|

State of Florida

|

Public Service Commission

Capital Circle Office Center ● 2540 Shumard

Oak Boulevard

Tallahassee, Florida 32399-0850

-M-E-M-O-R-A-N-D-U-M-

|

|

DATE:

|

November 22, 2022

|

|

TO:

|

Office of Commission Clerk (Teitzman)

|

|

FROM:

|

Office of the General Counsel (Sapoznikoff)

Division of Accounting

and Finance (Norris, Sewards, Andrews, Fletcher)

Division of Economics (Guffey)

|

|

RE:

|

Docket No. 20220171-WS – Proposed

amendments to Rule 25-30.110, F.A.C., Records and Reports; Annual Reports,

and Rule 25-30.420, F.A.C., Establishment of Price Index; Adjustment of

Rates; Requirement of Bond; Filings After Adjustment; Notice to Customers.

|

|

AGENDA:

|

12/06/22 – Regular Agenda – Rule Proposal - Interested Persons May

Participate

|

|

COMMISSIONERS ASSIGNED:

|

All Commissioners

|

|

PREHEARING OFFICER:

|

Passidomo

|

|

RULE STATUS:

|

Proposed, may be deferred

|

|

SPECIAL INSTRUCTIONS:

|

None

|

|

|

|

|

Case Background

This rulemaking

was initiated to update water and wastewater utility rules, and associated

forms related to the filing of annual reports and the provision of price index

documents. The draft amendments are

intended to allow email filing of annual reports, to provide that the

Commission will email the price index documents and annual report forms to the

water and wastewater utilities, and to add a customer notice to the

Commission form that is contained in the rule.

This

recommendation addresses whether the Commission should propose the amendment

of:

·

Rule 25-30.110, Florida Administrative Code

(F.A.C.), Records and Reports; Annual Reports

·

Rule 25-30.420, F.A.C., Establishment of Price

Index; Adjustment of Rates; Requirement of Bond; Filings After Adjustment;

Notice to Customers

The Notice of

Rule Development for Rule 25-30.110 appeared in the August 19, 2022, edition of

the Florida Administrative Register, Vol. 48, No. 162. The Notice of Rule Development for Rule

25-30.420 appeared in the May 11, 2022, edition of the Florida Administrative

Register, Vol. 48, No. 92. No workshops

were requested and none were held. The

Commission has jurisdiction pursuant to Sections 120.54, 350.127(2), 367.081,

and 367.121, Florida Statutes (F.S.).

Discussion

of Issues

Issue 1:

Should the Commission propose the amendment of Rules

25-30.110 and 25-30.420, F.A.C.?

Recommendation:

Yes, the Commission should

propose the amendment of Rules 25-30.110 and 25-30.420, F.A.C., as set forth in

Attachment A. The Commission should also

certify Rule 25-30.110, F.A.C., as a minor violation rule. Rule 25-30.420,

F.A.C., should remain as not a minor violation rule. (Sapoznikoff, Guffey, Norris,

Sewards, Andrews)

Staff Analysis:

The draft amended rules

have been revised with non-substantive changes to improve clarity. Attachment A contains all of staff’s

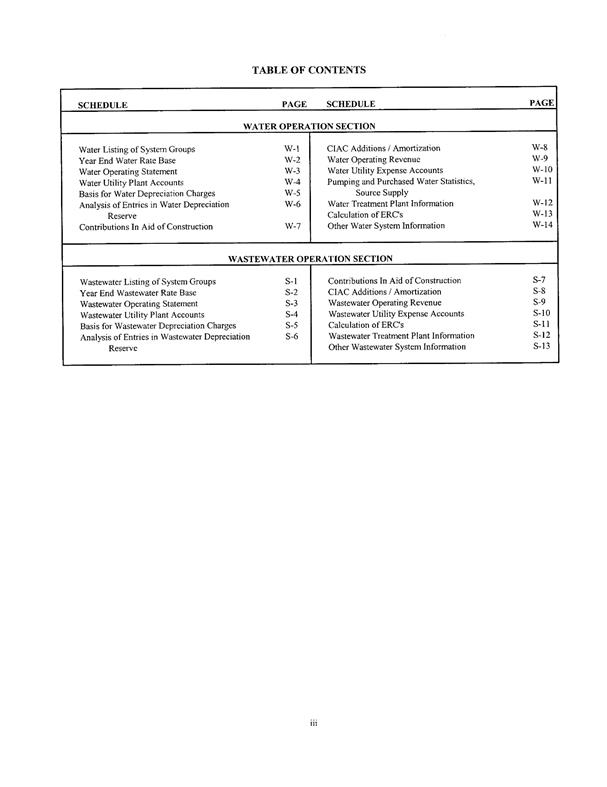

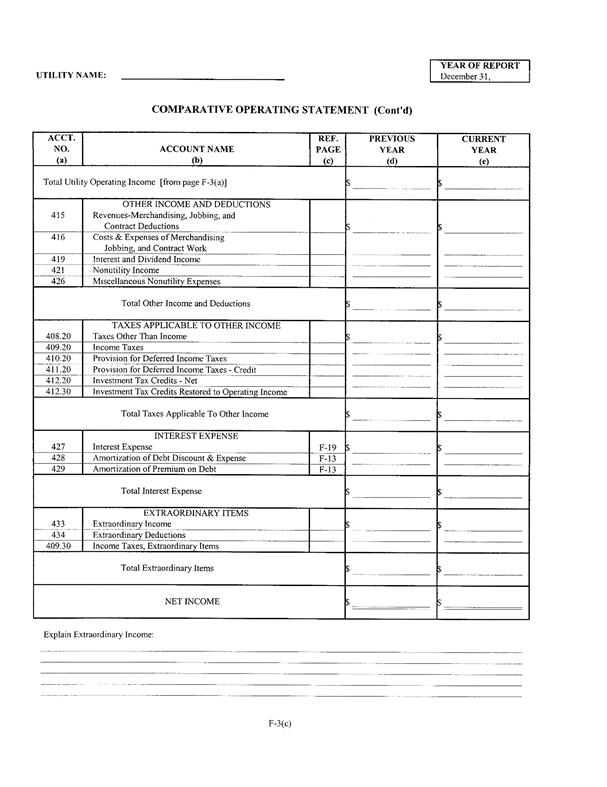

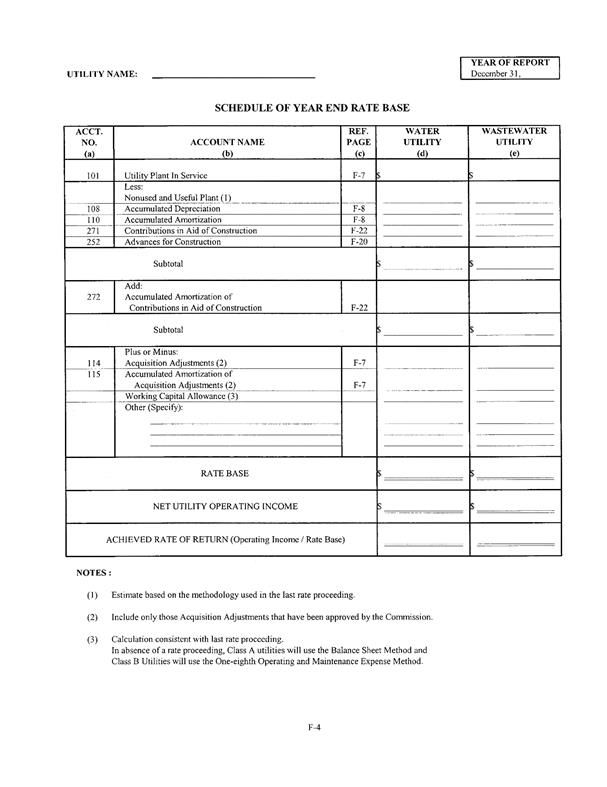

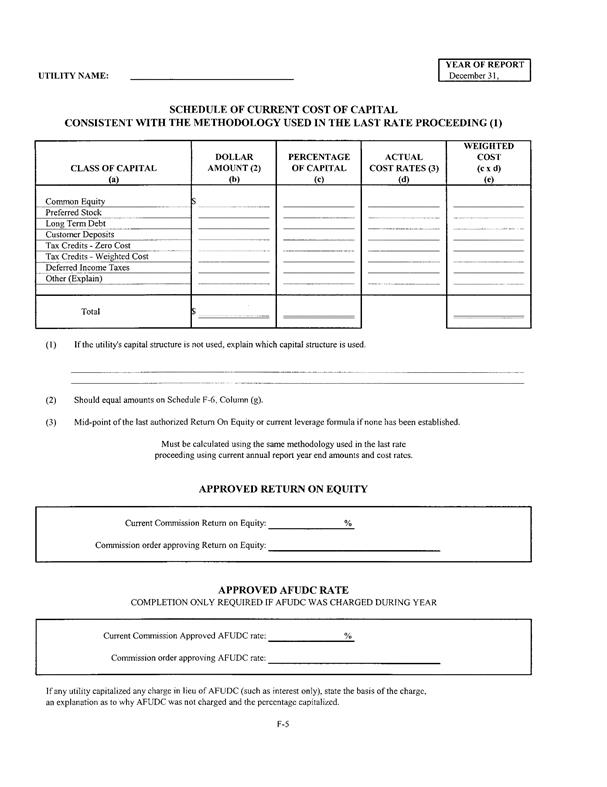

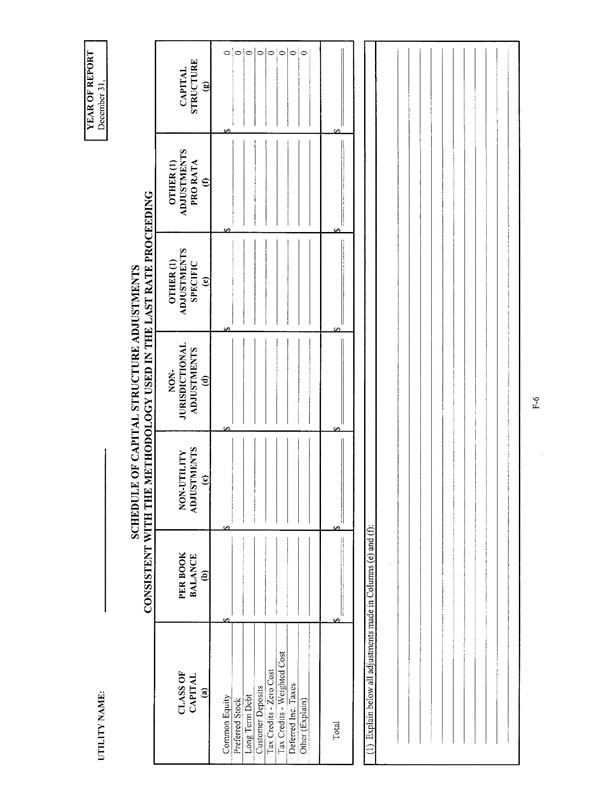

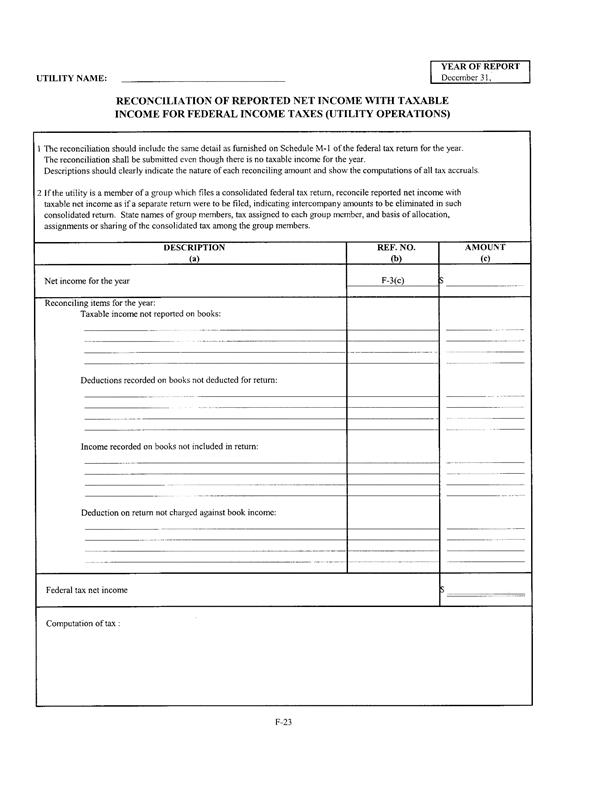

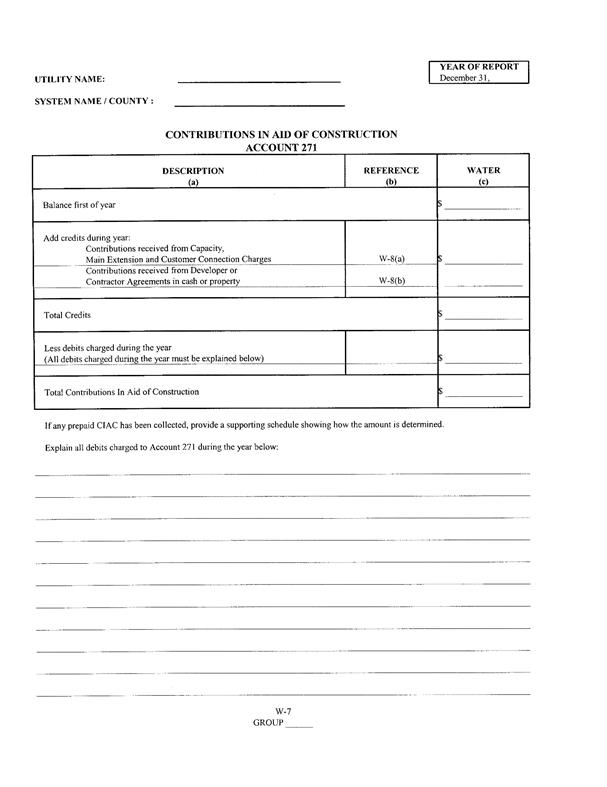

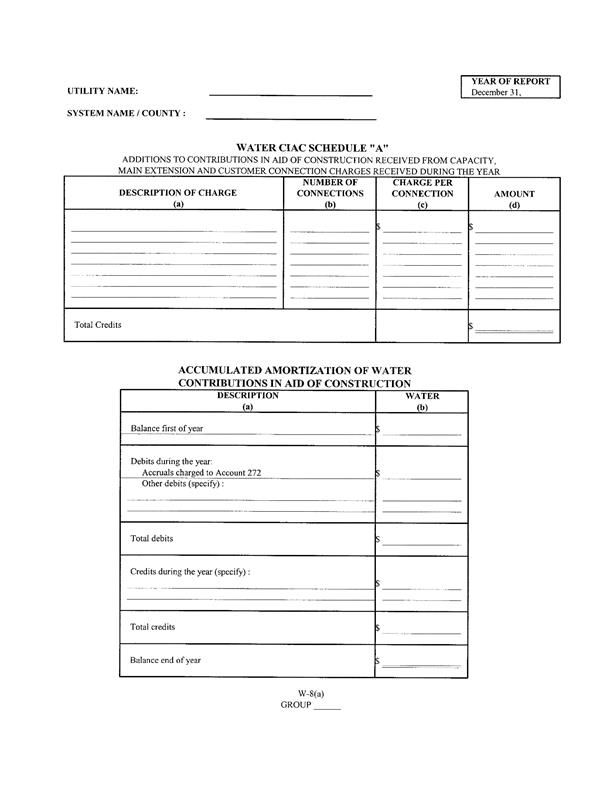

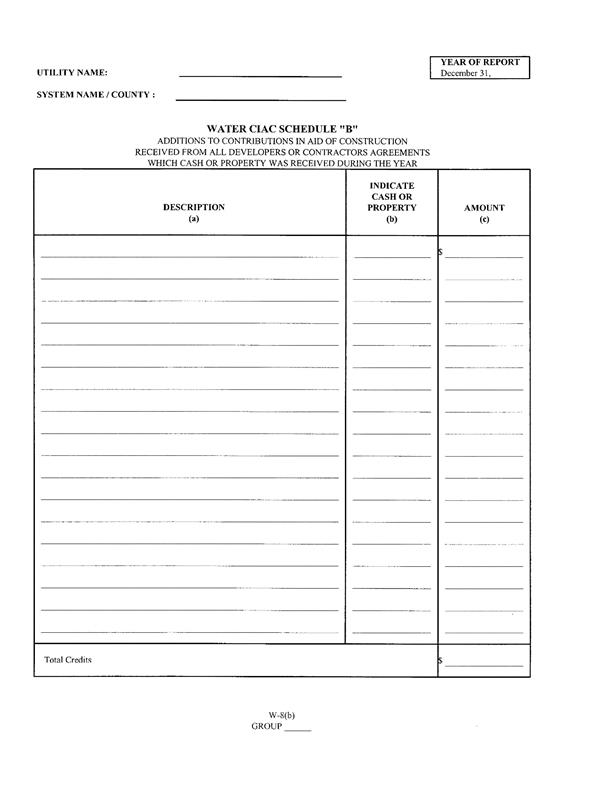

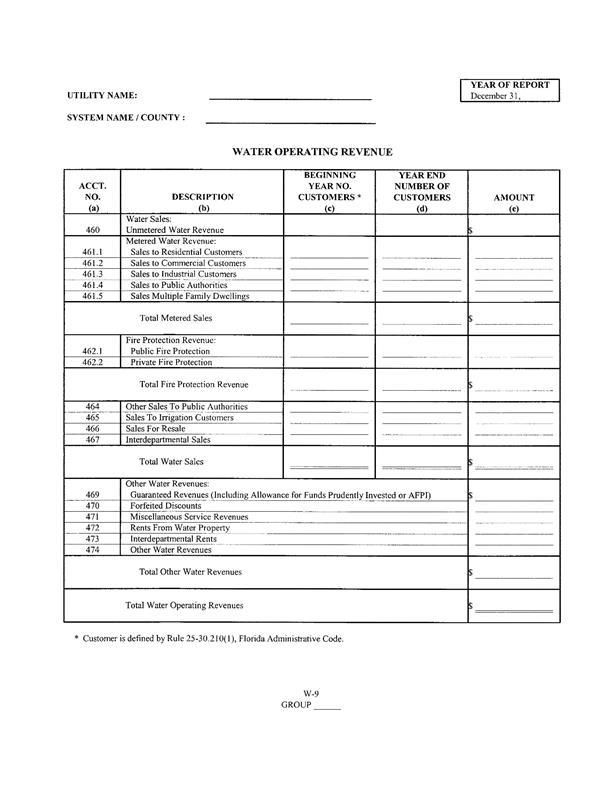

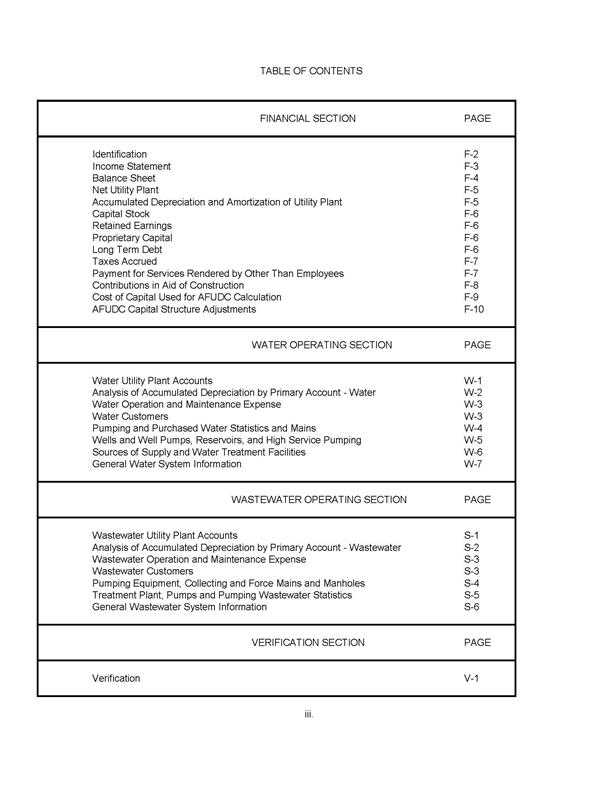

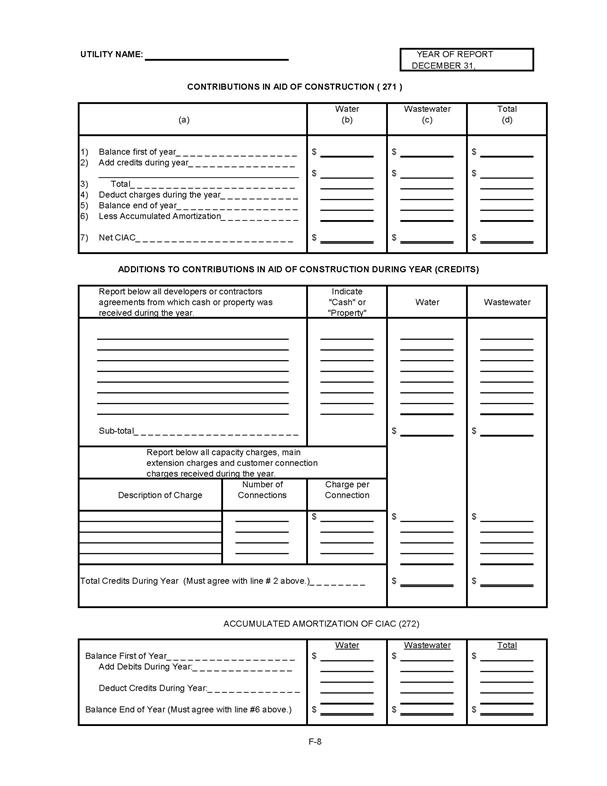

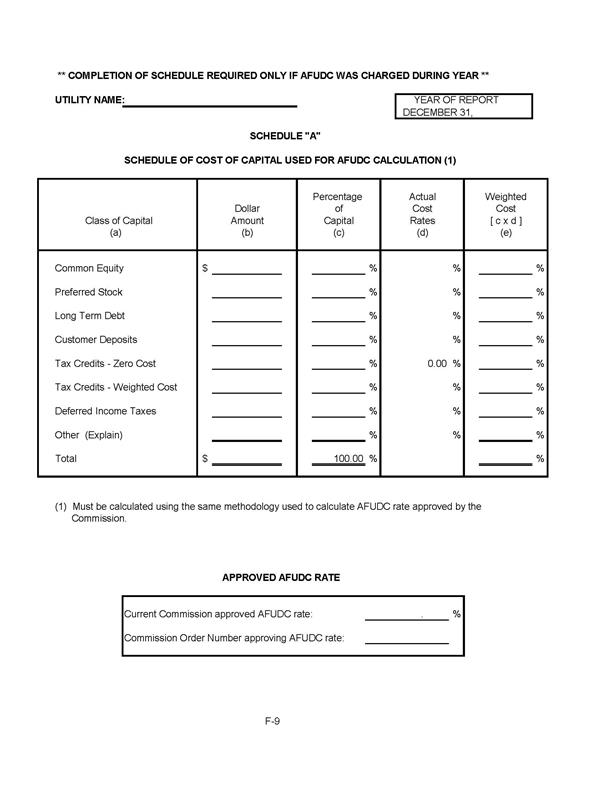

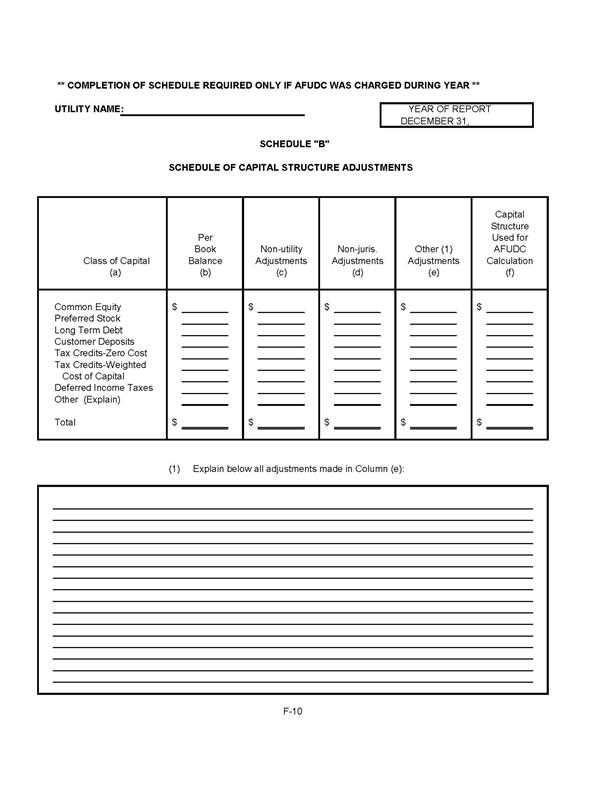

recommended amendments to Rule 25-30.110, F.A.C., (beginning on page 6) and

Rule 25-30.420, F.A.C., (beginning on page 135). Staff’s recommendations on substantive amendments

to these rules are discussed in more detail below.

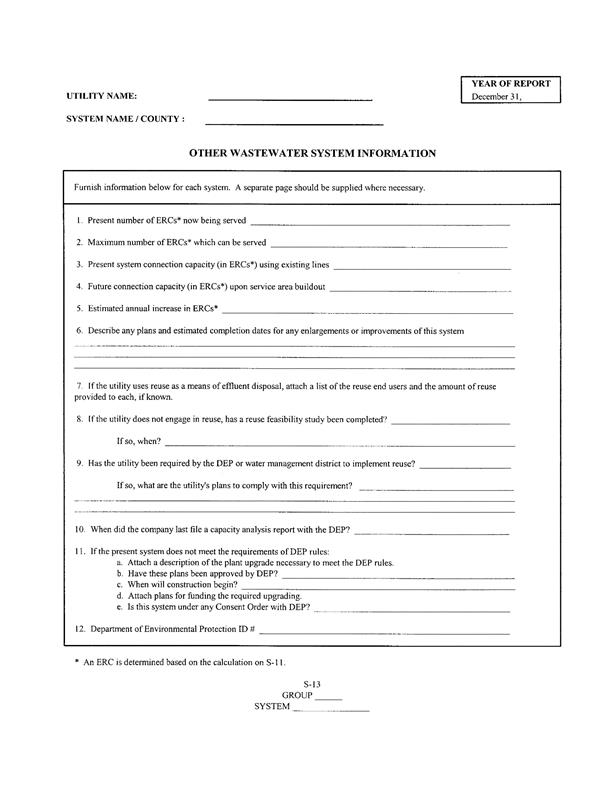

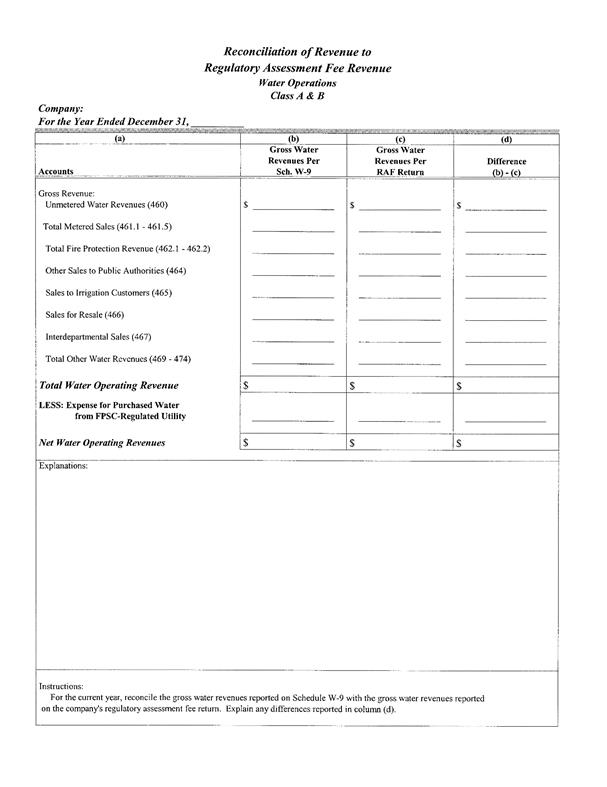

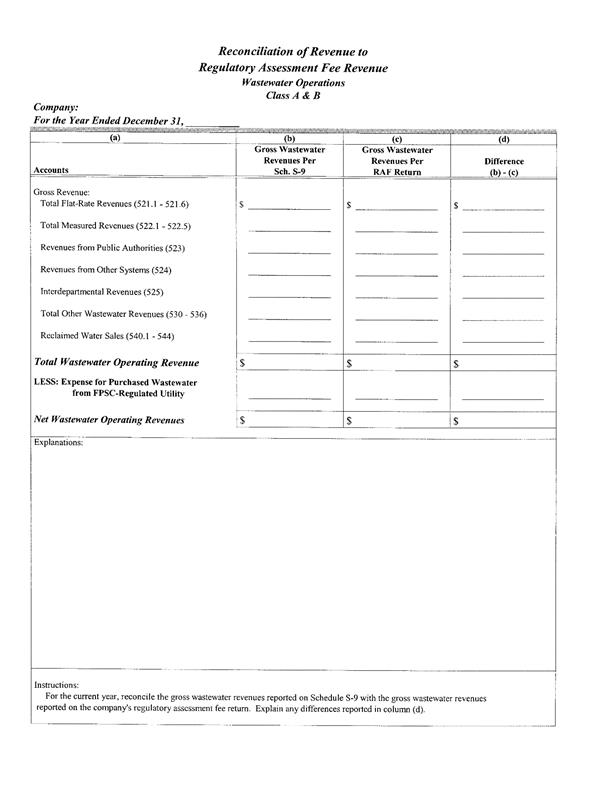

Rule 25-30.110, F.A.C., Records and Reports; Annual Reports

The purpose of the recommended

amendments to Rule 25-30.110, F.A.C., is to specify that the Commission will

send a blank copy of the appropriate annual report form to each utility via

email, unless a physical copy is requested by the utility, as well as allowing

a utility to file its completed annual report with the Commission via email. The rule amendments indicate how a copy of

“Regulations to Govern the Preservation of Records of Electric, Gas and Water

Utilities,” with which the utilities must comply, may be obtained. The amendments also provide clarification of

the method of delivery for the blank annual report form, provide the specific

email address a utility should use if filing its annual report electronically,

and clarifies what constitutes filing, delivery, and receipt of the annual

report. The amendments update the

process regarding calculation of interest on penalties for untimely filed

annual reports to reflect current practice.

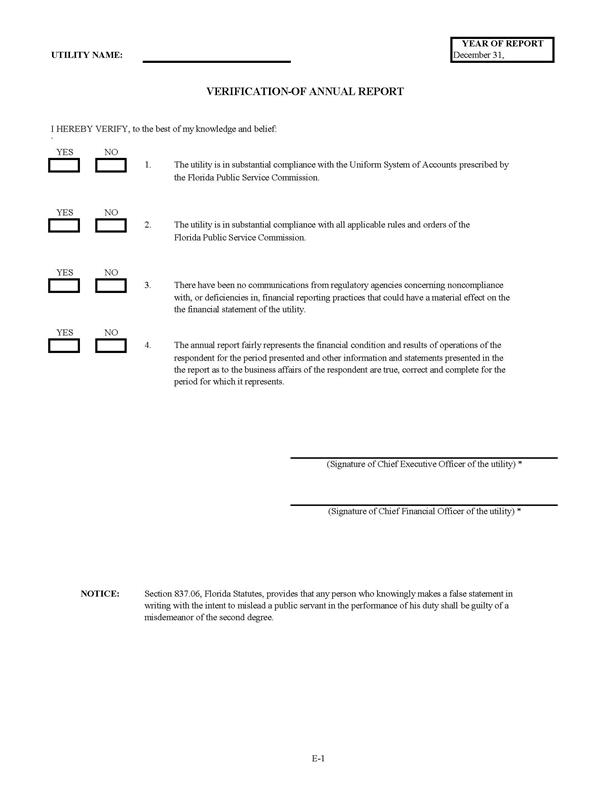

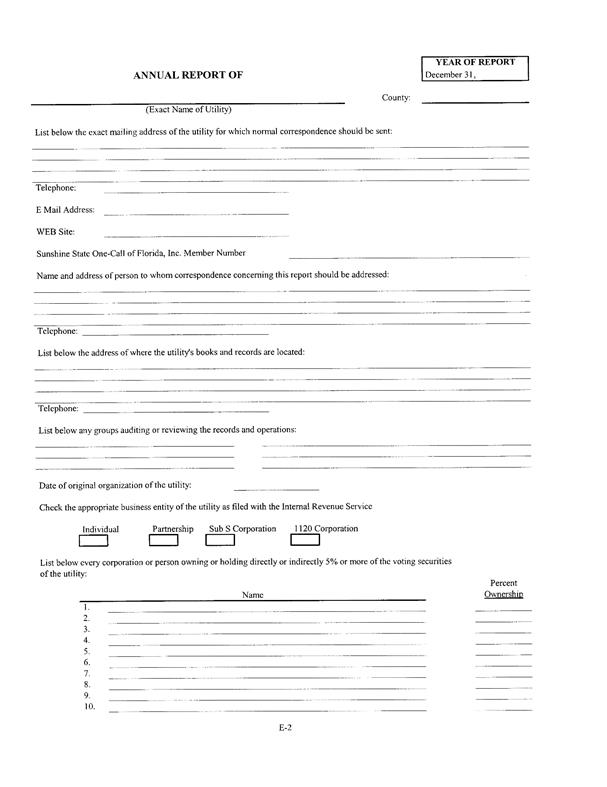

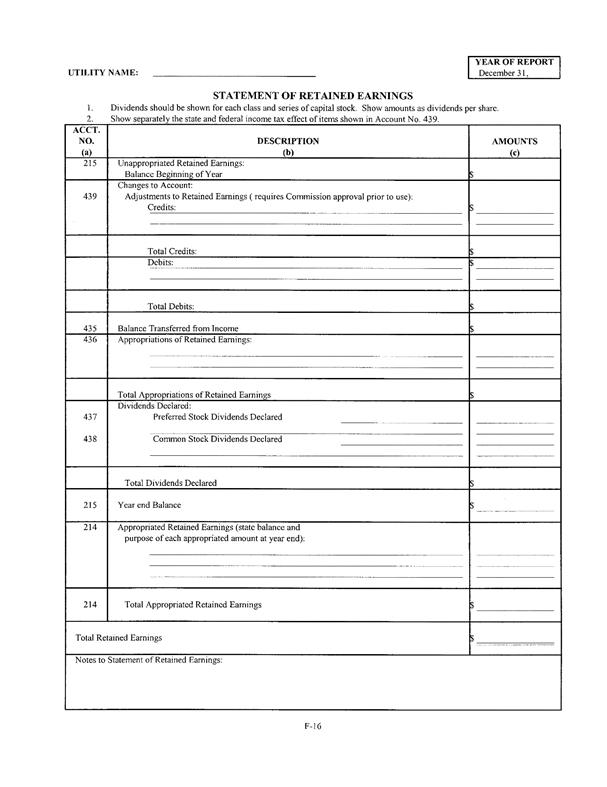

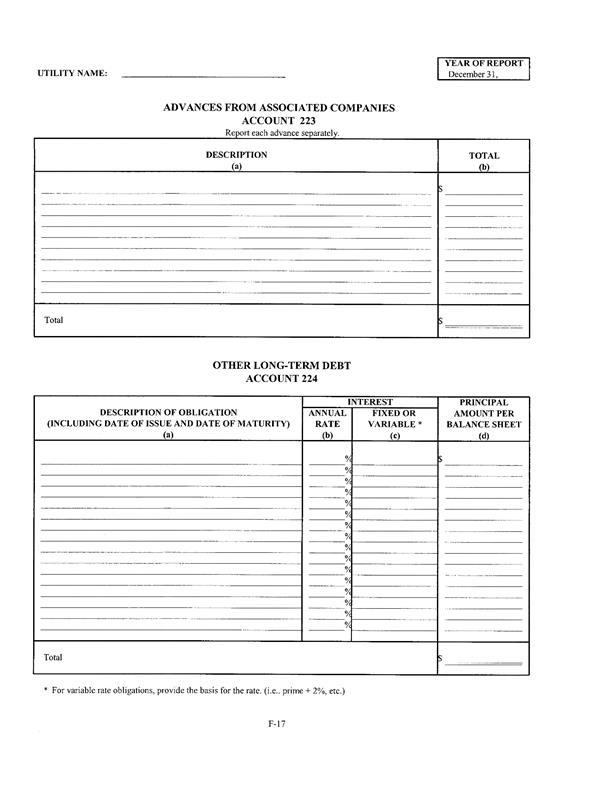

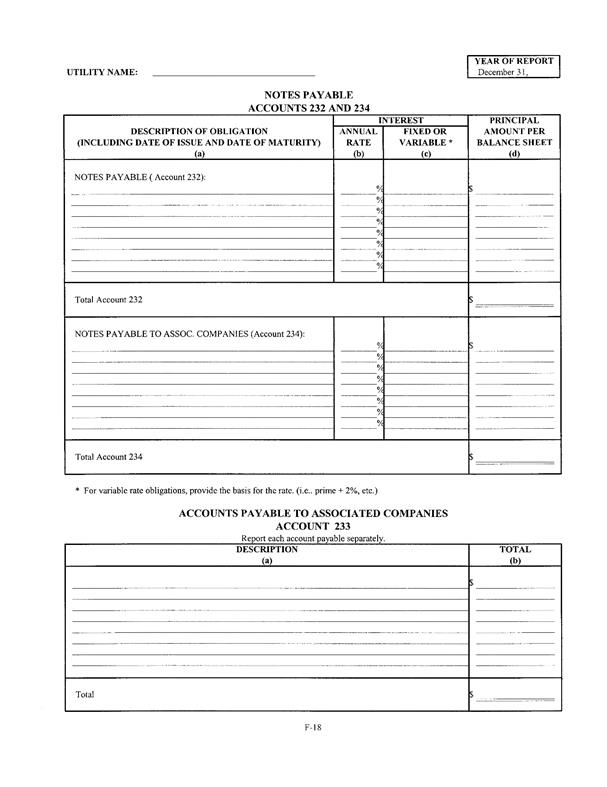

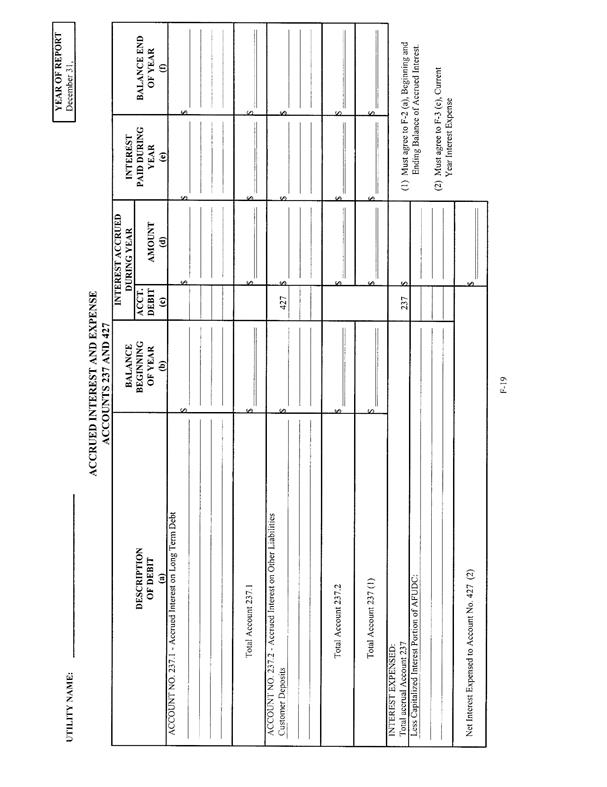

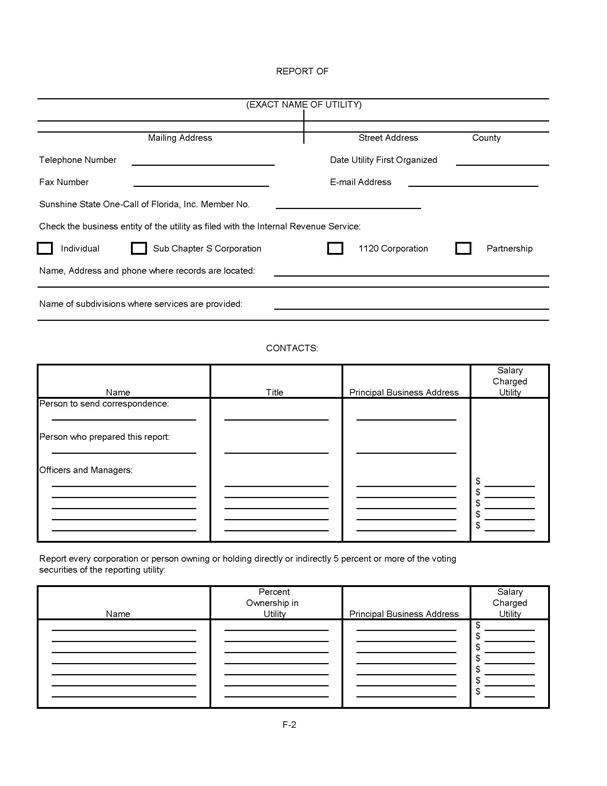

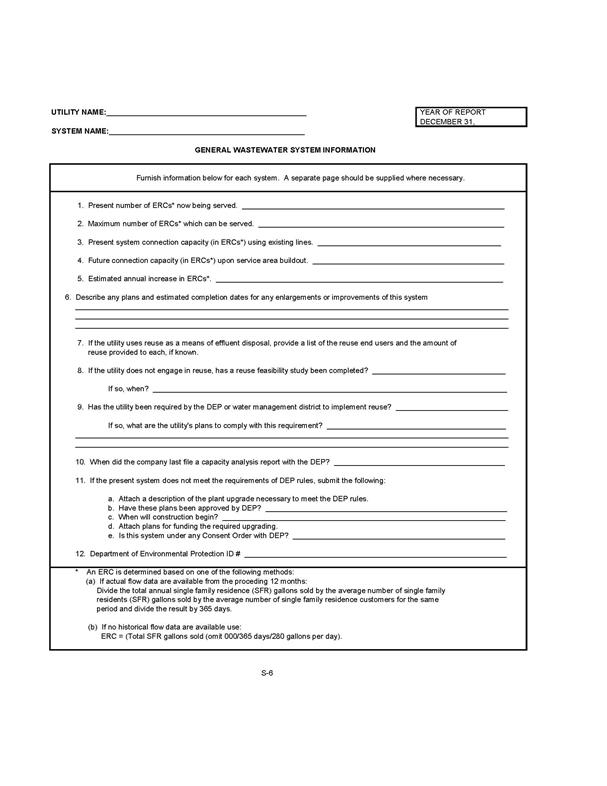

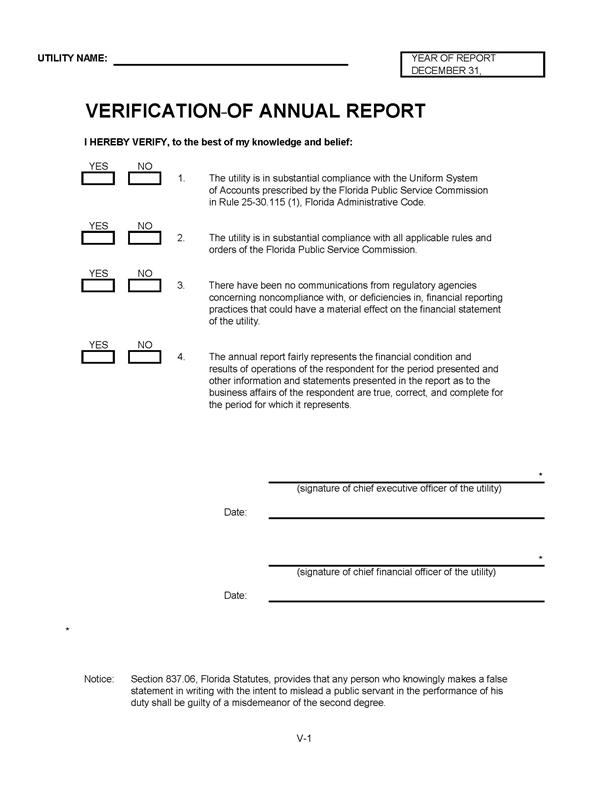

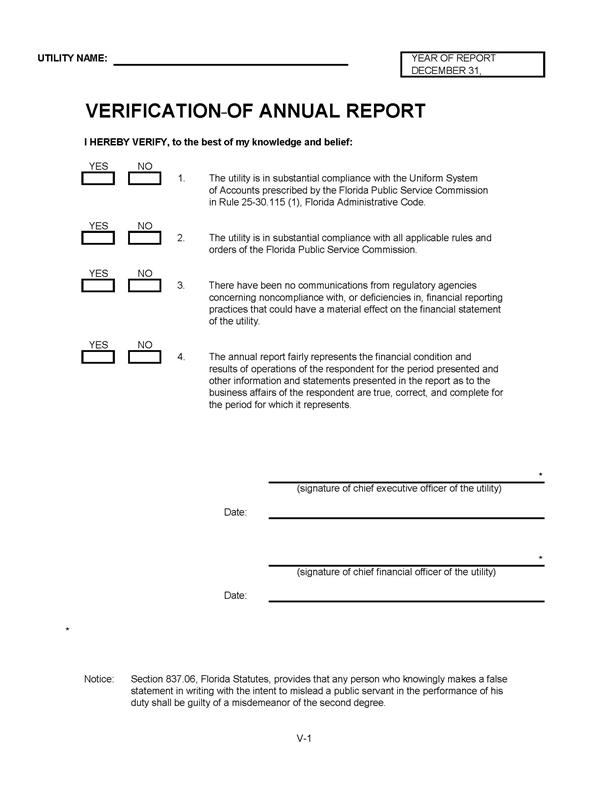

Finally, the amendments overall update and clarify the rule language. Forms PSC 1032 and PSC 1033, which are

incorporated by reference in the rule, were updated to reflect verification,

rather than certification, to comport with statutory authority. The forms were also updated to remove the

requirement that two officers identify which of the four items are

verified. These changes are reflected on

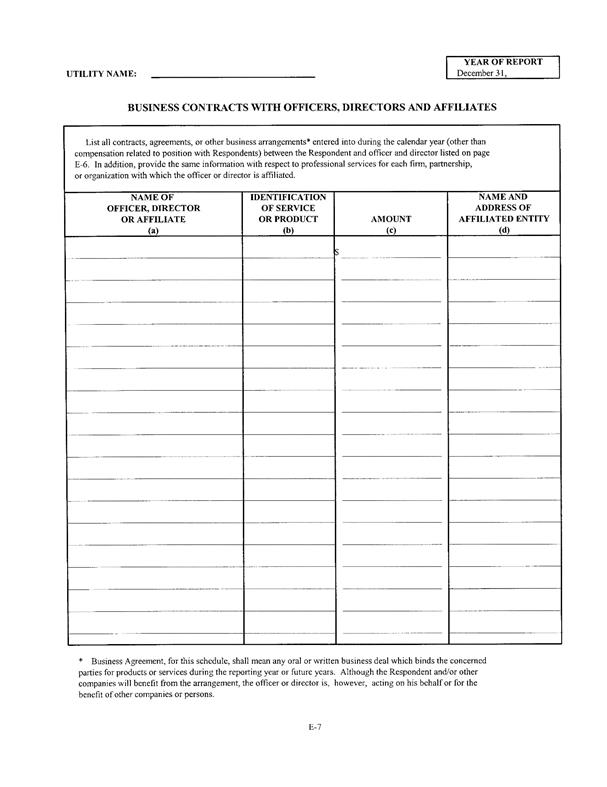

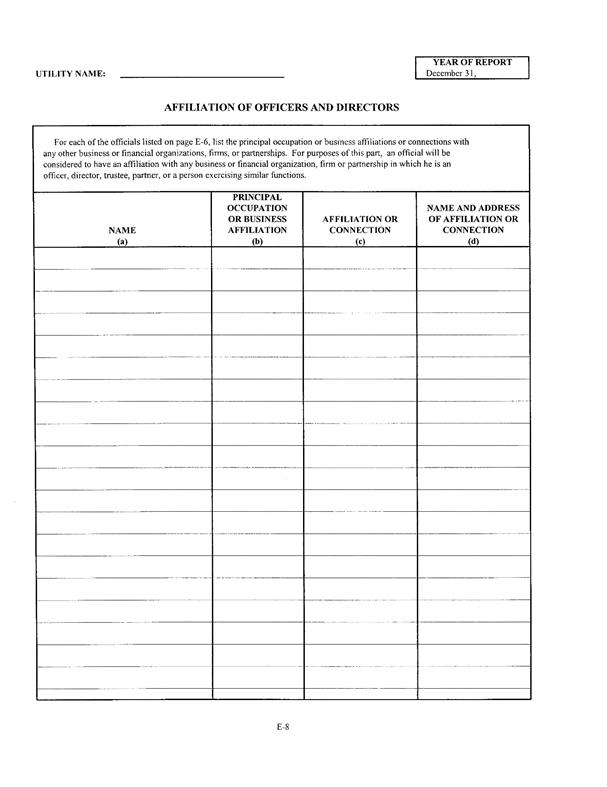

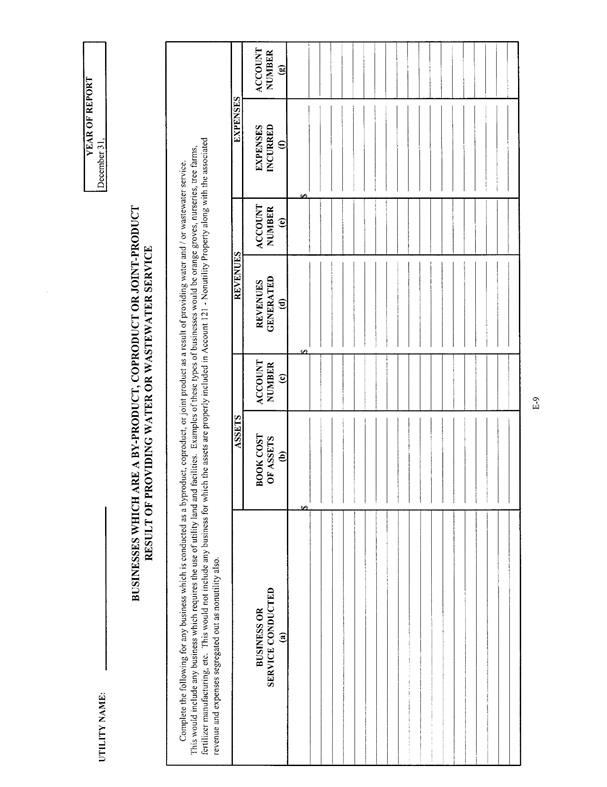

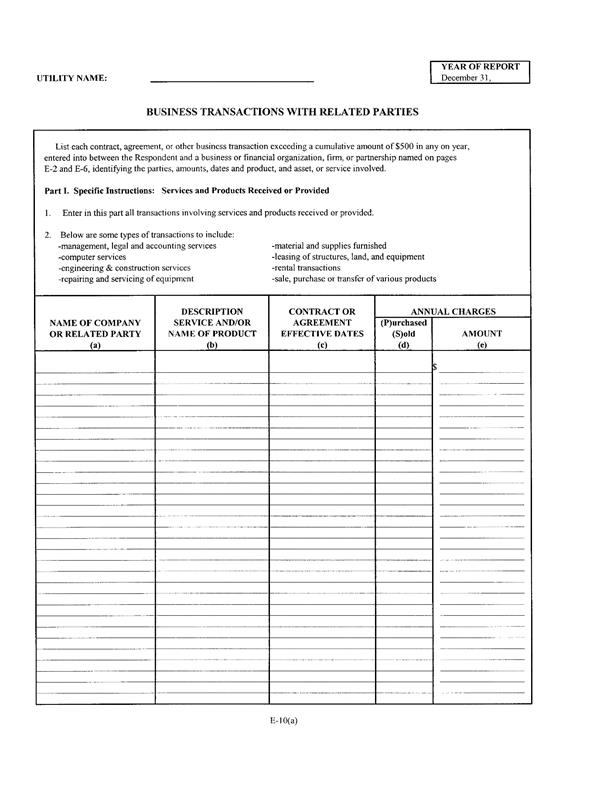

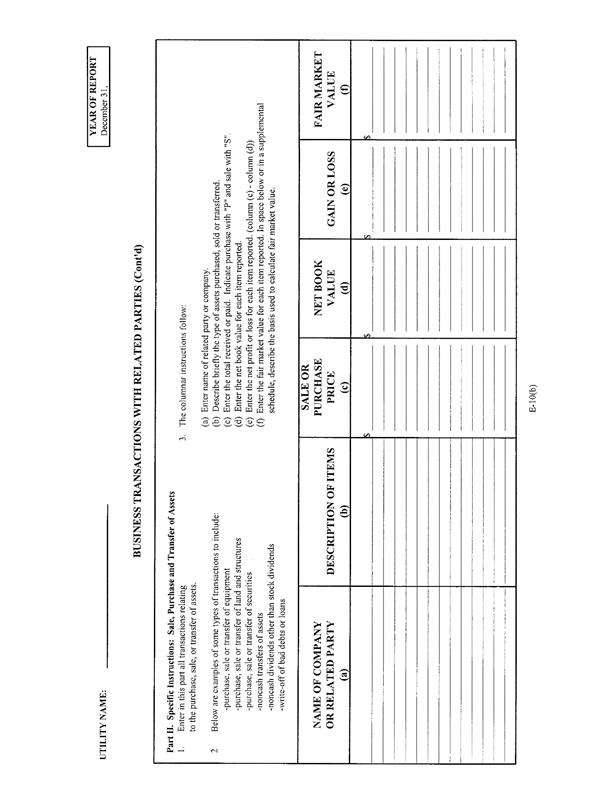

page E-1 of Form PSC 1032 (page 22) and page V-1 of Form PSC 1033 (page 134).

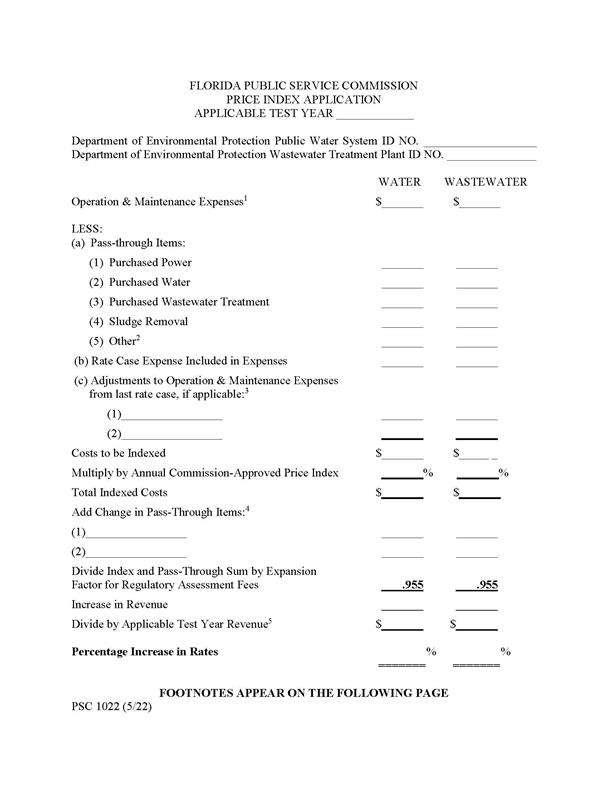

Rule 25-30.420, F.A.C.,

Establishment of Price Index; Adjustment of Rates; Requirement of Bond, Filings

After Adjustment; Notice to Customers

The primary purpose of the recommended amendments to Rule

25-30.420, F.A.C., is to allow the Commission’s Division of Accounting and

Finance to email the Proposed Agency Action (PAA) order establishing the index

for the year and the Price Index Application to the water and wastewater

utilities under the Commission’s jurisdiction.

Currently, the Office of the Commission Clerk mails the PAA order and

Price Index Application. The recommended

revisions also provide the option for the utilities to request a paper copy of

the Price Index Application. Finally,

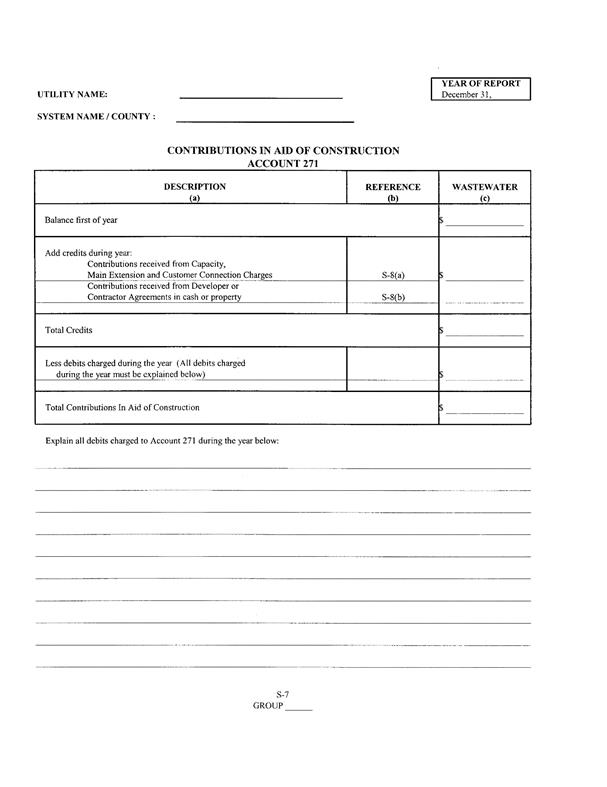

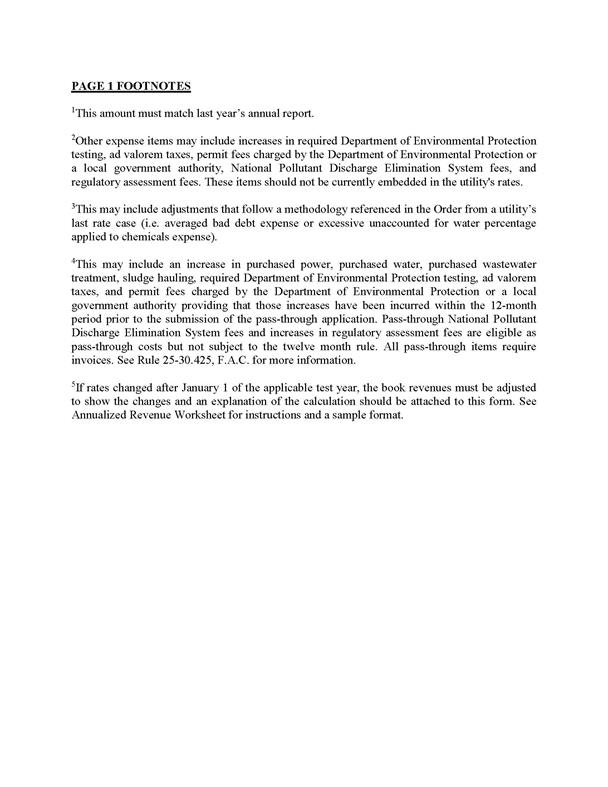

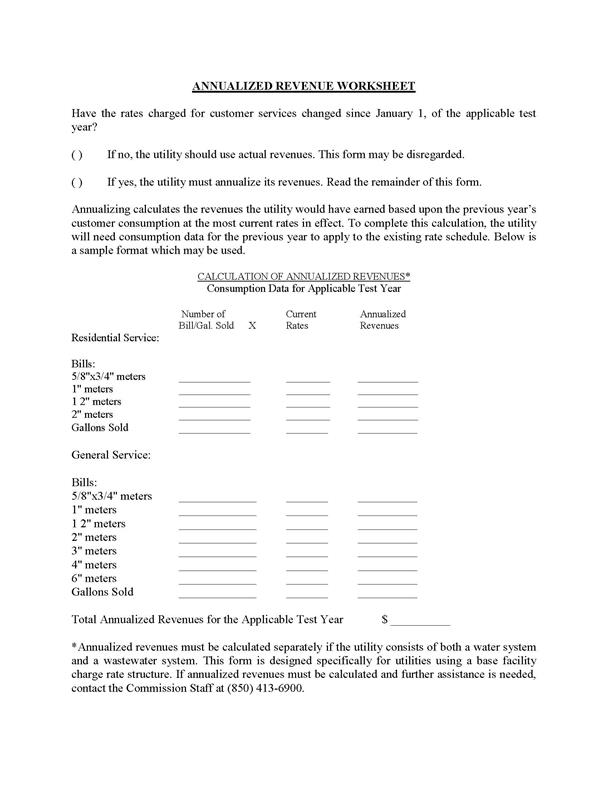

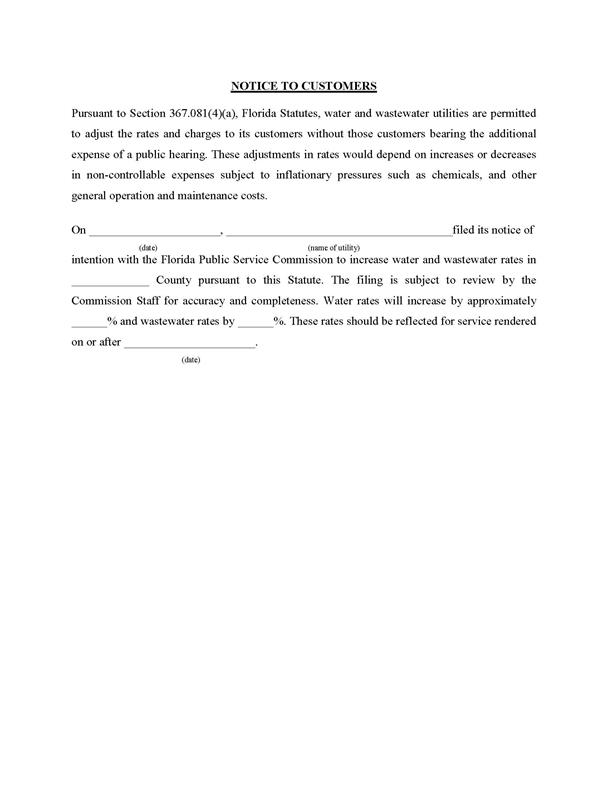

the amendments overall update and clarify the rule language. Form PSC 1022, which is incorporated by

reference in the rule, was updated by the addition of an additional “Notice to

Customers” referencing subsections 367.081(4)(a) and (b), F.S. This page was added to the end of the form

(page 146).

Minor Violation Rules Certification

Pursuant to Section 120.695,

F.S., the agency head must certify for each rule filed for adoption

whether any part of the rule is designated as a rule the violation

of which would

be a minor violation. Rule

25-30.110, F.A.C., is currently listed on the Commission’s website as a rule for which a violation

would be minor because violation of the rule would not result in economic or physical harm to a person or have an adverse effect

on the public health, safety,

or welfare or create a significant threat of

such harm. The amendments to that rule would not change its status as a minor violation

rule. Thus, staff

recommends that the Commission certify

Rule 25-30.110, F.A.C., as a

minor violation rule.

Rule

25-30.420, F.A.C., is not currently listed on the Commission’s website as a

rule for which a violation would be minor because violation of the rule would

result in economic harm to ratepayers. Thus,

staff recommends that the Commission certify that Rule 25-30.420, F.A.C., is

not a rule that the violation of which would be a minor violation pursuant to

Section 120.695, F.S. The amendments to

that rule would not change the rule’s status as not being a minor violation

rule.

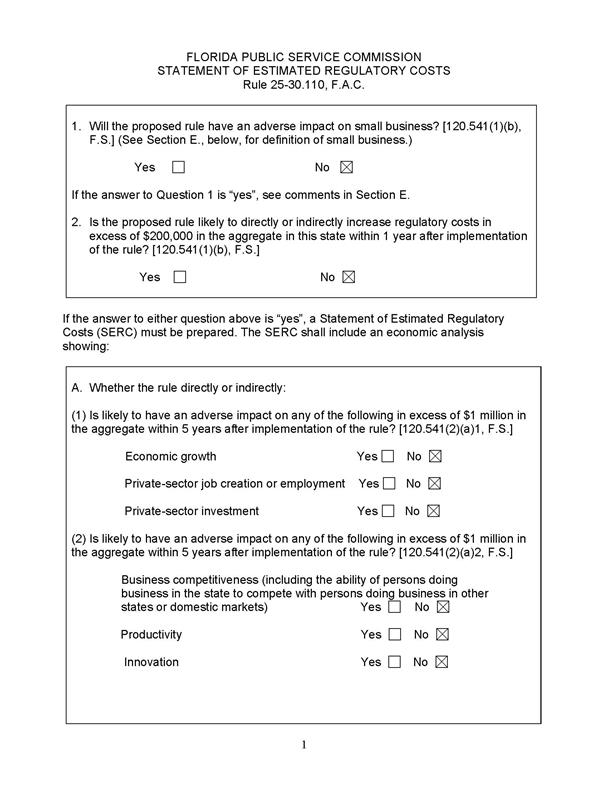

Statement of Estimated

Regulatory Costs

Pursuant to Section

120.54(3)(b), F.S., agencies are encouraged to prepare a statement of estimated

regulatory costs (SERC) before the adoption, amendment, or repeal of any rule. Attachment B to this Recommendation contains

the SERCs for both rules. The SERC for

Rule 25-30.110, F.A.C., begins on page 147, and the SERC for Rule 25-30.420,

F.A.C., begins on page 152.

The SERCs conclude that the

amendments to the rules will not likely directly or indirectly increase

regulatory costs in excess of $200,000 in the aggregate in Florida within one

year after implementation. Further, the

SERCs’ economic analysis concludes that the amendments to the rules will not

likely have an adverse impact on economic growth, private sector job creation

or employment, private sector investment, business competitiveness,

productivity, or innovation in excess of $1 million in the aggregate within

five years of implementation. Thus, the rules do not require legislative

ratification pursuant to Section 120.541(3), F.S. In addition, the SERCs state that the

amendments to the rules will not have an adverse impact on small business and

will have no impact on small cities or counties. The SERCs conclude that there will be no

transactional costs likely to be incurred by individuals and entities required

to comply with the requirements of the rule. No regulatory alternatives were

submitted pursuant to Section 120.541(1)(a), F.S. None of the impact/cost criteria established

in Section 120.541(2)(a), F.S., will be exceeded as a result of the recommended

amendments to Rules 25-30.110 and 25-30.420, F.A.C.

Conclusion

Based on the foregoing, staff

recommends the Commission propose the amendment of Rules 25-30.110 and

25-30.420, F.A.C., as set forth in Attachment A. Staff also recommends that the Commission

certify Rule 25-30.110, F.A.C., as a minor violation rule, and that Rule

25-30.420, F.A.C., remain as not a minor violation rule.

Issue 2:

Should this docket be closed?

Recommendation:

Yes. If no requests for

hearing, information regarding the SERCs, proposals for a lower cost regulatory

alternative, or the Joint Administrative Procedures Committee (JAPC) comments

are filed, the rules should be filed with the Department of State, and the

docket should be closed. (Sapoznikoff)

Staff Analysis:

If no requests for

hearing, information regarding the SERCs, proposals for a lower cost regulatory

alternatives, or JAPC comments are filed, the rules may be filed with the

Department of State and the docket should be closed.

25-30.110

Records and Reports; Annual Reports.

(1) Records.

(a) Each utility must shall

preserve its records in accordance with the “Regulations to Govern the

Preservation of Records of Electric, Gas and Water Utilities” as issued by the

National Association of Regulatory Utility Commissioners, as revised October

2007 May 1985, which is incorporated by reference into this rule.

“Regulations to Govern the Preservation of Records of Electric, Gas and Water

Utilities” is copyrighted and may be inspected and examined at no cost at the

Florida Public Service Commission, 2540 Shumard Oak Boulevard, Tallahassee,

Florida 32399-0850. A copy may be obtained from the National Association of

Regulatory Utility Commissioners, 1101 Vermont

Avenue, N.W., Suite 200, Washington, D.C. 20005.

1. Those utilities that choose to

convert documents from their original media form must shall

retain the original source documents as required by subsection (1)(a) of

this rule paragraph 25-30.110(1)(a), F.A.C., for a minimum of three

years, or for any lesser period of time specified for that type of record in

the “Regulations to Govern the Preservation of Records of Electric, Gas and

Water Utilities,” after the date the document was created or received by the

utility. This paragraph does not require the utility to create paper copies of

documents where the utility would not otherwise do so in the ordinary course of

its business. The Commission may waive the requirement that documents be retained

in their original form Uupon a showing by a utility that it

employs a storage and retrieval system that consistently produces clear,

readable copies that are substantially equivalent to the originals, and clearly

reproduces handwritten notations on documents, the utility does not have to

meet the requirement to retain documents in their original form.

2. The utility must shall

maintain written procedures governing the conversion of source documents to a

storage and retrieval system, which procedures ensure the authenticity of

documents and the completeness of records. Records maintained in the storage

and retrieval system must be easy to search and easy to read.

(b) Unless otherwise authorized by the

Commission, each utility must shall maintain its records at the

office or offices of the utility within this state and must shall

keep those records open for inspection during business hours by Commission

staff.

(c) Any utility that keeps its records

outside the state must shall reimburse the Commission for the

reasonable travel expense incurred by each Commission representative during any

review of the out-of-state records of the utility or its affiliates. Reasonable

travel expenses are those travel expenses that are equivalent to travel

expenses paid by the Commission in the ordinary course of its business.

1. The utility must shall

remit reimbursement for out-of-state travel expenses within 30 days from the

date the Commission mails the invoice.

2. The reimbursement requirement in

paragraph (1)(c) shall is not applicable for the following be

waived:

a. For A any

utility that makes its out-of-state records available at the utility’s office

located in Florida or at another mutually agreed upon location in Florida

within 10 working days from the Commission’s initial request. If 10 working

days is not reasonable because of the complexity and nature of the issues

involved or the volume and type of material requested, the Commission will

may establish a different time frame for the utility to bring records

into the state. For individual data requests made during an audit, the response

time frame established in Rule 25-30.145, F.A.C., will shall

control; or

b. For Aa utility

whose records are located within 50 miles of the Florida state line.

(2) In General. Each utility must

shall furnish to the Commission at such time and in such forms as the

Commission may require, the results of any required tests and summaries of

any required records. The utility must shall also furnish the

Commission with any information concerning the utility’s facilities or

operation that the Commission may requests and requires

for determining rates or judging the practices of the utility. All such data,

unless otherwise specified, must shall be consistent with and

reconcilable with the utility’s annual report to the Commission.

(3) Annual Reports: Filing Extensions.

Each utility must shall file with the Commission annual reports

on the applicable forms in subsection (4) of this rule prescribed

by the Commission. The obligation to file an annual report for any year will

shall apply to any utility which is subject to this Commission’s

jurisdiction as of December 31 of that year, whether or not the utility has

actually applied for or been issued a certificate.

(a) The Commission will shall,

by January 15 of each year, email a send one blank copy of the

appropriate annual report form to each utility company. A utility may

request a hard copy of the forms in subsection (4) of this rule from the Commission’s

Division of Accounting and Finance. The failure of a utility to receive a report

form will shall not excuse the utility from its obligation to

timely file the annual report. An original and two copies of Tthe

annual reports must shall be filed with the Commission, either

by mail or by email, on or before March 31 for the preceding year ending

December 31. Annual reports filed by email must be sent to AnnualReport@psc.state.fl.us.

Annual reports are considered filed on the day they are postmarked,

or received and logged in by Annual reports filed by mail must be sent

to the Commission’s Division of Accounting and Finance in Tallahassee.

(b) An Aannual

reports is are considered on filed if they

are it is properly addressed and emailed or mailed with

sufficient postage, and postmarked, by no later than the due

date. If an For annual reports is sent by

registered mail, the date of the registration is the postmark date. The

registration is evidence that the annual report was delivered. If an For

annual reports is sent by certified mail and the receipt

is postmarked by a postal employee, the date on the receipt is the postmark

date. The postmarked certified mail receipt is evidence that the an

annual report return was delivered. However, if a utility’s

annual report is not actually received by the Commission’s Division of

Accounting and Finance in Tallahassee, that utility must resend it upon

request, despite any prior presumption of delivery.

(c) A utility may file a written

request for an extension of time to file its annual report with the Commission’s

Division of Accounting and Finance no later than March 31. One extension of

30 days will be automatically granted upon request. A request for a longer

extension must be accompanied by a statement of good cause, such as

financial hardship, severe illness, or significant weather events such as

hurricanes, but good cause does not include reasons such as management

oversight or vacation time, and must shall specify the date

by which the report will be filed.

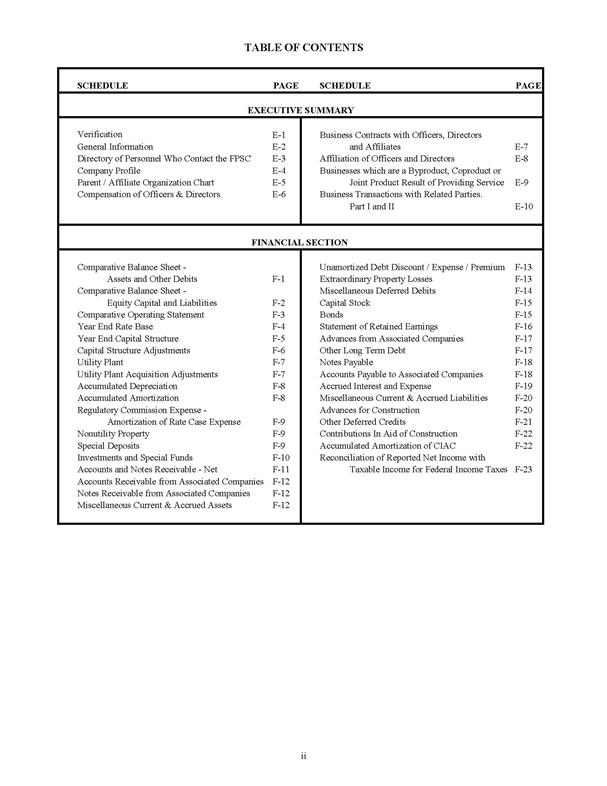

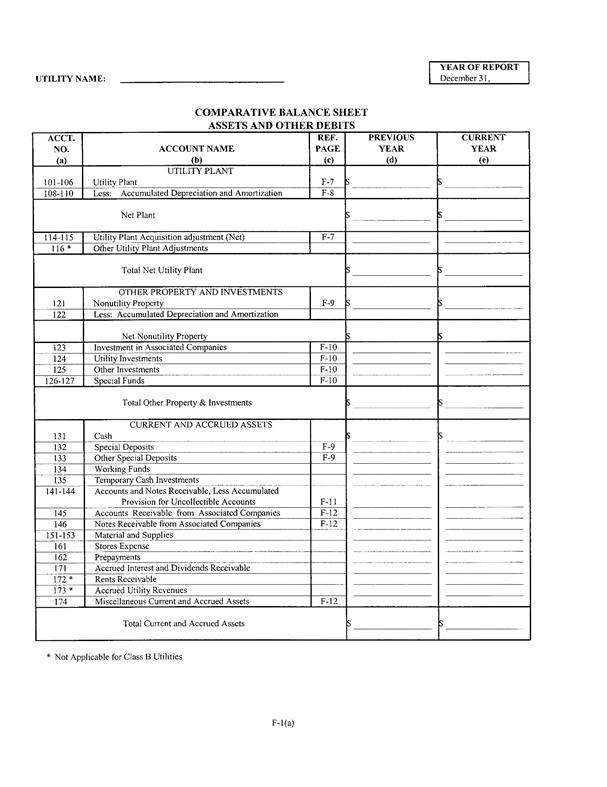

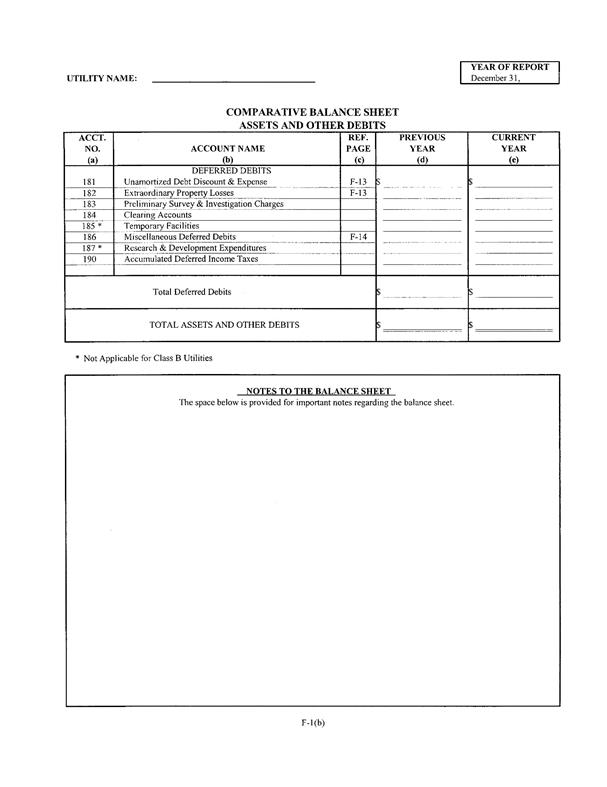

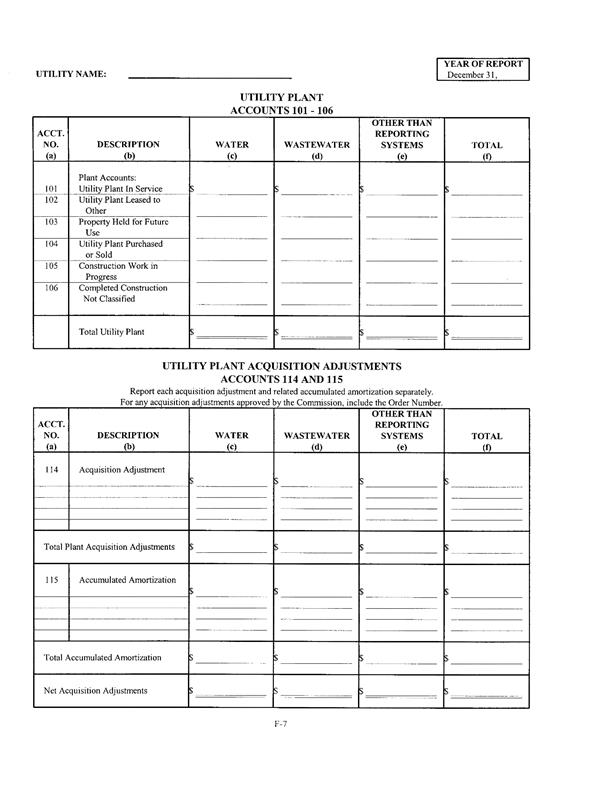

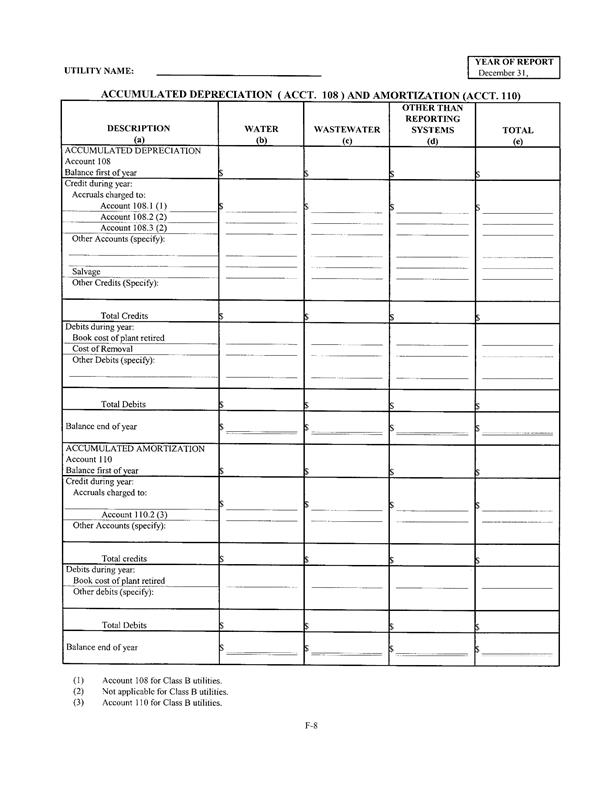

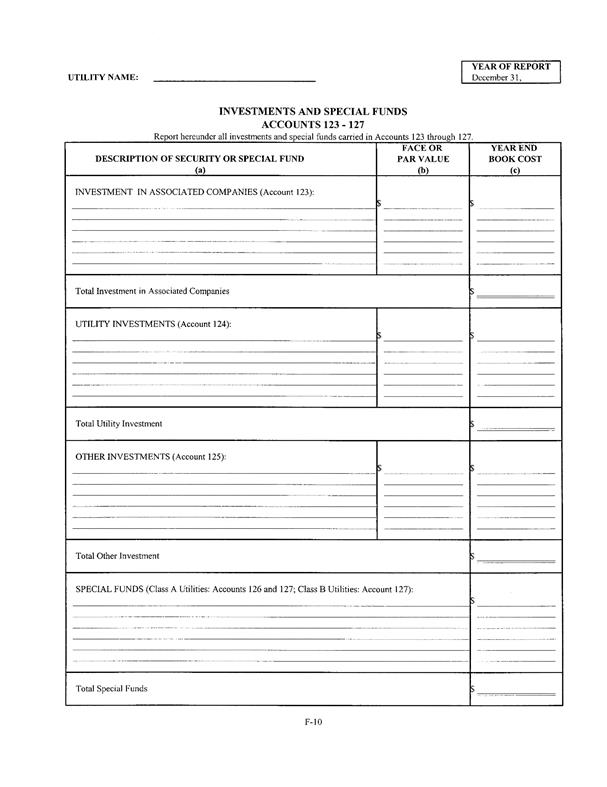

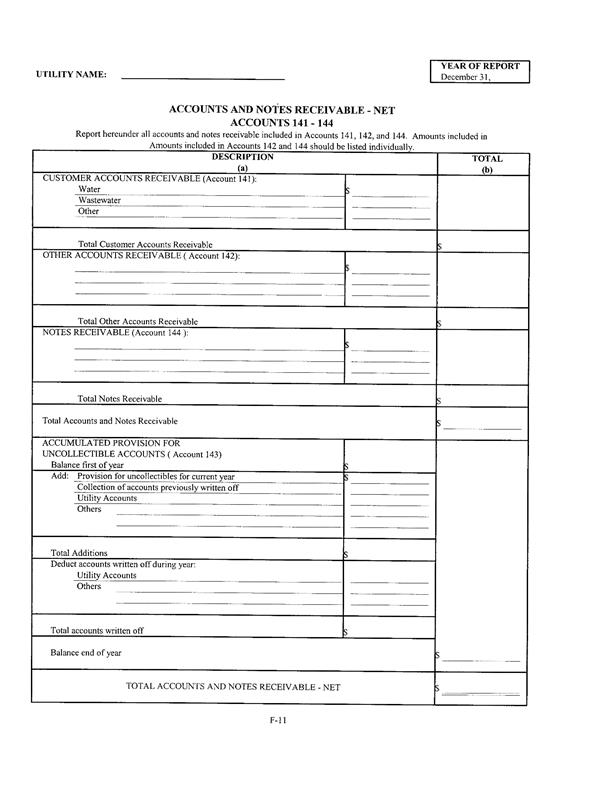

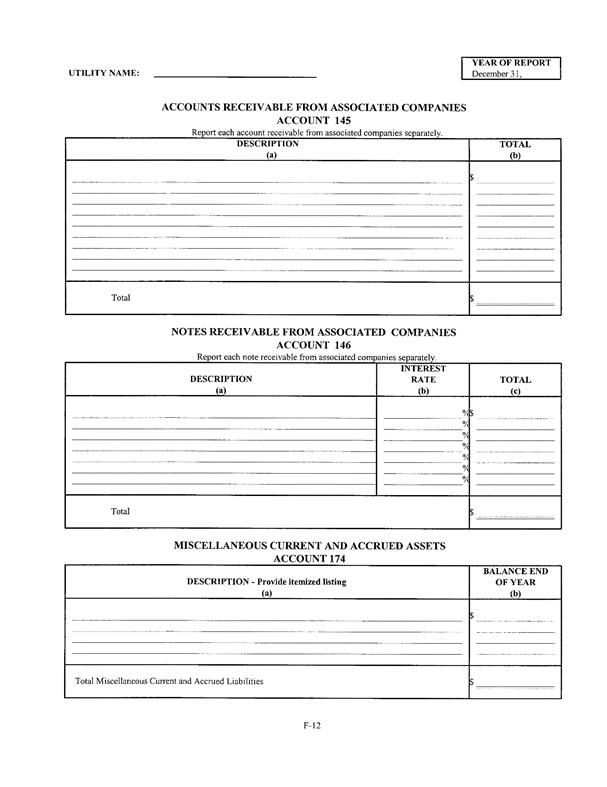

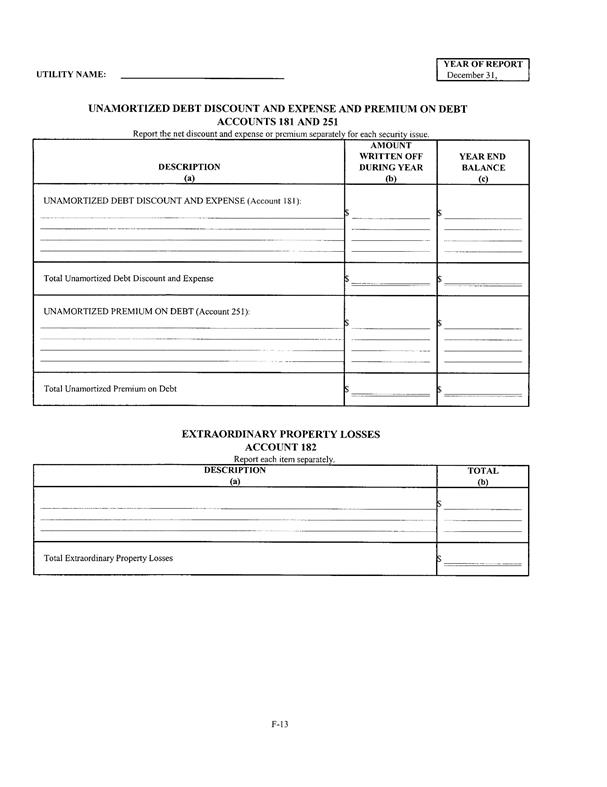

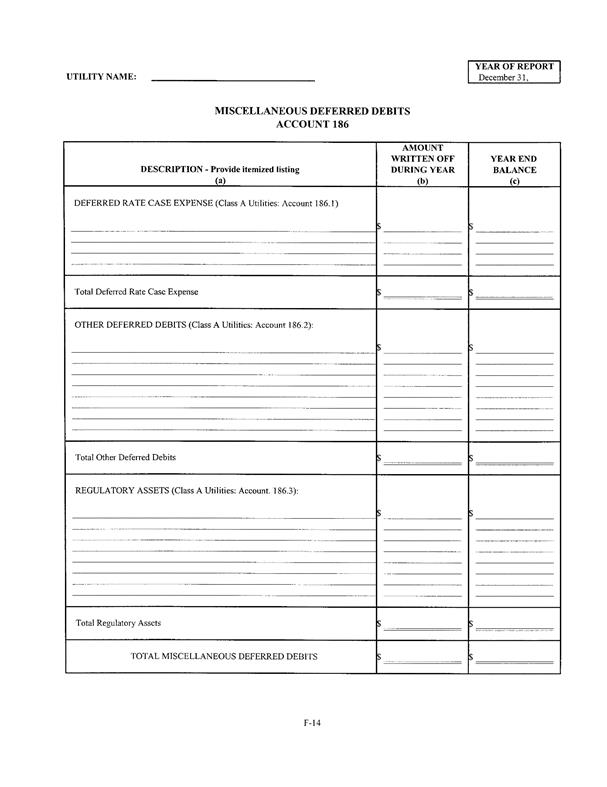

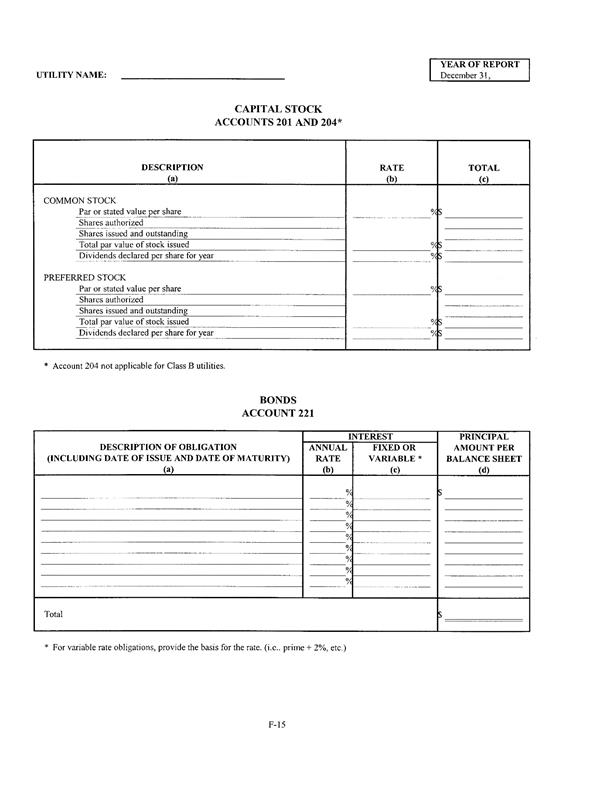

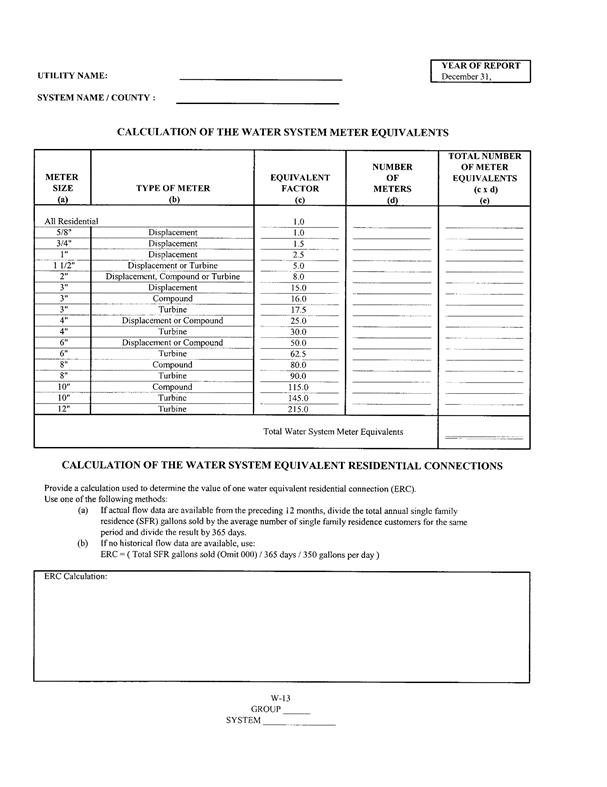

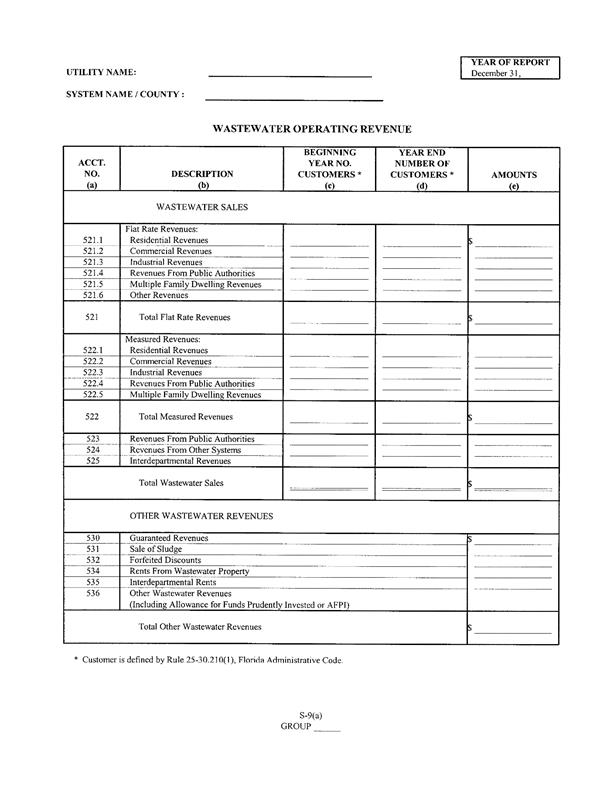

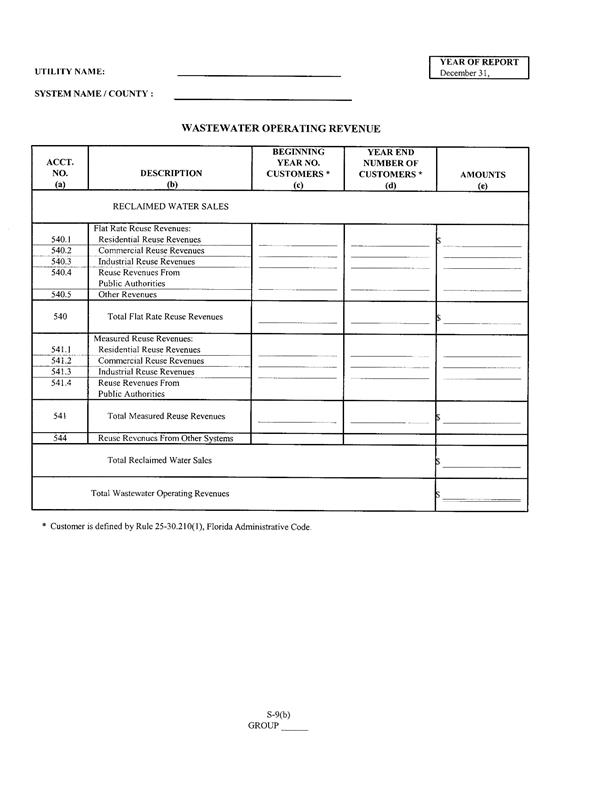

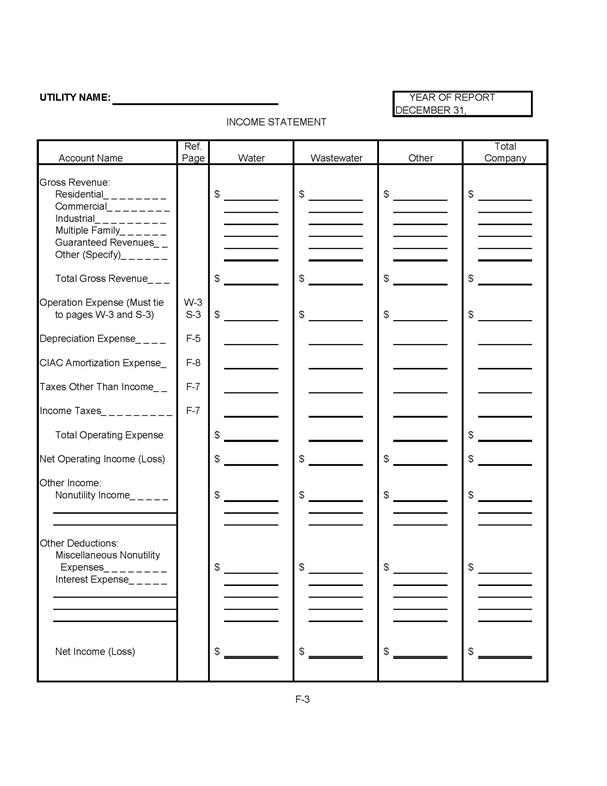

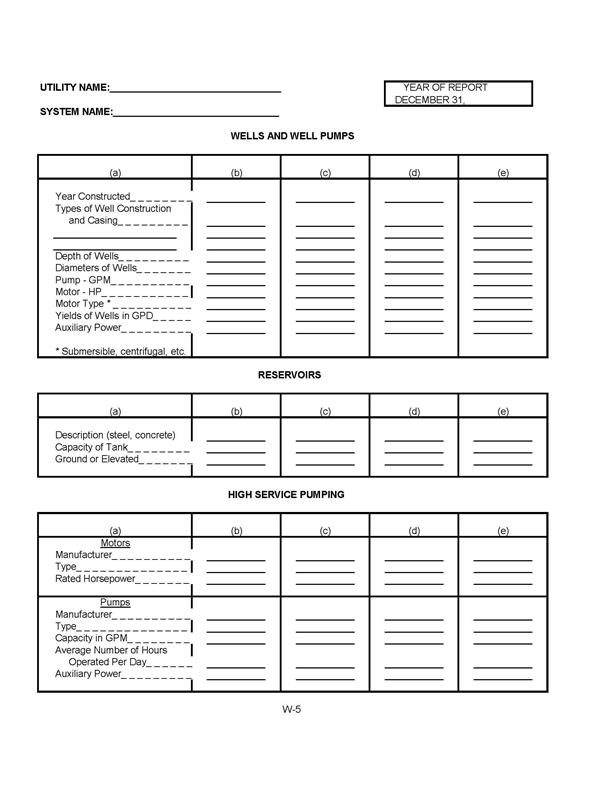

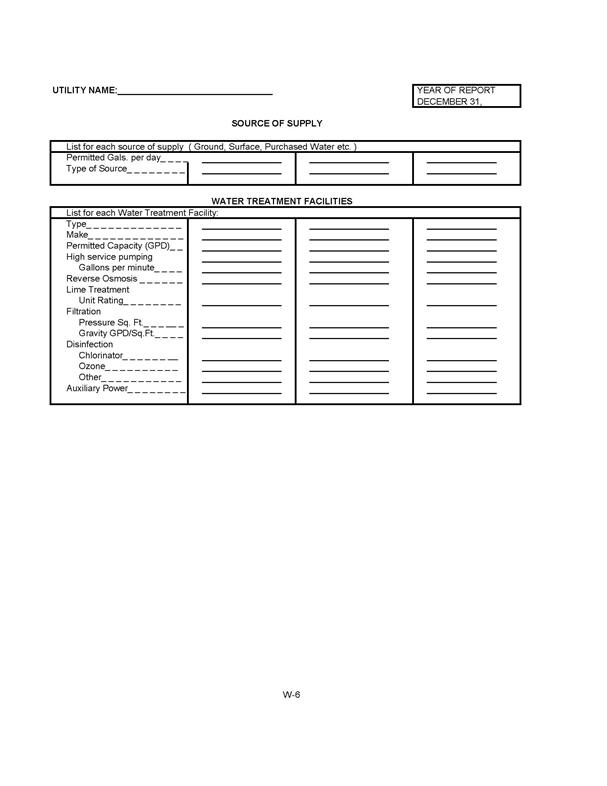

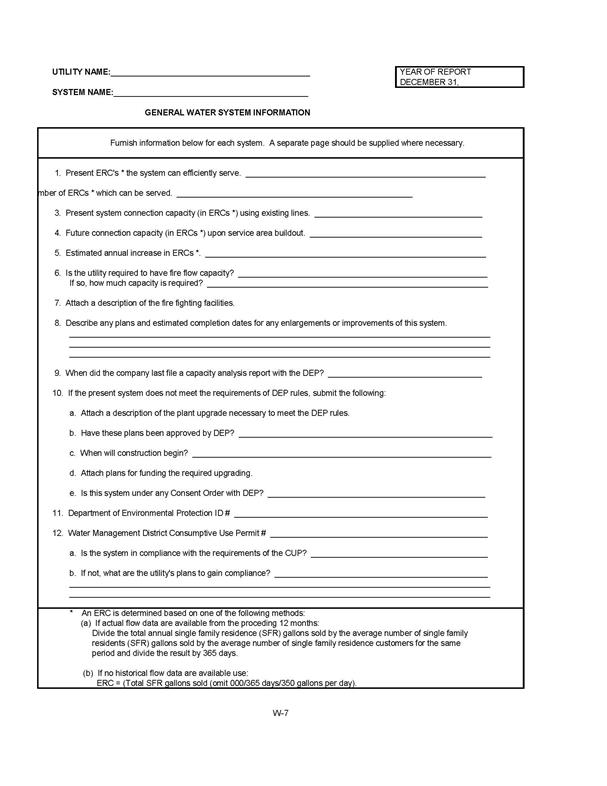

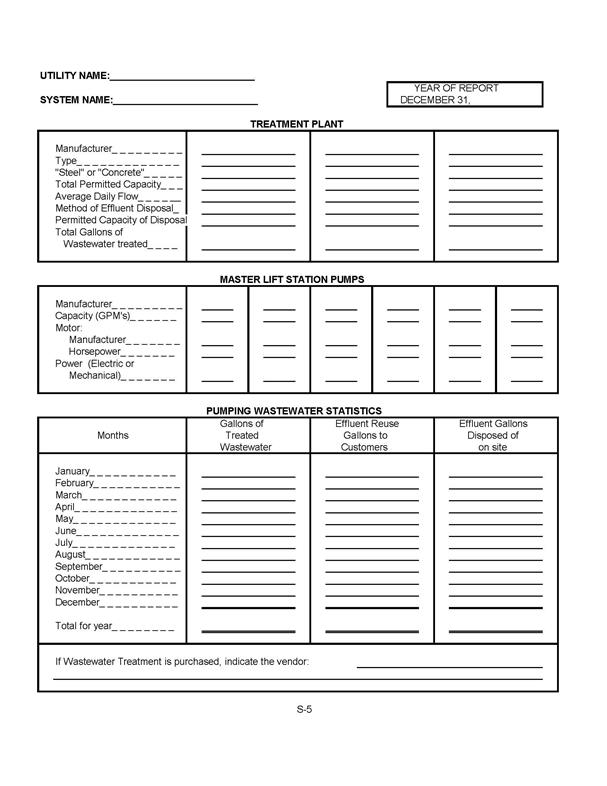

(4) Annual Reports; Contents. The

appropriate annual report form required from each utility will shall

be determined by using the same three classes of utilities used by the National

Association of Regulatory Utility Commissioners for publishing its system of

accounts: Class A (those having annual water or wastewater operating revenues

of $1,000,000 or more); Class B (those having annual water or wastewater

revenues of $200,000 or more, but less than $1,000,000); Class C (those

having annual water or wastewater revenues of less than $200,000). The

class to which a utility belongs will shall be determined by

using the higher of the average of its annual water or wastewater operating

revenues for each of the last three preceding years.

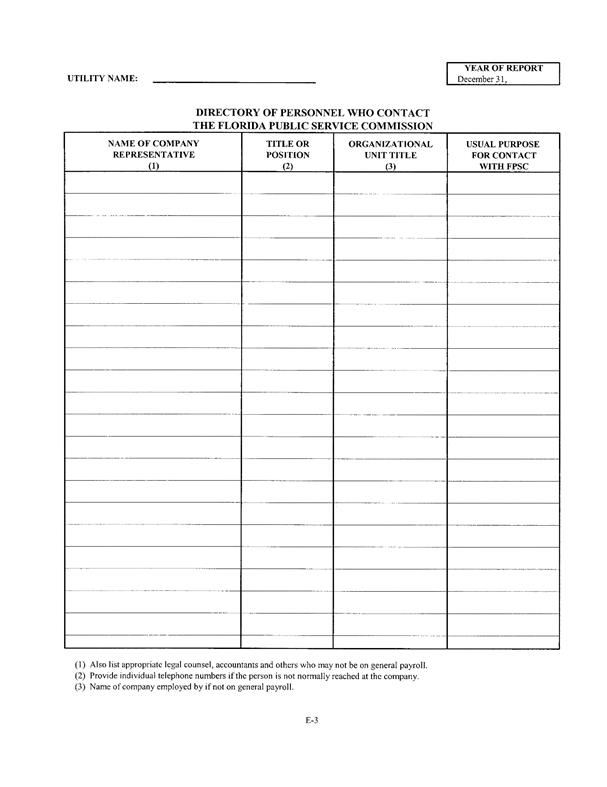

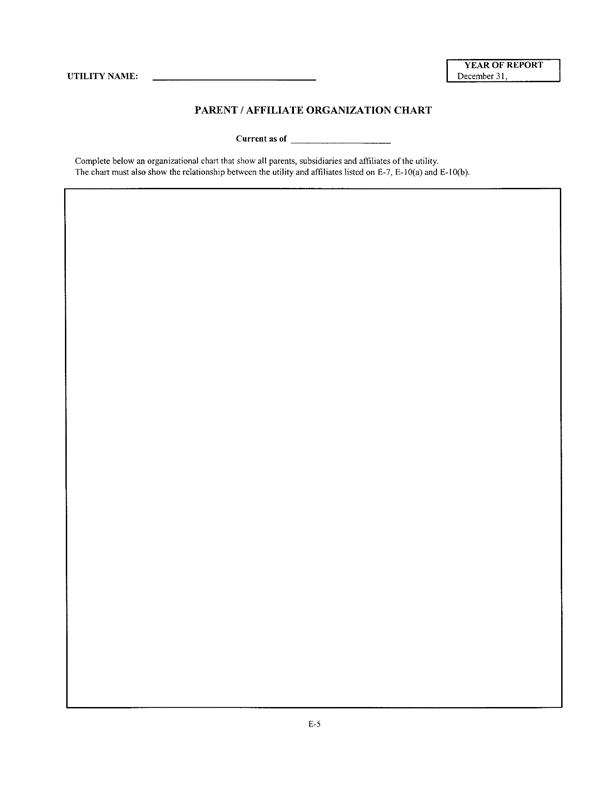

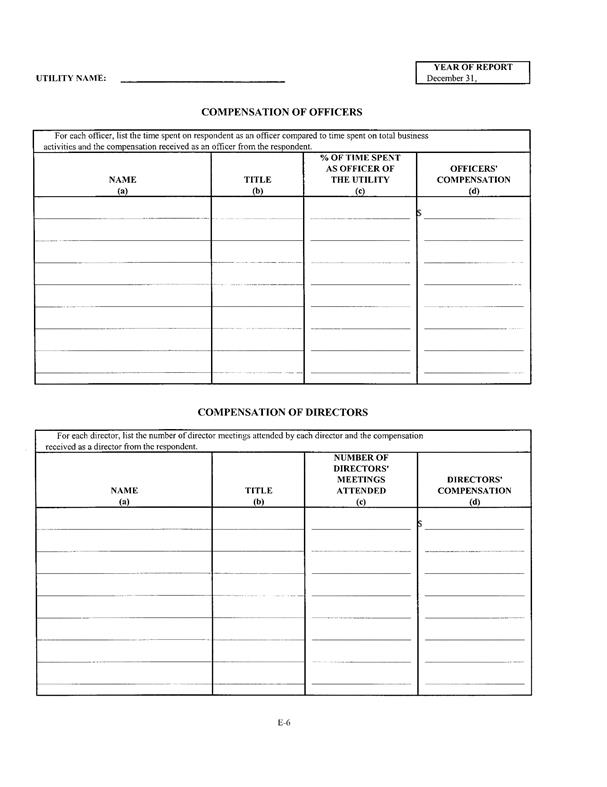

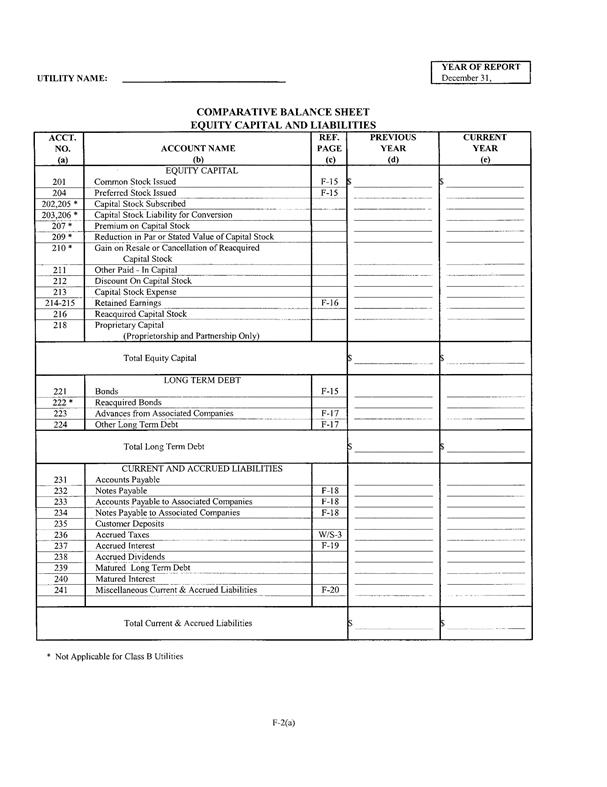

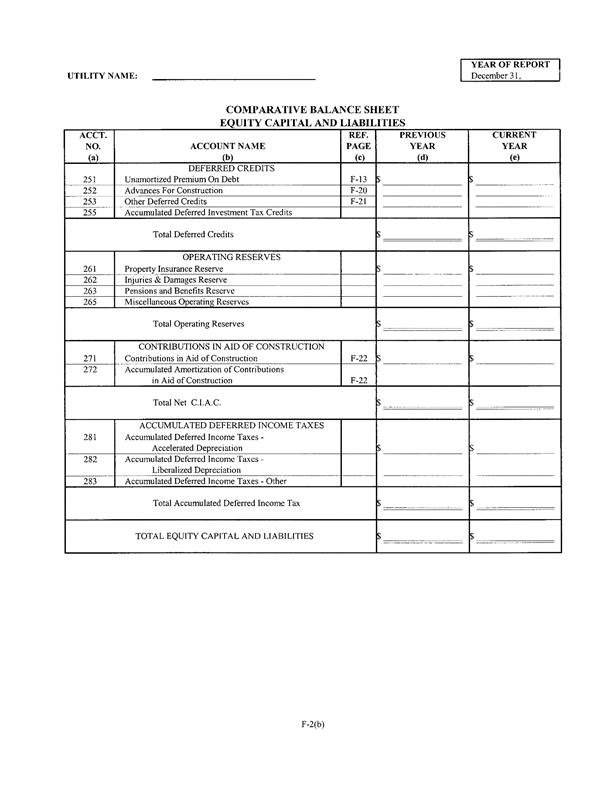

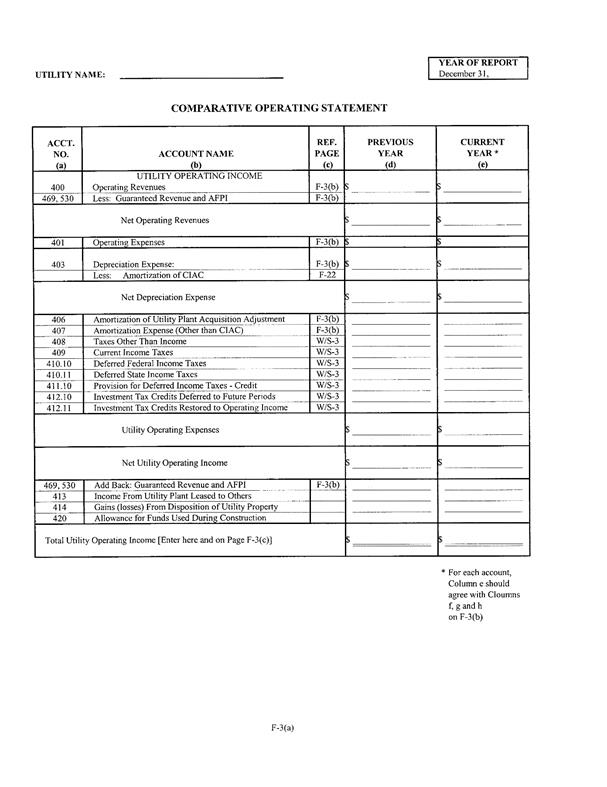

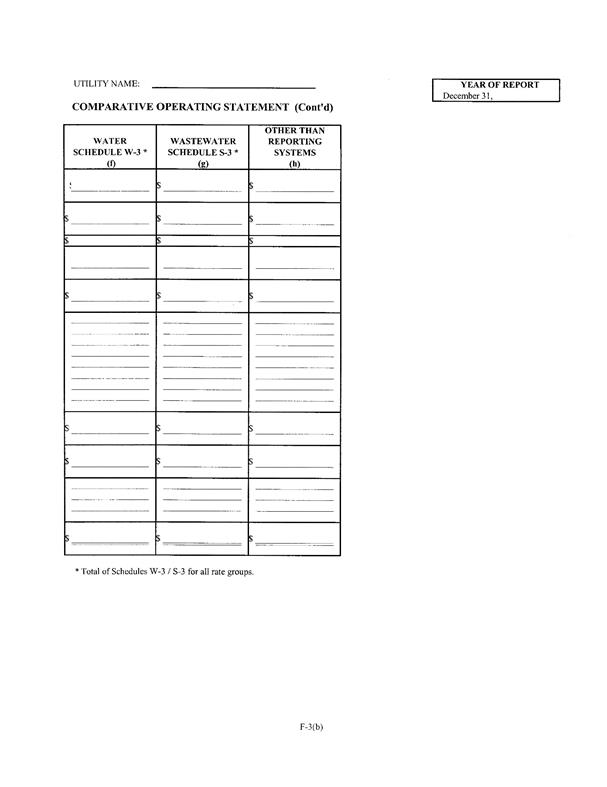

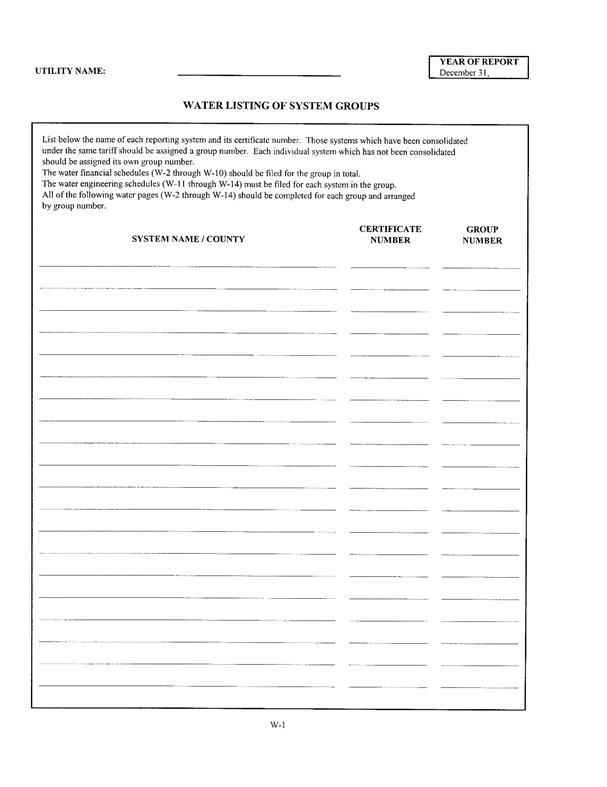

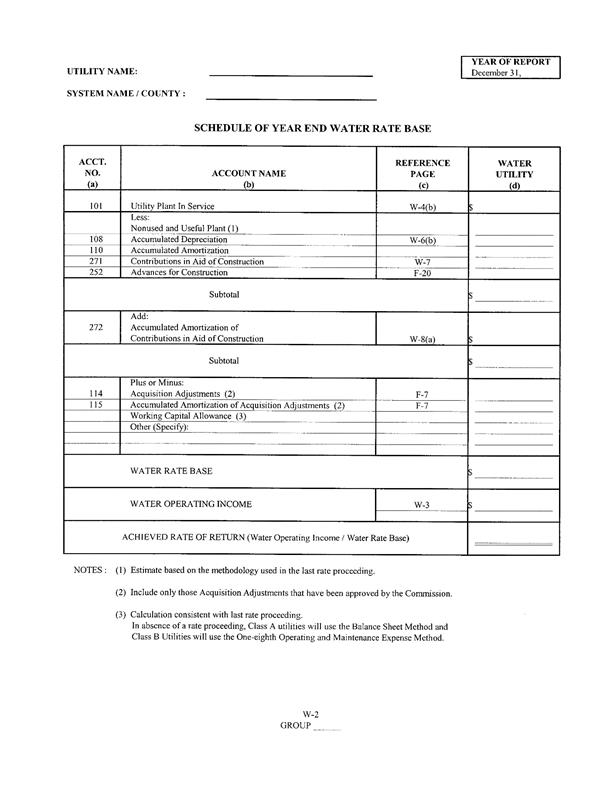

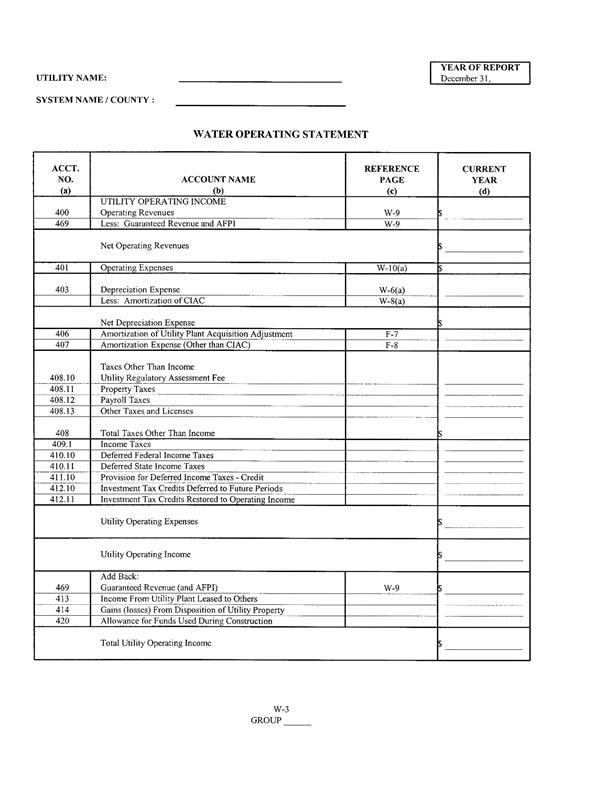

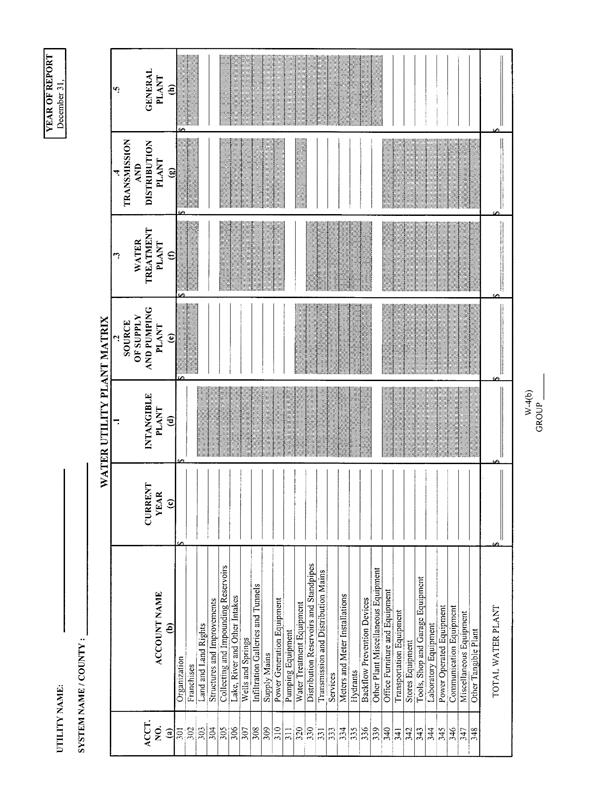

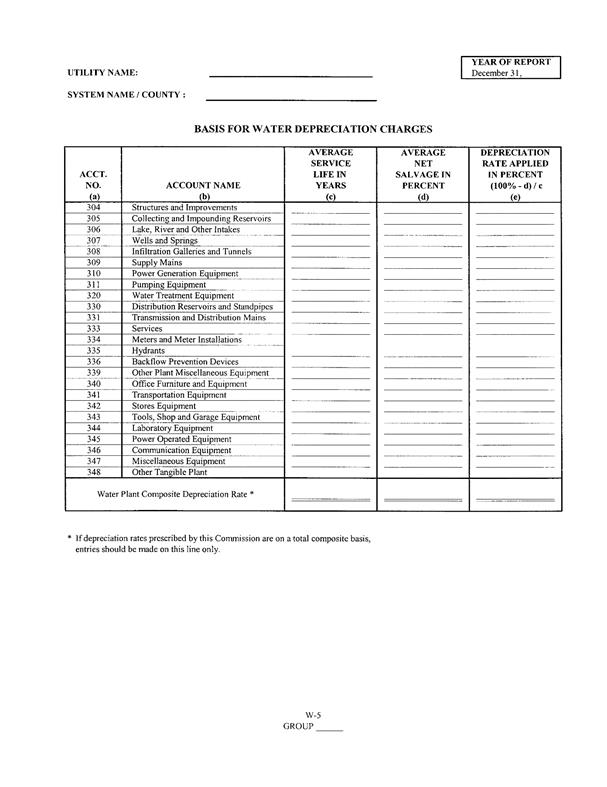

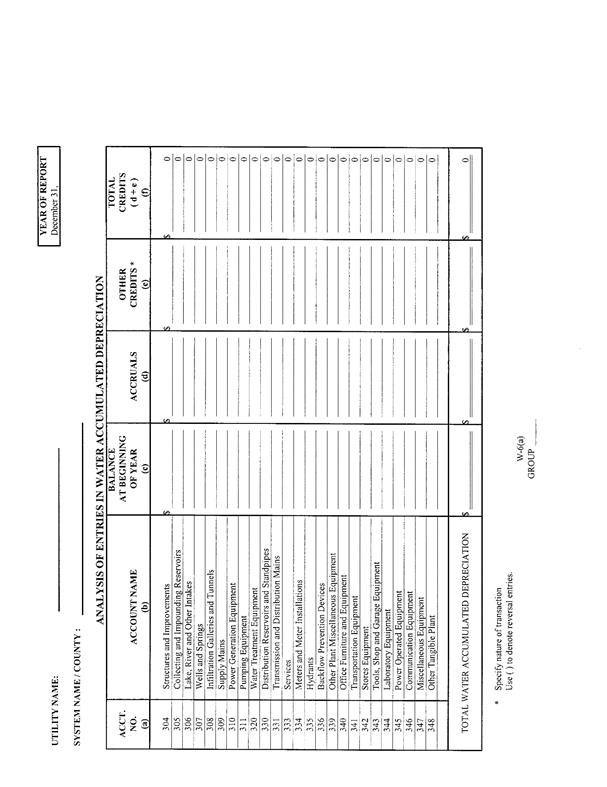

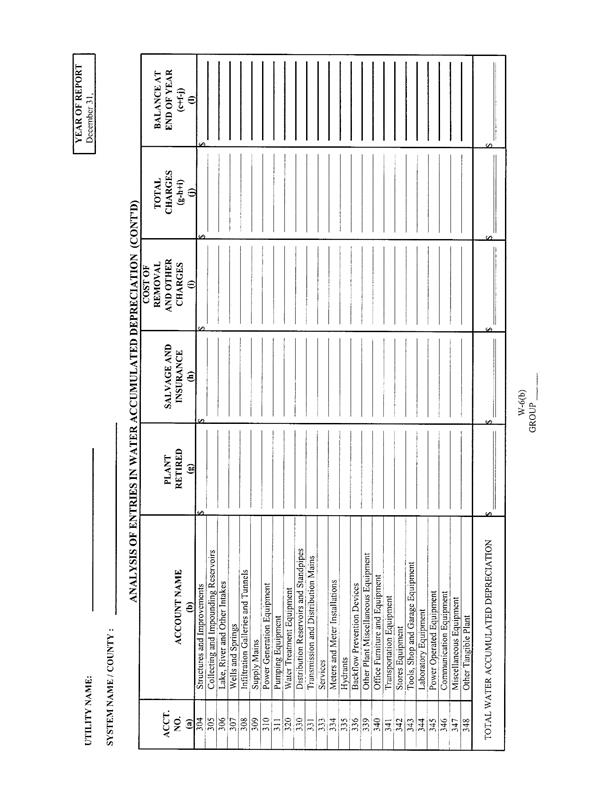

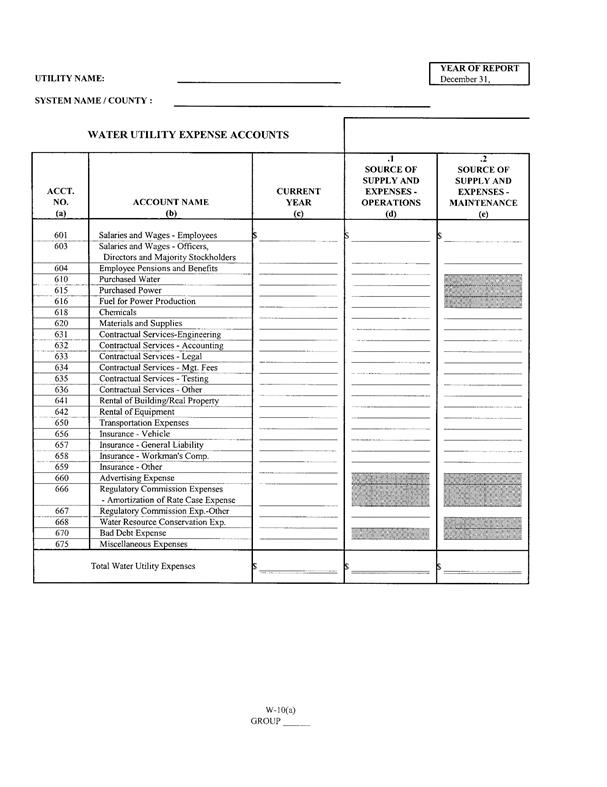

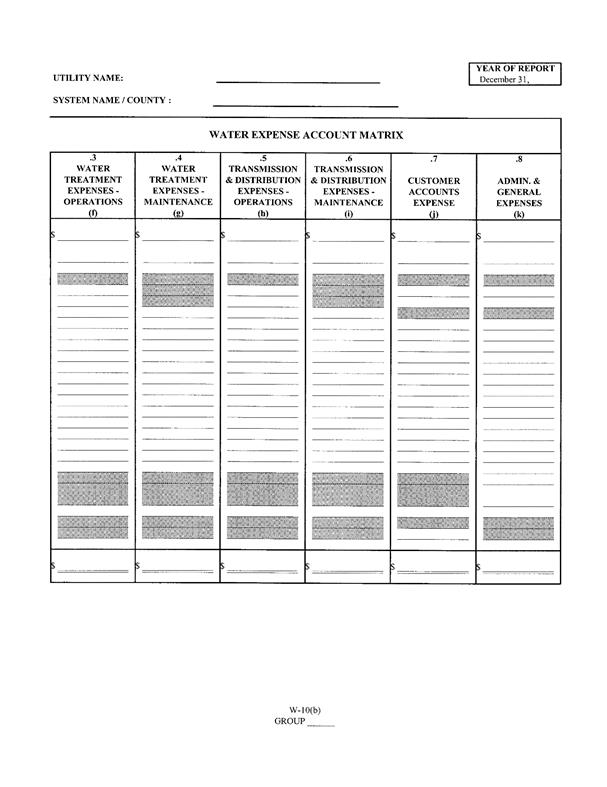

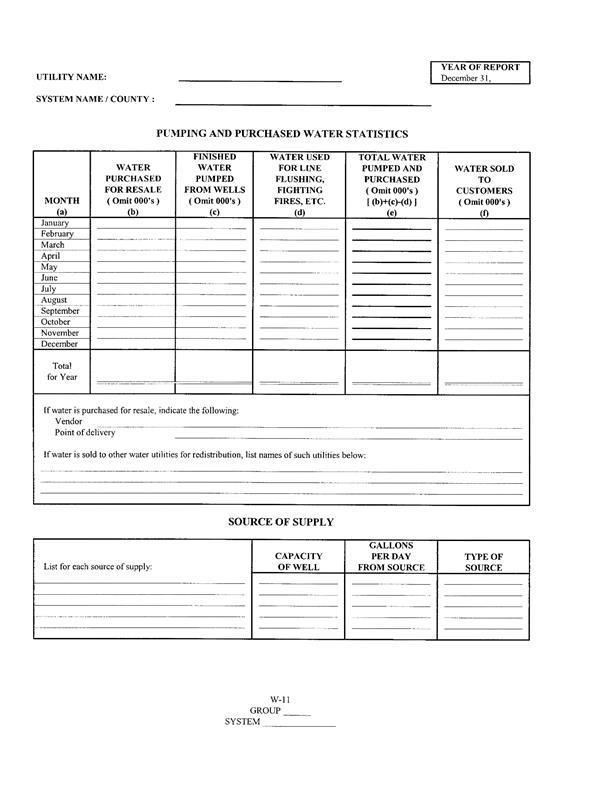

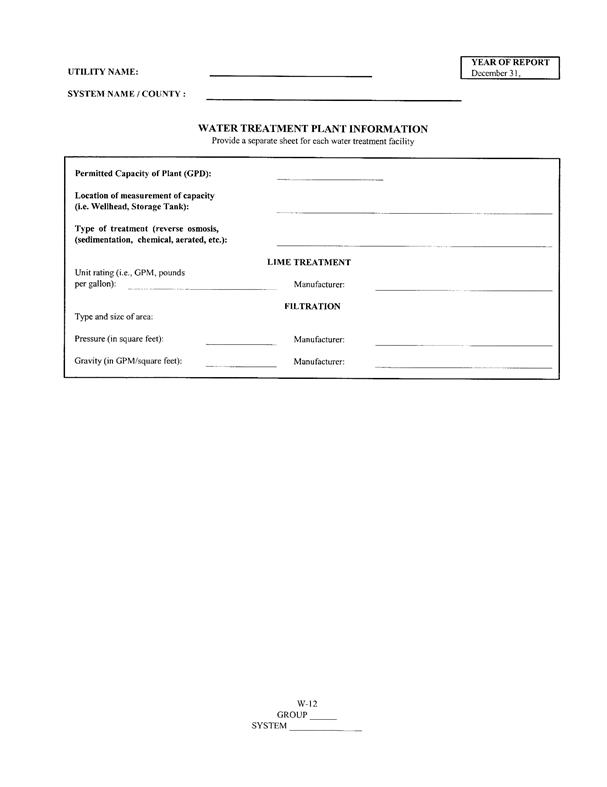

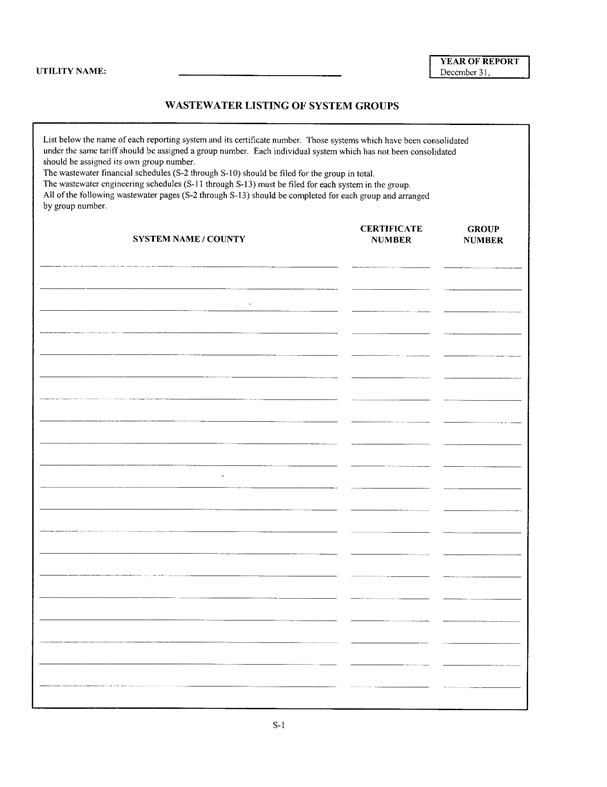

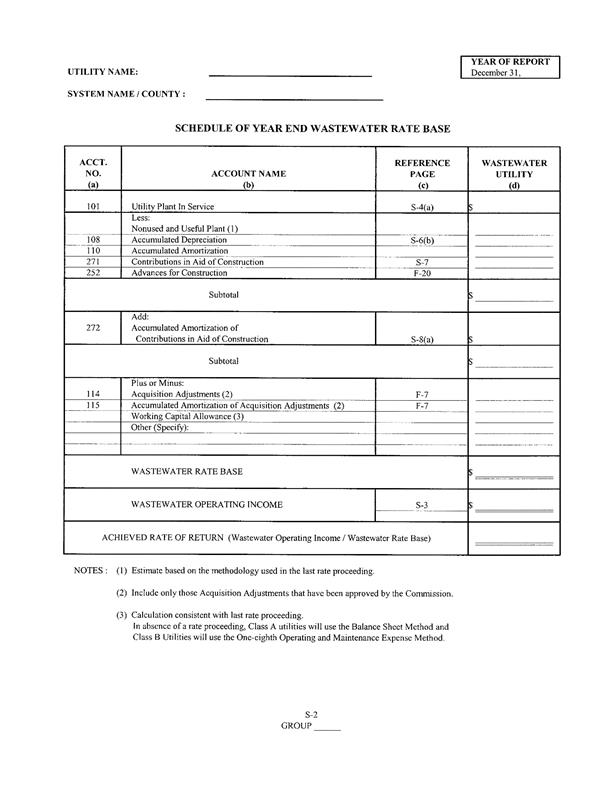

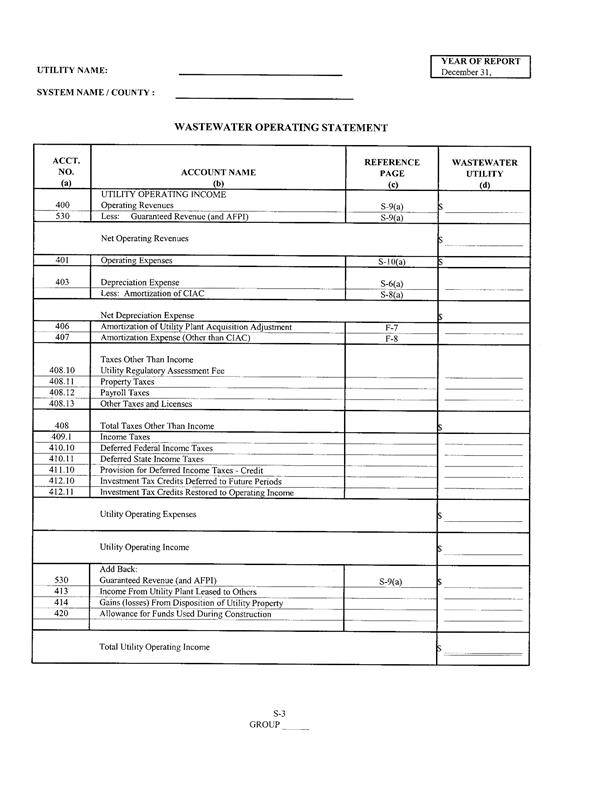

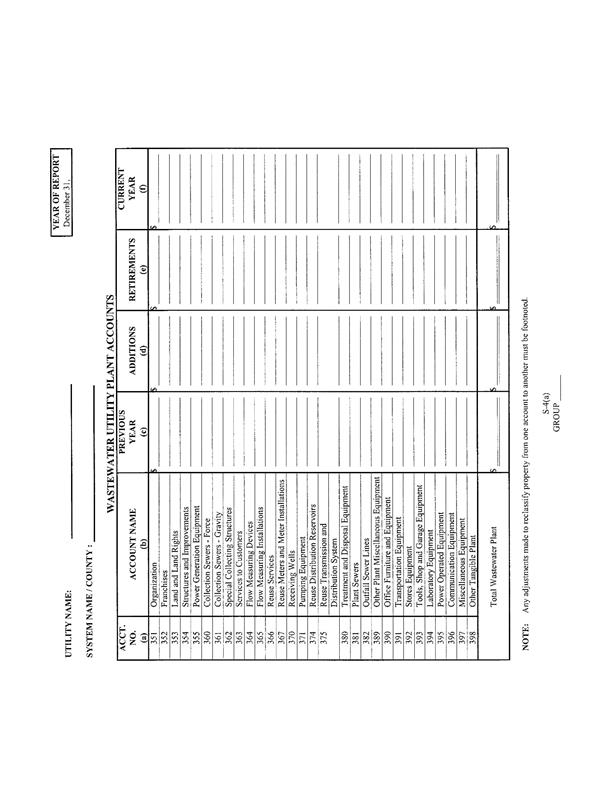

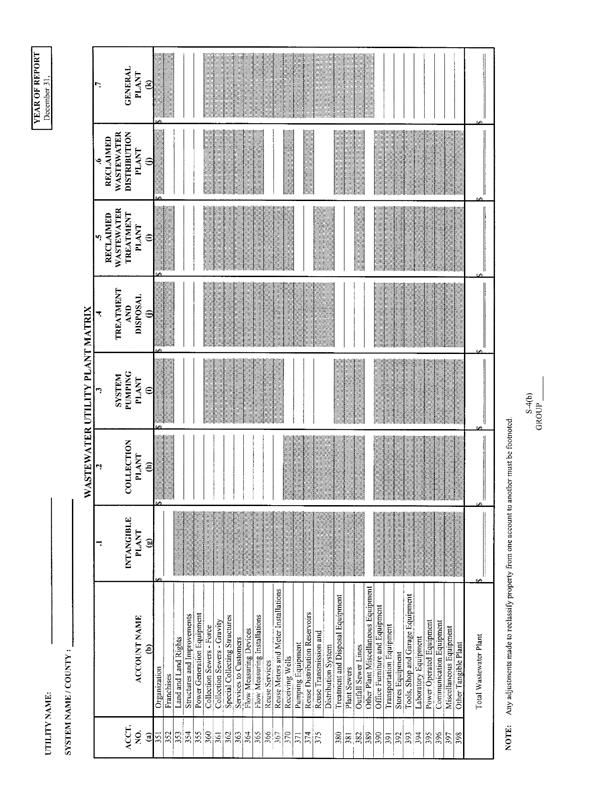

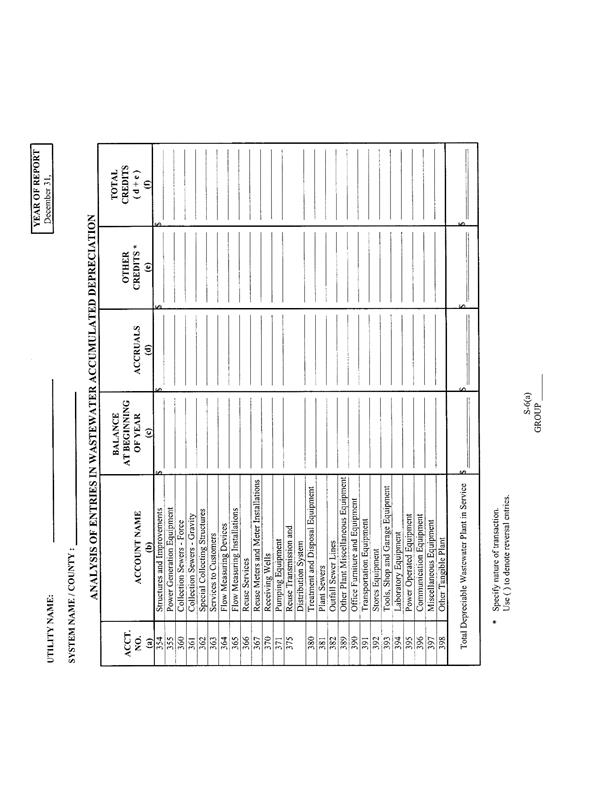

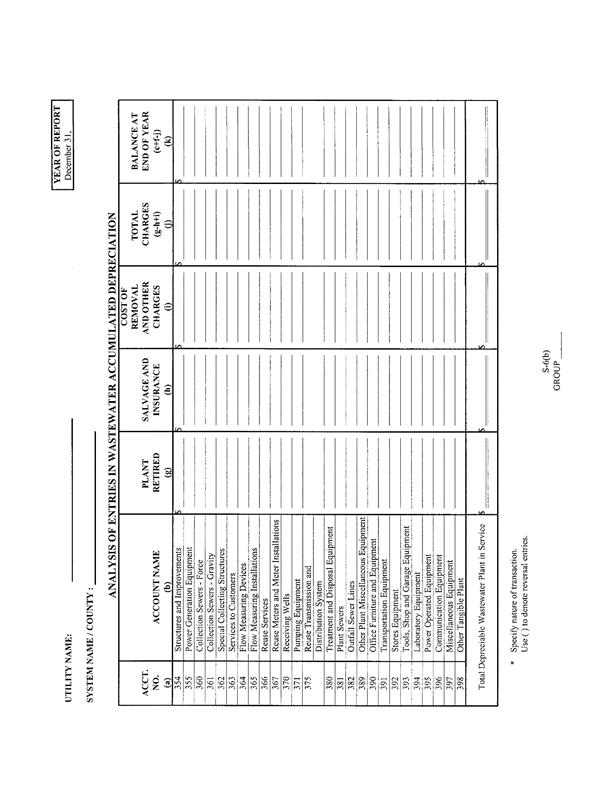

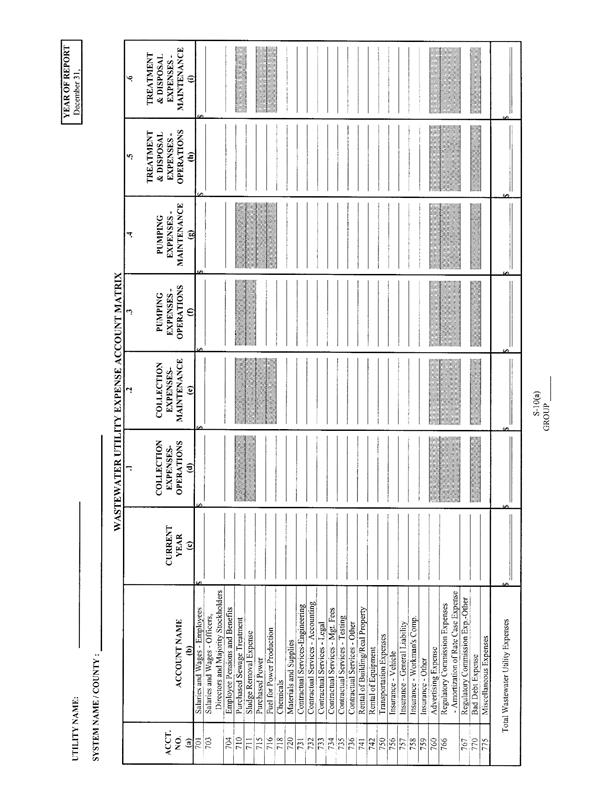

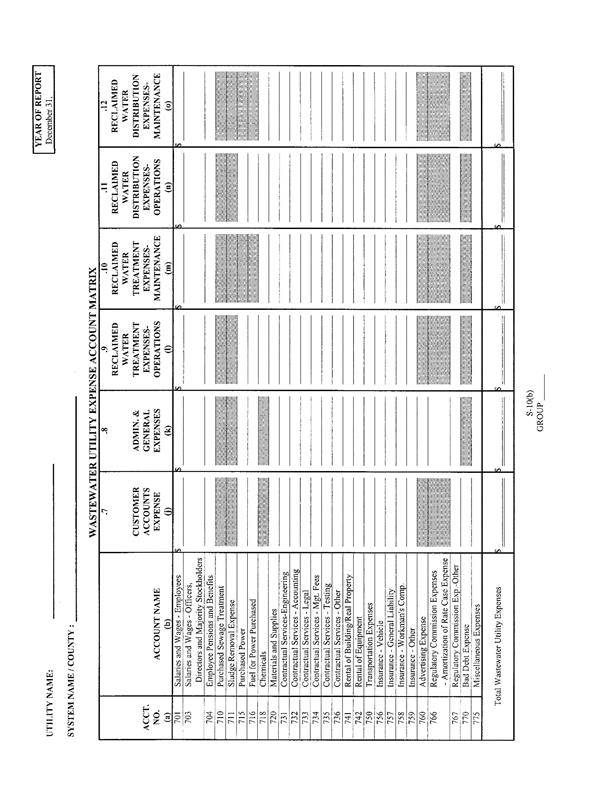

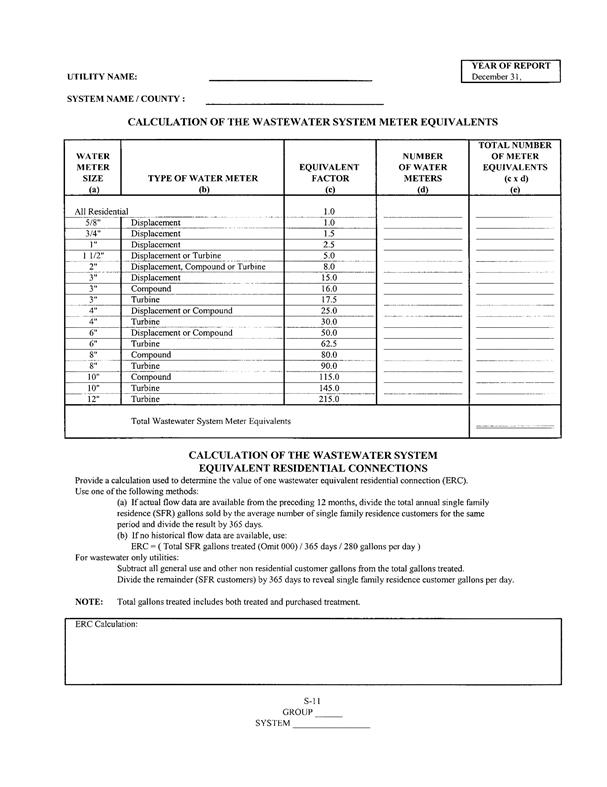

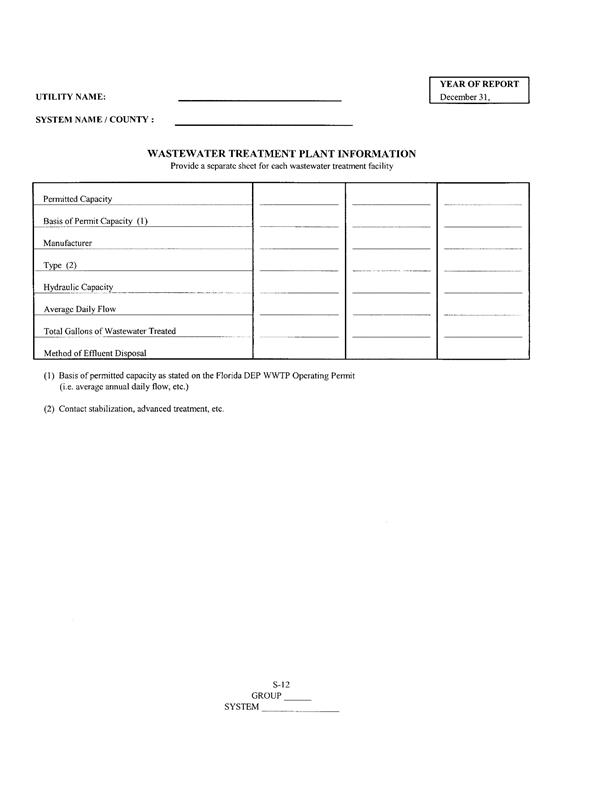

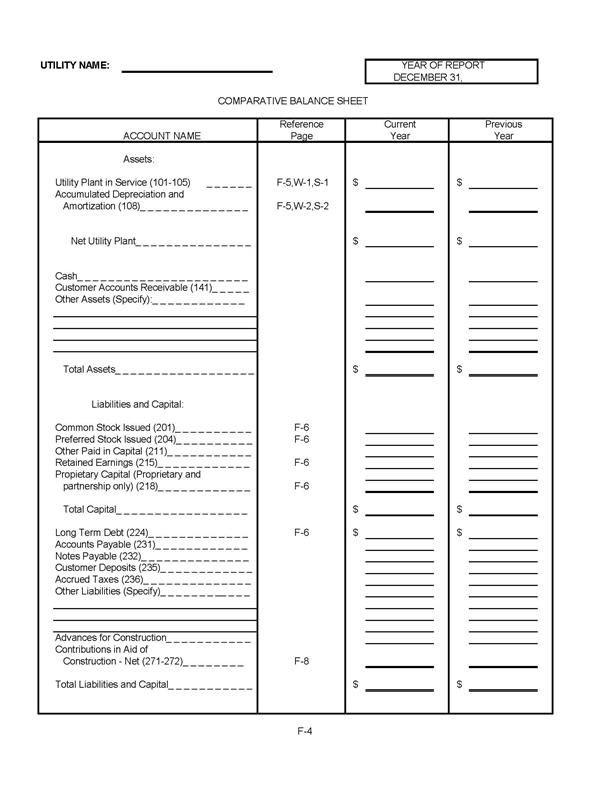

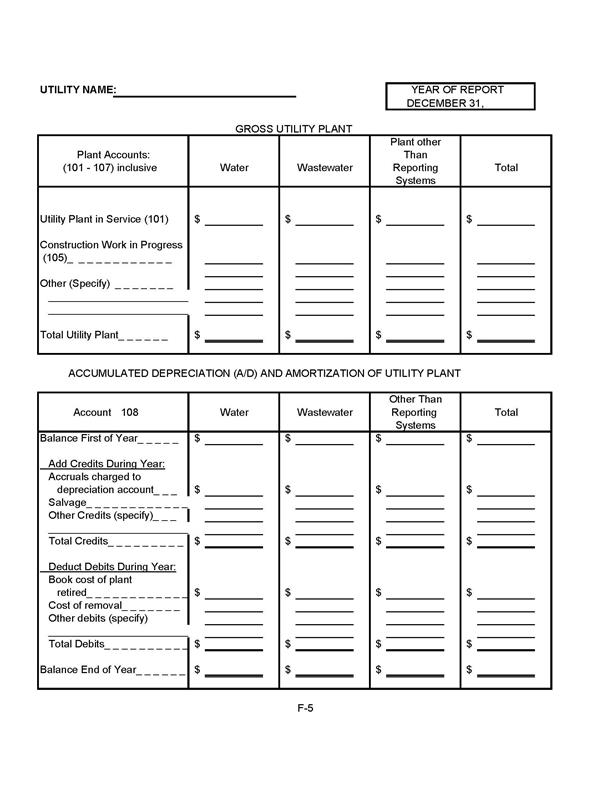

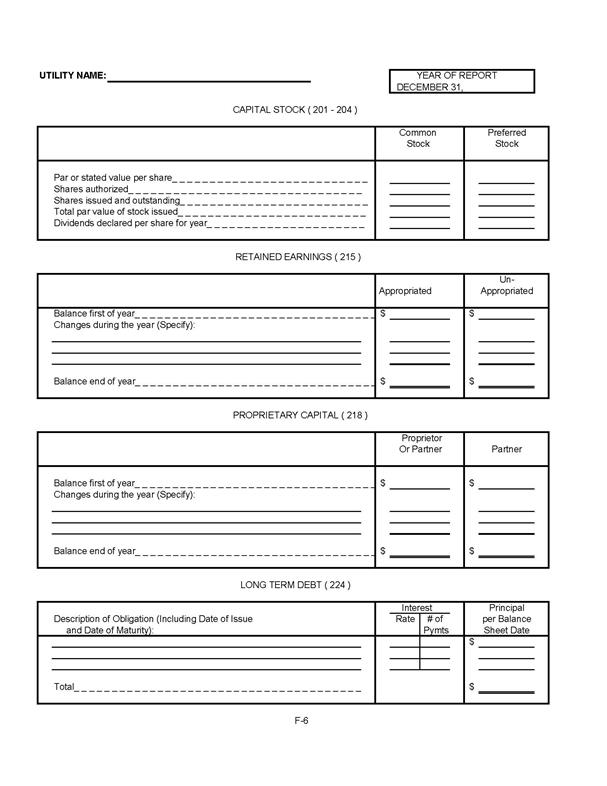

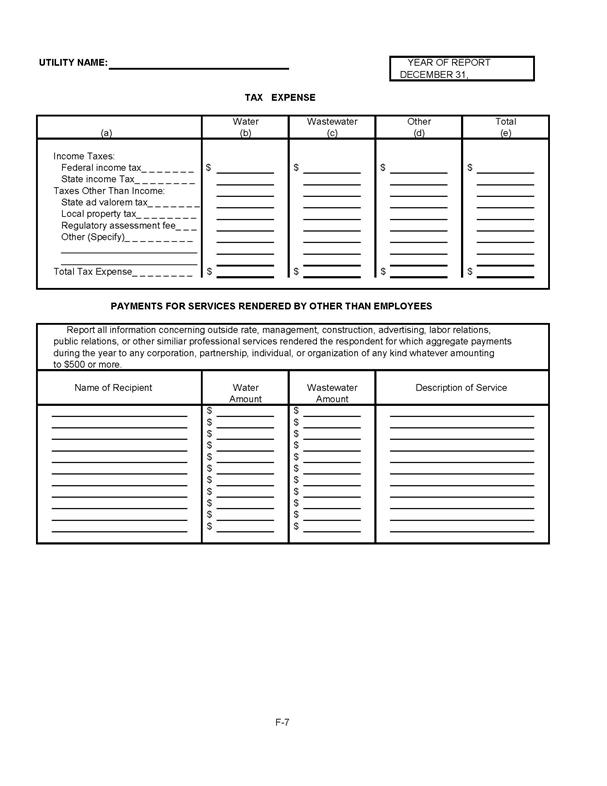

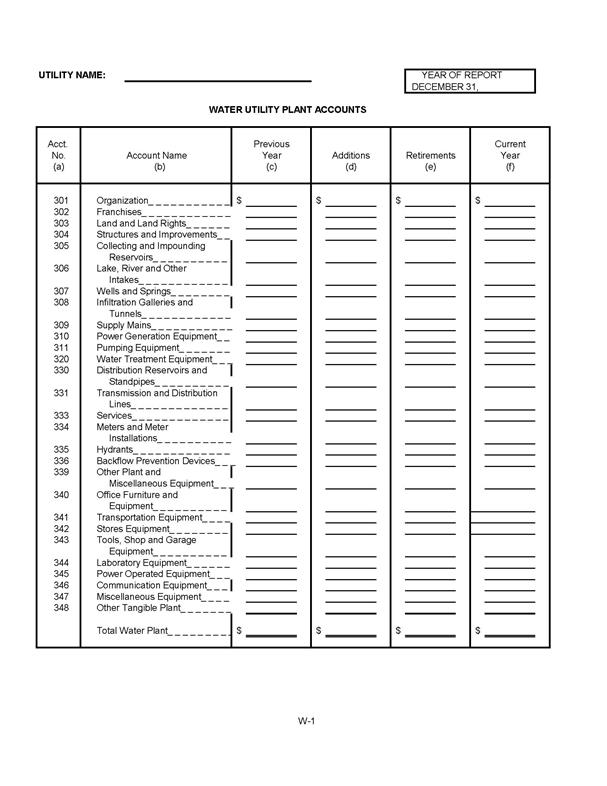

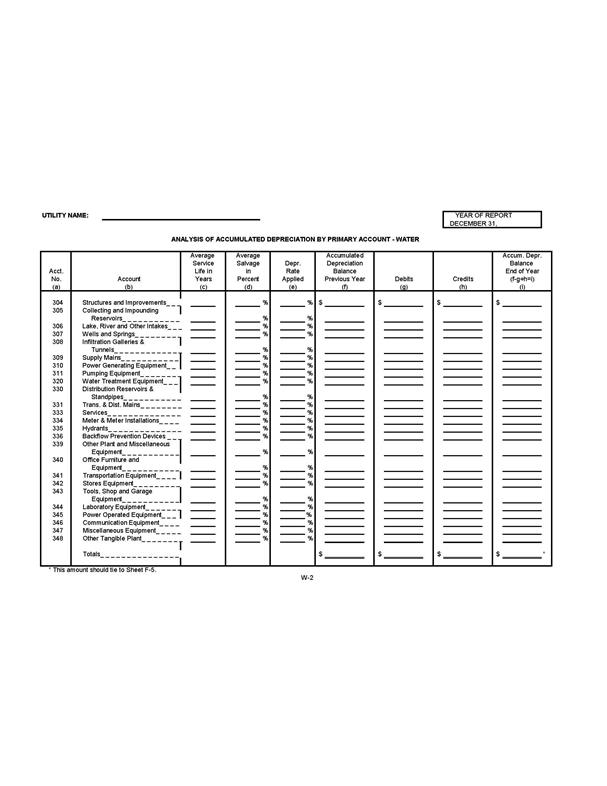

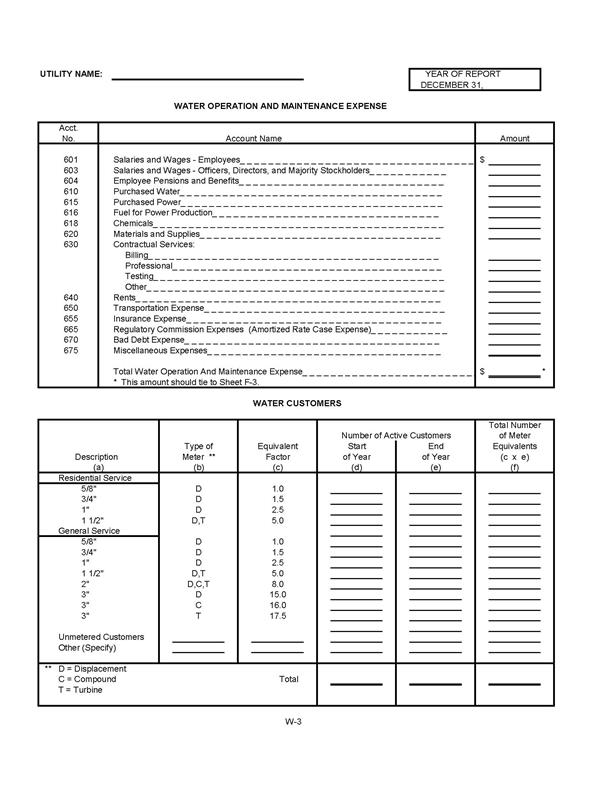

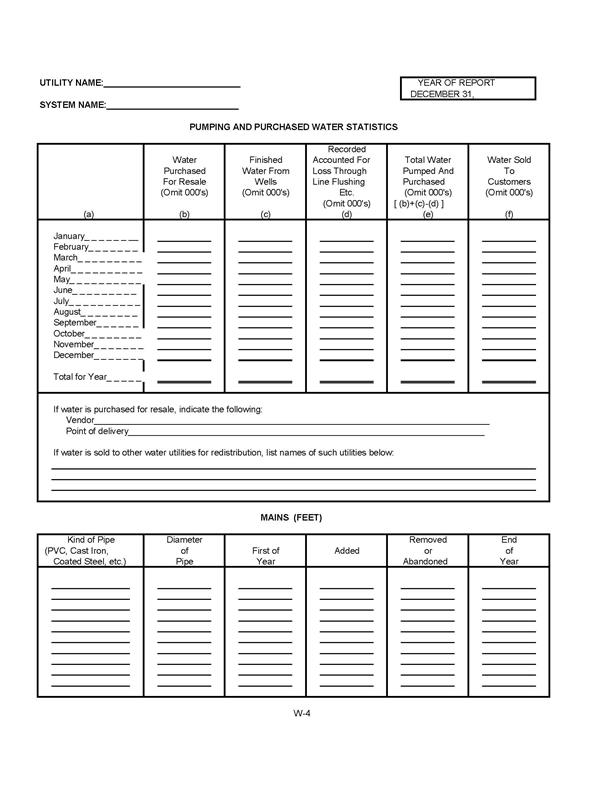

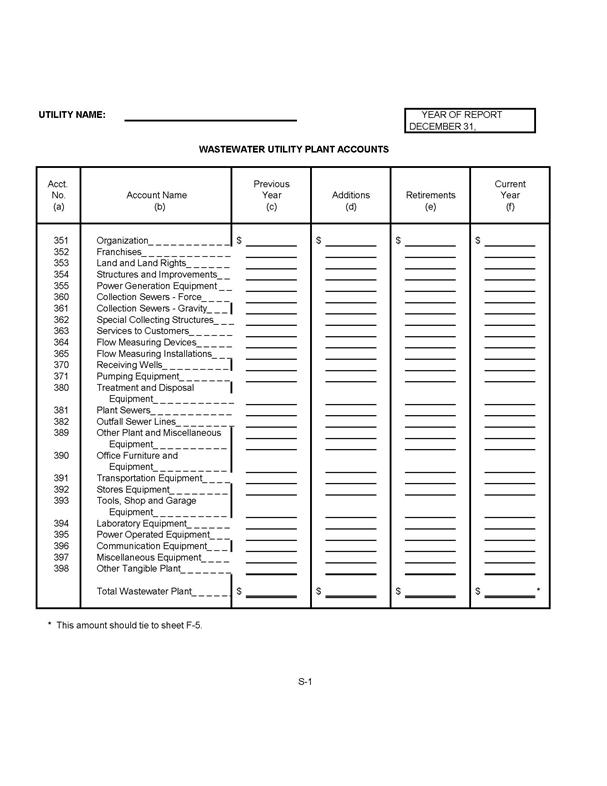

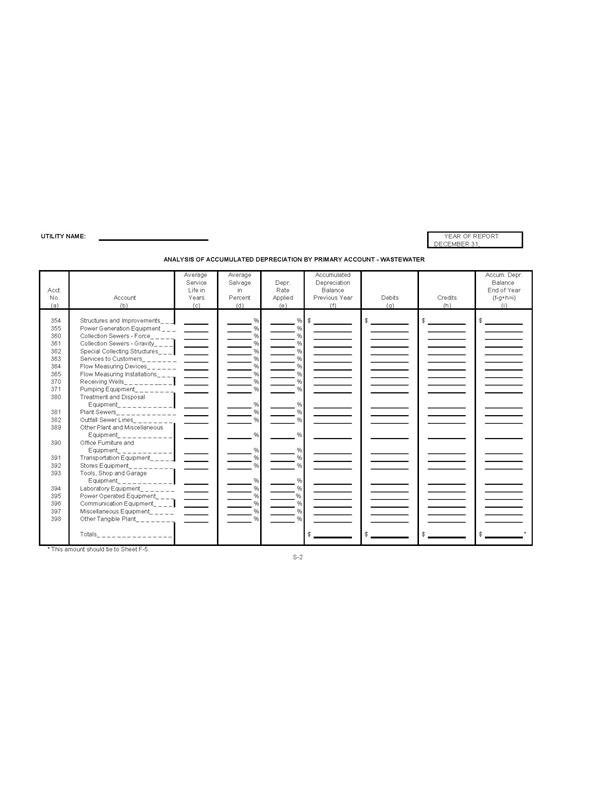

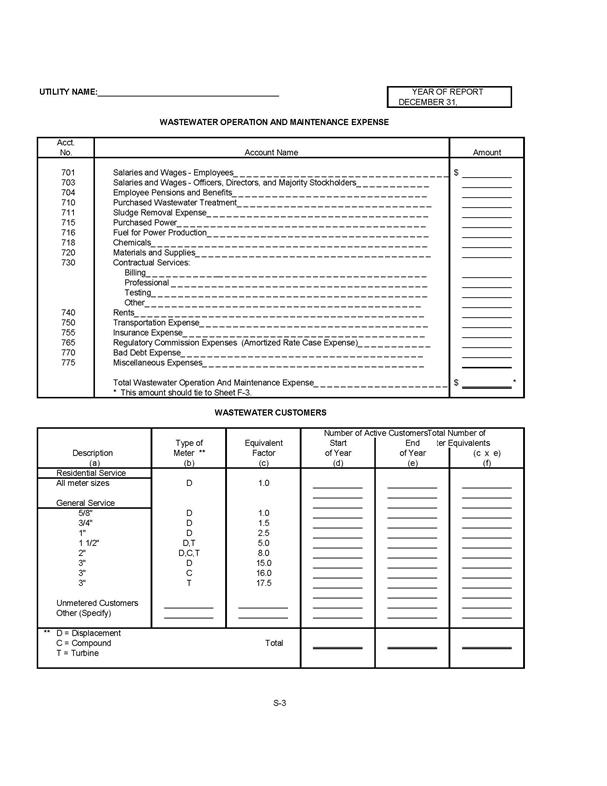

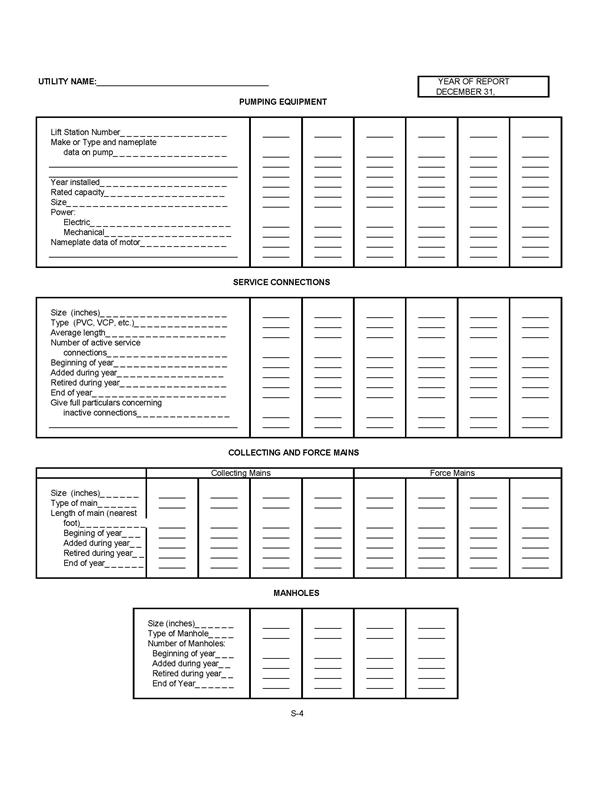

(a) Class A and B utilities must

shall file the annual report on Commission Form PSC 1032

(5/22), PSC/AFD 3-W (12/99) entitled “Class A or B Water

and/or Wastewater Utilities (Gross Revenues of $200,000 and more),”,

which is incorporated by reference into this rule and may be obtained from

[insert hyperlink].

(b) Class C utilities must shall

file the annual report on Commission Form PSC 1033 (5/22) PSC/AFD 6-W

12/99), entitled “Class C Water and/or Wastewater Utilities (Gross

Revenues of less than $200,000 each),”, which is in incorporated

by reference into this rule and may be obtained from [insert hyperlink].

(c) The foregoing forms can be obtained

from the Commission’s Division of Accounting and Finance.

(5) Certification of Annual Reports.

As part of the annual report, each utility must shall verify

certify the following in writing by the utility’s chief executive

officer and chief financial officer:

(a) Whether the utility is in

substantial compliance with the Uniform System of Accounts as prescribed by

Rule 25-30.115, F.A.C.;

(b) Whether the utility is in substantial

compliance with all applicable rules and orders of the Florida Public Service

Commission;

(c) Whether there have been any written

communications from regulatory agencies concerning noncompliance with, or

deficiencies in, financial reporting practices that could have a material

effect on the financial statements;

(d) Whether the financial statements

and related schedules fairly present the financial condition and results of

operations for the period presented and whether other information and

statements presented as to the business affairs of the respondent are true,

correct, and complete for the period which they represent.

(6) Annual Reports, Penalty for

Noncompliance. A penalty will shall be assessed against any utility that

fails to file an annual report or an extension in the following manner:

(a) Failure to file an annual report

or an extension on or before March 31;

(b) Failure to file a complete

annual report;

(c) Failure to file an original and

two copies of the annual report.

Any utility that fails to comply

with this rule shall be subject to the penalties imposed herein unless the

utility demonstrates good cause for the noncompliance. The Commission may, in

its discretion, impose penalties for noncompliance that are greater or lesser

than provided herein; such as in cases involving a flagrant disregard for the

requirements of this rule or repeated violations of this rule. No final

determination of noncompliance or assessment of penalty shall be made by the

Commission except after notice and an opportunity to be heard, as provided by

applicable law.

(d) Any utility which fails to pay a

penalty within 30 days after its assessment by the Commission shall be subject

to interest applied to the penalty up to and including the date of payment of

the penalty. Such interest shall be compounded monthly, based on the 30 day

commercial paper rate for high grade, unsecured notes sold through dealers by

major corporations in multiples of $1,000 as regularly published in the Wall

Street Journal.

(6)(7) Delinquent

Reports.

(a) Any utility that fails to file its

annual report or extension on or before March 31, or within the time specified

by any extension approved in writing by the Commission’s Division of

Accounting and Finance, will shall be subject to a penalty. The

penalty will shall be based on the number of calendar days

elapsed from March 31, or from an approved extended filing date, until the date

of filing. The date of filing will shall be included in the days

elapsed.

(b) The penalty for delinquent reports will

shall accrue based on the utility’s classification established under

subsection (4) of this rule, in the following manner for each day the

report is delinquent:

1. $25.00 per day for Class A

utilities;

2. $13.50 per day for Class B

utilities; and

3. $3.00 per day for Class C utilities.

(c) If a utility does not timely

file its annual report, in addition to the penalty determined by subsection

(6)(b) of this rule, interest on the penalty will also be assessed from the

date the annual report was due, up to and including the date the penalty is paid.

Such interest is based on the AA non-financial 30-day commercial paper rate published

by the Board of Governors of the Federal Reserve System on its website. Interest

will be compounded monthly.

(7)(8) Incomplete

Reports.

(a) The Commission’s Division of

Accounting and Finance will shall provide written notification to

a utility if its report does not contain information required by subsection (4)

of this rule. The utility must shall file the missing information

no later than 30 days after the date on the face of the notification. If the

utility fails to file the information within that period, the report will be

deemed delinquent and the utility will shall be subject to a

penalty as provided under paragraphs (6)(7)(a) and (b) of this

rule, except that the penalty will shall be based on the

number of days elapsed from the date the information is due to the date it is

actually filed. The date of filing will shall be included in the

elapsed days.

(b) A report is incomplete if any of

the schedules required by the following forms of this rule are not completed:

1. Form PSC 1032 (5/22) PSC/AFD

3-W (Rev. 12/99) for Class A and B utilities;

2. Form PSC 1033 (5/22) PSC/AFD

6-W (Rev. 12/99) for Class C utilities.

(c) An incomplete report will remain

incomplete until the missing information is filed with the Commission’s Division

of Accounting and Finance on the appropriate Commission form.

(8)(9) Incorrect Filing.

If a utility files an incorrect annual report it will shall be

considered delinquent and subject to a penalty on the same basis as a utility

that fails to timely file an annual report. The classification determining the

applicable penalty, as prescribed by paragraphs (6)(7)(a) and (b)

of this rule, will shall be determined by the latest annual

revenue figures available for the utility. The failure of a utility to receive

a report form for the correct class of utility will shall not

excuse the utility from its obligation to timely file the annual report for the

correct class of utility.

(10) Insufficient Copies. A utility

that fails to file one original and two copies of its annual report shall be

subject to a penalty of one dollar per page per missing copy. The Commission

will provide the utility with written notice that insufficient copies were

received. A penalty may be avoided if, within 20 days after the date of the

notice, the utility files the missing copies or requests that the Commission

copy its report for it and remits the appropriate fee for the copying.

(11) Other Penalties. The penalties

that may be assessed against a utility for failure to file an annual report in

compliance with the foregoing shall be separate and distinct from penalties

that may be imposed for other violations of the requirements of the Commission.

Rulemaking Authority

350.127(2), 367.121 FS. Law Implemented 367.121(1)(c), (g), (i), (k),

367.156(1), 367.161 FS. History–New 9-12-74, Amended 1-18-83, 2-25-85, 10-27-85,

Formerly 25-10.25, 25-10.025, Amended 11-10-86, 12-22-86, 3-11-91, 11-13-95,

5-1-96, 12-14-99,___________.

25-30.420

Establishment of Price Index, Adjustment of Rates; Requirement of Bond; Filings

After Adjustment; Notice to Customers.

(1) On or before March 31 of each year,

the Commission will shall establish a price increase or decrease

index as required by Section 367.081(4)(a), F.S. The Commission’s Division

of Accounting and Finance Office of Commission Clerk will shall email mail

each regulated water and wastewater utility a copy of the proposed agency

action order establishing the index for the year and a copy of Form PSC 1022 (5/22

9/18), entitled “Price Index Application,” which is incorporated into

this rule by reference and may be obtained from [hyperlink] http://www.flrules.org/Gateway/reference.asp?No=Ref-11101

and the Commission’s Division of Accounting and Finance. Utilities may request

a hard copy of the index application from the Commission’s Division of

Accounting and Finance. Applications

for the newly established price index will be accepted from April 1 of the year

the index is established through March 31 of the following year.

(a) The index will shall be

applied to all operation and maintenance expenses, except for amortization of

rate case expense, costs subject to pass-through adjustments pursuant to

Section 367.081(4)(b), F.S., and adjustments or disallowances made in a

utility’s most recent rate proceeding.

(b) In establishing the price index,

the Commission will consider cost statistics compiled by government agencies or

bodies, cost data supplied by utility companies or other interested parties,

and applicable wage and price guidelines.

(2) Any utility seeking to increase or

decrease its rates based upon the application of the index established pursuant

to subsection (1) and as authorized by Section 367.081(4)(a), F.S., must

shall file a notice of intention and the materials listed in paragraphs

(a) through (i) below with the Commission’s Division of Accounting and Finance

either by mail at 2540 Shumard Oak Boulevard, Tallahassee, Florida 32399 or by

email at Applications@psc.state.fl.us at least 60 days prior to the effective

date of the increase or decrease. Form PSC 1022 (5/22 9/18) is an

example application that may be completed by the applicant to comply with this

subsection. The adjustment in rates will shall take effect on the

date specified in the notice of intention unless the Commission finds that the

notice of intention or accompanying materials do not comply with Section

367.081(4), F.S. or this rule. The notice must shall be

accompanied by:

(a) Revised tariff sheets;

(b) A computation schedule showing the

increase or decrease in annual revenue that will result when the index is

applied;

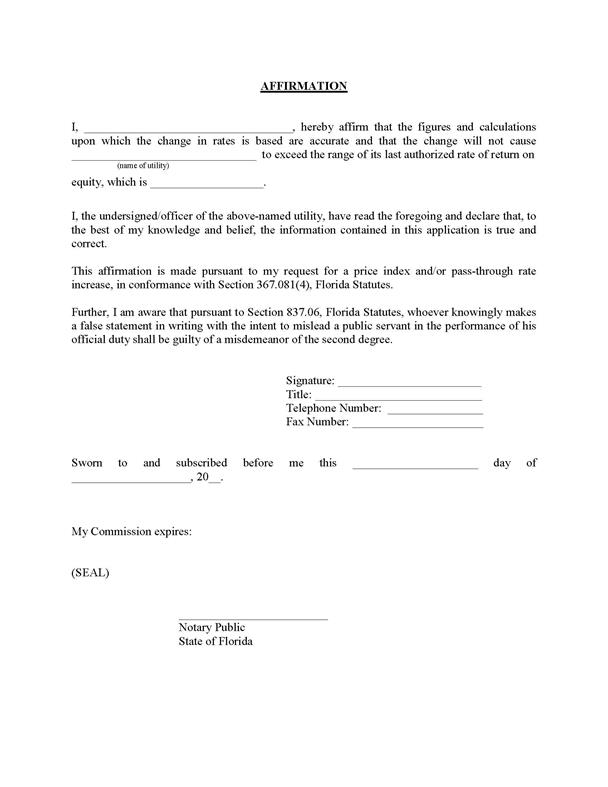

(c) The affirmation required by Section

367.081(4)(c), F.S.;

(d) A copy of the notice to customers

required by subsection (6);

(e) The rate of return on equity that

the utility is affirming it will not exceed pursuant to Section 367.081(4)(c),

F.S.;

(f) An annualized revenue figure for

the test year used in the index calculation reflecting the rate change, along

with an explanation of the calculation, if there has been any change in the

utility’s rates during or subsequent to the test year;

(g) The utility’s Department of

Environmental Protection Public Water System identification number and

Wastewater Treatment Plant Operating Permit number;

(h) A statement that the utility does

not have any active written complaints, corrective orders, consent orders, or

outstanding citations with the Department of Environmental Protection or the

County Health Department(s) or that the utility does have active written

complaints, corrective orders, consent orders, or outstanding citations with

the Department of Environmental Protection or the County Health Department(s);

(i) A copy of any active written

complaints, corrective orders, consent orders, or outstanding citations with

the Department of Environmental Protection or the County Health Department(s).

(3) If the Commission, upon its own

motion, implements an increase or decrease in the rates of a utility based upon

the application of the index established pursuant to subsection (1) and as

authorized by Section 367.081(4)(a), F.S., the Commission will require a

utility to file the information required in subsection (2).

(4) Upon a finding of good cause, the

Commission will shall require that a rate increase pursuant to

Section 367.081(4)(a), F.S., be implemented under a bond or corporate

undertaking in the same manner as interim rates. For purposes of this

subsection, “good cause” will shall include:

(a) Inadequate service by the utility;

(b) Inadequate record-keeping by the

utility such that the Commission is unable to determine whether the utility is

entitled to implement the rate increase or decrease under this rule.

(5) Prior to the time a customer begins

consumption at the rates established by application of the index, the utility

shall notify each customer of the increase or decrease authorized and explain

the reasons therefore.

(6) A No utility is

prohibited shall from filing file a notice of

intention pursuant to this rule unless the utility has filed with the

Commission an annual report as required by subsection 25-30.110(3), F.A.C., for

the test year specified in the order establishing the index for the year.

(7) A No utility is

prohibited shall from implementing a rate increase pursuant

to this rule within one year of the official date that it filed a rate

proceeding, unless the rate proceeding has been completed or terminated.

Rulemaking Authority

350.127(2), 367.081(4)(a), 367.121(1)(c), (f) FS. Law Implemented 367.081(4),

367.121(1)(c), (g) FS. History–New 4-5-81, Amended 9-16-82, Formerly 25-10.185,

Amended 11-10-86, 6-5-91, 4-18-99, 12-11-03, 9-3-19,_______________.