|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

August 22, 2019

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Office of the General Counsel (Harper)

Division of Accounting

and Finance (Norris, Sewards)

Division of Economics

(Hudson, Ramos, Guffey)

|

|

RE:

|

Docket No. 20190152-WS – Proposed Amendment

of Rule 25-30.350, F.A.C., Underbillings and Overbillings for Water and

Wastewater Service, and Rule 25-30.360, F.A.C., Refunds.

|

|

AGENDA:

|

09/05/19 – Regular Agenda – Rule Proposal – Interested Persons May

Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Fay

|

|

RULE STATUS:

|

Proposal May Be Deferred

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

Rule 25-30.350, Underbillings and

Overbillings for Water and Wastewater Service, Florida Administrative Code

(F.A.C.), addresses underbillings and overbillings by water and wastewater

companies. Subsection (2) of the rule provides the criteria for underbillings

and allows the customer to pay for the unbilled service over the same time

period as the time period during which the underbilling occurred or some other

mutually agreeable time period. In addition, the rule sets forth the criteria

by which an overbilling is determined and sets forth the procedure for how the

refund amount should be calculated based on available records. This rulemaking

does not amend any of the underbillings requirements. The focus of this

rulemaking is on the overbillings portion of Rule 25-30.350, F.A.C.

Rule 25-30.360,

Refunds, F.A.C., provides a process for disbursing overbilling refunds to water

and wastewater customers. The rule

sets forth the procedures for the timing of refunds, basis of the refund, cases

where refunds include interest, the method of refund distribursement, security

money collected subject to a refund, and refund reports.

On April 18,

2019, Office of Public Counsel (OPC) filed a petition for declaratory statement

that sought clarification on how the Commission applies Rule 25-30.350, F.A.C.,

and Rule 25-30.360, F.A.C., in the case of overbillings. On June 24, 2019, OPC

withdrew its petition for declaratory statement after staff agreed to initiate

rulemaking to explore whether Rule 25-30.350, F.A.C., and Rule 25-30.360,

F.A.C., should be amended to clarify the process that the Commission uses to

refund overbillings.

A Notice of

Development of Rulemaking was published in Volume 45, No. 120, of the Florida

Administrative Register on June 20, 2019. A rule development workshop was held

on July 15, 2019. Representatives from OPC and Utilities Inc. Florida were in

attendance.

This

recommendation addresses whether the Commission should amend Rules 25-30.350

and 25-30.360, F.A.C. The Commission has jurisdiction pursuant to Sections

120.54, 367.081, 367.091, and 367.161, Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission amend Rule 25-30.350, Underbillings

and Overbillings for Water and Wastewater Service, F.A.C., and Rule 25-30.360, Refunds,

F.A.C.?

Recommendation:

Yes, the Commission should amend Rule 25-30.350,

F.A.C., and Rule 25-30.360, F.A.C, as set forth in Attachment A. The Commission

should certify Rules 25-30.350 and 25-30.360, F.A.C., as minor violation rules.

(Harper, Sewards, Norris, Hudson, Guffey, Ramos)

Staff Analysis:

Rule 25-30.350, F.A.C., sets forth the procedure for

calculating overbillings. Rule 25-30.360, F.A.C., sets forth the procedure for disbursing

the amount of refunds. Staff believes that both Rule 25-30.350, F.A.C., and Rule

25-30.360, F.A.C., work in conjunction, i.e.,

once the Commission determines that a water or wastewater utility has overbilled

a customer pursuant to Rule 25-30.350, F.A.C., any refund required due to overbilling

must be disbursed by the utility pursuant to Rule 25-30.360, F.A.C. Staff recommends that both rules be amended

to clarify that the two rules are to function in conjunction with each other.

Staff recommends that subsection (3) of Rule 25-30.350,

F.A.C., include a reference to Rule 25-30.360, F.A.C., to clarify that if there

is a determination of overbilling, any refunds for overbillings must be disbursed

pursuant to Rule 25-30.360, F.A.C. Similarly, in subsection (1) of Rule 25-30.360, F.A.C., staff

recommends adding a reference to Rule 25-30.350, F.A.C., to clarify that before

a refund can be disbursed, the calculation for overbillings must first be made

pursuant to Rule 25-30.350, F.A.C. In other words, all refund calculations are

made pursuant to Rule 25-30.350, F.A.C., and the disbursement of the refunds

are made pursuant to Rule 25-30.360, F.A.C.

In addition, staff recommends removing the discretionary

language in subsection (1) of Rule 25-30.360, F.A.C., and the reference to the customer

deposit rule. Subsection (1) should instead state that unless another rule

specifically sets forth procedures for making refunds, Rule 25-30.360, F.A.C.,

is applicable in the case of a customer refund.

Minor Violation Rules Certification

Rules 25-30.350 and 25-30.360, F.A.C., are on the

Commission’s list of minor violation rules. Pursuant to Section 120.695, F.S., as

of July 1, 2017, the agency head shall certify whether any part of each rule

filed for adoption is designated as a minor violation rule. A minor violation

rule is a rule that would not result in economic or physical harm to a person

or an adverse effect on the public health, safety, or welfare or create a significant

threat of such harm when violated. Staff recommends that the Commission continue

to certify both rules as minor violation rules.

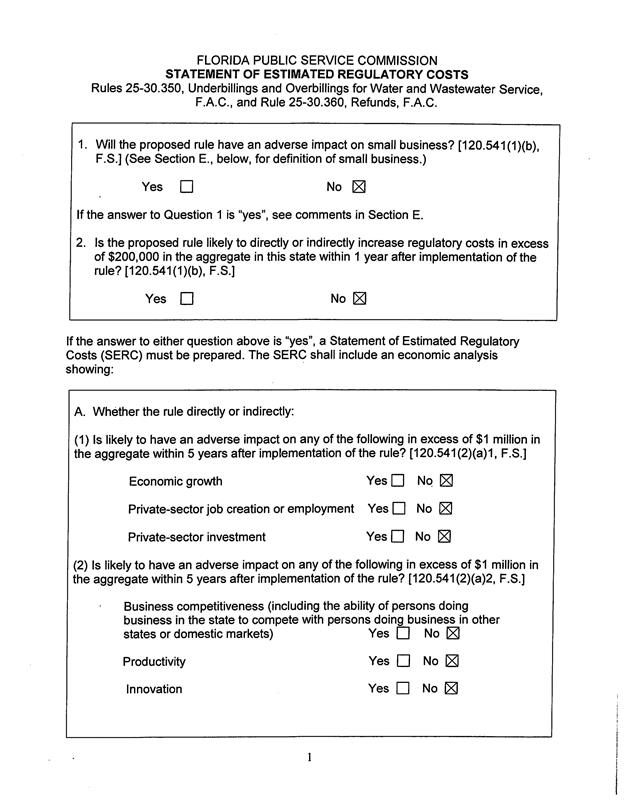

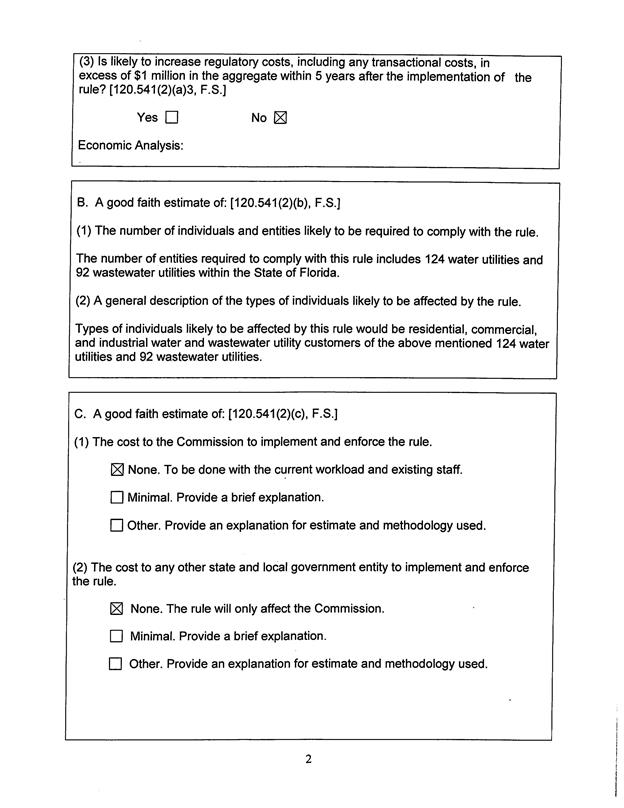

Statement of Estimated Regulatory Costs

Pursuant to Section 120.54(3)(b)1.,

F.S., agencies are encouraged to prepare a statement of estimated regulatory

costs (SERC) before the adoption, amendment, or repeal of any rule. A SERC was prepared for this rulemaking and

is appended as Attachment B. As required by Section 120.541(2)(a)1., F.S., the

SERC analysis includes whether the rule amendments are likely to have an

adverse impact on economic growth, private sector job creation or employment,

or private sector investment in excess of $1 million in the aggregate within five

years after implementation. Staff notes that none of the impact/cost criteria

will be exceeded as a result of the recommended revisions.

The SERC

concludes that the amendments to Rules 25-30.350 and 25-30.360, F.A.C., will

likely not directly or indirectly increase regulatory costs in excess of

$200,000 within 1 year after implementation. Further, the SERC concludes that the

amendment of the rules will not likely increase regulatory costs, including any

transactional costs, or have an adverse impact on business competitiveness,

productivity, or innovation in excess of $1 million in the aggregate within

five years of implementation. Thus, the amendment of the rules does not require

legislative ratification, pursuant to Section 120.541(3), F.S.

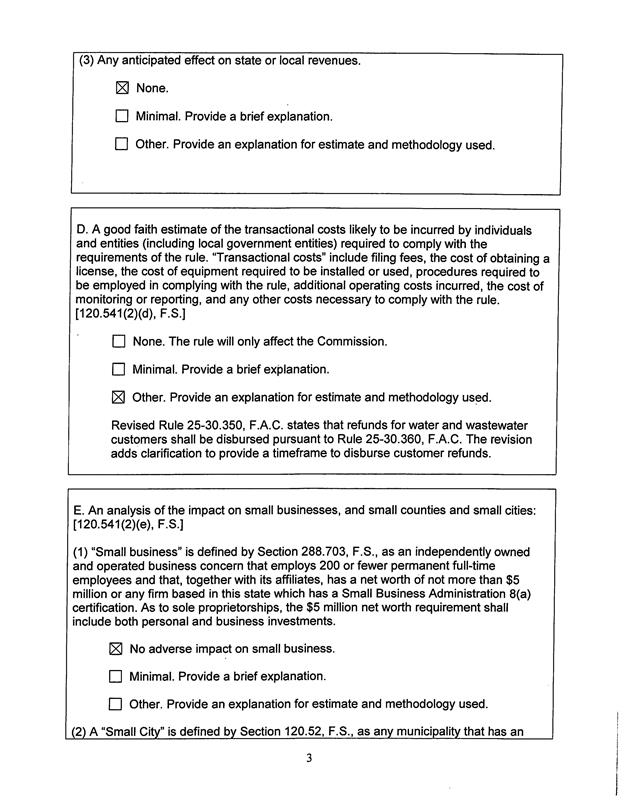

In

addition, the SERC states that the amendments to Rules 25-30.350 and 25-30.360,

F.A.C., would have no impact on small businesses, would have no implementation

or enforcement cost on the Commission or any other state and local government

entity, and would have no impact on small cities or small counties. The SERC states that no additional transactional

costs are likely to be incurred by individuals and entities required to comply

with the requirements.

Conclusion

The Commission should amend Rules 25-30.350 and 25-30.360,

F.A.C., as set forth in Attachment A. The Commission should certify Rules

25-30.350 and 25-30.360, F.A.C., as minor violation rules.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no

requests for hearing or comments are filed, the rules may be filed with the

Department of State, and this docket should be closed. (Harper)

Staff Analysis:

If no requests for hearing or comments are

filed, the rules may be filed with the Department of State, and this docket

should be closed.

25-30.350 Underbillings and Overbillings for Water and Wastewater Service.

(1)

A utility may not backbill customers for any period greater than 12 months for

any undercharge in billing which is the result of the utility’s mistake.

(a)

The utility shall allow the customer to pay for the unbilled service over the

same time period as the time period during which the underbilling occurred or

some other mutually agreeable time period. The utility shall not recover in a

ratemaking proceeding, any lost revenues which inure to the utility’s detriment

on account of this provision.

(b)

The revised bill shall be calculated on a monthly basis, assuming uniform

consumption during the month(s) subject to underbilling, based on the

individual customer’s average usage for the time period covered by the

underbilling. The monthly bills shall be recalculated by applying the tariff

rates in effect for that time period. The customer shall be responsible for the

difference between the amount originally billed and the recalculated bill. All

calculations used to arrive at the rebilled amount shall be made available to

the customer upon the customer’s request.

(2)

In the event of an overbilling, the utility shall refund the overcharge to the

customer based on available records. If the commencement date of the overbilling

cannot be determined, then an estimate of the overbilling shall be made based

on the customer’s past consumption.

(3)

In the event of an overbilling, the customer may elect to receive the refund as

a one-time disbursement, if the refund is in excess of $20, or as a credit to

future billings. Refunds for overbillings shall be disbursed pursuant to Rule

25-30.360, F.A.C.

Rulemaking

Authority 350.127(2), 367.121 FS. Law Implemented 367.091, 367.121 FS.

History–New 11-10-86, Amended 6-17-13, ______________.

25-30.360 Refunds.

(1)

Applicability. With the exception of deposit refunds, Aall

refunds under this chapter ordered by the Commission shall be

made in accordance with the provisions of this rule, unless another rule

in this chapter specifically sets forth the procedure for making refunds otherwise

ordered by the Commission. The calculation for overbillings shall be

pursuant to Rule 25-30.350, F.A.C., and disbursed pursuant to this rule.

(2)

Timing of Refunds. Refunds must be made within 90 days of the Commission’s

order unless a different time frame is prescribed by the Commission. A timely

motion for reconsideration temporarily stays the refund, pending the final

order on the motion for reconsideration. In the event of a stay pending

reconsideration, the timing of the refund shall commence from the date of the

order disposing of any motion for reconsideration. This rule does not authorize

any motion for reconsideration not otherwise authorized by Chapter 25-22,

F.A.C.

(3)

Basis of Refund. Where the refund is the result of a specific rate change,

including interim rate increases, and the refund can be computed on a per

customer basis, that will be the basis of the refund. However, where the refund

is not related to specific rate changes, such as a refund for overearnings, the

refund shall be made to customers of record as of a date specified by the

Commission. In such case, refunds shall be made on the basis of usage. Per

customer refund refers to a refund to every customer receiving service during

the refund period. Customer of record refund refers to a refund to every

customer receiving service as of a date specified by the Commission.

(4)

Interest.

(a)

In the case of refunds which the Commission orders to be made with interest,

the average monthly interest rate until refund is posted to the customer’s

account shall be based on the 30 day commercial paper rate for high grade,

unsecured notes sold through dealers by major corporations in multiples of

$1,000 as regularly published in the Wall Street Journal.

(b)

This average monthly interest rate shall be calculated for each month of the

refund period:

1.

By adding the published interest rate in effect for the last business day of

the month prior to each month the refund period and the published rate in

effect for the last business day of each month of the refund period divided by

24 to obtain the average monthly interest rate;

2.

The average monthly interest rate for the month prior to distribution shall be

the same as the last calculated average monthly interest rate.

(c)

The average monthly interest rate shall be applied to the sum of the previous

month’s ending balance (including monthly interest accruals) and the current

month’s ending balance divided by 2 to accomplish a compounding effect.

(d)

Interest Multiplier. When the refund is computed for each customer, an interest

multiplier may be applied against the amount of each customer’s refund in lieu

of a monthly calculation of the interest for each customer. The interest

multiplier shall be calculated by dividing the total amount refundable to all

customers, including interest, by the total amount of the refund, excluding

interest. For the purpose of calculating the interest multiplier, the utility

may, upon approval by the Commission, estimate the monthly refundable amount.

(e)

Commission staff shall provide applicable interest rate figures and assistance

in calculations under this Rule upon request of the affected utility.

(5)

Method of Refund Distribution. For those customers still on the system, a

credit shall be made on the bill. In the event the refund is for a greater

amount than the bill, the remainder of the credit shall be carried forward

until the refund is completed. If the customer so requests, a check for any

negative balance must be sent to the customer within 10 days of the request.

For customers entitled to a refund but no longer on the system, the company

shall mail a refund check to the last known billing address except that no

refund for less than $1.00 will be made to these customers.

(6)

Security for Money Collected Subject to Refund. In the case of money being

collected subject to refund, the money shall be secured by a bond unless the

Commission specifically authorizes some other type of security such as placing

the money in escrow, approving a corporate undertaking, or providing a letter

of credit. The company shall provide a report by the 20th of each month

indicating the monthly and total amount of money subject to refund as of the

end of the preceding month. The report shall also indicate the status of

whatever security is being used to guarantee repayment of the money.

(7)

Refund Reports. During the processing of the refund, monthly reports on the

status of the refund shall be made by the 20th of the following month. In

addition, a preliminary report shall be made within 30 days after the date the

refund is completed and again 90 days thereafter. A final report shall be made

after all administrative aspects of the refund are completed. The above reports

shall specify the following:

(a)

The amount of money to be refunded and how that amount was computed;

(b)

The amount of money actually refunded;

(c)

The amount of any unclaimed refunds; and

(d)

The status of any unclaimed amounts.

(8)

Any unclaimed refunds shall be treated as cash

contributions-in-aid-of-construction.

Rulemaking

Authority 350.127(2), 367.121 FS. Law Implemented 367.081, 367.0814, 367.082(2)

FS. History–New 8-18-83, Formerly 25-10.76, 25-10.076, Amended 11-30-93,

________.

For example, a customer could receive monies back from

a utility pursuant to Rule 25-30.311,

Customer Deposits, F.A.C. Because Rule 25-30.311, F.A.C., specifically sets forth a procedure from

making refunds, it would continue to be an exception to the more general refund

requirements of Rule 25-30.360, F.A.C.