Case Background

On January 6,

2020, Tampa Electric Company (TECO) filed a petition for approval of a

temporary (5-year) waiver of certain requirements in Rule 25-6.064,

Contribution-in-Aid-of-Construction for Installation of New or Upgraded

Facilities, Florida Administrative Code (F.A.C.), for the installation of

primary voltage power lines to the location of electric vehicle (EV) fast

charging stations. TECO also asks in its petition that the Commission approve a

revised tariff sheet to reflect the requested temporary rule waiver.

Rule

25-6.064, F.A.C.

A copy of Rule

25-6.064, F.A.C., is appended as Attachment A. The purpose of Rule 25-6.064,

F.A.C., is to establish a uniform procedure by which investor-owned electric

utilities calculate amounts due as CIAC from customers who request new

facilities or upgraded facilities in order to receive electric service. The

intent of the rule is to quantify the costs for certain new or upgraded

facilities’ construction in order to accurately determine the appropriate

amount of CIAC to be collected. The rule reflects the Commission’s

long-standing policy that, where practical, the person who causes the costs to

be incurred should bear the burden of those costs.

Subsection (2)

of Rule 25-6.064, F.A.C., is the required formula for calculating CIAC for new

or upgraded overhead facilities, and states:

|

CIAC

|

=

|

Total estimated

work order job costs of installing facilities

|

_

|

4 years

expected incremental base energy revenue

|

_

|

4 years

expected incremental base demand

revenues, if applicable

|

Paragraph (2)(c)

of Rule 25-6.064, F.A.C, the subject of TECO’s petition, states:

The expected

annual base energy and demand charge revenues shall be estimated for a period

ending not more than 5 years after the new or upgraded facilities are placed in

service.

Subsection (6)

of the rule requires each investor-owned utility to “use its best judgement in

estimating the total amount of annual revenues which the new or upgraded

facilities are expected to produce.”

Subsection (7)

of the rule allows an investor-owned utility to waive all or a portion of CIAC

for customers, but requires the utility to reduce plant in service as if CIAC

had been collected, unless the Commission determines that there is a

quantifiable benefit to the general body of ratepayers.

TECO’s

Petition

TECO states that the purpose for the

temporary rule waiver is to create a pilot program to help encourage the growth

of EVs in Florida. TECO states that EVs present many benefits to Florida in

general and to TECO’s customer base, including lowering reliance on petroleum-based

fuels and a new and potentially beneficial electric load over which to spread

fixed costs. TECO asserts that “[o]ne of the known barriers to growth of the EV

market is the lack of public- and place-of-employment based fast charging

stations.” And that one of the major barriers to the more widespread

development of fast charging stations is “the initial cost to extend primary

voltage power lines to the location where the fast charger would be most

convenient to attract current and potential EV owners.”

TECO states that

the intent of the requested temporary rule waiver is to eliminate a barrier to

the construction of new EV fast charging stations. TECO states that annual revenues for fast

charging stations are “likely very low when the charger is first installed,

partly as it takes considerable time to make its market presence known to

attract customers, but also partly because there are not many EVs on the road

to take advantage of fast charges.” TECO asserts that the low initial revenue

equates to a minimal CIAC credit against what is often a substantial line

extension cost to hook up a EV fast charging station. TECO states that this is

an imposing barrier to the installation of EV fast charging stations.

To remove this

barrier, TECO is asking that a 10-year revenue estimation period be substituted

for the 5-year revenue estimation period in Rule 25-6.064(2)(c), F.A.C. TECO

states that if this rule waiver is granted, it will “use its best estimates to

calculate the highest base rate revenues expected to be received from each station

during the 10-year period,” under subsection (6) of the rule. TECO states that

use of a 10-year estimation period would result in lower CIAC for those third

party customers installing EV fast charging stations and, as a result, encourage

more development of EV fast charging stations.

Consistent with

its stated intent to create a pilot program, TECO is requesting that the

temporary rule waiver be limited to a period of 5 years. TECO states that 5

years will be sufficient to determine whether use of a 10-year estimating

period has a beneficial impact on the EV market. It further states that 5 years

would give time for the EV charging infrastructure market “to develop and grow

to such a point that this waiver can be removed – either because it is no

longer necessary to spur development of fast EV charging infrastructure or

because the technology no longer needs such support to enable the chargers to

be placed into service.”

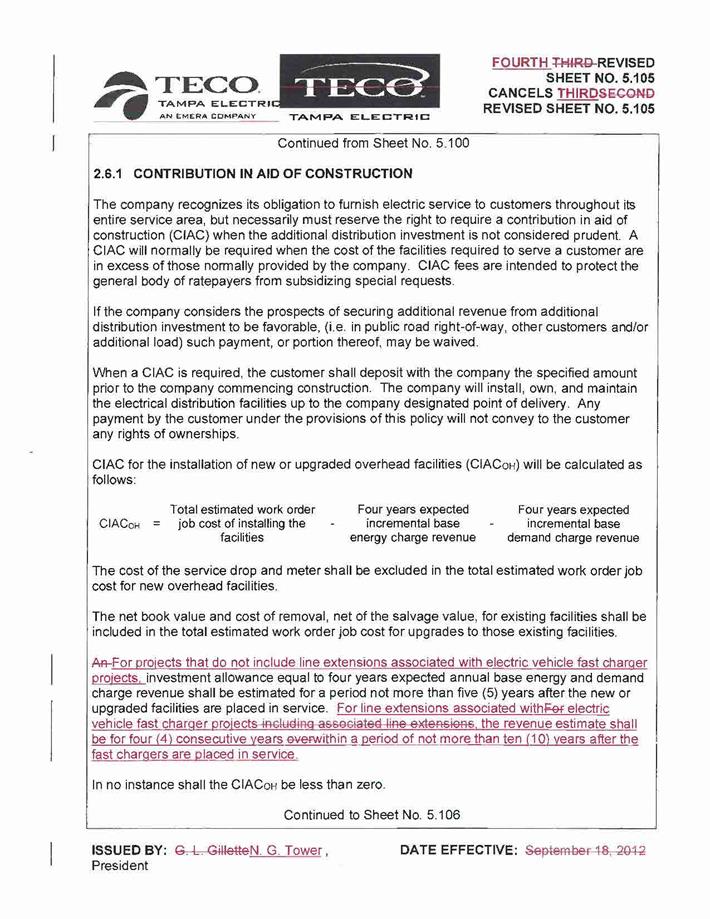

TECO also asks

the Commission to approve a new tariff sheet, Fourth Revised Sheet No. 5.105, to reflect the temporary rule

waiver. A copy of the revised tariff sheet is appended as Attachment B.

Procedural

Matters

Notice of the

petition was published in the Florida Administrative Register (F.A.R.) on

January 9, 2020, pursuant to Section 120.542(6), Florida Statutes (F.S.). The F.A.R.

notice stated, in accordance with Rule

28-104.003, F.A.C., that interested persons may submit written comments on the

petition within 14 days of the notice. No written comments were received on the

petition.

Pursuant to

Section 120.542(7), F.S., by letter dated January 24, 2020, staff requested

TECO provide additional information on the petition. TECO responded to staff’s

letter on February 6, 2020.

Staff held a

noticed, informal meeting on February 25, 2020, to allow the company and other

interested persons further opportunity to discuss the petition. Representatives

from TECO, the Office of Public Counsel (OPC), and the Southeast Energy

Efficiency Alliance participated at the meeting.

Section

120.542(7), F.S., requires the Commission to grant or deny a petition for rule waiver

within 90 days after receipt of the original petition, the last item of timely

requested additional material, or the petitioner’s written request to finish

processing the petition. Thus, the Commission must grant or deny the petition

no later than May 6, 2020, which is 90 days from February 6, 2020, the date of

TECO’s response to staff’s request for additional information. A petition not granted or denied within 90

days after receipt of a completed petition is deemed approved.

The Commission

has jurisdiction pursuant to Sections 120.542, 366.03, 366.05, and 366.06, F.S.

Discussion

of Issues

Issue 1:

Should the Commission grant TECO's petition for a

temporary waiver of or variance from Rule 25-6.064(2)(c), F.A.C., and approve

TECO's Fourth Revised Tariff Sheet No. 5.105?

Recommendation:

Yes, the petition for temporary rule waiver/variance

should be granted subject to the condition that TECO file annual reports during

the 5-year rule waiver/variance period, with the first report due on March 1,

2021. Each annual report should include the following information for the

preceding calendar year:

·

For each EV fast charger line

extension installed during the reporting period, the number of EV fast chargers

served, the total line extension cost, the CIAC collected, the total annual

revenue collected (demand and energy), the line extension usage metrics (demand

and energy), and the balance of any related cross subsidy (total cost less CIAC

collected less total energy/demand revenue collected to date);

·

System-wide Totals (summed for all

years since the time the temporary rule waiver/variance was granted) for each

of the following: EV fast charger line

extensions installed, the number of EV fast chargers served, EV fast charger

line extension costs, CIAC collected, total annual revenue collected (demand

and energy), line extension usage metrics (demand and energy), and the balance

of any related cross subsidy (total cost less CIAC collected less total

energy/demand revenue collected to date); and

·

Projected annual growth for the next

five years in TECO’s service territory of EVs, EV fast chargers, and EV fast

charger line extensions.

In addition, the Commission should approve TECO’s Fourth

Revised Tariff Sheet No. 5.105, which reflects the temporary rule

waiver/variance. The effective date of the revised tariff sheet should be the date

of the consummating order. Before the expiration of the 5-year rule

waiver/variance period, TECO should be required to file a revised tariff sheet

reflecting the removal of the temporary rule waiver/variance, which staff

should be given administrative authority to approve. (Cibula, McNulty, Smith II)

Staff Analysis:

TECO is asking that a 10-year revenue estimation period be

substituted for the 5-year revenue estimation period in Rule 25-6.064(2)(c),

F.A.C. TECO is requesting that the rule waiver be limited to a period of 5

years and apply only to the installation of primary voltage powers lines to the

location of EV fast charging stations.

Legal Standard for Rule Waivers or Variances

Rule waivers and variances

are governed by Section 120.542, F.S. Section 120.542(1), F.S., provides:

Strict application of uniformly applicable rule

requirements can lead to unreasonable, unfair, and unintended results in

particular instances. The Legislature finds that it is appropriate in such

cases to adopt a procedure for agencies to provide relief to persons subject to

regulation.

Section 120.542(2), F.S., states that the agency must

grant a rule variance or waiver if the petitioner demonstrates: (1) the purpose of the underlying statutes will be

or has been achieved by other means; and (2) that application of the rule would

create a substantial hardship or would violate the principles of fairness. A

substantial hardship is a “demonstrated economic, technological, legal, or

other type of hardship to the person requesting the variance or waiver.”

Principles of fairness are violated when “the literal application of a rule

affects a particular person in a manner significantly different from the way it

affects other similarly situated persons who are subject to the rule.”

Section 120.542(1), F.S., further states that an agency

may limit the duration of any grant for a variance or waiver and impose

conditions on the grant “only to the extent necessary for the purpose of the

underlying statute to be achieved.”

The Purpose of the Underlying Statutes

Rule 25-6.064, F.A.C., cites as its law implemented

Sections 366.03, 366.05(1), and 366.06(1), F.S. Sections 366.05 and 366.06,

F.S., authorize the Commission to prescribe just, fair, reasonable, and

compensatory rates. Section 366.03, F.S., requires investor-owned utilities to

furnish to each person applying for service reasonably sufficient, adequate,

and efficient service upon terms required by the Commission and prohibits an

investor-owned utility from giving any undue or unreasonable preference to any

persons or locality. TECO states that the purpose of these underlying statutes

will be achieved by other means if the temporary rule waiver is granted.

TECO states that Sections 366.03, 366.05(1), 366.06(1),

F.S., grant the Commission broad discretion in setting utility rates. It argues

that substituting a different estimation period for calculating the revenues

used to calculate CIAC due from EV fast charger installers will not result in

an undue or unreasonable preference to any person and will not impair the ability

of the Commission to prescribe fair, just, and reasonable rates. TECO states

that as the EV market develops, high-voltage chargers will be a new source of

load over which to spread TECO’s system costs, which will benefit all the

company’s customers.

In response to staff’s request for additional information,

TECO states that:

In the context of [TECO’s] petition, the company is not

asking to do away with the revenue credit or to even reduce the number of years

over which expected revenues are to be counted; rather, the company is seeking

to expand the period of time over which the four years of expected incremental

base energy revenue can be counted. Therefore, while the company does expect a

higher revenue credit to be realized, the concept behind the requested waiver

or variance is not materially different than the current policy.

TECO states in its petition that CIAC payments are

intended to reduce potential cross-subsidy between the load associated with the

new or upgraded facilities and existing customers taking service from existing

facilities and acknowledges that cross-subsidization will occur if the petition

is granted. TECO further states, however, that it anticipates a de minimis

impact on the general body of ratepayers because the company does not expect

the revised tariff to result in an amount of line extensions for high-voltage

EV chargers that would cause a material impact on the amount of CIAC collected

relative to TECO’s overall invested capital. In this regard, TECO states:

Thus, despite any initial cross-subsidization that may

occur, the result will be providing a reasonable preference for fast charging

infrastructure in these early market development years of EVs and be beneficial

for Tampa Electric’s ratepayers now and into the future. The selection of a further advanced period to

calculate the expected base revenues simply defers the period such a subsidy is

in place for the period before the four years of base revenues actually occurs. At that point, the subsidy ends and the

purposes of the rule are implemented.

TECO states that ratepayers benefit from the addition of

more EV fast charges “which can incent the faster acceptance and choice of EVs

by customers.” TECO states that EVs reduce emissions and utilize cleaner energy

generation by TECO, including solar photovoltaic sites, and reduce reliance on

petroleum-based fuels. Moreover, TECO states that EVs may someday be a valuable

resource to TECO’s general body of ratepayers as a new and potentially

beneficial electric load over which to spread fixed costs and “as a source of

energy storage and load shaping to meet future energy infrastructure and energy

control mechanisms.” TECO asserts that encouraging market development for EVs

meets the statutory directives of Sections 366.81, 366.94, 377.601, 377.815,

403.42, 627.06535, F.S., which it states support actions to facilitate and

benefit EVs and aim to reduce reliance on petroleum fuels in Florida.

TECO also asserts that the temporary rule waiver request

specifically aligns with Section 366.05(1)(a), F.S., which addresses the

Commission’s authority to “require repairs, improvements, additions,

replacements, and extensions to the plant and equipment of any public utility

when reasonably necessary to promote the convenience and welfare of the

public.” TECO states the temporary rule waiver promotes the convenience and

welfare of the public through encouraging the development of fast charging

stations “during this important period where there is need for more such

chargers to encourage the market for electric vehicles to grow.” TECO further

states the revised tariff would not be discriminatory because it will be

uniformly applied to any customer seeking a line extension to serve a Level 3

EV charging station during the 5-year temporary variance period.

Staff’s Analysis

As acknowledged by TECO in its petition, CIAC payments are

intended to reduce potential cross subsidy between the load associated with the

new or upgraded facilities and existing customers taking service from existing

facilities. Staff reviewed TECO’s petition with regard to (1) the potential for

cross subsidies that may result over an extended period if this waiver is

utilized, and (2) the lack of reliable quantifiable information regarding the

projected number of line extensions, line extension costs, and credit amounts

(offsetting revenue), which would aid in calculating the CIAC and the amount of

the potential subsidy.

It is a long-standing regulatory concept that a cross

subsidy occurs when the cost-causer does not fully pay for the costs incurred

to provide service, resulting in those unrecovered costs then shifting to the

general body of ratepayers. TECO argues that the added cross subsidy associated

with this pilot program should be considered in conjunction with anticipated

benefits. Primary among these benefits is the incremental load growth expected

to be realized from the proposed tariff revision. TECO contends that reducing

CIAC for the requested line extensions would allow the utility to serve more

high-voltage chargers, and thus spread the fixed costs of its system across

such consumption.

Staff reviewed potential cross subsidy in this case by

considering the recovery of costs under the rule versus the proposed rule

waiver. By rule, CIAC is calculated using the cost of (in this case) the line

extension and subtracting from that cost the expected revenues.

|

CIAC

|

=

|

Total estimated work order job costs of installing

facilities

|

_

|

4 years expected incremental base energy revenue

|

_

|

4 years expected base demand revenues

|

The CIAC is the portion of the line extension costs the

customer pays upfront when he or she initiates service. As shown above, the

CIAC payment is based on the costs of the new facilities, reduced by 4 years of

expected revenue. Per paragraph (2)(c) of the rule, the 4 years of expected

revenue must be estimated within a 5-year period after the new facilities are

placed in service. The 4 years of expected base energy and demand revenues

represent the time-limited credit allowed to the customer for the portion of

the installation costs not paid via the CIAC payment. This credit to CIAC is

expected to be offset by revenues from the customer after the 4-year period

concludes within the first 5 years following line extension installation.

TECO’s argument is that EV fast charger line extension revenues are expected to

be substantially less in years 1-5 than they would be in years 5–10. TECO

believes the proposal of a 10-year estimation timeframe “would lower the CIAC

barrier for construction of new high-voltage EV chargers, increase the number

of such chargers in the service territory and result in faster adoption of

electric vehicles.”

The extent and duration of the subsidy in this case is

dependent on cost and revenue data. TECO indicated that it has no cost-benefit

study or analysis or estimate of the beneficial load growth associated with the

program at this time. A

cost-benefit analysis of the program would require data that the utility has

indicated is not available, including the number of expected line extensions,

total line extension costs, and credit amounts.

TECO indicates it appears the subsidy, under the proposed

rule waiver, could be expected to continue beyond the rule’s standard 5 years,

but declining over this time period.

Staff has prepared an example of the potential subsidy based on a hypothetical

installation, as shown in Table 1-1. In this example, staff used TECO’s

estimated average EV fast charger line extension cost ($21,662 per line

extension, rounded to $21,000) and a company estimate of annual base revenue

growth associated with a single EV fast charger over a 10-year period.

Staff emphasizes that these revenue estimates are for illustrative purposes

only because, according to TECO, each line extension project is unique and

requires customers input to estimate.

Table 1-1 illustrates how CIAC is currently calculated by

Rule 25-6.064, F.A.C., versus TECO’s proposed CIAC rule waiver. The current

calculation reflects projected revenues of $5,000 in Years 2 through 5 ($1,000

+ $1,250 + $1,250 + $1,500). Subtracting this revenue credit from the estimated

line extension cost of $21,000 results in a $16,000 CIAC charge. This credit

would be offset in Year 5, once the $5,000 in incremental revenues has been

collected.

In contrast, TECO’s proposed CIAC rule waiver results in a

$20,000 credit, reflecting projected revenues of $20,000 in Years 7-10, which

is $15,000 higher than under the rule. This credit to CIAC would not be fully

offset by the customer’s revenues until Year 9, assuming the projected revenues

match the amount actually collected.

Thus, for this illustrative implementation of the CIAC

waiver, the subsidy would be greater ($20,000 rather than $5,000) and remain longer

(9 years rather than 5 years) under the proposed CIAC rule waiver for EV fast

charger line extensions. The period of time in which it takes for the credits

to CIAC based on expected revenues to be offset by actual revenues represents

the subsidization period since that is money that was spent by the utility, not

the customer or cost causer.

Staff notes that TECO has installed only one line

extension for EV fast chargers to date, yet it has provided EV fast charger

service to 13 locations in its service territory, serving over 50 EV fast

charger stations. Given the ability of TECO to provide service to a number of

potential EV fast charger locations without a line extension, staff believes

the total impact on net income resulting from the waiver will be smaller than

it would otherwise have been.

Staff believes that TECO has adequately demonstrated that

the purposes of the underlying statutes will still be achieved if the requested

temporary rule waiver/variance is granted for the temporary and limited purpose

of the pilot program. The Commission has broad authority pursuant to the

underlying statutes to set just, fair, and reasonable rates. Moreover, the

temporary rule waiver/variance will not completely do away with the revenue

credit or reduce the number of years over which expected revenues are to be

counted, it only expands the period of time over which the 4 years of expected

incremental base energy revenue can be counted. Thus, third party installers of

EV fast charging stations will still have to pay some amount of CIAC to have

the electric line extended, just at a lesser amount than required by the rule.

Substantial Hardship

TECO alleges that strict application of Rule 25-6.064,

F.A.C., will create a substantial hardship. Specifically, TECO states that the

5-year estimating period for calculating CIAC in paragraph (2)(c) of the rule

creates a substantial, imposing barrier to more widespread development of EV

fast chargers, which in turn discourages the growth of EVs. TECO opines that

this is because there is a substantial initial cost to extend primary voltage

power lines to the location where the fast charger would be most convenient to

attract current and potential EV owners.

TECO states that the expected 5-year revenues for a high-voltage EV

charger are likely very low when the charger is first installed, and this means

there will be a minimal credit against what is often a substantial line

extension cost to hook up such a fast charger. TECO asserts that “[t]his creates

a significant barrier to achieving the reduced emissions, reduced reliance on

petroleum-based fuels, and potential load growth in TECO’s service territory

that would benefit ratepayers.”

TECO states that the Commission’s draft Review of the 2019

Ten-Year Site Plans of Florida’s Electric Utilities shows that the growth rate

for EV adoption is expected to greatly accelerate over the next ten years. TECO

states that for this reason, moving from a 5-year to a 10-year estimation

period will result in a larger revenue credit, removing a substantial barrier

to the development of new high-voltage EV chargers now, and assisting in the

development of the EV market overall. TECO states that it believes that given

the projected acceleration in the EV adoption rate over the next 10 years and

the potential benefit the variance/waiver could provide to improving that

adoption rate, moving to a 10-year estimation period would lower the CIAC

barrier for construction of new high-voltage EV chargers, increase the number

of such chargers in the service territory, and result in faster adoption of

EVs.

Staff’s Analysis

Staff first notes that Rule 25-6.064(7), F.A.C., allows an

investor-owned utility to waive all or a portion of CIAC for customers, but

requires the utility to reduce plant in service as if CIAC had been collected,

unless the Commission determines that there is a quantifiable benefit to the

general body of ratepayers. In response to staff’s letter requesting additional

information, TECO stated that it could not quantify the benefit to customers at

this time. The

company further stated that the purpose of this program was to determine if

those benefits would materialize.

It opined that if no third parties avail themselves of the pilot program, then

there is no harm, but no benefit. If they do, TECO stated that it will try to

determine whether the benefits are sufficient to exceed what little subsidy is

provided. TECO

states that it intends to use the waiver period to monitor the applicability to

new EV fast charger installations, which it believes will assist in future

projections.

Staff believes that TECO has adequately demonstrated that

complying with Rule 25-6.064, F.A.C., would be a substantial hardship within

the meaning of Section 120.542, F.S., for the temporary and limited purpose of

the pilot program. Staff is concerned as to the limited quantifiable

information available. However, as stated above, staff sees the potential

benefit of allowing TECO to explore, for a limited time period, the extent to

which the current CIAC methodology presents a barrier to the installation of

line extensions to serve EV fast chargers.

Reporting Requirements as a Condition on the

Grant of Temporary Rule Waiver/Variance

Section 120.542(1), F.S., allows

agencies to impose conditions on rule waivers/variances, as long as those

conditions are necessary for the purpose of the underlying statute to be

achieved. Because this petition is a pilot program with the intent to eliminate

a barrier to the construction of new EV fast charging stations, and given the

lack of quantifiable information, staff believes certain reporting requirements

are necessary for monitoring the efficacy of the program and levels of cross

subsidy. Therefore, if the petition is granted by the Commission, staff

recommends that the Commission’s approval be conditioned on TECO filing annual

reports during the 5-year rule waiver/variance period, with the first report

due on March 1, 2021. Each annual report should include the following

information for the preceding calendar year:

·

For each EV fast charger line

extension installed during the reporting period, the number of EV fast chargers

served, the total line extension cost, the CIAC collected, the total annual

revenue collected (demand and energy), the line extension usage metrics (demand

and energy), and the balance of any related cross subsidy (total cost less CIAC

collected less total energy/demand revenue collected to date);

·

System-wide Totals (summed for all

years since the time the temporary rule waiver/variance was granted) for each

of the following: EV fast charger line

extensions installed, the number of EV fast chargers served, EV fast charger

line extension costs, CIAC collected, total annual revenue collected (demand

and energy), line extension usage metrics (demand and energy), and the balance

of any related cross subsidy (total cost less CIAC collected less total

energy/demand revenue collected to date); and

·

Projected annual growth for the next

five years in TECO’s service territory of EVs, EV fast chargers, and EV fast

charger line extensions.

As stated above, staff’s

underlying concern with this pilot program, aside from a lack of quantifiable

information, relates to the potential level of cross subsidies that may result

if this waiver is extensively utilized. However, staff believes that with the

limited nature of the program, along with the monitoring and reporting

requirements listed above, the level of the cross subsidies created by this

program should be relatively small compared to TECO’s net income.

Conclusion

Staff recommends that the Commission grant TECO’s petition

for temporary waiver of or variance from Rule 25-6.064(2)(c), F.A.C., subject to

the condition that TECO make the annual reporting requirements set forth above.

In addition, the Commission should approve TECO’s Fourth Revised Tariff Sheet

No. 5.105, which reflects the temporary rule waiver/variance. The effective

date of the revised tariff sheet should be the date of the consummating order.

Before the expiration of the 5-year rule waiver/variance period, TECO should be

required to file a revised tariff sheet reflecting the removal of the temporary

rule waiver/variance, which staff should be given administrative authority to

approve.

Issue 2:

Should this docket be closed?

Recommendation:

If no person whose substantial interests are

affected by the proposed agency action files a protest within 21 days of the

issuance of the order, a consummating order should be issued. TECO’s Fourth

Revised Sheet No. 5.105 should become effective upon issuance of the

consummating order. The docket should remain open for the annual reports. The

docket should be administratively closed when TECO’s revised tariff sheet

reflecting the removal of the temporary rule waiver/variance is administratively

approved by staff after the 5-year waiver/variance period expires. (Cibula)

Staff Analysis:

If no person whose substantial interests are

affected by the proposed agency action files a protest within 21 days of the

issuance of the order, a consummating order should be issued. TECO’s Fourth

Revised Sheet No. 5.105 should become effective upon issuance of the consummating

order. The docket should remain open for the annual reports. The docket should

be administratively closed when TECO’s revised tariff sheet reflecting the

removal of the temporary rule waiver/variance is administratively approved by

staff after the 5-year waiver/variance period expires.

If a protest is filed, TECO’s Fourth Revised Sheet No. 5.105

should not become effective.

25-6.064 Contribution-in-Aid-of-Construction for Installation

of New or Upgraded Facilities.

(1) Application and scope. The purpose

of this rule is to establish a uniform procedure by which investor-owned

electric utilities calculate amounts due as contributions-in-aid-of-construction

(CIAC) from customers who request new facilities or upgraded facilities in

order to receive electric service, except as provided in Rule 25-6.078, F.A.C.

(2)

Contributions-in-aid-of-construction for new or upgraded overhead facilities

(CIACOH) shall be calculated as follows:

|

CIACOH

|

=

|

Total estimated work

order job cost of installing the facilities

|

-

|

Four years expected

incremental base energy

revenue

|

-

|

Four years expected

incremental base demand revenue, if applicable

|

(a) The cost of the service

drop and meter shall be excluded from the total estimated work order job cost

for new overhead facilities.

(b) The net book value and cost of

removal, net of the salvage value, for existing facilities shall be included in

the total estimated work order job cost for upgrades to those existing

facilities.

(c) The expected annual base energy and

demand charge revenues shall be estimated for a period ending not more than 5

years after the new or upgraded facilities are placed in service.

(d) In no instance shall the CIACOH

be less than zero.

(3)

Contributions-in-aid-of-construction for new or upgraded underground facilities

(CIACUG) shall be calculated as follows:

|

CIACUG

|

=

|

CIACOH

|

+

|

Estimated difference

between cost of providing the service underground and overhead

|

(4) Each utility shall apply

the formula in subsections (2) and (3) of this rule uniformly to residential,

commercial and industrial customers requesting new or upgraded facilities at

any voltage level.

(5) The costs applied to the formula in

subsections (2) and (3) shall be based on the requirements of Rule 25-6.0342,

F.A.C., Electric Infrastructure Storm.

(6) All CIAC calculations under this

rule shall be based on estimated work order job costs. In addition, each

utility shall use its best judgment in estimating the total amount of annual

revenues which the new or upgraded facilities are expected to produce.

(a) A customer may request a review of

any CIAC charge within 12 months following the in-service date of the new or

upgraded facilities. Upon request, the utility shall true-up the CIAC to

reflect the actual costs of construction and actual base revenues received at

the time the request is made.

(b) In cases where more customers than

the initial applicant are expected to be served by the new or upgraded

facilities, the utility shall prorate the total CIAC over the number of end-use

customers expected to be served by the new or upgraded facilities within a

period not to exceed 3 years, commencing with the in-service date of the new or

upgraded facilities. The utility may require a payment equal to the full amount

of the CIAC from the initial customer. For the 3-year period following the

in-service date, the utility shall collect from those customers a prorated

share of the original CIAC amount, and credit that to the initial customer who

paid the CIAC. The utility shall file a tariff outlining its policy for the

proration of CIAC.

(7) The utility may elect to waive all

or any portion of the CIAC for customers, even when a CIAC is found to be

applicable. If however, the utility waives a CIAC, the utility shall reduce net

plant in service as though the CIAC had been collected, unless the Commission

determines that there is a quantifiable benefit to the general body of

ratepayers commensurate with the waived CIAC. Each utility shall maintain

records of amounts waived and any subsequent changes that served to offset the

CIAC.

(8) A detailed statement of its standard

facilities extension and upgrade policies shall be filed by each utility as

part of its tariffs. The tariffs shall have uniform application and shall be

nondiscriminatory.

(9) If a utility and applicant are

unable to agree on the CIAC amount, either party may appeal to the Commission

for a review.

Rulemaking

Authority 366.05(1), 350.127(2) FS. Law Implemented 366.03, 366.05(1),

366.06(1) FS. History–New 7-29-69, Amended 7-2-85, Formerly 25-6.64, Amended

2-1-07.