Discussion

of Issues

Issue 1:

Should the Commission approve the amended renewable

energy tariff and standard offer contract filed by Florida Power & Light

Company?

Recommendation:

Yes. The provisions of FPLís revised renewable

energy tariff and standard offer contract conform to the requirements of Rules

25-17.200 through 25-17.310, F.A.C. FPLís 2018 Ten-Year Site Plan does not

include any avoidable fossil fueled generating units, but has a projected

planned purchase of 325 megawatt (MW) in 2019 that is FPLís next planned

purchase that could be avoided or deferred. FPL has also identified its next

avoidable unit which is a 1,778 MW natural gas-fired combined cycle unit at a

greenfield site with an expected in-service date of June 1, 2028. FPLís revised

standard offer contract provides flexibility in the arrangement for payments so

that a developer of renewable generation may select the payment stream best

suited to its financial needs. Staff recommends that FPLís revised renewable

energy tariff and standard offer contract be approved as filed. (Wooten,

Wright, Higgins)

Staff Analysis:

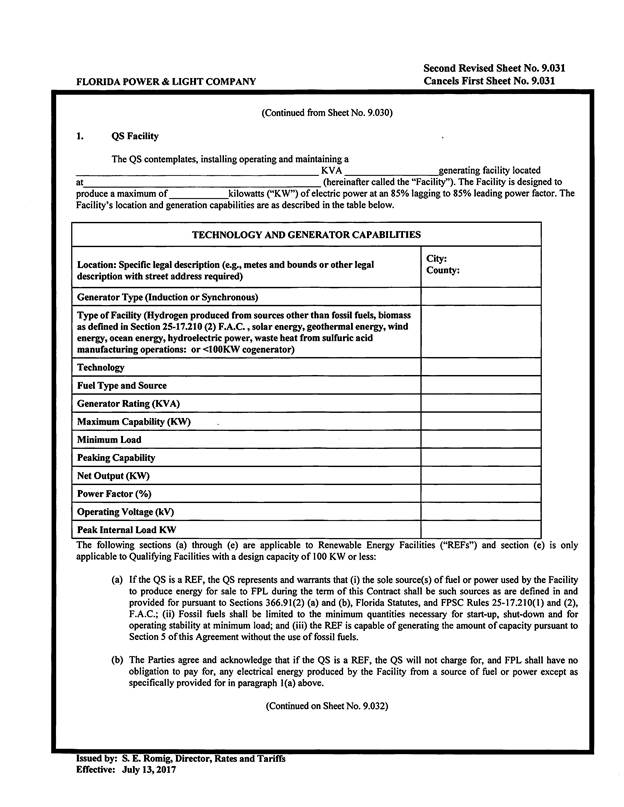

Rule 25-17.250, F.A.C., requires that FPL, an IOU,

continuously make available a standard offer contract for the purchase of firm

capacity and energy from renewable generating facilities (RF) and small

qualifying facilities (QF) with design capacities of 100 kilowatts (kW) or

less. Pursuant to Rules 25-17.250(1) and (3), F.A.C., the standard offer

contract must provide a term of at least 10-years, and the payment terms must

be based on the Utilityís next avoidable fossil-fueled generating unit

identified in its most recent Ten-Year Site Plan or, if no avoided unit is

identified, its next avoidable planned purchase. FPLís 2018 Ten-Year Site Plan

does not include any avoidable fossil fueled generating units but has a

projected planned purchase of 325 MW in 2019 that would be FPLís next planned

purchase that could be avoided or deferred. However, in an effort to encourage

renewable generation, FPL has identified its next avoidable unit as a 1,778 MW

natural gas-fired combined cycle unit at a greenfield site with an expected

in-service date of June 1, 2028. Both the avoided unit and avoided planned

purchase options are available for FPLís revised standard offer contract.

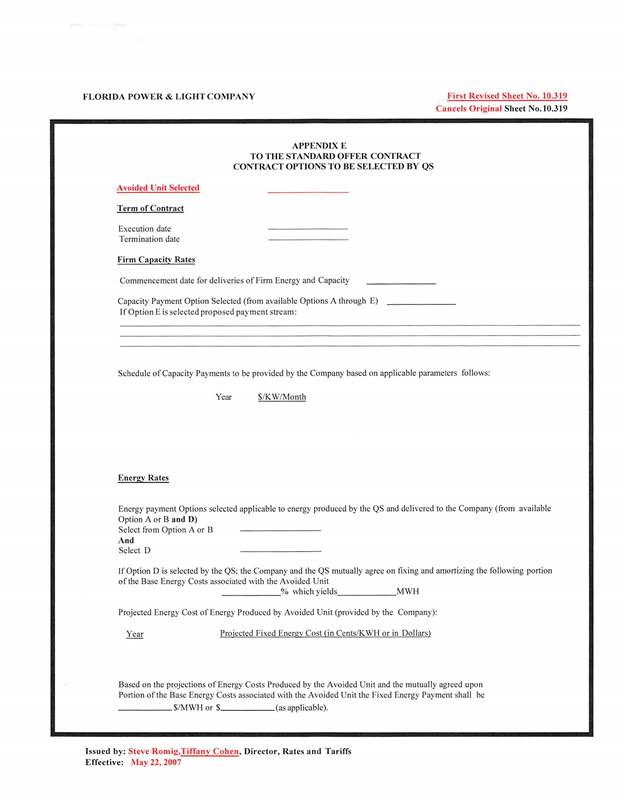

Under FPLís standard offer contract, the RF/QF operator

commits to certain minimum performance requirements based on the identified

avoided unit, such as being operational and delivering an agreed upon amount of

capacity by the in-service date of the avoided unit, and thereby becomes

eligible for capacity payments in addition to payments received for energy. The

standard offer contract may also serve as a starting point for negotiation of

contract terms by providing payment information to an RF/QF operator, in a

situation where one or both parties desire particular contract terms other than

those established in the standard offer.

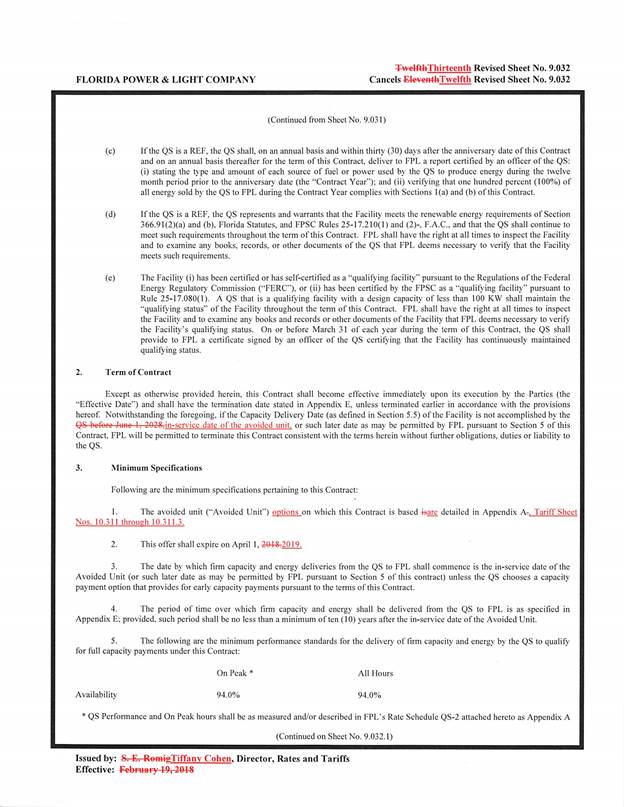

In order to

promote renewable generation, the Commission requires the IOU to offer multiple

options for capacity payments, including the options to receive early or

levelized payments. If the RF/QF operator elects to receive capacity payments

under the normal or levelized contract options, it will receive as-available

energy payments only until the in-service date of the avoided unit (in this

case June 1, 2028), and thereafter begin receiving capacity payments in

addition to energy payments. If either the early or levelized option is

selected, then the operator will begin receiving capacity payments earlier than

the in-service date of the avoided unit. However, payments made under the early

capacity payment options tend to be lower in the later years of the contract

term because the net present value (NPV) of the total payments must remain

equal for all contract payment options.

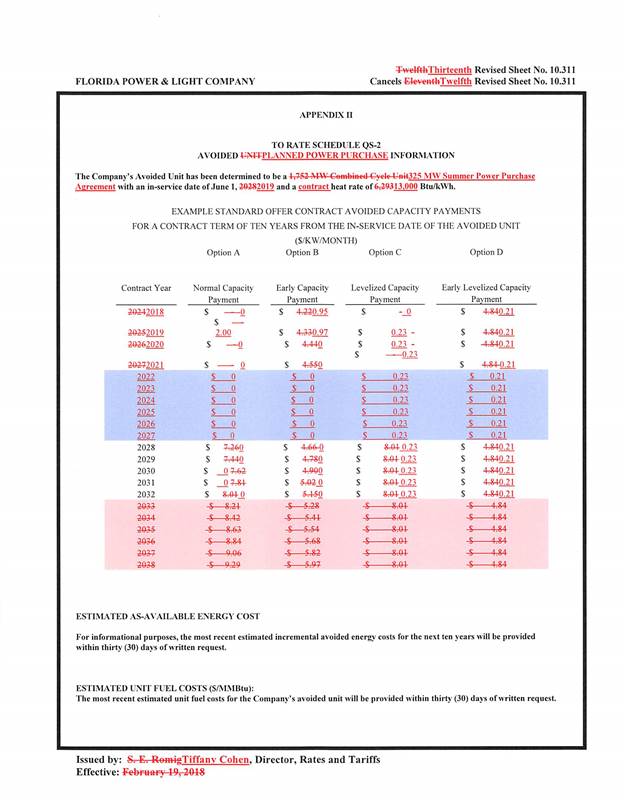

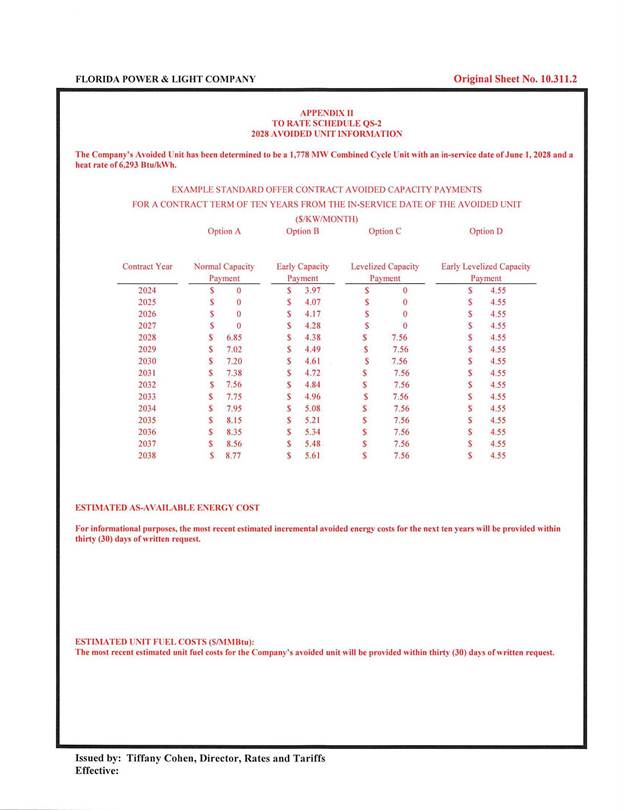

Table 1

below, contains estimates of the annual payments for each payment option

available under the revised standard offer contract to an operator choosing the

2028 avoided unit option. This is available to an operator with a 50 MW

facility operating at a capacity factor of 94 percent that meets the minimum requirement

specified in the contract to qualify for full capacity payments. Normal and

levelized capacity payments begin in 2028, reflecting the projected in-service

date of the avoided unit (June 1, 2028).

Table 1 - Estimated Annual Payments to a 50 MW

Renewable Facility

94 Percent Capacity Factor

|

Year

|

Energy Payment

|

Capacity Payment (By Type)

|

|

Normal

|

Levelized

|

Early

|

Early Levelized

|

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

|

2019

|

10,808

|

-

|

-

|

-

|

-

|

|

2020

|

9,513

|

-

|

-

|

-

|

-

|

|

2021

|

7,836

|

-

|

-

|

-

|

-

|

|

2022

|

8,501

|

-

|

-

|

-

|

-

|

|

2023

|

9,237

|

-

|

-

|

-

|

-

|

|

2024

|

9,730

|

-

|

-

|

2,445

|

2,825

|

|

2025

|

10,236

|

-

|

-

|

2,506

|

2,825

|

|

2026

|

11,235

|

-

|

-

|

2,569

|

2,825

|

|

2027

|

13,098

|

-

|

-

|

2,633

|

2,825

|

|

2028

|

12,312

|

4,111

|

4,581

|

2,699

|

2,825

|

|

2029

|

12,446

|

4,214

|

4,581

|

2,766

|

2,825

|

|

2030

|

12,992

|

4,319

|

4,581

|

2,835

|

2,825

|

|

2031

|

13,453

|

4,427

|

4,581

|

2,906

|

2,825

|

|

2032

|

13,930

|

4,538

|

4,581

|

2,978

|

2,825

|

|

2033

|

14,132

|

4,652

|

4,581

|

3,053

|

2,825

|

|

2034

|

14,483

|

4,768

|

4,581

|

3,129

|

2,825

|

|

2035

|

14,806

|

4,887

|

4,581

|

3,208

|

2,825

|

|

2036

|

15,178

|

5,009

|

4,581

|

3,288

|

2,825

|

|

2037

|

15,475

|

5,134

|

4,581

|

3,370

|

2,825

|

|

2038

|

15,820

|

5,263

|

4,581

|

3,454

|

2,825

|

|

Total

|

256,132

|

51,323

|

50,391

|

43,839

|

42,373

|

|

NPV (2019$)

|

115,228

|

15,671

|

15,671

|

15,671

|

15,671

|

Source: FPLís

Supplemental Response to Staffís First Data Request.

Table 2

below, contains estimates of the annual payments for each payment option

available under the revised standard offer contract if an operator chooses the

avoided planned power purchase contract. This contract is available to an

operator with a 50 MW facility operating at a capacity factor of 94 percent that

meets the minimum requirement specified in the contract to qualify for full

capacity payments. Normal and levelized capacity payments begin in 2019,

reflecting the projected purchase date of the avoided purchase (June 1, 2019).

Table 2 - Estimated

Annual Payments to a 50 MW Renewable Facility

94 Percent Capacity Factor

|

Year

|

Energy Payment

|

Capacity Payment (By Type)

|

|

Normal

|

Levelized

|

Early

|

Early Levelized

|

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

|

2019

|

10,808

|

1,200

|

111.4

|

585.0

|

101.3

|

|

2020

|

9,513

|

-

|

111.4

|

-

|

101.3

|

|

2021

|

7,836

|

-

|

111.4

|

-

|

101.3

|

|

2022

|

8,501

|

-

|

111.4

|

-

|

101.3

|

|

2023

|

9,237

|

-

|

111.4

|

-

|

101.3

|

|

2024

|

9,730

|

-

|

111.4

|

-

|

101.3

|

|

2025

|

10,236

|

-

|

111.4

|

-

|

101.3

|

|

2026

|

11,235

|

-

|

111.4

|

-

|

101.3

|

|

2027

|

13,097

|

-

|

111.4

|

-

|

101.3

|

|

2028

|

12,948

|

-

|

111.4

|

-

|

101.3

|

|

2029

|

12,831

|

-

|

111.4

|

-

|

101.3

|

|

2030

|

13,175

|

-

|

111.4

|

-

|

101.3

|

|

2031

|

16,168

|

-

|

111.4

|

-

|

101.3

|

|

2032

|

14,297

|

-

|

111.4

|

-

|

101.3

|

|

2033

|

14,224

|

-

|

111.4

|

-

|

101.3

|

|

2034

|

15,670

|

-

|

111.4

|

-

|

101.3

|

|

2035

|

15,904

|

-

|

111.4

|

-

|

101.3

|

|

2036

|

15,985

|

-

|

111.4

|

-

|

101.3

|

|

2037

|

16,901

|

-

|

111.4

|

-

|

101.3

|

|

2038

|

17,123

|

-

|

111.4

|

-

|

101.3

|

|

Total

|

266,330

|

1,200

|

2,228

|

585.0

|

2,025

|

|

NPV (2019$)

|

118,240

|

1,033

|

1,033

|

1,033

|

1,033

|

Source: FPLís Supplemental Response to Staffís First Data

Request.

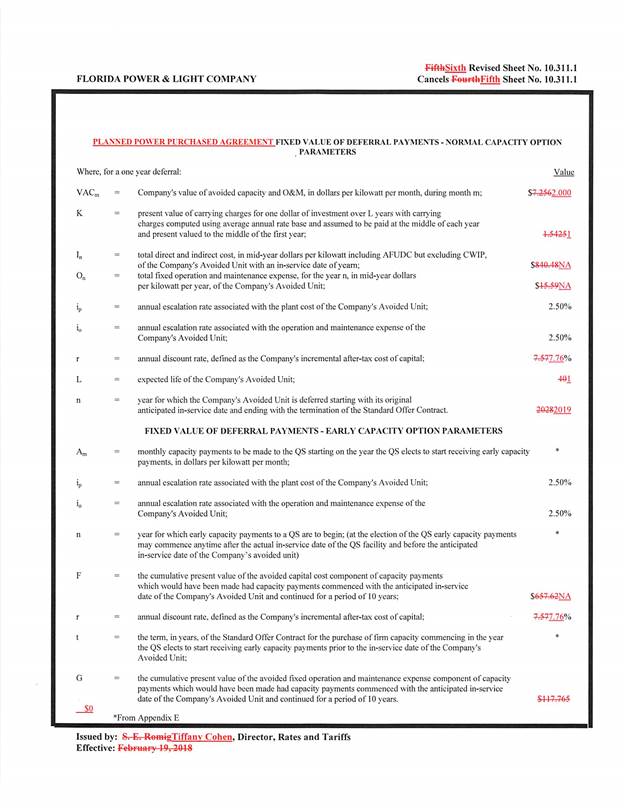

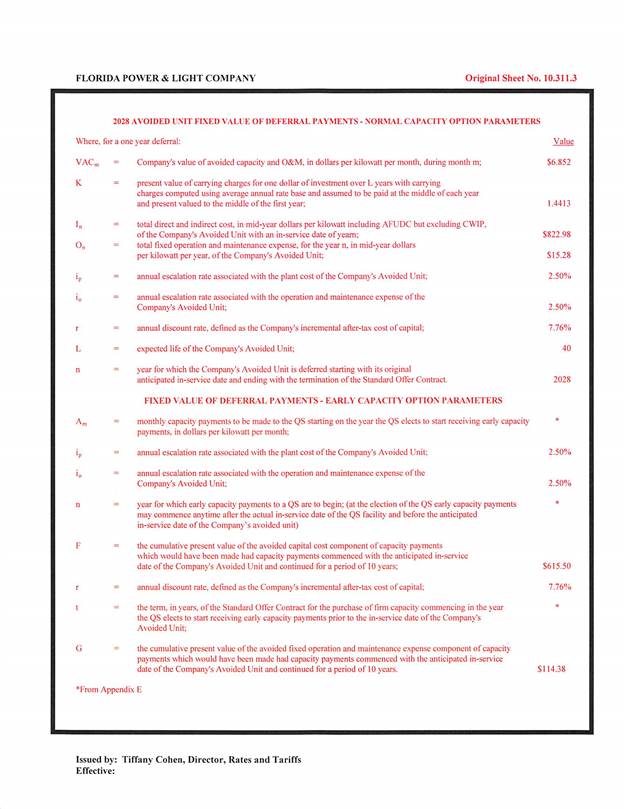

FPLís revised renewable energy tariff and standard offer

contract, in type-and-strike format, are included as Attachment A to this

recommendation. All of the changes made to the tariff sheets are

consistent with the updated avoided unit and an avoided unit selection option. Revisions

include updates to dates and payment information which reflect the current

economic and financial assumptions for the avoided unit and purchased power costs.

Additional language was introduced in Revised

Sheet 9.033 and Original Sheet 9.033.1 that addressed ďCapacity Delivery DateĒ

and ďDelivery Date ConditionsĒ that must be satisfied by the QF. In response to

a staff data request, FPL explained the clarifying language is significant and

essential for FPL because the Capacity Delivery Date is the date when the QF is

required to deliver to FPL, and is also the date when FPL is required to

receive and pay the Committed Capacity amount. FPL further clarified that the

additional Delivery Date Conditions are consistent with sound commercial practice

and will ensure that the QF will generate and deliver to FPL electric energy

safely and reliably for the Term of the Standard Offer Contract.

Conclusion

The provisions of FPLís revised renewable energy tariff

and standard offer contract conform to the requirements of Rules 25-17.200

through 25-17.310, F.A.C. FPLís 2018 Ten-Year Site Plan does not include any

avoidable fossil fueled generating units, but has a projected planned purchase

of 325 megawatt (MW) in 2019 that is FPLís next planned purchase that could be

avoided or deferred. FPL has also identified its next avoidable unit as a 1,778

MW natural gas-fired combined cycle unit at a greenfield site with an expected

in-service date of June 1, 2028. FPLís revised standard offer contract provides

flexibility in the arrangement for payments so that a developer of renewable

generation may select the payment stream best suited to its financial needs.

Staff recommends that FPLís revised renewable energy tariff and standard offer

contract be approved as filed.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. This docket should be closed upon issuance of a

consummating order, unless a person whose substantial interests are affected by

the Commissionís decision files a protest within 21 days of the issuance of the

Commissionís Proposed Agency Action Order. Potential signatories should be aware

that, if a timely protest is filed, FPLís standard offer contract may subsequently

be revised. (Dziechciarz)

Staff Analysis:

This docket should be closed upon the issuance of a

consummating order, unless a person whose substantial interests are affected by

the Commissionís decision files a protest within 21 days of the issuance of the

Commissionís Proposed Agency Action Order. Potential signatories should be

aware that, if a timely protest is filed, FPLís standard offer contract may

subsequently be revised.