|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

February 21, 2020

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Division of Engineering (Wright, Doehling,

Ellis, King)

Division of Accounting

and Finance (Mouring, Fletcher)

Division of Economics (Galloway, Wu)

Office of the General

Counsel (Trierweiler, Simmons)

|

|

RE:

|

Docket No. 20190061-EI – Petition for

approval of FPL SolarTogether program and tariff, by Florida Power &

Light Company.

|

|

AGENDA:

|

03/03/20 – Regular Agenda - Post-Hearing Decision - Participation

Limited to Commissioners and Staff

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Clark

|

|

CRITICAL DATES:

|

None

|

|

SPECIAL INSTRUCTIONS:

|

Staff recommends addressing the Issues in the following

order: Issues 2, 3, 1, 4 and 6.

|

|

|

|

|

Case Background

On

March 13, 2019, Florida Power & Light Company (FPL or Utility) filed a

petition (Petition) for a new voluntary community solar program (SolarTogether

Program or Program) and associated tariff. The proposed SolarTogether Program

is designed to allow FPL customers to subscribe to a portion of new solar

capacity built through the Program (subscription charge) and to receive a

credit of a portion of the system savings produced by that solar capacity

(subscription credit). Phase 1 of the Program consists of five FPL

SolarTogether projects that comprise a total of 20 solar photovoltaic (PV) power

plants. Each power plant is rated at 74.5 megawatts (MW) for a total of 1,490

MW that would provide electricity to all of FPL’s customers.

The Office of Public Counsel (OPC),

Walmart, Inc. (Walmart), the Southern Alliance for Clean Energy (SACE), Vote

Solar, and the Florida Industrial Power Users Group (FIPUG) were granted

intervention in this docket. In June of 2019, Vote Solar and OPC both filed

motions requesting the SolarTogether Program and tariff be set for an

administrative hearing. FPL objected to both motions. After considering the

arguments made by the parties, the matter was set for an administrative

hearing.

FPL filed its direct testimony on July 29,

2019. Staff, SACE, Walmart, Vote Solar, and OPC filed direct testimony on

September 3, 2019. FPL filed its rebuttal testimony on September 23, 2019,

which included a revised tariff. On September 27, 2019, OPC filed a motion for

continuance of the hearing, or in the alternative, a motion to strike portions

of FPL’s rebuttal testimony, arguing that there was insufficient time and

opportunity to address the tariff revisions filed with FPL’s rebuttal. FPL

filed a response in opposition to OPC’s motion. In response to OPC’s motion,

new controlling dates and discovery response times were established.

On October 9, 2019, FPL, SACE, Vote Solar,

and Walmart (Joint Movants) filed a Joint Motion to Approve Settlement (Joint

Motion), with the Joint Movants’ Stipulation and Settlement (Settlement

Agreement) attached. A newly revised tariff (proposed tariff or rate Schedule

STR; Attachment 1 to this recommendation) was included as Attachment I to the

Settlement Agreement. OPC filed a response in opposition to the Joint Motion on

October 16, 2019. In response to the new filings, the parties were allowed

additional discovery and an opportunity to file additional testimony with respect

to the proposed Settlement Agreement. Subsequently, both staff and OPC filed

supplemental testimony on November 15, 2019, with FPL filing supplemental

rebuttal testimony on November 27, 2019. On December 5, 2019, FPL filed a

Notice of Superseding Proposed Tariff, stating that Attachment I of the

Settlement Agreement supersedes the prior proposed tariffs in this docket.

On January 2, 2020, Duke Energy Florida,

LLC (DEF) filed a motion for leave to file amicus curiae comments, with

comments attached, in support of FPL’s Petition. DEF stated that the

SolarTogether Program would allow customers the opportunity to support

universal solar expansion which is already cost effective for all customers.

DEF also stated that a voluntary option like the SolarTogether Program provides

all customers with the benefits of utility-owned universal solar. DEF noted

that while the Program may result in a policy shift, approving the Program

would continue the Commission’s strong tradition of supporting public interest

programs that utilize creative regulatory outcomes in a consistent, measured

manner. OPC filed a response in opposition to DEF’s motion on January 9, 2020.

The Prehearing Conference was held on January 10, 2020. By Order No.

PSC-2020-0017-PHO-EI (Prehearing Order), DEF’s motion was granted.

The

administrative hearing was held on January 14-15, 2020. All parties, except

FIPUG, filed briefs on January 30, 2020. Because FIPUG did not file a brief, it

has waived all issues pursuant to the Prehearing Order (page 20). The Florida

Public Service Commission (Commission) has jurisdiction over this matter

pursuant to Sections 366.03, 366.05, and 366.06, Florida Statutes (F.S.).

Settlement Agreement

and Standard of Review

As

mentioned previously, there is an outstanding non-unanimous Joint Motion filed by

FPL, SACE, Vote Solar, and Walmart. The Joint Motion proposes that the

SolarTogether Program should be approved as described in FPL’s Petition, as

modified by FPL’s rebuttal testimony and exhibits, along with Paragraphs 4 and

5 within the Settlement Agreement. Paragraph 4 states that 37.5 MW, or 10% of

the residential capacity for Phase 1, will be allocated to low-income

customers. The subscription charge will not exceed the subscription credit in

any month for these customers. These provisions for the low-income participants

will begin with Project 3 with expected billing to start in February 2021.

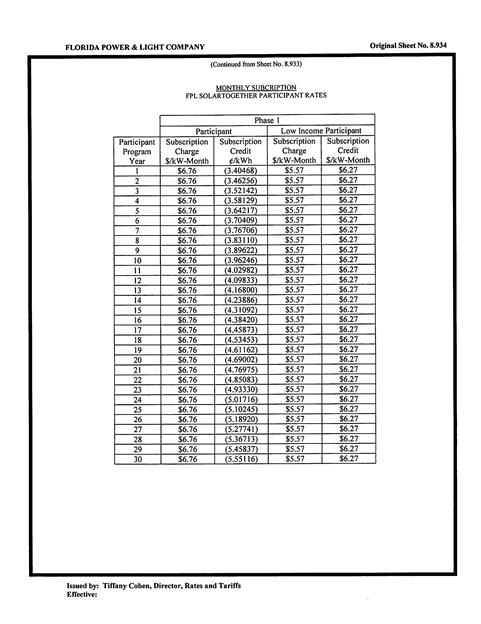

Paragraph 5 states the pricing for the subscription charge and the rate for the

subscription credit for both standard and low-income customers is set forth in

rate Schedule STR, Attachment 1 to this recommendation. Pursuant to paragraph

3(f) of the Settlement Agreement, participants may elect to have FPL retire on

their behalf all renewable energy certificates (RECs) associated with their

subscription; FPL will not utilize RECs generated by the Program.

Whether

or not a settlement is under consideration, the Commission is still bound by

Sections 366.01 and 366.06, F.S., which require that the Commission fix rates

that are fair, just, and reasonable and determine whether the resolution of the

case is in the public interest. Moreover, the Commission’s decision must be

supported by competent, substantial record evidence. Sierra Club v. Brown, 243 So. 3d 903, 909-910 (Fla. 2018), citing Citizens of State v. Florida Public

Service Comm'n, 146 So. 3d 1143, 1153-54, 1164, 1173 (Fla. 2014).

When

considering a settlement agreement, the Commission may look at the totality of

the settlement agreement to determine whether the agreement, taken as a whole,

resolves all the issues; establishes rates that are fair, just, and reasonable;

and is in the public interest. Florida

Industrial Power Users Group v. Brown, 273 So. 3d 926, 929-930 (Fla. 2019),

quoting Citizens 146 So. 3d at 1164 (Court

upheld Commission’s approval of a non-unanimous settlement agreement, finding

that the settlement agreement established rates that were just, reasonable, and

fair, and that the agreement was in the public interest and supported by

competent, substantial evidence). The Florida Supreme Court has also noted that

the prudence of large capital investments is a relevant consideration in the

Commission’s review of a settlement under its public interest standard, because

imprudent investment of millions of dollars would likely clash with a public

interest finding. Brown, 273 So. 3d

at 930, quoting Sierra Club v. Brown,

243 So. 3d 903, 912 (Fla. 2018). While the Commission may consider the prudence

of large capital investments under a settlement agreement, there is no affirmative

requirement that the Commission must make independent specific prudence findings

in a final order approving a settlement. Sierra

Club, 243 So. 3d at 912. The Florida Supreme Court has also noted that

although the Commission is not required by statute or case law to address each

issue of disputed fact in a final order approving a settlement, it nevertheless

has the discretion to do so. Citizens,

146 So. 3d at 1153. Thus, while the Commission has the authority to

consider a non-unanimous settlement,[1] it is not required to do so. The

Commission may consider the issues argued in this docket.

Rather than initially taking up the Joint Motion

at the outset, staff recommends that the Commission address the substantive

issues as discussed below. Addressing the substantive issues in this case will

effectively resolve the Joint Motion. At the conclusion of addressing all

issues, the Commission may either render the Joint Motion moot or take up and

rule on the Joint Motion as a fallout matter. Staff recommends this approach

for the following reasons:

·

The Settlement Agreement in this case, which

incorporates the proposed tariff, merely represents an agreement by some of the

parties to the proposed Program. Neither the Settlement Agreement nor the

record developed in this case deal with issues outside of the proposed Program

and tariff. There are no issues contained within staff’s recommendation that

are not contained within the proposed Program and tariff. In other words, the issues and analysis

reflected in staff’s recommendation essentially match up with and reflect the

sum and substance of the Settlement Agreement and proposed tariff, as

litigated.

·

The issues addressed at the hearing, and

presented in staff’s recommendation herein, were agreed upon by the parties at

the Prehearing Conference, which occurred after the filing of the Settlement

Agreement. Testimony and evidence were taken on these issues at the hearing. In

essence, the litigation of this case was based upon the issues agreed upon by

the parties, which were founded on the terms of the Settlement Agreement and

the proposed tariff.

·

Because the record in this case has been fully

developed and litigated and the issues track the Settlement Agreement and proposed

tariff as filed, taking up the issues in the staff recommendation will provide

the Commission with a better framework to ensure that its decision is supported

by substantial, competent evidence in the record and ultimately rendered in the

public interest.

In addressing the substantive issues, staff

recommends that the Commission take the issues up in the following order:

Issues 2, 3, 1, 4, and 6.

Executive Summary

Florida has

a regulatory framework established through statute that grants utilities

specific rights and responsibilities, including the obligation to serve all

customers within their service territory. The Commission regulates utilities to

ensure that customers receive adequate, safe electric service at rates that are

fair, just, and reasonable. The Commission has jurisdiction over the planning,

development, and maintenance of a coordinated electric power grid throughout

Florida. Generating electric utilities are required to annually submit to the

Commission a ten-year site plan (TYSP), which estimates the future electric

load requirements of customers, identifies the mix of resources to be used to

serve customers, and the general location of proposed power plant sites.

Underlying this process is the principle of “least-cost planning.” This

principle is founded upon engineering and economic analyses whereby the least-cost

option is selected in order to meet projected customer electric loads.

From the

outset of this proceeding, staff’s focus has been to understand the purpose and

impact of FPL’s voluntary tariff, its fundamental impact on current regulatory

policies and procedures, and its impact on the development of solar generation,

even as solar generation is projected to be a cost-effective alternative for

all customers. In other words, staff sought to identify the incremental

benefits of the SolarTogether Program and proposed tariff to the general body

of ratepayers applying current statutes, rules, regulatory policies, and practices.

The Commission should consider the following three policy questions when making

its final determination of whether the SolarTogether Program and proposed

tariff are in the public interest:

If generating facilities are built to meet

the desires of certain customers, should all the benefits and costs of such

facilities be allocated to those customers?

If solar generation is a cost-effective

alternative for all customers, is it appropriate to allocate a majority of

benefits to a small group of customers?

Does the proposed allocation of costs and

benefits result in undue discrimination or an undue preference?

In the past,

voluntary tariffs have been offered when the service desired (i.e., renewable

energy) was not cost competitive with traditional generation. Such offerings

provided a response to customer demands for a certain type of product.

Voluntary contributions were designed to recover the full incremental costs of

the desired service from those customers demanding the product, while most

importantly, holding the general body of ratepayers harmless.

Here the

proposed tariff would authorize FPL to accelerate the construction of solar

facilities and to add future solar facilities based upon the Utility’s

marketing efforts and the desires of a select group of customers rather than

adding generating units to satisfy projected reliability or economic needs for

all customers. As such, FPL’s proposed Program and associated rate Schedule STR

would disregard the principles of least-cost planning and the resulting costs

allocated to all customers.

Section

366.03, F.S., states in part that “[e]ach public utility shall furnish to each

person applying therefore reasonably sufficient, adequate, and efficient

service upon terms as required by the commission.” The Statute also states that

“[n]o public utility shall make or give any undue or unreasonable preference or

advantage to any person or locality, or subject the same to any undue or

unreasonable prejudice or disadvantage in any respect.” Granting a preference

to one group of customers or subjecting one group to disadvantage does not, per se, violate the statutory

prohibition, but that preference or disadvantage must be based on relevant,

significant facts explained in the Commission’s decision. Determining whether a

proposed tariff grants undue preference to a certain group or subjects a group

to undue prejudice is a fact-intensive inquiry.

Staff

evaluated the Program and proposed tariff’s impact on the three affected

entities: participants, the general body of ratepayers, and the Utility. The

evidence in the record suggests that there are six areas where undue preference

may exist. As discussed in Issue 2, these areas are: initial participant

allocation, allocation of net benefits, low-income carve-out, costs not fully

funded by participants, alternative to net metering, and subsequent participant

allocation. Some examples of preference include:

·

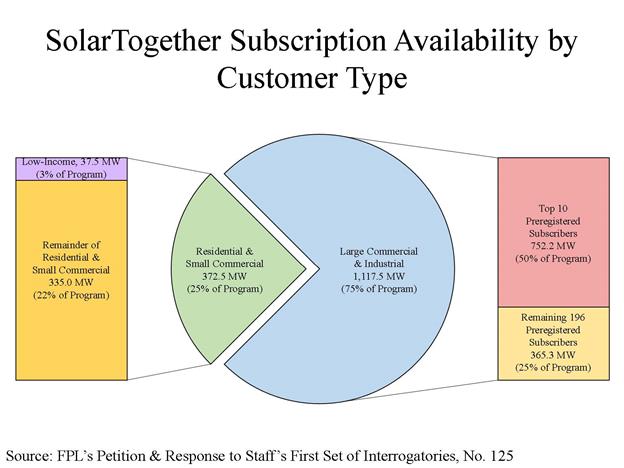

FPL allocating 75 percent (1,117.5 MW) of the

Program’s capacity to the pre-registered commercial, industrial, and

governmental accounts. Ten of these 206 pre-registered customers account for 50

percent of the total Program’s capacity. In contrast, FPL has not yet opened registration

for the estimated 74,500 residential and small business classes of customers

who are expected to subscribe.

·

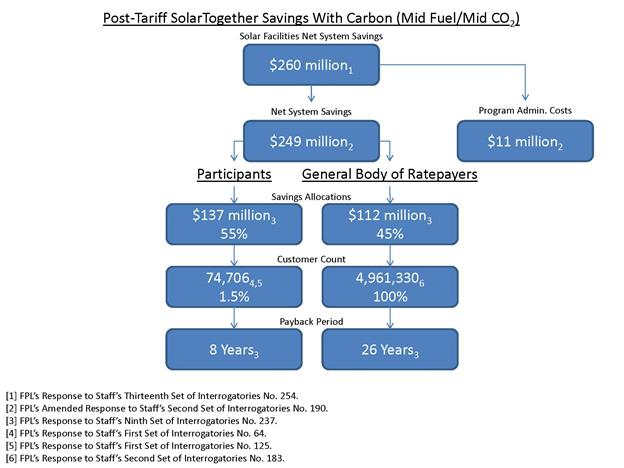

Only 1.5 percent of FPL’s 4.9 million customers

could participate in this Program. Those participants would receive bill

credits, which are essentially guaranteed, within eight years. On the other

hand, 98.5 percent of FPL’s customers, the non-participants, may see benefits

in the form of lower system costs, if at all, after 26 years.

·

Non-participants’ bills increase immediately,

whereas participants’ bills are gradually offset by a credit.

·

Participating customers are not paying the full

cost of the Program.

Therefore,

the proposed Program and tariff appear to result in an undue preference to

participants and subjects the general body of ratepayers to an undue

disadvantage.

On

the other hand, an incremental benefit of approving the Program appears to be

the acceleration of approximately 600 MW of solar generation from 2022 to 2021.

The record indicates that the acceleration of this solar generation would

result in a relatively slight increase in cost; however, FPL did not provide a

quantification of this cost. The acceleration of solar generation would also slightly

improve FPL’s fuel diversity, reduce CO2 emissions, and would

promote the development of renewable energy consistent with the Legislative findings

in Section 366.92, F.S.

If the Program

is not approved, the evidence still suggests that FPL could add over 1,700 MW

of future solar generation by 2022. As discussed in Issue 3, Projects 1, 2, and

3, which are approximately 900 MW, would satisfy FPL’s planning reserve margin

criterion for the years 2020 - 2021 and are consistent with the Utility’s

least-cost generation expansion plan, its 2019 TYSP. While FPL has demonstrated

that Projects 1, 2, and 3 are cost-effective generation additions, the incremental

cost of accelerating 600 MW (Projects 4 and 5), has not been quantified. As

such, even if the proposed Program and tariff is not approved, it appears that

constructing Projects 1, 2, and 3 would be a cost-effective addition to FPL’s

system that would benefit all customers. FPL may seek cost recovery of these

facilities at its next base rate proceeding under current regulatory policies

and procedures.

Options to Program as

Proposed

FPL argues that the proposed Program and associated tariff

would be the next step forward in promoting Florida’s energy policy contained

in Section 366.92, F.S., which is to promote the development of renewable

energy; protect the economic viability of Florida’s existing renewable energy

facilities; diversify the types of fuel used to generate electricity in

Florida; encourage the development of renewable generation; improve fuel

diversity; lessen Florida’s dependence on natural gas and fuel oil for the

production of electricity; minimize the volatility of fuel costs; encourage

investment within the state; improve environmental conditions; and, at the same

time, minimize the costs of power supply to electric utilities and their

customers. Staff explored various options that would achieve these same benefits

for all customers but did not require the proposed tariff to be implemented.

Such options would be consistent with the intent of Section 366.92, F.S., and also

avoid any semblance of an undue preference. These options included classifying

the solar facilities as a regulatory asset or creating a recovery mechanism

similar to ones approved in recent Solar Base Rate Adjustments (SoBRAs)

settlement agreements. While FPL agreed that such options could encourage the

development of solar generation, it did not support such action as it would not

be responsive to the primary purpose of the Program, which is to address “the

needs of customers who cannot or do not want to own a net metering system, but

are seeking a direct bill credit.”

Staff also considered the option of approving the tariff

as filed, but recovering the participant credits as a base rate expense item

rather than immediate recovery through FPL’s fuel clause. The estimated annual

credits for 2020 are $31.7 million and $105.1 million for 2021. While FPL would

bear the risk of these costs until its next rate case, such treatment would

provide participants the same benefits as proposed by FPL, eliminate an

immediate bill increase to the general body of ratepayers, and more closely

reflect the current risks to the general body of ratepayers and FPL associated

with traditional net metering. FPL did not support this option but admitted

that participating customers would be unaffected.

Discussion

of Issues

Issue 1:

Is FPL’s proposed SolarTogether Rider tariff an

appropriate mechanism to seek approval for the construction of 1,490 MW of new

solar generation facilities?

Recommendation:

No. FPL has not demonstrated the public benefit to

be gained by changing current regulatory policies and procedures regarding the

addition of generation assets. As such, approval of generation assets should

not be linked to a tariff proposal as requested by FPL. (Ballinger, Simmons,

Trierweiler)

Position of the Parties:

FPL: Yes. Customers are

actively seeking a program like SolarTogether in order to meet sustainability and

financial goals. No existing programs or tariffs fill this customer need. Moreover,

approving the facilities without an associated tariff would not meet the

customer need.

OPC: No.

FIPUG: FIPUG did not file a brief.

SACE: Yes. The Settlement Agreement

filed in this docket on October 9, 2019 between FPL, SACE, Vote Solar,

and Walmart fully resolves all matters between the referenced parties and

provides numerous benefits to both participants and the general body of

customers, and is therefore in the public interest. See Issue 4

VOTE

SOLAR: No position.

WALMART: Yes.

Parties’ Arguments

FPL

FPL argues

that its SolarTogether proposed tariff is the appropriate mechanism to allow

customers to participate voluntarily and more directly in the development of

solar energy in Florida. (FPL BR 6, 22, 37) The SolarTogether tariff expands

access to solar to all customers regardless of size, location, or income

levels. (FPL BR 2) FPL contends that customers are actively seeking a program

like SolarTogether in order to meet sustainability goals while also sharing in

the financial benefits of solar. (FPL BR 5, 9) Moreover, FPL asserts that regulation

should be responsive to the needs of customers and the Commission should be

open to new and innovative solutions that respond to customer needs and

captures benefits for all customers. FPL explains that this is particularly

true and relevant for customers wanting to ensure more of their electricity

needs are met by solar generation. (FPL BR 18) FPL states that no existing

programs or tariffs fill this customer need; however, approving the facilities

without an associated tariff would not meet the customer need. (FPL BR 37)

Regarding prudence, FPL asserts

that OPC’s claim that SolarTogether violates the requirement under Section

366.06(1), F.S., that only prudent capital projects may be factored into rates

and charges miscomprehends the law and the facts. (FPL BR 26) FPL contends that with respect to the law, the

Florida Supreme Court has confirmed that “when presented with a settlement

agreement, the Commission’s review shifts to the public interest standard.” And,

that the public interest standard considers “whether the agreement—as a

whole—resolved all the issues, established rates that were just, reasonable,

and fair, and is in the public interest.” Citing

Florida Indus. Power Users Group v. Brown, 273 So. 3d 926, 929-30 (Fla. 2019).

FPL further explains that the Court found the public interest standard itself

incorporates prudence considerations. OPC’s prudence challenge presumably rests

on its allegation that FPL has not demonstrated a resource need. (FPL BR 26)

Last, FPL contends that for the

past decade, the Commission’s constructive regulation has advanced Florida’s

renewable energy policy, which states:

It is the intent of the Legislature to

promote the development of renewable energy; protect the economic viability of

Florida’s existing renewable energy facilities; diversify the types of fuel

used to generate electricity in Florida; lessen Florida’s dependence on natural

gas and fuel oil for the production of electricity; minimize the volatility of

fuel costs; encourage investment within the state; improve environmental

conditions; and, at the same time, minimize the costs of power supply to

electric utilities and their customers. Section 366.92, F.S.

FPL asserts

that SolarTogether is the next important step forward in promoting this policy.

(FPL BR 21)

OPC

OPC argues

that the SolarTogether proposed tariff is not the appropriate mechanism for

approval of 1,490 MW of generation facilities. When the facilities are

considered as a 1,490 MW whole, as FPL requests, the subject generation

facilities are subject to the Power Plant Siting Act (PPSA).

Therefore, the addition of 1,490 MW in generation facilities in this docket

should be subjected to a need determination proceeding pursuant to the PPSA.

(OPC BR 2-3)

OPC contends

that FPL is proposing to change the definition of “need” in every applicable

regulatory context, including the long history and usage of the term in Commission

precedent. They argue the concept of need is a well-recognized term of art in

the resource planning context. (OPC BR 3) OPC

asserts that FPL further urges the Commission to adopt a broader, unprecedented

conception of need based on not merely customer preference, but also on

unquantified social and alleged economic need – “opportunities to make a

difference,” allegedly lower emissions, and temporary jobs associated with

construction of the solar plants. (OPC BR 3-4)

Next, OPC argues that FPL admitted

SolarTogether is not a least-cost plan, and that it had not provided the

Commission with an economic analysis of what it alleged was simply an

acceleration of its TYSP. Still, FPL seeks a finding of prudence for $1.8

billion in generation assets without a need determination for either the 1,490

MW whole or any individual 74.5 MW block, on the basis that its customers want

these particular solar assets. Moreover, FPL presented SolarTogether as an all

or nothing choice to the Commission, in that the Utility repeatedly stated it

does not want the facilities approved if the Program is not also approved in

the exact form FPL demands. (OPC BR 5)

Last, OPC argues that whether

evaluated under the PPSA or other relevant statutes related to the regulation

of electric generation, an interpretation of regulatory governance which rests

on approving a project based upon certain customers’ desires rather than on

empirical measures directly related to ensuring the grid provides adequate

electricity to the public at the lowest reasonable cost will set a precedent

which calls the entire electric regulatory structure and the regulatory compact

into question. (OPC BR 5-6) Taken to its logical end, contends OPC, where a

customer preference for a certain type of generation determines policy-making,

there is no particular need for a Public Service Commission – the job could be

done by simple polling. OPC asserts that the Commission is a creature of

statute, and thus lacks the authority to establish a new policy untethered to a

statute or legislative grant of authority to broaden the grounds on which

massive generation resources are approved. (OPC BR 6)

SACE

SACE did not specifically address

whether the proposed tariff is an appropriate mechanism to seek approval of new

solar generation facilities but rather argues that the Commission should

approve the Settlement Agreement filed on October 9, 2019. (SACE BR 3) SACE

argues that the Commission is afforded great deference to determine that a

settlement agreement between parties is in the public interest and that it has

been presented with substantial, competent evidence during the hearing upon

which to make a public interest determination. (SACE BR 4) SACE contends that,

taken as a whole, the proposed tariff and Program provisions embodied in the

Settlement Agreement provide a number of benefits that are clearly in the

public interest that include: expansion of renewable energy through the

development of 1,490 MW of clean, renewable power; diversification of the

state’s fuel mix; a cost-effective program; allocation of economic benefit to

both participants and the general body of ratepayers; prioritizing the customer

experience, including expanding participation to low-income families; meeting

FPL’s resource needs in 2020 and 2021; meeting the enormous customer demand for

solar power; and driving state economic development and local job creation. (SACE

BR 4-5)

Vote Solar

Vote Solar

did not take a position on this issue.

Walmart

Walmart did

not provide issue-specific arguments in its brief but stated, “Walmart believes

that the proposed Settlement Agreement, including the SolarTogether Settlement

Tariff, is a reasonable compromise of the Settling Parties’ different positions

in this case and is otherwise in the public interest.” (Walmart BR 2)

Analysis

Summary of Proposed

SolarTogether Program and Associated Tariff

In its brief,

FPL asserts that while many aspects of the SolarTogether Program were explored

during the hearing, the driving forces behind its Petition are not debatable: “FPL

is listening intently to its customers and is developing innovative solutions

to satisfy their needs in a manner that benefits all.” (FPL BR 1) The proposed Program

was developed to give customers the opportunity to “directly support the

expansion of solar power without the need to install solar on their rooftop.” (Petition

2) FPL initially conducted outreach and marketing efforts, which included

providing terms and expected pricing, to its largest energy and demand customers

in order to gauge interest in such a program. (TR 62-64; Petition 2) When

further describing customer desires regarding solar generation, FPL witness

Valle stated “[a]lthough their reasons for being interested in community solar

varied, a top driver was electric bill savings.” (TR 53) In addition to

requesting approval of the Program and associated tariff, FPL is also seeking

an advanced prudency determination for the costs associated with 1,490 MW of

solar generation to be installed between 2020 and 2021 that would provide

electricity to all of FPL’s customers. (TR 113-114; EXH 38, BSP 193)

From

November 29, 2018, through January 25, 2019, FPL opened a pre-registration

period for its commercial, industrial, and governmental accounts. (TR 62; EXH

39, BSP 236) During this period, 206 customers pre-registered for approximately

1,100 MW of solar capacity. (TR 130) Based on the high level of customer

interest, FPL sized Phase 1 of the Program to include the construction of 20

solar PV power plants, each rated at 74.5 MW for a total of 1,490 MW. (TR 50-51,

59-60) The first six sites (447 MW) are projected to be eligible for inclusion

in the Program by March 1, 2020. The next six sites (447 MW) are projected to

be eligible for inclusion by February 1, 2021, and the final eight sites (596

MW) of Phase 1 are projected to be eligible for inclusion by May 1, 2021. (TR

60, 197, 221)

According to

witness Valle, FPL would initially allocate 75 percent (1,117.5 MW) to the

pre-registered commercial, industrial, and governmental accounts. The remaining

25 percent of the Phase 1 capacity (372.5 MW) would be allocated to residential

and small business customers who would enroll through a web-based system. (TR

57-59) FPL would periodically reevaluate these allocations and adjust according

to demand without Commission approval. (TR 57) Once subscription limits are

met, customers would be waitlisted until an opportunity to enroll presented

itself. FPL would monitor enrollment levels to determine if/when additional

SolarTogether phases would be warranted. (TR 60) Witness Valle suggests that

FPL is not considering a second phase at this time until customer demand has

been determined. (TR 115-116)

FPL claims

that the SolarTogether facilities eliminate the need to construct 300 MW of

battery storage and one combustion turbine in the 2020-2023 time period. (TR

238) As such, FPL estimates that the

Phase 1 SolarTogether facilities would save all customers an estimated $249

million in cumulative present value of revenue requirements (CPVRR) over the

life of the units (30 years). (TR 75, 78, 87) The proposed tariff is designed

to share these benefits between participants and the general body of ratepayers.

(TR 76)

Participation

in the Program is voluntary, would not be tied to a long-term commitment, and

is portable within FPL’s service territory. (TR 61) Pursuant to the proposed

tariff, participating customers would be charged a fixed subscription charge of

$6.76 per kilowatt (kW) per month based on their subscription level, up to 100

percent of their previous annual usage. Participating customers would also

receive a cents/kWh credit based on the actual production of the SolarTogether

facilities. (Attachment 1) The credit escalates at a fixed rate of 1.7 percent

annually for a period of 30 years. (TR 78) The combination of the charge and

credit was designed to produce a simple payback of seven years to participating

customers. (TR 310-311, 323, 340) This simple payback calculation ignores the

time value of money, and using a CPVRR analysis yields an eight year payback

period. (TR 502-503; EXH 64) The revenues from the subscription charge would be

included as base revenues in FPL’s monthly earning surveillance reports. (TR

326) The credits would be recovered through FPL’s fuel clause. (TR 148, 328) The

administrative costs for the Program, approximately $11.5 million, would be

reflected as base rate recoverable costs. (TR 324; EXH 44, BSP 294) FPL will

not increase base rates during the term of its existing base rate settlement

but will include the SolarTogether costs and expenses in its monthly earnings

surveillance report. (EXH

38, BSP 146)

In addition to the SolarTogether subscription charges and

credits, participating customers can elect to have FPL retire, on their behalf,

any renewable energy certificates (RECs) associated with their SolarTogether

subscription. (TR 61; EXH 28) According to the Petition, RECs are defined by

the U.S. Environmental Protection Agency as “a market based instrument that

represents the property rights to the environmental, social, and other

non-power attributes of renewable electricity.” (Petition 7)

Summary of Current

Planning and Regulatory Framework

Commission witness

Hinton discussed the

principles of Florida’s regulatory framework and the Commission’s role. He

stated:

Florida has a regulatory framework

established through statute that grants utilities specific rights and

responsibilities, and that establishes particular roles and responsibilities

for the Commission as the economic regulatory agency….

Along with those rights, utilities have

the obligation to serve all customers within their service territory, and that

service must be adequate, safe, and reliable. Utilities are not permitted to

build unnecessary facilities or incur costs for unnecessary services. In

addition, utilities may not unduly discriminate or show preference in providing

service or charging rates.

The Commission’s role is to ensure that

customers receive adequate, safe electric service at rates that are fair, just,

and reasonable. Those rates may only recover the cost of plant that is actually

used and useful in the public service. The Commission also oversees the

reliability and sufficiency of the bulk power grid and ensures that any

additions to the grid are necessary and cost-effective. (TR 639-640)

Witness

Hinton also stated that the proposed SolarTogether Program was a departure from

traditional least-cost planning. (TR 644) The witness summarized least-cost

planning as follows:

Utilities annually assess forecasts of

customer load and reserve margins for a ten-year period and perform a system

reliability analysis. An evaluation of existing generating resources is

conducted by the utility in order to identify potential opportunities to

improve generation efficiency. If a need for additional capacity is identified

in a given year, the utility will develop alternative resource plans,

evaluating combinations of demand-side and supply-side resources, to determine

the most feasible, cost-effective approach to meet that need. The important

principle underlying this process is the idea of “least cost planning.”

(TR 640)

No other

witness offered an alternative view of the current regulatory framework.

Policy Implications of

Proposed Program

Chapters 366

and 186.801, F.S., and the Commission’s rules implementing these Statutes, provide

a solid framework for flexible utility resource planning that results in

cost-effective resource additions for the benefit of all customers. The

Commission fulfills its oversight and regulatory responsibilities while leaving

day-to-day planning and operations to utility management. While any generation addition

adds fixed costs to a utility’s rate base, the resulting addition also impacts

the system’s fuel and operation and maintenance (O&M) costs. (TR 227) Under

traditional least-cost planning methods, the selection of which type of

generating unit to add to the system is driven by CPVRR analyses. Such analyses

contain a base case and several sensitivities to determine the relative risk of

the proposed addition to changes in fuel prices, loads, emissions costs,

capital costs, etc. (TR 239, 506)

Evidence in

the record shows that FPL’s 2019 TYSP, which includes over 1,700 MW of future

solar generation by 2022, is the least-cost plan resulting in the lowest

levelized system average electric rate. (EXH 39, BSP 255; EXH 45, BSP 312) However,

FPL’s proposed Program and associated rate Schedule STR disregard the

principles of least-cost planning regarding resource additions and resulting

cost allocation. (EXH 39, BSP 253; EXH 47, BSP 344; EXH 51, BSP 371) OPC argues

that FPL admitted SolarTogether is not a least-cost plan, and that it had not

provided the Commission with an economic analysis of what it alleged was simply

an acceleration of its TYSP. (OPC BR 5)

Instead of adding generating

units to satisfy projected reliability or economic needs for all customers,

approval of the proposed tariff would authorize FPL to accelerate the

construction of solar facilities and to add future solar facilities based upon

the Utility’s marketing efforts and the desires of a select group of customers.

OPC contends that whether the generation to be added is evaluated under the PPSA or other relevant

statutes related to the regulation of electric generation, an interpretation of

regulatory governance which rests on approving a project based upon certain

customers’ desires, rather than on empirical measures directly related to

ensuring the grid provides adequate electricity to the public at the lowest

reasonable cost, will set a precedent which calls the entire electric regulatory

structure and the regulatory compact into question. (OPC BR 6)

Staff notes that if the proposed Program and tariff are

approved, FPL is projecting its reserve margin to be above 27 percent by 2025.

(EXH 39, Amended Interrogatory No. 190, Attachment 2) Even if the SolarTogether

facilities are cost-effective to the general body of ratepayers, as FPL has

claimed in its Petition and testimony, staff questions the public benefit to be

gained by approving a voluntary tariff that fundamentally changes current

regulatory policies and procedures. (Petition 4; TR 46) In the past, voluntary

tariffs have been offered when the service desired (i.e., renewable energy) was

not cost competitive with traditional generation. Such offerings provided a

response to certain customer demands for a certain type of product. Voluntary

contributions were designed to recover the full incremental costs of the

desired service while, most importantly, holding the general body of ratepayers

harmless. As discussed in Issue 2, staff recommends that the proposed Program

and rate Schedule STR result in an undue preference to participants and

subjects the general body of ratepayers to an undue disadvantage.

Conclusion

FPL has

not demonstrated the public benefit to be gained by changing current regulatory

policies and procedures regarding the addition of generation assets. As such, approval

of generation assets should not be linked to a tariff proposal as requested by

FPL.

Issue 2:

Does FPL’s proposed SolarTogether Rider tariff give

any undue or unreasonable preference or advantage to any person or locality or

subject the same to any undue or unreasonable prejudice or disadvantage in any

respect, contrary to Section 366.03, Florida Statutes?

Recommendation:

Yes. The SolarTogether Rider tariff grants an undue

preference to participants and subjects the general body of ratepayers to an undue

disadvantage. (Ballinger, Simmons, Trierweiler)

Position

of the Parties:

FPL: No. Undue

preferences are avoided by designing rates to recover costs allocated based on customer

cost responsibility. The standard is that no customer be harmed by rates

charged to other customers. Under SolarTogether, the general body of customers

will pay none of that cost while receiving 45% of the savings.

OPC: Yes.

FIPUG: FIPUG did not file a brief.

SACE: No. The Settlement Agreement

filed in this docket on October 9, 2019 between FPL, SACE, Vote Solar,

and Walmart fully resolves all matters between the referenced parties and

provides numerous benefits to both participants and the general body of

customers, and is therefore in the public interest. See Issue 4

VOTE

SOLAR: No. As

amended, the SolarTogether tariff strikes a fair and reasonable balance in the

allocation of the Program’s costs and benefits between the general body of

customers, non-subscribing customers, and subscribing customers (those who are

low-income and non-low-income), in consideration of the unique contributions,

needs and interests of each.

WALMART: No.

Parties’

Arguments

FPL

FPL argues that undue preferences

or subsidizations are avoided by designing rates to recover costs allocated to

customers based on their cost responsibility. (FPL BR 19, 38) FPL contends the

standard is that no customer or group of customers be harmed by the rates

charged to or offerings made to other customers. (FPL BR 19, 38) Moreover, FPL

states that, not only is there no harm, there are substantial benefits for all

customers. (FPL BR 38) Specifically, FPL argues the Program is structured so

that the participants are paying slightly more than 100 percent of the net

fixed costs while receiving just over half of the benefits. (FPL BR 7)

Conversely, the general body of ratepayers will not pay for any of the fixed

cost of the solar centers, but is projected to receive almost half (45 percent)

of the benefits. (FPL BR 7-8, 38) FPL further argues that unlike other

community solar programs in the country, SolarTogether shares the program

benefits with the general body of ratepayers. (FPL BR 9)

FPL states that the rate impact on

the general body of ratepayers resulting from SolarTogether in the near-term is

modest, short-lived and compares favorably against placing the 20 solar

facilities in service without the SolarTogether Tariff. (FPL BR 34) It notes

that the base portion of the bill would not change for the general body of

ratepayers through at least 2021 and in the years 2020 and 2021, the fuel

portion of the bill is projected to increase roughly 13 cents and 47 cents,

respectively. (FPL BR 20-21) FPL disagrees with OPC’s claim that the Program is

discriminatory, involuntary and subsidized. FPL explains that the SolarTogether

Program is projected to be cost-effective at a reasonable cost and provide net

benefits in the form of cost savings for the general body of ratepayers,

including participants and non-participants, i.e., all FPL customers. (FPL BR

30)

FPL asserts that customers

wishing to receive more solar generation by participating in the SolarTogether

Program are not “cost causers” as that term is traditionally used. Rather, the

participants are better described as “benefit facilitators” who will share an

estimated $112 million with the general body of ratepayers, roughly half of

which is in the form of base rate savings not subject to the volatility

associated with fuel and emissions prices. (FPL BR 31-32) As such, FPL explains

that the general body of ratepayers is not harmed, which is generally

understood to be required before there is a finding of undue discrimination or

preference. (FPL BR 32) Last, FPL clarifies that the cost of the low-income component

will be borne solely by the non-low-income participants. (FPL BR 38)

OPC

OPC argues that one group of

customers (non-participants) are subjected to unreasonably different levels of

costs, risks, projected savings amounts, and projected savings timeframes. It

asserts that FPL glosses over the fact that non-participants are treated in

distinctly different, prejudicial ways by relying on generalities which focus

heavily on projections based toward the end of the 30 year life of the Program,

while impacts during the early years are more certain than the benefit

projections (or guesses) made for later years, i.e., the 26 year range. (OPC BR

7)

OPC contends that from day one,

participants are guaranteed to receive a set of bill credits and bill

surcharges that are pre-scheduled in amount for the 30 year life of the Program

with bill credits exceeding the pre-scheduled bill surcharges, such that

participants would receive a net benefit or “payback” within eight years. (OPC

BR 7) Non-participants would see an immediate bill increase as a direct result

of participants’ bill credits being recovered from non-participants through the

fuel clause. Moreover, argues OPC, non-participants are only projected to see

some sort of payback or net savings 26 years after SolarTogether goes into

service, if ever. Therefore, non-participants might get a net benefit sometime

at the end of the 30 year life of the project, or they might actually receive a

net loss. Participants are essentially guaranteed their payback. (OPC BR 7-9) In

essence, FPL is asking non-participants to commit to carrying the costs of a

$1.8 billion project for the next 30 years in the hopes of “possibly” receiving

a net benefit of $112 million some 26 years in the future. OPC asserts the

question to ask is whether a reasonable person would make that investment. (OPC

BR 8)

OPC explains that Florida law

requires that rates and charges demanded by public utilities must be “fair.”

The law further prohibits public utilities from giving “any undue or

unreasonable preference or advantage to any person or locality,” or subjecting

them to “any undue or unreasonable prejudice or disadvantage in any respect.” OPC

contends that due to the disparate and speculative charges and terms, to which

non-participant customers would be subjected, the SolarTogether Program fails

to comply with the law which prohibits unreasonable preferences or

disadvantages for any customer as compared to another. (OPC BR 8)

OPC next explains that the

general body includes both participants and non-participants, so discussing the

two groups together only masks the unlawful preference, prevents meaningful

comparison of the two groups, and fails to address the critical point: that the

level of risk is vastly dissimilar for each group. Participants are not the

ones who bear the bulk of the risk, and in fact, they bear essentially no risk,

while non-participants bear the bulk of the risk. (OPC BR 9-10) OPC argues that

FPL’s claims that participants pay more than 100 percent of the Program’s construction

costs, or that non-participants pay none of the costs, are misleading. OPC

argues that FPL is seeking recovery of the entire cost of the Program, which is

forecasted to be $1.8 billion. In contrast, OPC notes that participants will

only contribute $1.3 billion, a $0.5 billion shortfall that would have to be

made up for by the general body of ratepayers, 97 percent of whom would be

non-participants. (OPC BR 10-11) OPC argues that even FPL concedes that

non-participants would pay for the Program, but that the Utility downplays the

amount by describing it as “minor.” (OPC BR 10) OPC asserts that should actual

costs of the Program be higher, or avoided benefits be lower, the general body

of ratepayers would be required to make up the difference. (OPC BR 11) OPC

argues that if FPL truly believed in its Program and projections that it would

collect all costs from its participants, and not seek rate base recovery as it

does in its petition, which shifts all risks to the general body of ratepayers

who are ultimately responsible for the costs of the Program. (OPC BR 11)

OPC asserts the “cost causers” or

“cost allocation” principle has been recognized by the Commission, the Florida

Legislature, and the Florida Supreme Court. These principles ensure that

entities or customers that demand and benefit from extraordinary costs will

bear those costs. The SolarTogether Program does not contain elements that

would justify deviation from this precedent. (OPC BR 11)

OPC next states that another

element of disparate treatment built into the SolarTogether Program is that

participants’ bills would contain line items to show the charges and

corresponding bill credits they receive pursuant to the Program. However, OPC

notes the record does not indicate non-participants would have the same level

of transparency, in terms of a line item to show them how much they are

involuntarily contributing to the Program by funding the net credits

paid to participants. OPC contends the evidence indicates the proposed tariff

does not require the customers’ bills to explicitly disclose or show the

information to non-participants. Rather, the testimony is that the charges to

non-participants will be hidden, without explanation, inside the fuel charge. (OPC

BR 13)

Last, OPC contends that FPL

reverse-engineered the Program structure to ensure that participating customers

obtain a seven year simple payback; however, achieving the seven year simple

payback for participants comes at the expense of non-participants. Therefore, argues

OPC, FPL arbitrarily proposed rates by first deciding the terms of the Program

(costs/credits/payback date) for one set of customers, then adjusting the

numbers for non-participants to pay whatever is necessary to keep the

participants’ terms at the pre-determined level. The Program was specifically

crafted to unduly benefit one group of customers to the detriment of another,

which violates the plain terms of Section 366.03, F.S. (OPC BR 13-14)

SACE

SACE did not specifically address

the issue of undue preference in its brief but rather argues that the

Commission should approve the Settlement Agreement filed on October 9, 2019,

that resolves all issues between FPL, SACE, Vote Solar and Walmart. (SACE BR 2)

SACE argues that the Commission is afforded great deference to determine that a

settlement agreement between parties is in the public interest and that it has

been presented with substantial, competent evidence during the hearing upon

which to make a public interest determination. (SACE BR 4) SACE contends that

the SolarTogether Program is cost-effective and fairly and reasonably allocates

benefits to all customers. As such, SACE requests that the Commission approve

the Settlement Agreement in its entirety and notes that the Commission is not

precluded by statute or case law from approving nonunanimous settlements. (SACE

BR 5)

Vote Solar

Vote Solar argues that the

benefits flowing from the new solar resources being added to FPL’s electric

grid under the SolarTogether Program will accrue to the general body of

ratepayers. The SolarTogether Program and tariff, as amended, is designed to

allocate 55 percent of the projected financial benefits specifically to

subscribing customers, with the other 45 percent going to all customers. (Vote

Solar BR 2-3) Subscribers will cover over 104.5 percent of the Program base

revenue requirements through a levelized subscription rate. Vote Solar argues

that the SolarTogether Program design is an improvement for the general body of

customers over the typical community solar design that would isolate all of the

financial benefits to subscribers. In exchange for this long-term benefit, Vote

Solar contends the general body of ratepayers contributes to the subscription

credit in the early years of the Program offering – with the average

residential monthly electric bill expected to go up no more than 47 cents

(peaking in 2021, and then decreasing after that). (Vote Solar BR 2-3)

Further, argues Vote Solar, there

is a public interest need for additional clean energy capacity that lowers

costs for customers suffering from high energy burdens. Low-income customers

face significant barriers to accessing clean energy. The SolarTogether Program

will begin to address those barriers by providing year-one savings for

low-income customers, with a “hold harmless” provision to ensure that a

participant’s bill will never go up in any month as a result of their

enrollment. (Vote Solar BR 3-4)

Walmart

Walmart did not provide

issue-specific arguments in its brief but stated, “Walmart believes that the

proposed Settlement Agreement, including the SolarTogether Settlement Tariff,

is a reasonable compromise of the Settling Parties’ different positions in this

case and is otherwise in the public interest.” (Walmart BR 2)

Analysis

The Commission has a

“long-standing regulatory philosophy . . . that tariffs are to be designed so

that the end user is fairly charged for his service and that the general body

of ratepayers does not unduly or unreasonably bear the costs of that service.”

This philosophy implements Section 366.03, F.S., which provides that “[n]o

public utility shall make or give any undue or unreasonable preference or

advantage to any person or locality, or subject the same to any undue or

unreasonable prejudice or disadvantage in any respect.” Some parties argue that

the proposed tariff grants preferential rates to its participants, and some

argue that the proposed tariff subjects the general body of ratepayers to

disadvantageous rates. However, the main question is not whether the proposed tariff

grants preference to some or disadvantages others, but whether that preference

and/or disadvantage is “undue or unreasonable.” Several

Commission orders and out-of-state court opinions provide guidance for

interpreting “undue or unreasonable” in this context. The Commission has taken

this language to mean that similarly situated customers must be treated

similarly.

The Court of Appeals for the D.C. Circuit has had occasion to interpret the

similarly worded Federal Power Act, and its approach mirrors the Commission’s. The

D.C. Circuit added that the reason for treating two entities differently must be

“based on relevant, significant facts which are explained.” BP Energy Co. v. FERC, 828 F.3d 959, 967

(D.C. Cir. 2016) (quoting Complex Consol.

Edison Co. of N.Y., Inc. v. FERC, 165 F.3d 992, 1012–13 (D.C. Cir. 1999)). Thus,

the Commission must make a factual determination as to whether any preference

granted by or disadvantage caused by a tariff is undue or unreasonable. See id.; Mtn. States Legal Found. v. Pub. Utils. Comm’n, 590 P.2d 495, 500

(Colo. 1979) (Carrigan, J., dissenting) (“Whether a particular classification

of ratepayers is reasonable or not is essentially a fact question for the

[Public Utilities Commission].”).

Section 366.03, F.S., also states

“[a]ll rates and charges made, demanded, or received by any public utility for

any service rendered, or to be rendered by it, and each rule and regulation of

such public utility, shall be fair and reasonable.” The Florida Supreme Court

made it clear that the Commission’s responsibility of making sure rates are

fair and reasonable not only extends to the parties appearing before the

Commission, but to the other utility

customers who are not directly involved in the proceeding.[10] Therefore,

staff evaluated the proposed tariff’s impact on FPL, Program participants, and

the “other utility customers,” i.e., the general body of ratepayers.

In its brief, FPL contends of its

Program that “the general body of ratepayers is not harmed, which is generally

understood to be required before there is a finding of undue discrimination or

preference.” (FPL BR 32; citing

verbatim FPL witness Deason’s testimony, TR 469). However, neither FPL nor witness

Deason provided the basis for this “general understanding,” and staff can find

no support in statute, rule, or precedent for it. Section 366.03, F.S., does

not define what constitutes an undue or unreasonable preference. However, the

statute does require that rates be fair and reasonable. Commission precedent

speaks to prohibiting rates that are unduly discriminatory, and that costs

associated with an optional tariff are appropriately borne by the cost causer. The Commission

must make a factual determination of whether the proposed tariff in this

instance gives an undue or unreasonable preference or advantage to any

customers, or subjects customers to any undue or unreasonable prejudice or

disadvantage. Determining whether FPL’s Program harms the general body of

ratepayers may indeed be an important consideration in this case. However, it

is not correct that a finding of harm to the general body of ratepayers is an

established or even “generally understood” prerequisite to a finding of undue

discrimination or preference.

The evidence in the record

suggests that there are six areas where a preference may exist. Each area is

discussed in more detail below.

Initial Participant

Allocation

Through discovery, the Utility

clarified that the purpose of the Program was to offer participants an

alternative to installing rooftop solar (net metering) thereby allowing

participants to achieve desired corporate/political goals of 100 percent

renewable energy. (EXH 38, BSP 157) Also, a top driver for participation was

electric bill savings. (TR 53) Staff recognizes that not all customers have the

financial or physical ability to install rooftop solar and that a community

solar program can help overcome these barriers. However, the proposed tariff

does not require a customer to provide any information suggesting that they are

physically or financially unable to install their own generation and net meter.

In addition, staff recommends that a corporate or political goal of 100 percent

renewable energy is self-imposed that should not be supported by other

ratepayers. In its brief, OPC appears to agree and states “FPL and its allies

want 98% of FPL’s customers to pay for the SolarTogether special interest

project or window dressing so that 1.5% of FPL’s customers can advertise “from

day one” that they obtain their energy from 100% renewable sources and meet

their nation-wide, private sustainability goals, even though the overall carbon

profile in FPL’s territory will not materially change and Florida’s

vulnerability to what SACE describes as the climate crisis has not materially

changed.” (OPC BR 5)

FPL initially conducted outreach

and marketing efforts, including sample terms and estimated pricing, to its

largest energy and demand customers in order to gauge interest in such a

program. (EXH 38, BSP 77-111; TR 62-64; Petition 2) At the conclusion of this

process, 206 customers pre-registered for approximately 1,100 MW of the

Program’s capacity. (TR 130) Attachment 2 to the recommendation contains a

summary of the initial participant allocation. (EXH 63) Many of these customers

pre-registered for 100 percent of their annual usage and 10 of the 206

pre-registered customers account for approximately 50 percent of the total

capacity. (EXH 38, BSP 179-180) In contrast, FPL has yet to open registration to

the estimated 74,500 residential and small business classes of customers. (EXH

38, BSP 125, 187) Therefore, the residential and small business customers will

have to wait until the Program is approved by the Commission to even try to

subscribe to any capacity. (TR 59) Furthermore, in total, only 1.5 percent of

FPL’s 4.9 million customers would be eligible to participate in this Program. (EXH

38, BSP 125; EXH 39, BSP 244; EXH 63) As such, the Program as proposed, by

definition, cannot and will not be used by 98.5 percent of FPL’s customers. Therefore,

if solar additions are now a cost-effective generation addition for all

customers, it appears the “need” for a voluntary tariff is only to assist a

certain small group of customers meet their self-imposed corporate or political

goal.

Allocation of Net

Benefits

As is common with new generation,

the revenue requirements (costs) for the SolarTogether facilities, including

capital, transmission, and O&M, exceed the initial system savings

(benefits) for avoided generation, transmission, fuel, emissions, and other items.

(EXH 50, Interrogatory No. 254, Attachment 1) Over time the benefits increase

and eventually exceed the costs, producing net savings to ratepayers. The

cumulative value of these costs and benefits is calculated as a CPVRR, which

determines the net savings compared to an alternative. The payback period, or

the amount of time the project’s cumulative benefits are forecasted to break

even with the project’s cumulative costs, can also be calculated using this

information. (TR 502-503) Under the Commission’s traditional regulatory

framework, the SolarTogether facilities are projected to save approximately

$260 million in net benefits on a CPVRR basis with a payback period of 21 years

for all ratepayers. (EXH 50, Interrogatory No. 254, Attachment 1; EXH 64)

FPL’s proposed Program and

associated tariff would alter the amount and allocation of net benefits in

three ways. First, the Utility would seek recovery of administrative costs to

operate the Program, approximately $11.5 million, which reduces the net benefits

from $260 million to $249 million. (TR 137; EXH 64)

Second, FPL designed the Program

and associated tariff so the credit amount paid to participants exceeds the

amount participants pay in subscription charges over the 30 year life of the

facilities. (TR 52, 339) Under the Program, participants would receive net benefits

of approximately $137 million, and reduce their payback period from 21 years to

only eight years. (TR 558; EXH 64) The general body of ratepayers, the vast

majority of whom are non-participants, would decrease their share of net

benefits from $260 million to $112 million, and increase their payback period

from 21 to 26 years. These impacts are summarized in Attachment 3. (EXH 64)

Third, FPL designed the Program’s

subscription credits to be a certain value with a fixed escalation rate, disregarding

potential changes in the actual costs for fuel and emissions, thereby reducing

the risk exposure for participants. (TR 118) As a result, the proposed tariff

essentially guarantees net bill credits to participants. Benefits to the

general body of ratepayers are speculative as these customers would bear the

risk of changes in fuel and emission costs forecasts. For example, the

participants’ credits include costs associated with carbon dioxide (CO2)

emissions beginning in 2026. (EXH 38, BSP 47-48) Staff notes that there is no current

or pending legislation regarding the cost of CO2 emissions at this

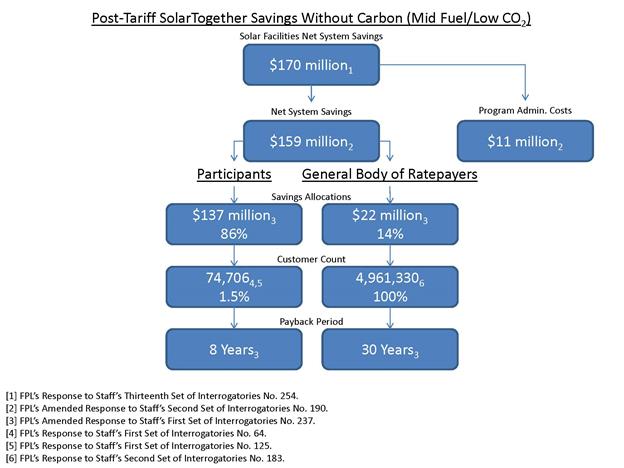

time. In a scenario with no CO2 related costs, under traditional

regulation, the net benefits to all ratepayers would drop to $170 million with

a payback period of 23 years. (TR 140; EXH 64) In that scenario, FPL designed

the Program so participants still receive the same net benefit of $137 million

with a payback period of eight years, but the general body of ratepayers would see

its net benefits reduced to only $22 million with a payback period of 30 years.

These impacts are summarized in Attachment 4. (EXH 64)

In discovery, staff requested that

the Utility evaluate the impact of sensitivities for fuel and emissions costs.

Under traditional ratemaking, there would be net benefits in all nine

sensitivities for all ratepayers. Under the Utility’s proposed Program, as seen

in Table 2-1, the participants’ charges and credits remain constant and provide

a net savings of $137 million with an eight year payback regardless of

sensitivity. However, net benefits to the general body of ratepayers vary, and

in some sensitivities are actually net costs, with ratepayers never receiving a

payback.

Table 2-1

FPL’s Nine

Sensitivities

Source:

(EXH 46, BSP 322)

Low-income Carve-out

Customer classes (e.g.

residential, commercial, industrial, etc.) are determined by their electric

usage characteristics. The proposed Program has set aside 37.5 MW for

low-income customers that will begin with Project 3 (billing date of February

2021). (TR 136) The proposed tariff itself does not contain this information or

any other allocation values. The proposed tariff defines a low-income

participant, a sub-set of the residential customer class, as those customers

whose income is at or below 200 percent of the federal poverty level. (Attachment

1; EXH 46, BSP 335) The proposed tariff also provides the low-income

participant with an immediate fixed bill reduction of $0.70/kW-month. In its

Petition, FPL estimates that a 5 kW subscription would equal 100 percent of an

average annual residential customer’s energy usage. (EXH 38, BSP 122) Therefore,

if a low-income customer subscribed for 5 kW, the estimated monthly bill

reduction for the low-income participant would be $3.50 per month for the

duration of their participation. The 37.5 MW allocated capacity would equate to

approximately 7,500 low-income customers. (EXH 46, BSP 335) FPL witness Valle

confirmed that FPL has more than 7,500 low-income customers. (TR 136) FPL has

proposed that the credits paid to all participants be collected through its

fuel adjustment clause. (TR 344) As such, the general body of ratepayers,

including non-participating low-income customers, will be paying for this

direct bill reduction.

The Commission has had little

opportunity to discuss preferential treatment to low-income customers in the

past, but other states have, and they have come to different conclusions,

demonstrating that whether a preferential rate for low-income customers is

“undue” is an open question. Compare Am.

Hoechest Corp. v. Dep’t of Pub. Utils., 399 N.E.2d 1, 3–5 (Mass. 1980)

(allowing preferential rates to low-income seniors on an experimental basis) with Mtn. States Legal Found., 590 P.2d

at 498 (disallowing preferential rates to low-income seniors and low-income

disabled customers). As discussed above, this determination is fact-intensive.

Thus, the Commission must decide whether the record evidence warrants preferential

rates for a small subset of FPL’s low-income ratepayers.

Costs Not Fully Funded

by Participants

The evidence indicates that the

proposed tariff would provide FPL with an alternative funding mechanism that

accelerates the development of solar generation. As discussed above, voluntary

tariffs have traditionally provided a response to certain customer demands for

a certain type of product while holding the general body of ratepayers

harmless. FPL’s existing SolarNow program is consistent with this policy and is

designed to hold non-participating customers harmless from any increased

expenses while the fuel saving benefits are realized equally among all

ratepayers. Unlike

prior Commission decisions regarding voluntary tariffs, the participating customers

of the proposed Program would not pay the full cost of the Program. For

example, the administrative costs of approximately $11.5 million would be

booked as a base rate expense for FPL’s surveillance reporting. (TR 322, 324)

Also, the cumulative present value of revenues to be collected from

participating customers is $1.3 billion (72.9 percent) of the $1.8 billion

associated with the 1,490 MW of solar generation. (EXH 42, BSP 281) FPL witness

Bores explained that:

. . . We are levelizing this revenue

requirement. And if you think about a revenue requirement, it normally declines

over time. Right. So we -- to minimize the day-one charge and make it, quote-unquote,

"economical" and encourage and meet the needs of the customers here,

we have levelized that charge. So, in the short term, there will be a

difference between the levelized charge to the participants and the actual

revenue requirement that will sit in rate base that will turn around over the life

of the project . . .

(TR 410)

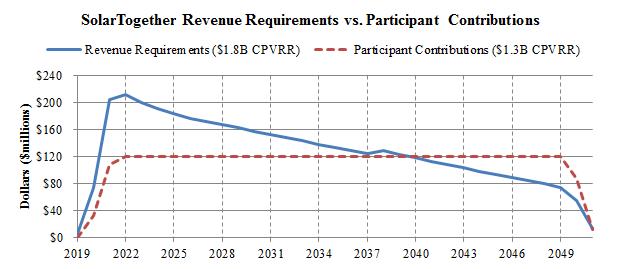

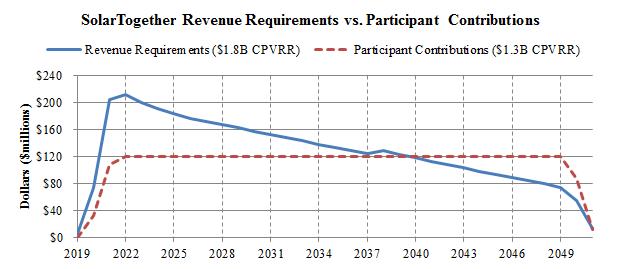

The line graph below shows that in

2022 there will be a revenue deficiency of approximately $90 million paid for

by the general body of ratepayers. (EXH 39, Amended Interrogatory No. 190,

Attachments 4 and 5) These revenue deficiencies gradually decrease and may be

addressed at each subsequent rate proceeding.

Figure 2-1

Source:

(EXH 39, Amended Interrogatory No. 190, Attachments 4 and 5)

OPC contends that the

participating customers of the proposed Program would not cover the full cost

of the Program and that FPL’s claims that participants pay 100 percent or more

of Program costs, or that non-participants pay none of the Program costs, are

misleading. OPC argues that FPL is seeking recovery of the entire cost of the

Program, which is forecasted to be $1.8 billion. In contrast, OPC notes that

participants would only contribute $1.3 billion, a $0.5 billion shortfall that

would have to be made up for by the general body of ratepayers, 97 percent of

whom would be non-participants. (OPC BR 10-11)

Staff observes that such a

disparity in the magnitude of savings and the relative payback shifts the

majority of risk to the general body of ratepayers, which may be unduly

discriminatory. To cover 100 percent of the costs associated with the solar

facilities, the participating customer charge would have to be increased from

$6.76/kW-month to $9.23/kW-month. (EXH 42, BSP 281; EXH 46, BSP 328) Staff

recommends that such a disparity in the allocation of costs is inconsistent

with the Commission’s policy to hold non-participating customers harmless when

offering a voluntary tariff for a special service.

Alternative to Net Metering

FPL witness Valle discussed the

Program as an alternative to net metering, especially for those customers who

are unable or unwilling to do so. (TR 49) Under a traditional net metering

arrangement, a customer would shoulder the full capital cost and construction

risk of installing solar generation on their premise. (TR 143-144) The customer

would not be able to transfer the solar facilities to another location and the

payback would be affected by the performance of the solar facilities and future

utility fuel and emission costs. (TR 144-145) According to witness Valle, such

a traditional net metering arrangement should have a payback of between 10 to

12 years. (TR 688) Under the proposed Program and associated tariff,

participants face no upfront capital or maintenance costs, and may exit the

Program with one month’s notice. (TR 146-147) Furthermore, the subscription

charges and credits were designed by FPL to give an essentially guaranteed

payback period of eight years. (TR 323; EXH 46, BSP 322) Participants would

also be eligible to transfer their participation to a new location within FPL’s

service territory. (TR 61) Overall, compared to traditional net metering, the

Program offers reduced risk and increased and essentially guaranteed rewards

for participants. (TR 146)

The Utility is

impacted by traditional net metering in that it would have lower energy and/or

demand sales, producing less overall revenue. (TR 74) While the Utility’s

energy costs would be offset by reduced fuel costs, base rates would not be

offset. These base rate reductions would be taken into account at the Utility’s

next base rate proceeding, in which the Utility’s fixed costs would have to be

spread across a smaller amount of demand and energy sales resulting in an

increase of base rates to the general body of ratepayers. (EXH 38, BSP 70-71) Under

the proposed tariff, FPL would not see any reduction in kWh sales or revenues

between rate cases. (EXH 38, BSP 71) The subscription charge would also reduce

base rate risks for the Utility as it is recovered on a fixed monthly basis

similar to the customer charge, rather than on an energy or demand basis for

traditional generation additions.

As risks decrease for the

participants and the Utility, they increase for the general body of ratepayers.

As the SolarTogether facilities would be included in FPL’s rate base, the

general body of ratepayers would be responsible for the capital, construction,

O&M and other costs. The general body of ratepayers would also see an

immediate increase in rates from the subscription credits through the fuel clause.

(EXH 38, BSP 149) As the subscription credits are based on a forecast of

benefits over the full life of the units, the general body of ratepayers have

all fuel and emissions costs risks shifted to them from the participants. As

such, the Program and proposed tariff shifts the majority of risk associated

with traditional net metering to the general body of ratepayers and may be unduly

discriminatory.