|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

May 30, 2019

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Office of the General Counsel (Davis,

Cibula)

Division of Economics

(Draper, Merryday, Guffey)

|

|

RE:

|

Docket No. 20180143-EI – Petition to

initiate rulemaking to revise and amend portions of Rule 25-6.0426, F.A.C.,

Recovery of Economic Development Expenses, by Florida Power & Light

Company, Gulf Power Company, and Tampa Electric Company.

|

|

AGENDA:

|

06/11/19 – Regular Agenda – Rule Proposal – Interested Persons May

Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Fay

|

|

RULE STATUS:

|

Proposal May Be Deferred

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

Rule 25-6.0426,

Florida Administrative Code, (F.A.C.), addresses the recovery of economic development

expenses for public electric utilities. The rule implements Section 288.035,

Florida Statutes (F.S.), which requires the Commission to adopt rules for the

recovery of economic development expenses by public utilities, including the

sharing of expenses by shareholders.

On July 30,

2018, Florida Power & Light Company (FPL), Gulf Power Company (Gulf), and

Tampa Electric Company (TECO) (collectively, petitioners) filed a joint

petition to initiate rulemaking to amend Rule 25-6.0426, F.A.C. In their

petition, the petitioners requested that the Commission amend the rule to

increase the cap on recoverable economic development expenses on a phased-in

basis through 2023.

On August 2, 2018, the Office of

Public Counsel (OPC) filed a notice of intervention which was acknowledged by Order

No. PSC-2018-0420-PCO-EI. Staff and OPC issued interrogatories and production of

documents to the petitioners, Duke Energy Florida (DEF), and Florida Public

Utilities Company (FPUC). The Commission granted the petition to initiate

rulemaking and noticed the development of the rule in the September 7, 2018

edition of the Florida Administrative Register, Vol. 44, No. 175.

A rule development workshop was

held on January 16, 2019, to obtain stakeholder comment on potential amendments

to the rule. FPL, Gulf, TECO, and OPC participated in the workshop and filed

post-workshop written comments. On March 14, 2019, the petitioners, Duke, and

FPUC responded to staff’s data request regarding the Statement of Estimated

Regulatory Cost (SERC).

This recommendation addresses

whether the Commission should propose the amendment of Rule 25-6.0426, F.A.C.,

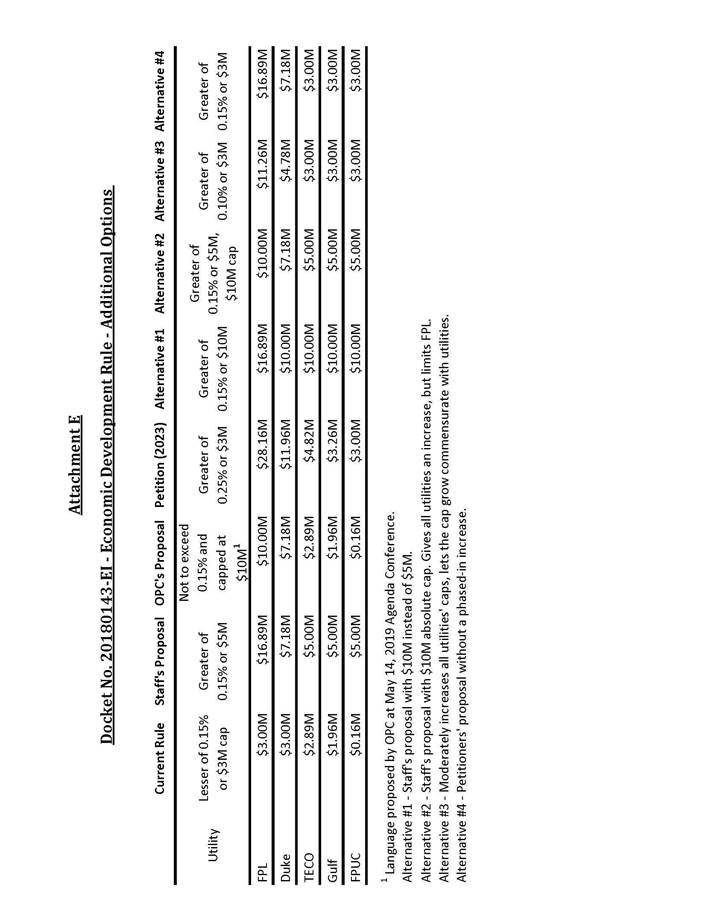

as set forth in Attachment A to the recommendation. The Commission deferred

consideration of the recommendation to the June 11, 2019 Agenda Conference.

The rule amendments as shown in Attachment A provide for an increase in the cap

of recoverable economic development expenses; however, they differ from the

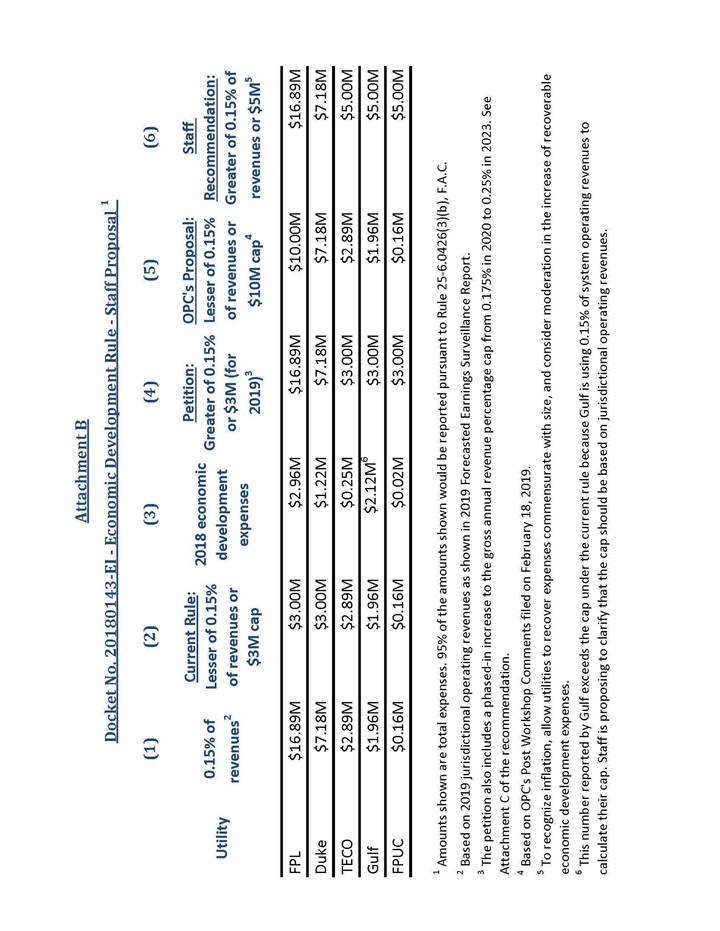

petitioners’ proposed amendments. Attachment B to the recommendation

illustrates recoverable economic development expenses for electric utilities

for 2019 under the current rule, petitioners’ proposed rule, OPC’s proposal

(based on OPC’s post-workshop comments), and staff’s recommended amendments. Revised

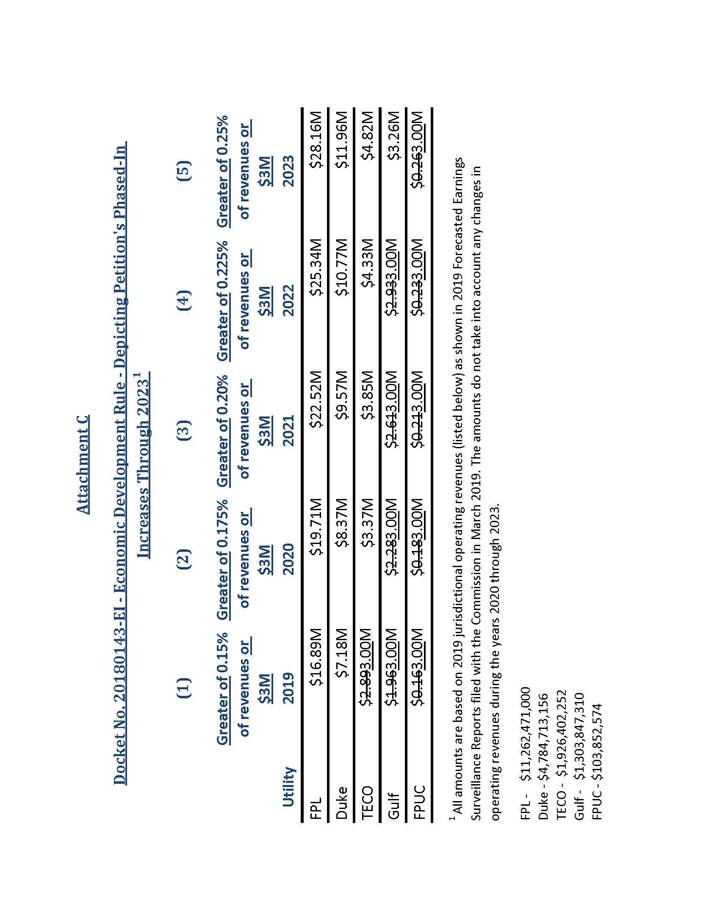

Attachment C further reflects the phased-in approach of percentage increases in

the cap from 2019-2023 as proposed in the petitioners’ proposed rule amendments.

Attachment D includes the Statement of Estimated Regulatory (SERC) costs. At

the May 14, 2019 Agenda Conference, the Commission directed staff to provide

additional options for its consideration, which staff has provided in

Attachment E.

Staff’s recommended rule amendments are based on the petition, the petitioners’

responses to staff’s and OPC’s interrogatories, the presentations and comments

made during the workshop, and the post-workshop written comments. The

Commission has jurisdiction pursuant to Sections 120.54, 350.127, and 288.035,

F.S.

Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rule

25-6.0426, F.A.C., Recovery of Economic Development Expenses?

Recommendation:

Yes, the Commission should propose the amendment of

Rule 25-6.0426, F.A.C., as set forth in Attachment A. The Commission should

certify Rule 25-6.0426, F.A.C., as a minor violation rule. (Davis, Draper,

Merryday)

Staff Analysis:

Staff recommends that the Commission propose the

amendment of Rule 25-6.0426, F.A.C., as set forth in Attachment A. Subsection

(3) of Rule 25-6.0426, F.A.C., is the only section of the rule for which

amendments were offered. Subsection (3) of Rule 25-6.0426, F.A.C., places a cap

on the amount of economic development expenses utilities may report for

surveillance reports and earnings review calculations in between rate cases. Staff’s

explanation as to its recommendation for the rule amendments is set forth in

more detail below.

Current Rule 25-6.0426, F.A.C.

Subsection (3) of the rule currently states:

Prior to each utility’s next rate

change enumerated in subsection (6), the amounts reported for surveillance

reports and earnings review calculations shall be limited to the greater of:

(a) The amount approved in each

utility’s last rate case escalated for customer growth since that time, or

(b) 95 percent of the expenses incurred for the

reporting period so long as such does not exceed the lesser of 0.15 percent of

gross annual revenues or $3 million.

When the rule was initially adopted in 1995, the

Commission established the cap on economic development expenses in paragraph

(3)(b) as the lesser of 0.15 percent of gross annual revenues or $3 million. The

rule provided that ratepayers would be responsible for 90 percent of economic

development expenses and shareholders for the remaining ten percent of economic

development expenses. The Commission established the 95 percent sharing

requirement when the rule was amended in 1998.

Petition to Initiate Rulemaking

The petitioners requested that subsection (3) of the rule

be amended as follows:

Prior to each utility’s next rate

change enumerated in subsection (6), the amounts reported for surveillance

reports and earnings review calculations shall be limited to the greater of:

(a) The amount approved in each

utility’s last rate case escalated for customer growth since that time, or

(b) 95 percent of the expenses

incurred for the reporting period so long as such does not exceed the greater

lesser of 0.15 percent of gross annual revenues or $3 million.

Beginning on January 1, 2020, the amounts reported for surveillance reports and

earnings review calculations shall not exceed the greater of $3 million or 95

percent of the following percentages of gross annual revenues: January 1, 2020

– 0.175 percent; January 1, 2021 – 0.2 percent; January 1, 2022 – 0.225

percent; and, January 1, 2023 and beyond – 0.25 percent.

Attachment C illustrates the

phased-in approach of percentage increases in the cap from 2019-2023 as

proposed in the petitioners’ proposed rule amendments. The petitioners stated that

although Rule 25-60.426, F.A.C., is intended to promote economic development in

Florida, the rule in its current form has become unduly restrictive. The $3

million expense cap set forth in the rule has not changed since 1995. For a

large utility like FPL, according to the petitioners, the current rule has limited

FPL’s recoverable economic development expenses to a flat $3 million per year

in each and every year since the rule’s inception over 20 years ago.

The petitioners asserted that the

impact of the utilities’ recoverable economic development expenses has steadily

eroded since the rule was first established in 1995, with the expense cap

decreasing by approximately 65 percent since 1995 due to inflation. The

petitioners further explained that both the restrictive impact of the cap on

large utilities and the steady erosion of the real value of the cap could be

substantially avoided by the above-requested amendments. The petitioners stated

in their post-workshop comments that these rule amendments are needed to

encourage utilities to broaden economic development in Florida by allowing

recovery of economic development expenses at levels commensurate with the

economic size and reach of each utility.

According to the petitioners, the

suggested rule amendments are not projected to have any adverse impacts to

their general body of ratepayers. The petitioners contend that customers will

see no rate increases as a result of the proposed rule amendments between rate

cases and that the revenue increases from new and expanding business will allow

for long-term fixed costs to be spread over a larger customer base, thereby

benefiting existing customers.

During the staff workshop, FPL explained that the current

$3 million cap creates tension between funding for economic development

staffing and other economic development activities, such as rate discounts. FPL

stated in its post-workshop comments that the proposed amendments to the rule “will

gradually increase the level of funding for promotion of economic development

for FPL from the current $3 million to approximately $27 million by 2023.” It

asserted that this will “permit FPL to continue expanding its promotion of

economic development in Florida” and “increase the funding available for

economic development activities of all Florida investor-owned utilities.” This

increase includes funding for staff in FPL’s Office of Economic Development

which “will provide an enhanced staff focus in the following areas: (1)

business development; (2) competitiveness; and (3) capacity building.”

Both Gulf and TECO stated in their post-workshop comments

that they are not currently spending up to the existing cap limits. Both

utilities also stated that they have no immediate plans to increase their

involvement in economic development activities should the cap be increased.

However, both utilities asserted that given the amount of time since the rule

has been amended and due to the increasing importance of fostering economic

development in Florida, it is appropriate to amend the rule to put the

utilities in a posture to respond to and address changing conditions in the

economic development marketplace.

OPC’s Comments

OPC stated in its post-workshop comments that it does not

“categorically object to some level of increase in the amount allowed in the

Rule as long as shareholders bear some of the increased costs that assumedly

will contribute to their return.” OPC pointed out that all the utilities stated

at the workshop that the utilities contribute no more than the five percent

required under paragraph (3)(b) of the rule. OPC stated that it is concerned

with “maintaining the appropriate balance between customer and shareholder

responsibility regarding the amount spent on economic development and the

amount paid by customers.”

In regard to the utilities’ request to change the word

“lesser” to “greater” in paragraph (3)(b) of the rule, OPC asserted that the

rule should remain the same. Instead, OPC suggested that the rule be amended to

increase the $3 million cap to $10 million.

OPC stated it is concerned that use of the word “greater”

instead of the limiting language “lesser” would “allow for increases in the

amount that can be spent on economic development with no dollar amount ‘cap’ in

the future.” It is concerned that there is a lack of evidence warranting the

level of increase requested by the utilities. It further stated that the

utilities did not “show that they were either foregoing economic development

opportunities due to lack of funding or that they were spending more than five

percent of shareholder monies on the costs for economic development

opportunities that would otherwise be foregone.”

OPC asserted that the limitations in the rule are

necessary because 95 percent of the costs are flowed through to the customers

and the majority of the utilities have not been spending the allowable amounts

under the current rule. It further asserted that “[a]llowing the cap to

increase from $3 million to $10 million is a 333 percent increase which would

allow all utilities to significantly increase spending for economic development

above what they are currently spending.”

Staff’s Recommended Amendments to the Rule

Based on the petition, the petitioners’ responses to

staff’s and OPC’s interrogatories, the presentations and comments made during

the workshop, and the post-workshop written comments, staff believes that Rule

25-6.0426, F.A.C., should be revised to further encourage utilities to promote

continued economic development. Therefore, as reflected in Attachment A, staff

recommends that Section (3) of Rule 25-6.0426, F.A.C., be amended as follows:

Prior to each utility’s next rate

change enumerated in subsection (6), the amounts reported for surveillance

reports and earnings review calculations shall be limited to the greater of:

(a) The amount and level of

sharing approved in each utility’s last rate case escalated for customer

growth since that time, or

(b) 95 percent of the total economic development

expenses incurred for the reporting period so long as the total economic

development expenses do such does not exceed the greater lesser

of 0.15 percent of jurisdictional

gross annual revenues or $53 million.

Attachment B to the recommendation illustrates recoverable

economic development expenses for electric utilities for 2019 under the current

rule, the petitioners’ proposed rule, OPC’s proposal (based on OPC’s post-workshop

comments), and staff’s recommended amendment as shown in Attachment A to the

recommendation. Attachment C essentially illustrates the phased-in approach of the

petitioners’ proposed annual cap increases from 2019-2023. Staff does not favor

a phased-in approach of cap increases for the reasons discussed below. Instead,

staff recommends a more moderate approach described as follows.

First, staff recommends that the Commission amend

paragraph (3)(b) of the rule to change the word “lesser” to “greater” and to

retain the current 0.15 percent ceiling. This amendment allows economic

development expenses to increase commensurate with a utility’s size, addressing

the petitioners’ concerns that the current rule is unduly restrictive for large

utilities such as FPL (when measured in operating revenues). This will result

in the ability of larger utilities to increase economic development expenses over

time as operating revenues grow.

Additionally, staff’s proposed language would allow

smaller utilities to increase their economic development expenses. Under the

current “lesser” language, 0.15 percent of revenues is the economic development

expense cap for Gulf and FPUC because 0.15 percent of jurisdictional operating

revenues falls below the current $3 million cap, as shown in Column 2 of

Attachment B. Under staff’s proposed amendment, changing “lesser” to “greater”

will increase the allowed expenditures for Gulf and FPUC to the dollar cap in

the rule, which would be $5 million as reflected in Column 6 of Attachment B.

Second, staff recommends that the Commission amend

paragraph (3)(b) to increase the $3 million cap to $5 million to address the

effects of inflation since 1995. Staff used the Consumer Price Index for all

Urban Consumers (CPI-U) to bring $3 million in 1995 dollars to a present value

of $4.95 million. This figure was rounded to $5 million for simplification. Adjusting

the cap from $3 million to $5 million, in conjunction with changing “lesser” to

“greater,” would allow all electric utilities to expand their economic

development spending as shown in Column 6 of Attachment B. Staff notes that

OPC’s proposal, as shown in Column 5 of Attachment B, does not provide for an

increase in economic development expenses for TECO, Gulf, and FPUC.

Finally, staff is recommending three minor modifications

to the rule to provide clarity to the rule. Staff recommends that the phrase

“and the level of sharing” be added to paragraph (3)(a) of the rule. The current

language may create uncertainty as to the percentage of economic development expenses

approved in a utility’s last rate case subject to sharing between shareholders

and ratepayers, if the Commission does not specifically address it. Section

288.035, F.S., states the “Commission shall adopt rules for the recovery of

economic development expenses by public utilities, including the sharing of

expenses by shareholders.” Therefore, this clarifies that the level of sharing by

the Commission in a rate case shall be utilized for surveillance purposes.

Staff also recommends that paragraph (3)(b) be amended to

add the phrase “total economic development expenses” to clarify that the cap

prescribed by paragraph (3)(b) includes a 5 percent shareholder contribution. The

amount reported for surveillance reports and earnings review calculations reflects

only the 95 percent ratepayer contribution.

Staff further recommends that subsection (3)(b) be amended

to add the word “jurisdictional” to clarify that the cap is derived from

jurisdictional gross annual revenues, as opposed to system gross annual

revenues. Jurisdictional revenues are derived from retail customers, which are

under the Commission’s jurisdiction. System revenues include retail as well as

wholesale customers, which are under federal jurisdiction. Staff believes this

clarification is needed after communications with the utilities revealed

different understandings of the term “gross annual revenues.”

The petitioners proposed phased-in increases to the

percentage cap, from 0.175 percent in 2020 to 0.25 percent in 2023, as shown in

Columns 2 and 5 of Attachment C of the recommendation. In the staff workshop,

the petitioners communicated that, if the rule is amended as the petition

proposes, the utilities are unlikely to immediately increase spending up to the

caps. This reflects the petitioners’ stated belief that spending should gradually

increase to a higher percentage over time. Staff believes having 0.15 percent

revenue cap (as in the current rule), rather than 0.25 percent, better

mitigates potential rate increases resulting from a larger increase in spending

allowed under the phased-in approach. Further, the utilities did not adequately

demonstrate the need to increase the existing percentage of revenues cap.

Therefore, staff does not believe the petitioners’ phased-in increases to the

percentage cap are warranted. If, with experience, the petitioners determine

that the proposed amendments limit economic development activities, then this can

be addressed in a rate case or further rule amendments may be proposed.

Minor Violation Rule Certification

Pursuant to Section 120.695, F.S., beginning July 1, 2017,

for each rule filed for adoption the agency head shall certify whether any part

of the rule is designated as a rule the violation of which would be a minor

violation. Rule 25-6.0426, F.A.C., is currently listed on the Commission’s website

as a rule for which a violation would be minor because violation of the rule

would not result in economic or physical harm to a person or have an adverse

effect on the public health, safety, or welfare or create a significant threat

of such harm. The amendments to the rule would not change its status as a minor

violation rule. Thus, staff recommends that the Commission certify Rule

25-6.0426, F.A.C., as a minor violation rule.

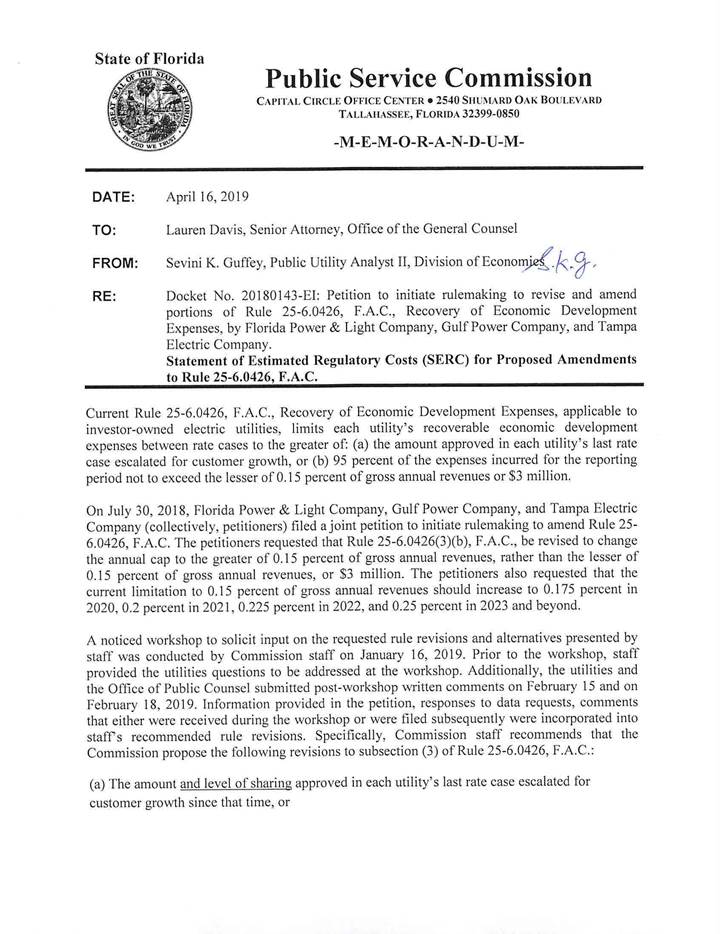

Statement of Estimated Regulatory Costs

Pursuant to Section 120.54, F.S., agencies are encouraged

to prepare a statement of estimated regulatory costs (SERC) before the

adoption, amendment, or repeal of any rule. The SERC is appended as Attachment D

to this recommendation. The SERC analysis also includes whether the rule is

likely to have an adverse impact on growth, private sector job creation or

employment, or private sector investment in excess of $1 million in the

aggregate within five years of implementation.

The SERC concludes that the rule will not likely directly

or indirectly increase regulatory costs in excess of $200,000 in the aggregate

in Florida within one year after implementation. Further, the SERC concludes that the rule

will not likely have an adverse impact on economic growth, private sector job

creation or employment, private sector investment, business competitiveness,

productivity, or innovation in excess of $1 million in the aggregate within

five years of implementation. Thus, the rule does not require legislative

ratification pursuant to Section 120.541(3), F.S. In addition, the SERC states that the rule

will not have an adverse impact on small business and will have no impact on

small cities or counties. No regulatory alternatives were submitted pursuant to

paragraph 120.541(1)(a), F.S. None of

the impact/cost criteria established in paragraph 120.541(2)(a), F.S., will be

exceeded as a result of the recommended revision.

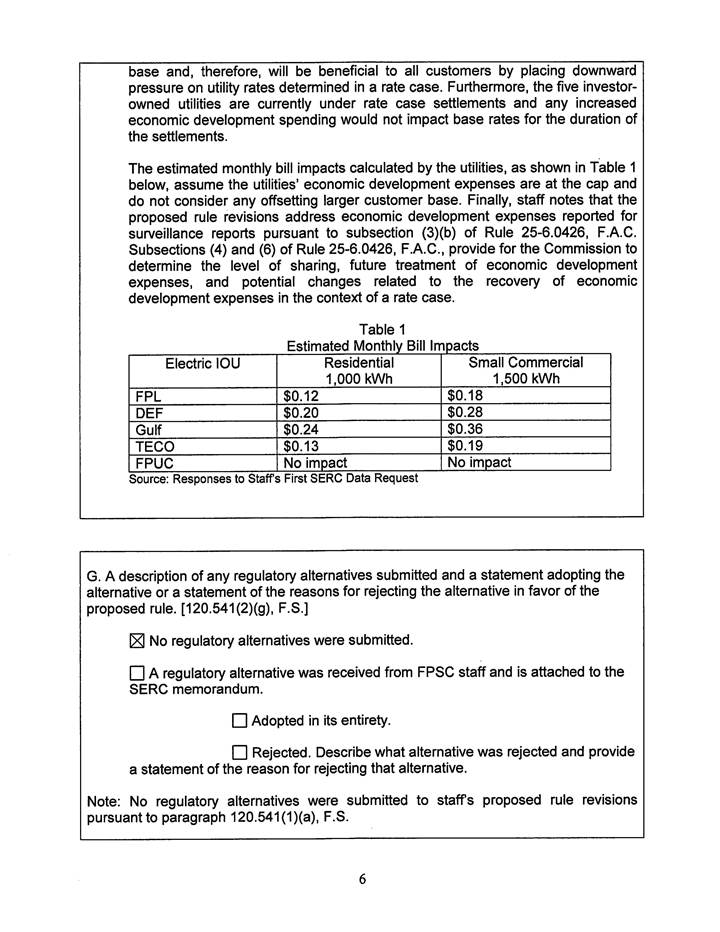

Customer Bill Impacts

The SERC includes an analysis of customer bill impacts of

the rule amendment as shown in Attachment D, page 24. As explained in the SERC,

estimated customer bill impacts for residential and small commercial customers

are projected by the petitioners, Duke, and FPUC to be minimal. In addition,

the customers will see no rate increases as a result of an increase in economic

development spending between rate cases. Finally, the petitioners assert in

their responses to staff’s SERC data requests, that any new load resulting from

economic development activities allows the petitioners to spread fixed costs

over a greater customer base, putting downward pressure on rates for all

customers.

Conclusion

Staff agrees with the petitioners that the current cap is

unduly restrictive, especially for a large utility like FPL, and that inflation

since 1995 has eroded the value of the $3 million cap. However, staff also

believes that while the Commission should continue to encourage economic

development, the Commission should consider moderation in the increase of

recoverable economic development expenses. Based on the foregoing, staff

recommends that the Commission propose the amendment of Rule 25-6.0426, F.A.C.,

as set forth in Attachment A. This more moderate approach when compared to the

petitioners’ request will provide the petitioners with the opportunity for

increased economic development spending to the benefit of the State of Florida.

In addition, the Commission should certify Rule 25-6.0426, F.A.C., as a minor

violation rule.

25-6.0426 Recovery of Economic Development

Expenses.

(1)

Pursuant to Section 288.035, F.S., the Commission shall allow a public utility

to recover reasonable economic development expenses subject to the limitations

contained in subsections (3) and (4), provided that such expenses are prudently

incurred and are consistent with the criteria established in subsection (7).

(2)

Definitions.

(a)

“Economic Development” means those activities designed to improve the quality

of life for all Floridians by building an economy characterized by higher

personal income, better employment opportunities, and improved business access

to domestic and international markets.

(b)

“Economic development organization” means a state, local, or regional public or

private entity within Florida that engages in economic development activities,

such as city and county economic development organizations, chambers of

commerce, Enterprise Florida, the Florida Economic Development Council, and

World Trade Councils.

(c)

“Trade show” means an exhibition at which companies, organizations, communities,

or states advertise or display their products or services, in which economic

development organizations attend or participate to identify potential

industrial prospects, to provide information about the locational advantages of

Florida and its communities, or to promote the goods and services of Florida

companies.

(d)

“Prospecting mission” means a series of meetings with potential industrial

prospects at their business locations with the objectives of convincing the

prospect that Florida is a good place to do business and offers unique

opportunities for that particular business, and encouraging the prospect to

commit to a visit to Florida if a locational search is pending or in progress.

(e) “Strategic plan” means a long-range

guide for the economic development of a community or state that focuses on

broad priority issues, is growth-oriented, is concerned with fundamental

change, and is designed to develop and capitalize on new opportunities.

(f)

“Recruitment” means active efforts to encourage specific companies to expand or

begin operations within Florida.

(3)

Prior to each utility’s next rate change enumerated in subsection (6), the

amounts reported for surveillance reports and earnings review calculations

shall be limited to the greater of:

(a)

The amount and level of sharing approved in each utility’s last rate

case escalated for customer growth since that time, or

(b)

95 percent of the total economic development expenses incurred for the

reporting period so long as the total economic development expenses do such

does not exceed the greater lesser of 0.15 percent of jurisdictional

gross annual revenues or $53 million.

(4)

At the time of each utility’s next rate case and for subsequent rate

proceedings enumerated in subsection (6) the Commission will determine the

level of sharing of prudent economic development costs and the future treatment

of these expenses for surveillance purposes.

(5)

Each utility shall report its total economic development expenses as a separate

line item on its income statement schedules filed with the earnings

surveillance report required by Rule 25-6.1352, F.A.C. Each utility shall make

a line item adjustment on its income statement schedule to remove the appropriate

percentage of economic development expenses incurred for the reported period

consistent with subsections (3) and (4).

(6)

Requests for changes relating to recovery of economic development expenses

shall be considered only in the context of a full revenue requirements rate

case or in a limited scope proceeding for the individual utility.

(7)

All financial support for economic development activities given by public

utilities to state and local governments and organizations shall be pursuant to

a prior written agreement. Recoverable economic development expenses shall be

limited to the following:

(a)

Expenditures for operational assistance, including:

1.

Planning, attending, and participating in trade shows;

2.

Planning, conducting, and participating in prospecting missions designed to

encourage the location in Florida of domestic and foreign companies;

3.

Providing financial support to economic development organizations to assist

with their economic development operations;

4.

Providing financial support to economic development programs or initiatives

identified or developed by Enterprise Florida, Inc.;

5.

Participating in joint economic development efforts, including public-private

partnerships, consortia, and multi-county regional initiatives;

6.

Participating in downtown revitalization and rural community developmental

programs.

7.

Supporting state and local efforts to promote small and minority-owned business

development efforts; and

8.

Supporting state and local efforts to promote business retention and expansion

activities.

(b)

Expenditures for assisting state and local governments in the design of

strategic plans for economic development activities, including:

1.

Making financial contributions to state and local governments to assist strategic

planning efforts; and

2.

Providing technical assistance, data, computer programming, and financial

support to state and local governments in the design and maintenance of

information systems used in strategic planning activities.

(c)

Expenditures of marketing and research services, including;

1.

Assisting state and local governments and economic development organizations in

marketing specific sites for business and industry development or recruitment;

2.

Assisting state and local governments and economic development organizations in

responding to inquiries from business and industry concerning the development

of specific sites within the utility’s service area;

3.

Providing technical assistance, data, computer programming, and financial

support to state and local governments in the design and maintenance of

geographic information systems, computer networks, and other systems used in

marketing and research activities;

4.

Providing financial support to economic development organizations to assist

with their research and marketing activities;

5.

Sponsoring publications, conducting direct mail campaigns, and providing

advertising support for state and local economic development efforts;

6.

Participating in cooperative marketing efforts with economic development

organizations;

7.

Helping state and local businesses identify suppliers, markets, and sources of

financial assistance;

8.

Helping economic development organizations identify specific industries and

companies for targeting and recruitment;

9.

Working with economic development organizations to identify businesses in need

of help for expansion, going out of business, or at risk of leaving the area;

10.

Providing site and facility selection assistance, including lists of commercial

or industrial sites, computer databases, toll-free telephone numbers, maps,

photographs, videos, and other activities in cooperation with economic

development organizations; and

11.

Supporting state and local efforts to promote exports of goods and services,

and other international business activities.

Rulemaking

Authority 288.035(3), 350.127(2) FS. Law Implemented 288.035 FS. History–New

7-17-95, Amended 6-2-98, 9-25-00,______________