Discussion

of Issues

Issue 1:

Should the transfer of Certificate No. 555-W in Alachua

County from Kincaid Hills Water Company to Gator Waterworks, Inc. be approved?

Recommendation:

Yes. The transfer of the water system and

Certificate No. 555-W is in the public interest and should be approved

effective the date of the Commission vote. The resultant order should serve as

the Buyer’s certificate and should be retained by the Buyer. The existing rates

and charges should remain in effect until a change is authorized by the

Commission in a subsequent proceeding. The tariffs reflecting the transfer

should be effective for services rendered or connections made on or after the

stamped approval date on the tariffs, pursuant to Rule 25-30.475, F.A.C. Gator

Waterworks should be responsible for filing the 2018 Annual Report, all future

annual reports, and RAFs subsequent to the date of closing. (O. Wooten,

Andrews, Bethea)

Staff Analysis:

On March 12, 2018, Gator Waterworks filed an

application for the transfer of Certificate No. 555-W from Kincaid to Gator

Waterworks pursuant to Rule 25-30.037, F.A.C. The application is in compliance

with Section 367.071, F.S., and Commission rules concerning applications for

transfer of certificates.

Noticing, Territory, and Land

Ownership

Gator Waterworks provided notice of the application

pursuant to Section 367.071, F.S., and Rule 25-30.030, F.A.C. No objections to

the transfer were filed, and the time for doing so has expired. The application

contains a description of the waster service territory which is appended to

this recommendation as Attachment A. The application contains a copy of a warranty

deed agreement that was executed on February 20, 2018, as evidence that Gator

Waterworks owns or has rights to long-term use of the land upon which the water

treatment facilities are located pursuant to Rule 25-30.037(2)(s), F.A.C.

Purchase Agreement and Financing

Pursuant to Rule 25-30.037(2)(i),

and (j), F.A.C., the application contains a statement regarding financing and a

copy of the Purchase Agreement, which includes the purchase price, terms of

payment, and a list of the assets purchased. The Seller retained the customer

deposits for appropriate disposition. There are no developer agreements or

customer advances that must be disposed of with regard to the transfer.

According to the purchase agreement, the total purchase price for the assets is

$82,500. An appropriate portion of this purchase price equal to unpaid past due

RAFs, fines, and interest was paid to the Commission at the date of closing. An

appropriate portion of this purchase price equal to the unpaid property taxes

due to Alachua County was paid to Alachua County at the date of closing. Eighty

percent of the remaining purchase price was paid to the Seller at the date of

closing with 20 percent of the remaining purchase price to be paid to the

Seller after Commission approval of the transfer. According to the Buyer, the

sale took place on February 23, 2018, subject to Commission approval, pursuant

to Section 367.071(1), F.S.

Facility

Description and Compliance

The water treatment system consists of two wells, with a

pair of hydropneumatic tanks rated at 3,100 and 5,000 gallons, a contact storage

tank rated at 1,000 gallons and uses hypo-chlorination for disinfection. The

distribution system consists of 17,000 feet of 2 inch Galvanized Iron Pipe

(GIP), 3,800 feet of 3 inch GIP, 3,400 feet of 4 inch GIP and 5,200 feet of 6

inch asbestos-cement pipe. The last sanitary survey of the facility was

conducted on April 29, 2016, by the Department of Environmental Protection (DEP).

There was one deficiency noted, which has been corrected. On December 22, 2016,

the DEP deemed the Utility was in compliance with applicable rules.

Technical and Financial Ability

Pursuant

to Rule 25-30.037(2)(l), F.A.C., the application contains statements describing

the technical and financial ability of Gator Waterworks to provide service to

the proposed service area. The application states that the

President, Gary Deremer, has over 29 years of Florida related water and

wastewater industry experience with previous private utility ownership of five

utility systems. Further, the application

indicates that the President has secured the services of U.S. Water Services

Corporation to provide contract operating service, as well as, billing and

collection services. Pursuant to Rule 25-30.037(2)(l), F.A.C., the

application contains statements describing the financial ability of Gator

Waterworks to provide service to the proposed service area. According to the

application, the Buyer has acquired the assets of the Utility. Staff also reviewed the personal financial statements of the primary

shareholder, which is the President.[7] Based on

the above, staff believes the Buyer has demonstrated the financial ability to

provide service to the existing service territory.

Rates and Charges

The Utility’s rates, charges, and customer deposits were approved in

the original grandfather certificate in 1993. The rates were subsequently

amended through three price index increases. The Utility’s existing rates are

shown on Attachment B. Rule 25-9.044(1), F.A.C., provides that, in the case of

a change of ownership or control of a utility, the rates, classifications, and

regulations of the former owner must continue unless authorized to change by

this Commission. Therefore, staff recommends that the Utility’s existing rates

and charges remain in effect until a change is authorized by this Commission in

a subsequent proceeding.

Regulatory Assessment Fees and Annual Reports

Staff has verified that the

Utility is current on the filing of RAFs through February 23, 2018. The Seller

is responsible for filing the 2017 Annual Report. However, the filing is

currently delinquent, and the Seller has not responded to two certified letters

regarding the delinquency. The Buyer has indicated that it does not possess the

records required to prepare the 2017 Annual Report.

The purpose of the annual report

filing requirement is to monitor earnings and gather information. The RAFs due

for the year 2017 were based on estimated earnings and were paid in full by the

Buyer. Staff believes that the absence of the 2017 Annual Report will not

impair the Commission from fulfilling its obligation to ensure safe and

reliable utility service, and the 2017 RAFs have already been paid. Therefore,

it is not crucial that the Commission obtain the 2017 Annual Report. The

Commission has previously not enforced this requirement for a utility in a

similar situation.

Accordingly, staff recommends the Commission not seek enforcement of the annual

report requirement for the year 2017. The Buyer will be responsible for filing

Gator Waterworks’ 2018 and subsequent annual reports and paying RAFs from

February 23, 2018, and all future years.

Conclusion

Staff recommends the transfer of the water system and

Certificate No. 555-W is in the public interest and should be approved

effective the date of the Commission vote. The resultant order should serve as

the Buyer’s certificate and should be retained by the Buyer. The existing rates

and charges should remain in effect until a change is authorized by the

Commission in a subsequent proceeding. The tariffs reflecting the transfer

should be effective for services rendered or connections made on or after the

stamped approval date on the tariffs, pursuant to Rule 25-30.475, F.A.C. Gator

Waterworks should be responsible for filing the 2018 Annual Report, all future

annual reports, and RAFs subsequent to the date of closing.

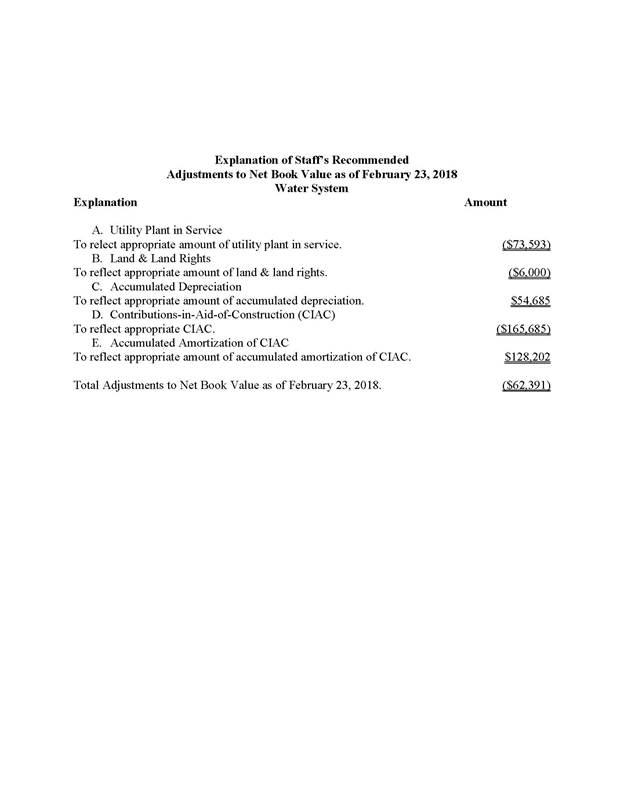

Issue 2:

What

is the appropriate net book value for the Gator Waterworks water system for

transfer purposes and should an acquisition adjustment be approved?

Recommendation: The

net book value of the water system for transfer purposes is $63,321 as of

February 23, 2018. An acquisition adjustment should not be included in rate

base. Within 90 days of the date of the final order, Gator Waterworks should be

required to notify the Commission in writing that it has adjusted its books in

accordance with the Commission’s decision. The adjustments should be reflected

in Gator Waterworks’ 2018 Annual Report when filed. (D. Andrews)

Staff

Analysis: Rate

base has never been established for this Utility. Audit staff was able to

obtain the Seller’s 1993 1120S Federal Tax Return. Thus, staff used the

December 31, 1992, amounts for utility plant in service and accumulated

depreciation beginning balances. The purpose of establishing net book value

(NBV) for transfers is to determine

whether an acquisition adjustment should be approved. The NBV does not include

normal ratemaking adjustments for used and useful plant or working capital. The

Utility’s NBV has been updated to reflect balances as of February 23, 2018. Staff’s

recommended NBV, as described below, is shown on Schedule No. 1.

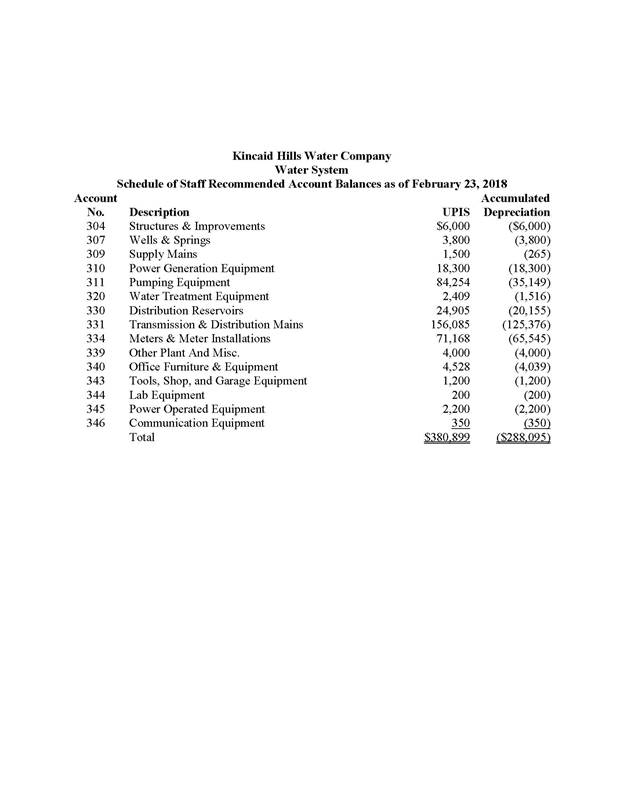

Utility

Plant in Service (UPIS)

The

Buyer’s plant value in its application for transfer reflected a water UPIS

balance of $454,492. Staff reviewed UPIS additions since the 1993 tax return

and has decreased UPIS by $73,593 to reflect unsupported plant additions.

Therefore, staff recommends that the Utility’s UPIS balance as of February 23,

2018, should be $380,899.

Land

The Buyer’s application for transfer reflected a land balance of

$14,000. In a warranty deed between Sheldon A. Brook, grantor, and Kincaid

Hills Water Company, grantee, dated October 5, 1982, the documentary stamps

supported $8,000 for utility land. There have been no additions to land purchased

since that deed was granted. Therefore,

staff has decreased land by $6,000. Staff recommends a land balance of $8,000,

as of February 23, 2018.

Accumulated

Depreciation

The Buyer’s application for

transfer reflected an accumulated depreciation balance of $342,780. Based on the UPIS adjustment discussed earlier, staff

calculated the appropriate accumulated depreciation balance to be $288,095. As

a result, accumulated depreciation should be decreased by $54,685 to reflect an

accumulated depreciation balance of $288,095 as

of February 23, 2018.

Contributions-in-Aid-of-Construction (CIAC)

and Accumulated Amortization of CIAC

As of February 23, 2018, the

Buyer’s application for transfer reflected a CIAC balance of $0 and an

accumulated amortization of CIAC balance of $0. The CIAC balance should be

increased by $156,085, and the accumulated amortization of CIAC balance should

be increased by $125,376, per Rule 25-30.570, F.A.C. This rule states that if

the amount of CIAC has not been recorded on the utility’s books and the utility

does not submit competent substantial evidence as to the amount of CIAC, the

amount of CIAC shall be imputed to be the proportion of the cost of the

facilities and plant attributable to the water transmission and distribution

system.

Additionally, the CIAC balance

should be increased by $9,600. Order No. PSC-1993-1027-FOF-WU approved service

availability charges of $75 for tap-in fees, $75 for meter installations, and

$450 for plant capacity charges for a total of $600. Audit staff scheduled

customer activity as shown in the annual reports from 1992 through 2016, and

noted that the customer count grew by 16 customers from December 31, 1992 to

December 31, 2007. After 2007, the customer count diminished over time. Audit

staff determined a balance of $9,600 ($600 x 16) for CIAC, and calculated a

balance of $2,826 for accumulated amortization of CIAC using a composite rate

of 2.5 percent as of February 23, 2018. Rule 25-30.570, F.A.C. relates to the

imputation of CIAC based on the premise that the developer donated the

transmission and distribution system when it was transferred. Cash CIAC

collected from service availability charges is unrelated to the cost of the

transmission and distribution system. Thus, cash CIAC should also be recognized

for the tap-in fees, meter installations, and plant capacity charges. As such,

staff increased CIAC by $165,685 ($156,085 + $9,600) and accumulated

amortization of CIAC by $128,202 ($125,376 + $2,826) to reflect the appropriate

balances. Therefore, staff recommends a CIAC balance of $165,685 and an

accumulated amortization of CIAC balance of $128,202 as of February 23, 2018.

Net Book Value

The Buyer’s application for

transfer reflected a NBV of $125,712. Based on the adjustments described above,

staff recommends that the NBV is $63,321. Staff’s recommended NBV and the

National Association of Regulatory Utility Commissioners, Uniform System of

Accounts (NARUC USOA) balance for UPIS and accumulated depreciation as of

February 23, 2018, are shown on Schedule No. 1.

Acquisition Adjustment

An acquisition adjustment results

when the purchase price differs from the NBV of the assets at the time of the

acquisition. The Utility and its assets were to be purchased for $82,500.

However, the contract for sale stated that the “final purchase price will be

determined by any change in Rate Base as determined by the FPSC during the

approval of transfer application. The final purchase price will be adjusted for

any reductions to the approved Rate Base as determined by the FPSC.” As stated

above, staff has determined the appropriate NBV total to be $63,321. Therefore,

the Utility and its assets were purchased for $63,321. Pursuant to Rule

25-30.0371, F.A.C., a positive acquisition adjustment may be appropriate when

the purchase price is greater than the NBV, and a negative acquisition

adjustment may be appropriate when the purchase price is less than NBV. However,

pursuant to Rule 25-30.0371(2), F.A.C.,

a positive acquisition adjustment shall not be included in rate base unless

there is proof of extraordinary circumstances. The Buyer did not request a

positive acquisition adjustment. As such, staff recommends that no positive

acquisition adjustment be approved.

Conclusion

Based on the above, staff recommends that the NBV of Kincaid Hills

water system for transfer purposes is $63,321 as of February 23, 2018. No

acquisition adjustment should be included in rate base. Within 90 days of the

date of the final order, the Buyer should be required to notify the Commission

in writing that it has adjusted its books in accordance with the Commission’s

decision. The adjustments should be reflected in Gator Waterworks’ 2018 Annual

Report when filed.

Issue 3:

Should the show cause proceeding against Kincaid Hills

Water Company be dismissed, and Docket No. 20170200-WU, be closed?

Recommendation:

Yes. If the Commission approves Gator Waterworks,

Inc.’s transfer application, then the show cause proceeding against Kincaid Hills

Water Company should be dismissed and Docket No. 20170200-WU should be closed. (Dziechciarz, DuVal)

Staff Analysis:

By Order No. PSC-2017-0470-PCO-WU, issued December

15, 2017, the Commission ordered Docket No. 20170200-WU to remain open until

certificate revocation proceedings were initiated. Gator Waterworks’

acquisition of Kincaid negates the need for a certificate revocation

proceeding. Therefore, if the Commission approves staff’s recommendation in

Issues 1 and 2, then the show cause proceeding against Kincaid Hills Water

Company should be dismissed and Docket No. 20170200-WU should be closed.

Conclusion

If the Commission approves Gator Waterworks, Inc.’s

transfer application, then the show cause proceeding against Kincaid Hills

Water Company should be dismissed and Docket No. 20170200-WU should be closed.

Issue 4:

Should these dockets be closed?

Recommendation:

If no protest to the proposed agency action is filed

by a substantially affected person within 21 days of the date of the issuance

of the order, a consummating order should be issued and these dockets should be

closed administratively upon Commission staff’s verification that the revised

tariff sheets have been filed, the Buyer has notified the Commission in writing

that it has adjusted its books in accordance with the Commission’s decision,

and proof that appropriate noticing has been done pursuant to Rule 25-30.4345,

F.A.C. (J. Crawford)

Staff Analysis:

If no protest to the proposed agency action is filed

by a substantially affected person within 21 days of the date of the issuance

of the order, a consummating order should be issued and these dockets should be

closed administratively upon Commission staff’s verification that the revised

tariff sheets have been filed, the Buyer has notified the Commission in writing

that it has adjusted its books in accordance with the Commission’s decision and

proof that appropriate noticing has been done pursuant to Rule 25-30.4345,

F.A.C.

Gator Waterworks,

Inc.

Water Territory Description

Alachua County

Alachua County, Florida, Kincaid

Hills

The following described lands

located in portions of Sections 11 and 12, Township 10-South,

Range 20-East, Alachua County,

Florida:

Kincaid Road Subdivision - A subdivision lying within the southwest

one-quarter of Section 11, Township 10 South, Range 20 East; encompassed within

the boundary commencing 2,280 feet north of the southwest corner of Section 11

, Township 10 South, Range 20 East and on the eastern side of Florida Highway

S-329A; thence running 1,880 feet east (to Southeast 33rd St.); thence running

600 feet south (to Southeast 18th Ave.); thence running 570 feet east (to

Southeast 35th Street); thence running 600 feet south (to Southeast 21st Ave.);

thence running 2450 feet west to Florida Highway S-329A; thence running 600

feet north (to Southeast 18th Ave.).

Devonshire Hills Subdivision - A subdivision lying within the

northeast one-quarter of Section 11, Township 10 South, Range 20 East;

encompassed within the boundary commencing at the point that is 600 feet

northwest of the point on the western boundary of Section 12, Township 10 South,

Range 20 East where it intersects Florida Highway 20; thence running 1,310 feet

south (to Southeast 18th Ave.); thence running 1,100 feet east; thence running

300 feet north (to Southeast 17th Ave.); thence running 550 feet west (to

Southeast 37th St.); thence running 540 feet north (to Southeast 15th Ave.);

thence running 200 feet west (to Southeast 36th St.); thence running 560 feet

north to Florida Highway 20; thence running 200 feet northwest along, and south

of, Florida Highway 20.

Kreftwood Estates Subdivision - A subdivision lying within the

southwest one-quarter of Section 12, Township 10 South, Range 20 East;

encompassed within the boundary commencing at the southwest corner of Section

12, Township 10 South, Range 20 East; thence running 1,800 feet north to

Florida Highway 20; thence running 750 feet southeast along the southern side

of Florida Highway 20 to the northwest corner of the Shady Lawn subdivision

(described below); thence running 1,350 feet south to Section 13, Township 10

south, Range 20 East; thence running 575 feet west to the southwest corner of

Section 12, Township 10 South, Range 20 East.

Shady Lawn Estates - A subdivision lying within the southwest

one-quarter of Section 12, Township 10 South, Range 20 East; encompassed within

the boundary commencing at the northeast corner of the Kreftwood Estates

subdivision (described above); thence running 750 feet southeast along the

southern side of Florida Highway 20; thence running 1,200 feet south toSection

13, Township 10 South, Range 20 East; thence running 575 feet west to the

southeastcorner of the Kreftwood Estate subdivision (described above).

FLORIDA PUBLIC SERVICE COMMISSION

Authorizes

Gator Waterworks, Inc.

Pursuant to

Certificate Number 555-W

To provide water service in Alachua

County in accordance with the provisions of Chapter 367, Florida Statutes,

and the Rules, regulations, and Orders of this Commission in the territory

described by the Orders of this Commission. This authorization shall remain in

force and effect until superseded, suspended, cancelled or revoked by Order of

this Commission.

Order Number Date Issued Docket Number Filing Type

PSC-93-1027-FOF-WU 07/13/1993 921195 -WU Grandfather Certificate

* * 20180066-WU Transfer of Certificate

* Order Numbers and dates to be provided at

time of issuance