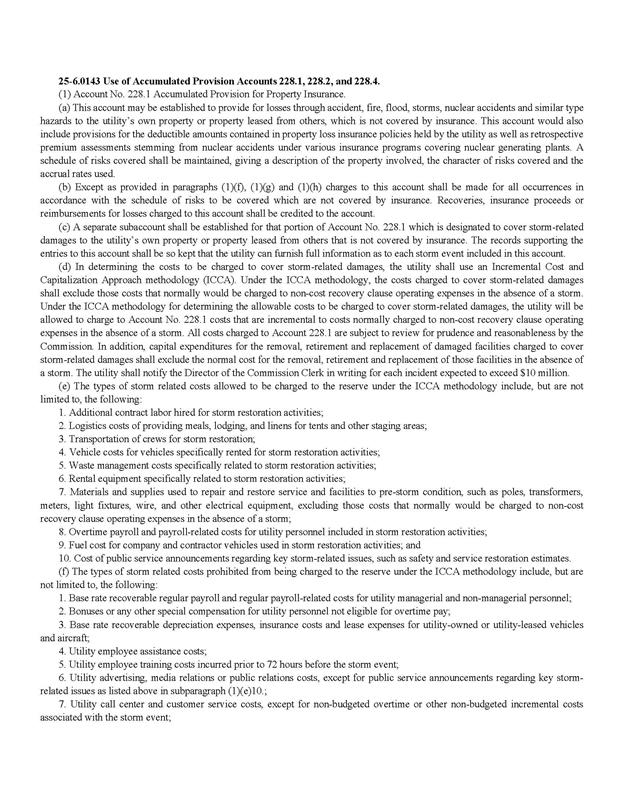

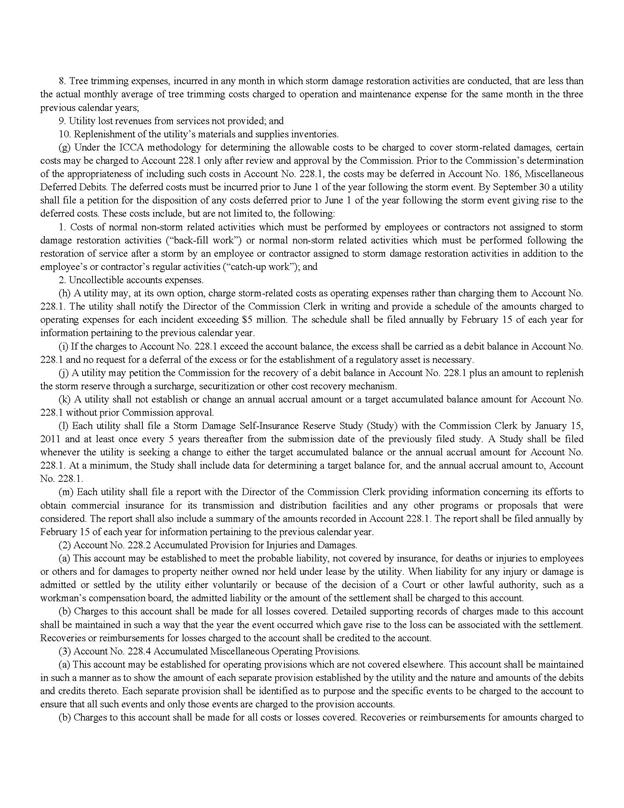

Discussion

of Issues

Issue 1:

Should the incremental cost and capitalization

approach (ICCA) found in Rule 25-6.0143, F.A.C., be used to determine the

reasonable and prudent amounts to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Yes, in part. The ICCA found in

Rule 25-6.0143, F.A.C., should be used, in part, to determine the reasonable

and prudent incremental amounts to be included in the restoration costs. For

Gulf, the ICCA in Rule 25-6.0143, F.A.C., should be used to determine the

reasonable and prudent amounts to be included in the restoration costs that

were charged to Account 228.1 for Hurricanes Sally and Zeta. For FPL, use of the

ICCA methodology to determine incremental O&M costs is not applicable in

evaluating storm restoration costs that were charged to base O&M expense

for Hurricane Isaias and Tropical Storm Eta. (Norris, Snyder)

Position of the Parties

Gulf & FPL:

Yes, in

part. The applicable ICCA methodology

should be used to determine the reasonableness and prudence of storm costs

charged to Account 228.1. Previously

approved settlement agreements and orders from this Commission should also be

used to determine the reasonable and prudent restoration costs. Additionally, certain provisions of the ICCA

methodology related to incremental O&M costs are not applicable in

calculating storm restoration costs for Hurricane Isaias and Tropical Storm Eta.

OPC:

a.

Docket No.

20200241-EI for Gulf’s Hurricane Sally.

Yes. Rule 25-6.0143(1)(d), F.A.C., states that

“[i]n determining the costs to be charged to cover storm-related damages, the

utility shall use an Incremental Cost and Capitalization Approach methodology

(ICCA)” and “[u]nder the ICCA methodology, the cost charged to cover

storm-related damages shall exclude those costs that normally would be charged

to non-cost recovery clause operating expenses in the absence of a storm.” These incremental costs are subject to

reasonable and prudence review.

b.

Docket No.

20210178-EI for FPL’s Hurricane Isaias.

Yes. The Rule requires the utility use an ICCA

methodology that excludes costs that normally would be charged to non-cost

recovery clause operating expenses in the absence of a storm. Under the Rule, a utility may choose to

charge these storm-related costs as operating expense, but has only one

description of storm-related damages or costs that may be recovered from

customers, despite recovery form. These incremental costs are subject to

reasonable and prudence review.

c.

Docket No.

20210178-EI for FPL’s Tropical Storm Eta.

Yes. The Rule requires the utility use an ICCA

methodology that excludes costs that normally would be charged to non-cost

recovery clause operating expenses in the absence of a storm. Under the Rule, a utility may choose to

charge these storm-related costs as operating expense, but has only one

description of storm-related damages or costs that may be recovered from customers,

despite recovery form. These incremental costs are subject to reasonable and

prudence review.

d.

Docket No.

20210179-EI for Gulf’s Hurricane Zeta.

Yes. Rule 25-6.0143(1)(d), F.A.C., states that

“[i]n determining the costs to be charged to cover storm-related damages, the

utility shall use an Incremental Cost and Capitalization Approach methodology

(ICCA)” and “[u]nder the ICCA

methodology, the cost charged to cover storm-related damages shall exclude

those costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm.”

These incremental costs are subject to reasonable and prudence review.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf & FPL

In their brief, Gulf and FPL (the Companies) asserted that

the applicable provisions of the ICCA methodology found in Rule 25-6.0143 (the

Rule) should be used to calculate Gulf’s incremental restoration costs for

Hurricanes Sally and Zeta, along with applicable provisions from the Hurricane

Irma Settlement Agreement, the Hurricane Michael Settlement Agreement, the

Hurricane Matthew Settlement Agreement, and the 2006 Storm Order.

(Gulf & FPL BR 12; TR 260)

Conversely, the Companies explained that pursuant to Rule

25-6.0143(1)(h), F.A.C., FPL opted to charge all non-capital storm costs

associated with Hurricane Isaias and Tropical Storm Eta to base O&M

expense. (Gulf & FPL BR 12) Thus, they maintained that certain provisions

of the ICCA methodology related to incremental O&M costs are not applicable

in calculating storm restoration costs for Hurricane Isaias and Tropical Storm

Eta. (Gulf & FPL BR 12) The Companies further clarified this assertion by

explaining that any non-capital storm costs considered non-incremental under

the ICCA methodology would have been recorded to base O&M expense anyway.

(Gulf & FPL BR 12).

OPC

OPC

stated the ICCA in Rule 25-6.0143, F.A.C., should be used in determining the

costs to be charged to cover storm-related damages. (OPC BR 5) OPC explained

that under the ICCA methodology, utilities are allowed to charge to Account

228.1 those incremental costs for non-cost recovery clause operating expense

incurred above the level that would ordinarily be incurred in the absence of a

storm, with the expectation that these costs are subject to review for

reasonableness and prudence. (OPC BR 6; TR 369)

OPC

acknowledged that under Rule 25-6.0143(1)(h), a utility may choose to charge

storm related costs to base O&M expense rather than charging them to

Account 228.1. (OPC BR 6) However, OPC maintained that despite the two forms of

recovery provided for in the Rule, it only contains one set of storm related

costs that may be recovered from customers and does not contain any exculpatory

term that relieves a utility from compliance with the Rule if it opts to charge

storm costs to base O&M expense. (OPC BR 6; TR 372)

ANALYSIS

Both parties agreed that the ICCA methodology in Rule

25-6.0143, F.A.C., should be used to determine the costs used to cover storm

related damages. (Gulf & FPL BR 12; OPC BR 5) As explained by FPL witness

Hughes, when storm restoration costs are charged to the storm reserve,

referenced by the Rule as Account 228.1, the ICCA methodology is used to

identify and remove non-incremental costs. (TR 265) The non-incremental costs

are then debited to base O&M expense. (TR 265) As Gulf charged storm

restoration costs for Hurricanes Sally and Zeta to the storm reserve, the ICCA

methodology should be applied for determining the reasonable and prudent

incremental storm restoration costs that were charged to Account 228.1 for

those storms.

As permitted by Rule 25-6.0143(1)(a), FPL elected to

forego seeking incremental recovery of Hurricane Isaias and Eta storm

restoration costs through a surcharge or depletion of the storm reserve and

opted to charge all non-capital storm restoration costs to base O&M expense.

(TR 313-314) As such, FPL maintained that the ICCA methodology is not

applicable for determining incremental O&M costs because it’s not

requesting any amounts be charged to the storm reserve. However, OPC contended

that despite the two forms of recovery provided for in the Rule, through the

storm reserve or charging to base O&M expense, it only contains one set of

storm related costs that may be recovered from customers and does not contain

any exculpatory term that relieves a utility from compliance with the Rule if

it opts to charge storm costs to base O&M expense. (OPC BR 6; TR 372)

Staff agrees with FPL’s interpretation of the Rule and

does not believe that the specific accounting instructions associated with

Account 228.1 should apply to costs that were not recorded or charged to that

account. This interpretation is not relieving FPL from compliance with the

Rule, as it is following subpart (1)(a) in its decision to charge the storm

restoration costs to base O&M expense.

CONCLUSION

The ICCA found in Rule 25-6.0143, F.A.C., should be used,

in part, to determine the reasonable and prudent incremental amounts to be

included in the restoration costs. For Gulf, the ICCA in Rule 25-6.0143,

F.A.C., should be used to determine the reasonable and prudent amounts to be

included in the restoration costs that were charged to Account 228.1 for

Hurricanes Sally and Zeta. For FPL, use of the ICCA methodology to determine

incremental O&M costs is not applicable in evaluating storm restoration

costs that were charged to base O&M expense for Hurricane Isaias and

Tropical Storm Eta.

Issue 2:

What is the reasonable and prudent amount of regular

payroll expense to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Staff recommends the total amounts of regular

payroll expense to be included in storm restoration costs, as reflected in the

table below.

|

Utility/Storm

|

Incremental

|

Capitalized

|

Non-Incremental (Charged to Base O&M Expense)

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$986,000

|

$-

|

$-

|

$1,100,000

|

$2,086,000

|

|

FPL—Isaias

|

$-

|

$255,000

|

$-

|

$416,000

|

$671,000

|

|

FPL—Eta

|

$-

|

$1,480,000

|

$3,000

|

$846,000

|

$2,329,000

|

|

Gulf—Zeta

|

$132,000

|

$-

|

$37,000

|

$135,000

|

$304,000

|

(Snyder)

Position of the Parties

Gulf:

For Docket No. 20200241-EI, $2.1 million for

Hurricane Sally and for Docket No. 20210179-EI, $304,000 for Hurricane Zeta are

the reasonable and prudent amounts of regular payroll expenses spent in direct

support of storm-related activities.

FPL:

For Docket No. 20210178-EI, $671,000 for Hurricane

Isaias and $2.3 million for Tropical Storm Eta are the reasonable and prudent

amounts of regular payroll expenses spent in direct support of storm-related

activities.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

Rule 25-6.0143(1)(f), F.A.C., lists the types of

storm-related costs that are prohibited from being charged to customers under

the ICCA methodology including base rate recoverable regular payroll and regular

payroll-related costs for utility managerial and non-managerial personnel. The

utility failed to limit its request to incremental costs by not removing

regular payroll and related costs. Thus,

OPC recommends that $0.957 million (jurisdictional) be disallowed in addition

to the costs already removed by the utility.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

Rule 25-6.0143(1)(f), F.A.C., lists the types of

storm-related costs that are prohibited from being charged to customers under

the ICCA methodology including base rate-recoverable regular payroll and

regular payroll-related costs for utility managerial and non-managerial

personnel. The utility failed to limit its request to incremental costs by not

removing all regular payroll and related costs.

Thus, OPC recommends that $0.320 million (jurisdictional) be disallowed

in addition to the costs already removed by the utility.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

Rule 25-6.0143(1)(f), F.A.C., lists the types of

storm-related costs that are prohibited from being charged to customers under

the ICCA methodology including base rate-recoverable regular payroll and

regular payroll-related costs for utility managerial and non-managerial

personnel. The utility failed to limit

its request to incremental costs by not removing regular payroll and related

costs. Thus, OPC recommends that $1.429

million (jurisdictional) be disallowed in addition to the costs already removed

by the utility.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

Rule 25-6.0143(1)(f), F.A.C., lists the types of

storm-related costs that are prohibited from being charged to customers under

the ICCA methodology including base rate-recoverable regular payroll and

regular payroll-related costs for utility managerial and non-managerial

personnel. The utility failed to limit

its request to incremental costs by not removing all regular payroll and

related costs. Thus, OPC recommends that

$0.131 million (jurisdictional) be disallowed in addition to the costs already

removed by the utility.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf

Sally

Gulf asserted that the total amount of storm restoration

costs related to regular payroll and related overhead costs for Hurricane Sally

is $2.1 million. (EXH 11, 43) After the application of the ICCA methodology,

$1.1 million was deemed as non-incremental and $968,000 was considered incremental.

(Gulf & FPL BR 15) The $1.1 million was charged to base O&M expenses

pursuant to the 2006 Storm Order.

(TR 456) Gulf determined the total non-incremental payroll by calculating the

budgeted base O&M payroll percentage as compared to total budgeted payroll

for the month in which the storm occurred, and then multiplied that percentage

by the total actual payroll costs incurred for Gulf’s employees directly

supporting storm restoration. (TR 271-272, 291-292) Gulf contended this is

consistent with the intent and purpose of the ICCA methodology. (Gulf & FPL

BR 13)

Zeta

Gulf asserted that the total amount of storm restoration

costs related to regular payroll and related overhead costs for Hurricane Zeta

is $304,000. (EXH 12, 44) Gulf identified $37,000 as capital and $135,000 as

non-incremental with the remaining $132,000 deemed incremental. (Gulf & FPL

BR 16) The $135,00 was charged to base O&M expenses pursuant to the 2006

Storm Order.Gulf

determined the total non-incremental payroll by calculating the budgeted base

O&M payroll percentage as compared to total budgeted payroll for the month

in which the storm occurred, and then multiplied that percentage by the total

actual payroll costs incurred for Gulf’s employees directly supporting storm

restoration. (TR 271-272, 291-292) Gulf contended this is consistent with the

intent and purpose of the ICCA methodology. (Gulf & FPL BR 13)

FPL

Isaias

FPL asserted that the total amount of storm restoration

costs related to regular payroll and related overhead for Hurricane Isaias is

$671,000. (EXH 25, 46) FPL determined the total non-incremental payroll by

calculating the budgeted base O&M payroll percentage as compared to total

budgeted payroll for the month in which the storm occurred, and then multiplied

that percentage by the total actual payroll costs incurred for FPL’s employees

directly supporting storm restoration. (TR 271-272, 291-292) FPL contended this

is consistent with the intent and purpose of the ICCA methodology. (Gulf &

FPL BR 13)

Eta

FPL asserted that the total amount of storm restoration

costs related to regular payroll and related overhead for Tropical Storm Eta is

$2.3 million. (EXH 26, 46) FPL identified $3,000 of this amount that was

charged to capital. FPL determined the total non-incremental payroll by

calculating the budgeted base O&M payroll percentage as compared to total

budgeted payroll for the month in which the storm occurred, and then multiplied

that percentage by the total actual payroll costs incurred for FPL’s employees

directly supporting storm restoration. (TR 271-272, 291-292) FPL contended this

is consistent with the intent and purpose of the ICCA methodology. (Gulf &

FPL BR 13)

OPC

OPC contented that the Companies failed to limit its costs

charged to customers to only those incremental costs above the “costs that

normally would be charged to non-cost recovery clause operating expenses in the

absence of a storm.” (OPC BR 10; TR 396) Gulf failed to exclude all

straight-time labor and related loadings costs as required by the Rule. (OPC BR

10; TR 396) Gulf only excluded a portion of straight-time labor and related

loadings for non-cost recovery clause operating expenses included in its 2020

budget. (OPC BR 10; TR 396) Witness Kollen recommended a reduction, on a retail

jurisdictional basis, of $0.957 million for Hurricane Sally, $0.320 million for

Hurricane Isaias, $1.429 million for Tropical Storm Eta, and $0.131 million for

Hurricane Zeta. (OPC BR 10; TR 399-400)

ANALYSIS

Rule 25-6.0143(1)(e)8, F.A.C., states that “overtime payroll

and payroll related costs for utility personnel included in storm restoration

activities” are allowed to be charged to the reserve under the ICCA

methodology. Staff believes that the full amounts calculated by Gulf and FPL are

allowable under Rule 25-6.0143, F.A.C.

OPC witness Kollen testified that the Companies failed to

limit their costs charged to customers to only those incremental costs above

the costs that normally would be charged to non-cost recovery clause operating

expenses in the absence of a storm, and the Companies failed to exclude all

straight-time labor and related loadings costs as required by the Rule. (TR

396) OPC argued that Gulf excluded only 45 percent of the distribution

straight-time labor costs and 41 percent of the straight-time transmission

labor costs related to Hurricane Sally and 40 percent of the distribution

straight-time labor costs and 29 percent of the straight-time transmission

labor costs for Hurricane Zeta. (TR 396) FPL excluded only 48 percent of the

distribution straight-time labor costs and 34 percent of the straight-time

transmission labor costs related to Hurricane Isaias and 37 percent of the

distribution straight-time labor costs and 16 percent of the straight-time

transmission labor costs for Tropical Storm Eta. (TR 396)

The Companies asserted that the total amounts of storm

restoration costs related to regular payroll and related overhead costs are

$2.1 million for Hurricane Sally, $671,000 for Hurricane Isaias, $2.3 million

for Tropical Storm Eta, and $304,000 for Hurricane Zeta. (EXH 11-12, 25-26,

43-44, 46) FPL witness Hughes testified that the Companies’ regular payroll

costs recovered through base O&M expense are non-incremental. (TR 455-456)

However, during a storm event, the Companies’ regular payroll normally

recovered through capital or cost recovery clauses can be charged to the storm

reserve based on the 2006 Storm Order which stated, “otherwise, the costs would

effectively be disallowed because there is no provision to recover those costs

in base rate operation and maintenance costs.…” (TR

455-456)

The Companies determined the amount of non-incremental

payroll by calculating the respective Company’s budgeted base O&M payroll

percentage as compared to total budgeted payroll for the month in which the storm

occurred, including cost recovery clauses and capital by cost center. That

percentage was then multiplied by the total actual payroll costs incurred

(excluding overtime) for the Companies’ employees directly supporting storm

restoration. (TR 271-272, 291-292) The Companies argued that while Rule

25-6.0143, F.A.C., does not expressly state how the ICCA methodology should be

applied to regular payroll, the Rule does provide guidance on this issue. (TR

457) FPL witness Hughes testified that Rules 25-6.0143(1)(f)1 &

25-6.0143(1)(d), F.A.C., read in conjunction with Rule 25-6.0143(1)(f)7,

F.A.C., shows that the Rule should be applied to exclude the normal regular

base payroll O&M expense that would have been incurred in the absence of

the storm. (TR 457)

Staff agrees with witness Hughes’ application of the Rule.

Therefore, staff believes that the regular payroll and related overhead costs to

be included in storm restoration costs are $2.1 million for Hurricane Sally,

$671,000 for Hurricane Isaias, $2.3 million for Tropical Storm Eta, and

$304,000 for Hurricane Zeta; these costs should be recovered through a

surcharge, charged to base O&M expense, or capitalized, as specified in the

table below.

CONCLUSION

Staff recommends the total amounts of regular payroll expense

to be included in storm restoration costs, as reflected in the table below.

|

Utility/Storm

|

Incremental

|

Capitalized

|

Non-Incremental (Charged to Base O&M Expense)

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$986,000

|

$-

|

$-

|

$1,100,000

|

$2,086,000

|

|

FPL—Isaias

|

$-

|

$255,000

|

$-

|

$416,000

|

$671,000

|

|

FPL—Eta

|

$-

|

$1,480,000

|

$3,000

|

$846,000

|

$2,329,000

|

|

Gulf—Zeta

|

$132,000

|

$-

|

$37,000

|

$135,000

|

$304,000

|

Issue 3:

What is the reasonable and prudent amount of

overtime payroll expense to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Staff recommends the total amounts of overtime

payroll expense to be included in storm restoration costs, as reflected in the

table below.

|

Utility/Storm

|

Incremental

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$3,200,000

|

$-

|

|

FPL—Isaias

|

$-

|

$4,700,000

|

|

FPL—Eta

|

$-

|

$8,800,000

|

|

Gulf—Zeta

|

$339,000

|

$-

|

(Snyder)

Position of the Parties

Gulf:

For Docket No. 20200241-EI, $3.2 million for

Hurricane Sally and for Docket No. 20210179-EI, $339,000 for Hurricane Zeta are

the reasonable and prudent amounts of overtime payroll expenses spent in direct

support of storm-related activities.

FPL:

For Docket No. 20210178-EI, $4.7 million for

Hurricane Isaias and $8.8 million for Tropical Storm Eta are the reasonable and

prudent amounts of overtime payroll expenses spent in direct support of

storm-related activities.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

The utility failed to limit its request to incremental

costs by simply claiming that the entire overtime payroll and related costs

were incremental, although the base revenue requirement includes overtime

payroll and related costs. It failed to

provide the amounts included in the base revenue requirement which results in

overstating overtime. OPC recommends 25%

disallowance in the absence of necessary detail being provided by the utility.

Thus, $0.802 million (jurisdictional) should be disallowed.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

The utility failed to limit its request to incremental

costs by not removing all non-incremental overtime payroll costs by simply

claiming that the entire overtime payroll and related costs were incremental,

although the base revenue requirement includes overtime payroll and related

costs. It failed to provide the amounts

included in the base revenue requirement which results in overstating overtime. OPC recommends 25% disallowance in the absence

of necessary detail being provided by the utility. Thus, $1.146 million

(jurisdictional) should be disallowed.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

The utility failed to limit its request to incremental

costs by not removing all non-incremental overtime payroll costs by simply

claiming that the entire overtime payroll and related costs were incremental,

although the base revenue requirement includes overtime payroll and related

costs. It failed to provide the amounts

included in the base revenue requirement which results in overstating

overtime. OPC recommends 25%

disallowance in the absence of necessary detail being provided by the utility.

Thus, $2.097 million (jurisdictional) should be disallowed.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

The utility failed to limit its request to incremental

costs by not removing all non-incremental overtime payroll costs by simply

claiming that the entire overtime payroll and related costs were incremental,

although the base revenue requirement includes overtime payroll and related

costs. It failed to provide the amounts

included in the base revenue requirement which results in overstating

overtime. OPC recommends 25%

disallowance in the absence of necessary detail being provided by the utility.

Thus, $0.084 million (jurisdictional) should be disallowed.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf

The Companies stated that its accounting for overtime

payroll storm restoration costs for Hurricane Sally is consistent with the ICCA

methodology under Rule 25-6.0143, F.A.C. (Gulf & FPL BR 16) Gulf & FPL contended

that the overtime payroll for the storm events was neither budgeted nor planned

and is therefore incremental. (Gulf & FPL BR 18; TR 460, 503-504) The

Companies asserted that the total amount of overtime payroll and related

overhead costs is $3.2 million for Hurricane Sally, $4.7 million for Hurricane

Isaias, $8.8 million for Tropical Storm Eta, and $339,000 for Hurricane Zeta. (Gulf

& FPL BR 18; EXH 11, 12, 25, 43, 44. 45, 46)

OPC

OPC argued that the Companies made no adjustments to

remove storm costs that were non-incremental or capitalizable, thus failing to

limit storm costs to those that are incremental. (OPC BR 13) OPC also argued

that the Companies failed to provide the amount of overtime payroll and related

expenses that was included in Gulf’s base rates. (OPC BR 13-14; TR 401) OPC

recommended a 25-percent disallowance on all incremental amounts of overtime

costs. (OPC BR 13-14; TR 402) Witness Kollen recommended a disallowance for

claimed overtime payroll and related costs of $0.802 million for Hurricane

Sally, $1.146 million for Hurricane Isaias, $2.097 million for Tropical Storm

Eta, and $0.084 million for Hurricane Zeta. (OPC BR 13-14; TR 402)

ANALYSIS

Rule 25-6.0143(1)(e)8, F.A.C., states “overtime payroll

and payroll related costs for utility personnel included in storm restoration

activities” are allowed to be charged to the reserve under the ICCA

methodology. Staff believes that the full amount calculated by Gulf and FPL is

allowable under Rule 25-6.0143, F.A.C.

OPC witness Kollen testified that the Companies failed to

provide the amount of overtime payroll and related expenses that was included

in base rates and without the overtime payroll and related amounts in base

rates, it is not possible to quantify the amount normally incurred. (TR 401) He

asserted that because all overtime payroll and related costs were claimed by

the Companies, without excluding the amount of overtime payroll and related

costs normally included in base rates, the claimed overtime payroll and related

costs amounts are overstated. (TR 401) Witness Kollen recommended a 25-percent

disallowance for all overtime expenses in absence of the information to

calculate the non-incremental amount more precisely. (TR 402)

The Companies stated the total amount of overtime payroll

and related overhead costs is $3.2 million for Hurricane Sally, $4.7 million

for Hurricane Isaias, $8.8 million for Tropical Storm Eta, and $339,000 for

Hurricane Zeta. (EXH 11-12, 25-26, 43-46) The Companies argued that they do not

budget for overtime payroll expenses for qualifying storm events and thus these

costs are unplanned and incremental as they relate to the ICCA methodology. (Gulf

& FPL BR 16-17) FPL witness Hughes explained that base rates in effect

during 2020 were the result of Commissioned-approved settlement agreements

entered into by both Gulf and FPL in separate rate case dockets, and in these

settlement agreements, overtime payroll for the storm events were neither

budgeted nor planned. (TR 460, 503-504; EXH 28) Thus, witness Hughes argued

that any and all associated overtime payroll is incremental. (TR 460) Staff

agrees with FPL witness Hughes, as the overtime costs for storm events are not

budgeted nor planned and are therefore incremental and should be included in

storm restoration costs. These costs should be recovered through a surcharge or

charged to base O&M expense, as specified in the table below

CONCLUSION

Staff recommends the total amounts of overtime payroll expense

to be included in storm restoration costs, as reflected in the table below.

|

Utility/Storm

|

Incremental

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$3,200,000

|

$-

|

|

FPL—Isaias

|

$-

|

$4,700,000

|

|

FPL—Eta

|

$-

|

$8,800,000

|

|

Gulf—Zeta

|

$339,000

|

$-

|

Issue 4:

What is the reasonable and prudent amount of

contractor costs to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Staff recommends the total amounts of contractor

costs to be included in storm restoration costs, as reflected in the table

below.

|

Utility/Storm

|

Incremental

|

Capitalized

|

Insurance

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$93,100,000

|

$-

|

$16,400,000

|

$16,100,000

|

$125,600,000

|

|

FPL—Isaias

|

$-

|

$36,300,000

|

$-

|

$-

|

$36,300,000

|

|

FPL—Eta

|

$-

|

$77,370,000

|

$30,000

|

$-

|

$77,400,000

|

|

Gulf—Zeta

|

$5,730,000

|

$-

|

$70,000

|

$-

|

$5,800,000

|

(P. Buys)

Position of the Parties

Gulf:

For Docket No. 20200241-EI, $125.6 million for

Hurricane Sally and for Docket No. 20210179-EI, $5.8 million for Hurricane Zeta

are the reasonable and prudent amounts of contractor that were necessary to

support Gulf’s storm restoration effort.

FPL:

For Docket No. 20210178-EI, $36.3 million for

Hurricane Isaias and $77.4 million for Tropical Storm Eta are the reasonable

and prudent amounts of contractor costs that were necessary to support storm

restoration effort.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

The base revenue requirement includes costs for embedded

line contractors that normally work for the utility and were used for storm

restoration. The utility did not provide

the information necessary to exclude these costs based on the historic

three-year average resulting in overstating contract labor. OPC recommends 2% of the requested contract

labor be disallowed in the absence of necessary detail being provided by the

utility. Thus, $1.416 million

(jurisdictional) should be disallowed.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

The base revenue requirement includes costs for embedded

line contractors that normally work for the utility and were used for storm

restoration. The utility did not provide

the information necessary to exclude these costs based on the historic

three-year average resulting in overstating contract labor. OPC recommends 2% of the requested contract

labor be disallowed in the absence of necessary detail being provided by the

utility. Thus, $0.612 million (jurisdictional) should be disallowed.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

The base revenue requirement includes costs for embedded

line contractors that normally work for the utility and were used for storm

restoration. The utility did not provide the information necessary to exclude

these costs based on the historic three-year average resulting in overstating

contract labor. OPC recommends 2% of the

requested contract labor be disallowed in the absence of necessary detail being

provided by the utility. Thus, $1.325 million (jurisdictional) should be

disallowed.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

The base revenue requirement includes costs for embedded

line contractors that normally work for the utility and were used for storm

restoration. The utility did not provide the information necessary to exclude

these costs based on the historic three-year average resulting in overstating

contract labor. OPC recommends 2% of the

requested contract labor be disallowed in the absence of necessary detail being

provided by the utility. Thus, $0.109 million (jurisdictional) should be

disallowed.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf & FPL

The Companies argued that their accounting for contractor

storm restoration costs for Hurricanes Sally, Zeta, and Isaias, and Tropical

Storm Eta, was consistent with the ICCA methodology under Rule 25-6.0143,

F.A.C., and prior Commission Orders. The Companies opined that OPC’s

recommendation to reduce the amount by 2 percent without detailed justification

is unsupported and should be rejected. (Gulf & FPL BR 19)

In their brief, the Companies described the model used for

estimating the amount of construction man-hours needed to restore service.

Information such as travel distance, relative labor costs, and resource

availability is considered when decisions are made regarding final contractor

and mutual-aid resources. The Companies argued that each storm is different and

that the cheapest restoration costs are not always equivalent to the safest and

most timely restoration options. (Gulf & FPL BR 19-20)

In response to OPC’s argument, the Companies opined that

they are permitted to charge costs for additional contractor labor for storm

restoration activities to the service reserve pursuant to Rule 25-6.0143(e)(1),

F.A.C. Contractor costs are incremental in nature because if the storm event

did not happen, the Companies would not need to hire additional contractor

labor. (Gulf & FPL BR 20) Further, the Companies argued that any contractor

costs not recovered through normal base rates are eligible to be recovered

through the storm reserve. OPC alleges that the Companies refused to give a

three-year historical average on the embedded line contractor costs; however,

as the Companies argued, OPC ignored the fact that the 2007 version of Rule

25-6.0143, F.A.C., applies to these storms and that version does not require

historical average data to be given to justify the costs. (Gulf & FPL BR

20) In addition, the Companies argued the base rates in effect during 2020 were

the result of settlement agreements approved by the Commission, and did not

specify an amount for embedded line contractors and embedded line contractor

costs because storm events are neither budgeted nor planned, and by definition,

incremental. (Gulf & FPL BR 20-21)

OPC

OPC argued that the Companies failed to demonstrate that

its line contractor costs are all incremental. As a result, OPC proposed a 2

percent disallowance for claimed line contractor costs. In support of its

position, OPC cited Rule 25-6.0143, F.A.C., which describes the ICCA methodology,

and states that utilities are only allowed to charge costs to the storm account

if the costs are incremental. The Rule also allows for additional contract

labor that complies with the ICCA methodology. Additionally, OPC believes FPL

charged storm costs to its base O&M rather than its storm reserve, due to

its reserve surplus amortization mechanism (RSAM). (OPC BR 15-16)

OPC is concerned that the Companies will be permitted to

recover their contractor costs twice, both through base rates and a storm surcharge

or through the RSAM. OPC was unable to calculate the non-incremental amount of

contractor costs because the Companies refused to provide historical data to

quantify the embedded costs included in base rates. (OPC BR 16-17) Not all

contractor costs are incremental since some are budgeted and planned for

through base rates; however, costs recovered through the storm account should

all be incremental pursuant to the Rule. Therefore, OPC argued that the

Companies failed to meet their burden of demonstrating that all contractor

costs included in storm cost recovery are incremental. As a result, OPC argued

a 2 percent disallowance should be applied. (OPC BR 17-18)

ANALYSIS

Pursuant to Rule 25-6.0143, F.A.C., the ICCA methodology

is to be used to determine costs for storm-related damages. The Rule also lists

types of storm related costs that are allowed, such as additional contractor

labor and transportation of crews for storm restoration. Table 4-1 identifies

the revised contractor costs that Gulf and FPL are requesting to be recovered

for Hurricanes Sally, Zeta, and Isaias and Tropical Storm Eta.

Table 4-1

Gulf and FPL Original and

Revised Contractor Costs Per Storm ($million)

|

|

Hurricane Sally (Gulf)

|

Hurricane Zeta (Gulf)

|

Hurricane Isaias (FPL)

|

Tropical Storm Eta (FPL)

|

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

|

Contractor Costs

|

$126.6

|

$125.6

|

$5.8

|

$5.8

|

$36.4

|

$36.3

|

$78.2

|

$77.4

|

|

Capital Cost

|

16.4

|

16.4

|

0.07

|

0.07

|

0.0

|

0.0

|

0.03

|

0.03

|

|

Insurance Receivable

|

16.1

|

16.1

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

0.0

|

|

Total

|

$94.1

|

$93.1

|

$5.7

|

$5.7

|

$36.4

|

$36.3

|

$78.2

|

$77.4

|

Source: EXH 11; EXH 12; EXH 25; EXH 26; EXH 43; EXH 44;

EXH 45; & EXH 46

OPC witness Futral testified that certain amounts

associated with various vendors were accrued as estimates and posted to the

general ledger, but that the invoices were either double posted, not received

and paid, or consisted of different amounts compared to the original estimates.

(TR 419) In response, Gulf and FPL agreed to reduce the amounts of the

contractors’ costs as shown in Table 4-1 as the Revised Request.

OPC Witness Kollen testified that the Companies used

embedded line contractors to respond to storms. He argued that the costs of

embedded contractors are recovered in the Companies’ base revenues. Witness

Kollen further testified that neither FPL or Gulf reduced its contractor costs

by “the costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm” as required by Rule

25-6.0143(1)(d), F.A.C. He stated that as a result, the contractor costs are

overstated. Witness Kollen argued that the Companies are not entitled to

recover these costs twice, once in the base revenues and then again either

through a storm surcharge or through a charge to base O&M expense under the

RSAM. He stated that the Companies objected and refused to provide the historic

information necessary to quantify the embedded contractor costs. (TR 403)

Moreover, according to witness Kollen the historic information would be used to

determine a three-year historic average similar to what is used to exclude

vegetation management. Because he did not have the information at the time he

filed his testimony, witness Kollen recommended a disallowance of 2 percent for

the contractor costs in addition to the revisions already agreed to by Gulf and

FPL. This recommended 2 percent adjustment results in the following

disallowances to contractor costs: $1.46 million for Hurricane Sally, $0.612

million for Hurricane Isaias, $1.325 million for Tropical Storm Eta, and $0.109

million for Hurricane Zeta. (TR 404)

In rebuttal, FPL witness Hughes testified that witness

Kollen’s proposed adjustments are based entirely on his erroneous application

of the ICCA methodology. (TR 455) Witness Hughes testified that the Companies

followed Rule 25-6.0143(1)(e)1., F.A.C., which states “additional contractor

labor hired for storm restoration activities” are allowed to be recovered. He

further testified that the contractor costs are neither budgeted nor planned

and that they are therefore incremental in nature. The Companies would not have

incurred these contractor expenses if it were not for the storms. (TR 461)

The base rates in effect for 2020 were the result of settlement

agreements, as such they did not fix or otherwise specify the amounts

attributed to embedded line contractors. The Companies noted that the actual

amount of embedded line contractor expense to be charged to base rates

fluctuates from year to year, but the fluctuations do not alter the fixed base

rates charged to customers under the settlement agreements. (EXH 47, BSP 00007;

EXH 48, BSP 00031; EXH 49, BSP 00056) The Companies also stated that embedded

contractors are paid for “day-to-day services” pursuant to their contracts for

blue-sky work. When the embedded contractors are mobilized for storm

restoration work, a storm rate goes into effect, which applies to both embedded

and non-embedded contractors. (EXH 47, BSP 00015; EXH 48, BSP 00046; EXH 49,

BSP 00063) In addition, as witness Hughes testified, Commission staff conducted

an audit to determine if the storm costs were properly stated and recorded, and

the final audit report reflected no findings regarding the costs incurred

during the restoration of the storms. (TR 454)

As discussed in Issue 1, it appears that Gulf and FPL

followed the 2007 version of Rule 25-6.0143, F.A.C., which was in place during

Hurricanes Sally, Isaias, and Zeta, and Tropical Storm Eta. The storms took

place during the 2020 hurricane season, which was prior to the 2021 revision of

the Rule. (Gulf & FPL BR 12) Staff disagrees with OPC that costs for the

use of embedded contractors deployed for storm restoration are charged to base

rates. During the hearing, FPL witness Hughes demonstrated that the costs for

embedded line crews that are redeployed from normal operations to storm

activities are not recovered in FPL’s base rates. (TR 325) He further explained

that any contractor costs which are not recovered through normal base rates

would be eligible to be recovered as part of the storm reserve, as they are

incremental. (TR 326) Therefore, it appears that the Companies are not double-recovering

these costs as OPC alleges. Further, OPC witness Futral testified that the

Companies’ resulting “audit and verification processes for all overhead line

and vegetation management contractor invoices were systematic, comprehensive,

and effective in auditing all submitted costs elements.” (TR 418) It appears

that the Companies’ adjustments are consistent with the ICCA methodology and

therefore appropriate for recovery. Based on the above information, staff

recommends the reasonable and prudent contractor costs to be included in storm

restoration costs are the Companies’ revised costs shown in Table 4-1; these

costs should be recovered through a surcharge, charged to base O&M expense,

or offset by an insurance receivable, as specified in the table below.

CONCLUSION

Staff recommends the total amounts of contractor costs to

be included in storm restoration costs, as reflected in the table below.

|

Utility/Storm

|

Incremental

|

Capitalized

|

Insurance

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$93,100,000

|

$-

|

$16,400,000

|

$16,100,000

|

$125,600,000

|

|

FPL—Isaias

|

$-

|

$36,300,000

|

$-

|

$-

|

$36,300,000

|

|

FPL—Eta

|

$-

|

$77,370,000

|

$30,000

|

$-

|

$77,400,000

|

|

Gulf—Zeta

|

$5,730,000

|

$-

|

$70,000

|

$-

|

$5,800,000

|

Issue 5:

What is the reasonable and prudent amount of

vegetation and line clearing costs to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Staff recommends the total amounts of vegetation and

line clearing costs to be included in storm restoration costs, as reflected in

the table below.

|

Utility/Storm

|

Incremental

|

Non-Incremental (Charged to Base O&M Expense)

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$26,600,000

|

$-

|

$700,000

|

$27,300,000

|

|

FPL—Isaias

|

$-

|

$11,800,000

|

$1,200,000

|

$13,000,000

|

|

FPL—Eta

|

$-

|

$11,200,000

|

$-

|

$11,200,000

|

|

Gulf—Zeta

|

$1,200,000

|

$-

|

$700,000

|

$1,900,000

|

(P. Buys)

Position of the Parties

Gulf:

For Docket No. 20200241-EI, $27.3 million for

Hurricane Sally and for Docket No. 20210179-EI, $1.9 million for Hurricane Zeta

are the reasonable and prudent amounts of vegetation and line clearing costs

associated Gulf’s storm restoration effort.

FPL:

For Docket No. 20210178-EI, $13.0 million for

Hurricane Isaias and $11.2 million for Tropical Storm Eta are the reasonable

and prudent amounts of vegetation and line clearing costs associated with its

storm restoration effort.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

Rule 25-6.0143(1)(d), F.A.C., requires storm costs must

exclude those costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm.

Costs for various overhead line and vegetation management contractors

were accrued as estimates and posted to the general ledger, but the invoices

were either double posted, not received and paid, or differed in amount

compared to the original estimates. OPC

is recommending $0.229 million (jurisdictional) be disallowed.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

Rule 25-6.0143(1)(d), F.A.C., requires storm costs must

exclude those costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm.

Costs for various overhead line and vegetation management contractors

were accrued as estimates and posted to the general ledger, but the invoices

were either double posted, not received and paid, or differed in amount

compared to the original estimates. OPC

is recommending $0.081 million (jurisdictional) be disallowed.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

Rule 25-6.0143(1)(d), F.A.C., requires storm costs must

exclude those costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm.

Costs for various overhead line and vegetation management contractors

were accrued as estimates and posted to the general ledger, but the invoices

were either double posted, not received and paid, or differed in amount

compared to the original estimates. OPC

is recommending $0.116 million (jurisdictional) be disallowed.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

Rule 25-6.0143(1)(d), F.A.C., requires storm costs must

exclude those costs that normally would be charged to non-cost recovery clause

operating expenses in the absence of a storm.

Costs for various overhead line and vegetation management contractors

were accrued as estimates and posted to the general ledger, but the invoices

were either double posted, not received and paid, or differed in amount

compared to the original estimates. OPC

is recommending $0.005 million (jurisdictional) be disallowed.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf & FPL

The Companies argued that their accounting for vegetation

and line clearing costs is consistent with the ICCA methodology under Rule

25-6.0143, F.A.C., the Hurricane Irma Settlement Agreement, and the Hurricane

Michael Settlement Agreement. The Companies opined that the costs were

reasonable and prudent and noted that OPC praised their accounting, auditing

and verification process. Further, the Companies argued that OPC’s recommendation

to reduce vegetation and line clearing costs for Hurricanes Sally, Zeta, and

Isaias, and Tropical Storm Eta, is unsupported and should be rejected. (Gulf

& FPL BR 22)

In 2019, FPL entered into the Hurricane Irma Settlement

Agreement with OPC. In 2020, Gulf entered into the Hurricane Michael Settlement

Agreement with OPC. Based on procedures implemented in both settlements, the

Companies provided OPC with records for overhead line and vegetation crews in

“flat files” that are electronic and searchable. In addition, the Companies

implemented their iStormed Application (the App), which contains electronic

timesheets and expense information for overhead line and vegetation crews

contractors. All of the contractor invoices were reviewed by FPL’s cost finalization

team and any applicable adjustments and exceptions were documented in the flat

files. (Gulf & FPL BR 22-23)

The Companies noted that OPC praised the App and its

accounting processes. (TR 441-442) However, OPC alleged that certain amounts

associated with various vendors were posted to the general ledger incorrectly.

The Companies provided additional cost support, work papers, contracts, and

invoices to support the payments, and also made the appropriate minor

adjustments. The Companies argued these adjustments were reflected in witness

Hughes’ rebuttal testimony and that the Commission should reject OPC’s

recommendation to disallow these adjustments. (Gulf & FPL BR 23-24)

The Companies further argued that OPC made several

recommendations that fall outside the scope of this proceeding. OPC recommended

that the Companies expand the App to include underground crews, arborists,

transmission storm restoration contractors, and damage assessors. OPC also

recommended that the Commission direct the Companies to institute a binder file

structure where a physical binder would be provided to OPC. The Companies

argued that the Prehearing Officer determined this was beyond the scope of this

proceeding and the appropriate relief is to disallow the disputed costs and not

to impose new procedural requirements. (Gulf

& FPL BR 24)

OPC

OPC stated that Rule 25-6.0143, F.A.C., describes the ICCA

methodology, which only allows utilities to charge costs to the storm account

if the costs are incremental. The Rule also allows for additional vegetation

management costs that comply with the ICCA methodology. OPC further stated that

the Rule allows utilities to charge storm costs to base O&M expense instead

of the storm reserve, and pointed out that FPL charged storm costs to its

O&M expense because of its RSAM. OPC argued the Rule only has one

description of storm-related damages or storm costs that may be recovered and

that description is not dependent on the method of recovery, i.e., storm

surcharge or O&M expense. (OPC BR 19)

OPC stated that witness Futral’s audit team reviewed

copies of all invoices over $10,000 provided by the Companies and verified the

timing of costs incurred, whether the costs were appropriate for storm cost

recovery by storm, line item costs matching contract and purchase order

pricing, and the total invoice levels matching the general ledger, and that

there were no duplications of individual costs items. The audit results, as confirmed

through discovery, showed that certain amounts were based on estimated amounts

due, invoices that were not received, or the amount paid differed from original

estimates. Therefore, OPC recommends disallowing $0.2229 million for Hurricane

Sally, $0.005 million for Hurricane Zeta, $0.081 million for Hurricane Isaias,

and $0.116 million for Tropical Storm Eta. (OPC BR 19-20)

OPC recommended that copies of all relevant invoice

documentation related to all contractors and vendors that do not use the App be

provided with the Notice of Filings to assist in the review process. OPC also

recommended that the App be expanded to include underground line crews,

arborists, transmission storm restoration contractors, and damage assessors. In

addition, OPC recommended that the Companies provide a binder file structure

where each vendor is assigned a binder in which all relative information

(invoices, timesheets) is included. OPC argued that, currently, FPL puts each

invoice in individual files and the individual files are not grouped or

identified by vendor. OPC further opined that this existing process is

unnecessarily burdensome, time consuming, and costly, and thus is neither

reasonable nor prudent. (OPC BR 20-21).

ANALYSIS

Pursuant to Rule 25-6.0143, F.A.C., the ICCA methodology

is to be used to determine costs to cover storm-related damages. The Rule also

explains that if tree trimming expenses are incurred in the same month as storm

restoration, and are less than the actual monthly average for the same month in

the three previous calendar years, then those tree trimming expenses are excluded

from storm related costs. Table 5-1 identifies the revised vegetation and line

clearing costs that Gulf and FPL are requesting to be recovered for Hurricanes

Sally, Zeta, and Isaias, and Tropical Storm Eta.

Table 5-1

Gulf and FPL Original and

Revised Vegetation and Line Clearing Costs Per Storm ($million)

|

|

Hurricane Sally (Gulf)

|

Hurricane Zeta (Gulf)

|

Hurricane Isaias (FPL)

|

Tropical Storm Eta (FPL)

|

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

Original Request

|

Revised Request

|

|

Vegetation and

Line Clearing Costs

|

$26.2

|

$27.3

|

$1.9

|

$1.9

|

$12.8

|

$13.0

|

$10.4

|

$11.2

|

|

ICCA Adjustments

|

0.7

|

0.7

|

0.7

|

0.7

|

1.2

|

1.2

|

0.0

|

0.0

|

|

Total

|

$25.5

|

$26.6

|

$1.2

|

$1.2

|

$11.6

|

$11.8

|

$10.4

|

$11.2

|

Source: EXH 11; EXH 12; EXH 25; EXH 26; EXH 43; EXH 44;

EXH 45; & EXH 46

OPC witness Futral testified that his team found the

Companies’ iStormed App and resulting audit and verification process for all

overhead line and vegetation management contractor invoices to be systematic,

comprehensive, and effective in auditing all submitted costs elements. He

further testified that the process was effective in auditing the vendor

invoices, documenting exceptions, making reductions where appropriate, and

ultimately in authorizing payments. (TR 418-419) In addition, witness Futral

testified that certain amounts associated with various vendors were accrued as

estimates and posted to the general ledger. However, the invoices were either

double posted, not received and paid, or the amounts differed when compared to

the original estimate. As such, he recommended the following disallowances:

$0.229 million for Hurricane Sally, $0.005 million for Hurricane Zeta, $0.081

million for Hurricane Isaias, and $0.116 million for Tropical Storm Eta. (TR

419) It is unclear if witness Futral’s recommended adjustments apply to all

categories (e.g., payroll, contractor costs, logistics) or just the vegetation

and line clearing category. However, the Companies testified that they

incorporated all adjustments to the final storm costs, which included

adjustments identified by the Companies in their responses to discovery. Table

5-1 reflects the revised adjustments to the vegetation and line clearing costs

and are shown as the Revised Request.

In addition, witness Futral recommended that the Companies

provide copies of all contracts and invoices for overhead line and vegetation

management contractors, as well as other vendors, with their Notice of Filings.

Witness Futral testified this would avoid unnecessary delays for the reviewers.

He also recommended that the Companies institute a Binder file structure to

help streamline the auditing process. Witness Futral testified that currently

the Companies provide an accounts payable detail list of all invoices. The

details as well as the invoices are saved as individual pdf files with a

document number as the file name. He further testified that a reviewer is

required to first determine the document number for each vendor invoice, and

then locate the associated pdf file. Finally, Witness Futral’s final recommendation

was for the Companies to expand the iStorm App to include underground line

contractors, arborists, transmission storm restoration contractor, and damage

assessors. (TR 419-420)

In rebuttal, FPL witness Hughes testified that the

Companies updated their costs as identified in responses to discovery requests

and as shown in Table 5-1. (TR 465) While these updates slightly reduced

vegetation and line clearing costs, FPL found that it inadvertently added some

costs to contractor costs instead of vegetation and line clearing costs which

resulted in a net increase to some vegetation and line clearing costs. (EXH 48,

BSP 00040-00041) The contractor costs were also adjusted accordingly as

discussed in Issue 4. Witness Hughes testified that instituting a Binder file

structure is not required under the Storm Rule nor does it fall under the

provisions of FPL’s Hurricane Irma settlement. He testified that the Companies

provided searchable electronic files for each of the storm events with their

petitions for this proceeding. Witness Hughes further testified that searchable

electronic files are more efficient when reviewing a large volume of data. (TR

454)

It appears that the Companies made adjustments that were

identified by OPC and in discovery. As such, staff recommends the revised

vegetation and line clearing costs, as shown in Table 5-1, are reasonable and

prudent. However, staff disagrees with OPC’s process improvement

recommendations. As FPL argued in its brief, the Prehearing Officer determined

this request was beyond the scope of this proceeding. The Prehearing Office

further stated that the appropriate relief is to disallow the disputed costs

and not to impose new procedural requirements. (Gulf

& FPL BR 24) Based on the above information, staff recommends the

reasonable and prudent vegetation and line clearing costs to be included in

storm restoration costs are the Companies’ revised costs shown in Table 5-1;

these costs should be recovered through a surcharge or charged to base O&M

expense, as specified in the table below

CONCLUSION

Staff recommends the total amounts of vegetation and line

clearing costs to be included in storm restoration costs, as reflected in the

table below.

|

Utility/Storm

|

Incremental

|

Non-Incremental (Charged to Base O&M Expense)

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$26,600,000

|

$-

|

$700,000

|

$27,300,000

|

|

FPL—Isaias

|

$-

|

$11,800,000

|

$1,200,000

|

$13,000,000

|

|

FPL—Eta

|

$-

|

$11,200,000

|

$-

|

$11,200,000

|

|

Gulf—Zeta

|

$1,200,000

|

$-

|

$700,000

|

$1,900,000

|

Issue 6:

What is the reasonable and prudent amount of

employee expenses to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

Staff recommends that the total amount of employee

expenses to be included in storm restoration costs is $278,000 for Hurricane

Sally, $14,000 for Hurricane Isaias, $37,000 for Tropical Storm Eta, and

$53,000 for Hurricane Zeta. All employee expenses are non-incremental costs,

are not recoverable under the ICCA methodology, and should be charged to base

O&M expense. (Norris, Snyder)

Position of the Parties

Gulf:

For Docket No. 20200241-EI, $278,000 for Hurricane

Sally and for Docket No. 20210179-EI, $53,000 for Hurricane Zeta are the

reasonable and prudent amounts of employee assistance expenses associated with

Gulf’s storm restoration effort.

FPL:

For Docket No. 20210178-EI, $14,000 for Hurricane

Isaias and $37,000 for Tropical Storm Eta are the reasonable and prudent

amounts of employee assistance associated with its storm restoration effort.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

The employee expenses included in the utility’s request

should be reduced consistent with OPC’s positions on the disallowance of

non-incremental regular payroll and overtime payroll.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

The employee expenses included in the utility’s request

should be reduced consistent with OPC’s positions on the disallowance of

non-incremental regular payroll and overtime payroll.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

The employee expenses included in the utility’s request

should be reduced consistent with OPC’s positions on the disallowance of

non-incremental regular payroll and overtime payroll.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

The employee expenses included in the utility’s request

should be reduced consistent with OPC’s positions on the disallowance of

non-incremental regular payroll and overtime payroll.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf & FPL

Witness Hughes testified that employee assistance expenses

are not recoverable under the ICCA methodology pursuant to Rule

25-6.0143(1)(f), F.A.C., and are considered non-incremental costs. (TR 273,

293, 310) However, the Companies disagreed with OPC’s recommendation to

completely disallow these costs, because they are non-incremental. (Gulf &

FPL BR 25) Gulf & FPL argued that a storm cost is not disallowed as a base

O&M expense solely because it is non-incremental under the ICCA methodology

rather the costs would have to be found imprudent or unreasonable to make such

an adjustment. (Gulf & FPL BR 25-26) The Companies also noted that OPC did

not characterize or claim that the employee assistance expenses were

unreasonable or imprudent. (OPC BR 25) The Companies maintained that the total

amount of employee assistance expenses is $278,000 for Hurricane Sally, $37,000

for Hurricane Isaias, ount is considered non-incremental. (OPC BR 26; EXH 11,

12, 25, 26, 43, 44, 45, 46)

OPC

OPC argued that employee expenses should be reduced

consistent with OPC’s positions on the disallowance of non-incremental regular

payroll and overtime payroll. (OPC BR 22)

ANALYSIS

As testified by FPL witness Hughes, Rule 25-6.0143(1)(f)4,

F.A.C., prohibits employee assistance costs from being charged to the reserve

under the ICCA methodology, thus making them non-incremental. (TR 273, 293,

310) Gulf chose to seek recovery for Hurricane Sally and Hurricane Zeta storm

restoration costs through separate storm recovery surcharges. (TR 317) As such,

Gulf removed employee assistance expense from the total incremental amount of

storm restoration costs for each storm pursuant to ICCA methodology and charged

them to base O&M expense. (TR 271, 271, 308, 310; EXH 43, 44) Although FPL

is not seeking recovery of any incremental storm restoration costs for

Hurricane Isaias or Tropical Storm Eta through a surcharge or depletion of the

storm reserve, it identified the storm restoration costs charged to base

O&M expense that would be considered non-incremental costs under the ICCA

methodology and employee assistance expense was included. (TR 291, 293) Staff

agrees with FPL witness Hughes regarding the amounts and treatment of employee

assistance expenses for the four storms.

In its post-hearing brief, OPC recommended the

disallowance of employee expense, consistent with its position on the

disallowance of non-incremental regular payroll and overtime payroll. (OPC BR

22) It referred to the same reasons discussed in other issues without

explaining how they applied to this specific expense category and cited the

same summary of its interpretation of Rule 25.6-0143 that was included in each

issue of its post-hearing brief. (OPC BR 21-22) Employee assistance expense was

not addressed as being imprudent or unreasonable in OPC’s testimony, and the

arguments in its post-hearing brief are not clear. Thus, staff believes OPC’s

proposed disallowance is unsupported.

CONCLUSION

Staff recommends that the total amount of employee

expenses to be included in storm restoration costs is $278,000 for Hurricane

Sally, $14,000 for Hurricane Isaias, $37,000 for Tropical Storm Eta, and

$53,000 for Hurricane Zeta. All employee expenses are non-incremental costs,

are not recoverable under the ICCA methodology, and should be charged to base O&M

expense.

Issue 7:

What is the reasonable and prudent amount of

materials and supplies expense to be included in the restoration costs?

a.

Docket No. 20200241-EI for Gulf’s Hurricane Sally.

b.

Docket No. 20210178-EI for FPL’s Hurricane Isaias.

c.

Docket No. 20210178-EI for FPL’s Tropical Storm Eta.

d.

Docket No. 20210179-EI for Gulf’s Hurricane Zeta.

Recommendation:

The Companies properly applied the ICCA methodology

when expensing the cost of material and supplies and have removed all

non-incremental costs. Staff recommends that the total amount of materials and

supplies expense to be included in storm restoration costs, as reflected in the

table below.

|

Utility/Storm

|

Incremental

|

Capitalized

|

Total

|

|

Recovered through Storm Restoration

Surcharge

|

Charged to Base O&M Expense

|

|

Gulf—Sally

|

$7,300,000

|

$-

|

$3,000,000

|

$10,300,000

|

|

FPL—Isaias

|

$-

|

$39,000

|

$3,000

|

$42,000

|

|

FPL—Eta

|

$-

|

$185,000

|

$347,000

|

$532,000

|

|

Gulf—Zeta

|

$75,000

|

$-

|

$104,000

|

$179,000

|

(D. Phillips)

Position of the Parties

Gulf:

$10.3 million for Docket No. 20200241-EI and

$179,000 for Docket No. 20210179-EI are the reasonable and prudent amounts of

material and supplies expenses associated with Gulf’s storm restoration effort.

FPL:

For Docket No. 20210178-EI, $42,000 for Hurricane

Isaias and $532,000 for Tropical Storm Eta are the reasonable and prudent

amounts of material and supplies expenses associated with its storm restoration

effort.

OPC:

a. Docket No. 20200241-EI for Gulf’s Hurricane

Sally.

The utility failed to eliminate all non-incremental costs

for materials and supplies. Although the

utility objected, they did provide the information necessary to exclude these

materials and supplies costs based on the historic three-year average. However, the utility did not remove all

non-incremental costs which results in overstating materials and supplies in

storm costs. Thus, OPC is recommending

$0.063 million (jurisdictional) be disallowed.

b. Docket No. 20210178-EI for FPL’s Hurricane

Isaias.

The utility failed to eliminate all non-incremental costs

for materials and supplies. Although the

utility objected, they did provide the information necessary to exclude these

materials and supplies costs based on the historic three-year average. However, the utility did not remove all

non-incremental costs which results in overstating materials and supplies in

storm costs. Thus, OPC is recommending

$0.038 million (jurisdictional) be disallowed.

c. Docket No. 20210178-EI for FPL’s Tropical

Storm Eta.

The utility failed to eliminate all non-incremental costs

for materials and supplies. Although the

utility objected, they did provide the information necessary to exclude these

materials and supplies costs based on the historic three-year average. However, the utility did not remove all

non-incremental costs which results in overstating materials and supplies in

storm costs. Thus, OPC is recommending

$0.182 million (jurisdictional) be disallowed.

d. Docket No. 20210179-EI for Gulf’s Hurricane

Zeta.

The utility failed to eliminate all non-incremental costs

for materials and supplies. Although the

utility objected, they did provide the information necessary to exclude these

materials and supplies costs based on the historic three-year average. However, the utility did not remove all

non-incremental costs which results in overstating materials and supplies in

storm costs. Thus, OPC is recommending

$0.063 million (jurisdictional) be disallowed.

Staff Analysis:

PARTIES’ ARGUMENTS

Gulf & FPL

The Companies stated that Rule 25-6.0143(1)(e), F.A.C.,

allows the cost of materials and supplies used to restore service to be charged

to the storm reserve account for recovery except for those that would normally

be charged to the non-cost recovery clause operating expenses in the absence of

a storm. (Gulf & FPL BR 27) The Companies asserted that they increased

inventory in preparation for storm season but do not expense those supplies as

a cost until they are actually used. The Companies argued that since cost for materials

and supplies related to recovery from each of the storm events were not

considered when setting base rates, they are incremental, and as such are

eligible to be recovered through the storm reserve. (Gulf & FPL BR 27) The

Companies determined the total amount of material and supplies associated with

each storm event, then after application of the ICCA methodology, made a

determination of the capital and incremental costs. (Gulf & FPL BR 27, 28)

Sally

Gulf asserted that the total amount of material and

supplies expenses associated with Hurricane Sally is $10.3 million, of which

$3.0 million is identified as capital and $7.3 million is considered

incremental. (Gulf & FPL BR 28)

Zeta

Gulf asserted that the total amount of material and

supplies expenses associated with Hurricane Zeta is $179,000, of which $104,000

is identified as capital while the remaining $75,000 is considered incremental.

(Gulf & FPL BR 28)

Isaias

FPL asserted that the total amount of material and

supplies expenses associated with Hurricane Isaias is $42,000, of which $3,000

is identified as capital. FPL chose to charge all materials and supplies

expenses associated with Hurricane Isaias to base O&M expense. (Gulf &

FPL BR 28)

Eta

FPL asserted that the total amount of material and supplies

expenses associated with Tropical Storm Eta is $532,000, of which $347,000 is

identified as capital. FPL chose to charge all materials and supplies expenses

associated with Tropical Storm Eta to base O&M expense. (Gulf & FPL BR

28)

OPC