Case Background

Rule

25-30.457, Florida Administrative Code (F.A.C.), Limited Alternative Rate

Increase, was adopted in 2005 pursuant to Section 367.0814(9), Florida Statutes

(F.S.), as an alternative to the staff assisted rate case procedure for water

or wastewater utilities. The rule is

applicable to water and wastewater utilities whose total gross annual operating

revenues are $300,000 or less. The purpose of the rule is to allow small

utilities to obtain a limited amount of rate relief more quickly than would

occur in rate cases filed under Rule 25-30.455, Staff Assistance in Rate Cases,

or Rule 25-30.456, Staff Assistance in Alternative Rate Setting, thus resulting

in less costly regulation through lower rate case expense and reduction in

Commission staff labor.

At the April 2,

2019 Commission Conference, the Commission heard three petitions for limited

rate increase. The Office of Public Counsel (OPC)

participated at that Commission Conference and, although not opposing the

requested rate increase in those dockets, OPC raised concerns about Rule

25-30.457, F.A.C. OPC stated that it did not believe that the rule had an

objective cost-based method by which to approve increases or to set specific

rates. OPC stated that it had raised

these concerns with the Office of General Counsel and anticipated developing

suggestions and possible rule amendments to address its concerns.

On May 15, 2019,

staff held a noticed, informal meeting with interested persons to discuss the

possible amendment of Rule 25-30.457, F.A.C. Attending the meeting and

providing comments were OPC; Investor Owned Utilities, consisting of eighteen

utilities (“Collective Utilities”); U.S. Water Services Corporation; and Florida

Utility Services. The Notice of Rule Development for amending Rule 25-30.457,

F.A.C., was published in the Florida Administrative Register on October 9,

2019, and a staff rule development workshop was held on October 30, 2019.

Post-workshop comments were submitted by OPC. The Commission has jurisdiction

pursuant to Sections 350.127(2), 367.0814, 367.121, and 120.54, F.S.

Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rule

25-30.457, F.A.C., Limited Alternative Rate Increase?

Recommendation:

Yes, the Commission should propose the amendment of

Rule 25-30.457, F.A.C., as set forth in Attachment A of this recommendation. The

Commission should also certify Rule 25-30.457, F.A.C., as a minor violation

rule. (Cowdery, T. Brown, Norris,

Coston, Guffey)

Staff Analysis:

Staff is recommending that Rule 25-30.457, F.A.C,

should be amended to clarify rule requirements and better organize the rule. In

addition, staff is recommending restructuring of the rule to specifically

identify what information is needed in the application, including an

explanation of the reasons why the utility is asking for the rate increase. The

recommended rule amendments are set forth in Attachment A. The substantive recommended rule amendments

are discussed in more detail below.

Draft Subsection (2) – The Application

Under the current Rule 25-30.457,

F.A.C., an applicant is required to file information required by subsections

(7) – (9) of the rule. In addition,

paragraphs (5)(a) – (h) of the current rule provide that in determining whether

to grant or deny the petition, the Commission will consider certain other

criteria, such as whether the petitioner has filed annual reports, paid

applicable regulatory assessment fees, or has at least one year of experience

in utility operation.

OPC argued that subsection (5)

fails to establish adequate standards for agency decisions because the rule

does not state whether or not the criteria listed must be met by the utility,

thus giving the Commission too much discretion in granting or denying rate

increases. OPC gave as an example paragraph (5)(g), which states that the

Commission, in determining whether to grant or deny the petition, must consider

whether the utility was granted a rate case increase within the 2-year period

prior to receipt of the limited alternative rate increase petition. OPC points out that it is not clear whether

the utility would or would not qualify for a rate increase if it had been

granted a rate case increase within the past two years.

In order to address this concern,

the draft rule adds a new subsection (2) that lists all the information that must be contained in the limited

alternative rate increase application. The requirements in paragraphs

(2)(a)-(f) and (i) are currently required in existing rule subsections

(7)-(9). Attachment A, pages 10-11. In addition, staff is recommending that the

following information, currently listed in subsection (5) as criteria to be

considered, should be required in the application in new subsection (2) of the

draft rule:

(j) A statement that the utility is currently in compliance

with its annual report filing in accordance with Rule 25-30.110(3), F.A.C.;

(k) A statement that the utility has paid all required

regulatory assessment fees or is current on any approved regulatory assessment

fee payment plan;

(l) A statement that an order in a rate proceeding that

established the utility’s rate base, capital structure, annual operating

expenses and revenues has been issued for the utility within the 7-year period

prior to the official date of filing of the application; and

(m) Any additional relevant information in support of the

application and reasons why the information should be considered.

Attachment A, page 9.

Staff recommends that certain

subsection (5) criteria currently considered by the Commission in determining

whether to grant or deny a petition should not be required as part of the

application for rate increase. Specifically, a utility should not be required

to organize its books and records consistent with Rule 25-30.110, have at least

one year of experience in utility operation, or have had a rate case increase

within the 2-year period prior to the Commission’s receipt of the application.

Staff does not believe that these criteria are relevant in deciding whether a

small utility should be granted a rate increase under the Rule 25-30.457,

F.A.C. The determination of whether a rate increase should be granted is based

on whether the utility’s revenue requirements are sufficient to allow it to

earn a fair rate of return on its rate base. For these reasons, staff

recommends that the criteria in paragraphs (5)(a), (b), (e), and (g) in the

current rule should be deleted.

OPC was also concerned that Rule

25-30.457, F.A.C., does not sufficiently require the utility to identify the

reasons why a rate increase is needed or what percentage increase would be

appropriate. To address this concern, staff recommends adding the following new

application requirements:

(2)(g) A statement

providing the specific basis or bases for the requested rate increase.

(h) If the requested

rate increase is based upon the utility’s underearning or the utility’s

expectation to underearn, a statement explaining why the utility is, or is expected

to, underearn its authorized rate of return.

Staff believes that these requirements should give the

customers and the Commission an understanding of why a rate increase is being

requested. In addition, as part of its review of limited alternative rate

increase applications, staff reviews the utility’s annual reports, past rate

orders, and utility responses to staff requests for information such as anticipated capital plant

improvements, replacements, and repairs, and known and measurable changes in

operating expenses. This information forms a basis for making staff’s

recommendation on whether a utility is entitled to an increase, and if so, how

much of an increase. Overall, staff believes that the recommended draft rule clearly

specifies what information a utility must provide in its application and that

the Commission will have the information it needs to make an informed decision.

Draft Subsections (7) and (8) – Revenue held

subject to refund and staff earnings review

Under subsection (12) of the

current rule, the utility is required to hold any revenue increase subject to

refund with interest under Rule 25-30.360, F.A.C., for a period of 15 months

after the filing of the utility’s annual report for the year the increased

rates were implemented. Under current subsection (13), a staff earnings review

of the utility’s annual report is conducted to determine any potential

overearnings. Security for money collected subject to refund is required, and

the utility must provide a monthly report on the total amount of money collected

subject to refund and the status of the security being used to guarantee

repayment of the money.

At the informal meeting and in

its comments, Collective Utilities stated that under the current rule, the

period of time a rate increase is held subject to refund can be significantly

long, depending on the timing of when the rates are implemented compared to

when its annual report is filed. If a rate increase is implemented early in the

year, the annual report for the year the rates were implemented would be filed

the following March or April. The rate increase revenues would need to be held

for a period of an additional 15 months after that, meaning the increased

revenues may need to be held subject to refund for more than two years.

Collective Utilities also raised

the issue that small Class C water and wastewater utilities often have

difficulty obtaining appropriate security. For this reason, Collective

Utilities argued, limited alternative rate increase applications should be treated

like price index increases that, under Section 367.081(4)(d), F.S., are not

required to have a bond or corporate undertaking. Collective Utilities stated that, in

addition, utilities that receive price index increases are not required to

comply with Rule 25-30.360(6), F.A.C., which requires monthly reports showing

the monthly and total amount of money collected subject to refund and the status

of the security being used to guarantee repayment of any potential refund. Collective

Utilities states that this monthly reporting should not be required for limited

alternative rate increases because the long reporting time period is

burdensome, it is unknown what refund amount, if any, may be required, and the

refund may be significantly less than the increase that was granted. Further,

Collective Utilities states that Commission staff, in reviewing a limited

alternative rate increase application, conducts a thorough evaluation and

analysis to determine whether a utility should receive a rate increase and what

percentage should be approved.

In order to address the

regulatory lag described above, staff is recommending that rather than wait for

the utility to file an annual report before conducting an earnings review, as

described in the current rule, staff would conduct an earnings review of the

twelve-month period following the implementation of the revenue increase. As

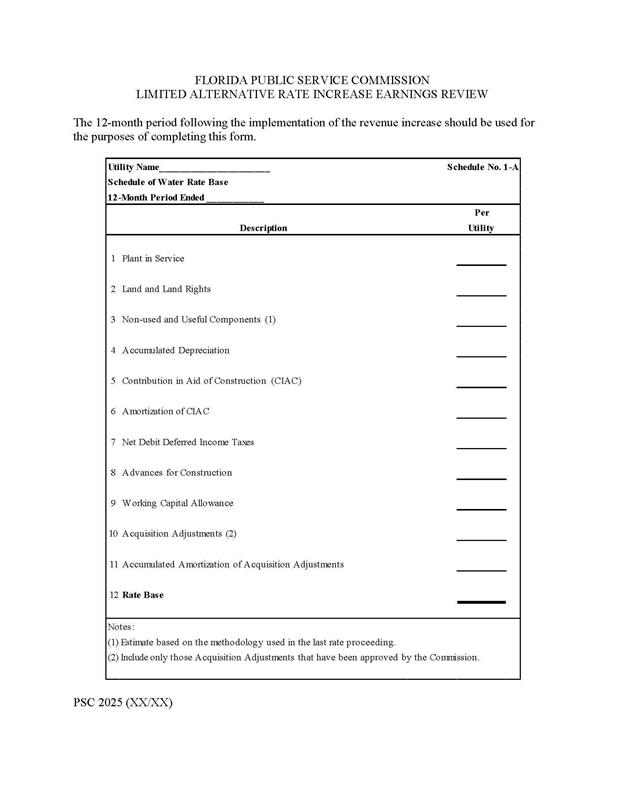

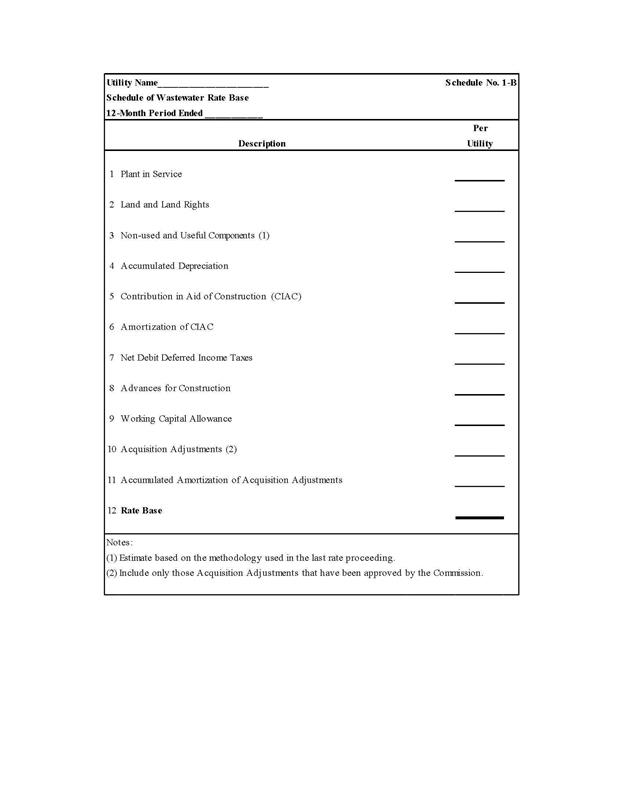

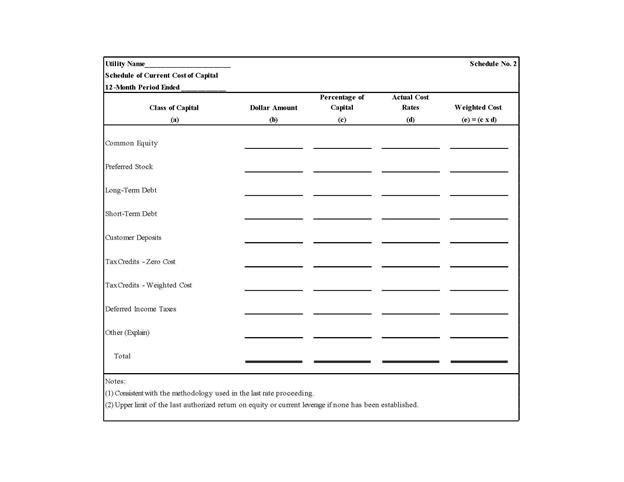

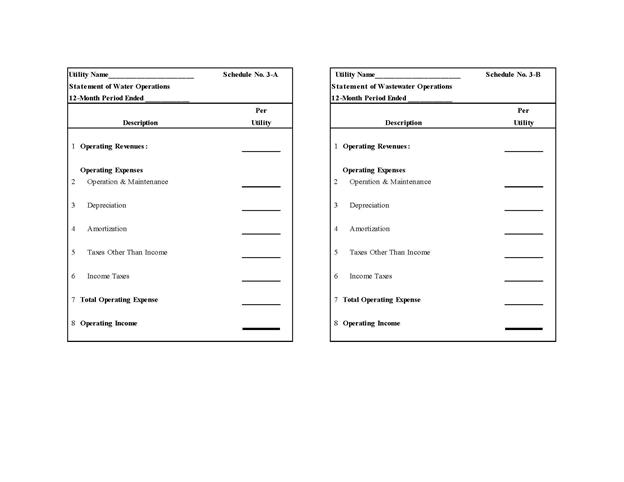

part of this new process, utilities would be required to file a Limited

Alternative Rate Increase Earnings Review form within 90 days of the end of the

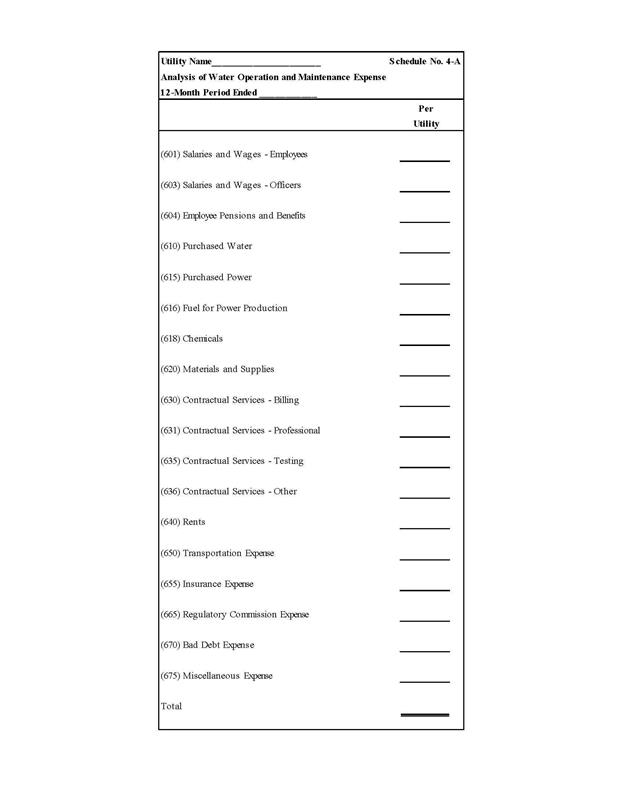

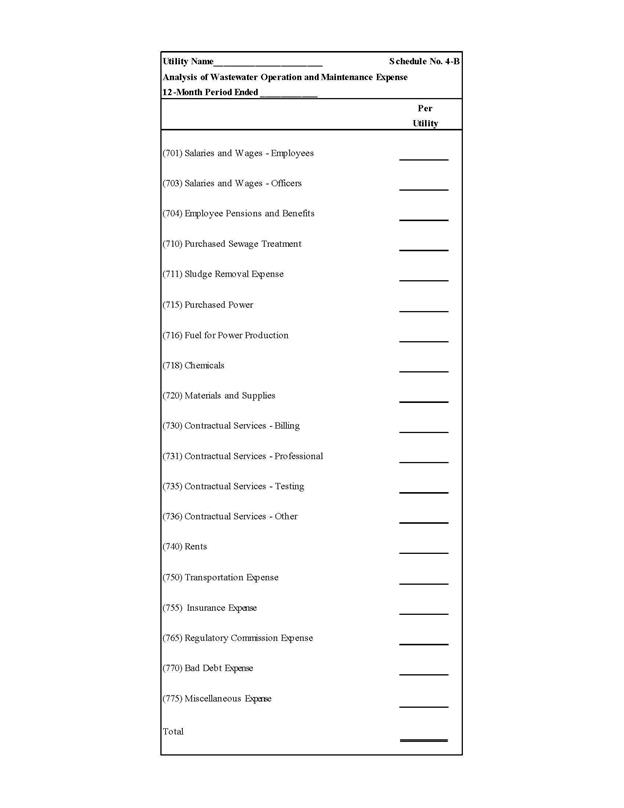

twelve-month period, subject to an extension of time for good cause. The new

form requires the utility to file rate base schedules, current cost of capital,

operating income, and operation and maintenance expense. Attachment A, pages 14-19.

When submitted to the Commission, the

attached form would include information that should be readily available to the

utility as part of its normal business and financial operations. In turn, staff

would be able to identify any potential over-earnings earlier than under the

current rule.

Further, staff believes that any revenue increase granted

under Rule 25-30.457, F.A.C., should be held subject to refund with interest in

accordance with subsection 25-30.360(4), F.A.C., but that a utility should not

be required to provide security for money collected subject to refund or file

monthly refund reports with the Commission. The inclusion of the security

requirement may have inadvertently prevented small water and wastewater

utilities from being able to use the rule. Similarly, the monthly reporting

requirement may have been burdensome to some small water and wastewater

utilities. Neither the security

requirement nor the monthly reporting requirement is required as part of an index

increase, which Rule 25-30.457, F.A.C., was designed to emulate. The removal of

these requirements may enable additional utilities to use the limited

alternative rate increase process in rate setting. Use of this process is meant

to provide a more stable revenue stream, and, thus, a more financially sound

utility, which benefits both the utilities and their customers.

Minor Violation

Rules Certification

Pursuant to Section 120.695, F.S., the agency head must

certify for each rule filed for adoption whether any part of the rule is

designated as a rule the violation of which would be a minor violation. Rule

25-30.457, F.A.C., is currently listed on the Commission’s website as a rule

for which a violation would be minor because violation of the rule would not

result in economic or physical harm to a person or have an adverse effect on

the public health, safety, or welfare or create a significant threat of such

harm. The amendments to the rule would not change its status as a minor

violation rule. Thus, staff recommends that the Commission certify Rule

25-30.457, F.A.C., as a minor violation rule.

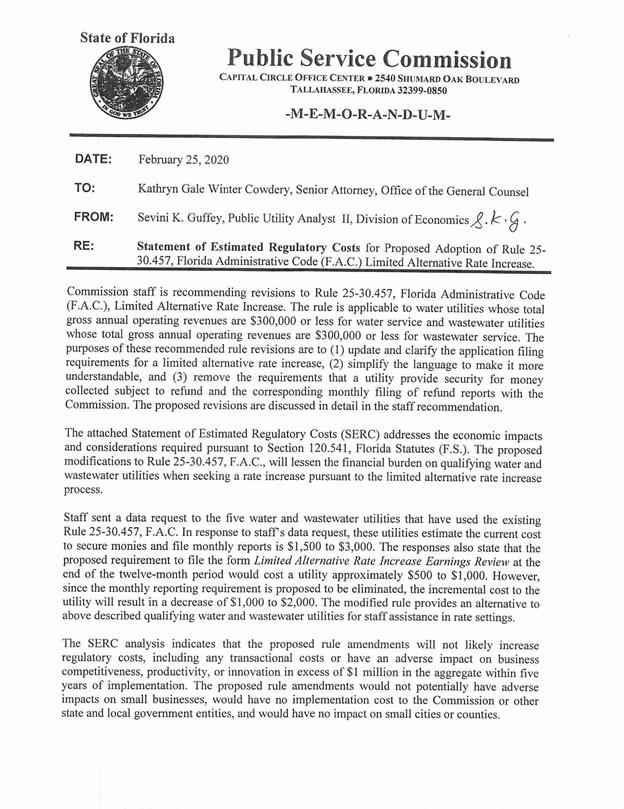

Statement of

Estimated Regulatory Costs

Pursuant to Section 120.54(3)(b), F.S., agencies are

encouraged to prepare a statement of estimated regulatory costs (SERC) before

the adoption, amendment, or repeal of any rule. The SERC is appended as

Attachment B to this recommendation.

The SERC concludes that the rule will not likely directly

or indirectly increase regulatory costs in excess of $200,000 in the aggregate

in Florida within one year after implementation. Further, the SERC economic analysis concludes

that the rule will not likely have an adverse impact on economic growth,

private sector job creation or employment, private sector investment, business

competitiveness, productivity, or innovation in excess of $1 million in the

aggregate within five years of implementation. Thus, the rule does not require

legislative ratification pursuant to Section 120.541(3), F.S. In addition, the

SERC states that the rule will not have an adverse impact on small business and

will have no impact on small cities or counties. The SERC concludes that any

transactional costs likely to be incurred by small utilities using the rule

would be completely offset by the savings incurred. No regulatory alternatives

were submitted pursuant to paragraph 120.541(1)(a), F.S. None of the

impact/cost criteria established in paragraph 120.541(2)(a), F.S., will be

exceeded as a result of the recommended amendments to Rule 25-30.457, F.A.C.

Conclusion

Based on the foregoing, staff recommends the Commission

propose the amendment of Rule 25-30.457, F.A.C., as set forth in Attachment A.

Staff also recommends that the Commission certify Rule 25-30.457, F.A.C., as a

minor violation rule.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no requests for hearing, information

regarding the SERC, proposals for a lower cost regulatory alternative, or JAPC

comments are filed, the rule should be filed with the Department of State, and

the docket should be closed. (Cowdery)

Staff Analysis:

If no requests for hearing,

information regarding the SERC, proposals for a lower cost regulatory

alternative, or JAPC comments are filed, the rule may be filed with the

Department of State and the docket should be closed.

25-30.457 Limited Alternative Rate Increase.

(1)

As an alternative to a staff assisted rate case as described in Rrule

25-30.455, F.A.C., or to staff assistance in alternative rate setting as

described in Rrule 25-30.456, F.A.C., water utilities whose total

gross annual operating revenues are $300,000 or less for water service and

wastewater utilities whose total gross annual operating revenues are $300,000

or less for wastewater service may file

with the Office of Commission Clerk an application petition the

Commission for a limited alternative rate increase of up to 20 percent

applied to metered or flat recurring rates of all classes of service by

filing with the Office of Commission Clerk the information required by

subsections (7), (8) and (9) of this rule.

(2) The application for limited alternative

rate increase must contain the following information:

(a)

The name of the utility as it appears on the utility’s certificate and the

address of the utility’s principal place of business;

(b)

The type of business organization under which the utility’s operations are

conducted;

(c)

If the utility is a corporation, the date of incorporation and the names and

addresses of all persons who own five percent or more of the utility’s stock;

(d)

If the utility is not a corporation, the names and addresses of the owners of

the business;

(e)

A schedule showing the annualized revenues by customer class and meter size for

the most recent 12-month period using the rates in effect at the time the

utility files its application;

(f)

A schedule showing the current and proposed rates for all classes of customers;

(g)

A statement providing the specific basis or bases for the requested rate

increase;

(h)

If the requested rate increase is based upon the utility’s underearning or the

utility’s expectation to underearn, a statement explaining why the utility is,

or is expected to, underearn its authorized rate of return;

(i)

A statement that the figures and calculations upon which the change in rates is

based are accurate and that the change will not cause the utility to exceed its

last authorized rate of return on equity;

(j)

A statement that the utility is currently in compliance with its annual report

filing in accordance with Rule 25-30.110(3), F.A.C.;

(k)

A statement that the utility has paid all required regulatory assessment fees

or is current on any approved regulatory assessment fee payment plan;

(l)

A statement that an order in a rate proceeding that established the utility’s

rate base, capital structure, annual operating expenses and revenues has been

issued for the utility within the 7-year period prior to the official date of

filing of the application; and

(m)

Any additional relevant information in support of the application and reasons

why the information should be considered.

(3) Within 30 days of the application’s filing

date, Commission staff will notify the utility in writing that the application

requirements of subsection (2) of this rule have been met or that the

requirements of subsection (2) have not been met with an explanation of the

application’s deficiencies.

(2) Within 30 days of receipt of the

completed petition, the Commission will evaluate the petition and determine the

petitioner’s eligibility for a limited alternative rate increase.

(3)

The Commission will notify the petitioner in writing as to whether the petition

is accepted or denied. If the petition is accepted, staff assistance in

alternative rate setting will be initiated. If the petition is denied, the

notification of petition denial will state the deficiencies in the petition

with reference to the criteria set out in subsection (5) of this rule.

(4)

The date of Commission staff’s written notification to the utility that the

requirements of subsection (2) of this rule have been met will be considered

the date of official acceptance by the Commission of the application. The

official date of filing is established as will be 30 days after

the official acceptance by the Commission of the application date of the

written notification to the petitioner of the Commission’s acceptance of the petition.

The application is deemed denied if the utility does not remit the filing

fee as required by paragraph 25-30.020(2)(f), F.A.C., within 30 days after the

official acceptance of the application.

(5)

In determining whether to grant or deny the petition, the Commission will

consider the following criteria:

(a)

Whether the petitioner qualifies for staff assistance pursuant to subsection

(1) of this rule;

(b)

Whether the petitioners’ books and records are organized consistent with rule

25-30.110, F.A.C, so as to allow Commission personnel to verify costs and other

relevant factors within the 30-day time frame set out in this rule;

(c)

Whether the petitioner has filed annual reports;

(d)

Whether the petitioner has paid applicable regulatory assessment fees;

(e)

Whether the petitioner has at least one year of experience in utility

operation;

(f)

Whether the petitioner has filed additional relevant information in support of

eligibility together with reasons why the information should be considered;

(g)

Whether the utility was granted a rate case increase within the 2-year period

prior to the receipt of the petition under review;

(h)

Whether a final order in a rate proceeding that established the utility’s rate

base, capital structure, annual operating expenses and revenues has been issued

for the utility within the 7-year period prior to the receipt of the petition

under review.

(6)

The Commission will deny the petition if the petitioner does not remit the

filing fee, as provided by paragraph 25-30.020(2)(f), F.A.C., within 30 days

after official acceptance of the petition.

(7)

Each petitioner for limited alternative rate increase shall provide the

following general information to the Commission:

(a)

The name of the utility as it appears on the utility’s certificate and the

address of the utility’s principal place of business; and,

(b)

The type of business organization under which the utility’s operations are

conducted:

1. If the petitioner is a corporation,

the date of incorporation and the names and addresses of all persons who own

five percent or more of the petitioner’s stock; or

2.

If the petitioner is not a corporation, the names and addresses of the owners

of the business.

(8)

The petitioner shall provide a schedule showing:

(a)

Annualized revenues by customer class and meter size for the most recent

12-month period using the rates in effect at the time the utility files its

petition; and,

(b)

Current and proposed rates for all classes of customers.

(9)

The petitioner shall provide a statement that the figures and calculations upon

which the change in rates is based are accurate and that the change will not

cause the utility to exceed its last authorized rate of return on equity.

(5)(10)

A financial or engineering audit of the utility’s financial or engineering

books and records will shall not be required in determining

whether to approve or deny the application conjunction with the petition

under review.

(6)(11) Based upon the

criteria contained in subsection (2), the Commission will approve, deny, or

approve the application The petition will be approved, denied, or

approved with modifications that may include a reduction or an increase

in the requested rate increase, within 90 days from the official filing

date as established in subsection (4) of this rule.

(7)(12)

Any revenue increase granted under the provisions of this rule shall be held

subject to refund with interest in accordance with subsection rule

25-30.360(4), F.A.C., for a period of 15 months after the filing of

the utility’s annual report required by rule 25-30.110, F.A.C., for the year

the adjustment in rates was implemented. Subsection 25-30.360(6),

F.A.C., does not apply to any money collected subject to refund under this

subsection.

(8)(13)

To insure overearnings will not occur due to the implementation of this rate

increase, Tthe Commission staff will conduct an

earnings review of the twelve-month period following the implementation of

the revenue increase. utility’s annual report to determine any

potential overearnings for the year the adjustment in rates was implemented.

(a)

At the end of the twelve-month period, the utility has 90 days to complete and

file Form PSC 1025 (X/XX), entitled “Limited Alternative Rate Increase Earnings

Review,” which is incorporated into this rule by reference and is available at

[Dep’t of State hyperlink].

(b)

In the event the utility needs additional time to complete the form, the

utility may request an extension of time supported by a statement of good cause

that must be filed with Commission staff within seven days prior to the 90-day deadline. “Good cause” means a showing of financial

hardship, unforeseen events, or other events outside the control of the

utility, but does not include reasons such as management oversight.

(c)(14)

If, within 15 months after the filing of a utility’s annual report the

Commission staff’s earnings review demonstrates finds that the

utility exceeded the range of its last authorized rate of return on equity after

an adjustment in rates, as authorized by this rule, was implemented within the

year for which the report was filed, such overearnings, up to the amount

held subject to refund, with interest, shall be disposed of for the benefit of

the customers. If the Commission staff

determines that the utility did not exceed the range of its last authorized

return on equity, the revenue increase will no longer be held subject to

refund.

(9)(15)

In the event of a protest of the pProposed aAgency

aAction oOrder is protested pursuant to Rrule

28-106.111, F.A.C., by a substantially affected person other than the utility,

the utility must file a staff assisted rate case application pursuant to Rule

25-30.455, F.A.C., within 21 days from the date the protest is filed or the

utility’s application for a limited alternative rate increase will be deemed

withdrawn.

(10)

Upon the utility filing a staff assisted rate case application pursuant to

subsection (9) of this rule:

(a)

unless the Proposed Agency Action Order proposes a rate reduction, Tthe

utility may implement the rates established in the pProposed aAgency

aAction oOrder on a temporary basis subject to

refund with interest in accordance with Rrule 25-30.360, F.A.C.;

upon the utility filing a staff

assisted rate case application pursuant to rule 25-30.455, F.A.C., within 21

days of the date the protest is filed.

(b)(16)

In the event of a protest, Tthe limit on the maximum increase

provided in subsection (1) of this rule will shall no longer

apply; and

(c)

The application will be processed under Rule 25-30.455, F.A.C.

(17)

If the utility fails to file a staff assisted rate case application within 21

days in the event of a protest, the petition for a limited alternative rate

increase will be deemed withdrawn.

Rulemaking Authority 350.127(2),

367.0814, 367.121 FS. Law Implemented 367.0814 FS. History–New 3-15-05, Amended

12-16-08, 8-10-14, 7-1-18,____________.