Discussion

of Issues

Issue 1:

Should the Commission approve FPUC's, Fort Meade's,

and Chesapeake's proposed GRIP surcharges for the period January through

December 2021?

Recommendation:

Yes, the Commission should approve FPUC's, Fort Meade's,

and Chesapeake's proposed GRIP surcharges for the period January through

December 2021. (Ward)

Staff Analysis:

The GRIP surcharges have been in place since January

2013 for FPUC and Chesapeake, while Fort Meade’s surcharges were first

implemented in January 2017. In response to staff’s data request, the companies

stated that replacement projects in Lake Worth, West Palm Beach, Palm Beach,

Winter Haven, and Lake Wales were completed in 2020. Additional replacement

projects in Lake Worth, Palm Beach, West Palm Beach, Lantana, Lake Alfred,

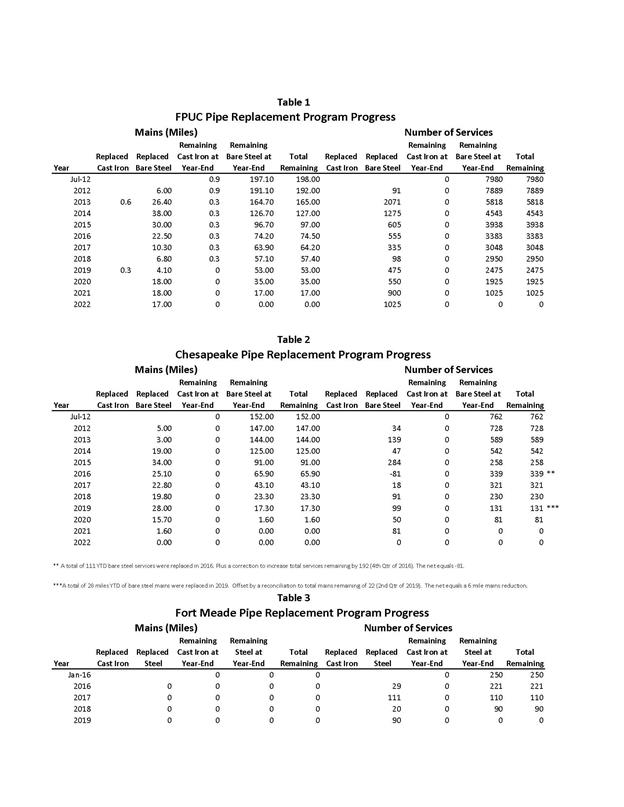

Haines City, and Plant City were projected to continue into 2021. Attachment A

provides an update of mains and services replaced and replacement forecasts.

The companies stated that they prioritize the potential replacement projects

focusing on areas of high consequence and areas more susceptible to corrosion.

FPUC’s True-ups by Year

FPUC’s calculation for the 2021 GRIP revenue requirement

and surcharges includes a final true-up for 2019, an actual/estimated true-up

for 2020, and projected costs for 2021. FPUC was authorized to recover $747,727

of annual GRIP expenses in base rates; therefore, the $747,727 is excluded from

the GRIP surcharge calculation.

Final True-up for 2019

FPUC stated that the revenues collected through the GRIP

surcharges for 2019 were $9,210,533, compared to a revenue requirement of

$9,820,941, resulting in an under-recovery of $610,408. The 2018 over-recovery

of $2,616,870, the 2019 under-recovery of $610,408, and interest of $59,250

associated with any over- and under-recoveries results in a final 2019

over-recovery of $2,065,712.

Actual/Estimated 2020 True-ups

FPUC provided actual revenues for January through July

2020 and estimated revenues for August through December 2020, totaling

$9,184,211, compared to an actual/estimated revenue requirement for 2020 of

$10,931,270, resulting in an under-recovery of $1,747,059. The 2019 over-recovery

of $2,065,712, the 2020 under-recovery of $1,747,059, and interest of $12,577

results in a total 2020 over-recovery of $331,231.

Projected 2021 Costs

FPUC expects capital expenditures of $17,750,000 for the

replacement of cast iron/bare steel infrastructure in 2021. The return on investment

(which includes federal income taxes, regulatory assessment fees, and bad

debt), depreciation expense, and property tax and customer notification expense

associated with that investment is $11,695,318. Subtracting the revenue

requirement for bare steel replacement included in base rates results in a 2021

revenue requirement of $10,947,591. After subtracting the total 2020

over-recovery of $331,231, the 2021 revenue requirement is $10,616,361. Table

1-1 shows FPUC’s 2021 revenue requirement calculation.

Table 1-1

FPUC 2021 Revenue

Requirement Calculation

|

2021 Projected Expenditures

|

$17,750,000

|

|

Return on Investment

|

$7,317,570

|

|

Depreciation Expense

|

2,398,413

|

|

Property Tax and Customer Notice Expense

|

1,979,335

|

|

2021 Revenue Requirement

|

$11,695,318

|

|

Less Revenue Requirement in Base Rates

|

747,727

|

|

2021 GRIP Revenue Requirement

|

$10,947,591

|

|

Less 2020 Over-recovery

|

331,231

|

|

2021 Total Revenue Requirement

|

$10,616,361

|

Source: Schedule C-2, page 4 of 18 in petition (Docket No.

20200207-GU).

Chesapeake’s True-ups by Year

Chesapeake’s calculation for the 2021 GRIP revenue

requirement and surcharges includes a final true-up for 2019, an

actual/estimated true-up for 2020, and projected costs for 2021. Chesapeake

does not have a replacement recovery amount embedded in base rates.

Final True-up for 2019

Chesapeake stated that the revenues collected for 2019

were $4,099,554, compared to a revenue requirement of $3,703,085, resulting in an

over-recovery of $396,469. The 2018 over-recovery of $192,146, 2019

over-recovery of $396,469, and interest of $11,270 associated with any over-

and under-recoveries results in a final 2019 over-recovery of $599,885.

Actual/Estimated 2020 True-up

Chesapeake provided actual GRIP revenues for January

through July 2020 and estimated revenues for August through December 2020,

totaling $3,053,757, compared to an actual/estimated revenue requirement of

$3,951,203, resulting in an under-recovery of $897,446. The 2019 over-recovery

of $599,885, 2020 under-recovery of $897,446, and interest of $2,807 associated

with any over- and under-recoveries results in a total 2020 under-recovery of

$294,754.

Projected 2021 Costs

Chesapeake projects capital expenditures of $250,000 for

the replacement of cast iron/bare steel infrastructure in 2021. Chesapeake has

almost completed its infrastructure replacement project, two years ahead of the

originally scheduled completion date of 2022, with only one replacement project

in Plant City scheduled for 2021. The return on investment (calculated on the

total GRIP investment installed to date), depreciation expense, and property

tax and customer notification expense to be recovered in 2021 totals $3,843,929.

After adding the total 2020 under-recovery of $294,754, the total 2021 revenue

requirement is $4,138,683. Table 1-2 shows Chesapeake’s 2021 revenue

requirement calculation.

Table 1-2

Chesapeake 2021 Revenue

Requirement Calculation

|

2021 Projected Expenditures

|

$250,000

|

|

Return on Investment

|

$2,380,672

|

|

Depreciation Expense

|

779,113

|

|

Property Tax and Customer Notice Expense

|

684,144

|

|

2021 Revenue Requirement

|

$3,843,929

|

|

Plus 2020 Under-recovery

|

294,754

|

|

2021 Total Revenue Requirement

|

$4,138,683

|

Source: Schedule C-2, page 10 of 18 in petition (Docket

No. 20200207-GU).

Fort Meade’s True-ups by Year

Fort Meade started its replacement program in 2016 and

first implemented GRIP surcharges in January 2017. Unlike FPUC and Chesapeake,

only bare steel services (and no mains) require replacement in Fort Meade. Fort

Meade’s replacement program was completed in 2019.

Final True-up for 2019

Fort Meade stated that the revenues collected for 2019

were $29,923, compared to a revenue requirement of $24,087, resulting in an

over-recovery of $5,836. Adding the 2018 under-recovery of $3,693, the 2019

over-recovery of $5,836, and $29 for interest associated with any over- and under-recoveries,

the final 2019 over-recovery is $2,113.

Actual/Estimated 2020 True-up

Fort Meade provided actual GRIP revenues for January

through July 2020 and estimated revenues for August through December 2020

totaling $29,315, compared to an actual/estimated revenue requirement of

$25,474, resulting in an over-recovery of $3,841. Adding the 2019 over-recovery

of $2,113, the 2020 over-recovery of $3,841, and interest of $33 associated

with any over- and under-recoveries, the resulting total 2020 true-up is an

over-recovery of $5,987.

Projected 2021 Costs

Fort Meade projects capital expenditures of $0 for the

replacement of cast iron/bare steel infrastructure in 2021, as the replacement

program was completed in 2019. Therefore, the 2021 GRIP factors are designed to

only recover the remaining 2020 over-recovery of $5,987 and the revenue

requirement of $25,474 associated with the 2020 year-end total investment

($25,474 - $5,987 = $19,487).

Proposed Surcharges for FPUC, Chesapeake, and

Fort Meade

As established in the 2012 order approving the GRIP

program, the total 2021 revenue requirement is allocated to the rate classes

using the same methodology used for the allocation of mains and services in the

cost of service study used in the utilities’ most recent rate case. The

respective percentages were multiplied by the 2021 revenue requirements and

divided by each rate class’ projected therm sales to provide the GRIP surcharge

for each rate class.

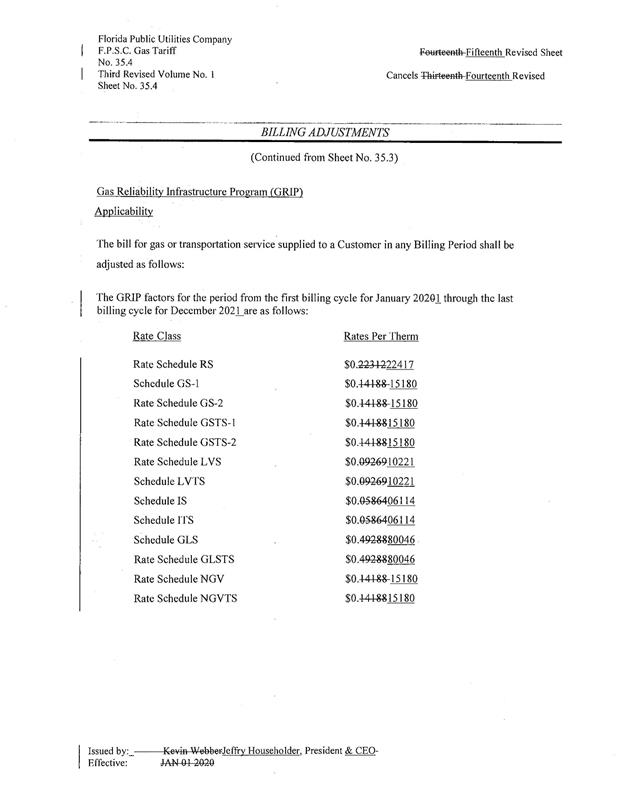

The proposed 2021 GRIP surcharge for FPUC’s residential

customers on the Residential Service (RS) schedule is $0.22417 per therm

(compared to the current surcharge of $0.22312 per therm). The monthly bill

impact is $4.48 for a residential customer using 20 therms per month. The

proposed FPUC tariff page is shown in Attachment B.

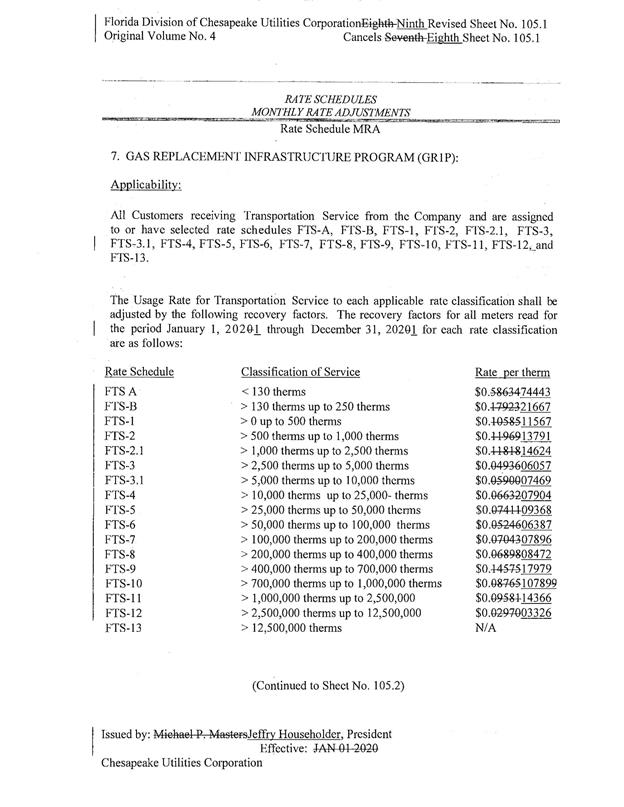

The proposed 2021 GRIP surcharge for Chesapeake’s

residential customers on the FTS-1 schedule is $0.11567 per therm (compared to

the current surcharge of $0.10585). The monthly bill impact is $2.31 for a

residential customer using 20 therms per month. The proposed Chesapeake tariff

pages are contained in Attachment C.

The proposed 2021 GRIP surcharge for Fort Meade’s

residential customers on the RS schedule is $0.16325 per therm (compared to the

current surcharge of $0.24865). The monthly bill impact is $3.27 for a

residential customer using 20 therms per month. The proposed Fort Meade tariff

page is shown in Attachment D.

Conclusion

Staff believes the calculation of the 2021 GRIP surcharge

revenue requirement and the proposed GRIP surcharges for FPUC, Chesapeake, and

Fort Meade are reasonable and accurate. Staff recommends approval of FPUC’s,

Chesapeake’s, and Fort Meade’s proposed GRIP surcharges for the period January

through December 2021.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If Issue 1 is approved and a protest is filed

within 21 days of the issuance of the order, the tariffs should remain in

effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order. (Osborn, Crawford)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the tariffs should remain in effect, with

any revenues held subject to refund, pending resolution of the protest. If no

timely protest is filed, this docket should be closed upon the issuance of a

consummating order.