Case Background

On September 16,

2022, Tampa Electric Company (TECO or Company) filed a petition to adjust the

Clean Energy Transition Mechanism (CETM) revenue requirement established in

Paragraph 5 of the 2021 Stipulation and Settlement Agreement (2021 Agreement).

The Commission previously approved the 2021 Agreement in Order No.

PSC-2021-0423-S-EI. Paragraph 5 of the 2021 Agreement provides

for initial CETM charges, or rates, to recover an annual revenue requirement of

$68,550,000, effective January 1, 2022. Per the 2021 Agreement, the CETM is a

levelized annual recovery amount that extends through 2036, and is subject to

periodic factor updates (every three years) as well as adjustments to account

for all rate of return adjustments (i.e. resets to the Company’s mid-point

return on equity) and corporate income tax rate changes.

The CETM is made

up of two cost categories. The first category includes Big Bend Units One, Two,

and Three retirements, as well as the Company’s dismantlement reserve

deficiency for the Big Bend Assets. The second category includes costs

associated with Automated Meter Reading (AMR) meter retirements. All such costs

were identified in testimony and minimum filing requirements (MFRs) in Docket

No. 20210034-EI.

In the instant

petition, TECO requests that the Commission increase the CETM to $69,168,529,

and approve revised customer rates resulting from this change effective January

1, 2023. Such rates are reflected in the

proposed revisions to the Company’s tariff page submitted with its Petition,

and included as Attachment A to the recommendation. Consistent with Subparagraph 5(f) of the 2021

Agreement, TECO seeks this increase in order to reflect TECO’s Revised

Authorized Return on Equity (ROE) mid-point of 10.20 percent effective July 1,

2022, as approved in Order No. PSC-2022-0322-FOF-EI.

The Commission

has jurisdiction over this matter pursuant to Sections 366.06 and 366.076,

Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission approve the updated Clean

Energy Transmission Mechanism (CETM) amount of $69,168,529?

Recommendation:

Yes, the updated 2023 CETM amount of $69,168,529

should be approved. (Norris, Gatlin)

Staff Analysis:

Subparagraphs 5(a) and 5(c) of the 2021 Agreement

provided that TECO transfer retiring AMR assets and certain retiring Big Bend

assets into regulatory asset accounts and recover the costs of those assets

from customers using a levelized CETM tariff with a revenue requirement of

$68,550,000 effective with the first billing cycle in January 2022.

TECO is required to update CETM factors periodically beginning in 2024 and

every three years thereafter until the 15-year CETM period expires as stated in

subparagraph 5(d). However, in subparagraph 5(f), TECO is required to adjust CETM

factors to reflect changes to the Company’s updated overall rate of return,

including, but not limited to, operation of the ROE Trigger mechanism.

As memorialized in Order No. PSC-2022-0322-FOF-EI, the Commission

approved TECO’s petition to implement the ROE Trigger provisions of

subparagraph 2(b) of the 2021 Agreement following an evidentiary hearing on

August 16, 2022. As a

result, the Company’s authorized ROE mid-point was increased by 25 basis points

from 9.95 percent to 10.20 percent, effective as of July 1, 2022, for all

regulatory purposes. In its petition to implement the 2023 CETM, TECO provided

a calculation adjusting the CETM revenue requirement amount to $69,168,529 to

reflect the Company’s 10.20 percent authorized ROE mid-point. Staff reviewed

the Company’s calculations and recommends the updated amount be approved.

Issue 2:

Should the Commission approve TECO's revised CETM

rates and tariff, effective with the first billing cycle of January 2023?

Recommendation:

Yes, the Commission should approve TECO’s revised

CETM rates and tariff, as shown in Attachment A to the recommendation, effective

with the first billing cycle of January 2023. (Draper, Hampson, Kunkler)

Staff Analysis:

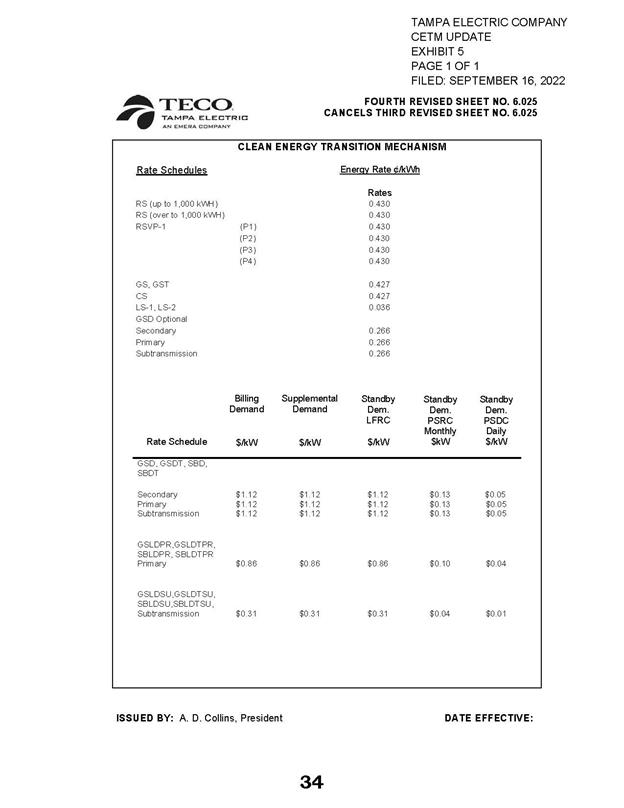

TECO’s petition included proposed Fourth Revised

Tariff Sheet No. 6.025 (Exhibits 5 and 6 to the petition), the allocation of

the updated CETM amount of $69.17 million to the rate classes, (Exhibit 3 to

the petition), and the updated CETM factor calculations (Exhibit 4 to the

petition).

As required by the 2021 Agreement, the allocations of the

updated CETM amount to the rate classes are the same used in the initial CETM

calculations. Accordingly, each rate class receives an increase in the

allocated CETM revenue requirement. However, the residential CETM rate

decreases from 0.441 cents per kilowatt-hour (kWh) to 0.430 cents per kWh. Actual

revenues collected from the residential rate class exceeded projected revenues

when the CETM rate was first calculated, requiring a downward adjustment to the

residential CETM rate.

Staff confirmed that the billing determinants used to

calculate the proposed CETM factors are consistent with the billing

determinants in TECO’s most recent Energy Conservation Cost Recovery Clause (ECCR)

filing, and are in compliance with the 2021 Settlement Agreement. TECO’s most

current ECCR filing, in Docket No. 20220002-EI, was filed on August 5, 2022.

Staff has reviewed TECO’s tariff sheets and supporting

documentation. The calculations are accurate. The Commission should approve TECO’s

revised CETM rates and tariff, as shown in Attachment A to the recommendation, effective

with the first billing cycle of January 2023.

Issue

3:

Should this docket be closed?

Recommendation:

If a protest is

filed within 21 days of the issuance of the order, the tariffs should remain in

effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon

the issuance of a consummating order. (Dose)

Staff Analysis:

If a protest is filed within 21 days of the issuance

of the order, the tariffs should remain in effect, with any revenues held

subject to refund, pending resolution of the protest. If no timely

protest is filed, this docket should be closed upon the issuance of a consummating

order.