Discussion

of Issues

Issue 1:

Should the Commission approve Gulf’s Petition for

Waiver of a portion of Rule 25-6.0436(7)(a), Florida Administrative

Code (F.A.C.)?

Recommendation:

Yes. The portion of Rule 25-6.0436(7)(a),

F.A.C., from which Gulf requests a waiver requires that a utility obtain

Commission approval for authority to make adjustments for unrecovered

investments associated with the retirement of major installations prior to the

date of such retirement. Staff recommends that Gulf has demonstrated that

applying the rule in this docket and making the Company’s Petition subject to

denial solely because of timing would impose a substantial hardship on the Company.

Gulf has also demonstrated that the purposes of the statutes underlying the

portion of the Rule being waived will be served by other means during the

upcoming base rate proceeding. (Stiller, J. Crawford)

Staff Analysis:

Gulf is seeking a waiver from the portion of Rule 25-6.0436(7)(a),

F.A.C., which requires Commission approval for

authority to address unrecovered investments related to the retirement of major

installations prior to the date of their retirement.

The Waiver

Request

In its Petition filed November 10, 2020, Gulf requested authority

to establish two regulatory assets (one in rate base and one in the Environmental

Cost Recovery Clause) related to the unrecovered investments associated with

the early retirement of the coal generation assets and capability at Plant

Crist Units 4-7, and to defer the recovery of such regulatory assets until base

rates are reset in a general base rate proceeding. Gulf also requested

Commission approval for a corresponding Mid-Course Correction to its 2021 Environmental

Cost Recovery Clause factors.

Because Gulf has requested Commission approval for this

authority after the proposed early retirement date of the major installations,[2] the

Company is seeking a waiver of the first clause of Rule 25-6.0436(7)(a), F.A.C.,

underscored below:

Prior to the date of retirement of major

installations, the Commission shall approve capital

recovery schedules to correct associated calculated deficiencies where a

utility demonstrates that (1) replacement of an installation or group of

installations is prudent and (2) the associated investment will not be

recovered by the time of retirement through the normal depreciation process.

Gulf has not requested a waiver of any other portion of

Rule 25-6.0436(7)(a),

F.A.C., or any other Commission rule.

The Company’s original request

for a waiver was contained in paragraph six of its Petition. However, the

request was unclear and failed to comply with the requirements of Section 120.542,

F.S. Accordingly, staff requested that if Gulf wished to waive a portion of the

Commission’s rules, it should file a petition consistent with the requirements

of Section 120.545, F.S., and Rule 28-104.002, F.A.C. Gulf subsequently

submitted a stand-alone Petition for Waiver, which was filed in this docket on

January 19, 2021. Pursuant to Section 120.542(6), F.S., notice of Gulf’s Waiver

Petition was published in the January 22, 2021 edition of the Florida

Administrative Register, Vol. 47, No. 14. No comments were submitted on the

Waiver Petition.

Legal

Standard for Rule Variances and Waivers

Section

120.542(1), F.S., states that the purpose of a rule variance or waiver[3] is to

provide relief to persons subject to regulation in cases where strict

application of rule requirements can lead to unreasonable, unfair, and

unintended results in particular circumstances. Section 120.542(2), F.S., sets

forth a two-prong test for granting variances or waivers to rules. If the

petitioner satisfies both prongs of the test, the agency must grant the

variance or waiver.

First, the

petitioner must show that “application of [the] rule would create a substantial

hardship or would violate principles of fairness.” A “substantial hardship” is

a “demonstrated economic, technological, legal, or other type of hardship.” Principles

of fairness are violated when “the literal application of a rule affects a

particular person in a manner significantly different from the way it affects

other similarly situated persons who are subject to the rule.” Second, the

petitioner must demonstrate that it will achieve the purpose of the underlying

statutes by other means.

Each

petitioner for rule variance or waiver has the burden of proving its

entitlement to a variance or waiver under its particular circumstances. Thus,

the Commission’s determination as to whether a petitioner should be granted a

variance or waiver is based on whether the legal test has been met under the

specific circumstances of each petitioner.

Substantial

Hardship

The 2020 Gulf and Florida Power & Light Company Ten-Year Site

Plan set forth the Company’s anticipated timeframes for the conversion of Plant

Crist Units 6 and 7 from coal-fired generation to natural-gas fired generation[4] as

well as for the corresponding retirement of coal generation assets and

capability at Plant Crist Units 4-7. The Site Plan slated the conversion of

Plant Crist Units 6 and 7 to natural gas for fourth quarter 2020 or first

quarter 2021. The coal assets associated with Plant Crist Units 4-7 were

scheduled to be retired December 31, 2021.

On September 26, 2020, Hurricane Sally damaged Plant

Crist. Gulf represents that this damage was significant, and that it caused the

Company to assess the benefits of converting Plant Crist Units 6 and 7 to

natural gas instead of making the repairs necessary to return these Units to

coal-burning generation. This comparison demonstrated greater cost benefits by

completing an early conversion of Plant Crist Units 6 and 7 to natural gas

instead of repairing and temporarilyreturning them to coal operations. This conclusion

lead Gulf to file the instant Petition for authority to address the unrecovered

investments associated with the coal operation assets and capability of Plant

Crist Units 4-7.

Gulf states that prior to Hurricane Sally, it had planned to file

with the Commission a request for approval of regulatory assets or capital

recovery schedules associated with the retirement of coal operations at Plant

Crist Units 4-7 in 2021 by separate petition or with its planned base rate case

filing. However, the timing of the proposed retirement was accelerated unforeseeably

by the damage caused by Hurricane Sally. Gulf asserts that the Petition,

though admittedly filed after the proposed date of retirement of Plant Crist

Units 4-7, was submitted as soon as practicable after completion of post-Hurricane

Sally assessments and analyses. The Company argues that because the timing and

extent of damage from Hurricane Sally were unforeseen, application of Rule 25-6.0436(7)(a),

F.A.C., to categorically prohibit it from reacting to this significant

change by accelerating planned conversions imposes a substantial hardship. Gulf

notes that the conversion of Plant Crist Units 6 and 7 was anticipated within

the next calendar year, and that the creation of the regulatory assets and Mid-Course

Correction will result in an estimated savings to ratepayers of $3.6 million.

Gulf projects the Mid-Course Correction will enable a decrease of $3.71/1,000

kWh on a monthly residential bill. The alternative, continues Gulf, was

to repair Plant Crist Units 6 and 7, operate on coal for the short-term, and

then complete the conversion to natural gas operations later in 2021, all while

foregoing these projected savings. Such an alternative would pose a substantial

hardship in terms of financial costs and operational inefficiencies.

Purpose of

the Underlying Statute

Rule

25-6.0436(7)(a), F.A.C., implements three statutes. The first is Section

350.115, F.S., which provides the Commission authority to “prescribe by rule

uniform systems and classifications of accounts for each type of regulated

company and approve or establish adequate, fair, and reasonable depreciation

rates and charges.” The second statute implemented is Section 366.04,(2)(f),

F.S., which grants the Commission authority to “prescribe and require the

filing of periodic reports and other data as may be reasonably available and as

necessary to exercise its jurisdiction hereunder.” The third statute

implemented by the Rule is Section 366.06(1), F.S., which requires, inter alia, that the Commission “keep a

current record of the net investment of each public utility company” and

establish adequate, fair, and reasonable depreciation rates and charges.

Gulf notes

that nothing in its waiver request alters its substantive reporting

requirements or affects Commission jurisdiction. Gulf asserts that the

Commission can fully address all issues related to establishing adequate, fair,

and reasonable depreciation rates and charges, and the appropriate treatment of

unrecovered investments during a general base rate proceeding.

Conclusion

Staff

believes Gulf has demonstrated that applying the Rule in this docket would

impose a substantial hardship on the Company. Gulf has also demonstrated that

the purposes of the statutes underlying the portion of the Rule being waived

will be served by other means. Staff notes that the Commission has previously

waived a separate time requirement in Rule 25-6.0436, F.A.C., on a request from

another utility that had experienced damage from a hurricane.[5] Staff

therefore recommends that the Commission approve Gulf’s Petition for Waiver of

a portion of Rule 25-6.0436(7)(a), F.A.C.

Issue 2:

Should the Commission approve Gulf’s request to

create two regulatory assets related to the retirement of Plant Crist Units 4,

5, 6 and 7 and defer the recovery of the regulatory assets to a future

proceeding?

Recommendation:

Yes. The Commission should approve Gulf’s request to

create two regulatory assets related to the early retirement of coal generation assets and capability at Plant

Crist Units 4, 5, 6 and 7 and defer the recovery of the regulatory assets to a

future proceeding. Further, the Commission should find that the approval to

record the regulatory assets for accounting purposes does not limit the

Commission’s ability to review the amounts and recovery period for

reasonableness in a future proceeding in which the regulatory assets are

included. (Snyder, P. Buys)

Staff Analysis:

On November 10, 2020, Gulf filed a petition seeking

approval to create two regulatory assets, representing an unrecovered $67.6

million in base rate capital investment and $394.5 million in ECRC capital

investments ($462.2 million in total), due to the early retirement of coal

generation assets and capability at Plant Crist Units 4, 5, 6 and 7. Gulf seeks

to defer base rate and ECRC recovery of the regulatory assets, and

determination of the associated amortization periods, until Gulf's base rates

are next reset in a general base rate proceeding. Gulf’s decision to retire the

Units early was based on significant damage caused to the Units by Hurricane

Sally. Gulf had originally planned to convert Crist Units 6 and 7 from coal to

natural gas generation in the fourth quarter 2020 to first quarter 2021

timeframe, maintain Crist Units 6 and 7 as available capacity during 2021, and

retire the coal generation assets and capability of Crist Units 4-7 on or about

December 31, 2021, upon the completion of other investments to provide power to

Gulf customers. As of retirement of Crist Units 4-7 on October 15, 2020, the

Net Book Value of the Units was approximately $462 million. The following table

contains the start of service year and previously scheduled retirement year for

each of the Units.

|

Unit #

|

Start of Service

Year

|

Previous

Retirement Year

|

|

4

|

1959

|

2024

|

|

5

|

1961

|

2026

|

|

6

|

1970

|

2035

|

|

7

|

1973

|

2038

|

In the last proceeding in which the Commission reviewed

the depreciation rates of Crist Units 4-7, the estimated retirement dates

ranged from 2024 through 2038. In February 2019, Gulf’s management approved

a plan to switch the primary fuel type from coal to natural gas, with the coal

generation assets remaining available until December 2021 to serve as a back-up

fuel option. In its filings in the 2020 Fuel Docket, Gulf had already ceased

using coal at Crist Units 4 and 5, and planned to use coal at Crist Units 6 and

7 until October 2020.

On September 16, 2020, Hurricane Sally caused significant

damage to the Plant Crist site. Due to the hurricane damage sustained at Crist

Units 4-7, Gulf decided to retire the coal generation assets and capability at

an even earlier date, October 15, 2020, instead of repairing the coal

generation assets of Crist Units 4-7. This left approximately 240,000 tons of

coal unburned and located either at Plant Crist or at the Alabama State Docks.

In its petition, Gulf supported its decision by providing a cumulative present

value of revenue requirements (CPVRR) analysis evaluating the cost

effectiveness of repairing the coal generation assets of the Crist Units and

retiring them in December 2021, versus the October 2020 retirement of the coal

generating assets. The CPVRR analysis provided three scenarios on the

disposition of the remaining 240,000 tons of unburned coal, which would either

be burned over a six month period or sold. The retirement option was more cost

effective in each scenario, producing an estimated savings of between $3.6

million and $4.9 million. In response to staff’s data request, Gulf provided an

analysis of a fourth scenario, in which the unburned coal would be burned over

a shorter three-month period. The estimated savings in this scenario was

reduced to $1.7 million. The primary driver of savings is the differential

between coal and natural gas fuel prices and the additional operational costs

of the coal generation assets.

Based on this preliminary analysis, shifting the early

retirement date from December 2021 to October 2020 appears to generate customer

savings. However, the Commission has not reviewed either the conversion to

natural gas, which allows the early retirement of the coal generation assets,

or the early retirement date of December 2021, against which the

cost-effectiveness analysis was conducted. Gulf has also provided no

information supporting either the conversion to natural gas or the December

2021 early retirement date used in the CPVRR analysis.

Based on these factors, staff recommends that the

Commission not make a final prudence determination of whether the October 2020

early retirement of the coal generating assets and capability is reasonable at

this time. The next opportunity to review the full record to determine the

prudency of the retirement of the coal generation assets and capability at

Plant Crist Units 4-7 would be Gulf’s next general base rate proceeding.

Because these Units are being retired early, certain

entries must be made to Gulf’s books and records. Rule 25-6.0436(6), Florida

Administrative Code (F.A.C.), requires a utility to compile an annual

depreciation status report showing changes to categories of depreciation that

will require a revision. In addition, Rule 25-6.0436(7)(a), F.A.C., provides

that:

Prior to the date of retirement of major installations,

the Commission shall approve capital recovery schedules to correct associated

calculated deficiencies where a utility demonstrates that (1) replacement of an

installation or group of installations is prudent and (2) the associated

investment will not be recovered by the time of retirement through the normal

depreciation process.

Gulf’s current depreciation rates are based on retirement

dates of 2024, 2026, 2035, and 2038 for these Units. Therefore, the investment

in these Units will not be recovered through the normal depreciation process

due to the early retirement of these Units.

The retirement and deferral of recovery for these Units

affects Gulf’s ECRC factors. In Attachment AE-1 of its petition, Gulf provides

capital recovery schedules for these Units for both base and clause recovery.

The NBV for the portion of Units 4-7 recovered through the ECRC is $394,547,432

and the accumulated depreciation is $204,005,124. With the retirement and

deferral of recovery of these Units, the resulting ECRC factors would reduce

Gulf’s revenue requirement by $30,051,492.

The concept of deferral accounting allows companies to

defer costs due to events beyond their control and seek recovery through rates

at a later time. If the subject costs are significant, the alternative would be

for a company to seek a rate proceeding each time it experiences an exogenous

event. In staff’s opinion, it is appropriate to create the requested regulatory

assets for the amounts associated with the early retirement of the coal

generation assets and capability at Plant Crist and defer recovery until the amounts

can be addressed in a future proceeding. Further, the Commission should find

that the approval to record the regulatory assets for accounting purposes does

not limit the Commission’s ability to review the amounts and recovery period

for reasonableness in a future proceeding in which the regulatory assets are

included. On January 11, 2021, FPL filed a request for approval of a base rate

proceeding. Gulf

formally merged into FPL in January 2021, with operational consolidation to be

essentially complete by January 2022.

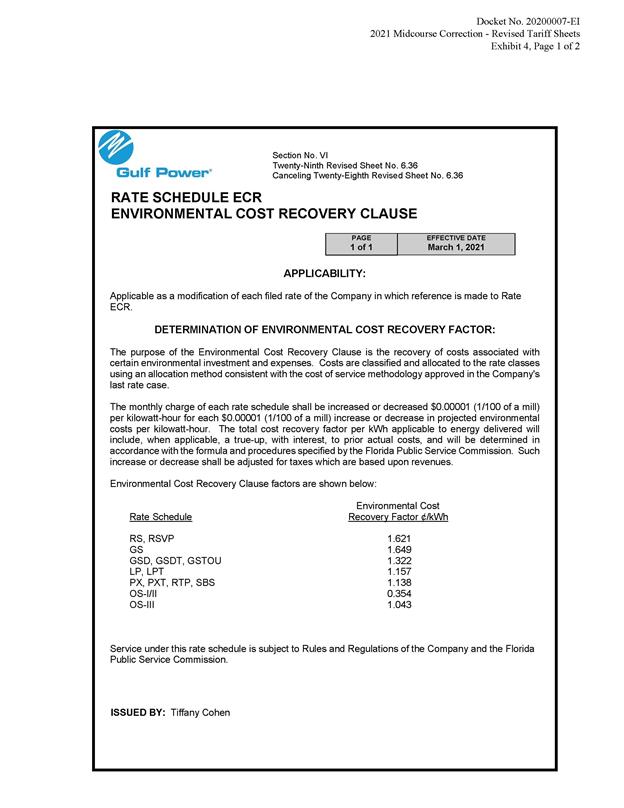

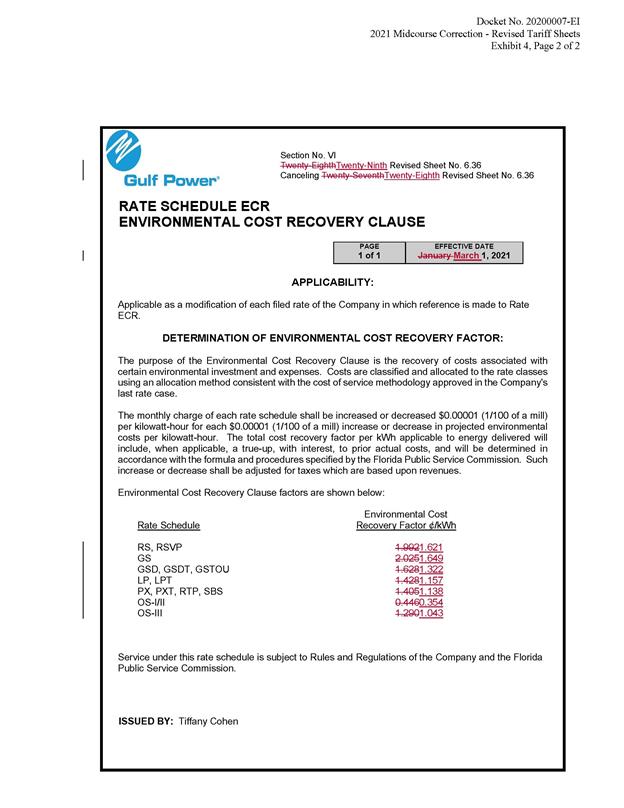

Issue 3:

Should the Commission approve Gulf’s petition to

reduce its currently-approved 2021 Environmental Cost Recovery Clause (ECRC)

factors and tariff for the period March through December 2021 to reflect the

early retirement of the coal generation assets and capability at Plant Crist

Units 4-7?

Recommendation:

Yes. The Commission should approve Gulf’s petition

to revise the currently-approved 2021 ECRC factors and tariff for the period

March through December 2021, to reflect the early retirement of the coal

generation assets and capability at Plant Crist Units 4-7. The proposed tariff,

as shown in Attachment A to the recommendation, should go into effect March 2,

2021. (Forrest)

Staff Analysis:

Gulf stated in its petition that the early

retirement of the Plant Crist Units 4-7 will reduce the projected amount identified

for collection through the ECRC. As such, the Company has requested that the

2021 ECRC factors be reduced to reflect the retirement of the Plant Crist

assets. As discussed in Issue 2, Gulf stated that approval of the requested

Mid-Course Correction to the ECRC factors would reduce the Company’s annual

revenue requirement by $30,051,492.

The current residential ECRC factor is 1.992 cents per

kilowatt-hour (¢/kWh). The residential factor with the proposed ECRC revenue

reduction would be 1.621 ¢/kWh. This proposal would reduce a 1,000 kWh

residential bill by $3.71. Gulf stated the allocation method used to calculate

this reduction is consistent with the cost of service methodology approved in

the Company's last rate case.

Staff recommends that the Commission approve tariff sheet

No. 6.36 to revise the currently-approved 2021 ECRC factors and tariff for the

period March through December 2021 to reflect the early retirement of the coal

generation assets and capability at Plant Crist Units 4-7. The proposed tariff,

as shown in Attachment A to the recommendation, should go into effect March 2,

2021

Issue 4:

Should this docket be closed?

Recommendation:

If no person whose substantial interests are

affected by the proposed agency action files a protest within 21 days of the

issuance of the order, this docket should be closed upon the issuance of a

consummating order. (Stiller).

Staff Analysis:

At the conclusion of the protest period, if no protest

is filed this docket should be closed upon the issuance of a consummating

order.