Discussion

of Issues

Issue 1:

Should the Commission approve FPUC’s, Chesapeake’s,

and Fort Meade’s proposed GRIP surcharges for the period January through

December 2023?

Recommendation:

If the Commission has not yet made a decision in the

2022 rate case prior to December 1, 2022, then the GRIP surcharges as shown in

Attachment C to the recommendation should go into effect for the period January

through December 2023, and the surcharges in Attachment B should be denied. If the Commission approves in the 2022 rate

case the Companies’ proposals to roll the GRIP investment into rate base prior

to December 1, 2022, then the Commission should approve FPUC’s, Chesapeake’s,

and Fort Meade’s proposed GRIP surcharges for the period January through

December 2023, as shown in Attachment B to the recommendation, and the

surcharges shown in Attachment C should be denied.

If the Commission approves to consolidate the rate classes

in the 2022 rate case, within 10 business days after the Commission vote in the

2022 rate case docket, the Companies should recalculate the GRIP surcharges for

the consolidated rate classes. The revised GRIP surcharges should be submitted

for staff’s administrative approval and should be effective concurrent with any

revised Commission-approved base rates in the rate case docket. (Hampson)

Staff Analysis:

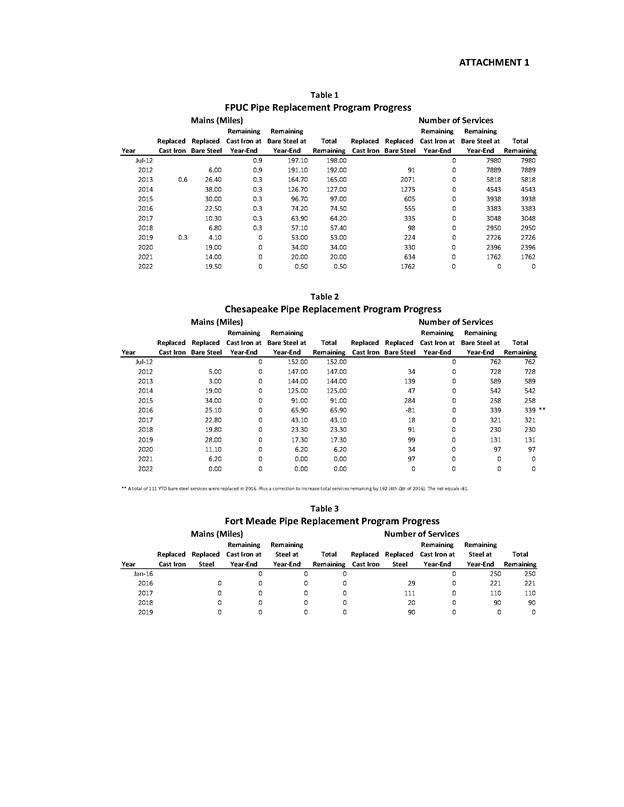

The GRIP surcharges have been in place since January

2013 for FPUC and Chesapeake, while Fort Meade’s surcharges were first

implemented in January 2017. Fort Meade completed its replacement program in

2019 and Chesapeake completed its replacement program in 2021. FPUC completed replacement

projects in 2022 in areas including the City of Boynton Beach, the City of West

Palm Beach, and the City of Lantana. FPUC

has approximately 0.5 miles of pipeline to replace in 2023, due to some permit

delays. The

Companies stated that they prioritized the replacement projects focusing on

areas of high consequence and areas more susceptible to corrosion. Attachment A

to the recommendation provides an update of mains and services replaced through

2022 and replacement forecasts for 2023.

FPUC’s True-ups by Year

FPUC’s calculation for the 2023 GRIP revenue requirement

and surcharges includes a final true-up for 2021, an actual/estimated true-up

for 2022, and projected costs for 2023. In its 2008 rate case, FPUC was

authorized to recover $747,727 of annual bare steel replacement expenses in

base rates.

Therefore, the $747,727 recovered from base rates is excluded from the GRIP true-up

calculations for 2021 and 2022.

Final True-up for 2021

FPUC stated that the revenues collected through the GRIP

surcharges for 2021 were $10,676,905, compared to a revenue requirement of $12,789,617,

resulting in an under-recovery of $2,112,712. Therefore, the 2020 over-recovery

of $326,121, the 2021 under-recovery of $2,112,712, and interest of $160

associated with any over- and under-recoveries results in a final 2021 under-recovery

of $1,786,751.

Actual/Estimated 2022 True-ups

FPUC provided actual revenues for January through July

2022 and estimated revenues for August through December 2022, totaling $16,474,089,

compared to an actual/estimated revenue requirement for 2022 of $15,431,274,

resulting in an over-recovery of $1,042,817. Therefore, the 2021 under-recovery

of $1,786,751, the 2022 over-recovery of $1,042,817, and interest of $9,859

results in a total 2022 under-recovery of $753,793.

Projected 2023 Costs

FPUC projects zero capital expenditures for the

replacement of cast iron/bare steel infrastructure in 2023. FPUC

moved $153,684,138 of total qualified investment into rate base in the rate

case docket. That amount represents the total investment projected at the time

of the rate case filing in May 2022. For the GRIP filing in September 2022,

FPUC had additional months of actual investment costs and an updated investment

amount of $159,599,228, leaving $5,915,090 ($159,599,228 - $153,684,138) to be

recovered through the 2023 GRIP factors as shown in Attachment B to the

recommendation.

The return on investment (which includes federal income

taxes, regulatory assessment fees, and bad debt), depreciation expense, and

property tax associated with the $5,915,090 investment, after subtracting accumulated

depreciation, is $366,128. After including the total 2022 under-recovery of $753,793,

the 2023 revenue requirement is $1,119,921. Table 1-1 shows FPUC’s 2023 revenue

requirement calculation.

Table 1-1

FPUC 2023 Revenue

Requirement Calculation

|

2023 Projected Expenditures

|

$0

|

|

Return on Investment

|

$187,999

|

|

Depreciation Expense

|

126,275

|

|

Property Tax Expense

|

51,855

|

|

2023 GRIP Revenue Requirement

|

$366,128

|

|

Plus 2022 Under-recovery

|

+753,793

|

|

2023 Total Revenue Requirement

|

$1,119,921

|

|

|

|

Source: Witness Waruszewski

Testimony Schedules C-2, Page 4, and D-1, Page 5

Chesapeake’s True-ups by Year

Chesapeake’s calculation for the 2023 GRIP revenue

requirement and surcharges includes a final true-up for 2021, an

actual/estimated true-up for 2022, and projected costs for 2023. Chesapeake

does not have a replacement recovery amount embedded in base rates.

Final True-up for 2021

Chesapeake stated that the revenues collected for 2021

were $4,067,038, compared to a revenue requirement of $4,102,754, resulting in

an under-recovery of $35,715. The 2020 under-recovery of $278,276, 2021

under-recovery of $35,715 and $124 for interest associated with any over- and

under-recoveries results in a final 2021 under-recovery of $314,115.

Actual/Estimated 2022 True-up

Chesapeake provided actual GRIP revenues for January

through July 2022 and estimated revenues for August through December 2022,

totaling $3,789,938, compared to an actual/estimated revenue requirement of $4,309,484,

resulting in an under-recovery of $519,544. The 2021 under-recovery of $314,115,

2022 under-recovery of $519,544, and interest of $8,855 associated with any

over- and under-recoveries results in a total 2022 under-recovery of $842,515.

Projected 2023 Costs

Chesapeake projects zero capital expenditures for the

replacement of cast iron/bare steel infrastructure in 2023, as the company

completed the replacement program in 2021. Chesapeake moved $41,948,432 of

total qualified investment into rate base in the rate case docket. That amount

represents the total investment projected at the time of the rate case filing

in May 2022. For the GRIP filing in September 2022, Chesapeake had additional

months of actual investment costs and an updated investment amount of $41,872,674,

leaving ($75,758) ($41,948,432 - $41,872,674) as a credit to the 2023 GRIP

factors, as shown in Attachment B to the recommendation.

The return on investment (which includes federal income

taxes, regulatory assessment fees, and bad debt), depreciation expense, and

property tax associated with the ($75,758) investment, after subtracting accumulated

depreciation, is ($48,807). The 2023 GRIP factors for Chesapeake are designed

to collect the remaining 2022 under-recovery of $842,515 and the revenue

requirement of ($48,807) associated with the 2022 investment. Table 1-2 shows

Chesapeake’s 2023 revenue requirement calculation.

Table 1-2

Chesapeake 2023 Revenue

Requirement Calculation

|

2023 Projected Expenditures

|

$0

|

|

Return on Investment

|

($37,095)

|

|

Depreciation Expense

|

(1,560)

|

|

Property Tax Expense

|

(10,152)

|

|

2023 Revenue Requirement

|

($48,807)

|

|

Plus 2022 Under-recovery

|

+842,515

|

|

2023 Total Revenue Requirement

|

$793,707

|

Source: Witness Waruszewski

Testimony Schedules C-2, Page 10, and D-1, Page 11

Fort Meade’s True-ups by Year

Fort Meade finished its replacement program in 2019.

Unlike FPUC and Chesapeake, only bare steel services (and no mains) required replacement

in Fort Meade.

Final True-up for 2021

Fort Meade stated that the revenues collected for 2021 were

$26,629, compared to a revenue requirement of $24,363, resulting in an

over-recovery of $2,266. Adding the 2020 over-recovery of $8,427, the 2021 over-recovery

of $2,266, and $3 for interest associated with any over- and under-recoveries,

the final 2021 over-recovery is $10,696.

Actual/Estimated 2022 True-up

Fort Meade provided actual GRIP revenues for January

through July 2022 and estimated revenues for August through December 2022

totaling $26,501, compared to an actual/estimated revenue requirement of

$24,881, resulting in an over-recovery of $1,619. Adding the 2021 over-recovery

of $10,696, the 2022 over-recovery of $1,619, and interest of $212 associated

with any over- and under-recoveries, the resulting total 2022 true-up is an

over-recovery of $12,527.

Projected 2023 Costs

Fort Meade projects zero capital expenditures for the

replacement of cast iron/bare steel infrastructure in 2023, as the company

completed the replacement program in 2019. Fort Meade’s total investment of

$253,934 has been moved into rate base in the rate case docket, with no rate

base balance remaining to be recovered through the 2023 GRIP factors. Therefore,

the 2023 GRIP factors, as shown in Attachment B to the recommendation, will be

a credit on customers’ bills and are designed to refund the remaining 2022

over-recovery of $12,527.

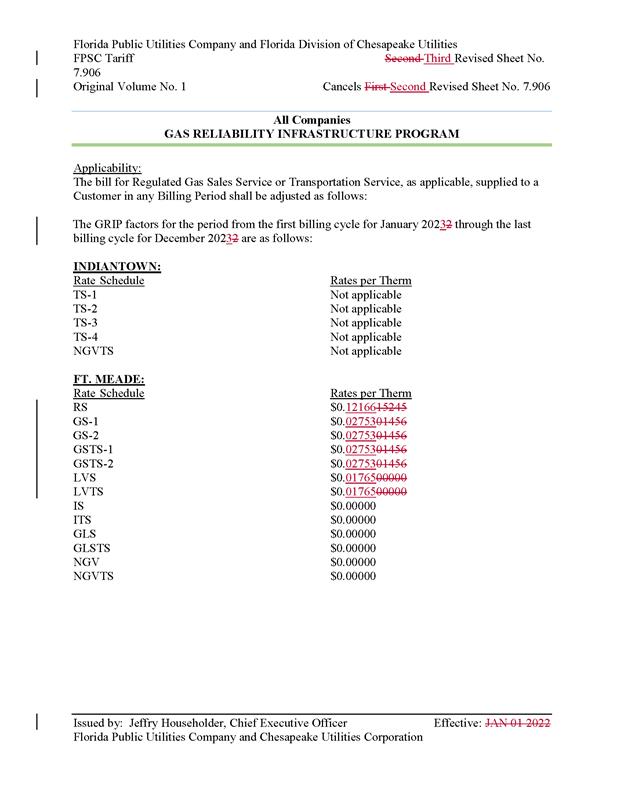

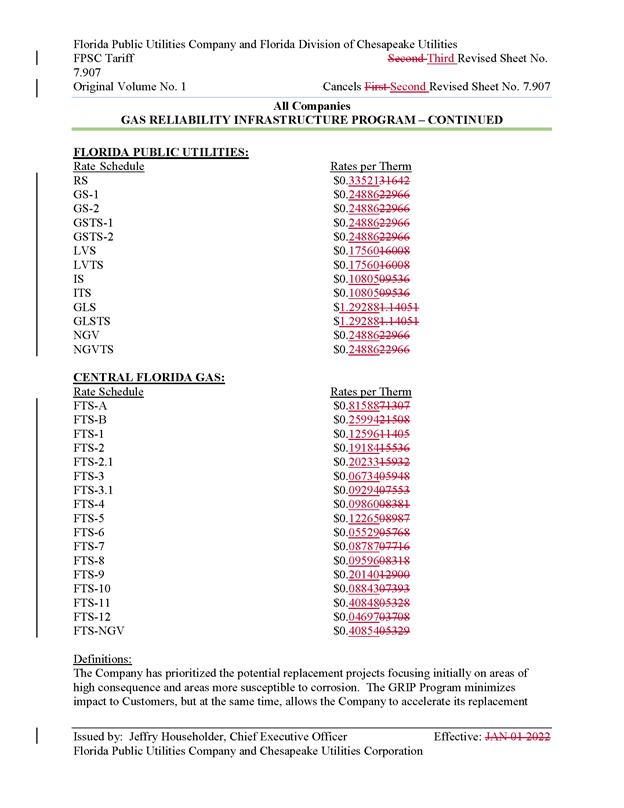

Proposed Surcharges for FPUC, Chesapeake, and

Fort Meade

As established in the 2012 Order approving the GRIP

program, the total 2023 revenue requirement is allocated to the rate classes

using the same methodology used for the allocation of mains and services in the

cost of service study used in the utilities’ most recent rate case. The

respective percentages were multiplied by the 2023 revenue requirements and

divided by each rate class’ projected therm sales to provide the GRIP surcharge

for each rate class.

The proposed 2023 GRIP surcharge for FPUC’s residential

customers on the Residential Service (RS) schedule is $0.02166 per therm

(compared to the current surcharge of $0.31642 per therm). The monthly bill

impact is $0.43 for a residential customer using 20 therms per month. The

proposed FPUC GRIP surcharges are shown in Attachment B, Tariff Sheet No.

7.907.

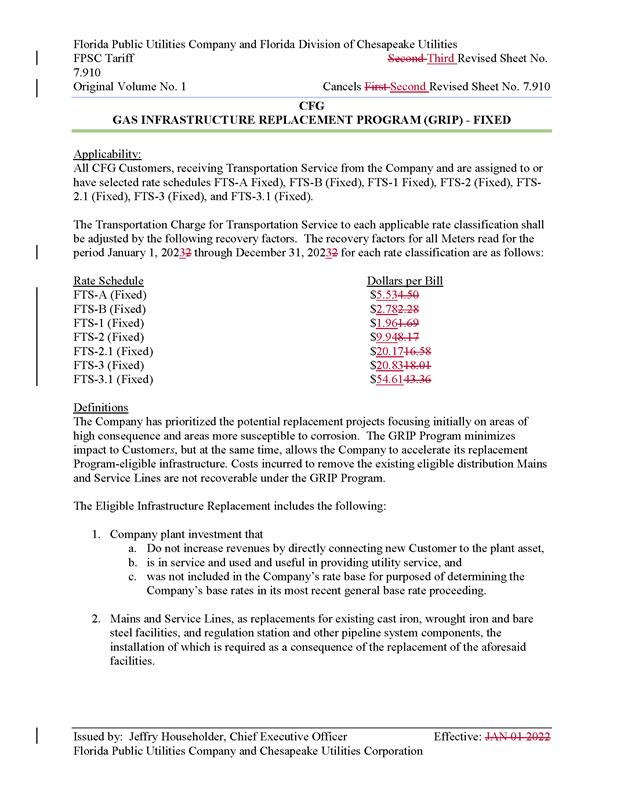

The proposed 2023 GRIP surcharge for Chesapeake’s

residential customers on the FTS-1 schedule is $0.01970 per therm (compared to

the current surcharge of $0.11405). The monthly bill impact is $0.39 for a

residential customer using 20 therms per month. The proposed Chesapeake GRIP

surcharges are shown in Attachment B, Tariff Sheet Nos. 7.907 and 7.910.

The proposed 2023 GRIP surcharge for Fort Meade’s residential

customers on the RS schedule is ($0.12822) per therm (compared to the current

surcharge of $0.15245). The monthly bill impact is a credit of $2.56 for a

residential customer using 20 therms per month. The proposed Fort Meade GRIP

surcharges are shown on Tariff Sheet No. 7.906 in Attachment B.

Conclusion

If the Commission has not yet made a decision in the 2022

rate case prior to December 1, 2022, then the GRIP surcharges as shown in

Attachment C to the recommendation should go into effect for the period January

through December 2023, and the surcharges shown in Attachment B should be

denied. If the Commission approves in

the 2022 rate case the Companies’ proposals to roll the GRIP investment into

rate base prior to December 1, 2022, then the Commission should approve FPUC’s,

Chesapeake’s, and Fort Meade’s proposed GRIP surcharges for the period January

through December 2023, as shown in Attachment B to the recommendation, and the

surcharges shown in Attachment C should be denied.

If the Commission approves to consolidate the rate classes

in the 2022 rate case, within 10 business days after the Commission vote in the

2022 rate case docket, the Companies should recalculate the GRIP surcharges for

the consolidated rate classes. The revised GRIP surcharges should be submitted

for staff’s administrative approval and should be effective concurrent with any

revised Commission-approved base rates in the rate case docket.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If Issue 1 is approved and a protest is filed

within 21 days of the issuance of the order, the approved tariffs should remain

in effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order. (Dose)

Staff Analysis:

If Issue 1 is approved and a protest is filed within

21 days of the issuance of the order, the approved tariffs should remain in

effect, with any revenues held subject to refund, pending resolution of the

protest. If no timely protest is filed, this docket should be closed upon the

issuance of a consummating order.