Discussion

of Issues

Issue

1:

Should

the Commission approve TECO's Mid-Course Petition to adjust its fuel and

capacity cost recovery factors and the associated tariff sheets?

Recommendation:

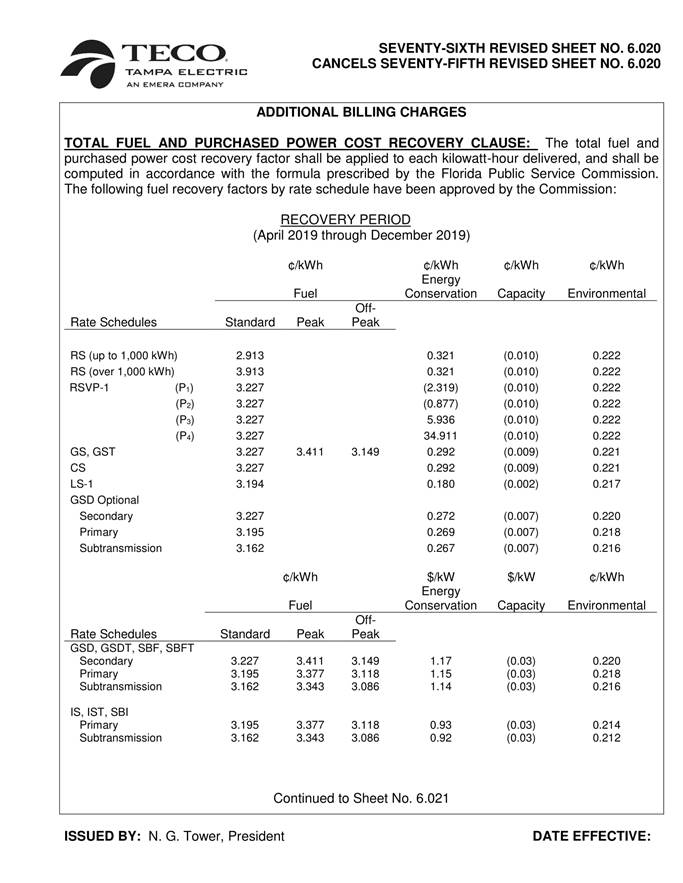

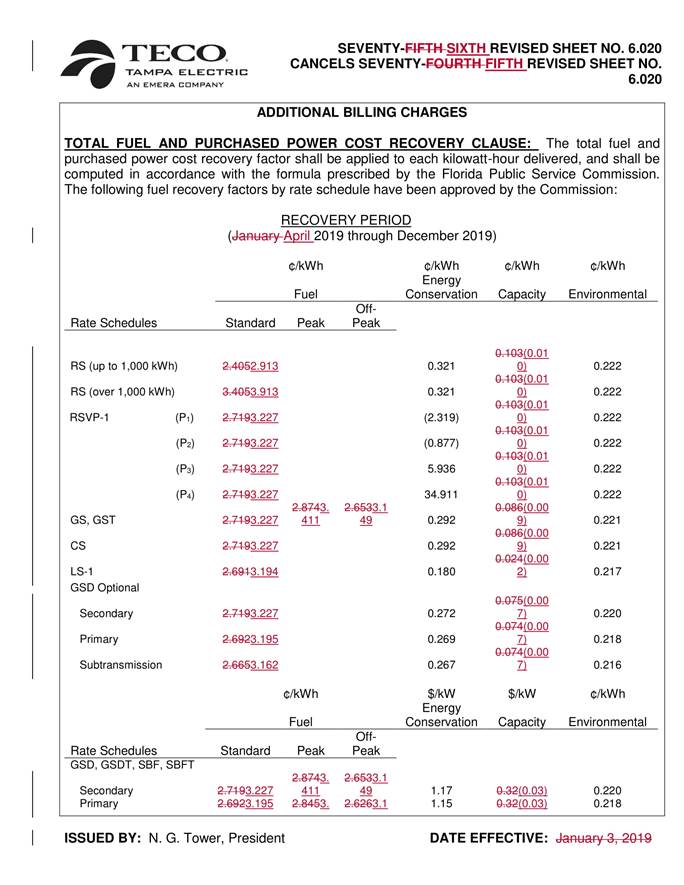

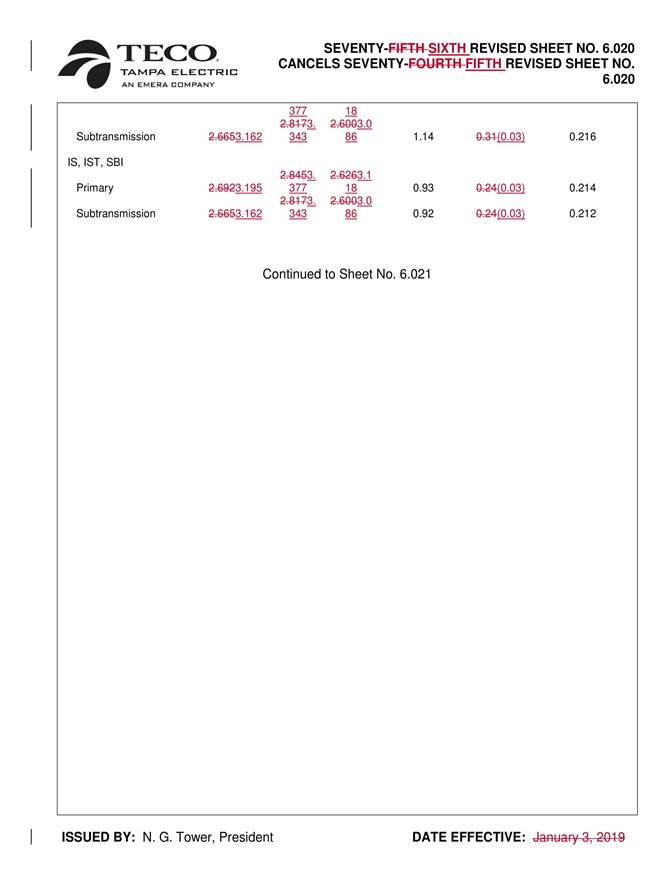

The revised fuel and capacity

cost recovery factors are presented in Attachment A and the associated tariff sheets

are presented in Attachment D. (Barrett, Guffey)

Staff

Analysis:

Mid-course

Adjustment for Fuel and Capacity Cost Recovery Factors

In the

Mid-Course Petition, TECO presents data from two time periods, true up results

from 2018, and projected information for 2019. A secondary distinction is drawn

between fuel cost recovery amounts and capacity cost recovery amounts for each

period, resulting in four individual components to evaluate as part of TECO’s

Mid-Course Petition:

1.

Fuel cost recovery amounts from 2018;

2.

Capacity cost recovery amounts from 2018;

3.

Projected fuel cost recovery amounts for 2019; and

4.

Projected capacity cost recovery amounts for 2019.

TECO

analyzed its actual and estimated balances using the calculation set forth in

Rule 25-6.0424, F.A.C., to arrive at two variations for recovering the amounts identified

in the Mid-Course Petition.

First, the Company calculated a mid-course adjustment based

on the recovery of all aspects of the fuel and capacity cost recovery balances.

This calculation yielded a mid-course correction value of 24.9 percent.

Although TECO referenced the results of this calculation, the Company did not

include supporting schedules for this alternative in its Mid-Course Petition.

TECO also calculated a mid-course adjustment based on the

recovery of revised capacity-related costs for 2018 and 2019, and the revised 2019

fuel costs. TECO’s calculation did not include the revised shortfall of its

2018 fuel cost true-up. According to the Company, the mid-course calculation

using these balances results in a mid-course correction of 16.0 percent. This

alternative aligns with the requested relief, and TECO asserts that it will

prepare a petition to request recovery of the final fuel cost amounts for 2018 for

consideration at the November 5-7, 2019 hearing.

True-Up Amounts from

2018 (Fuel and Capacity)

On the fuel

cost recovery side, TECO states that elevated natural gas prices were the principle

driver of the $36,970,912 under-recovery balance for fuel for 2018. In response

to a data request, the Company stated that lower than historic average gas

storage levels and early season cold weather in the northeast sparked higher

market prices in the latter portions of 2018. TECO did not incorporate the

under-recovery balance in the calculations to determine the new cost recovery

factors that are presented in the Mid-Course Petition. Rather, the Company asserts

that this balance will be addressed in the normal hearing cycle planned for the

fall of 2019. By forgoing cost recovery of this amount during the remainder of

2019, TECO hopes to mitigate what otherwise would be a significant increase in

customer bills. By delaying the recovery of the unrecovered balance, the amount

will be included in the calculation of total fuel expenses for 2020, and

recovered in factors over a 12-month period, compared to a 9-month period if

the balance was included in the requested mid-course correction.

On the

capacity cost recovery side, TECO states that the true-up balance for 2018 was a

$5,458,886 under-recovery. For context, an under-recovery amount of $2,784,988

was approved for collection in 2019 in the 2018 Fuel Order. In the Mid-Course

Petition, the Company included the final true-up adjustment under-recovery

amount of $2,673,898 in its calculations of the revised cost recovery factors

for April through December, 2019.

Revised Projected

Amounts for 2019 (Fuel and Capacity)

As a basis

for its Mid-Course Petition, TECO revised its fuel and capacity cost recovery

projections for 2019. The original projections for 2019 were filed on August

24, 2018, and evaluated in Docket No. 20180001-EI. The fuel and capacity cost

recovery factors that were approved in the 2018 Fuel Order are based, in large

part, on the forecasted projections for 2019.

As

reflected in Schedule E1, TECO’s original projection for fuel costs in 2019

reflects an estimate of $537,871,753 for its Total Fuel and Net Power

Transactions. The Company states that its revised projection for 2019 shows an

increase of $75,514,842, reflecting a new amount of $613,386,595. As with the

under-recovered fuel cost recovery balance from 2018, TECO attributes the

increase to elevated projected natural gas prices for the period. In response

to a data request, the Company stated that the concerns over limited supplies

of natural gas contributed to higher projected prices for 2019, compared to the

prior forecast. As referenced earlier, weather-related concerns impact forward

market prices for natural gas.

In the

2018 Fuel Order, the Commission approved $17,124,796 as the projected amount of

capacity costs for TECO in 2019. The Company asserts that its original

projection for capacity in 2019 was based upon a planned capacity purchase that

did not materialize. Because this purchase for 2019 did not materialize, the

Company’s revised end-of-period balance for 2019 is an over-recovery of $14,240,130.

Summary of Mid-Course

Petition

TECO is requesting mid-course adjustments to fully recover

the capacity-related balances (2018 and 2019), and the revised estimate of its 2019

fuel costs. At this time, the Company is not seeking to recover the 2018 true-up

under recovery. The revised fuel and capacity cost recovery balances the

Company seeks to recover would be recovered between April and December, 2019

through the fuel and capacity cost recovery factors, as shown on Tables 1 and 2

of Attachment A, and the associated tariff sheets presented in Attachment D.

Table 1-1

below shows that if TECO’s Mid-Course Petition is approved, a residential

customer using 1,000 kilowatt hours (kWh) of electricity will see a net

increase of $4.05 per month on their bill, with the fuel cost recovery portion

of their bill rising by $5.08 per month, partially offset by a reduction on the

capacity portion of the bill.

Table 1-1

Requested Recovery

TECO Typical 1,000-kWh Residential

Customer Bill Comparison

for the period January-December, 2019

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Component

|

Current

(January-December)

|

Proposed

(April-December)

|

Bill Impact

|

|

Base Charge

|

$66.53

|

$66.53

|

$0.00

|

|

Fuel Cost Recovery

|

24.05

|

29.13

|

5.08

|

|

Conservation Cost

Recovery

|

3.21

|

3.21

|

0.00

|

|

Capacity Cost Recovery

|

1.03

|

(0.10)

|

(1.13)

|

|

Environmental Cost

Recovery

|

2.22

|

2.22

|

0.00

|

|

Subtotal

|

$97.04

|

$100.99

|

$3.95

|

|

Gross Receipts Tax

|

2.49

|

2.59

|

0.10

|

|

Totals

|

$99.53

|

$103.58

|

$4.05

|

Source:

Mid-Course Correction filing, Schedule E10, Bates Stamped Page 46.

Analysis

As

noted above, the currently-approved

fuel and capacity cost recovery factors for TECO were developed based,

in large part, on the projected fuel and capacity cost amounts for 2019 that

were filed in Docket No. 20180001-EI, on August 24, 2018. The Company stated

that the main driver for the under-recovery balance for fuel in 2018 was the

cost difference between projected and actual prices for natural gas. Because

TECO observed these elevated market prices in the final months of 2018, the

Company re-examined its 2019 fuel price forecasts and filed its Mid-Course

Petition for adjusted cost recovery factors.

Staff’s review of the

requested relief

TECO

prepares fuel forecasts on a regular and routine basis, and filed its

Mid-Course Petition in order to respond to market-driven changes to costs the

Company incurred for the predominate fuel used in its generating fleet, natural

gas. Although capacity-related over-recovered balances are presented, staff

believes the balances for fuel-related costs are the principle concern that

TECO has for requesting new cost recovery factors.

In order

to prepare its forward year projection filing, the Company analyzed forecasted

fuel price data for 2019 based on a forward natural gas price forecast

utilizing the NYMEX natural gas futures contract prices for five consecutive

business days in April 2018.

For its fuel price projections, a delivered price of $3.82 per MMBtu was

calculated for natural gas.

In its original projection filing, TECO estimated 16,516,370 megawatt-hours

(87.90 percent) of its generation would come from natural gas, while coal would

account for 1,249,950 megawatt-hours (6.66 percent).

The original and revised forecasts used the same sources for forecasting data,

although in response to a data request, the Company acknowledged that slightly

modified forecasting assumptions were incorporated in its revised forecast.

On a

comparative basis, the revised fuel price forecast used NYMEX futures contract

pricing data for natural gas prices for five consecutive business days in early

December 2018. A revised delivered price of $4.20 per MMBtu was used for

natural gas in the more recent fuel price projection. Based on the revised

data, system generation is up slightly, with natural gas generation estimated

at 16,822,800 megawatt-hours (86.34 percent), while coal is up slightly to

1,639,120 megawatt-hours (8.41 percent.)

In response to a data request, TECO confirmed that no fuel delivery or transportation

arrangements changed between the period of time when the original and the

revised forecasts were prepared, and emphasized that the primary reason for

needing the requested mid-course adjustment to cost recovery factors is the change

in the forecasted price of natural gas. The Company stated that the elevated

prices that are presented in the most current forecast were likely triggered by

storage level concerns. Staff observes that storage-related concerns and

weather-driven demand are both factors in the commodity markets for natural gas

that are well outside of TECO’s control, but nevertheless influence the actual

costs the Company has, or will, incur when purchasing natural gas.

As noted

previously, TECO examined two variations for recovering the amounts identified

in the Mid-Course Petition, and requested the option that recovers the capacity

cost recovery amounts from 2018, the revised projected fuel cost recovery

amounts for 2019, and the revised projected capacity cost recovery amounts for

2019. TECO evaluated both variations in the context of how the requested relief

would impact the bill of a typical residential customer. Staff notes, however,

that by not including all known changes in costs in its requested relief, the

Company is pursuing an alternative that carries an element of risk.

Although

staff believes the requested relief presents a reasonable alternative for a

mid-course correction to TECO’s 2019 fuel and capacity cost recovery factors,

staff believes that with data from two time periods and a further breakdown

between fuel cost recovery amounts and capacity cost recovery amounts for each

period, other reasonable mid-course correction options can be constructed using

the same data. In order for the Commission to consider the range of options

available, two additional options that differ from the Company’s requested

relief are presented for the Commission to evaluate.

Option 1 (Full recovery

of all known changes in costs)

As noted

previously, mid-course corrections are considered preliminary procedural

decisions, and any over-recoveries or under-recoveries caused by or resulting

from the Commission-approved adjustments may be included in the following

year’s fuel or capacity factors. In the most recent mid-course correction

petitions the Commission has evaluated, all

known changes in costs were evaluated and incorporated into the revised factor

calculations. For consistency with that approach, Option 1 uses the Company’s

requested relief as a starting point, and adds in the true-up shortfall of the

2018 balance that TECO proposes to address at the November 5-7, 2019 hearing.

Staff

believes that by taking action on all known and updated estimated costs at the point

in time that such changes in costs are known, the effect of stacked (or

“pancaked”) cost recovery amounts is addressed. By not deferring action on any

costs, the hearing can focus on any new costs or adjustments that developed

without a concern of stacked amounts for recovery. Additionally, Option 1 allows

for recovery of all balances through revised 2019 fuel and capacity cost

recovery factors.

For comparative

purposes, the schedules to support the full recovery of all known changes in amounts

(Option 1) reflect that the fuel cost recovery portion of the bill for a

residential customer using 1,000 kilowatt hours (kWh) of electricity would rise

by $7.97 per month, rather than by $5.08 under the Company’s requested option.

The fuel amount is partially offset by the capacity cost amounts. The net bill

impact for Option 1 is an increase of $7.01 per month, as reflected in Table 1-2

below:

Table 1-2

Option 1 - - Full recovery

of all known changes in costs

TECO Typical 1,000-kWh Residential

Customer Bill Comparison

for the period January-December, 2019

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Component

|

Current

(January-December)

|

Option 1

(April-December)

|

Bill Impact

|

|

Base Charge

|

$66.53

|

$66.53

|

$0.00

|

|

Fuel Cost Recovery

|

24.05

|

32.02

|

7.97

|

|

Conservation Cost

Recovery

|

3.21

|

3.21

|

0.00

|

|

Capacity Cost Recovery

|

1.03

|

(0.10)

|

(1.13)

|

|

Environmental Cost

Recovery

|

2.22

|

2.22

|

0.00

|

|

Subtotal

|

$97.04

|

$103.88

|

$6.84

|

|

Gross Receipts Tax

|

2.49

|

2.66

|

0.17

|

|

Totals

|

$99.53

|

$106.54

|

$7.01

|

Source:

Tampa Electric Company’s Response to Staff’s First Data Request, Request No. 8, Schedule E10, Bates Stamped

Page 15.

Staff

believes Option 1 presents a reasonable alternative for a mid-course correction

to TECO’s 2019 fuel and capacity cost recovery factors, and is consistent with

the most recent past mid-course correction petitions the Commission has

evaluated.

Option 2 (Full recovery

of the 2018 costs only)

Option 2

is a proposal that blends aspects of TECO’s requested relief and the first option.

Absent a mid-course adjustment, the final cost recovery balances from a prior

year are ordinarily presented at the fall hearing, and the adjustments

resulting from those balances would be incorporated into the calculations to

develop forward-year cost recovery factors. Because TECO proposed parsing the treatment

of the fuel and capacity amounts from 2018 in the requested relief in its

Mid-Course Petition, the traditional process is modified.

If the

Mid-Course Petition is granted, the capacity balances from 2018 and 2019 are

combined, whereas under Option 2, only the 2018 portion would be incorporated

in revised factors for April through December 2019, and the adjustment balance for

2019 would be addressed in the fall hearing, with that balance being

incorporated into the calculation to develop the cost recovery factors for 2020

and recovered over a 12-month period. Option 2 aligns the treatment of the 2018

fuel and capacity balances, and proposes to recover these amounts in modified

factors for April through December 2019.

Under Option

2, no portion of estimated fuel and capacity balances for 2019 would be addressed

in the mid-course adjustment. The mid-course adjustment would be limited to

correcting the current recovery factors to recover the 2018 true-up of fuel and

capacity costs. The 2019 balances would be evaluated in the November 5-7, 2019

hearing. Although there is a risk that the balances for 2019 could grow larger

before the hearing takes place, the opposite could occur as well, and the fuel

and/or the capacity balances could be smaller. In addition, although the most

current fuel price forecast reflects more updated information than the original

forecast, the fuel and capacity balances for 2019 in the current forecast

contains estimated data for every month. By pursuing Option 2 and by deferring

recovery of the fuel and capacity estimates for 2019 at this time, the balances

presented in the November hearing are likely to include 6 to 7 months of actual

data, as well as estimated data based on a later forecast.

For

comparative purposes, the schedules to support Option 2 reflect that the fuel

cost recovery portion of the bill for a residential customer using 1,000 kilowatt

hours (kWh) of electricity would rise by $2.64 per month, compared to $5.08 for the Company’s

requested option, and $7.97 under Option 1. The bill impact for the capacity

portion would also rise by $0.25 per month. When the Gross Receipts Tax is

incorporated, the total bill impact to fully recover only the 2018 costs is an

increase of $2.96 per month, as reflected in Table 1-3 below:

Table 1-3

Option 2 - - Full recovery

of 2018 costs only

TECO Typical 1,000-kWh Residential

Customer Bill Comparison

for the period January-December, 2019

|

(1)

|

(2)

|

(3)

|

(4)

|

|

Component

|

Current

(January-December)

|

Option 2

(April-December)

|

Bill Impact

|

|

Base Charge

|

$66.53

|

$66.53

|

$0.00

|

|

Fuel Cost Recovery

|

24.05

|

26.69

|

2.64

|

|

Conservation Cost

Recovery

|

3.21

|

3.21

|

0.00

|

|

Capacity Cost Recovery

|

1.03

|

1.28

|

0.25

|

|

Environmental Cost

Recovery

|

2.22

|

2.22

|

0.00

|

|

Subtotal

|

$97.04

|

$99.93

|

$2.89

|

|

Gross Receipts Tax

|

2.49

|

2.56

|

0.07

|

|

Totals

|

$99.53

|

$102.49

|

$2.96

|

Source: Tampa Electric Company’s Response to

Staff’s Second Data Request, Request No. 7, Schedule E10, Bates Stamped Page 19.

Staff

believes Option 2 presents a reasonable alternative for a mid-course correction

to TECO’s 2019 fuel and capacity cost recovery factors.

Summary of all cost

recovery options

Table 1-4

below summarizes the three cost recovery options discussed above. For ease of

reference, the cost recovery components that are part of TECO’s Mid-Course

Petition are listed below:

1.

Fuel cost recovery amounts from 2018;

2.

Capacity cost recovery amounts from 2018;

3.

Projected fuel cost recovery amounts for 2019; and

4.

Projected capacity cost recovery amounts for 2019.

Table 1-4

Summary of Options

TECO Typical 1,000-kWh Residential Customer

Bill Comparison

for the period January-December, 2019

|

|

Company Proposal

(Cost recovery for components 2, 3, and 4 in

mid-course correction)

|

Option 1 Proposal

(Cost recovery for all components in mid-course correction)

|

Option 2 Proposal

(Cost recovery for components 1 and 2 in mid-course

correction)

|

|

Compo-

nent

|

Current

(January-December)

|

Proposed

(April-December)

|

Bill Impact

|

Proposed

(April-December)

|

Bill Impact

|

Proposed

(April-December)

|

Bill Impact

|

|

Base Charge

|

$66.53

|

$66.53

|

$0.00

|

$66.53

|

$0.00

|

$66.53

|

$0.00

|

|

Fuel Cost

Recovery

|

24.05

|

29.13

|

5.08

|

32.02

|

7.97

|

26.69

|

2.64

|

|

Conserv. Cost Recovery

|

3.21

|

3.21

|

0.00

|

3.21

|

0.00

|

3.21

|

0.00

|

|

Capacity

Cost Recovery

|

1.03

|

(0.10)

|

(1.13)

|

(0.10)

|

(1.13)

|

1.28

|

0.25

|

|

Envirom.Cost Recovery

|

2.22

|

2.22

|

0.00

|

2.22

|

0.00

|

2.22

|

0.00

|

|

Subtotal

|

$97.04

|

$100.99

|

$3.95

|

$103.88

|

$6.84

|

$99.93

|

$2.89

|

|

Gross Receipts Tax

|

2.49

|

2.59

|

0.10

|

2.66

|

0.17

|

2.56

|

0.07

|

|

Totals

|

$99.53

|

$103.58

|

$4.05

|

$106.54

|

$7.01

|

$102.49

|

$2.96

|

Customer

Notifications

In response to a staff data request,

TECO stated that it issued news releases and information on social media

concurrent with its filing of the Mid-Course Petition (dated January 15, 2019).

The Company will notify customers about this pending matter with on-bill messaging

for paper and paperless bills in advance of the rates taking effect. In

addition, TECO stated that a website link provides information regarding the

proposed rate change effective with the April 2019 billing cycle.

The Company stated that it plans a second news release after the Commission

votes on its Mid-Course Petition.

If

approved by the Commission at the March 5, 2019 Agenda Conference, TECO’s

Mid-Course Petition will result in higher fuel cost recovery factors, and lower

capacity cost recovery factors for TECO’s customers, effective with the April

2019 billing cycle. Typically, effective dates are set a minimum of 30 days

after a Commission vote modifying the charges as the result of a mid-course

correction.[11] This time

limit is imposed in order to prevent new rates from being applied to energy

consumed before the effective date of the Commission’s action, i.e., the date

of the vote. However, the Commission also has implemented charges in less than

30 days when circumstances warrant.[12]

In this instance, the interval between the Commission’s vote on this matter

(March 5, 2019) and the proposed implementation date (April 2019 billing cycle,

which begins on April 2, 2019) is 27 days. Although this filing, if approved,

results in a net increase to cost recovery factors, staff believes the notification

interval is sufficient.

Conclusion

The

revised fuel and capacity cost recovery factors are presented in Attachment A

and the associated tariff sheets are presented in Attachment D.

Alternatively,

the Commission may consider options to adjust TECO’s fuel and capacity cost

recovery factors. Option 1 is a mid-course correction that allows for the

recovery of the 2018 and 2019 projected fuel and capacity costs through revised

2019 fuel and capacity factors, while Option 2 is a mid-course correction that

limits the mid-course recovery to the 2018 projected fuel and capacity costs. The

revised fuel and capacity cost recovery factors for Options 1 and 2 are presented

in Attachments B and C, respectively. Under either of these options, the

revised fuel and capacity cost recovery factors should become effective with

the April 2019 billing cycle, which begins on April 2, 2019.

If the

Commission approves Options 1, 2, or another alternative, the Commission should

give staff administrative authority to approve the tariff sheets that implement

the Commission’s vote.

Issue

2:

Should

this docket be closed?

Recommendation:

The

fuel docket is on-going and should remain open. (Brownless, Nieves)

Staff Analysis:

The fuel docket is on-going and should remain open.