Discussion

of Issues

Issue 1:

Are the installed costs of the solar projects

proposed by DEF (Twin Rivers, Santa Fe, Charlie Creek, Duette, and Sandy Creek)

within the installed cost cap required by subparagraph 15(a) of the 2017

Settlement?

Recommendation:

Yes. The estimated installed costs appear reasonable

and the resulting weighted average cost of the combined projects in DEF’s Third

SoBRA tranche is below the installed cost cap of $1,650 per kilowatt

alternating current (kWac), as required by the 2017 Settlement.

(Phillips)

Staff Analysis:

The Third SoBRA tranche consists of five projects:

Twin Rivers, Santa Fe, Charlie Creek, Duette, and Sandy Creek. Each of the

projects is designed to be approximately 75 MW. The capacity and projected in-service

dates for each project are listed in Table 1-1. DEF is only seeking recovery

through the SoBRA Mechanism of 56.6 MW of the Sandy Creek project. The recovery

of the remaining 18.3 MW of capacity may be addressed in a future docket.

Table 1-1

Installed Capacity and Projected

In-Service dates of Third SoBRA Tranche

|

Project Name

|

Capacity (MW)

|

Estimated In-Service Date

|

|

Twin Rivers

|

74.9

|

February 2021

|

|

Santa Fe

|

74.9

|

March 2021

|

|

Charlie Creek

|

74.9

|

December 2021

|

|

Duette

|

74.5

|

December 2021

|

|

Sandy Creek

|

74.9 (56.6 SoBRA)

|

April 2022

|

Source: Direct Testimony of

DEF witness Benjamin M. H. Borsch Exhibit (BMHM-1)

Paragraph 15 of the 2017 Settlement outlines the

conditions under which DEF may seek cost recovery of certain solar facilities.

Subparagraph 15(c) outlines the issues to be considered for projects that are

below 75 MW. The requirements for average installed cost and overall

reasonableness of costs are addressed in this issue, while system

cost-effectiveness, and need for the facilities, are addressed in Issues 2 and

3, respectively.

Subparagraph 15(a) of the 2017 Settlement specifies that

the weighted average cost of all projects in a SoBRA tranche may be no more

than $1,650 per kWac installed to be eligible for recovery. The 2017

Settlement states all construction costs for the projects are to be included,

such as land acquisition costs. The estimated installed cost and cost per kWac

for each project are listed in Table 1-2. The unit cost of both the weighted

average of all projects and each project individually are below the $1,650/ kWac

requirement. The amount listed for the Sandy Creek project is the total amount,

but only a partial amount coinciding with the 56.6 MW of capacity will be

allowed recovery through the SoBRA mechanism.

Table 1-2

Estimated Installed Cost, in

Total and by Unit of Capacity

|

Project Name

|

Estimated Installed Cost

($)

|

Estimated Installed Cost

($/kWac)

|

|

Twin Rivers

|

$100,037,587

|

$1,336

|

|

Santa Fe

|

$108,910,046

|

$1,454

|

|

Charlie Creek

|

$97,950,968

|

$1,308

|

|

Duette

|

$108,572,491

|

$1,457

|

|

Sandy Creek

|

$99,123,932

|

$1,323

|

|

Weighted

Average Unit Cost

|

-

|

$1,376

|

Source: Direct Testimony of

DEF witness Benjamin M. H. Borsch Exhibit (BMHM-1)

In three of the projects, DEF will be leasing the land for

the facility instead of purchasing it. Lease costs are not included in the

$/kWac calculation. In response to staff’s data requests, the Company provided

the estimated net present value of payments under these three leases. Even including

lease costs as part of the $/kWac calculation, the weighted average cost

of all projects is less than the $1,650/kWac installed cost cap.

The installed cost of a project consists of major

equipment, balance of system, construction management, transmission

interconnection, and land cost. This includes but is not limited to the cost of

solar panels, transformers, contractors, legal fees, development fees, and

insurance. DEF utilized a competitive process when soliciting contractors and

procuring material and equipment for the Third SoBRA tranche. Given the use of

competitive bidding in multiple aspects of the projects, the costs appear to be

reasonable.

Conclusion

Based on staff’s review, the estimated installed costs

appear reasonable and the resulting weighted average cost of the combined

projects in DEF’s Third SoBRA tranche is below the installed cost cap of $1,650

per kWac, as required by the 2017 Settlement.

Issue 2:

Are the solar projects proposed by DEF cost

effective pursuant to subparagraph 15(c) of the 2017 Settlement?

Recommendation:

Yes. DEF’s proposed Third SoBRA tranche would result

in lower system costs as compared to the system without the projects, as

required by the 2017 Settlement. (Phillips)

Staff Analysis:

Subparagraph 15(c) defines the cost-effectiveness of

a SoBRA tranche to be whether the projects will lower the projected system

cumulative present value revenue requirement (CPVRR) as compared to a system

without the projects. This compares the cost of the added generation,

transmission, operation and maintenance (O&M) and other expenses of the

proposed SoBRA tranche to the avoided traditional generation, transmission,

fuel, and O&M expenses that would otherwise have been incurred if the

facilities were not constructed.

Overall, DEF estimates that the Third SoBRA tranche would

produce savings of $37 million over the life of the projects before

consideration of costs associated with carbon dioxide (CO2) and

equivalent emissions. Inclusive of CO2 emissions costs, DEF

estimates a savings of $234 million. The primary driver of the savings is

avoided fuel costs, approximately $435 million, followed by avoided generation

costs of $217 million, and avoided CO2 emissions costs of $197

million. The Company also ran scenarios with high and low fuel costs, with only

the low fuel and no CO2 emission cost scenario resulting in a loss

for customers, of approximately $20 million. The breakeven point for the Third

SoBRA tranche is expected to be in 2048 if carbon emission costs are not

included and 2040 if carbon emission costs are included. The results of each

scenario are listed in Table 2-1.

Table 2-1

System CPVRR Savings/(Costs)

by Fuel and Emissions Scenario ($ Millions)

|

Fuel / Emissions

Scenario

|

High Fuel

|

Mid Fuel

|

Low Fuel

|

|

No CO2

|

$173

|

$37

|

($20)

|

|

With CO2

|

$376

|

$234

|

$177

|

Source: Direct Testimony of

DEF witness Benjamin M. H. Borsch Exhibit (BMHM-4)

Conclusion

Based on staff’s review, DEF’s proposed Third SoBRA

tranche would result in lower system costs as compared to the system without

the projects, as required by the 2017 Settlement.

Issue 3:

Are the solar projects proposed by DEF needed

pursuant to subparagraph 15(c) of the 2017 Settlement?

Recommendation:

Yes. DEF’s proposed Third SoBRA tranche is needed as

it will produce economic benefits to the general body of ratepayers, provide

firm summer capacity, and increase the fuel diversity of DEF’s generation. (Phillips)

Staff Analysis:

Subparagraph 15(c) of the 2017 Settlement specifies

that one of the issues to be considered is whether, when considering all

relevant factors, there is a need for the SoBRA projects. Need is undefined in

the 2017 Settlement, but can be reasonably interpreted to include multiple

forms of need, such as economic, reliability, and fuel diversity.

As discussed in Issue 2, the Third SoBRA tranche is

projected to produce savings over the life of the project between $37 and $234

million, with and without CO2 emission costs, respectively. In

response to staff’s data request, DEF estimates that for its scenario including

CO2 emissions costs, annual customer savings begin in 2040 and

continue for the life of the projects. Based

on this analysis, an economic need could be supported.

Regarding reliability, due to their production

characteristics solar facilities only contribute towards the reliability of the

summer peak. Each of the facilities has been constructed at a direct current

capacity of approximately 130 percent of the alternating current capacity,

resulting in increased energy during shoulder periods, and increased

contribution towards summer firm capacity. While DEF’s net firm system demand

is lower in summer than in the winter, summer tends to control unit addition

planning. The proposed solar facilities would improve DEF’s summer reserve

margin slightly in the early years while decreasing its winter reserve margin

by avoiding or deferring conventional generation, addressing a reliability

need. The projects will also defer the construction of a single combustion

turbine in the year 2027 that would otherwise be needed for reliability

purposes.

Fuel diversity through renewable energy generation, such

as the projects of DEF’s Third SOBRA tranche, is encouraged by several

statutes, including Section 366.91, F.S., which states in part:

Renewable energy resources have the potential to help

diversify fuel types to meet Florida’s growing dependency on natural gas for

electric production, minimize the volatility of fuel costs, encourage

investment within the state, improve environmental conditions, and make Florida

a leader in new and innovative technologies.

The energy production of the Third SoBRA tranche would

offset the remainder of the DEF system’s fuel consumption, which is primarily

natural gas.

Conclusion

There is a need for DEF’s proposed Third SoBRA tranche

when considering the economic, system reliability, and fuel diversity benefits

to the general body of ratepayers.

Issue 4:

Are the solar projects proposed by DEF otherwise in

compliance with the terms of paragraph 15 of the 2017 Settlement?

Recommendation:

Yes. DEF’s Third SoBRA tranche meets the

requirements of the 2017 Settlement and the projects are eligible for cost

recovery through the SoBRA mechanism established therein. (Phillips)

Staff Analysis:

Paragraph 15 of the 2017 Settlement outlines various

criteria and requirements to be met by projects to be considered eligible for

recovery through the SoBRA mechanism it established. These include: the

reasonableness of installed costs which must include certain categories of

costs and be below an installed cost threshold, as discussed in Issue 1 based

on subparagraph 15(a); the projection that the projects will produce system

savings on a CPVRR basis, as discussed in Issue 2 based on subparagraph 15(c);

and whether, when considering all relevant factors, there is a need for the projects,

as discussed in Issue 3 based on subparagraph 15(c).

Other requirements exist within Paragraph 15 for the projects,

discussing various factors such as the role of affiliate companies, the amount

of capacity allowed to be sought by year, and how the calculation of the

revenue requirement is to be conducted. Based on staff’s review, these factors,

along with those outlined in Issues 1 through 3 have been met by DEF’s Third

SoBRA tranche.

Conclusion

Based on staff’s review, DEF’s Third SoBRA tranche meets

the requirements of the 2017 Settlement and the projects are eligible for cost

recovery through the SoBRA mechanism established therein.

Issue 5:

What is the annual revenue requirement associated

with each of the solar projects proposed by DEF?

Recommendation:

The total jurisdictional annual revenue requirement

associated with each of the five proposed projects is as listed in Table 5-1.

(Higgins)

Staff Analysis:

In the 2017 Settlement, DEF received authorization

for a framework to recover costs associated with the construction and operation

of a then-conceptual series of solar generating facilities.

The authorized SoBRA framework included conditions by which the Company may

petition the Commission to implement project-specific estimated annual revenue

requirements subject to certain agreed-upon conditions.

The instant petition by the Company represents the final SoBRA-related request

under the 2017 Settlement.

The Company is requesting the Commission approve annual

revenue requirements for the five plants that comprise DEF’s Third SoBRA under

the 2017 Settlement. The requested revenue requirements are associated with these

five proposed generating plants: Twin Rivers, Santa Fe, Charlie Creek, Duette, and

Sandy Creek. As shown in Issue 1, the Twin Rivers and Santa Fe projects are

planned to go into service in early 2021, while Charlie Creek and Duette projects

are planned to go into service in the fourth quarter of 2021, and the Sandy

Creek project is planned to go into service during the second quarter of 2022.

Staff notes the capital and O&M portions of Sandy

Creek’s annual revenue requirement have been reduced to 75.6 percent to reflect

only 56.6 megawatts of the 74.9 megawatts of the facility’s capacity being

included for recovery under the SoBRA framework. DEF may seek recovery of

the remaining portion of the Sandy Creek plant in a separate proceeding.

The major classifications/components of the requested

annual revenue requirement are: production and transmission costs related to

capital deployment, production and transmission depreciation and

depreciation-related expenses, operation and maintenance expenses, insurance

and property expenses, and taxes.

The proposed cumulative annual revenue requirement

associated with all five plants under the Third SoBRA is approximately $62.5

million. Staff notes that per the terms of the 2017 Settlement, DEF is required

to perform a true-up if the actual/final capital expenditures are different from

the estimated capital expenditures, or if the facility in-service dates vary

from those originally assumed. Any credit/refund is to be effectuated through

the Capacity Cost Recovery Clause. Table

5-1 displays the proposed cumulative annual revenue requirements by plant

associated with DEF’s Third SoBRA request:

Table 5-1

Third SoBRA Estimated Jurisdictional

Annual Revenue Requirement

|

Plant

|

Revenue Requirement ($000)

|

|

Twin

Rivers

|

$13,083

|

|

Santa

Fe

|

13,902

|

|

Charlie

Creek

|

12,475

|

|

Duette

|

13,400

|

|

Sandy

Creek

|

9,683

|

|

Total

|

$62,543

|

Source: Direct Testimony of

DEF witness Thomas G. Foster, Exhibit (TGF-1)

Conclusion

The total jurisdictional annual revenue requirement

associated with each of the five proposed projects is as listed in Table 5-1.

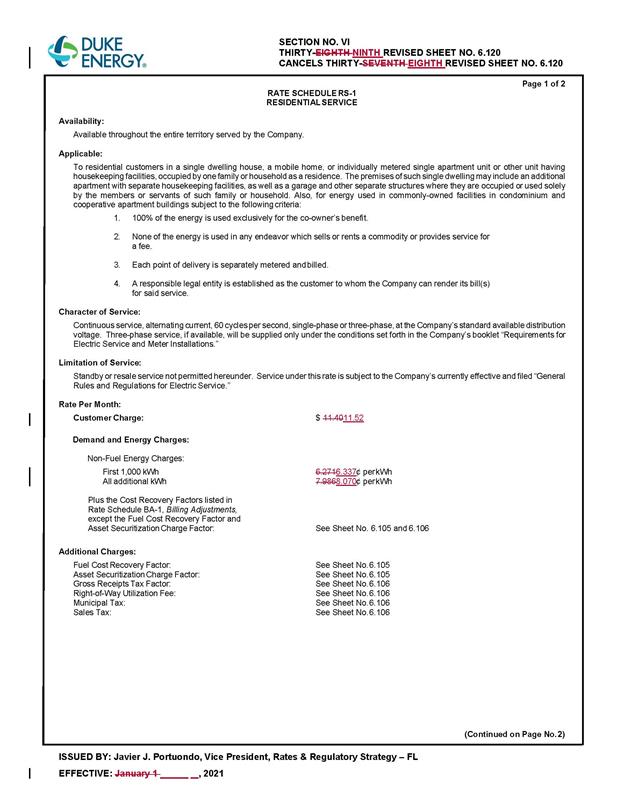

Issue 6:

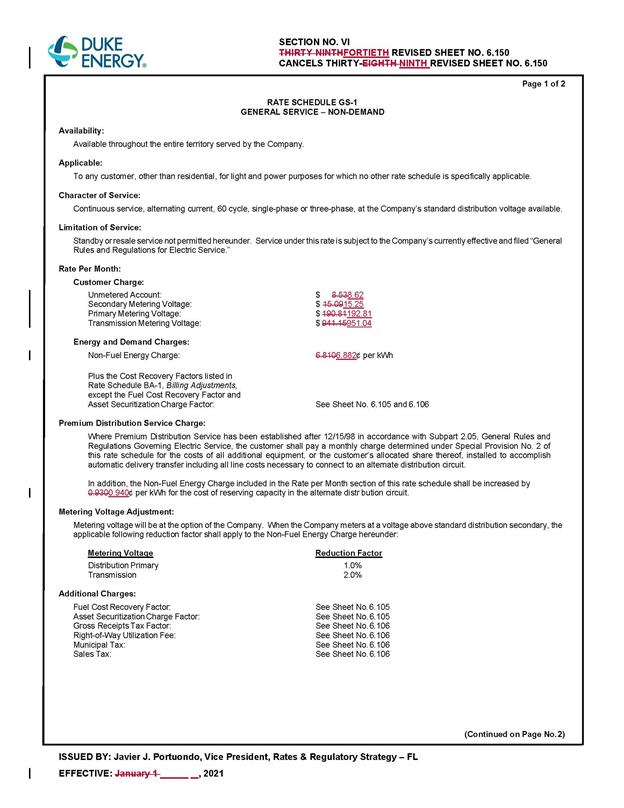

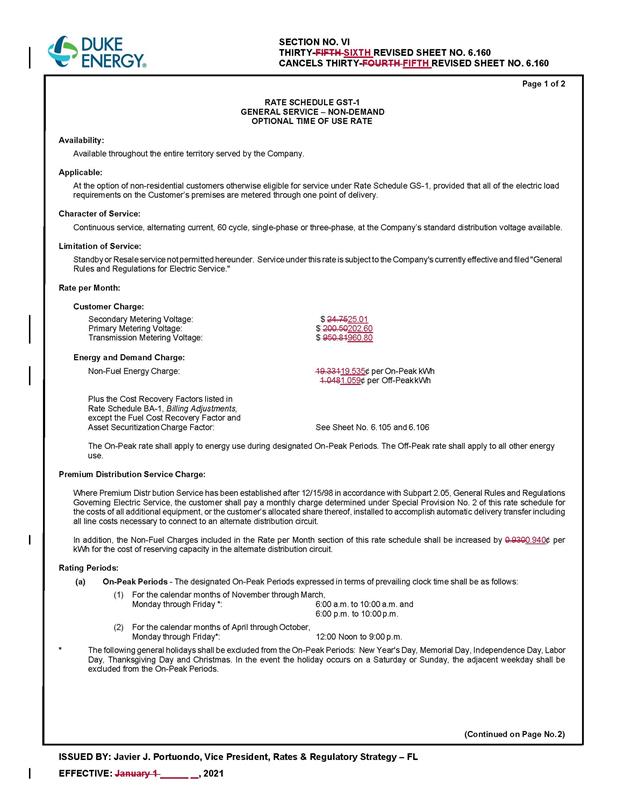

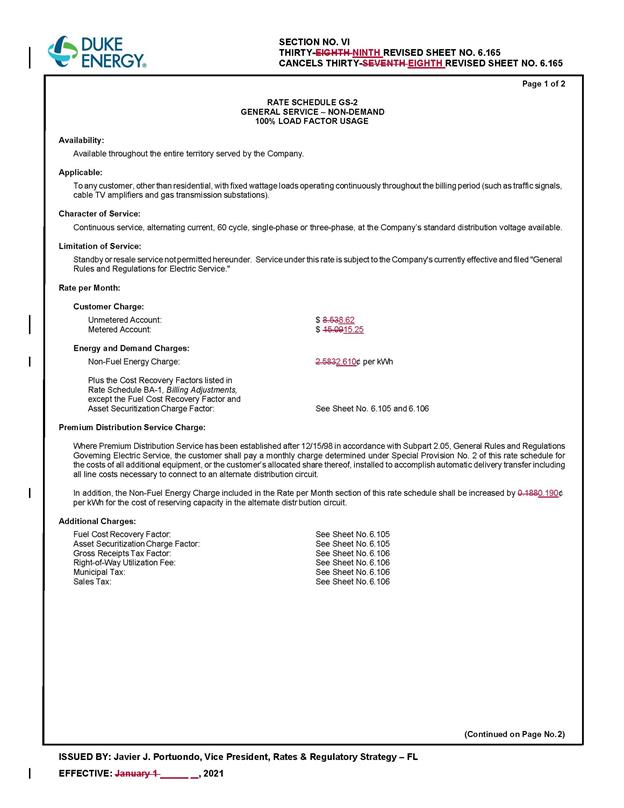

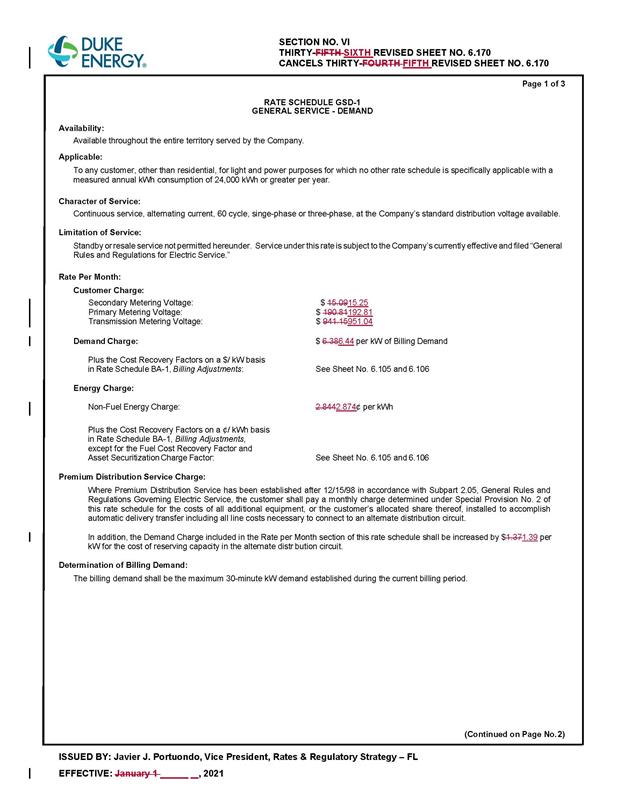

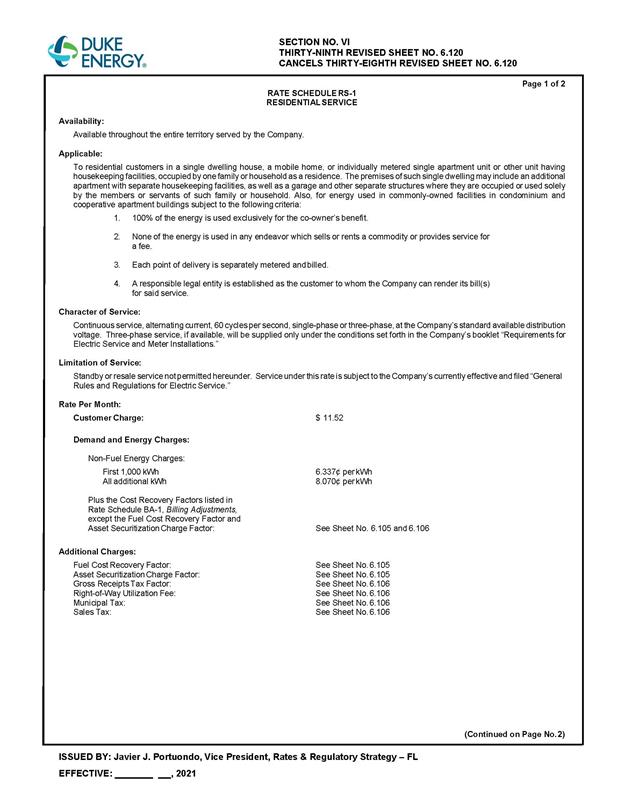

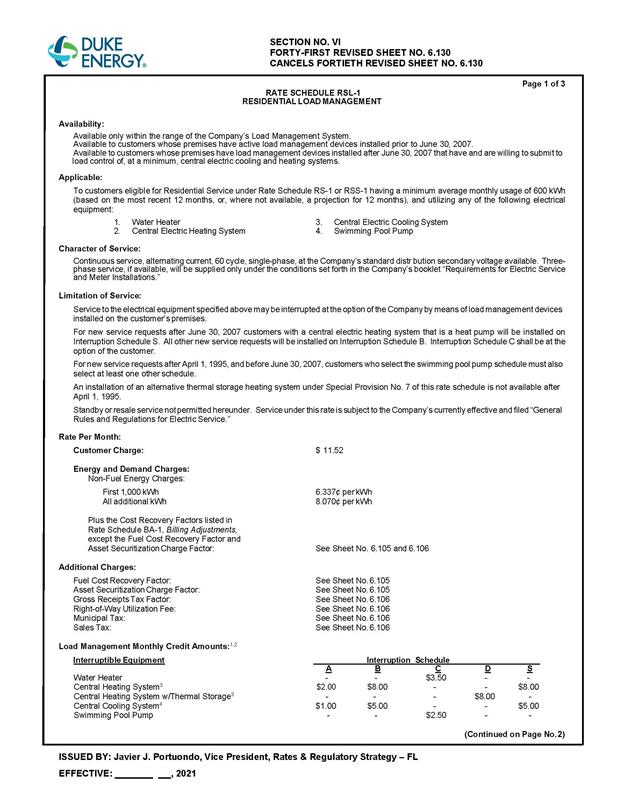

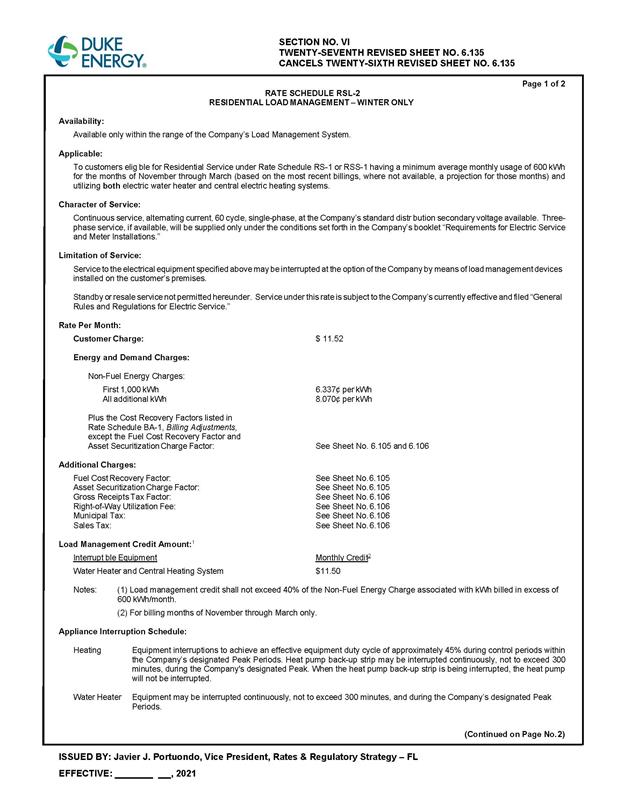

Should the Commission approve the tariff sheets

reflecting the annual revenue requirements for the Twin Rivers and Santa Fe solar

projects? In addition, should the Commission grant staff administrative

authority to approve the tariffs for the Charlie Creek, Duette solar projects

and the Sandy Creek projects?

Recommendation:

Yes. The Commission should approve the tariff sheets

as shown in Attachment A of the recommendation, which reflect the annual

revenue requirements listed in Issue 5 for the Twin Rivers and Santa Fe projects,

effective with the first billing cycle on or after the commercial in-service

date of both units. In addition, the Commission should grant staff

administrative authority to approve tariffs for the Charlie Creek and Duette projects

for implementation effective with the first billing cycle on or after the commercial

in-service date of both units and the Sandy Creek project for implementation

effective with the first billing cycle on or after the commercial in-service

date of that unit, using the annual revenue requirements listed in Issue 5 for

each of these projects. (Forrest, Coston)

Staff Analysis:

Issue 5 of the

recommendation provides the annual revenue requirements associated with each of

the five projects proposed by DEF in its proposed Third SOBRA. As noted in

Issue 1, these projects have varying implementation dates. As such, the Company

has requested that the rates be implemented over three phases.

The Company stated in its

petition that the Twin Rivers and Santa Fe projects are scheduled to go into

commercial service in early 2021. Per the 2017 Settlement, subparagraph 15(g),

“DEF shall be authorized to begin applying the base rate charges for each

adjustment authorized by this Paragraph to meter readings beginning with the

first billing cycle on or after the commercial in-service date of that solar

generation project.” DEF clarified with staff that the Twin Rivers project is

scheduled for a February 2021 in-service date and the Santa Fe project is

scheduled for a March 2021 in-service date; therefore, under the scheduled

in-service dates the tariffs, as shown in Attachment A to the recommendation,

would be effective with the first billing cycle in April 2021. The Company

should provide notification in the docket file of the actual in-service dates

of these projects.

The proposed tariffs reflecting

the revenue requirements for the Twin Rivers and Santa Fe projects are included

as Attachment A of the recommendation. These tariffs reflect a total revenue

requirement of $13,083,000 for the Twin Rivers project and $13,902,000 for the

Santa Fe project. The uniform percentage increase calculations for the class

revenue increases and resulting base rate increases are shown in Exhibit C to

the petition, which are calculated using the methodology approved in subparagraph

15(e) of the 2017 Settlement. For a residential customer using 1,000 kilowatt-hours,

the monthly base rate increase will be $0.78.

DEF stated in its petition that

the Charlie Creek project and Duette project are anticipated to go online in

the last quarter of 2021 and that the Sandy Creek project is anticipated to go

online in the second quarter of 2022. The Company requested staff be given

administrative authority to approve the tariffs associated with these projects

at the time the units go online. As with the Twin Rivers and Santa Fe projects,

the Company should provide notification in the docket file of the actual

in-service date of these projects.

Conclusion

Staff recommends that the Commission should approve the

tariff sheets as shown in Attachment A of the recommendation, which reflect the

annual revenue requirements listed in Issue 5 for the Twin Rivers and Santa Fe

projects, effective with the first billing cycle on or after the commercial

in-service date of both units. In addition, the Commission should grant staff

administrative authority to approve tariffs for the Charlie Creek and Duette projects

for implementation effective with the first billing cycle on or after the commercial

in-service date of both units and the Sandy Creek project for implementation

effective with the first billing cycle on or after the commercial in-service

date of that unit, using the annual revenue requirements listed in Issue 5 for

each of these projects.

Issue 7:

Should this docket be closed?

Recommendation:

If a protest is filed within 21 days of the issuance

of the order, the tariffs should remain in effect, with any revenues held

subject to refund, pending resolution of the protest. If no timely protest is

filed, this docket should be closed upon the issuance of a consummating order.

(Stiller, Trierweiler)

Staff Analysis:

If a protest is filed within 21 days of the issuance

of the order, the tariffs should remain in effect, with any revenues held

subject to refund, pending resolution of the protest. If no timely protest is

filed, this docket should be closed upon the issuance of a consummating order.