Petition was filed with the intention of

the proposed decrease in rates becoming effective July 1, 2018. Typically,

effective dates are set at a minimum of 30 days after a Commission vote

modifying the charges as the result of a mid-course correction.[3] This time

limit is imposed in order to not have new rates applied to energy consumed

before the effective date of the Commissionís action. However, the Commission

has also implemented charges in less than 30 days when circumstances warrant.[4] In this

instance, the interval between the Commissionís vote on this matter (June 5,

2018), and the proposed implementation date (expected to be July 1, 2018) is 25

days. Since this filing, if approved, results in a decrease to cost recovery

factors, staff recommends that the 25 day interval is sufficient.

Staff recommends

approval of FPLís Mid-Course Petition which was filed to address a federal tax

reduction. Approval will allow for a reduction in the ECRC factors and will

decrease customer bills. The revised factors and associated tariffs should

become effective July 1, 2018.

Issue 2:

Should this docket be closed?

Recommendation:

No. The ECRC docket is on-going and should remain

open. (Murphy)

Staff Analysis:

The ECRC docket is on-going and should remain open.