|

State of Florida

|

Public Service Commission Capital Circle Office Center ● 2540 Shumard

Oak Boulevard -M-E-M-O-R-A-N-D-U-M- |

||

|

DATE: |

|||

|

TO: |

Office of Commission Clerk (Stauffer) |

||

|

FROM: |

Division of Accounting and Finance (Cicchetti) Division of Economics (Sibley, Hudson) Office of the General Counsel (Crawford) |

||

|

RE: |

|||

|

AGENDA: |

06/05/18 – Regular Agenda – Tariff Filing – Interested Persons May Participate |

||

|

COMMISSIONERS ASSIGNED: |

|||

|

PREHEARING OFFICER: |

|||

|

7/1/2018 (60-Day Suspension Date) |

|||

|

SPECIAL INSTRUCTIONS: |

Place next to Docket No. 20180059-WU. |

||

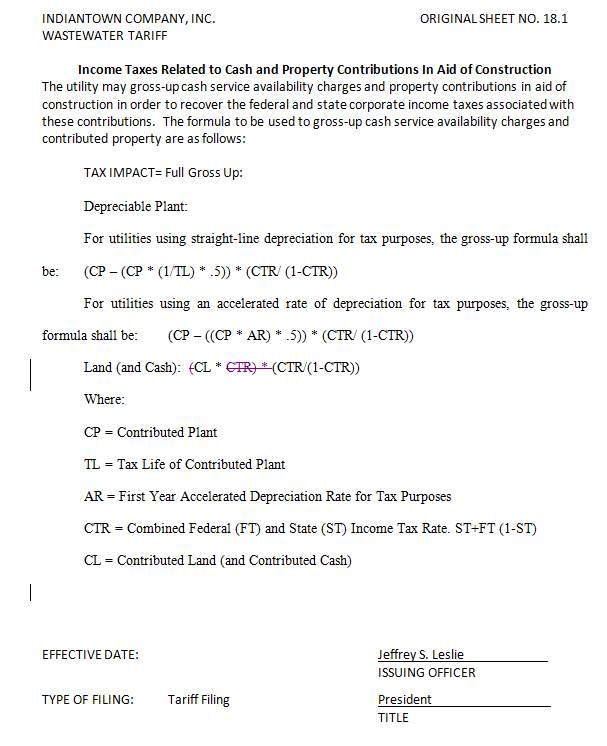

Indiantown Company, Inc. (Indiantown or utility) is a Class A utility providing water and wastewater services in Martin County to approximately 2,181 customers. The utility reported in its 2016 annual report operating revenues in the amount of $758,519 for water and $1,241,519 for wastewater. The utility did not collect any contributions in aid of construction (CIAC) for 2016.

On April 20, 2018, the Commission approved CIAC gross-up tariffs for the utility. After the approval of the gross-up tariff, the utility found a typographical error found in the formula for land and cash contributions. On May 2, 2018, the utility filed a tariff reflecting the correction in the formula. Attachment A of this recommendation shows the corrected tariff in legislative format. This recommendation addresses the utility's request for approval of a corrected gross-up tariff. The Commission has jurisdiction pursuant to Sections 367.081 and 367.091, Florida Statutes.