Discussion

of Issues

Issue 1:

Should the Commission

approve the amended standard offer contract and rate schedule COG-2 filed by

Duke Energy Florida, LLC?

Recommendation:

Yes. The provisions of DEF’s amended standard offer

contract and associated rate schedule COG-2 conforms to the requirements of

Rules 25-17.200 through 25-17.310, F.A.C. The amended standard offer contract offers

multiple payment options so that a developer of renewable generation may select

the payment stream best suited to its financial needs. (Phillips)

Staff Analysis:

Section 366.91(3), F.S., and Rule 25-17.250, F.A.C.,

require that an IOU continuously make available a standard offer contract for

the purchase of firm capacity and energy from renewable generating facilities

(RF) and small qualifying facilities (QF) with design capacities of 100

kilowatts (kW) or less. Pursuant to Rules 25-17.250(1) and (3), F.A.C., the

standard offer contract must provide a term of at least 10 years, and the

payment terms must be based on the utility’s next avoidable fossil-fueled

generating unit identified in its most recent Ten-Year Site Plan, or if no

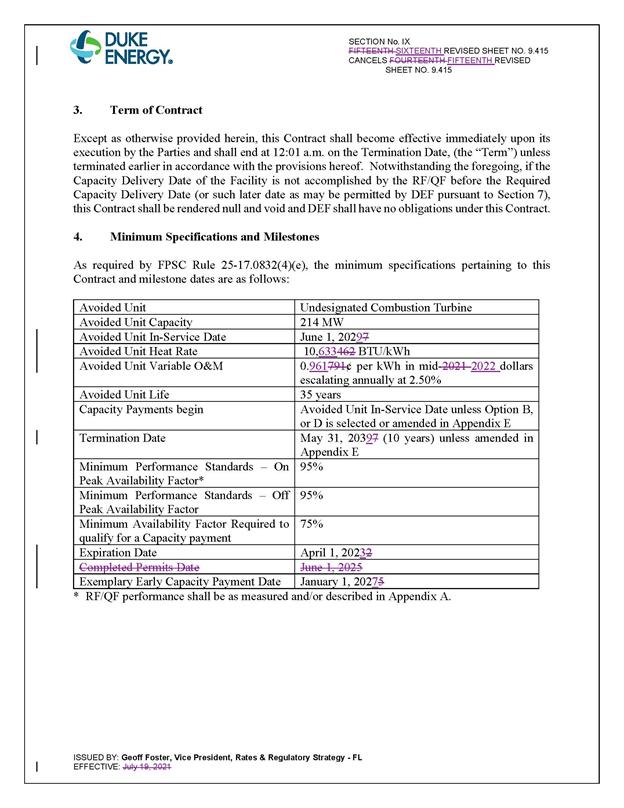

avoided unit is identified, its next avoidable planned purchase. DEF has

identified a 214 megawatt (MW) natural gas-fueled combustion turbine (CT) as

the next avoidable planned generating unit in its 2022 Ten-Year Site Plan. The

projected in-service date of the avoided CT is June 1, 2029, with planned

construction beginning in July 2026.

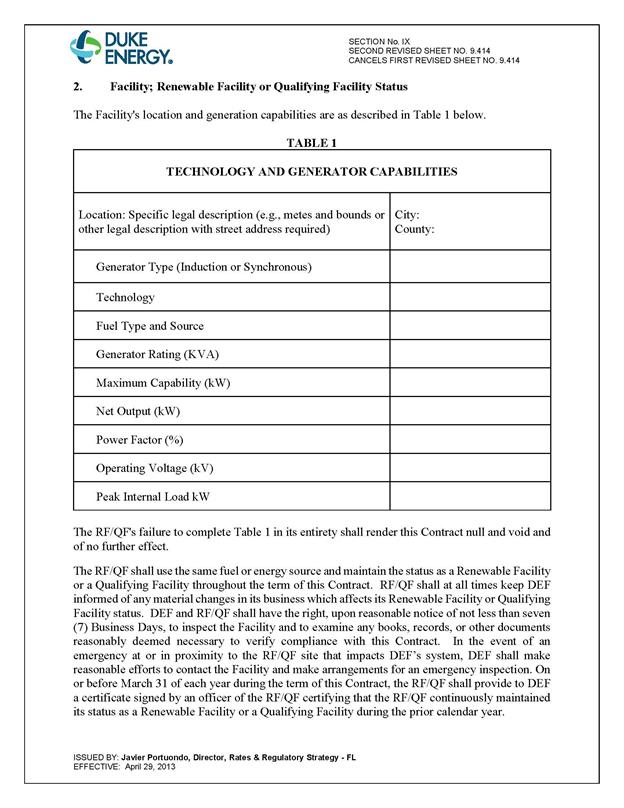

Under DEF’s standard offer contract, the RF/QF operator

commits to certain minimum performance requirements based on the identified

avoided unit, such as being operational and delivering an agreed upon amount of

capacity by the in-service date of the avoided unit, and thereby becomes

eligible for capacity payments in addition to payments received for energy. The

standard offer contract may also serve as a starting point for negotiation of

contract terms by providing payment information to an RF/QF operator, in a

situation where one or both parties desire particular contract terms other than

those established in the standard offer.

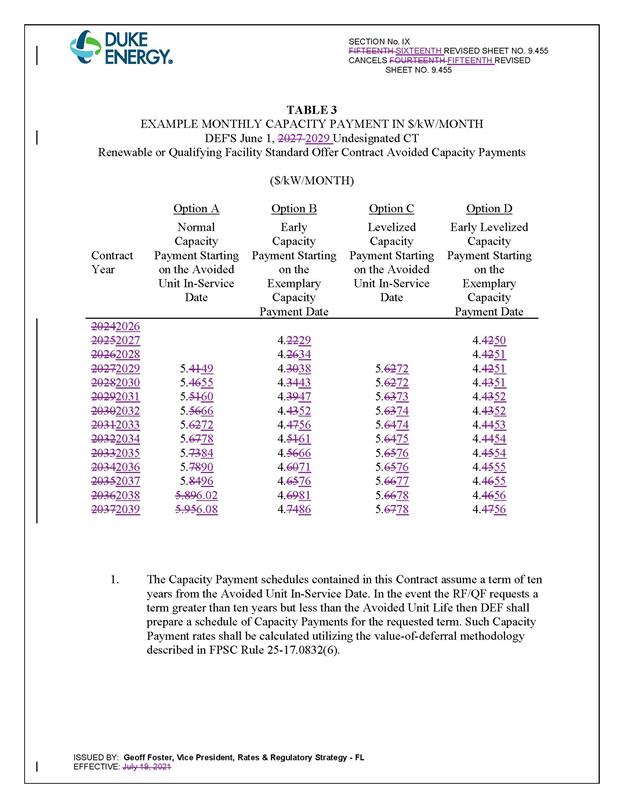

In order to promote renewable generation, the Commission

requires the IOU to offer multiple options for capacity payments, including the

options to receive early or levelized payments. If the RF/QF operator elects to

receive capacity payments under the normal or levelized contract options, it

will receive as-available energy payments only until the in-service date of the

avoided unit (in this case June 1, 2029), and thereafter, begin receiving

capacity payments in addition to firm

energy payments. If either the early or early levelized option is selected,

then the operator will begin receiving capacity payments earlier than the

in-service date of the avoided unit. However, payments made under the early

capacity payment options tend to be lower in the later years of the contract

term because the net present value (NPV) of the total payments must remain

equal for all contract payment options.

Table 1 contains DEF’s estimates of the annual payments

for the normal and levelized capacity payment options available under the

revised standard offer contract to an operator with a 50 MW facility, operating

at a capacity factor of 95 percent, which is the minimum capacity factor

required under the contract to qualify for full capacity payments. Normal and

levelized capacity payments begin with the projected in-service date of the

avoided unit (June 1, 2029) and continue for 10 years, while early and early

levelized capacity payments begin two years prior to the in-service date, or

2027 for this example.

Table 1 - Estimated Annual Payments to

a 50 MW Renewable Facility

(95% Capacity Factor)

|

Year

|

Energy Payment

|

Capacity Payment

|

|

Normal

|

Levelized

|

Early

|

Early Levelized

|

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

$(000)

|

|

2023

|

13,273

|

-

|

-

|

-

|

-

|

|

2024

|

11,866

|

-

|

-

|

-

|

-

|

|

2025

|

10,656

|

-

|

-

|

-

|

-

|

|

2026

|

10,581

|

-

|

-

|

-

|

-

|

|

2027

|

10,470

|

-

|

-

|

2,547

|

2,698

|

|

2028

|

11,411

|

-

|

-

|

2,574

|

2,701

|

|

2029

|

11,299

|

1,922

|

2,027

|

2,600

|

2,704

|

|

2030

|

11,637

|

3,328

|

3,478

|

2,627

|

2,707

|

|

2031

|

12,013

|

3,362

|

3,482

|

2,654

|

2,710

|

|

2032

|

12,180

|

3,397

|

3,485

|

2,681

|

2,713

|

|

2033

|

12,243

|

3,432

|

3,489

|

2,709

|

2,716

|

|

2034

|

13,149

|

3,468

|

3,493

|

2,737

|

2,719

|

|

2035

|

13,820

|

3,503

|

3,497

|

2,765

|

2,722

|

|

2036

|

14,812

|

3,540

|

3,501

|

2,794

|

2,726

|

|

2037

|

16,109

|

3,576

|

3,506

|

2,823

|

2,729

|

|

2038

|

16,187

|

3,613

|

3,510

|

2,852

|

2,732

|

|

2039

|

17,432

|

3,651

|

3,514

|

2,882

|

2,736

|

|

2040

|

18,447

|

3,689

|

3,519

|

2,912

|

2,740

|

|

2041

|

18,936

|

3,727

|

3,524

|

2,942

|

2,743

|

|

2042

|

19,130

|

3,766

|

3,528

|

2,973

|

2,747

|

|

Total

|

275,652

|

47,975

|

47,554

|

44,075

|

43,543

|

|

Total (NPV)

|

147,062

|

21,236

|

21,236

|

21,236

|

21,236

|

Source: DEF’s Response to Staff’s First Data Request

DEF’s standard offer contract, in type-and-strike format,

is included as Attachment A to this recommendation. The changes made to DEF’s tariff

sheets are consistent with the updated avoided unit. Revisions include updates

to calendar dates and payment information which reflect the current economic

and financial assumptions for the avoided unit. In addition, the language in Section

14(g), Sheet No. 9.428, was revised to now require that the RF/QF maintain the

licensing and certification approvals necessary to operate the facility and

failure to do so constitutes a default. Previously, the language required

licensing and certification approval be achieved to initiate construction of

the facility by no later than the Completed Permits Date and failure to do so

constituted a default. Section 10.5.4, which is unchanged, already requires the

RF/QF to operate and maintain the facility to meet applicable laws, which would

include licensing and certification. Staff believes the change to the language in

Section 14(g) is reasonable and consistent with Section 10.5.4 of DEF’s

existing standard offer contract.

Conclusion

The provisions of DEF’s amended standard offer contract

and associated rate schedule COG-2 conforms to the requirements of Rules

25-17.200 through 25-17.310, F.A.C. The amended standard offer contract offers

multiple payment options so that a developer of renewable generation may select

the payment stream best suited to its financial needs.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. This docket should be closed upon issuance of a

consummating order, unless a person whose substantial interests are affected by

the Commission’s decision files a protest within 21 days of the issuance of the

Commission’s Proposed Agency Action Order. Potential signatories should be aware

that, if a timely protest is filed, DEF’s standard offer contract may

subsequently be revised. (Jones)

Staff Analysis:

This docket should be closed upon the issuance of a

consummating order, unless a person whose substantial interests are affected by

the Commission’s decision files a protest within 21 days of the issuance of the

Commission’s Proposed Agency Action Order. Potential signatories should be

aware that, if a timely protest is filed, DEF’s standard offer contract may

subsequently be revised.