Discussion

of Issues

Issue 1:

Should the Commission approve TECO's requested

accounting treatment related to its AMI meters?

Recommendation:

Yes. Staff

recommends that the Commission approve TECO’s requested accounting treatment

related to its AMI meters. (Brownless, Higgins)

Staff Analysis:

Background

On April 23, 2019, TECO filed a petition effectively

requesting authorization to suspend and reverse the depreciation expense on

assets comprising its AMI program and recommence the depreciation expense on

those assets on January 1, 2022. TECO first

began installing and recording depreciation expense for AMI meters in 2016 and is

in the process of replacing all of its current AMR meters with AMI meters. TECO estimates that AMI meters will be

deployed system wide by year-end 2021 along with all of the back-office

functions and communication systems necessary to make the AMI meters fully

functional. Once the AMI meters are fully

functional, the system will be able to provide customer service tools, remote

connection/disconnection of service, and information regarding an individual

customer’s energy usage.

TECO is currently depreciating

AMI meter investment for both regulatory and federal income tax purposes from the

point of purchase. The specific

accounting treatment TECO is proposing is to remove current AMI meter

investment from Plant in Service Account 101 and place it into Construction

Work in Progress (CWIP) Account 107.

Future AMI meter investment made from 2019 through 2021 would also be

placed in CWIP Account 107 where such assets would not be depreciated. On

January 1, 2022, the date that TECO estimates the AMI infrastructure

will be fully functional, AMI meter investment would be booked to plant and depreciation

expense would begin anew.

The depreciation expense

associated with the 2016 through May 2019 AMI meter investment that TECO is

proposing be reversed totals approximately $460,000. TECO states that reversing the prior AMI

depreciation would be “immaterial to the presentation of its financial

statements as a whole.”

The accounting method by which

meters are depreciated is addressed in Rule 25-6.0142, Florida Administrative

Code (F.A.C.). Rule 25-6.0142(1),

F.A.C., incorporates the Uniform System of Accounts prescribed by the Code of

Federal Regulations, Title 18, Chapter I, Subchapter C, Part 101, into the

rule. By this incorporation, meters are

given “cradle-to-grave” accounting treatment.

“Cradle-To-Grave Accounting” is defined in the rule as “[a]n accounting

method which treats a unit of plant as being in service from the time it is

first purchased until it is finally junked or disposed of in another manner.” Further, meters that are in the “shop for

refurbishing or in stock/inventory awaiting reinstallation [are] treated as

being in service.” Applying this rule to

the present situation, TECO must begin depreciating its AMI meters from the

date of purchase.

IRS Reg. Sec. 1.167(a)-(11)(e)(1)

treats the depreciation of plant assets differently. For purposes of depreciation for federal

taxes, an asset is placed in service when it is “first placed in a condition or

state of readiness and availability for a specifically assigned function.” Applying this regulation to the present

situation, TECO concludes that it does not have to begin depreciating the AMI

meters until the date that they are fully functional, i.e., until the

back-office functions and communications systems necessary to allow the AMI

meters to fully perform are in place, currently estimated to be by January 1,

2022.

For tax years 2016 and 2017, TECO

depreciated both AMI and AMR meters for federal tax purposes. TECO has not yet filed its 2018 federal tax

return which is due between October 1 and 15, 2019. TECO intends to claim zero tax deprecation

for AMI for 2018 and to true-up for the cumulative tax depreciation it took for

years prior to 2018, thus aligning the federal tax treatment with the treatment

requested here.

The depreciation of AMR meters is

also addressed in Section 8 of TECO’s 2017 Settlement approved by Order No.

PSC-2017-0456-S-EI. Section 8(b) states as follows:

(b) Notwithstanding the non-deferral language in

Paragraph 4, unless the company proposes a special capital recovery schedule

and the Commission approves it, if coal-fired generating units or other assets

are retired or planned for retirement of a magnitude that would ordinarily or

otherwise require a special capital recovery schedule, such assets will

continue to be depreciated using their then existing depreciation rates and

special capital recovery issues will be addressed in conjunction with the

company’s next depreciation study. If the company installs Automated Meter

Infrastructure (“AMI”) meters and retires Automated Meter Reading (“AMR”)

meters during the Term, such assets will continue to be depreciated using their

then existing depreciation rates and special capital recovery issues will be

addressed in conjunction with the company’s next depreciation study.

[Emphasis added.]

TECO takes the position that

Section 8(b) requires it to continue depreciating its AMR meters even if

replaced by AMI meters. TECO also takes

the position that Section 8(b) does not address the depreciation treatment of AMI

at all. TECO acknowledges that the language

of Section 8(b) can reasonably be read to mean that both AMI and AMR meters

will be depreciated concurrently during the term of the 2017 Settlement. However, TECO argues that the signatories to

the 2017 Agreement did not intend that result.

TECO states that the use of the term “assets” in Section 8(b) “refers to

the AMR meters that would be replaced by AMI meters resulting in an unrecovered

net book value amount.” TECO also states that the use of the term

“rates” was a “scrivener’s error” and should have been “rate” to “reflect the

fact that there is only one approved rate for meters in Account 370 - Meters.”

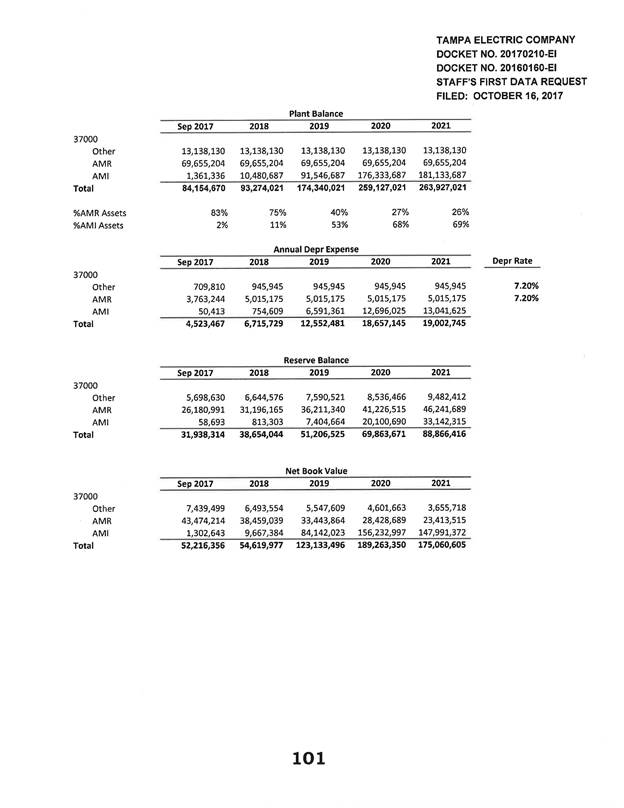

TECO’s response to Staff’s First

Data Request No. 22 in the 2017 Settlement docket indicates that, at the time

that the 2017 Settlement was signed, the Company did intend to depreciate both

its AMI and AMR meters concurrently at an annual rate of 7.2 percent from 2017

through 2021 (the 2017 Settlement term).

[Attachment A]

The Office of Public Counsel

(OPC) agrees that TECO’s request “does not violate the terms of the 2017

Agreement and does not object to the relief requested in the Petition.” The Florida Industrial Power Users Group

(FIPUG) and the Florida Retail Federation (FRF) “do not object to the relief

requested in the Petition.” The West Central Florida Hospital Utility

Association (HUA) does not have a position on the Petition. Likewise, the Federal Executive Agencies

(FEA) do not have a position on the Petition.

The reasons given by TECO for

approval of the requested AMI accounting treatment are as follows:

·

Every

signatory to the 2017 Settlement either supports the proposed treatment of AMI

depreciation or does not object to it.

[Staff First Data Request No. 15, revised on June 17, 2019]

·

The

change in depreciation treatment of AMI meters will match IRS Sec.

1.167(a)-(11)(e)(1)’s treatment since they are not currently providing their

“specifically designed function.”

[Petition at 7; Staff Second Data Request No. 1]

·

Allowing

depreciation of AMI meters when all AMI installations

and back-office system integration are complete, estimated to be January 2022,

prevents any intergenerational inequities.

[Petition at ¶ 14]

·

The

continued depreciation of AMR meters will decrease the undepreciated net book

value of those assets which will in turn reduce, or may eliminate, the amount

of a capital recovery schedule for those assets in TECO’s next depreciation

study filed with its next base rate case.

·

Per

Section 9 of the 2017 Settlement, as implemented by Order No. PSC-

2019-0234-AS-EI,

due to the passage of the Tax Cuts and Jobs Act of 2017 (TCJA) TECO is required

to make a one-time bill credit of $11,500,000 in January of 2020.

·

The

passage of the TCJA in December of 2017 also resulted in the loss of bonus

depreciation on additions to utility plant which has a negative impact on

accumulated deferred income taxes in the Company’s capital structure. This negative impact will increase in the

future as less income tax is deferred.

[Staff’s First Data Request No. 5; Staff’s Second Data Request at No. 6]

·

As

of the March 2019 Earnings Surveillance Report, TECO’s rate of return (ROR) is

6.14 percent and its return on equity (ROE) is 10.18 percent. TECO’s current return on equity earnings

range is 9.25 percent to 11.25 percent with a mid-point of 10.25 percent. [Staff’s Second Data Request No. 6] The proposed accounting treatment for AMI

would result in approximately a $233,000 higher net operating income and 1

basis point increase in return on equity in the March 2019 Earnings

Surveillance Report. [Staff’s Data

Request No. 7] TECO projects that by

2021, if this petition is not approved, AMI depreciation expense will have a

19.2 basis points negative impact on ROE.

[Staff Data Request No. 7]

Analysis

The first issue to address in

determining whether TECO’s petition should be granted is to determine the

procedural nature of TECO’s request to delay depreciation of the AMI

assets. In short, is this: 1) a de facto request for a waiver of Rule

25-6.0142(3), F.A.C., or 2) an addition to, or clarification of, the 2017

Settlement?

A request for waiver of a rule is

controlled by Section 120.542, F.S., and Chapter 28-104, F.A.C., which require

that the petition for waiver be so named and filed with both the agency and the

Joint Administrative Procedures Committee (JAPC). Further, the request must state: 1) the rule

or portion of the rule for which waiver is requested; 2) the statute the rule

is implementing; 3) the type of action requested; 4) the “specific facts that

demonstrate a substantial hardship or violation of principles of fairness that

would justify a waiver or variance for the petitioner”; 5) the “reason why the

variance or the waiver requested would serve the purposes of the underlying

statute”; and 6) whether the waiver is temporary or permanent. TECO’s petition does not meet these

requirements. While some of the facts

plead by TECO could demonstrate why the variance would serve the purposes of

the underlying statutes,

there is no argument developed on this point.

Additionally, TECO has not filed its petition with JAPC nor asked the

Commission to follow the procedures set forth in Section 120.542(6), F.S. Thus, in its present form, the petition does

not contain the required information for processing it as a rule waiver even if

the procedural filing requirements had been followed or could now be initiated.

At the most basic level, TECO’s

request seeks to supplement Section 8(b) of the 2017 Settlement by addressing

the depreciation treatment of AMI meters both during and at the end of the

settlement term thereby allowing AMI meters to be treated differently than they

otherwise would be under Rule 25-6.0142, F.A.C.

For this reason, staff recommends that TECO’s request be treated as an

addition to, or clarification of, Section 8(b) of the 2017 Settlement.

The standard for determining

whether TECO’s request to supplement the 2017 Settlement should be granted is

whether the requested accounting treatment is in the public interest when the

2017 Settlement is taken as whole. This

is the same standard the Commission applied when initially determining whether

the 2017 Settlement should be approved.

Upon review of TECO’s response to

Staff’s First Data Request No. 22 in the 2017 Settlement docket, staff is of

the opinion that TECO and the other signatories to the 2017 Settlement intended

to depreciate both the AMR and AMI meters during the 2017 Settlement term. This treatment is consistent with Rule

25-6.0142, F.A.C., and the plain language of Section 8(b). It appears that the parties to the 2017

Settlement were concerned about leaving as small an amount as possible of

undepreciated AMR expense at the end of the settlement term. This goal is

reasonable given that TECO was receiving bonus depreciation under

federal tax provisions at that time. The

loss of bonus depreciation is a significant change in circumstances. Further, staff agrees that TECO’s proposal to

reverse all depreciation entries associated with AMI meters will have a very

small impact on its financial statements.

Additionally, the Commission’s

approval of the 2017 Settlement was based, in part, on the fact that the

parties negotiated a “stay out” provision of four years during which time base

rates would not change, for reasons other than those provided for in the 2017

Settlement, unless TECO earned above or below its authorized range of 9.25 to

11.25 percent. The passage of the TCJA, which took place

after the execution of the 2017 Settlement, has had an unexpected negative

financial impact on TECO by eliminating bonus depreciation and thereby

effectively decreasing the amount of TECO’s zero cost capital. If no change is made to the depreciation

treatment of AMI meters, the greater level of depreciation expense will further

depress TECO’s ability to earn within its authorized rate of return range at

current base rates.

OPC does not consider TECO’s

proposal to violate the terms of the 2017 Settlement nor does any other

signatory to the 2017 Settlement oppose TECO’s request. It is clear that TECO’s proposed treatment of

the AMI meters will have the effect of decreasing pressure on its ability to

earn within its authorized range and increase the likelihood that TECO can

maintain its current base rates until December 31, 2021. Given these factors, it is staff’s recommendation

that the 2017 Settlement, using TECO’s proposed treatment of the AMI meters, when

taken as a whole, continues to be in the public interest.

Conclusion

Staff recommends that the Commission approve TECO’s requested

accounting treatment related to its AMI meters because TECO’s proposed

treatment of AMI meter depreciation expense, when evaluated in light of the

whole 2017 Settlement, continues to be in the public interest.

Issue 2:

Should TECO continue recording depreciation expense

on existing AMR meters during the term of the 2017 Settlement?

Recommendation:

Yes. The

continued depreciation of existing AMR meters is consistent with the 2017 Settlement. (Brownless, Higgins)

Staff Analysis:

It is staff’s opinion that the terms of Section 8(b)

of the Company’s 2017 Settlement, approved by Order No. PSC-2017-0456-S-EI,

require TECO to continue recording depreciation of its AMR assets if replaced

by AMI assets during the term of the settlement. As such, this issue has already been addressed

and ruled upon. Further, if AMR assets are still in use or

in-service as defined by Rule 25-6.0142(2)(d), F.A.C., after the 2017

Settlement period, those assets should continue to be depreciated at the then

Commission-approved rate.

Conclusion

Staff recommends the Company

continue to follow the terms of the 2017 Settlement, specifically Section 8(b),

as it relates to the bookkeeping of AMR meters during the settlement period.

Issue 3:

Should this docket be closed?

Recommendation:

If no person whose substantial interests are

affected by the proposed agency action files a protest within 21 days of the

issuance of the order, this docket should be administratively closed upon the

issuance of a consummating order.

(Brownless)

Staff Analysis:

At the conclusion of the protest period, if no

protest is filed, this docket should be administratively closed upon the

issuance of a consummating order.