Case Background

On September 1,

2020, Peoples Gas System (PGS) filed a petition for approval of its final 2019

true-up, projected 2020 true-up, and 2021 revenue requirement and surcharges

associated with the cast iron/bare steel replacement rider (CI/BSR Rider or

rider). The rider was originally approved in Order No. PSC-12-0476-TRF-GU (2012

order) to recover the cost of accelerating the replacement of cast iron and

bare steel pipes through a surcharge on customers’ bills. PGS’s current surcharges were approved in

Order No. PSC-2019-0549-TRF-GU. In the 2012 order, the Commission found

that “replacement of these types of pipelines is in the public interest to

improve the safety of Florida's natural gas infrastructure, and reduce the

possibility of loss of life and destruction of property should an incident

occur."

In Order No.

PSC-17-0066-AS-GU, the Commission approved a comprehensive settlement agreement

between PGS and the Office of Public Counsel (OPC). The settlement agreement, in part, added

problematic plastic pipe (PPP) installed in the company's distribution system

to eligible replacements under the rider. PPP was manufactured before 1983 and

has significant safety concerns. In certain areas, the PPP is interspersed

with, or connected to, the cast iron/bare steel pipe that is being replaced

under the rider. As provided for in the settlement agreement, PPP replacements

are included in the calculation of the 2021 rider surcharges.

On June 8, 2020,

PGS filed a petition for a base rate increase in Docket No. 20200051-GU. As

part of the rate case, PGS requested to start billing the interruptible service

rate classes (SIS, IS, and ISLV) the CI/BSR Rider surcharges effective January

1, 2021. Currently, interruptible service customers are not paying a CI/BSR

surcharge. After discussion with staff, PGS

decided to remove the request with regards to the interruptible service

rate classes from Docket No. 20200051-GU and request consideration in the

instant docket.

On October 22,

2020, PGS filed a Joint Motion for Approval of Settlement Agreement in the rate

case docket. Included in the Settlement Agreement is a

provision to move $23.6 million of the 2021 CI/BSR revenue requirement related

to PGS’s CI/BSR investments made through December 31, 2020 ($200.7 million)

from recovery through the CI/BSR surcharges to recovery through base rates

effective January 1, 2021. The instant petition reflects this provision of the

Settlement Agreement and excludes the $23.6 million from the calculation of the

2021 CI/BSR surcharges.

In its

petition, PGS waived the 60-day file-and-suspend provision of Section

366.06(3), Florida Statutes (F.S.). The Commission has jurisdiction over this

matter pursuant to Sections 366.03, 366.04, 366.05, and 366.06, F.S.

Discussion

of Issues

Issue 1:

Should the Commission approve PGS’s request to apply

the CI/BSR surcharge to the interruptible service rate classes?

Recommendation:

Yes, the Commission should approve PGS’s request to

apply the CI/BSR surcharge to the interruptible service rate classes effective

January 1, 2021. This ensures that all customers are contributing towards the

CI/BSR replacement costs. (Ward)

Staff Analysis:

The CI/BSR Rider charges have been in effect since

January 2013. In PGS’s original petition, the utility excluded its interruptible

service customers from the CI/BSR Rider surcharge. Interruptible service customers

include the following rate classes: Small

Interruptible Service (SIS), Interruptible Service (IS), and Interruptible

Service – Large Volume (ISLV). In response to staff’s first data request, PGS

stated that at the time of the original petition, a majority of interruptible

service customers were directly connected to an interstate pipeline and did not

use a large portion of PGS’s distribution system.

After further consideration, the utility believes that all

customers benefit from the replacement of aging infrastructure, which allows

the utility to maintain a safe, reliable system. Therefore, the utility believes

that it is “fair and reasonable for customers in these rate classes to

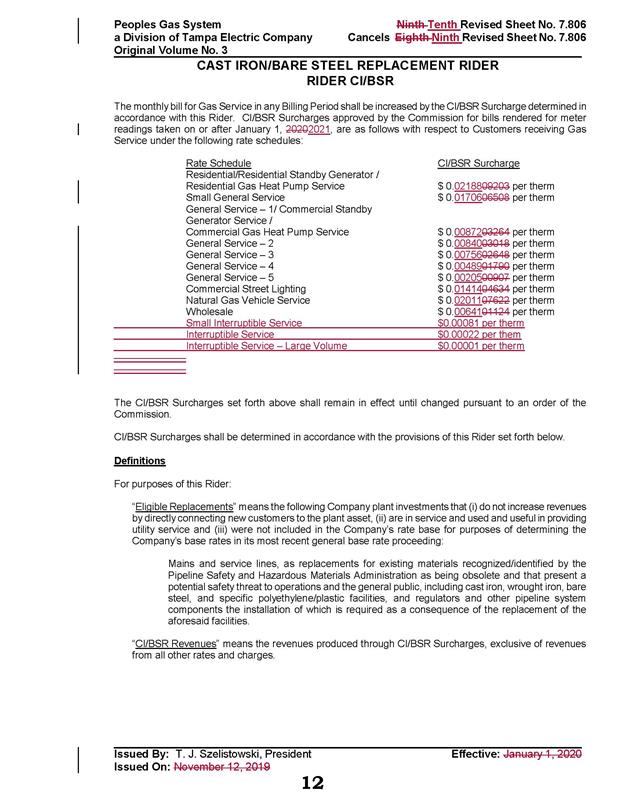

contribute a proportional cost of the program.” The proposed 2021 factors for these rate

classes are included in Tariff Sheet No. 7.806 (Attachment B).

In Exhibit D of its petition, PGS provided CI/BSR factor

calculations for all rate classes with and without the interruptible rate

classes. The non-interruptible rate classes benefit from PGS’s proposal by

receiving a minor reduction in their CI/BSR factor. Staff notes that since the

allocation of the CI/BSR costs to the rate classes is based on the percent of

total plant allocated to the rate classes in PGS’s last rate case, the

interruptible service classes only receive a small percent allocation of the

total CI/BSR costs. Based on

the average therm usage for interruptible customers provided by PGS in its 2020

rate case filing, staff calculated the monthly bill impact of the proposed

CI/BSR surcharges for an SIS customer to be $117, for an IS customer to be

$182, and for an ISLV customer to be $50.

Conclusion

Staff has reviewed PGS’s filings and supporting

documentation and believes that interruptible service customers benefit from

the replacement of the utility’s aging infrastructure under this rider.

Therefore, the Commission should approve PGS’s request to apply the CI/BSR

surcharge to the interruptible service rate classes effective January 1, 2021.

This ensures that all customers are contributing towards the CI/BSR replacement

costs.

Issue 2:

Should the Commission approve PGS’s proposed CI/BSR

Rider surcharges for the period January through December 2021?

Recommendation:

Yes, the Commission should approve PGS’s proposed

CI/BSR Rider surcharges for the period January through December 2021. (Ward)

Staff Analysis:

The

CI/BSR Rider charges have been in effect since January 2013. Rider PPP charges

have been in effect since 2017. In 2020, PGS’s cast iron and bare steel

replacement activity focused in the areas of Miami, Tampa, St. Petersburg,

Orlando, Jacksonville, Eustis, Daytona, and Ocala. In 2021, PGS states it will

focus on replacement projects in Miami, Tampa, St. Petersburg, Orlando, Jacksonville,

Avon Park, Daytona, and Ocala. The projected completion date for the CI/BSR

replacement program is 2022 for mains and services. The replacement of PPP is

expected to continue until 2028.

Attachment A

to this recommendation contains tables which display the replacement progress

and forecasts for CI/BSR (Table 2) and for PPP (Table 3). Additionally, PGS

provided Table 1 which consolidates the actual and projected CI/BSR and PPP

miles replaced investment for each year of the program and the corresponding

revenue requirements.

True-ups by Year

PGS's

calculation for the 2021 revenue requirement and surcharges includes a final

true-up for 2019, an actual/estimated true-up for 2020, and projected costs for

2021. Pursuant to the 2012 order, the capital expenditures for 2017 through

2019 exclude the first $1 million of facility replacements each year because

that amount is included in rate base. PGS has included depreciation expense

savings as discussed in the 2012 order; however, the utility has not identified

any operations and maintenance savings.

Final

True-up for 2019

Exhibit A of

the petition shows that the revenues collected for 2019 were $10,398,531

compared to a revenue requirement of $13,781,390, resulting in an

under-recovery of $3,382,859. The final 2018 over-recovery of $15,885, 2019

under-recovery of $3,382,859, and interest of $15,576 associated with any over-

and under-recoveries results in a final 2019 under-recovery of $3,382,549.

Actual/Estimated

2020 True-up

In Exhibit B

of the petition, PGS provided actual revenues for January through July and

forecast revenues for August through December of 2020, totaling $18,660,466,

compared to an actual/estimated revenue requirement of $19,287,435, resulting

in an under-recovery of $626,969. The final 2019 under-recovery of $3,382,549,

2020 under-recovery of $626,969, and interest of $14,824 associated with any

over- and under- recoveries results in a total 2020 under-recovery of $4,024,341.

Projected

2021 Costs

Exhibit C of

the petition shows PGS projects investment or capital expenditures of

$35,475,247 for the replacement of cast iron/bare steel infrastructure and PPP

in 2021. As shown in Table 1 of Attachment A of the recommendation, this

consists of the CI/BSR infrastructure investment of $16,171,113 and the PPP

investment of $19,304,134. The return on investment (which includes federal

income taxes, regulatory assessment fees, and bad debt), depreciation expense

(less savings), and property tax expense associated with that investment is

$1,427,069. After adding the total 2020 under-recovery of $4,024,341, the total

2021 revenue requirement is $5,451,411. Table 2-1 displays the 2021 revenue

requirement calculation.

Table

2-1

2021 Revenue Requirement

|

2021 Projected Expenditures

|

$35,475,247

|

|

Return on Investment

|

$1,295,164

|

|

Depreciation Expense (less savings)

|

170,926

|

|

Property Tax Expense

|

(39,021)

|

|

2021 Revenue Requirement

|

$1,427,069

|

|

Plus 2020 Under-recovery

|

4,024,341

|

|

Total 2021 Requirement

|

$5,451,411

|

Source: Page

1 of 3 in Exhibit C in petition (Docket No. 20200206-GU).

Proposed Surcharges

As

established in the 2012 order, the total 2021 revenue requirement is allocated

to rate classes using the same methodology that was used for the allocation of

mains and services in the cost of service study used in PGS's most recent rate

case. After calculating the percentage of total plant costs attributed to each

rate class, the respective percentages were multiplied by the 2021 revenue

requirement resulting in the revenue requirement by rate class. Dividing each

rate class's revenue requirement by projected therm sales provides the rider

surcharge for each rate class. In the instant petition, PGS has requested to

alter the allocation methodology to include interruptible service customers in

the CI/BSR surcharge.

If the

Commission approves Issue 1, the proposed 2021 rider surcharge for residential

customers would be $.02188 per therm (compared to the current surcharge of

$.09203). The 2021 monthly bill impact will be $.44 for a residential customer

who uses 20 therms. The reduction in the surcharges is the result of a Settlement

Agreement filed in the rate case docket, as discussed in the case background,

which moves $23.6 million of the 2021 revenue requirement to recovery through

base rates effective January 1, 2021. The proposed Tariff Sheet No. 7.806 is

Attachment B to this recommendation.

Conclusion

Staff reviewed PGS’s filings and supporting documentation

and believes that the calculations are consistent with the methodology approved

in the 2012 order and are reasonable and accurate. Therefore, staff recommends

approval of PGS’s proposed 2021 CI/BSR Rider surcharges to be effective for the

period January through December 2021.

Issue 3:

Should this docket be closed?

Recommendation:

Yes. If Issues 1 and 2 are approved and a protest

is filed within 21 days of the issuance of the order, the tariff should remain

in effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order. (Osborn, Crawford)

Staff Analysis:

If Issues 1 and 2 are approved and a protest is

filed within 21 days of the issuance of the order, the tariff should remain in

effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order.