Discussion

of Issues

Issue

1:

Is the

quality of service provided by North Peninsula Utilities Corporation

satisfactory?

Recommendation:

Yes.

NPUC has been responsive to customer complaints, and intends to complete the

pro forma plant improvements discussed in Issue 4 to be in compliance with the

DEP, and to help ensure customer satisfaction. Therefore, staff recommends that

the quality of service be considered satisfactory. (Thompson)

Staff Analysis:

Pursuant

to Section 367.081(2)(a)1, F.S., and Rule 25-30.433(1), Florida Administrative

Code (F.A.C.), in wastewater rate cases, the Commission shall determine the

overall quality of service provided by the utility. For a wastewater only

utility, the determination is made from an evaluation of the utility’s attempt

to address customer satisfaction. The Rule further states that outstanding

citations, violations, and consent orders on file with the DEP and the county

health department, along with any DEP and county health department officials’

testimony concerning quality of service shall be considered. In addition, any

customer testimony, comments, or complaints received by the Commission are also

reviewed. The operating condition of the wastewater system is addressed in

Issue 2.

The Utility’s Attempt to Address Customer

Satisfaction

Staff reviewed the complaints filed in the Commission’s Consumer

Activity Tracking System (CATS), filed with the DEP, and received by the

Utility from July 1, 2013, through June 30, 2018. Staff has also performed a

supplemental review of the complaints filed in CATS and with the DEP during the

course of this docket, and following the customer meeting held on May 8, 2019.

Table 1-1 shows the number of complaints reviewed by source and subject.

Table 1-1

Number of Complaints by

Source and Subject

|

Subject of Complaint

|

CATS Records

|

DEP Records

|

Utility Records

|

Total

|

|

Overflows Outside Utility Property

|

2

|

1

|

9

|

12

|

|

Plant Noise

|

1

|

2

|

4

|

7

|

|

Plant Odor

|

1

|

3

|

5

|

9

|

|

Plant Fencing

|

-

|

-

|

1

|

1

|

|

Equipment State

|

1

|

1

|

1

|

3

|

|

Other

|

-

|

-

|

1

|

1

|

|

Total*

|

5

|

7

|

21

|

33

|

*A single customer complaint may be

counted multiple times if it fits into multiple categories.

One complaint

was filed in CATS during the specified timeframe on September 15, 2017. The

customer reported that wastewater had overflowed into several front yards in the

neighborhood. The Utility’s response stated that the problem was caused by losing

power during Hurricane Irma. Once the storm subsided, the Utility pumped down

the lift station until power was restored. When the storm and river water

receded from the customer’s property, the Utility pumped out the swale and

disinfected the area to resolve the issue. Two additional complaints have been

received during the course of this docket. One complaint was from the same

customer and they again reported that wastewater had overflowed into their

yard. They stated that this has happened five times since 2006, and that the

Utility has not upgraded its equipment to resolve this issue. They stated that

the Utility did not respond to the issue for over 24 hours; therefore, lime

became caked onto their new pavers. The Utility’s response stated that a power

surge appeared to damage the alarm system that advises the Utility of issues.

The Utility hired an electrician to repair this issue. Regarding the customer’s

statement about NPUC taking over 24 hours to respond to the issue, the Utility

stated that the septic company’s truck broke down on the way to clean the customer’s

area. The Utility asserted that the customer did not want an employee from the

Utility to clean their pavers; therefore, a septic company cleaned them at a

later date. The other complaint was related to pump noise and odor. The Utility

requested that a Volusia County Environmental Specialist test the noise levels

at the facility, and the Utility was determined to be in compliance with the

Volusia County noise ordinance. Regarding the odor, the Utility stated that it

could have been caused by periodic pumping of sludge, which is a part of normal

operation, or equipment failures which are repaired as quickly as possible. These

complaints have been closed.

The Utility

received a total of 16 customer complaints during the specified timeframe and

two during the course of this docket. The majority of complaints received were

related to overflows, odor, and noise. NPUC stated that overflows outside the

Utility property have been few, but those that occurred were due to electrical

power failures, mechanical problems, or storms/hurricanes. The Utility has replaced

parts for the control system to the lift stations and installed surge

protectors for control panels, and it intends to continue to make upgrades to its

electrical system and mechanical equipment through pro forma plant improvements

discussed in Issue 4. Regarding plant odor, the Utility stated that this is due

to periodic sludge pumping as previously noted or mechanical problems which are

repaired as soon as possible. Staff did not notice any excessive odors during

the site visit; however, as noted by the Utility, the odor does tend to be more

prominent in the direction of the wind. Regarding plant noise, NPUC is in

compliance with the Volusia County noise ordinance as stated above. However,

the Utility has installed sound deadening fences to help with this issue. Other

complaints received and resolved by the Utility include a fallen fence, a

damaged manhole, and depression in a customer’s yard due to a cracked clay pipe.

The DEP provided four complaints during this timeframe related to odor, noise

and equipment state, and one during the course of this docket related to an

overflow. The complaint received related to an overflow overlapped one of the

complaints received by the Utility during the course of this docket. The DEP

investigated these issues, and the complaints were closed.

A customer

meeting was held on May 8, 2019. Sixteen customers were in attendance and six

customers provided oral comments. At the meeting, customers expressed concerns

regarding the issues discussed above as well as rate concerns. The customers

discussed the necessity of plant equipment improvements to control plant noise,

odor, and overflows. The condition of the wastewater facility will be addressed

in Issue 2.

Conclusion

NPUC has been responsive to customer complaints, and

intends to complete the pro forma plant improvements discussed in Issue 4 to be

in compliance with the DEP, and to help ensure customer satisfaction.

Therefore, staff recommends that the quality of service be considered satisfactory.

Issue

2:

Are

the infrastructure and operating conditions of North Peninsula Utilities

Corporation’s wastewater system in compliance with DEP regulations?

Recommendation:

NPUC

is not currently in compliance with the DEP, but is working to address the

issues noted in the DEP Consent Order through the pro forma plant improvements

discussed in Issue 4. The Utility also plans to address other plant

improvements necessary to ensure that its facilities and equipment are in safe,

efficient, and proper condition. (Thompson)

Staff Analysis:

Rule 25-30.225(2), F.A.C., requires each wastewater

utility to maintain and operate its plant and facilities by employing qualified

operators in accordance with the rules of the DEP. Rule 25-30.433(2), F.A.C.,

requires consideration of whether the infrastructure and operating conditions

of the plant and facilities are in compliance with Rule 25-30.225, F.A.C. In

making this determination, the Commission must consider testimony of the DEP

and county health department officials, compliance evaluation inspections,

citations, violations, and consent orders issued to the utility, customer

testimony, comments, and complaints, and utility testimony and responses to the

aforementioned items.

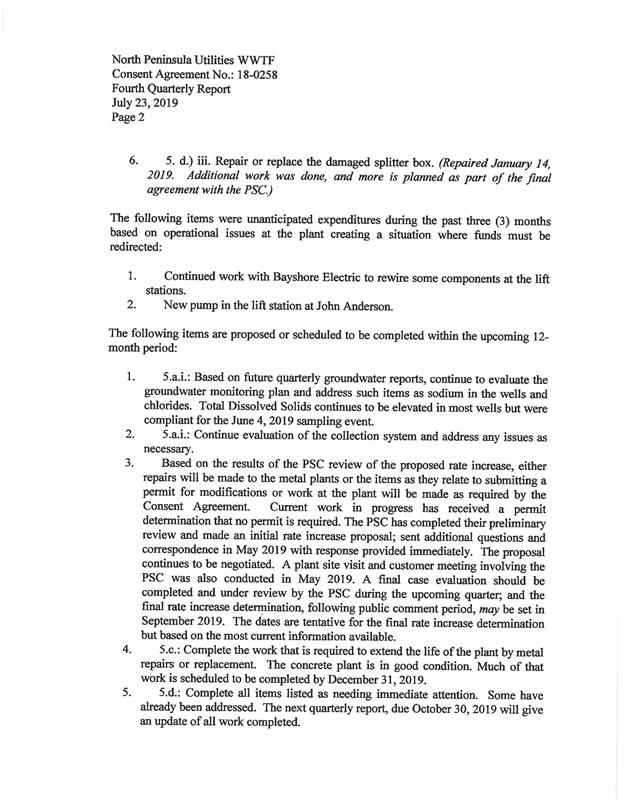

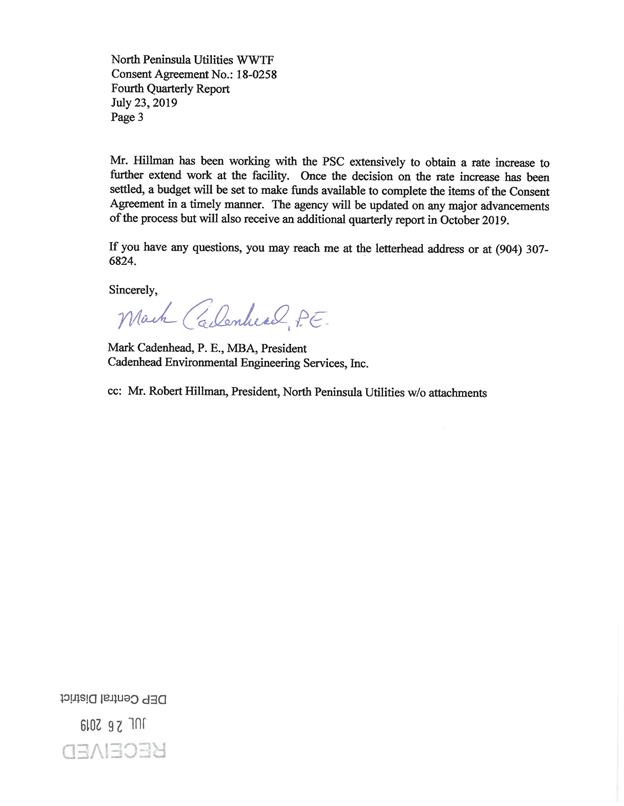

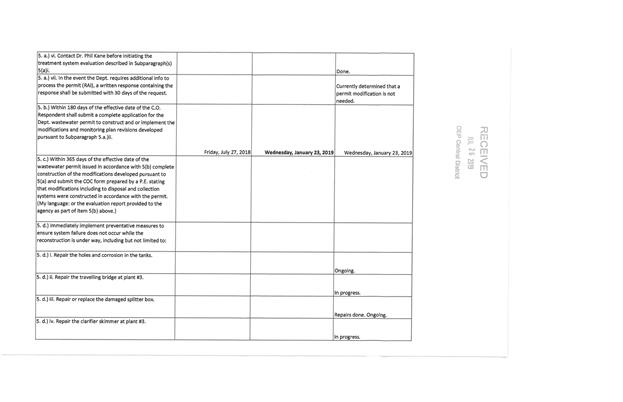

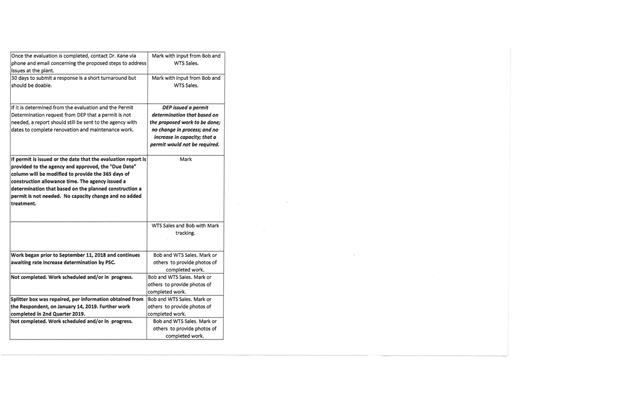

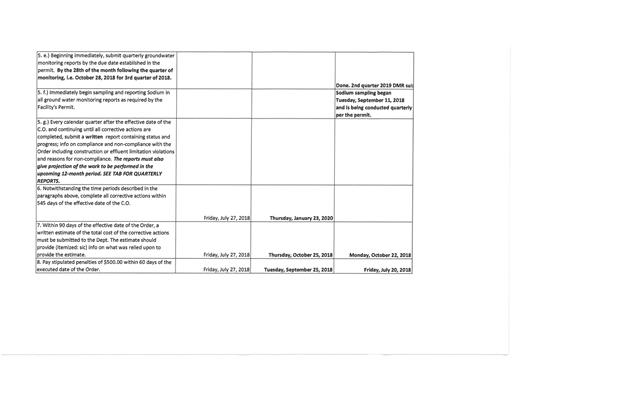

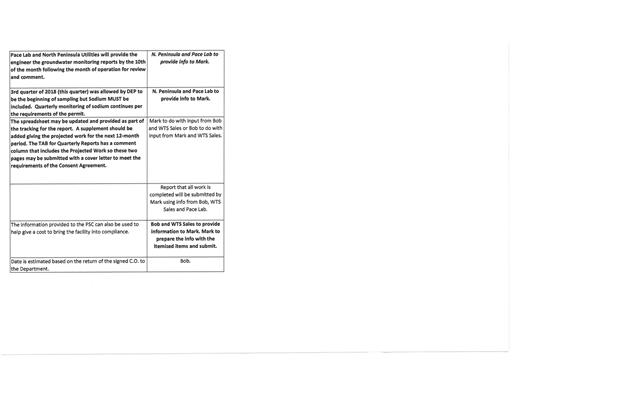

Wastewater System Operating Condition

NPUC’s wastewater system is an existing 210,000 gallons

per day (gpd) design capacity and 181,000 gpd annual average daily flow (AADF)

permitted capacity domestic wastewater treatment plant (WWTP). Staff reviewed

NPUC’s compliance evaluation inspections conducted by the DEP to determine the

Utility’s overall wastewater facility compliance. A review of the March 7, 2017

inspection, indicated that NPUC’s wastewater treatment facility was in

compliance with the DEP’s rules and regulations. However, as a result of the

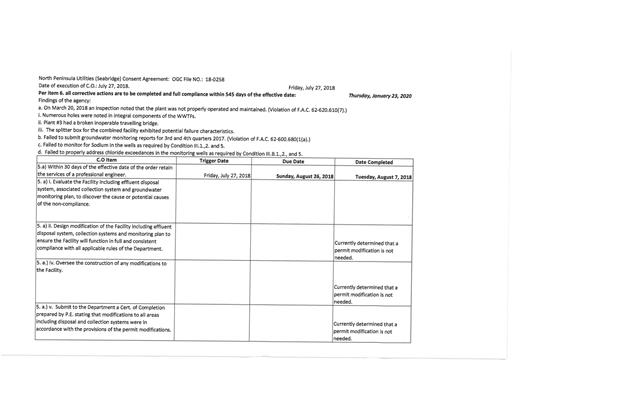

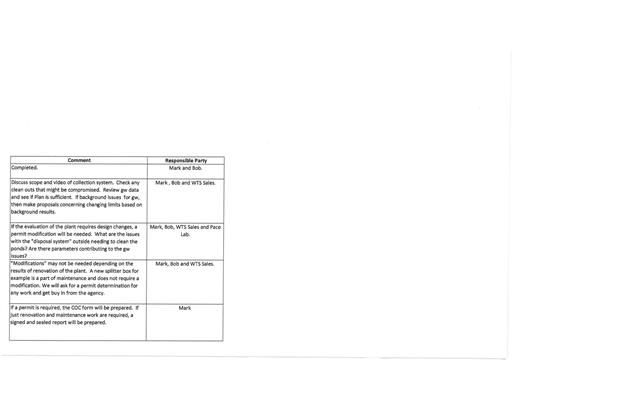

March 20, 2018, inspection NPUC was issued a Consent Order from the DEP to

address noted disrepairs. The Consent Order requires NPUC to immediately

implement preventative measures to ensure system failure does not occur due to

deteriorating facility components while reconstruction is under way. This

includes but is not limited to: (1) repairing the holes and corrosion in the

tanks; (2) repairing the travelling bridge at Plant #3; (3) repairing or

replacing the damaged splitter box; and (4) repairing the clarifier skimmer at

Plant #3. The Utility is working to address the deficiencies noted in the

Consent Order from the DEP through the pro forma plant improvements discussed

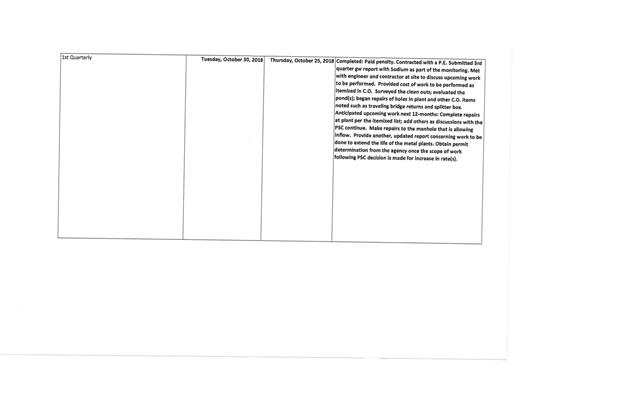

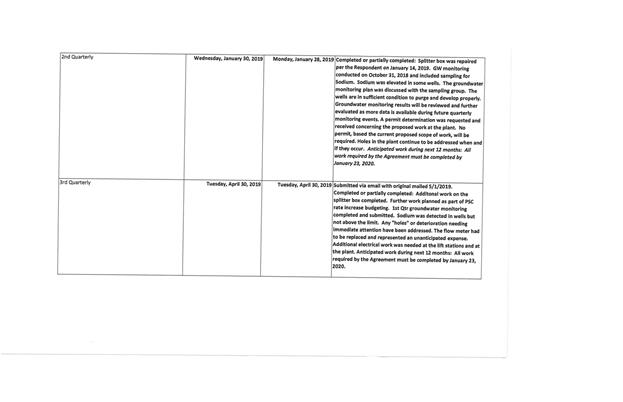

in Issue 4. NPUC is required to provide quarterly progress updates to the DEP,

and the most recent update is included as Attachment A. As of now, the work

completed by NPUC to address noted deficiencies includes having partially

repaired holes in the tanks, and having repaired the damaged splitter box.

Conclusion

NPUC is not currently in compliance with the DEP, but is

working to address the issues noted in the DEP Consent Order through the pro

forma plant improvements discussed in Issue 4. The Utility also plans to

address other plant improvements necessary to ensure that its facilities and

equipment are in safe, efficient, and proper condition.

Issue

3:

What

are the used and useful (U&U) percentages of North Peninsula Utilities

Corporation's WWTP and collection system?

Recommendation:

NPUC’s

WWTP and collection system should both be considered 100 percent U&U. Additionally,

staff recommends no adjustment to purchased power and chemicals should be made

for excessive infiltration and inflow (I&I). (Thompson)

Staff Analysis:

NPUC’s wastewater system

was constructed in 1979. As stated in Issue 2, NPUC’s wastewater facility is

permitted by the DEP as a 181,000 gpd AADF facility. The collection system is

composed of vitrified clay pipes (VCP) and polyvinyl chloride (PVC) pipes, and

there are two lift stations in the service area. NPUC’s wastewater collection

system comprises 5,420 feet of 6 inch PVC force mains, 10,305 feet of 8 inch

VCP collecting mains, and 10,777 feet of 8 inch PVC collecting mains. There are

approximately 87 manholes in the service area.

Rates were last established for

NPUC in Docket No. 20000715-SU, and the Utility’s U&U for its WWTP and

collection system were last determined in that docket as well. In

that docket, the Commission determined the Utility’s WWTP and collection system

to be 100 percent U&U.

Infiltration and Inflow

Infiltration typically results from groundwater entering a

wastewater collection system through broken or defective pipes and joints;

whereas, inflow results from water entering a wastewater collection system

through manholes or lift stations. By convention, the allowance for

infiltration is 500 gpd per inch diameter pipe per mile, and an additional 10

percent of residential water billed is allowed for inflow. Rule 25-30.432,

F.A.C., provides that in determining the WWTP amount of U&U, the Commission

will consider I&I.

Since all wastewater collection

systems experience I&I, the conventions noted above provide guidance for

determining whether the I&I experienced at a WWTP is excessive. Staff

calculates the allowable infiltration based on system parameters, and

calculates the allowable inflow based on water sold to customers. The sum of

these amounts is the allowable I&I. Staff next calculates the estimated

amount of wastewater returned from customers. The estimated return is

determined by summing 80 percent of the water sold to residential customers

with 90 percent of the water sold to non-residential customers. Adding the

estimated return to the allowable I&I yields the maximum amount of

wastewater that should be treated by the wastewater system without incurring

adjustments to operating expenses. If this amount exceeds the actual amount

treated, no adjustment is made. If it is less than the gallons treated, then

the difference is the excessive amount of I&I.

The allowance for infiltration

was calculated as 6,953,527 gallons per year. However, as discussed in Issue

10, the Utility has a flat rate billing structure, and the format of the

metered water data provided would require a significant amount of time to

determine the water usage per customer. Therefore, staff was unable to determine

the allowance for inflow and thus the total allowable I&I, or the maximum

amount of wastewater allowed to be treated.

Used and Useful Percentages

As noted above, the Commission

previously found both the WWTP and collection system to be 100 percent U&U.

The Utility has not increased the capacity of its WWTP, but it has expanded its

territory since rates were last established. The Utility has currently only

connected four new customers since the territory amendment, but has additional

connection capacity of 288 equivalent residential connections (ERCs). However,

the Utility has not built additional facilities to address the increased

capacity of its collection system. Therefore, consistent with the Commission’s

previous decision, staff recommends the Utility’s WWTP and collection system be

considered 100 percent U&U.

Conclusion

NPUC’s WWTP and collection system should be considered 100 percent

U&U. Additionally, staff recommends no adjustment to purchased power and

chemicals should be made for excessive I&I.

Issue

4:

What

is the appropriate average test year rate base for North Peninsula Utilities

Corporation?

Recommendation:

The

appropriate average test year rate base for the Utility is $232,047.

(Richards, Thompson)

Staff Analysis:

The

appropriate components of the Utility’s rate base include utility plant in

service (UPIS), land, accumulated depreciation,

contributions-in-aid-of-construction (CIAC), accumulated amortization of CIAC,

and working capital. The last proceeding that established balances for rate

base was Docket No. 20000715-SU.[5] Staff selected the test year

ended June 30, 2018, for the instant rate case. A summary of each component and

the recommended adjustments follows.

Utility

Plant in Service (UPIS)

The Utility

recorded $960,499 for UPIS. Staff recommends a UPIS balance of $892,604 which

represents a reduction of $67,895. The staff audit identified several

adjustments resulting in a net decrease to UPIS of $77,595 to reflect the

appropriate balances and additions that were not booked. Staff increased UPIS

by $1,462 for the connection of a new customer. Staff also made an averaging

adjustment to decrease UPIS by $5,409. Staff made an adjustment increasing UPIS

by $47,088 to reflect pro forma plant additions offset by a decrease of $33,441

to reflect pro forma plant retirement. Staff recommends an average UPIS balance

of $892,604 ($960,499 - $77,595 + $1,462 - $5,409 + $47,088 - $33,441).

Pro

Forma Plant Additions

Table 4-1 shows NPUC’s pro forma plant projects, some of

which were explicitly mandated by the DEP Consent Order. Other projects are

plant improvements necessary for the Utility to continue to provide reliable

service to its customers, consistent with the DEP Consent Order and Rule

25-30.225, F.A.C. The wastewater treatment facility is located on a narrow

peninsula between the Atlantic Ocean and the Halifax River in Ormond Beach,

Florida. According to the Utility, weather and saltwater conditions have led to

the corrosion of the wastewater facility. The Utility asserts that the area

frequently experiences strong storms, and that the facility has dealt with two

major hurricanes in recent years. During the site visit, staff corroborated the

corrosive condition of the facility.

As contemplated by Section

367.081(2)(a)2, F.S., staff has included pro forma items that have been

completed or are anticipated to be completed by June 30, 2020, 24 months after

the end of the test year. The Replace Travelling Bridge Return at Plant #3 was explicitly

mandated for completion in the DEP Consent Order. The other items mandated for

completion by the DEP are operation and maintenance (O&M) pro forma items;

therefore, these and other O&M pro forma expense items are included in

Table 7-3 in Issue 7. Table 4-2 is a cost breakdown of the pro forma plant

projects.

Table 4-1

Pro-Forma Plant Items

|

Project

|

Acct. No.

|

Amount

|

Retirement

|

|

Replace Lift Station #1 Panel and New Electrical Equipment

|

371

|

$8,000

|

($6,000)

|

|

New Sludge Return Troughs in Plant #1

|

380

|

$7,911

|

($5,933)

|

|

Repaired and Replaced Parts for Control Systems to Lift

Station

|

371

|

$1,670

|

($1,253)

|

|

Replace Air Supply Lines in Clarifiers

|

380

|

$3,447

|

($2,585)

|

|

Installed New Motors for the Treatment Plant and Lift

Station #2

|

371

|

$2,360

|

($1,770)

|

|

Two New Mechanical Gear Drives

|

380

|

$8,105

|

($6,079)

|

|

Installed New Ultrasonic Flow Meter

|

364

|

$2,500

|

($0)

|

|

Installed Surge Protectors for Control Panels

|

380

|

$686

|

($515)

|

|

Replaced Main Circuit Board and Flying Lead Transformer

|

380

|

$315

|

($236)

|

|

Replaced Bad Wire to Subpanel and All Damaged Components

|

380

|

$3,660

|

($2,745)

|

|

Rebuilt Pump for Lift Station #2

|

371

|

$1,315

|

($986)

|

|

Installed New Magnetic Contactor

|

380

|

$468

|

($351)

|

|

Replace Travelling Bridge Return at Plant #3*

|

380

|

$5,275

|

($3,956)

|

|

Replaced Entrance Gate

|

354

|

$1,375

|

($1,031)

|

Source:

Responses to staff data requests. *DEP mandated item.

Table 4-2

Pro Forma Plant

|

Acct.

|

Addition

|

Retirement

|

Dep

Exp.

|

Net

Plant

|

A/D

Adj.

|

|

354

|

$1,375

|

$1,031

|

$13

|

$331

|

$1,019

|

|

364

|

$2,500

|

$0

|

$500

|

$2,000

|

($500)

|

|

371

|

$13,345

|

$10,009

|

$223

|

$3,114

|

$9,786

|

|

380

|

$29,868

|

$22,401

|

$498

|

$6,969

|

$21,903

|

|

|

$47,088

|

$33,441

|

$1,233

|

$12,414

|

$32,207

|

Source: Responses to staff

data requests.

Although the DEP explicitly

mandated certain items for completion in the Consent Order, it required NPUC to

“Immediately implement preventative measures to ensure system failure does not

occur due to deteriorating facility components while the process of

reconstruction is under way, including but not limited to . . .” those specific

items. Also, Rule 25-30.225, F.A.C., requires each wastewater utility to

construct, maintain, and operate its plant in such a way that ensures all of

the utility’s facilities and equipment are in proper condition for rendering

safe and adequate service. The items requested in addition to the DEP mandated

items are also necessary for the upkeep of the facility. Table 4-3 shows the

status of completion for each pro forma project.

Table 4-3

Pro Forma Project Status of

Completion

|

Project

|

Completed

|

To Be Completed by 12/31/2019

|

To Be Completed by 1/31/2020

|

|

Replace Lift Station #1 Panel and New Electrical Equipment

|

|

X

|

|

|

New Sludge Return Troughs in Plant #1

|

|

X

|

|

|

Repaired and Replaced Parts for Control Systems to Lift

Station

|

X

|

|

|

|

Replace Air Supply Lines in Clarifiers

|

|

X

|

|

|

Installed New Motors for the Treatment Plant and Lift

Station #2

|

X

|

|

|

|

Two New Mechanical Gear Drives

|

|

X

|

|

|

Installed New Ultrasonic Flow Meter

|

X

|

|

|

|

Installed Surge Protectors for Control Panels

|

X

|

|

|

|

Replaced Main Circuit Board and Flying Lead Transformer

|

X

|

|

|

|

Replaced Bad Wire to Subpanel and All Damaged Components

|

X

|

|

|

|

Rebuilt Pump for Lift Station #2

|

X

|

|

|

|

Installed New Magnetic Contactor

|

X

|

|

|

|

Replace Travelling Bridge Return at Plant #3*

|

|

X

|

|

|

Replaced Entrance Gate

|

X

|

|

|

|

Repair Holes in Tank*

|

|

X

|

|

|

Repaired Splitter Box*

|

X

|

|

|

|

Repair Clarifier Skimmer at Plant #3*

|

|

X

|

|

|

Sanitary Manhole Repair

|

|

|

X

|

|

Repair Holes in Bulkhead & Sidewall of Plant #1

|

|

X

|

|

Source: Responses to staff

data requests. *DEP mandated item.

As stated in Issue 2, the work completed by NPUC to

address the deficiencies noted in the DEP Consent Order includes having

partially repaired holes in the tanks, and having repaired the damaged splitter

box. Work is currently under way to complete the remaining projects mandated by

the DEP, and the Utility intends to have each completed by the end of December

2019 as shown in Table 4-3.

Staff requested that all bids

received be provided for each requested pro forma project. Two bids were

provided for the Sanitary Manhole Repair, Replace Lift Station #1 Panel and New

Electrical Equipment, and Replaced Entrance Gate projects, and the least cost

bidder was selected. For the DEP mandated items, New Sludge Return Troughs in

Plant #1, Two New Mechanical Gear Drives, Replace Air Supply Lines in

Clarifiers, and Repair Holes in Bulkhead & Sidewall of Plant #1 pro forma

projects, the Utility stated that additional bids were requested; however,

other vendors were unwilling to provide bids against a vendor that is familiar

with the facility. The Utility asserts that the vendor completing these

projects has worked with the facility since operations began and has a thorough

understanding of the needed improvements.

All other projects listed in

Table 4-3 were emergency items requiring immediate attention; therefore, the

Utility did not have time to request multiple bids. Due to the deadline of January 23, 2020,

contemplated in the DEP Consent Order for the completion of all mandated items,

and the requirements of Rule 25-30.225, F.A.C., staff recommends that these

project costs are appropriate.

Land &

Land Rights

The

Utility recorded a test year land value of $46,800. Based on staff’s review, no

adjustments are necessary. Therefore, staff recommends that the land and land

rights balance remain $46,800.

Accumulated

Depreciation

The

Utility recorded an accumulated depreciation balance of $926,024. Staff

recommends an accumulated depreciation balance of $735,029, which represents a

reduction of $190,995. Staff recalculated the accumulated depreciation balance

using the prescribed depreciation rates set forth in Rule 25-30.140, F.A.C.,

and included depreciation associated with plant additions and retirements.

Staff has decreased accumulated depreciation by $158,547 to reflect the

appropriate test year starting balance of $767,477. Staff’s balance includes

adjustments the Utility should have recorded, and adjustments to correct

accounts that the Utility continued to depreciate past the life of the asset.

Staff increased accumulated depreciation by $21 for the connection of a new

customer. Staff also made an averaging adjustment to accumulated depreciation

that resulted in a decrease of $262. Further, staff made corresponding

adjustments to accumulated depreciation based on the pro forma plant additions

and retirements resulting in an additional decrease of $32,207. Staff’s

adjustments result in an accumulated depreciation balance of $735,029 ($926,024

– $158,547 + $21 – $262 – $32,207).

Contributions

In Aid of Construction (CIAC)

The

Utility recorded a CIAC balance of $640,994. Staff recommends a CIAC balance of

$641,725, which represents an increase of $731. In June 2018, a new customer

was connected to the Utility’s force main, however, the Utility did not reflect

a customer connection during the test year. As a result, staff increased CIAC

by $1,462 ($762 main extension charge and a $700 inspection fee). Additionally,

staff decreased CIAC by $731 to reflect an averaging adjustment. Staff

recommends the appropriate CIAC balance is $641,725 ($640,994 + $1,462 – $731).

Accumulated

Amortization of CIAC

The

Utility recorded accumulated amortization of CIAC of $640,994. Staff recommends

accumulated amortization of CIAC of $641,015, which represents an increase of

$21. Prior to adding the new customer connection, CIAC was fully amortized in

the year ended 2007. Staff increased accumulated amortization of CIAC by $21 to

reflect the new connection. Staff recommends accumulated amortization of CIAC

balance of $641,015 ($640,994 + $21).

Working

Capital Allowance

Working

capital is defined as the short-term funds that are necessary to meet operating

expenses of the Utility. Consistent with Rule 25-30.433(2), F.A.C., staff used

the one-eighth of the O&M expense formula approach for calculating the

working capital allowance. Staff also removed the unamortized balance of rate

case expense of $1,147 ($4,589 ÷ 4)

pursuant to Section 367.081(9), F.S.[6]

Applying this formula, staff recommends a working capital allowance of $28,381

($227,050 ÷ 8),

based on the adjusted O&M expense of $227,050 ($228,197 – $1,147).

Rate Base

Summary

Based on

the foregoing, staff recommends that the appropriate average test year rate

base is $232,047. Rate base is shown on Schedule No. 1-A. The related

adjustments are shown on Schedule No. 1-B.

Issue

5:

What

is the appropriate return on equity and overall rate of return for North

Peninsula Utilities Corporation?

Recommendation:

The

appropriate return on equity (ROE) is 10.55 percent with a range of 9.55

percent to 11.55 percent. The appropriate rate of return is 6.70 percent.

(Richards)

Staff Analysis:

The Utility has negative

common equity of $940,160 on its 2018 annual report due to a negative retained

earnings balance. In accordance with Commission practice, staff set the

negative common equity to zero.[7] The

Utility does not have any customer deposits on its books. The Utility also

recorded a long-term debt balance of $1,093,091.

The Utility’s capital structure

has been reconciled with staff’s recommended rate base. The appropriate ROE for

the Utility is 10.55 percent based upon the Commission-approved leverage

formula currently in effect.[8] Staff

recommends an ROE of 10.55 percent with a range of 9.55 percent to 11.55

percent, and an overall rate of return of 6.70 percent. The overall rate of return

is the Utility’s weighted average cost of long-term debt. The long-term debt is

comprised of multiple notes at different rates, which equates to a weighted

average of 6.70 percent, as detailed in Table 5-1. The ROE and overall rate of

return are shown on Schedule No. 2.

Table 5-1

Long-Term Debt – Weighted

Average

|

Loan

|

Amount

|

% of

Total

|

Int.Rate

|

Weighted

Cost

|

|

Intracoastal Bank

|

$727,307

|

66.54%

|

6.70%

|

4.46%

|

|

Line of Credit – PNC

|

17,136

|

1.57%

|

10.29%

|

0.16%

|

|

Business Card – PNC

|

13,696

|

1.25%

|

14.58%

|

0.18%

|

|

SeaCoast Bank

|

68,896

|

6.30%

|

6.08%

|

0.38%

|

|

Intracoastal Bank

|

218,968

|

20.03%

|

6.08%

|

1.22%

|

|

Pro Forma Project Loan

|

47,088

|

4.31%

|

7.00%

|

0.30%

|

|

Total

|

$1,093,091

|

100.00%

|

|

6.70%

|

Source: Audit Report and

Utility responses to staff data requests.

Issue

6:

What

are the appropriate test year revenues for North Peninsula Utilities

Corporation?

Recommendation:

The

appropriate test year revenues for NPUC’s wastewater system are $243,777.

(Bruce)

Staff Analysis:

NPUC does not keep a formal

general ledger, but rather an excel spreadsheet of the check register. As a

result, staff used the regulatory assessment fee (RAF) form as a basis for the

test year revenues. The RAF forms reflected test year revenues of $242,291.

Staff also evaluated the billing determinants and the number of miscellaneous

occurrences during the test year. The Utility had a price index increase subsequent

to the test year. The Utility’s billing determinants and the rates that became

effective after the test year result in annualized test year service revenues

of $241,705. In addition, the Utility had 306 test year late payment

occurrences. Applying the Utility’s approved miscellaneous service charges to

the number of occurrences during the test year result in miscellaneous revenues

of $2,072. Thus, test year revenues

should be $243,777 ($241,705 + $2,072). Staff made an adjustment of $1,486

($243,777 - $242,291) to reflect the appropriate test year revenues. Based on

the above, staff recommends that the appropriate test year revenues for NPUC’s

wastewater system are $243,777.

Issue

7:

What

is the appropriate test year operating expense for North Peninsula Utilities

Corporation?

Recommendation:

The

appropriate amount of operating expense for the Utility is $254,765.

(Richards)

Staff Analysis:

The

Utility recorded total operating expense of $322,537. The test year O&M

expenses have been reviewed by staff, including invoices and other supporting

documentation. Staff has made the following adjustments to the Utility’s

operating expenses as discussed below.

O&M

Expenses

Sludge Removal (711)

The

Utility recorded sludge removal expense of $22,860. Staff reviewed invoices

provided by the Utility and agrees with the amount. Staff recommends no

adjustment to sludge removal expense.

Purchased Power (715)

The

Utility recorded purchased power expense of $12,245. Staff decreased purchased

power expense by $949 to remove out of test year amounts. Staff also decreased

this amount by $33 to reflect removal of late fees. Therefore, staff recommends

purchased power expense of $11,263 ($12,245 – $949 – $33).

Chemicals (718)

The

Utility recorded chemicals expense of $5,776. Staff decreased chemicals expense

by $389 to remove out of test year amounts. Therefore, staff recommends

chemicals expense of $5,387 ($5,776 – $389).

Materials and Supplies (720)

The

Utility recorded materials and supplies expense of $613 for two orders of File

Cards. Staff believes these cards are for billing the customers. Staff reviewed

the invoices provided by the Utility in response to staff’s second data request

and agrees with this amount; therefore, staff recommends no adjustment to

materials and supplies expense.[9]

Contractual Services – Engineering

(731)

The

Utility recorded contractual services – engineering expense of $800. The

Utility retained the services of Cadenhead Environmental Engineering Services,

Inc. (Cadenhead) to prepare a Florida Department of Environmental Protection

(FDEP) permit renewal application. In response to staff’s fifth data request,

the Utility paid Cadenhead $1,600 to prepare and submit the renewal application

to FDEP, which was paid in two installments of $800.[10]

The application fee due to FDEP was $3,000 paid on March 2, 2018. The permit

covers a five-year period. Staff increased engineering expense by $120 to

reflect the total expense of $4,600 ($1,600 + $3,000) amortized over five

years. Therefore, staff recommends contractual services – engineering expense

of $920 ($4,600 / 5).

Contractual Services – Accounting

(732)

The

Utility recorded contractual services – accounting expense of $4,500. In

response to staff’s second data request, the Utility stated that Martin, Klayer

and Associates provided bookkeeping and accounting services for $1,350 plus

$750 for preparation of the Utility’s tax return, IRS Form 1120S.[11] The bookkeeping and

accounting services provided by Martin, Klayer and Associates took place

outside of the test year and appear duplicative of the services provided by

Willdan Financial Services, therefore staff recommends removing $1,350.

The

Utility contracts with Willdan Financial Services to provide the following

services at a cost of $2,400:

- Prepare

the Annual Report for the year in an Excel compatible format for

submission to the Florida Public Service Commission.

- Coordinate

with Utility staff to prepare and submit the required Annual Report

paperwork and copies to the Commission.

- Prepare

any necessary true-up journal entries to be posted by the Utility to its

accounting records.

- Prepare

any necessary monthly journal entries including those for depreciation and

amortization expense.

- Prepare

Annual Indexing application and file with the Commission.

Staff

recommends contractual services – accounting expense of $3,150 ($750 + $2,400)

Contractual Services – Legal (733)

The

Utility recorded contractual services – legal expense of $1,030. This expense

was for a one time legal matter. Staff removed this amount due to lack of

supporting documentation from the Utility. In response to staff’s seventh data

request the Utility stated it contracts with Doran Sims Wolfe & Ciocchetti

for legal expenses which relate to collection activities on behalf of NPUC.[12] On average, the Utility

pays $150 for these collection activities four times a year. Therefore, staff

recommends contractual services – legal expense of $600 ($150 × 4).

Contractual Services – Management

Fees (734)

The

Utility recorded Contractual Services – management fee of $135,487. This

expense is paid to Peninsula Management Incorporated (PMI) based on a contract

between NPUC and PMI to handle the administrative and management functions of

the Utility. The President and Vice President of the Utility are also the

owners of PMI. The first time an expense was approved for the PMI contract by

the Commission was in Docket No. 19960984-SU.[13]

The approved amount was $20,000. The PMI contract consists of two parts;

Overhead and Administration, and a Management Fee. The Management Fee is

compensation for the President and Vice President of NPUC who are also the

owners. Staff recommends $29,812 for the Overhead and Administration portion of

the contract, plus $62,273 for the Officer Salary portion of the contract, for

a total Management Fee of $92,085 ($29,812 + $62,273).

Overhead and Administration

The

Utility recorded $33,960 for the overhead and administration portion of the PMI

contract. In attachment 4 of the Utility’s response to staff’s second data

request, the Utility provided a list of the services and costs included in the

PMI contract classified as Overhead and Administration.[14]

Staff recommends two adjustments to the overhead and administration expense: a

reduction of $3,600 for Miscellaneous Expenses and a reduction of $548 to

Vehicle Expense. Table 7-1 summarizes the overhead and administration costs

included in the PMI contract and staff’s adjusted amounts.

Table 7-1

PMI

Contract – Overhead and Administration

|

Service

|

Per

Utility

|

Staff

Adj.

|

Per Staff

|

|

Office

Rental

|

$6,600

|

$0

|

$6,600

|

|

Employee

Salary

|

$12,960

|

$0

|

$12,960

|

|

Utilities,

Insurance, Supplies & Equipment

|

$4,800

|

$0

|

$4,800

|

|

Miscellaneous

Expenses

|

$3,600

|

($3,600)

|

$0

|

|

Auto

Expense

|

$6,000

|

($548)

|

$5,452

|

|

Total:

|

$33,960

|

($4,158)

|

$29,812

|

Source: Staff’s second and

fifth data requests.

Office Rental

The

Utility shares office space with HW Peninsula, LLC which is also owned by

NPUC’s owners. In response to staff’s fifth data request, the Utility provided

a copy of the office lease dated December 1, 2009, which is currently in

effect.[15] According to the Utility,

NPUC’s portion of the office rental is $6,600 per year. Staff believes this

amount for office rental is reasonable and therefore, recommends no adjustment

to the office rental portion of the contract with PMI.

Employee Salary

There is

one employee who is paid through the PMI contract. This employee is responsible

for many of the daily administrative duties necessary for NPUC such as billing,

customer service, customer receipts and accounts receivable. In addition, the

employee is responsible for setting up new customer accounts and closing

cancelled customer accounts. The Utility, through PMI, pays an annual salary of

$12,960 for this employee. Staff believes this amount as a salary for one

employee is reasonable, and therefore, recommends no adjustment to the employee

salary portion of the contract with PMI.

Utilities, Insurance, Supplies and

Equipment

According

to the Utility, the annual costs for office utilities, insurance, supplies,

equipment, accounting and office up-keep is $4,800. Staff believes this amount

is reasonable for a business this size, and therefore, recommends no adjustment

to NPUC’s office utilities, insurance, supplies and equipment portion of the

contract with PMI.

Miscellaneous Expenses

PMI

charges the Utility $3,600 to cover miscellaneous expenses. In response to

staff’s fifth data request, the Utility stated that miscellaneous expenses

include, “various miscellaneous expenses incurred throughout the year including

printing supplies (ink and toner), small equipment purchases (i.e. dot-matrix

printer for bills, laptops), incidentals, office supplies, etc.”[16] Staff believes the $3,600

for miscellaneous expenses is duplicative of what is included in supplies and

equipment above and unsupported, therefore staff recommends removing the $3,600

for miscellaneous expense.

Auto Expense

The

Utility does not own any vehicles. NPUC/PMI owners and its employee use their

personal vehicles for Utility purposes. PMI charges NPUC $6,000 per year for

vehicle expense. In response to staff’s first data request, the Utility logs

approximately 9,400 miles of travel annually.[17]

The Internal Revenue Service (IRS) standard mileage rate for 2019 is $0.58 per

mile driven for business use. Based on the IRS standard, staff believes the appropriate

vehicle expense is 9,400 miles times $0.58 per mile, or $5,452 annually.

Therefore, staff decreased the vehicle expense by $548 ($6,000 – $5,452).

Management Fee

The

management fee portion of the PMI contract is the combined compensation paid to

the President and Vice President of NPUC. During the test year ended June 30,

2018, PMI billed NPUC $101,527 for the compensation portion of the management

fee. The amount is determined on a per ERC basis and is currently based on 603

ERCs. The most recent PMI contract includes a management fee of $14.18 per ERC

which was last increased in 2017. In response to staff’s seventh data request,

NPUC stated that in a typical month, the President works an average of 100

hours and the Vice President works an average of 15 hours on Utility matters,

for a total of 115 hours per month.[18]

Based on a typical work month of approximately 173 hours, 115 hours equates to

66 percent of one full-time officer. Staff believes compensation of $101,527

for two officers that collectively work 115 hours per month is unreasonable.

Using

the 2018 American Water Works Association (AWWA) Small Utility Survey, staff

determined the position of Small System General Manager with a salary range of

$64,143 to $93,680 was representative of the duties performed by NPUC’s

President and Vice President as described in the Utility’s response to staff’s

seventh data request.[19] A salary range for a

President and Vice President was not listed in the 2018 AWWA Small Utility

Survey. Considering that NPUC’s President and Vice President combine to

contribute 66 percent of one full-time officer, a reasonable salary range would

be between $42,638 ($64,143 X 0.66) and $62,273 ($93,680 X 0.66). The

Commission has approved president/owner salaries of $78,709,[20] $72,704,[21] and $63,200,[22] in recent SARC dockets

similar to this rate case. Accordingly, staff believes compensation of $62,273

for the President and Vice President combined is reasonable and recommends a

reduction of $38,804 to the Utility’s requested amount of $101,527.

Contractual Services – Testing

(735)

The

Utility recorded a contractual services' – testing fee of $12,588. The Utility

contracts with Wetherell Treatment Systems to perform state required tests as

detailed in Table 7-2 below totaling $10,288. The Utility also contracts with

Pace Analytical Services for other EPA regulated testing totaling $2,300. Staff

agrees with this amount and therefore recommends no adjustment to contractual

services – testing expense.

Table 7-2

State

Required Tests performed by Wetherell Treatment Systems

|

Description

|

Amount

|

|

Effluent

CBOD and TSS Tests

|

$4,248

|

|

Fecal

Coliform Tests

|

$1,540

|

|

Nitrate

Tests

|

$1,080

|

|

TDS

and Chloride Analysis

|

$1,680

|

|

Nitrogen

Tests

|

$1,020

|

|

Phosphorus

Tests

|

$720

|

|

Total

|

$10,288

|

Source: Utility response to staff data requests

Contractual Services – Other (736)

The

Utility recorded contractual services – other of $34,788. The Utility contracts

outside individuals for the supervision and repairs of the treatment plant, in

addition to the operation of the plant. The Utility recorded $25,317 for

supervision and repairs of the plant. Staff reviewed all of the invoices and

verified the expenses. Staff increased this amount by $95 to reflect the total

amount reflected on the invoices. Staff recommends a total of $25,412 ($25,317

+ $95) for plant supervision and repairs.

The

plant operator generally works 12 hours per week. In an email to staff, the

Utility advised that they entered into a new agreement with the plant operator,

which increased the pay rate from $9,471 ($15.18 hourly) to $12,480 ($20.00

hourly) in order to more closely reflect the average pay rate for a state

licensed plant operator.[23] This increase represents an

additional $3,009 ($12,480 – $9,471) annually. Staff believes the increased pay

rate of $12,480 is reasonable and therefore recommends an increase of $3,009.

Staff

also increased this amount by $3,715 to reflect expenses amortized over five

years associated with pro forma projects shown in Table 7-3 below.

Table 7-3

Pro Forma O&M Items

|

Project

|

Acct. No.

|

Amount

|

|

Repair Holes in Tank*

|

380

|

$4,606

|

|

Repair Splitter Box*

|

380

|

$1,675

|

|

Repair Clarifier Skimmer at Plant #3*

|

380

|

$1,826

|

|

Sanitary Manhole Repair

|

363

|

$2,468

|

|

Repair Holes in Bulkhead & Sidewall of Plant #1

|

380

|

$8,000

|

|

Total

|

-

|

$18,575

|

Source: Responses to staff data

requests. *DEP mandated item.

Table 7-4

details the services provided by contractual services – other. Staff recommends

contractual services – other expense of $41,607 ($25,412 + $12,480 + $3,715).

Table 7-4

Services

Provided in Contractual Services – Other

|

Description

|

Amount

|

|

Treatment

Plant Supervision and Repairs

|

$25,412

|

|

Salary

for Treatment Plant Operator

|

$12,480

|

|

Pro

forma Expenses

|

$3,715

|

|

Total

|

$41,607

|

Source:

Utility response to staff data requests.

Insurance – General Liability (757)

The

Utility recorded insurance – general liability expense of $2,252. Staff

decreased this amount by $30 to reflect removal of late fees charged to the

Utility. Therefore, staff recommends insurance – general liability expense of

$2,222 ($2,252 – $30).

Rate Case Expense (766)

The

Utility paid a filing fee of $1,000 on September 5, 2018. The Utility, in its

SARC filing, did not record any rate case expense. By Rule 25-22.0407, F.A.C.,

the Utility is required to mail notices of the customer meeting, notices of

final rates in this case, and notices of four-year rate reduction to its

customers. For these notices, staff has estimated $714 for postage expense,

$346 for printing expense, and $65 for envelopes, resulting in a noticing

expense of $1,125 ($714 + $346 + $65).

Staff

estimated $200 for lodging expense for the Utility to send a representative to

the Commission Conference. The distance from Ormond Beach to Tallahassee is 456

miles round trip.[24] Using the 2019 IRS approved

business travel rate of $0.58 per mile, mileage expense is $264 (456 x $0.58).

Total travel expense to attend the Commission Conference is estimated to be

$464 ($200 + $264).

The

Utility has retained the services of Willdan Financial Services to assist with

this rate case and submitted three invoices each for $1,000 dated February 11,

2019; April 17, 2019; and July 1, 2019.[25]

Florida Statute 367.0814 F.S. states:

The

Commission may award rate case expenses for attorney fees or fees of other

outside consultants if such fees are incurred for the purpose of providing consulting

or legal services to the Utility after the initial staff report is made

available to customers and the Utility.

The

Staff Report was filed on April 9, 2019, therefore only the costs incurred on

the April 17, and July 1 invoices are eligible for recovery through rates.[26] Staff recommends a

consultant fee of $2,000.

Based on

the above, staff recommends total rate case expense of $4,589 ($1,000 + $1,125

+ $464 + $2,000), which amortized over four years results in a rate case

expense of $1,147 ($4,589 ÷

4).

Regulatory Commission Expense –

Other (767)

The

Utility incurred expenses in a previous Service Territory

Expansion in Docket No. 20130209-SU which have not been recovered through

rates. The expansion was due, in part, to a DEP plan to move residents living

on the peninsula off of their current septic tank system and on to a sewage

system. In December of 2015, Volusia County enacted an ordinance that requires

mandatory connection to municipal or investor owned wastewater facilities

within five years when such facilities become available.[27]

Rule 25-30.433, F.A.C., states that non-recurring expenses shall be amortized

over a five-year period unless a shorter or longer period can be justified.

Staff believes using a four-year amortization period is appropriate as the

expenses were incurred over a four-year period from 2013 to 2016. If a longer

amortization period were to be used, full recovery of the expenses would not be

realized until after 2023.

In

response to an inquiry by staff, the Utility reported a cost of $145,481, which

amortized over four years, equates to $36,370 annually for legal and

engineering expenses related to Docket No. 20130209-SU.[28]

The Utility retained the services of GAI Consultants and Hartman Consultants,

LLC to provide engineering services. Additionally, the Utility retained Holland

& Knight and Dean Mead to provide legal services. Staff has verified

invoices for GAI Consultants and agrees with the invoiced amount of $24,721.

Staff also verified invoices for Hartman Consultants, LLC in the amount of

$38,440.[29]

In reference

to the $52,605 billed by Holland & Knight, the Utility indicated NPUC has

an outstanding balance of $25,459 for the services provided by Holland &

Knight. The Utility advised staff it has been in discussions with Holland &

Knight to write-off all or a portion of the outstanding balance. As of December

31, 2018, there is an outstanding balance due to Holland & Knight of

$25,459. Therefore, staff recommends allowing only the paid portion to Holland

& Knight of $27,146 ($52,605 – $25,459) be eligible for recovery. The

Utility reported a cost of $29,714 for legal services provided by Dean Mead.

Staff

recommends a total amount of $120,022 ($24,721 + $38,440 + $27,146 + $29,714)

be amortized over four years for an annual amount of $30,005 ($120,022 ÷ 4). This amount represents an adjustment of

$6,365.

Miscellaneous Expense (775)

The

Utility recorded miscellaneous expense of $7,067. In response to staff’s fifth

data request, staff discovered that a $1,000 payment to the City of Ormond

Beach was a one-time deposit necessary for the Utility to provide water to a

worksite in response to Hurricane Irma.[30]

This amount was nonrecurring and the Utility received a refund of the deposit.

Staff recommends removing the $1,000.

The

Utility uses Roto-Rooter at various times throughout the year to help clear

lines and perform other services as necessary. Two invoices were submitted by

the Utility for work performed at residential addresses, one for $604 which was

work performed due to Hurricane Irma including a $9 interest payment for a past

due amount, and $650 for root clearing from a customer’s wastewater lines.

These invoices totaled $1,254 ($604 + $650). Staff removed the $9 interest

payment and amortized the remaining $1,245 ($1,254 – $9) over five years for an

annual amount of $249 ($1,245 ÷

5).

In

response to staff’s second data request, the Utility submitted an invoice for

Woody’s Septic Tank for $1,313.[31] According to the invoice,

the services provided by Woody’s Septic Tank fell outside of the test year.

Staff recommends removing the full amount of $1,313.

The

Utility records $2,555 annually for postage as part of their billing expenses.

With 433 customers, this amount equates to approximately $0.49 ($2,555 ÷ 12 ÷

433) per customer per month. Staff agrees with this postage rate per customer.

Staff agrees with all other costs associated with miscellaneous expense as

detailed in Table 7-4. Therefore, staff recommends miscellaneous expense of

$3,749 ($7,067 – $1,000 – $1,005 – $1,313)

Table 7-4

Miscellaneous

Expenses

|

Description

|

Per

Utility

|

Staff Adj

|

Per Staff

|

|

City

of Ormond Beach (Hydrant Meter Deposit)

|

$1,000

|

($1,000)

|

$0

|

|

Roto-Rooter

|

$1,254

|

($1,005)

|

$249

|

|

Woody’s

Septic Tank

|

$1,313

|

($1,313)

|

$0

|

|

Postage

|

$2,555

|

$0

|

$2,555

|

|

Annual

Billing Software License

|

$520

|

$0

|

$520

|

|

Tools

and Supplies

|

$275

|

$0

|

$275

|

|

Florida

Department of State (Corporation Renewal)

|

$150

|

$0

|

$150

|

|

Total

|

$7,067

|

($3,318)

|

$3,749

|

Source: Utility response to staff data requests.

O&M

Expenses Summary

The

Utility recorded O&M expenses of $276,376 for the test year. Based on the

above adjustments, staff recommends that the O&M expense balance be

decreased by $48,179, resulting in a total O&M expense of $228,197

($276,376 - $48,179). Staff’s recommended adjustments to O&M expenses are

shown on Schedule 3-C.

Depreciation

Expense

The

Utility recorded depreciation expense of $27,508 for the test year. Staff

determined that the Utility continued to depreciate plant accounts after they

had been fully depreciated. Staff recalculated depreciation expense using the

prescribed rates set forth in Rule 25-30.140, F.A.C. and reduced depreciation

expense by $22,910. Staff also removed depreciation expense of $41 from account

352 – Franchises which appeared to become fully depreciated after the end of

the test year. Further, staff increased depreciation expense by $1,233

associated with pro forma plant additions. Based on the above, staff recommends

a test year depreciation expense of $5,791 ($27,508 – $22,910 - $41 + $1,233).

Taxes Other

Than Income (TOTI)

The

Utility recorded TOTI of $18,653. Staff increased this amount by $67 to reflect

the appropriate RAFs based on corrected Utility test year revenues. Staff

increased TOTI by $888 to reflect the increased property taxes due to pro forma

plant additions.[32] Staff increased TOTI by

$1,169 to reflect the appropriate RAFs associated with the recommended revenue

increase. Staff is therefore recommending TOTI of $20,777 ($18,653 + $67 + $888

+ $1,169).

Income Tax

The

Utility is a Subchapter S Corporation and therefore did not record any income

tax expense for the test year. NPUC has shown a net loss for the last several

years in its Annual Reports. Staff recommends no adjustment to income tax

expense.

Operating

Expenses Summary

The application of staff’s recommended

adjustments to North Peninsula’s test year operating expenses result in operating

expense of $254,765. Operating expenses are shown on Schedule No. 3-A. The

related adjustments are shown on Schedule No. 3-B.

Issue

8:

Should

the Commission utilize the operating ratio methodology as an alternative method

of calculating the wastewater revenue requirements for NPUC, and, if so, what

is the appropriate margin?

Recommendation:

Yes.

As required by rule, the Commission must utilize the operating ratio

methodology for calculating the revenue requirement for NPUC. The margin should

be 12 percent of O&M expense, capped at $15,000. (Richards)

Staff Analysis:

Rule 25-30.4575(2), F.A.C., requires that the

Commission use the operating ratio methodology if the utility’s rate base is

below 125 percent of O&M expenses. The rule states the Commission will

apply a margin of 12 percent when determining the revenue requirement, up to

$15,000. The operating ratio methodology will be applied when the utility’s

rate base is no greater than 125 percent of O&M expenses. The use of the

operating ratio methodology does not change the utility’s qualification for a

staff assisted rate case under Rule 25-30.455(1), F.A.C.

The operating ratio methodology is an alternative to the

traditional calculation of revenue requirements. Under this methodology,

instead of applying a return on the Utility’s rate base, the revenue

requirement is based NPUC’s total O&M expenses plus a margin of $15,000.

This methodology has been applied in cases in which the traditional calculation

of the revenue requirement would not provide sufficient revenue to protect

against potential variances in revenues and expenses. As discussed in Issues 4

and 7, staff has recommended a rate base of $232,047 and O&M expenses of $228,197.

Based on recommended amounts, NPUC’s rate base is 102 percent of total O&M

expenses. Furthermore, the application of the operating ratio methodology does

not change the Utility’s qualification for a SARC. As such, NPUC meets the

criteria for the operating ratio methodology established in Rule 25-30.4575(2),

F.A.C. Therefore, staff recommends the application of the operating ratio

methodology at a margin of 12 percent of O&M expenses with a cap of $15,000

for determining the wastewater revenue requirement.

Issue

9:

What

is the appropriate revenue requirement?

Recommendation:

The

appropriate revenue requirement is $269,765, resulting in an annual increase of

$25,988 (10.66 percent). (Richards)

Staff Analysis:

NPUC should be allowed an annual increase of

$25,988 (10.66 percent). The calculations are shown in Table 9-1.

Table 9-1

Revenue

Requirement

|

Adjusted

O&M Expense

|

$228,197

|

|

Operating

Margin (%)

|

12.00%

|

|

Operating

Margin ($27,384 capped at $15,000 Cap)

|

$15,000

|

|

Adjusted

O&M Expense

|

$228,197

|

|

Depreciation

Expense (Net)

|

$5,791

|

|

Taxes

Other Than Income

|

$20,777

|

|

Income

Taxes

|

0

|

|

Revenue

Requirement

|

$269,765

|

|

Less

Test Year Revenues

|

243,777

|

|

Annual

Increase

|

$25,988

|

|

Percent

Increase

|

10.66%

|

Issue

10:

What

is the appropriate rate structure and rates for North Peninsula Utilities

Corporation’s wastewater systems?

Recommendation:

The

recommended rate structure and monthly wastewater rates are shown on Schedule

No. 4. The Utility should file revised tariff sheets and a proposed customer

notice to reflect the Commission-approved rates. The approved rates should be

effective for service rendered on or after the stamped approval date on the

tariff sheets pursuant to Rule 25-30.475(1), F.A.C. In addition, the approved

rates should not be implemented until staff has approved the proposed customer

notice and the notice has been received by the customers. The Utility should

provide proof of the date notice was given within 10 days of the date of the

notice. (Bruce)

Staff Analysis:

NPUC is located in Volusia County

within the St. Johns River Water Management District. The Utility provides

wastewater service to 428 residential single family homes, four condominium

associations, and a restaurant. Water service is provided by the City of Ormond

Beach. The Utility’s current wastewater rates consist of a monthly flat rate

per ERC for the residential and general service classes, which was approved in

1985.[33] A

residential single family home and condominium unit are billed as one ERC.

However, the restaurant is billed as 14 ERCs.[34] For the condominium associations, the Utility

sends one bill to each condominium association based on the respective number

of ERCs.

In order to evaluate alternative

rate structures, staff requested the Utility provide metered water data. The Utility

provided 12 months of metered water data from the City of Ormond Beach (City);

however, due to the format of the data, it would take a significant amount of

administrative time to identify and isolate the water usage for each customer.

The Utility also expressed concern that it would incur additional costs, on a

prospective basis, for obtaining the monthly metered water usage data from the City

for billing purposes. Therefore, staff does not believe that it is cost

effective to bill based on the metered water usage. Staff recommends that the Utility

continue the current flat rate structure based on ERCs. As a result, staff

calculated 7,200 ERCs for wastewater as shown on Table 10-1. Staff’s

recommended flat rates are shown on Schedule No. 4. Because a single bill is

sent to each condominium association, staff recommends bulk flat rates

based on the respective ERCs.

Table 10-1

Staff’s Calculated ERCs

|

Wastewater

Customers

|

Number

of Units

|

Monthly

ERCs

|

Annual

ERCs

|

|

Residential

|

|

|

|

|

Single Family Residential Homes

|

428

|

428

|

5,136

|

|

|

|

|

|

General Service

|

|

|

|

|

Las Olas Townhomes

|

6

|

6

|

72

|

|

Ocean Air

|

17

|

17

|

204

|

|

Seabridge North

|

65

|

65

|

780

|

|

Seabridge South

|

70

|

70

|

840

|

|

Restaurant

|

1

|

14

|

168

|

|

|

|

|

|

Total ERCs

|

|

600

|

7,200

|

The recommended rate structures and

monthly wastewater rates are shown on Schedule No. 4. The Utility should file

revised tariff sheets and a proposed customer notice to reflect the

Commission-approved rates. The approved rates should be effective for service

rendered on or after the stamped approval date on the tariff sheets pursuant to

Rule 25-30.475(1), F.A.C. In addition, the approved rates should not be

implemented until staff has approved the proposed customer notice and the

notice has been received by the customers. The Utility should provide proof of

the date notice was given within 10 days of the date of the notice.

Issue

11:

What

is the appropriate amount by which rates should be reduced in four years after

the published effective date to reflect the removal of the amortized rate case expense?

Recommendation:

In

four years, the wastewater rates should be reduced, as shown on Schedule No. 4,

to remove rate case expense grossed-up for RAFs and amortized over a four-year

period. The decrease in rates should become effective immediately following the

expiration of the four-year rate case expense recovery period, pursuant to

Section 367.081(8), F.S. NPUC should be required to file revised tariffs and a

proposed customer notice setting forth the lower rates and the reason for the

reduction no later than one month prior to the actual date of the required rate

reduction. If the Utility files this reduction in conjunction with a price

index or pass-through rate adjustment, separate data should be filed for the

price index and/or pass-through increase or decrease and the reduction in the

rates due to the amortized rate case expense. (Bruce, Richards) (Final Agency Action)

Staff Analysis:

Section 367.081(8), F.S.,

requires that the rates be reduced immediately following the expiration of the

four-year period by the amount of the rate case expense previously included in

rates. The reduction will reflect the removal of revenue associated with the

amortization of rate case expense and the gross-up for RAFs. This results in a

reduction of $1,201.

The wastewater rates should be

reduced, as shown on Schedule No. 4, to remove rate case expense grossed-up for

RAFs and amortized over a four-year period. The decrease in rates should become

effective immediately following the expiration of the four-year rate case

expense recovery period, pursuant to Section 367.081(8), F.S. NPUC should be

required to file revised tariffs and a proposed customer notice setting forth

the lower rates and the reason for the reduction no later than one month prior

to the actual date of the required rate reduction. If the Utility files this

reduction in conjunction with a price index or pass-through rate adjustment,

separate data should be filed for the price index and/or pass-through increase

or decrease and the reduction in the rates due to the amortized rate case

expense.

Issue

12:

Should

the recommended rates be approved for North Peninsula Utilities Corporation on

a temporary basis, subject to refund with interest, in the event of a protest

filed by a party other than the Utility?

Recommendation:

Yes.

Pursuant to Section 367.0814(7), F.S., the recommended rates should be approved

for the utility on a temporary basis, subject to refund with interest, in the

event of a protest filed by a party other than the utility. NPUC should file

revised tariff sheets and a proposed customer notice to reflect the

Commission-approved rates. The approved rates should be effective for service

rendered on or after the stamped approval date on the tariff sheet, pursuant to

Rule 25-30.475(1), F.A.C. In addition, the temporary rates should not be implemented

until staff has approved the proposed notice, and the notice has been received

by the customers. Prior to implementation of any temporary rates, the utility

should provide appropriate security. If the recommended rates are approved on a

temporary basis, the rates collected by the utility should be subject to the

refund provisions discussed below in the staff analysis. In addition, after the

increased rates are in effect, pursuant to Rule 25-30.360(6), F.A.C., the

utility should file reports with the Commission's Office of Commission Clerk no

later than the 20th of each month indicating the monthly and total amount of

money subject to refund at the end of the preceding month. The report filed

should also indicate the status of the security being used to guarantee

repayment of any potential refund. (Richards) (Final Agency Action)

Staff Analysis:

This recommendation proposes an increase in

wastewater rates. A timely protest might delay what may be a justified rate

increase resulting in an unrecoverable loss of revenue to the utility.

Therefore, pursuant to Section 367.0814(7), F.S., in the event of a protest

filed by a party other than the utility, staff recommends that the recommended

rates be approved as temporary rates. NPUC should file revised tariff sheets

and a proposed customer notice to reflect the Commission-approved rates. The

approved rates should be effective for service rendered on or after the stamped

approval date on the tariff sheet, pursuant to Rule 25-30.475(1), F.A.C. In

addition, the temporary rates should not be implemented until staff has

approved the proposed notice, and the notice has been received by the

customers. The recommended rates collected by the utility should be subject to

the refund provisions discussed below.

NPUC should be authorized to collect the

temporary rates upon staff's approval of an appropriate security for the

potential refund and the proposed customer notice. Security should be in the

form of a bond or letter of credit in the amount of $17,558. Alternatively, the utility could establish an escrow

agreement with an independent financial institution.

If the utility chooses a bond as security, the

bond should contain wording to the effect that it will be terminated only under

the following conditions:

1) The Commission approves the rate increase;

or,

2) If the Commission denies the increase, the

utility shall refund the amount collected that is attributable to the increase.

If the utility chooses a letter of credit as a

security, it should contain the following conditions:

1) The letter of credit is irrevocable for the

period it is in effect, and,

2) The letter of credit will be in effect until

a final Commission order is rendered, either approving or denying the rate

increase.

If security is provided through an escrow

agreement, the following conditions should be part of the agreement:

1) The

Commission Clerk, or his or her designee, must be a signatory to the escrow

agreement; and,

2) No

monies in the escrow account may be withdrawn by the utility without the prior

written authorization of the Commission Clerk, or his or her designee;

3) The

escrow account shall be an interest bearing account;

4) If a

refund to the customers is required, all interest earned by the escrow account

shall be distributed to the customers;

5) If a

refund to the customers is not required, the interest earned by the escrow

account shall revert to the utility;

6) All

information on the escrow account shall be available from the holder of the

escrow account to a Commission representative at all times;

7) The

amount of revenue subject to refund shall be deposited in the escrow account

within seven days of receipt;

8) This

escrow account is established by the direction of the Florida Public Service

Commission for the purpose(s) set forth in its order requiring such account.

Pursuant to Cosentino v. Elson, 263 So. 2d 253 (Fla. 3d DCA 1972),

escrow accounts are not subject to garnishments;

9) The

account must specify by whom and on whose behalf such monies were paid.

In no instance should the maintenance and

administrative costs associated with the refund be borne by the customers.

These costs are the responsibility of, and should be borne by, the utility.

Irrespective of the form of security chosen by the utility, an account of all

monies received as a result of the rate increase should be maintained by the

utility. If a refund is ultimately required, it should be paid with interest

calculated pursuant to Rule 25-30.360(4), F.A.C.

Should the recommended rates be approved by the

Commission on a temporary basis, NPUC should maintain a record of the amount of

the security, and the amount of revenues that are subject to refund. In

addition, after the increased rates are in effect, pursuant to Rule

25-30.360(6), F.A.C., the utility should file reports with the Commission's

Office of Commission Clerk no later than the 20th of each month indicating the

monthly and total amount of money subject to refund at the end of the preceding

month. The report filed should also indicate the status of the security being

used to guarantee repayment of any potential refund.

Issue 13:

Should

North Peninsula Utilities Corporation be required to notify the Commission

within 90 days of an effective order finalizing this docket, that it has

adjusted its books for all the applicable National Association of Regulatory

Utility Commissioners (NARUC) Uniform System of Accounts (USOA) associated with

the Commission approved adjustments?

Recommendation:

Yes.

The Utility should be required to notify the Commission, in writing, that it

has adjusted its books in accordance with the Commission’s decision. NPUC

should submit a letter within 90 days of the final order in this docket,

confirming that the adjustments to all the applicable National Association of

Regulatory Utility Commissioners (NARUC) Uniform System of Accounts (USOA) primary

accounts, as shown on Schedule No. 5, have been made to the Utility’s books and

records. In the event the Utility needs additional time to complete the

adjustments, notice should be provided not less than seven days prior to the