Discussion

of Issues

Issue 1:

Should the Commission approve FPUC and FPUC – Fort

Meade’s revised transportation imbalance tariffs as contained in Attachments 1 and

2 to this recommendation?

Recommendation:

Yes, the Commission should approve FPUC and FPUC –

Fort Meade’s revised transportation imbalance tariffs as contained in

Attachments 1 and 2 to this recommendation. The proposed revisions are designed

to act as a deterrent for long monthly imbalances, provide benefits to sales

customers, and are consistent with the Florida Division of Chesapeake Utilities

Corporation’s imbalance tariffs. The revised tariffs should become effective on

April 2, 2019. (Guffey, Merryday)

Staff Analysis:

The companies proposed to revise their methodology for

calculating billing adjustments to pool managers for monthly imbalances. Specifically,

the companies proposed to modify the imbalance cash-out tiers and associated

cash-out rates. Imbalances occur when the amount of natural gas delivered by a

pool manager and the amount of natural gas consumed by transportation customers

varies.

Background

Rule 25-7.0335, Florida Administrative Code, (F.A.C.), requires

local distribution companies (LDCs), such as FPUC and FPUC – Fort Meade, to

make gas transportation service available to non-residential customers.

Transportation service is a voluntary program that allows customers to use a

pool manager, or third party marketer or shipper, rather than the LDC to meet

their natural gas requirements. In a transportation service environment, the

LDC only transports natural gas from the gate station (delivery point at which natural

gas is transferred from the interstate pipeline to the LDC’s distribution

system) to the transportation customer’s meter. Customers who purchase their natural

gas from the LDC are referred to as sales customers.

Both FPUC and FPUC – Fort Meade function as traditional

LDCs providing gas service for sales customers and provide optional

transportation service as required by Rule 25-7.0335, F.A.C. There

are currently 13 pool managers qualified to serve FPUC and FPUC – Fort Meade’s

transportation customers in aggregated customer pools. The transportation

customers pay the pool manager’s charges for natural gas and are not subject to

the companies’ Commission-approved Purchased Gas Adjustment (PGA) rates,

whereas sales customers are subject to PGA rates. The Commission does not

approve or review the natural gas prices the pool managers offer.

Current Imbalance Tariffs

Gas is delivered by the pool managers to the LDC’s gate

station at a constant level daily even though transportation customers’ daily

therm usage varies, creating negative or positive imbalances. At the end of

each month, the companies calculate each pool manager’s imbalance level by

aggregating customer usage in their pool and comparing it to the pool manager’s

natural gas deliveries.

A negative (short) imbalance results when the gas

consumption of a transportation customer pool exceeds what the pool manager

delivered that month; therefore, the companies sell natural gas to the pool

manager. A positive (long) imbalance results when more natural gas was

delivered than was needed for the transportation customers; therefore, the

companies purchase the excess gas delivered by the pool manager. To calculate

invoices to pool managers for a long imbalance or amounts due to the companies

for a short imbalance, the amount (in therms) of the long or short imbalance is

multiplied by the applicable imbalance tier. The resulting amount is then

multiplied by the PGA rate, i.e., cash-out rate. The proposed revisions to the companies’

tariff provisions that contain the imbalance tiers and cash-out rates are

discussed in detail below.

Proposed Revisions to Imbalance Tariffs

Imbalance Tiers

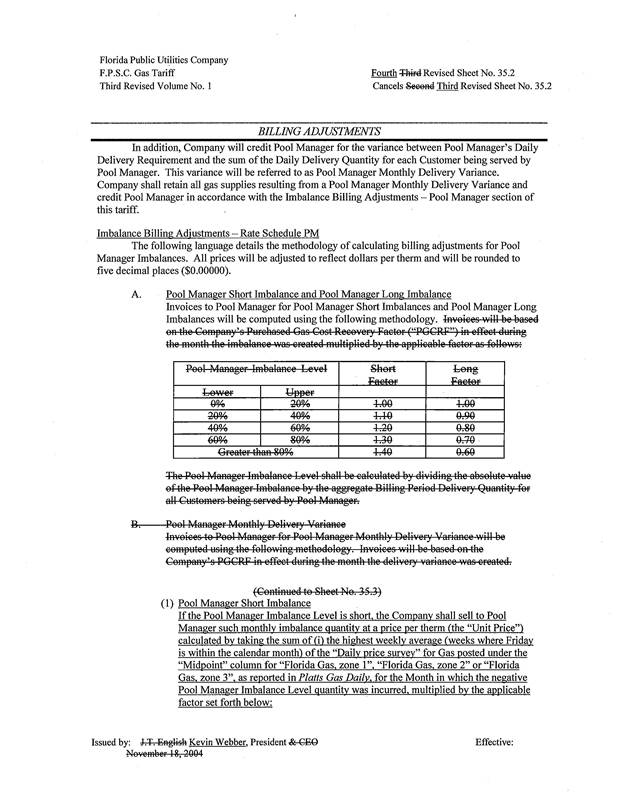

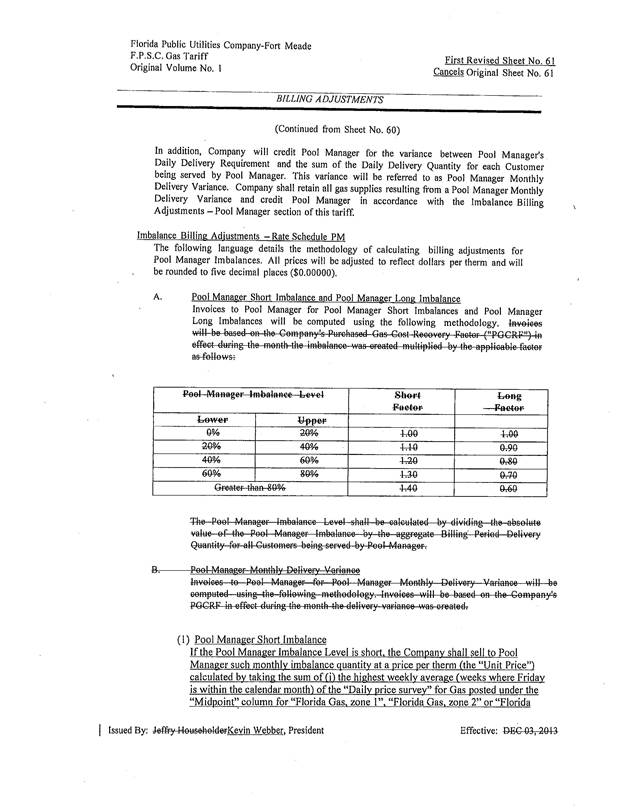

The companies explained that the current imbalance tiers

are very broad. The imbalance tiers represent the difference, expressed as a

percentage, between the natural gas quantity delivered (in therms) by the pool

manager and the natural gas consumed (in therms) by the transportation

customers. As shown in Table 1-1 below, the first tier is from zero to 20

percent; therefore, if a pool manager delivers between zero and 20 percent more

natural gas than what is consumed, the companies must pay the pool manager the

full PGA rate for the excess gas delivered. The next tier, 20 percent to 40

percent, provides for a payment of a long position at 90 percent of the PGA

rate. Similar calculations are used to determine payment amounts to or from

pool managers depending on position and tier.

Table 1-1

Current Imbalance Tiers

|

Imbalance Tiers

|

Short Factor

|

Long Factor

|

|

Lower

|

Upper

|

|

|

|

0%

|

20%

|

1.00

|

1.00

|

|

20%

|

40%

|

1.10

|

0.90

|

|

40%

|

60%

|

1.20

|

0.80

|

|

60%

|

80%

|

1.30

|

0.70

|

|

Greater than 80%

|

1.40

|

0.60

|

Source: Docket No. 20190036-GU

petition

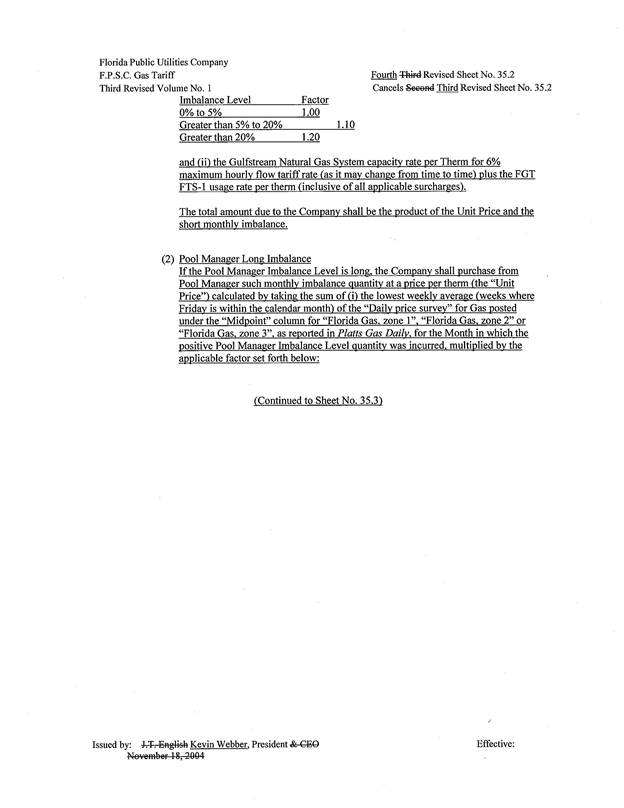

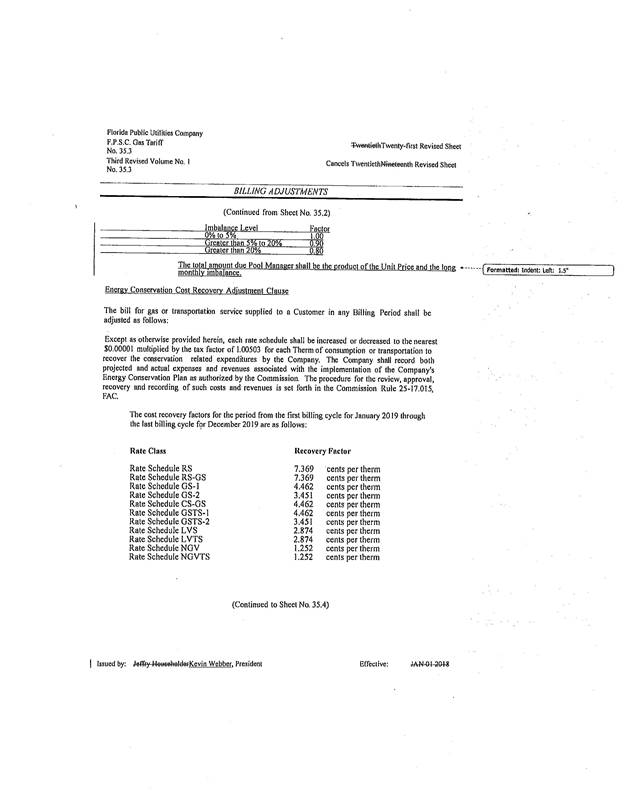

The companies proposed to revise

the imbalance tiers as shown in Table 1-2 below. As Table 1-2 demonstrates, the

proposed imbalance tiers only provide a 100 percent payout for a long position

from zero to five percent.

Table 1-2

Proposed Imbalance Tiers

|

Imbalance Tiers

|

Short Factor

|

Long Factor

|

|

Lower

|

Upper

|

|

|

|

0%

|

5%

|

1.00

|

1.00

|

|

5%

|

20%

|

1.10

|

0.90

|

|

Greater than 20%

|

1.20

|

0.80

|

Source: Docket No. 20190036-GU

petition

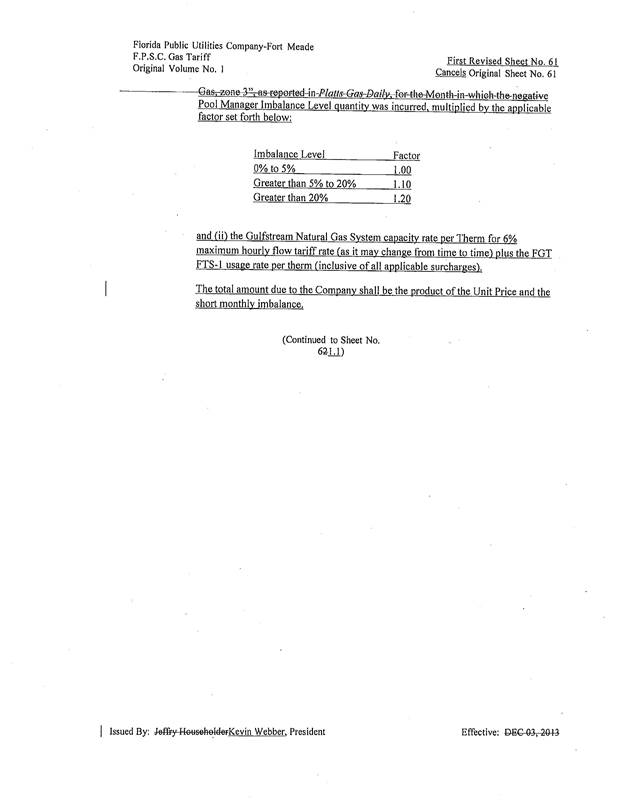

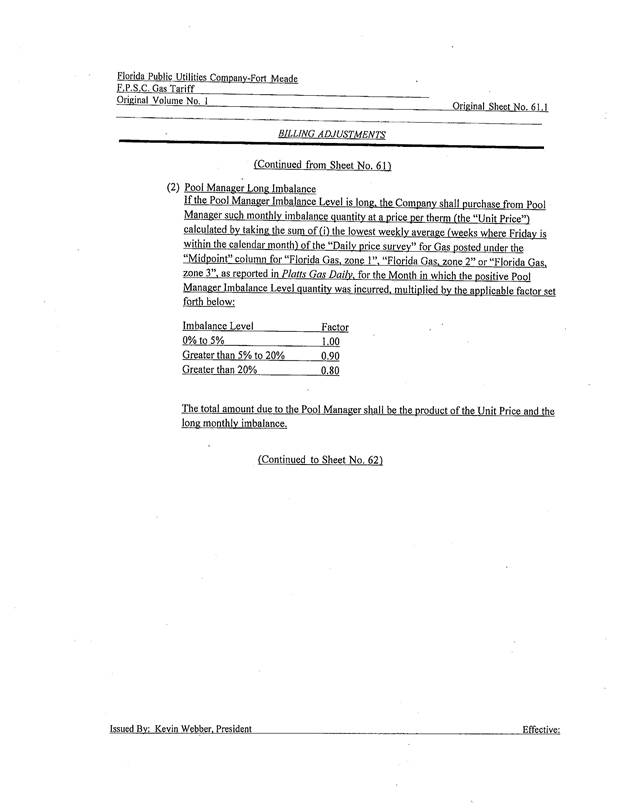

Cash-out Rate for Monthly Imbalance Amounts

The companies’ second revision is to change the cash-out rate

for monthly imbalance amounts as shown in the proposed tariffs. Instead of the

PGA rate, the companies proposed to use market- based natural gas cash-out

rates as reported in the Platts Gas Daily and published interstate pipeline

capacity charges. The Platts Gas Daily provides natural gas commodity prices in

various areas of the US natural gas market.

The companies assert that proposed cash-out rates are

indicative of the natural gas prices in the market. The PGA rate is typically

higher than market based natural gas prices as it includes interstate and

intrastate pipeline demand charges for all the capacity the companies need to

hold to serve their sales customers and costs related to the companies’

purchase gas function.

To support their petition, the companies explained that over

the last three years, payments to pool managers have increased. In response to

staff’s data request, the companies provided monthly imbalance quantities. The monthly

imbalance quantities (in therms) show that for the period January 2015 through

December 2018, the net total of each pool manager’s monthly imbalance was a

long imbalance, i.e., the pool managers delivered excess natural gas.

Therefore, the companies made the following annual payments to pool managers

for excess natural gas delivered: $2.1M (2015), $2.8M (2016), $4.9M (2017), and

$3.5M (2018). These payments to pool managers are included in the calculation

of the PGA rate. The companies assert that the proposed lower cash out rates

should provide a price signal to pool managers to not overschedule natural gas

deliveries. A reduction in the payment amounts to pool managers for long

imbalances will provide downward pressure on the PGA rate benefitting the sales

customers.

The companies assert that the long positions are an

indication that some pool managers may intentionally purchase more natural gas in

the market than the amount needed to serve their customer pool in order to sell

the excess (long) gas quantity back to the companies at the PGA rate. The

companies explained that any excess natural gas purchased from the pool

managers either is used by the sales customers or sold to an interstate

pipeline. Any revenue received from an interstate pipeline is credited to the

PGA charge; however, the interstate pipeline’s cash-out rates are typically

based on the New York Mercantile Exchange, which is less than the companies’

PGA rates.

Conclusion

The proposed revisions are intended as a deterrent to long

monthly imbalances and provide benefits to sales customers. Furthermore, the

proposed revisions are consistent with Florida Division of Chesapeake Utilities

Corporation’s (Chesapeake) current Commission-approved imbalance tariffs. FPUC

is a wholly-owned subsidiary of Chesapeake Utilities Corporation which is

headquartered in Dover, Delaware. Chesapeake is an operating division of

Chesapeake Utilities Corporation. The companies expressed a desire to have

consistent tariff provisions across their Florida business units.

The companies stated that they have communicated with the pool managers

about the proposed revisions and that the pool managers have been supportive. Staff

recommends that the Commission approve FPUC and FPUC – Fort Meade’s tariff

modifications as shown in Attachments 1 and 2 to this recommendation. The revised tariffs should

become effective on April 2, 2019.

Issue 2: Should this docket

be closed?

Recommendation:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order. (Nieves)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order.