Case Background

On March 16,

2020, Peoples Gas System (Peoples or utility) filed a petition for approval of

a Liquified Natural Gas (LNG) Service tariff. LNG is natural gas that has been

cooled to negative 260 degrees Fahrenheit, which causes the gas to condense

into a liquid. Once in liquid form, the natural gas is 1/600th of its original

volume, allowing for increased storage potential. LNG is currently used in

Florida as a transportation fuel for maritime, rail, and other transportation

applications. The proposed LNG tariff is contained in Attachment A of the

recommendation.

Peoples waived

the 60-day file and suspend provision pursuant to Section 366.06(3), Florida

Statutes (F.S.), in an email dated April 9, 2020. Staff issued two data requests in this

docket. Staff issued its first data

request to Peoples on April 2, 2020, to which the utility responded on April

17, 2020. Staff issued its second data request on July 31, 2020, to which the

utility responded on August 7, 2020. The Commission acknowledged the

intervention of the Office of the Public Counsel (OPC) in this docket by Order

No. PSC-2020-0181-PCO-GU, issued June 10, 2020. OPC served interrogatories and

requests for production on Peoples on June 5, 2010, which Peoples responded to

on July 6, 2020.

On May 22, 2020,

a noticed informal telephonic meeting was held with Commission staff, Peoples,

OPC, and other interested persons. At the meeting, Peoples provided a

presentation that has been placed in the docket file. On July 31, 2020, Eagle LNG Partners

(Eagle LNG), an interested person in the docket, submitted a letter to the Commission stating its opposition to the

proposal. On August 13, 2020, Peoples submitted to

the Commission a letter in response to Eagle LNG’s letter of opposition. Copies of both letters have been filed as

correspondence in this docket. On August 17,

2020, a second noticed informal telephonic meeting was held with Commission

staff, Peoples, OPC, Eagle LNG, and other interested persons.

Commission Jurisdiction

Section 366.02(1), F.S., in part, defines a "public

utility" as an entity that supplies gas (natural, manufactured, or similar

gaseous substance) to the public within Florida. Section 366.02(1), F.S.,

also excludes from the definition of “public utility” municipal utilities,

rural cooperatives, and:

persons supplying

liquefied petroleum gas, in either liquid or gaseous form, irrespective of the

method of distribution or delivery, or owning or operating facilities beyond

the outlet of a meter through which natural gas is supplied for compression and

delivery into motor vehicle fuel tanks or other transportation containers, unless such person also supplies electricity

or manufactured or natural gas. [Emphasis added]

Therefore, staff believes that Peoples’ proposed LNG

service would fall under the activities of a public utility, as contemplated

under Section 366.02(1), F.S., and the Commission may exercise jurisdiction

over Peoples’ rates and service in this area, pursuant to Section 366.04, F.S.

Based on this interpretation, the Commission would also have jurisdiction over

this matter pursuant to Sections 366.03, 366.05, and 366.06, F.S.

Discussion

of Issues

Issue 1:

Should the Commission approve Peoples’ proposed LNG

tariff?

Recommendation:

Yes. Staff recommends that the Commission should

approve Peoples’ proposed LNG tariff, as shown in Attachment A, effective with

the issuance of the final Order in this docket. The LNG tariff would provide

Peoples with an opportunity to provide LNG services to interested customers. A

participating customer would enter into a contract with Peoples and all capital

and operating costs associated with the LNG facility should be borne by the

customer. (Ward, Coston)

Staff Analysis:

In its petition, Peoples stated that major maritime

and cruise companies, along with several of Florida’s largest ports, have

expressed interest in the utility providing an LNG fuel option through the

development of LNG infrastructure. The utility highlighted that the

International Maritime Organization, the specialized United Nations agency that

sets global standards for the safety, security and environmental performance of

international shipping, has required the marine sector to reduce sulphur

emissions from ships by 80 percent beginning January 1, 2020. As a result, many

maritime companies are considering natural gas as a fuel for cruise ships,

container vessels, and bulk carriers.

In addition to the maritime industry, the utility also

stated that other industries have expressed an interest in using LNG for

transportation fuel. Examples provided in the petition include refuse companies

using natural gas for transportation fleets and railroads using natural gas to

power locomotives. Peoples stated that a significant challenge to using LNG as

a transportation fuel is the lack of storage and bunkering facilities in

Florida. The proposed tariff would allow Peoples the opportunity to work with

these industries to create the supply infrastructure needed to meet the growing

demand for LNG. Florida currently has three LNG plants (two in Jacksonville,

one in Miami) that are owned and operated by unregulated LNG providers.

Potential

Benefits of LNG

Peoples stated that the benefit of natural gas in its

liquid state is that it is approximately 600 times less voluminous than gas in

its traditional gaseous state. Converting natural gas into a liquid state makes

it possible to transport natural gas to places that pipelines may not currently

serve, thus potentially expanding the use of natural gas as a transportation

fuel. Additionally, on-site LNG could serve as an immediate solution for

customers who are unable to wait for pipeline infrastructure installation. The

utility stated that LNG facilities could also provide greater resiliency for

participating customers by avoiding disruptions caused by weather or supply

interruptions. Currently, Florida does not have any large-scale storage

facilities and relies on natural gas to be transported through interstate and

intrastate pipeline systems.

The provision of LNG in Florida is a competitive market and

other operators in this market are not subject to the Commission’s

jurisdiction. Peoples seeks to include LNG service under its regulated tariff,

rather than through an unregulated subsidiary, because Peoples believes that

doing so creates operating efficiencies in terms of customer points of contact,

operations and management expense, and

economies of scale.

Peoples explains that a prospective LNG customer would

typically issue a Request for Proposals for the construction and maintenance of

LNG facilities and Peoples could potentially compete with other unregulated LNG

providers for the provision of such LNG service. Peoples’ petition is the first

request by a Florida investor-owned natural gas company for an LNG tariff.

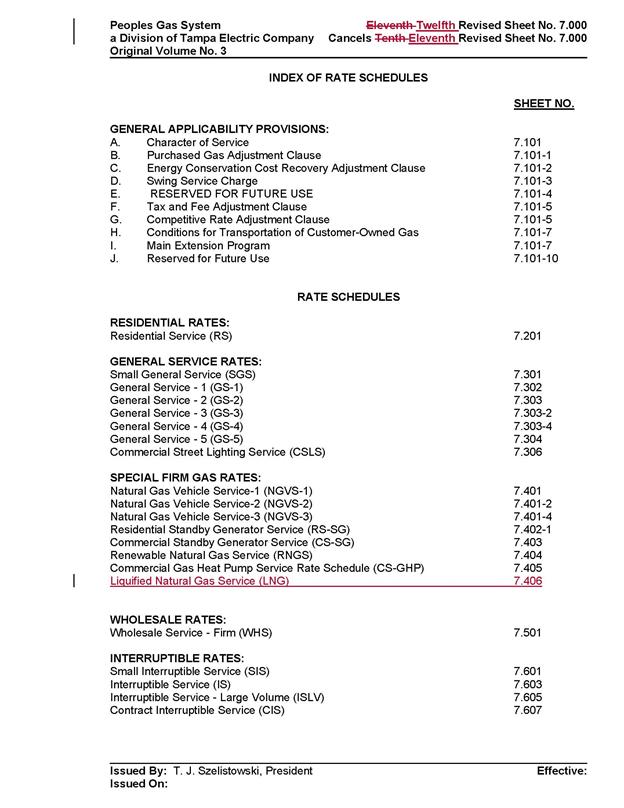

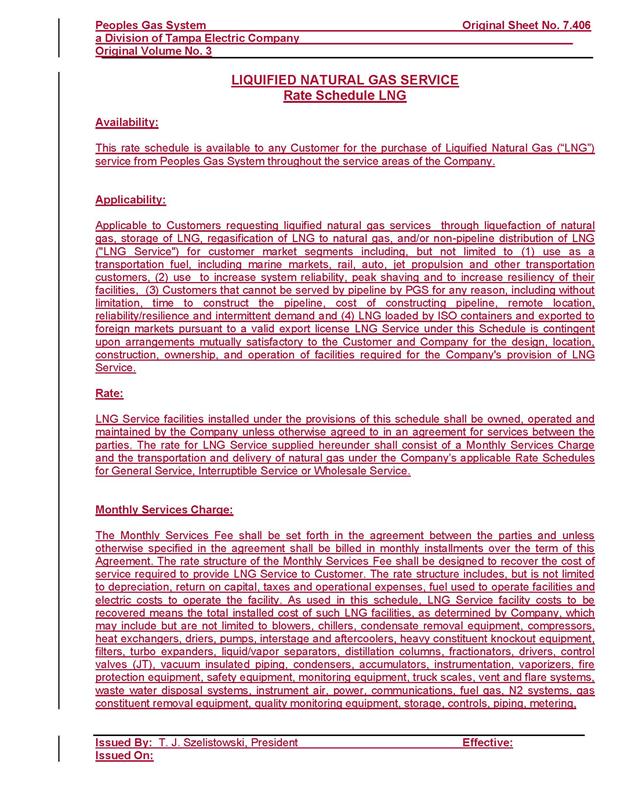

Proposed

Liquified Natural Gas Tariff

Under Peoples’ proposed tariff, a participating customer

would receive distribution service from the utility and pay Peoples’ otherwise

applicable rates, clauses and riders, and taxes based on the volume of the

natural gas delivered to the LNG facility. Additionally, customers would pay a

monthly LNG services charge specific to that customer, which would be

calculated based on Peoples’ gross investment in the storage and/or

liquefaction facilities that serve the customer, as established in the LNG

tariff. These facilities would be installed and maintained by Peoples and could

be installed on either utility-owned property or the customer’s premises.

Peoples stated that “each LNG facility built by Peoples pursuant to the tariff

will be unique to the particular customer(s) and industries served by such

facility.” Peoples expects that the requested LNG facilities will be in one of

the following categories: (1) LNG liquefaction, storage, regasification and

truck loading facilities; (2) LNG storage facilities; or (3) LNG mobile storage

and regasification facilities.

As outlined in the proposed tariff, Peoples would enter

into an agreement with the customer to construct the LNG facility and provide

the liquified natural gas. The agreement would include the required monthly

services charge, which is designed for all costs to be fully paid by the

customer over the life of the agreement.

The utility asserted that the monthly services charge

would be designed to recover the cost of service to provide LNG service to a customer.

The cost of service would include, but not be limited to, depreciation expense,

return on capital, property taxes, insurance, operational expenses, and the

fuel and electricity used to operate the LNG facilities. The costs of an LNG

facility would include all of the necessary components and equipment needed to

build the specific LNG facility for a customer’s end use. Peoples stated that

each facility would be designed for the specific needs and anticipated demand

of each customer and the final costs would reflect that specific unit. Proposed

tariff sheet No. 7.406 provides a listing of specific equipment that could be

necessary for the construction of an LNG facility.

Peoples stated in its response to staff’s first data

request that the potential costs to construct an LNG facility under this tariff

could range from $25 million to over $100 million.

The utility stated that it would evaluate each potential customer’s credit

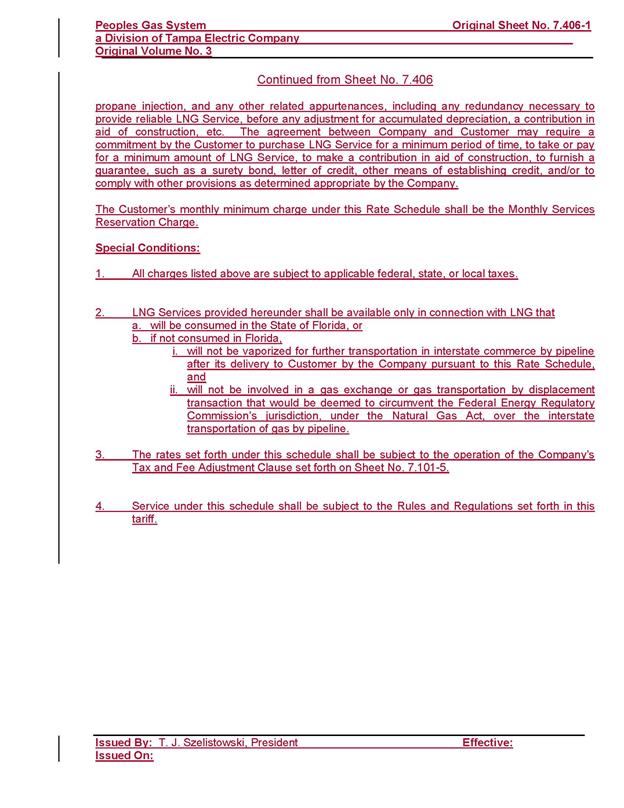

worthiness prior to initiating an agreement under the tariff. Specifically, proposed tariff sheet No. 7.406-1 states that:

The agreement between Company and Customer may require

a commitment by the Customer to purchase LNG Service for a minimum period of

time, to take or pay for a minimum amount of LNG Service, to make a contribution

in aid of construction, to furnish a guarantee, such as a surety bond, letter

of credit, other means of establishing credit, and/or to comply with other

provisions as determined appropriate by the Company.

In addition, Peoples stated that the contract agreements

under the proposed LNG tariff would be required to comply with the utility’s

Corporate Governance policy. This policy requires that contracts of a certain

amount be reviewed and authorized by differing levels of senior management prior

to execution. For the contract to be authorized by Peoples’ governance body,

the customer must have demonstrated that it meets or exceeds a level of credit

worthiness. Peoples stated that this step would help ensure that a customer

taking service under this tariff should have the long-term financial stability

to meet its obligations under the LNG service agreement. Peoples does not

intend to bring individual LNG contracts before the Commission for approval.

Comments

filed by Eagle LNG and Peoples’ Response

On July 31, 2020, Eagle LNG

submitted a letter to the Commission requesting that the Commission deny

Peoples’ proposed LNG tariff. Eagle LNG asserts four reasons as to why the

Commission should deny the proposed tariff. First, Eagle LNG states that the LNG

market is competitive and Commission regulation is only required when there is

a natural monopoly. Second, approval of the tariff would put the general body

of ratepayers at risk if the LNG customer can not fulfill its obligation under

the contract and ratepayer risk is not justified in a competitive market.

Third, Eagle LNG believes that Peoples should offer LNG services through a

separate, non-regulated, company (i.e., a subsidiary of the corporate parent

Emera). Finally, Eagle LNG believes that approval of the proposed LNG tariff

sends the wrong signal to the competitive LNG market in Florida and puts Eagle

LNG at a competitive disadvantage.

On August 13, 2020, Peoples submitted a letter to the

Commission in response. First, Peoples asserts that the proposed tariff does

not require Commission oversight of the LNG market; rather the LNG tariff is a

natural extension of Peoples’ natural gas business. Second, Peoples states that

the LNG tariff would not put ratepayers at risk as Peoples will not be building

speculative facilities, rather the utility will be building specific facilities

to meet a requesting customer’s needs.

Peoples further states it will be contracting with well-capitalized

customers and it is thus extremely unlikely that an LNG customer would default

or declare bankruptcy. Third, Peoples states the proposed LNG tariff will not

cause cross subsidization or regulatory inefficiency. Creating a separate

company for LNG services would create greater inefficiencies and adding

additional customers benefits the general body of ratepayers. Finally, Peoples

asserts that the proposed LNG tariff would provide another LNG option to

potential customers, increasing competition.

Similar

Tariff Concepts

Peoples

believes that the Commission has previously approved tariffs for Peoples that

are similar in concept. The Commission first approved Peoples’ Natural Gas

Vehicle Service (NGVS) tariffs in 1992 and

more recently modified the NGVS tariff in 2017. The

NGVS tariffs provide options for Peoples to install and maintain private or

public fueling stations for compressed natural gas customers while allowing

Peoples to recover its cost of providing these services. The monthly services

charge calculation methodology under this tariff is 1.6 times the utility’s

gross investment in the facilities. Similar to the LNG market, the provision of

fueling stations for compressed natural gas customers is a competitive market.

In 2017,

the Commission approved a tariff to accommodate the receipt of renewable

natural gas (RNG) on Peoples’ distribution system. The

RNG tariff allows Peoples to recover from biogas producers the cost of

upgrading the biogas and does not contain standard charges, as the services

provided varies based on the steps needed to upgrade the biogas to RNG. The

monthly services charge is equal to a mutually agreed upon percentage (between

Peoples and the biogas producer) multiplied by Peoples’ gross investment in the

facilities necessary to provide biogas upgrading services.

Impact

on General Body of Ratepayers

Peoples

asserted that all costs associated with building and operating an LNG facility

under this tariff would be borne by the end-use customers and would have no

impact on the general body of ratepayers. The utility stated in response to

staff’s second data request that the assets, revenue, and expenses associated

with this tariff would be included as part of its rate base surveillance

reports; however, the utility stated that the LNG monthly services charge

received from the LNG customer would offset the revenue requirements for these

facilities.

In

response to OPC’s interrogatory No. 4, the utility stated that in the unlikely

event that unforeseen “risks impact an LNG investment based on the proposed

tariff any application of cost to the general body of rate payers would have to

be sought through a general base rate increase proceeding and approved by the

Public Service Commission.”

Based on this response, and discussions during the informal meetings, Peoples

could consider seeking cost recovery for any remaining costs of an LNG facility

from its general body of ratepayers should a customer default on an LNG

contract. Peoples believes that the likelihood of such an event to be very

remote. Additionally, if Peoples were to

seek cost recovery from the general body of ratepayers for an LNG facility, the

Commission would evaluate the prudency of Peoples’ decision to enter into the

contract and any impacts, including costs and benefits, to the general body of

ratepayers.

An additional impact on the general body of ratepayers under this tariff

could be potential technical and administrative personnel costs associated with

implementing the tariff. Peoples stated in response to staff’s second data

request that the utility does not anticipate incurring significant upfront

costs to implement this tariff. The utility does anticipate hiring technical

and administrative support in order to respond to customer requests for LNG

services and will incorporate this program into its existing pipeline, compressed

natural gas, and renewable natural gas development team. The utility stated

that the additional staffing cost would be subject to review by the Commission

as part of a future base rate proceeding.

Under this tariff, the utility would actively participate in Requests for

Proposals by companies interested in obtaining LNG services. This process will

require Peoples to place resources towards bidding for, and potentially

negotiating, an LNG services contract. In response to staff’s data request, the

utility stated that it does not anticipate requesting recovery from its general

body of ratepayers of any costs incurred as a result of an LNG bid or contract negotiations

that does not result in a constructed facility.

With respect to the Commission’s Purchased Gas Adjustment (PGA) clause,

Peoples asserted in response to OPC’s interrogatory No. 2 that the proposed LNG

tariff is not contemplated to have any impact on the PGA costs for the general

body of ratepayers. Peoples explained that an LNG customer will procure its own

natural gas supply and, therefore, will not be included as a PGA customer.

Staff is recommending approval of the petition based, in part, on

Peoples’ assertion that it will implement a reasonable process to evaluate the

credit worthiness of a potential customer and the utility’s internal risk

assessment policies. Based on this process, the utility does not anticipate any

cost impact on the general body of ratepayers. Nonetheless, staff does

recognize that, if approved, the Commission may be asked to evaluate cost

recovery for any tariff default or under-recovery in a future rate petition. If

this occurs, the utility should be put on notice that, as part of its review,

the Commission will complete a thorough analysis of the utility’s due diligence

in entering into the contract, including the sufficiency of contract provisions

designed to protect the general body of ratepayers.

Potential Benefit to the General Body of

Ratepayers

Peoples stated that the proposed tariff would provide a benefit to the

general body of ratepayers. The utility

stated that potential customers under this tariff would increase the volume of

gas on the existing distribution system. The utility stated this should result

in lower overall costs to Peoples’ general body of ratepayers through economies

of scale, by spreading fixed costs across a larger customer base. Peoples noted

that customers receive the same benefit through its existing NGVS tariff.

In addition, Peoples stated that LNG has been used as a viable option by

natural gas utilities to meet peak customer demand. While not currently

planned, the utility highlighted that there could be a potential scenario in

which Peoples could expand its supply portfolio for diversity and reliability

using LNG by partnering with a customer under this tariff, potentially taking

advantage of economies of scale. If this scenario were to arise, the utility

stated that the capacity or reliability needs that benefit the general body of

ratepayers would require recovery through a general base rate proceeding.

Conclusion

Staff has reviewed Peoples’ proposed LNG tariff, the utility’s

responses to staff’s and OPC’s data and discovery requests, and the letter

submitted by Eagle LNG and Peoples’ response. Staff believes that Peoples’

proposed LNG service would fall under the activities of a public utility, as

contemplated under Section 366.02(1), F.S., and the Commission may exercise

jurisdiction over Peoples’ rates and service in this area, pursuant to Section

366.04, F.S. Based on this interpretation, the Commission would also have

jurisdiction over this matter pursuant to Sections 366.03, 366.05, and 366.06,

F.S.

Staff recognizes that, if approved, the Commission may be

asked to evaluate cost recovery for any tariff default or under-recovery in a

future rate petition. If this occurs, the utility should be put on notice that,

as part of its review, the Commission will complete a thorough analysis of the

utility’s due diligence in entering into the contract, including the

sufficiency of contract provisions designed to protect the general body of

ratepayers.

Staff recommends approval of Peoples’ proposed LNG tariff,

as shown in Attachment A, effective with the issuance of the final Order in

this docket. The LNG tariff would provide Peoples with an opportunity to

provide LNG services to interested customers and the utility has demonstrated a

reasonable approach to implementing the tariff. A participating customer would

enter into a contract with Peoples and all capital and operating costs

associated with the LNG facility should be borne by the customer over the life

of the contract.

Issue 2:

Should this docket be closed?

Recommendation:

If no protest is filed by a substantially affected

person within 21 days of the issuance of the order, a consummating order should

be issued and the docket should be closed. (Schrader)

Staff Analysis:

If no protest is filed by a substantially affected

person within 21 days of the issuance of the order, a consummating order should

be issued and the docket should be closed.