|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

May 2, 2019

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Division of Accounting and Finance (Perez,

Snyder, D. Smith, Mouring)

Division of Economics

(Guffey, Draper)

Division of Engineering

(P. Buys, Doehling, Thompson, Wooten, Ellis, Graves)

Office of the General

Counsel (Simmons, J. Crawford, A. King)

|

|

RE:

|

Docket No. 20190038-EI – Petition for

limited proceeding for recovery of incremental storm restoration costs

related to Hurricane Michael, by Gulf Power Company.

|

|

AGENDA:

|

05/14/19 – Regular Agenda – Participation is at the Commission’s

Discretion

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Fay

|

|

CRITICAL DATES:

|

07/01/19 (Requested Implementation Date)

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

On February 6,

2019, Gulf Power Company (Gulf or Company) filed a petition for a limited

proceeding seeking authority to implement an interim storm restoration recovery

charge to recover a total of $342 million for incremental restoration costs

related to Hurricane Michael and to replenish its storm reserve. In its

petition, Gulf asserts that as a result of Hurricane Michael, Gulf incurred

total retail recoverable costs of approximately $350 million less the $48

million pre-storm balance of the storm reserve, resulting in net recoverable

costs of $302 million. In addition, Gulf proposes to replenish its storm

reserve to the $41 million balance as of December 31, 2016. The $342 million includes interest of $15.3

million on the unamortized storm reserve balance. Gulf filed its petition pursuant to the

provisions of the Stipulation and Settlement Agreement (SSA) approved by the Commission

in Order No. PSC-2017-0178-S-EI. Pursuant to Paragraph 7(a) of the SSA,

Gulf can recover storm costs, not exceeding $4.00/1,000 kWh on monthly

residential customer bills, on an interim basis, beginning 60 days following

the filing of a petition for recovery. In addition, pursuant to Paragraph 7(b),

Gulf may petition the Commission to allow for a charge greater than $4.00/1,000

kWh, or a period longer than 12 months, if costs exceed $100 million in a

calendar year. In its petition, Gulf has requested an interim storm restoration

recovery charge of $8.00/1,000 kWh on a residential bill, effective with the

first billing cycle for April 2019. On

March 13, 2019, Gulf requested that the Commission suspend the 60-day timeframe

set forth in the SSA, and requested that the Commission approve the storm

restoration recovery charge to become effective with the first billing cycle in

July 2019. The Company estimates that

the proposed recovery charge will need to be in effect for approximately 60

months.

The Office of

Public Counsel’s intervention in this docket was acknowledged in Order No.

PSC-2019-0087-PCO-EI, issued March 6, 2019.

The Commission

has jurisdiction over this matter pursuant to Sections 366.04, 366.05, 366.06,

and 366.076, Florida Statutes.

Discussion

of Issues

Issue 1:

Should the Commission authorize Gulf to implement an

interim storm restoration recovery charge?

Recommendation:

Yes. The Commission

should authorize Gulf to implement an interim storm restoration recovery charge,

subject to refund. Once the total actual

storm costs are known, Gulf should be required to file documentation of the

storm costs for Commission review and true up of any excess or shortfall. (Perez,

Mouring)

Staff Analysis:

As stated in the Case Background, Gulf filed a petition

for a limited proceeding seeking authority to implement an interim storm

restoration recovery charge to recover a total of $342 million for the

incremental restoration costs related to Hurricane Michael and to replenish its

storm reserve. The requested recovery of

$342 million represents net retail recoverable costs of approximately $302

million, plus an additional $41 million to replenish the storm reserve to the

balance that existed on December 31, 2016. In

addition, the $342 million includes interest on the unamortized storm reserve

balance of $15.3 million. Gulf has

requested an interim storm restoration recovery charge of $8.00 on a monthly

1,000 kWh residential bill, effective with the first billing cycle for July

2019. The Company estimates that the

proposed recovery charge will need to be in effect for approximately 60 months.

In its petition, Gulf asserts that it incurred total

retail recoverable costs of approximately $350 million as a result of Hurricane

Michael. Gulf represented that this

amount was calculated in accordance with the Incremental Cost and

Capitalization Approach (ICCA) methodology prescribed in Rule 25-6.0143,

Florida Administrative Code (F.A.C.).

The net retail recoverable costs of $302 million were determined by

reducing the $350 million total costs by the pre-storm storm reserve balance of

$48 million. The SSA also allows Gulf to

request the replenishment of its storm reserve to the $41 million balance that

existed on December 31, 2016.

The approval of an interim storm restoration recovery

charge is preliminary in nature and is subject to refund pending a further

review once the total actual storm restoration costs are known. After the actual costs are reviewed for

reasonableness and prudence, and are compared to the actual amount recovered

through the interim storm restoration recovery charge, a determination will be

made whether any over/under recovery has occurred. The disposition of any over/under recovery,

and associated interest, would be considered by the Commission at a later date.

Based on a review of the information provided by Gulf in

its petition, staff recommends that the Commission authorize Gulf to implement

an interim storm restoration recovery charge, subject to refund. Once the total actual storm costs are known,

Gulf should be required to file documentation of the storm costs for Commission

review and true up of any excess or shortfall.

Issue 2:

Should the Commission approve Gulf's proposed interim

storm restoration recovery tariffs as shown in Attachment A to the

recommendation?

Recommendation:

Yes, the Commission should approve Gulf's proposed

interim storm restoration recovery tariffs as shown in Attachment A to the

recommendation. The proposed tariffs should become effective with the first

billing cycle of July 2019. (Guffey, Draper)

Staff Analysis:

In its March 13, 2019 letter to the Commission, Gulf

proposed to begin applying the interim storm restoration recovery charge to

customer bills with the first billing cycle of July 2019, and to include the

charge in the non-fuel energy charge on customer bills. The proposed

approximate 60-month recovery period would be subject to modification based upon

the Commission’s final decision regarding actual charges. In support of its

rate calculations, Gulf provided Exhibit E to the petition.

Exhibit E illustrates the computation of the proposed

interim storm restoration recovery charges for each rate class. Gulf

represented that it followed the methodology for allocation of storm costs

among rate classes consistent with the cost of service study filed in its 2016

rate case (Docket No. 20160186-EI). Staff reviewed Gulf’s calculations and

believes the allocation methodology to be reasonable. The storm restoration

costs are weighted to reflect storm restoration costs by function such as

distribution and transmission (92 percent and 7 percent, respectively).

Application of the allocation methodology for the

residential customer rate class results in a proposed interim storm recovery

charge of 0.8 cents per kilowatt hour (kWh), which equates to $8.00 on a 1,000

kWh residential electric bill. The proposed interim charges for all rate

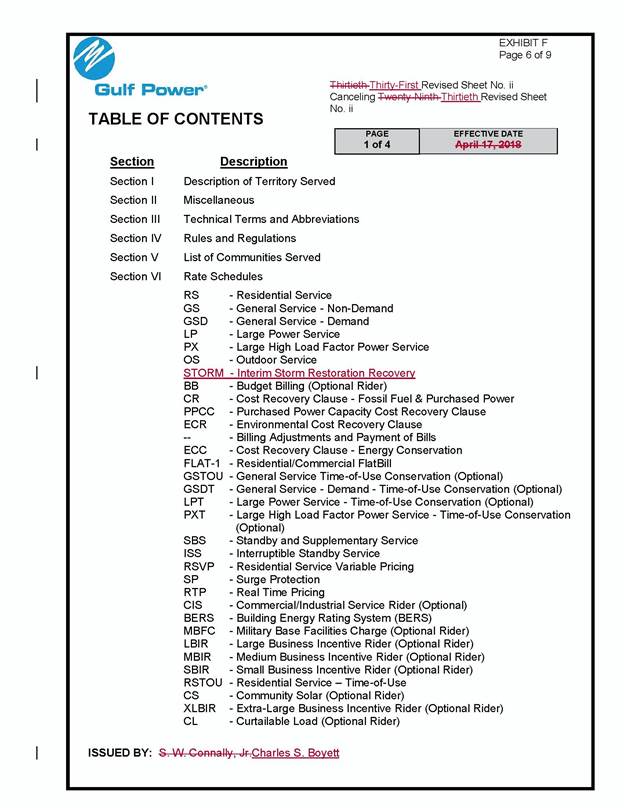

classes are presented in Twenty-Second Revised Sheet No. 6.25, included in

Exhibit F to Gulf’s petition. Revised

Exhibit F also includes Table of Contents to add the interim storm restoration

recovery charge. The proposed tariff

sheets are included in Attachment A to this recommendation.

In its response to staff’s first data request, Gulf

provided customer notifications for staff review and stated that the customers

will be notified by media news releases, Company website, bill inserts, and by

telephone to the Company’s largest commercial customers.

Based on its review of the information provided by Gulf,

staff recommends the Commission approve Gulf's proposed interim storm

restoration recovery tariffs, subject to refund, as shown in Attachment A to

the recommendation. The proposed tariffs should become effective with the first

billing cycle of July 2019.

Issue 3:

What is the appropriate security to guarantee the

amount collected subject to refund through the interim storm restoration recovery

charge?

Recommendation:

The appropriate security to guarantee the funds

collected subject to refund is a corporate undertaking. (Hightower, D. Buys)

Staff Analysis:

Staff recommends that all funds collected subject to

refund be secured by a corporate undertaking. The criteria for a corporate

undertaking include sufficient liquidity, ownership equity, profitability, and

interest coverage to guarantee any potential refund. Staff reviewed Gulf’s

financial statements to determine if the Company can support a corporate

undertaking to guarantee the funds collected for recovery of incremental storm

restoration costs related to Hurricane Michael. Gulf’s 2015, 2016, and 2017

financial statements were used to determine the financial condition of the

Company. Gulf’s financial performance demonstrates adequate levels of

liquidity, ownership equity, profitability, and interest coverage to guarantee

the potential refund.

Staff believes Gulf has adequate resources to support a

corporate undertaking in the amount requested. Based on this analysis, staff

recommends that a corporate undertaking of $68 million is acceptable. This

brief financial analysis is only appropriate for deciding if the Company can

support a corporate undertaking in the amount proposed and should not be considered

a finding regarding staff's position on other issues in this proceeding.

Issue 4:

Should this docket be closed?

Recommendation:

No, this docket should remain open pending final

reconciliation of actual recoverable Hurricane Michael storm costs with the

amount collected pursuant to the interim storm restoration recovery charge, and

the calculation of a refund or additional charge if warranted. (Simmons)

Staff Analysis:

No, this docket should remain open pending final

reconciliation of actual recoverable Hurricane Michael storm costs with the

amount collected pursuant to the interim storm restoration recovery charge, and

the calculation of a refund or additional charge if warranted.