Case Background

From

March 25, 2020, through April 2, 2020, the four investor-owned utilities (IOUs)

in the State of Florida that generate their own electricity filed for

mid-course corrections of their currently-approved fuel costs/factors.[1] These mid-course correction petitions were

filed and are being addressed as part of the Florida Public Service

Commission’s (Commission) annual fuel and purchased power cost recovery (fuel

clause) docket.

Mid-Course Corrections

Mid-course corrections are part of the fuel

clause proceeding, and such corrections are used by the Commission between fuel

clause hearings whenever costs deviate from revenues by a significant margin.

Petitions for mid-course corrections to fuel factors are addressed by Rule 25-6.0424,

Florida Administrative Code (F.A.C.). Under this rule, a utility must notify

the Commission whenever it expects to experience an under-recovery or

over-recovery greater than 10 percent. Pursuant to Rule 25-6.0424, F.A.C., the

mid-course percentage is the estimated end-of-period total net true-up amount

divided by the current period’s total actual and estimated jurisdictional fuel

revenue applicable to period amount.

Mid-course corrections are considered preliminary procedural decisions,

and any over-recoveries or under-recoveries caused by or resulting from the

Commission-approved adjusted fuel factors may be included in the following

year’s fuel factors. In this instance, the proposed revisions to current

fuel cost recovery levels are being driven by a significant decline in the market-based

price for natural gas. Rule 25-6.0424(2), F.A.C., does not require an under-recovery

or over-recovery of 10 percent for the Commission to approve a mid-course

correction.

The monthly natural gas price at the time

2020 projections were filed in September 2019 was $2.56 per Million British

thermal units (MMBtu).

Four months later in January 2020, or in the first month when new rates of the

2020 clause cycle became effective, the monthly spot price was down 21 percent,

falling to $2.02 per MMBtu. The forward prices currently being quoted on The

New York Mercantile Exchange (NYMEX) for all months through the end of the

third-quarter 2020, remain below $2.20 per MMBtu (at Henry Hub) as of April l0,

2020. Staff

notes these quoted spot market prices are lower than the utility-specific

figures discussed later in the recommendation due to the addition of

transportation and other costs to the utility figures.

In

this proceeding,

the Commission is being asked to reduce the expected fuel and capacity costs to

customers. Specific treatment of the projected fuel mid-course correction over-recoveries

further described below varies by utility; however, all are requesting approval

of an accelerated method of flowing the projected over-recoveries of fuel and

capacity charges to their respective customers. The “lump sum” approach of flowing

the projected over-recoveries is meant to aid in counteracting the adverse

economic conditions resulting from the Coronavirus Disease 2019 (COVID-19)

global pandemic. Throughout this recommendation, staff may

refer to the mid-course correction dollars being flowed to customers in a

non-levelized manner as a “bill credit.” However, the proposed approaches

simply effectuate flowing all or a majority of the mid-course correction amounts

in one- or three-month timeframes, rather than the standard approach of spreading

the total amount over all remaining months in a period. In this instance, the

standard approach,

including normal noticing timeframes, would be to flow the total mid-course

correction amount ratably over the June through December time period.

Petitions

For

purposes of this recommendation, the individual petitions are being addressed as

Issues 1 through 4, in chronological order, by date when the Commission

received the utility’s filing.

On

March 25, 2020, Tampa Electric Company (Tampa Electric) filed its Petition

for Mid-Course Correction of its Fuel Cost Recovery Factors and Capacity Cost

Recovery Factors (Tampa Electric Petition). Through its petition, Tampa Electric is

seeking authorization to lower its currently-approved 2020 fuel and capacity

cost recovery factors from June through December 2020, as well as issue line

item bill credits in the months of June, July, and August 2020.

On

April 1, 2020, Florida Power & Light Company (FPL) filed its Mid-Course

Correction Petition (FPL Petition). FPL is seeking authorization to lower its

currently-approved 2020 fuel cost recovery factors for the month of May 2020.

FPL’s current level of actual and projected fuel cost recovery has not breached the 10 percent threshold; thus, the filing

was not prompted by the noticing requirement pursuant to Rule 25-6.0424(2), F.A.C.

However, FPL indicated that its proposed action is primarily intended to

help mitigate the adverse economic impacts of the COVID-19 pandemic.

On

April 2, 2020, Gulf Power Company (Gulf) filed its Mid-Course Correction

Petition (Gulf Petition). Gulf is seeking authorization to issue a

line item bill credit for the month of May 2020.

On

April 2, 2020, Duke Energy Florida, LLC (DEF) filed its Emergency Petition

for a Temporary Mid-Course Correction (DEF Petition). DEF is seeking authorization to lower its

currently-approved fuel cost recovery factors for the month of May 2020. DEF’s

current level of actual and projected fuel cost recovery has not breached the 10

percent threshold; thus, its filing was not prompted by the noticing

requirement pursuant to Rule 25-6.0424(2), F.A.C. As with FPL, DEF indicated in

its filing that the proposed action is in response to the adverse economic

impacts of the COVID-19 pandemic.

Effective Dates and Noticing

Requirement

FPL,

Gulf, and DEF have requested that the revised tariffs become effective to

essentially produce a one-time bill reduction in the month of May 2020. This

matter is scheduled to be voted on at the April 28, 2020 Special Agenda

Conference. Typically, effective dates are set a minimum of 30 days after a

vote modifying charges. This time limit is imposed in order to avoid having new

rates applied to energy consumed before the effective date of the Commission’s

action, i.e., the date of the vote. However, the Commission has also

implemented charges as a result of mid-course corrections in less than 30 days

when circumstances warrant. Further, the Florida Supreme Court has

recognized that the fuel clause proceeding “is a continuous proceeding and

operates to a utility’s benefit by eliminating regulatory lag.” In this instance, there can be no

prejudice to the customers because their total rate would be decreasing, not

increasing. Therefore, customers would receive the benefit of reduced fuel rates

as quickly as administratively possible.

The

Commission has jurisdiction in this matter pursuant to Sections 366.04, 366.05,

and 366.06, Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission

approve Tampa Electric’s petition to reduce its currently-approved 2020 fuel

and capacity cost recovery factors for purposes of flowing to customers a

projected over-recovery of fuel and capacity charges during the period of June

through December 2020, and issue fuel-related bill credits in June, July, and

August 2020?

Recommendation:

Yes. Staff recommends the

Commission approve Tampa Electric’s petition to reduce its currently-approved

2020 fuel and capacity cost recovery factors for purposes of flowing to

customers a projected over-recovery of fuel and capacity charges during the

period of June through December 2020, and issue fuel-related bill credits

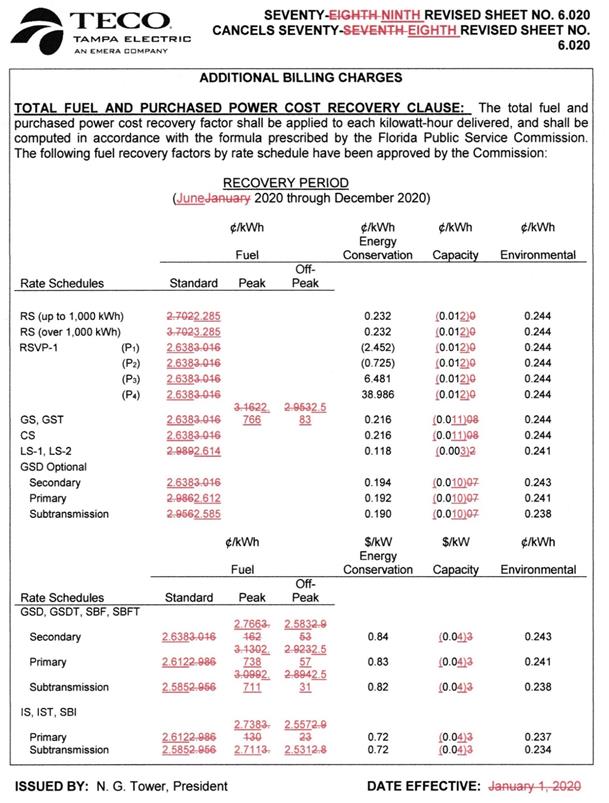

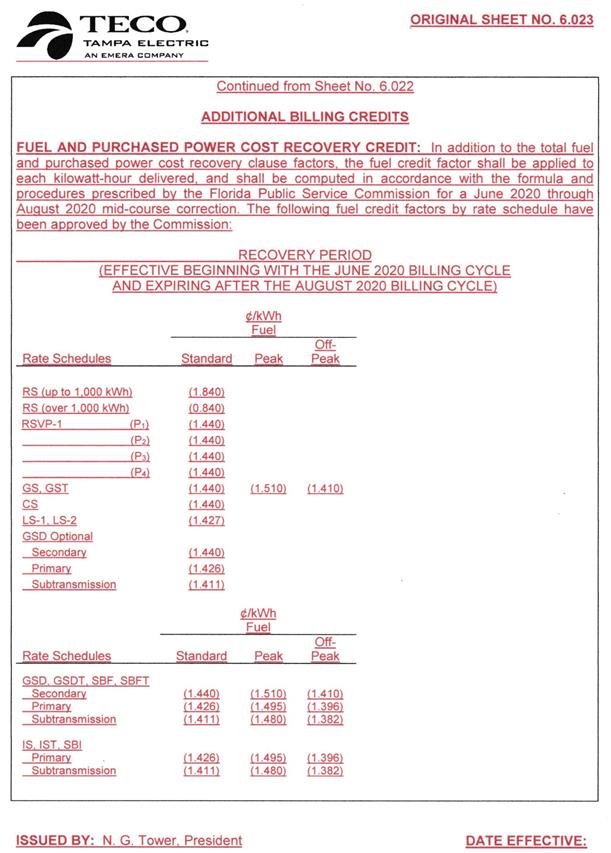

during June, July, and August 2020. The tariffs as shown on Attachment A should

be approved effective June 1, 2020. Staff should be given administrative

authority to approve the First Revised Tariff Sheet No. 6.023, effective

September 2020. (Higgins, Draper)

Staff Analysis:

On an annual basis, Tampa

Electric and other electric IOUs in Florida participate in a technical hearing

in this docket for the purposes of evaluating actual and projected fuel,

purchased power, and capacity-related costs of service. The most-recent hearing

took place on November 5, 2019. The Fuel Order issued from the 2019 hearing set

forth the fuel, purchased power, and capacity cost recovery factors that were implemented

by all IOUs in Florida effective with the first billing cycle of January 2020.

Tampa Electric’s petition includes both fuel and capacity mid-course correction

requests.

Tampa Electric has proposed to flow the total mid-course correction

amount through the combination of a fuel credit for the months June through

August 2020 (as shown in Attachment A, Tariff Sheet No. 6.023) and a reduction

to the currently-approved fuel and capacity factors for the period June through

December 2020 (as shown in Attachment A, Tariff Sheet No. 6.020). The fuel

credit will be shown as a separate line item on the bill. For a residential

customer using 1,000 kWh per

month, the proposed 3-month fuel credit is $18.40. The residential fuel rate

reduction associated with the remainder of the mid-course correction is $4.17

per 1,000 kWh (7 months, June through December). As proposed, the mid-course

correction amount related to capacity will be distributed normally over the

remaining 7-month period for a residential rate reduction of $0.22 per 1,000

kWh.

Mid-Course Correction - Fuel

With respect to the components of the mid-course correction calculation,

which in this case returns the total dollar amount used to calculate the

proposed rate reductions, Tampa Electric combined its final 2019 fuel over-recovery

of $35,821,098, with its 2020 actual and estimated fuel over-recovery of $94,867,488,

resulting in an estimated total over-recovery of $130,688,586. This is the

total amount requested be returned to customers in 2020. The fuel

mid-course correction position following the calculation methodology in Rule

25-6.0424(1)(a), F.A.C., is 22.3 percent.

The projected 2020 over-recovery of fuel charges is specifically

associated with a decline in actual and re-projected fuel costs. Tampa

Electric’s original estimation of natural gas costs for 2020 were formulated

based on May 2019 futures data. At that time, Tampa Electric projected the

average delivered cost of natural gas to be $3.68 per MMBtu. Tampa Electric now

projects, based on March 2020 data, the average 2020 cost of natural gas will

be $3.16 per MMBtu (reduction of 14 percent).

Mid-Course Correction - Capacity

As part of its request, Tampa Electric is proposing to reduce its 2020

capacity cost recovery factors by a projected 2020 over-recovery of $2,885,599.

Tampa Electric’s capacity mid-course correction position following the

calculation methodology in Rule 25-6.0424(1)(a), F.A.C., is 182 percent. Tampa

Electric stated the projected over-recovery was caused by the inclusion of two

Solar Base Rate Adjustment (SoBRA) true ups and additional firm power purchase

agreements (netted against the SoBRA true ups) in its revised capacity cost

estimate for 2020.

Tampa Electric, unlike with its fuel reduction, did not incorporate a

final 2019 capacity over-recovery of $111,228 in the mid-course adjustment as

it believes the amount is “de minimus” to the overall request. Tampa

Electric claimed it will return the $111,228 to customers in 2021, or through

the normal course of action during this fuel clause cycle. As proposed, the

mid-course correction related to capacity will be distributed over the June

through December time period. Staff agrees with this assessment concerning the

relative size of the 2019 capacity over-recovery as compared to the total

mid-course adjustment and believes Tampa Electric’s proposed treatment is

reasonable.

Bill Impacts

Table 1-1 below displays the bill

impact to a residential customer using 1,000 kilowatt-hours (kWh) of

electricity a month and further discusses the effects of Tampa Electric’s

request.

Tampa Electric’s current total

residential charge for 1,000 kWh of usage is $102.19. Effective with the June

2020 billing cycle and continuing through August, the proposed charge will be

$78.82, or a decrease of $23.37 (22.9 percent). The proposed June through

August line item bill credit is $18.40. Effective with the September 2020

billing cycle and continuing through December, the bill will be $97.69. The

June through December portion (i.e., amount not included in the monthly

credits) of the fuel mid-course correction reflects a reduction of $4.17 per

1,000 kWh. Concerning the non-residential classes, commercial, and industrial

customers can expect a reduction of 14 to 20 percent, depending on usage. Tampa

Electric stated that it will provide customers notice of the changes with its

June bills and on its website. The Company also filed the tariff (First Revised

6.023) for after the credit concludes post-August 2020. Staff requests

administrative authority to approve the First Revised Tariff Sheet No. 6.023,

effective September 2020. Further, Tampa Electric indicated in paragraph 20 of

its petition that it consulted with the Office of Public Counsel (OPC) about

its primary proposal (factors shown on Attachment A) and that the OPC is in

support of the proposal.

Alternative Treatment

If the Commission is not inclined to authorize the issuance of bill

credits for the months of June, July, and August 2020, Tampa Electric

has filed information detailing the return of the 2020 mid-course correction

amount through the normal levelized rate approach over the June through

December 2020 period. The associated tariff is not attached to this

recommendation, but has been filed and can readily be administered if the

Commission so desires.

Conclusion

Staff recommends the Commission approve Tampa Electric’s petition to reduce

its currently-approved 2020 fuel and capacity cost recovery factors for purposes

of flowing to customers a projected over-recovery of fuel and capacity charges

during the period of June through December 2020, and issue fuel-related bill

credits in the months of June, July, and August 2020. The tariffs as

shown on Attachment A should be approved effective June 1, 2020. Staff should

be given administrative authority to approve the First Revised Tariff Sheet No.

6.023, effective September 2020.

Issue

2: Should the Commission approve FPL’s

petition to reduce, for one month, its currently-approved 2020 fuel cost

recovery factors for purposes of flowing to customers a projected over-recovery

of 2020 fuel charges in the month of May 2020?

Recommendation:

Yes.

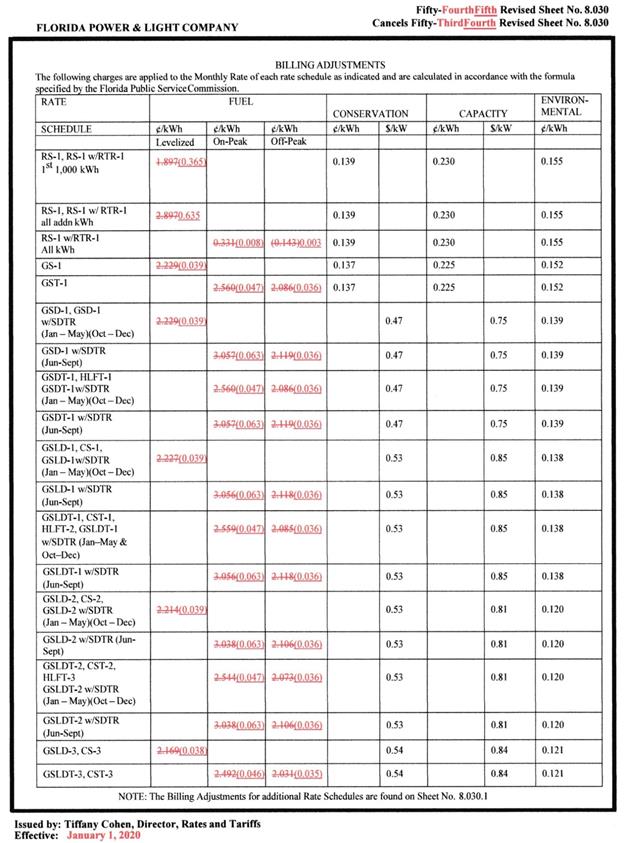

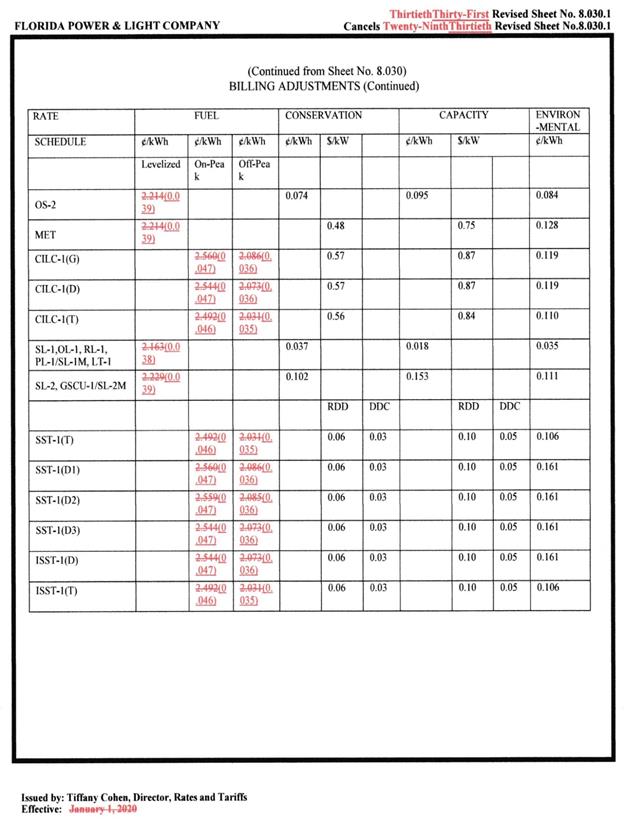

Staff recommends the Commission approve FPL’s petition to reduce, for one

month, its currently-approved 2020 fuel cost recovery factors for purposes of flowing

to customers a projected over-recovery of 2020 fuel charges in the month of May

2020. The tariffs as shown on Attachment B should be approved effective May 1,

2020. Staff should be given administrative authority to approve tariffs

effective June 1, 2020, as these reflect the fuel factors approved in Order No.

PSC-2019-0484-FOF-EI. (Higgins, Draper)

Staff Analysis:

Mid-Course Correction

FPL has proposed to address a

projected 2020 fuel over-recovery of $206,083,515 by reducing its fuel factors

in the month of May 2020. The projected 2020 over-recovery of fuel charges is specifically

associated with a decline in projected fuel costs. However, as mentioned in the

Case Background section of this recommendation, FPL’s fuel mid-course

correction position following the calculation methodology in Rule 25-6.0424(1)(a),

F.A.C., is 6.3 percent, which is under the 10 percent threshold prompting a noticing

requirement pursuant to the same rule. FPL’s original projection of natural gas

costs for 2020 was formulated near the end of July 2019. At that time, FPL

projected the average delivered cost of natural gas to be $4.06 per MMBtu. FPL

now projects, based on March 2020 data, the average 2020 cost of natural gas

will be $3.53 per MMBtu (reduction of 13 percent).

As noted, FPL’s re-projection of

2020 fuel costs returns an estimated over-recovery of $206.1 million.

Typically, at this point in a fuel clause cycle a utility would incorporate any

over- or under-recovery from the prior period (prior calendar year) into its

mid-course correction request. However, FPL has proposed to address its final

prior period true up amount, which is a net under-recovery of $51.6 million, as

part of its 2021 fuel cost recovery request. In support of the requested

treatment, FPL contends that by excluding the 2019 true up amount, it is

maximizing the effect of the May 2020 rate reduction. FPL’s requested approach

is, in principle, similar to Tampa Electric’s proposal relating to its 2019

capacity cost over-recovery discussed in Issue 1 (i.e. not incorporating a

prior period true up amount). Further, FPL cited Order No. PSC-2019-0109-PCO-EI

as precedent wherein the Commission authorized an electric utility to implement

a mid-course correction that excluded the prior year’s under-recovery amount.

As part of the mid-course

correction filing, FPL updated its projections for purchased power, qualifying

facilities, and economy purchases due to the updated fuel pricing and input assumptions.

Regarding capacity cost recovery, FPL did not propose any changes to its

currently-approved factors.

Bill Impacts

Table 2-1 below displays the bill

impact to a residential customer using 1,000 kWh of electricity a month and further

discusses the effects of FPL’s request.

FPL’s current total residential

charge for 1,000 kWh of usage for January through April 2020 is $96.04.

Effective May 2020, the Commission approved by Order No. PSC-2019-0484-FOF-EI

FPL’s 2020 SoBRA which would have increased the 1,000 kWh bill to $96.43.

Applying the proposed one-time fuel credit decreases the $96.43 bill to $73.36,

or a reduction of $23.07 in May (23.9 percent).

FPL requested that it be allowed

to return to the fuel adjustment factors approved by Order No.

PSC-2019-0484-FOF-EI following the one-time May reduction. Thus, if approved by

the Commission, effective with the June 2020 billing cycle, the residential

charge for 1,000 kWh will return to $96.43. Concerning non-residential

customers, FPL reports that typical bill reductions will range from

approximately 24 to 30 percent for commercial customers, and approximately 53

percent for industrial customers.

FPL’s proposed tariff is shown on

Attachment B to this recommendation. FPL stated that it has provided notice of

its request for a mid-course correction with its April customer bills, subject

to Commission approval.

Conclusion

Staff recommends the Commission approve FPL’s petition to reduce, for one

month, its currently-approved 2020 fuel cost recovery factors for purposes of flowing

to customers a projected over-recovery of fuel charges during the month of May

2020. The tariffs as shown on Attachment B should be approved effective

May 1, 2020. Staff should be given administrative authority to approve tariffs

effective June 1, 2020, as these reflect the fuel factors approved in Order No.

PSC-2019-0484-FOF-EI.

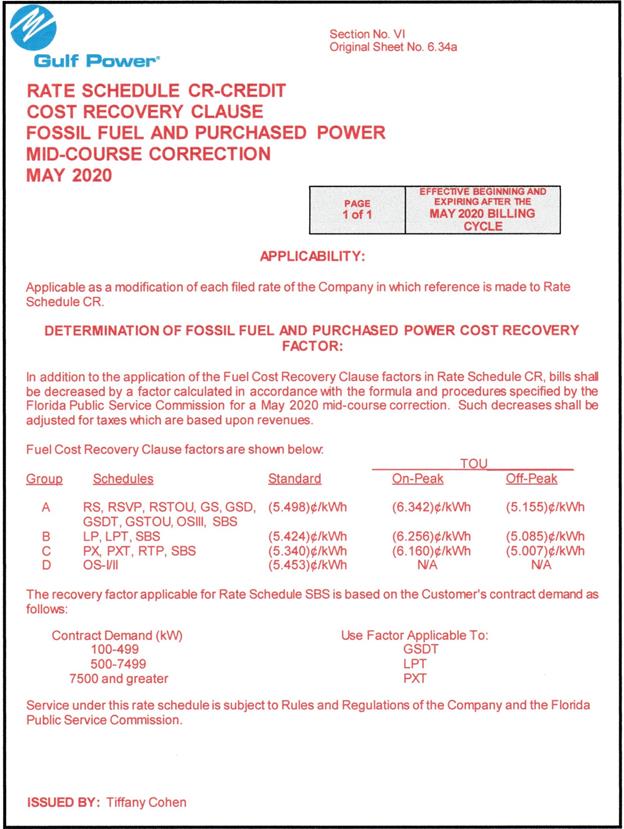

Issue 3:

Should the Commission

approve Gulf's petition to provide customers a fuel-related bill credit during

the month of May 2020?

Recommendation:

Yes. Staff recommends the

Commission approve Gulf's petition to provide customers a fuel-related bill

credit during the month of May 2020 for purposes of flowing to customers a

projected over-recovery of fuel costs. The tariff showing the fuel credit as

shown in Attachment C should be approved effective May 1, 2020. Staff should be

given administrative authority to approve the First Revised Tariff Sheet No.

6.34a effective June 1, 2020. (Higgins, Draper)

Staff Analysis:

Gulf participated in the

Commission’s most-recent fuel hearing which took place on November 5, 2019. The

Fuel Order issued from the 2019 hearing set forth Gulf’s fuel, purchased power,

and capacity-related cost recovery factors effective with the first billing

cycle of 2020.

Mid-Course Correction

With respect to the components of the mid-course correction calculation,

which returns the total dollar amount used to calculate the proposed reduction,

Gulf combined its final 2019 over-recovery

of $8,868,596 with its estimated

2020 over-recovery of $42,404,427,

resulting in a total estimated 2020 over-recovery of $51,273,023, or the total

mid-course correction amount proposed to be flowed to customers. Gulf’s fuel mid-course

correction position following the calculation methodology in Rule 25-6.0424,

F.A.C., is 14.7 percent.

The projected 2020 over-recovery of fuel

charges is specifically associated with a decline in projected fuel costs. Gulf’s

original projection of 2020 natural gas costs was formulated near the end of

July 2019. At that time, Gulf projected the average cost of natural gas to be

$3.39 per MMBtu. Gulf now projects, based on March 2020 data, the average 2020

cost of natural gas will be $2.57 per MMBtu (reduction of 24.2 percent).

Gulf proposed to flow its projected 2020 over-recovery of $51.3 million

to customers through a bill credit in the month of May 2020. As part of

the mid-course correction filing, Gulf updated its projections for purchased

power and economy purchases due to the updated fuel pricing and input

assumptions. Regarding capacity cost recovery, Gulf did not propose any changes

to its currently-approved factors.

Bill Impacts

Table 3-1 below displays the bill

impact to a residential customer using 1,000 kWh of electricity a month and further

discusses the effects of Gulf’s request.

Gulf’s current total residential

charge for 1,000 kWh of usage is $140.43. By applying the proposed one-month

fuel credit, the total bill lowers to $84.04, or a reduction of $56.39 (40.2

percent) for the month of May 2020. The proposed fuel credit is shown in

Attachment C, Original Sheet No. 6.34a, which is effective for the May 2020

billing cycle. Gulf also filed its First Revised Tariff Sheet No. 6.34a for

after the credit concludes post May 2020. Staff requests administrative

authority to approved the First Revised Tariff Sheet No. 6.34a effective June

2020. Concerning non-residential customers, Gulf reports that typical bill

reductions will range from approximately 40 to 54 percent for small commercial

customers, approximately 53 percent for medium commercial customers, and

approximately 56 percent for large commercial customers.

Gulf’s proposed tariff is shown on Attachment C to this recommendation. Gulf

stated that it has provided notice of this request for a mid-course correction

with its April customer bills, subject to Commission approval.

Conclusion

Staff recommends the

Commission approve Gulf's petition to provide customers a fuel-related bill

credit during the month of May 2020 for purposes of flowing to customers a

projected over-recovery of fuel costs. The tariff showing the fuel credit as

shown in Attachment C should be approved effective May 1, 2020. Staff should be

given administrative authority to approve the First Revised Tariff Sheet No.

6.34a effective June 1, 2020.

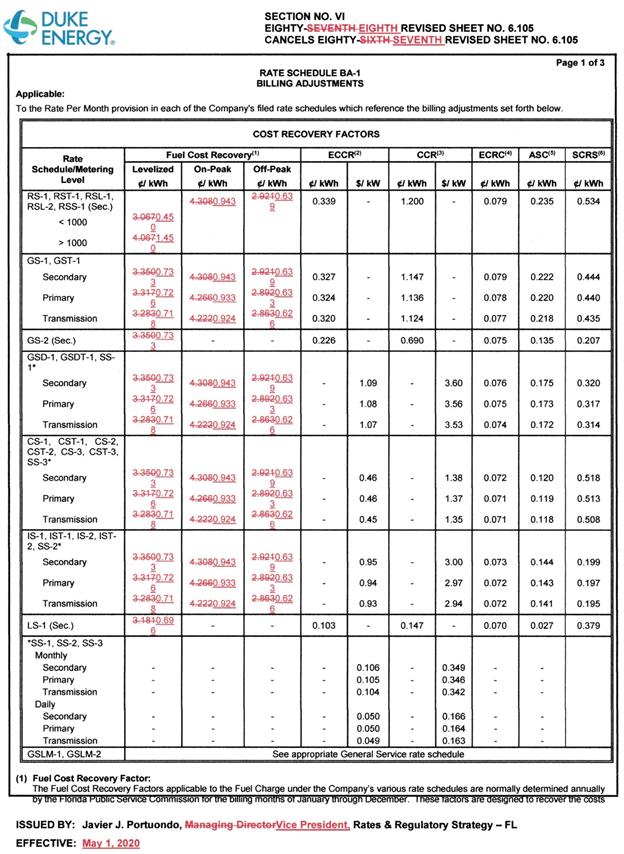

Issue 4:

Should the Commission

approve DEF’s petition to reduce, for one month, its currently-approved 2020 fuel

cost recovery factors for purposes of flowing to customers a projected

over-recovery of fuel charges in the month May 2020?

Recommendation:

Yes. Staff recommends the

Commission approve DEF’s petition to reduce, for one month, its

currently-approved 2020 fuel cost recovery factors for purposes of flowing to

customers a projected over-recovery of fuel charges during the month May 2020. The

tariffs as shown on Attachment D should be approved effective May 1, 2020.

Staff should be given administrative authority to approve tariffs effective

June 1, 2020, as these reflect the fuel factors approved in Order No.

PSC-2019-0484-FOF-EI. (Higgins, Draper)

Staff Analysis:

DEF participated in the

Commission’s most-recent fuel hearing which took place on November 5, 2019. The

Fuel Order issued from the 2019 hearing set forth DEF’s initial 2020 fuel,

purchased power, and capacity-related cost recovery factors effective with the

first billing cycle of 2020. DEF

implemented a previously-approved rate change effective April 2020.

The April rate adjustment is associated with the DeBary solar project going

into service. Although the April 2020 rates differ from the March rates shown

on Schedule E-10 of the DEF Petition, staff discusses its rate recommendation

from the April 2020 levels.

Mid-Course Correction

With respect to the components of the mid-course correction calculation,

which in this case returns the total dollar amount used to calculate the

proposed rate reductions, DEF

combined its total 2019 fuel under-recovery of $21,535,230, with its estimated 2020 fuel over-recovery

of $99,767,015, resulting in a

net mid-course correction amount of $78,231,785. This is total amount proposed

to be flowed to customers. DEF’s fuel mid-course correction position following

the calculation methodology in Rule 25-6.0424(1)(a) F.A.C., is 6.1 percent, which is under the 10

percent threshold prompting a noticing requirement pursuant

to the same rule.

The projected 2020 over-recovery of fuel charges is specifically

associated with a decline in projected fuel costs. DEF’s original projection of

its 2020 natural gas cost was formulated in June 2019. At that time, DEF

projected the average cost of natural gas to be $4.06 per MMBtu. DEF now

projects the average 2020 cost of natural gas will be $3.68 per MMBtu (or reduction

of 9.4 percent).

DEF has proposed to address its 2020 mid-course amount of approximately $78.2

million through reduced fuel cost recovery factors for the month of May 2020. DEF

stated it did not revise any of its planned power purchases but “will continue

to utilize power purchases when needed to economically and reliably support the

needs of the system.”

Further, DEF did not propose any changes to its currently-approved Capacity

Cost Recovery factors.

Bill Impacts

Table 4-1 below displays the rate

impact to a residential customer using 1,000 kWh of electricity a month and

further discusses the effects of DEF’s request.

DEF’s current total residential

charge for 1,000 kWh of usage is $129.74. By applying the proposed one-month

fuel rate decrease, the total charge lowers to $102.90, or a reduction of

$26.84 (20.7 percent) for the month of May 2020. DEF requested that it be

allowed to return to the rates approved by Order No. PSC-2019-0484-FOF-EI

following the one-time May reduction (from June through December 2020). Concerning

non-residential customers, DEF reports that typical bill reductions will range

from approximately 20 to 32 percent for commercial customers, and approximately

25 to 45 percent for industrial customers. DEF’s

proposed tariff is shown on Attachment D to this recommendation. DEF stated

that it will provide notice of the changes with the May billing statement and

on its website.

Conclusion

Staff recommends the Commission

approve DEF’s petition to reduce, for one month, its currently-approved 2020

fuel cost recovery factors for purposes of flowing to customers a projected

over-recovery of fuel charges in the month of May 2020. The tariffs as shown on

Attachment D should be approved effective May 1, 2020. Staff should be given

administrative authority to approve tariffs effective June 1, 2020, as these

reflect the fuel factors approved in Order No. PSC-2019-0484-FOF-EI.

Issue 5:

Should this docket be closed?

Recommendation:

No. The 20200001-EI docket is an on-going proceeding

and should remain open. (Brownless)

Staff Analysis:

The 20200001-EI (fuel clause) docket is an on-going proceeding

and should remain open.