Discussion

of Issues

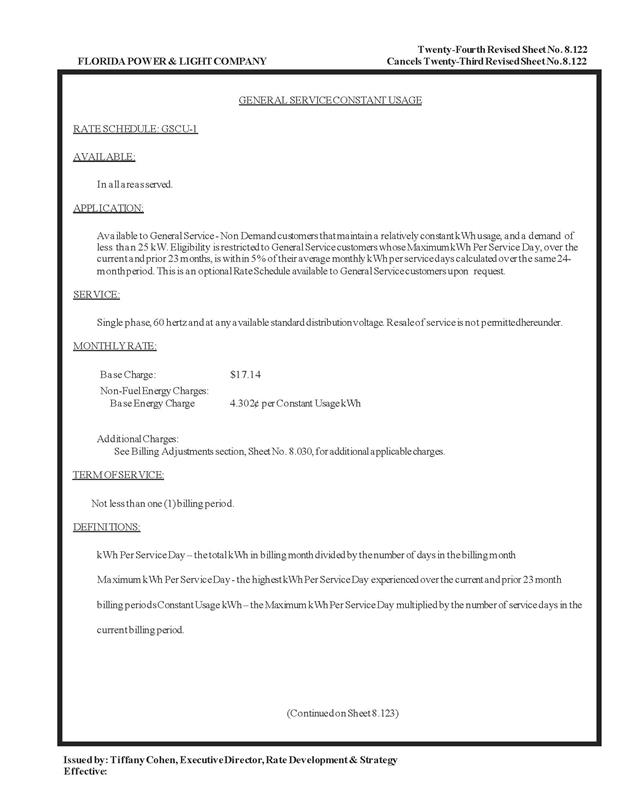

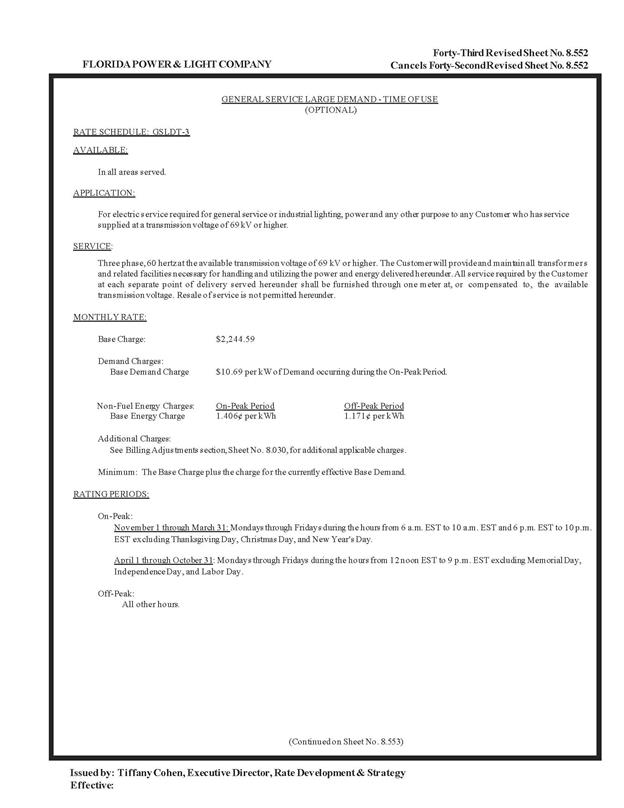

Issue 1:

Should the Commission approve FPLís calculation of

the tax savings associated with the IRA for 2022?

Recommendation:

Yes. The Commission should approve FPLís

calculations for the net tax savings of $35,747,856 for 2022 resulting from the

Companyís election to use PTCs instead of ITCs as allowed by the IRA. (D. Buys,

Mouring)

Staff Analysis:

Effective January 1, 2022, the IRA expanded federal

income tax benefits for renewable energy by allowing owners of solar projects

which begin construction before 2025 the option to elect to receive Production

Tax Credits (PTCs) instead of Investment Tax Credits (ITCs). FPL has elected to

use PTCs instead of ITCs because it provides a greater tax benefit and customer

savings. The application of PTCs to FPLís six rate base solar facilities

results in a tax savings of $31,195,561. In comparison, the amortization of

ITCs is $1,773,277 per year. The ITC amortization, and a $7,548,582 adjustment

to account for the impact to the capital structure due to a net decrease of

unamortized ITCs and increase in accumulated deferred income taxes (ADITs), is netted

against the PTC balance. In addition, state income tax expense and other

non-jurisdictional adjustments increased by $1,223,010 due to the removal of

the ITCs and is also offset against PTC tax savings. In total, the net change

in FPLís jurisdictional adjusted base revenue requirement is a reduction of $35,747,856.[2] Staff

reviewed FPLís calculations in the amended petition filed on November 14, 2022,

in the instant docket, and believes they are reasonable and appropriate. FPLís

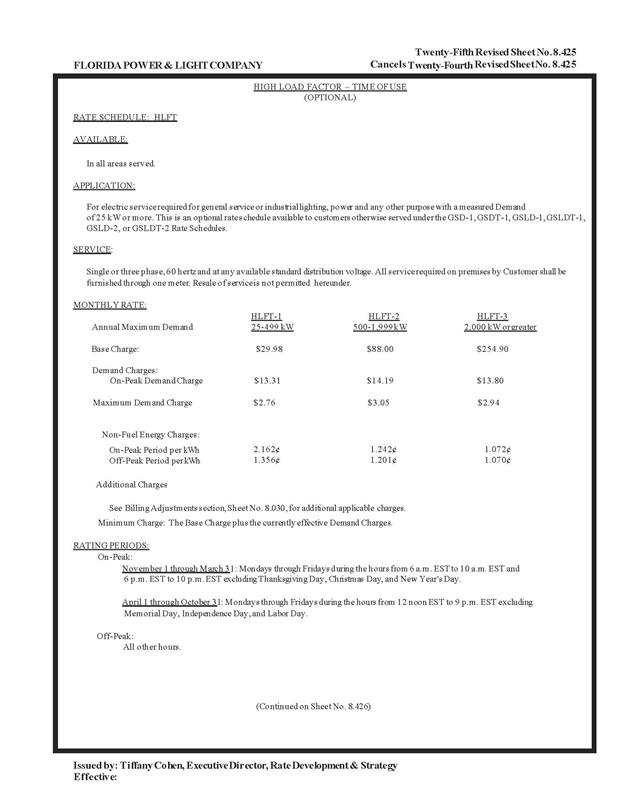

calculations are summarized in Table 1-1. Based on the aforementioned, staff

recommends the Commission approve FPLís calculations of net tax savings of $35,747,856

for 2022 resulting from the Companyís election to use PTCs instead of ITCs as

allowed by the IRA.

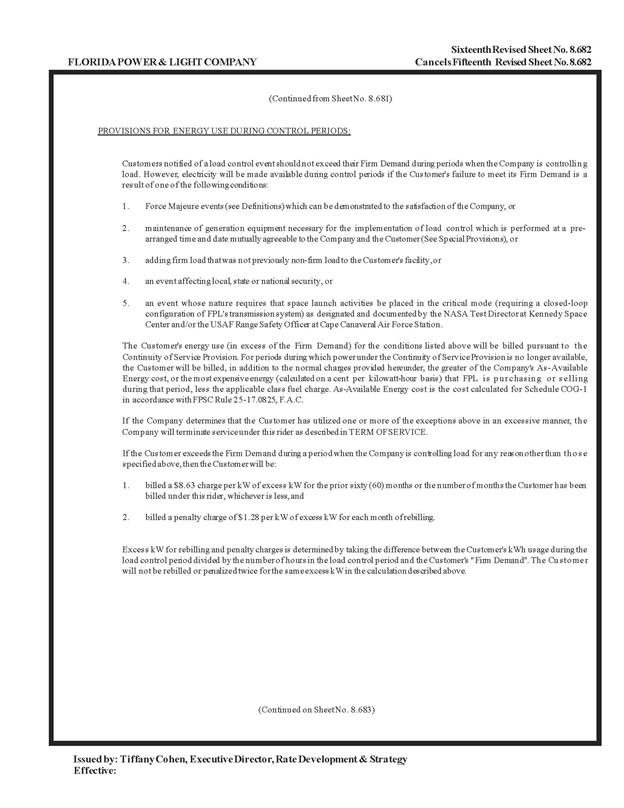

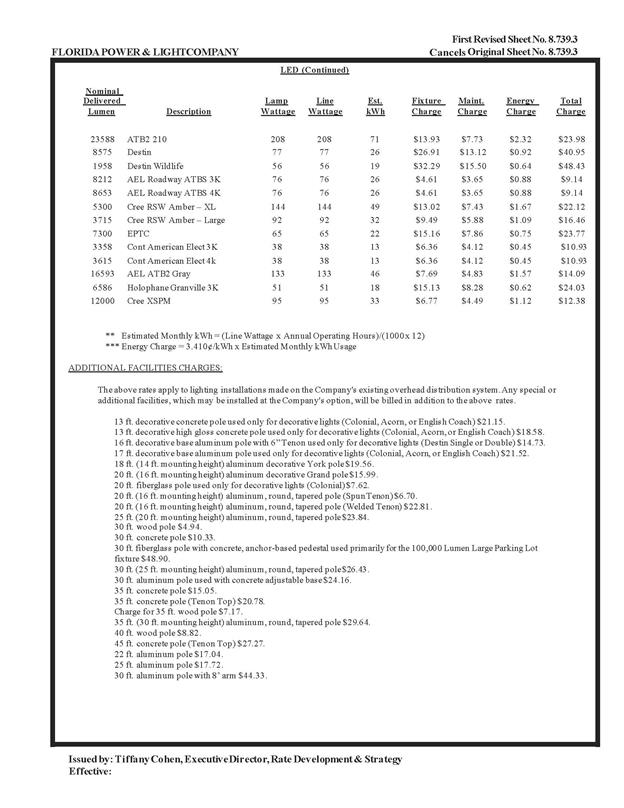

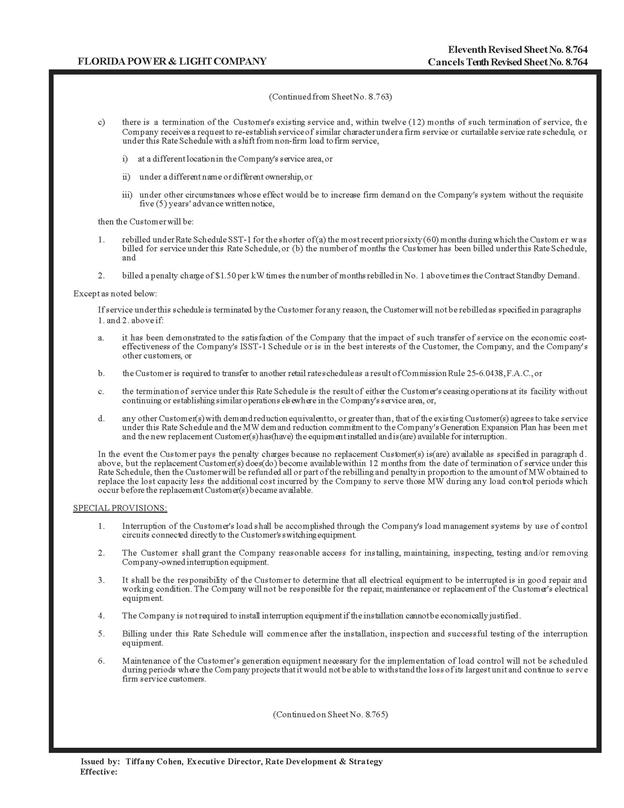

|

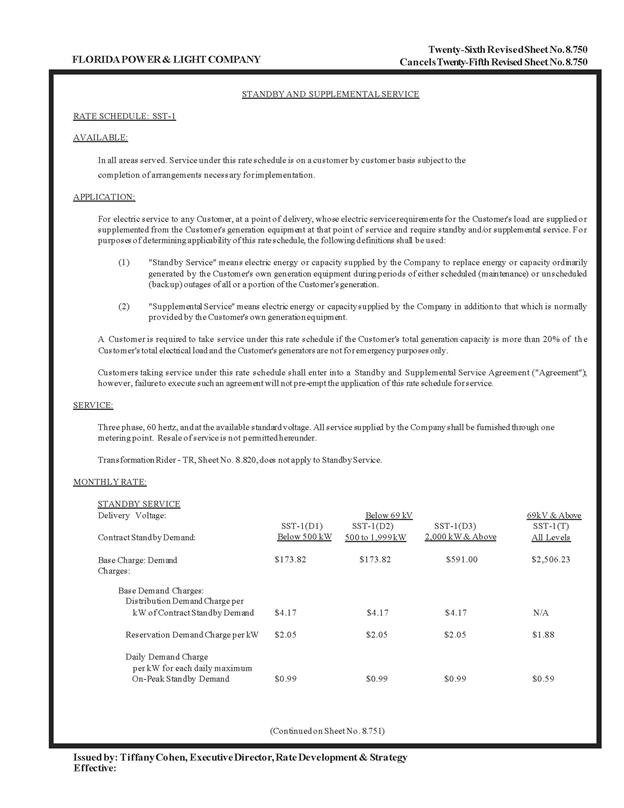

Table 1-1

|

|

Calculation

of PTC impact on 2022 Revenue Requirement

|

|

Production Tax Credits

|

$31,195,561

|

|

ITC Amortization Removal

|

(1,773,277)

|

|

State Income Tax Expense and Other Non-Jurisdictional

Adjustments

|

(1,223,010)

|

|

ITC Capital Structure Impact

|

7,548,582

|

|

Net Reduction in 2022 Revenue Requirement

|

$35,747,856

|

Source: DN 11040-2022.

Issue 2:

Should the Commission approve FPLís request to flow

back to customers the full 2022 tax reform impact through a one-time reduction

to its Capacity Cost Recovery Clause (CCR) factors in January 2023?

Recommendation:

Yes. Staff recommends the Commission approve a

refund of $35,747,856 in January 2023 through a one-time reduction to FPLís CCR

factors. (Cordell)

Staff Analysis:

As discussed in Issue 1, FPLís application of PTCs

has reduced its 2022 jurisdictional adjusted revenue requirement by $35,747,856.

Paragraph 13(a) of the 2021 Settlement states: ď[a]ny effects of tax reform on

the retail revenue requirements (but no earlier than January 1, 2022) through

the date of the base rate adjustment shall be flowed back to, or collected

from, customers through the [CCR] Clause on the same basis as used in any base

rate adjustment.Ē[3]

The impact of this refund on the capacity cost portion of

a 1,000 kilowatt-hour (kWh) residential bill for January 2023 will be a credit

of $1.97 on the 1,000 kWh residential bill. The Company believes applying the

entire 2022 refund to a single month, with a commensurate one-month rate impact,

will provide a more noticeable reduction to customersí bills than spreading the

refund over a full twelve-month period. After January, or from February through

December 2023, the proposed residential capacity charge will be $2.12 per 1,000

kWh.

Staff has reviewed the Companyís calculation of the net tax savings from the

effective date of the IRA, through the base rate adjustment, and† recommends the Commission approve a refund of

$35,747,856 in January 2023 through a one-time reduction to FPLís CCR factors.

Issue 3:

Should the Commission approve FPLís calculation of

the projected tax savings associated with the IRA for 2023?

Recommendation:

Yes. The Commission should approve FPLís calculations

of net tax savings of $69,743,460 for 2023 resulting from the Companyís

election to use PTCs instead of ITCs as allowed by the IRA. (D. Buys, Mouring)

Staff Analysis:

As discussed in Issue 1, FPL has selected the option

to receive PTCs instead of ITCs as allowed by the IRA. The application of PTCs

to FPLís ten solar facilities results in a tax savings of $82,432,142, which is

offset by a reduction to the ITC amortization balance of $12,688,682, for a net

tax savings of $69,743,460. The incremental change in 2023 jurisdictional

adjusted base revenue requirement is a reduction of $33,995,604, in addition to

the 2022 net tax savings of $35,747,856, for a total reduction in base revenue

requirement of $69,743,460.[5] FPL will

not finalize its 2023 Forecast Earnings Surveillance Report until early 2023,

and consequently, did not take into account the impacts to the capital

structure which would likely decrease the 2023 tax savings. FPL did not include

the 2023 state income tax impact which may also slightly decrease the tax

savings similar to its effect on the 2022 calculation. The effects of the IRA

on the Companyís capital structure and overall weighted average cost of capital

should be taken into account. Staff recommends that FPL be required to file

updated information within 90 days of when the 2023 Forecast Earning

Surveillance Report is filed with the Commission. Any necessary adjustments

should be addressed in a future proceeding. The projected change in FPLís base

revenue requirements is comprised of a $82.4 million reduction due to lower

operating income tax expense resulting from the inclusion of PTCs associated

with the Companyís base rate solar plants, offset by a $12.7 million increase

due to the removal of ITC amortization associated with the 2022 and 2023 solar

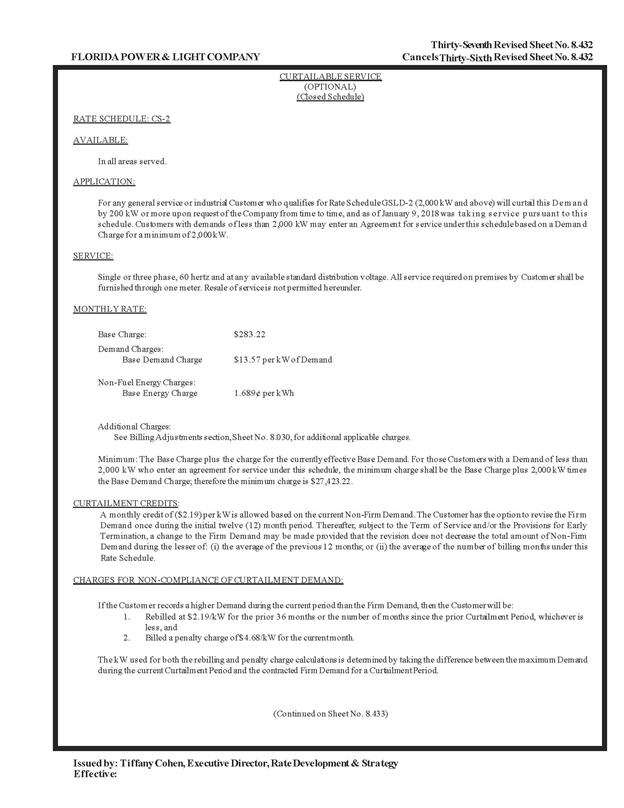

plants. FPLís calculations are summarized in Table 3-1. Staff reviewed FPLís

calculations in the amended petition filed on November 14, 2022, in the instant

docket, and believe they are reasonable and appropriate. Based on the aforementioned,

staff recommends the Commission approve FPLís calculations of net tax savings

of $69,743,460 for 2023 resulting from the Companyís election to use PTCs

instead of ITCs as allowed by the IRA.

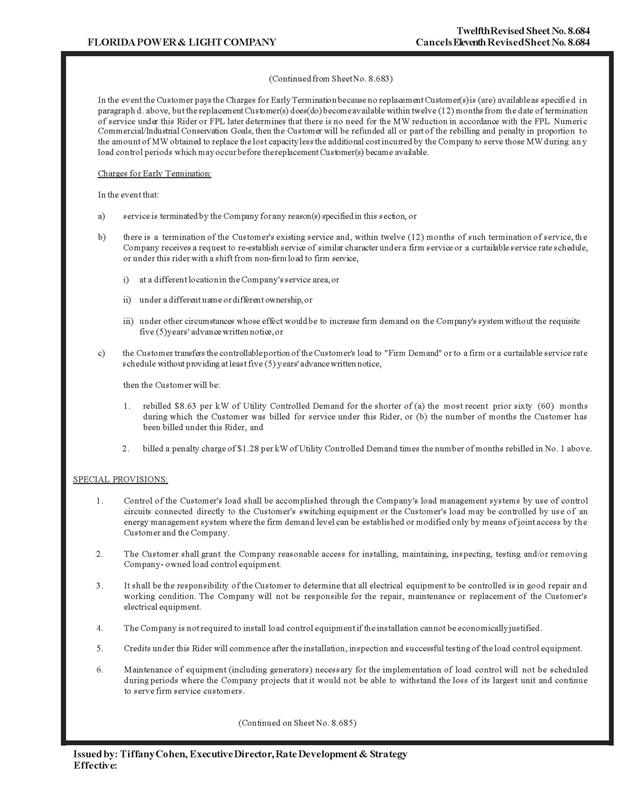

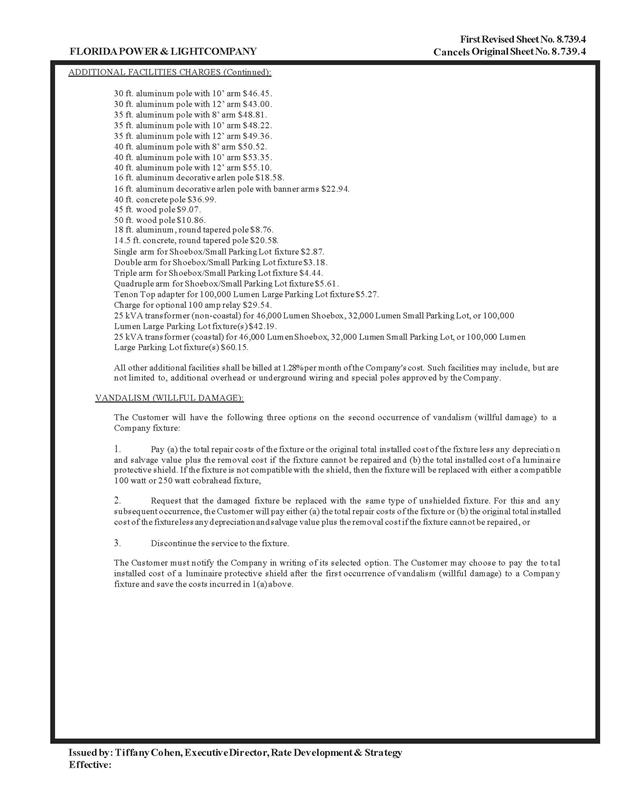

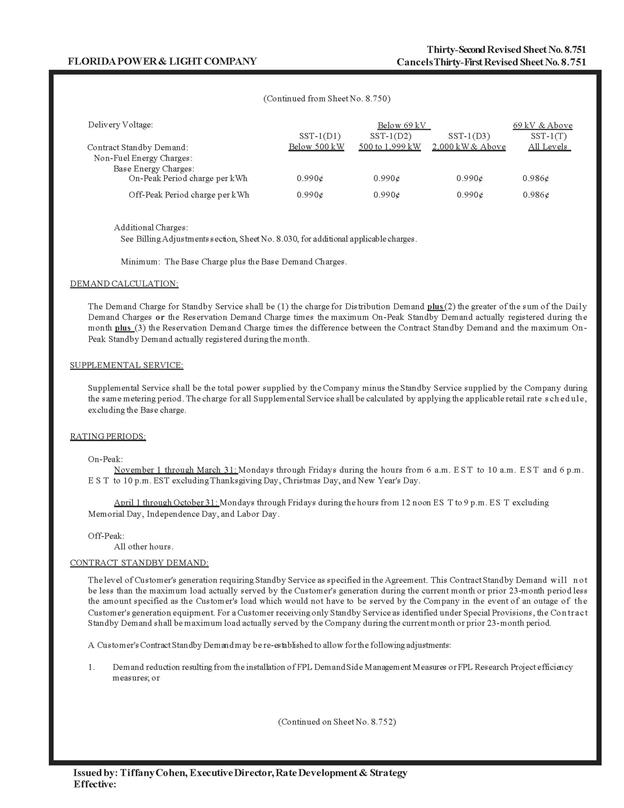

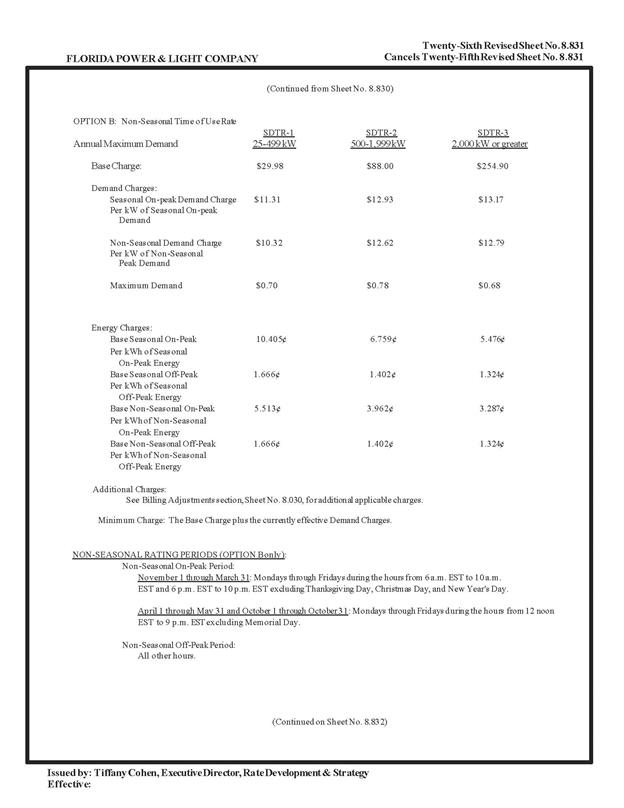

|

Table

3-1

|

|

Calculation

of PTC impact on 2023 Revenue Requirement

|

|

Production Tax

Credits

|

$82,432,142

|

|

ITC Amortization

Removal

|

(12,688,682)

|

|

Net Reduction in 2023

Revenue Requirement

|

69,743,460

|

|

Decrease in 2022

Revenue Requirement

|

(35,747,856)

|

|

Incremental Reduction

in 2023 Revenue Requirement

|

$33,995,604

|

Source: DN 11040-2022.

Issue 4:

Should the Commission approve FPLís request to flow

back to customers the projected 2023 tax savings through a reduction to base

rates beginning January 1, 2023?

Recommendation:

Yes. The Commission should approve FPLís request to

flow back to customers the projected net $69,743,460 tax savings through a

reduction to base rates beginning January 1, 2023.† (D. Buys, Mouring)

Staff Analysis:

As discussed in Issue 3, the Companyís election to

utilize PTCs instead of ITCs under the IRA has resulted in a projected net tax

savings of approximately $69.7 million. Under the provisions of Paragraph 13 of

the 2021 Settlement, the Company is required to quantify the impacts of federal

or state tax reform on its jurisdictional base revenue requirement as projected

in its Forecast Earnings Surveillance Report and adjust its jurisdictional base

revenue requirement through a uniform percentage decrease or increase to

customer, demand, and energy base rates for all retail customer classes. Staff

has reviewed the Companyís revised calculation of the projected net tax savings

associated with the IRA and the proposed method to flow back those tax savings

to customers and recommends that the proposed permanent reduction in

jurisdictional base rates is consistent with the terms of the 2021 Settlement

and should be approved.

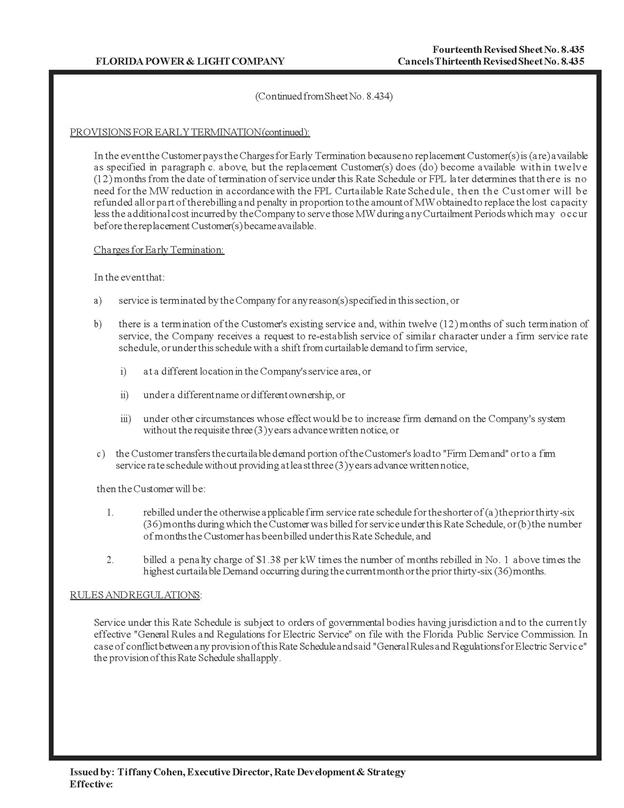

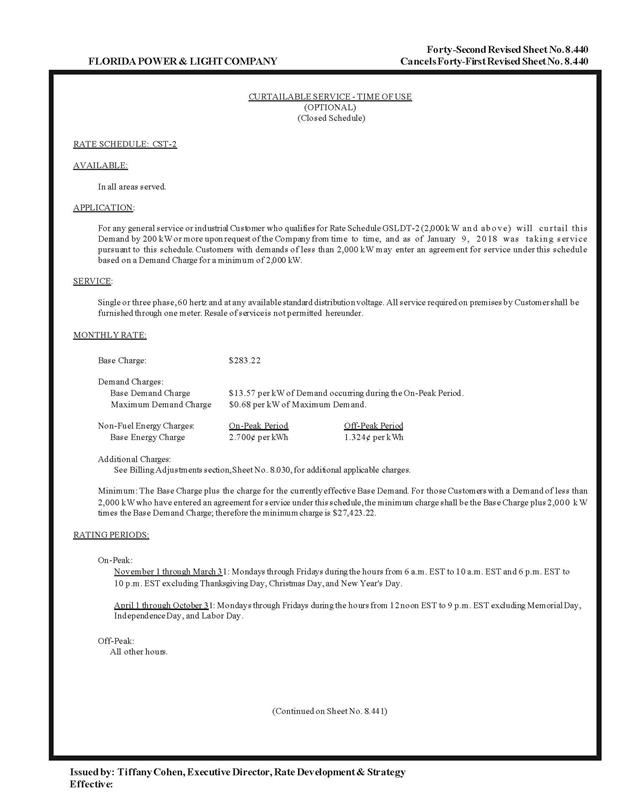

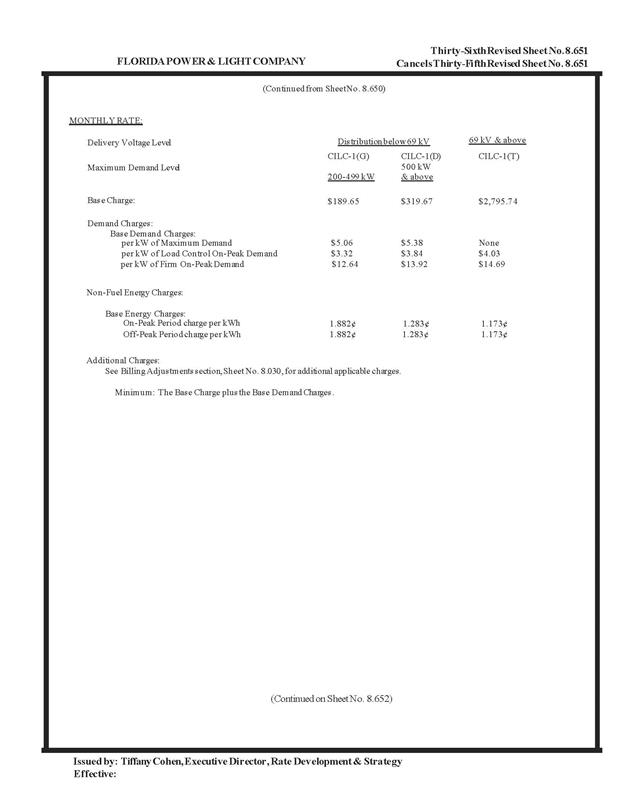

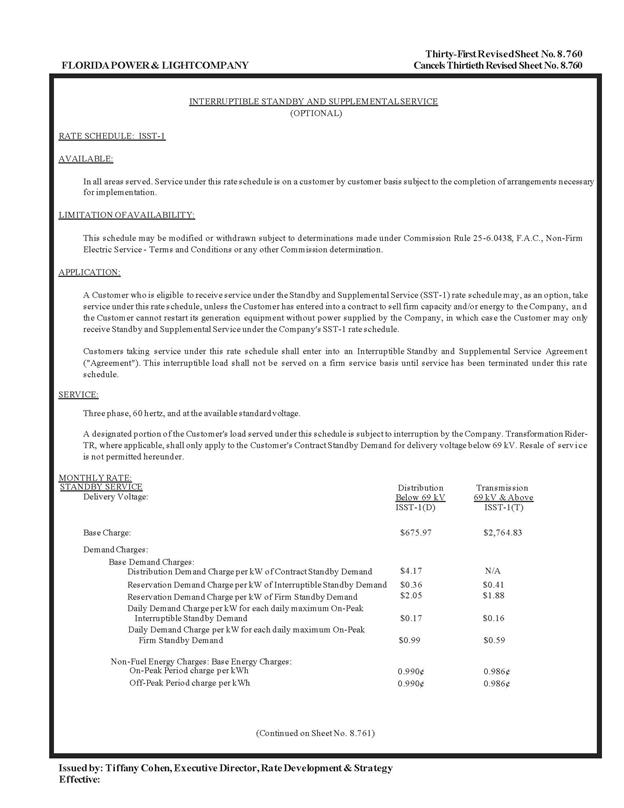

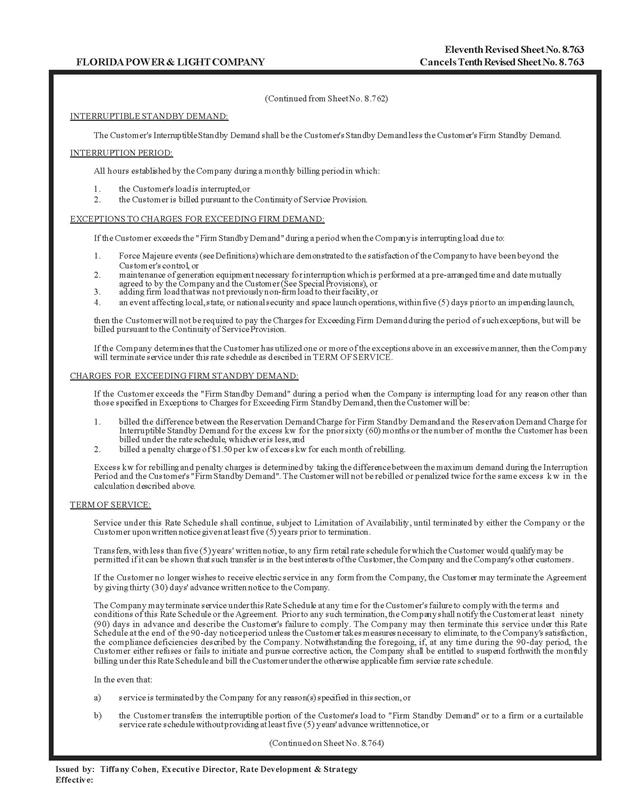

Issue 5:

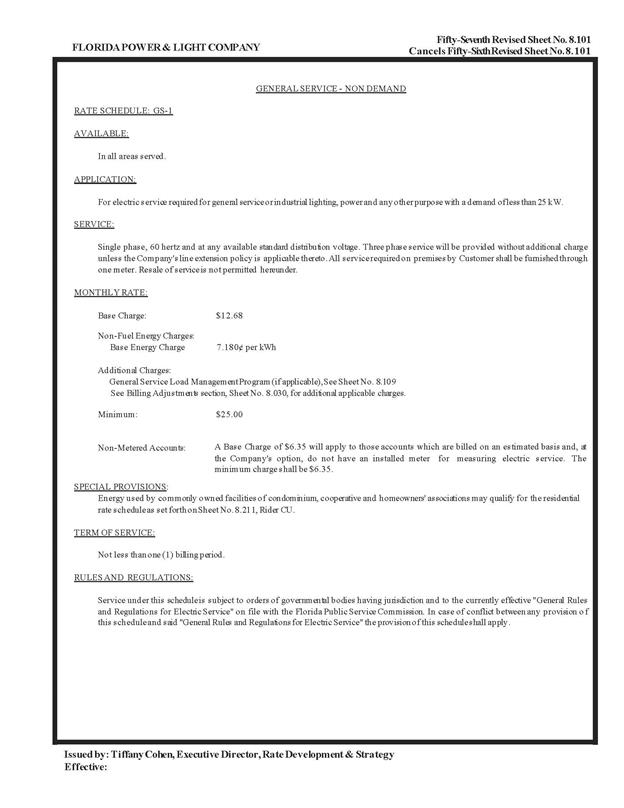

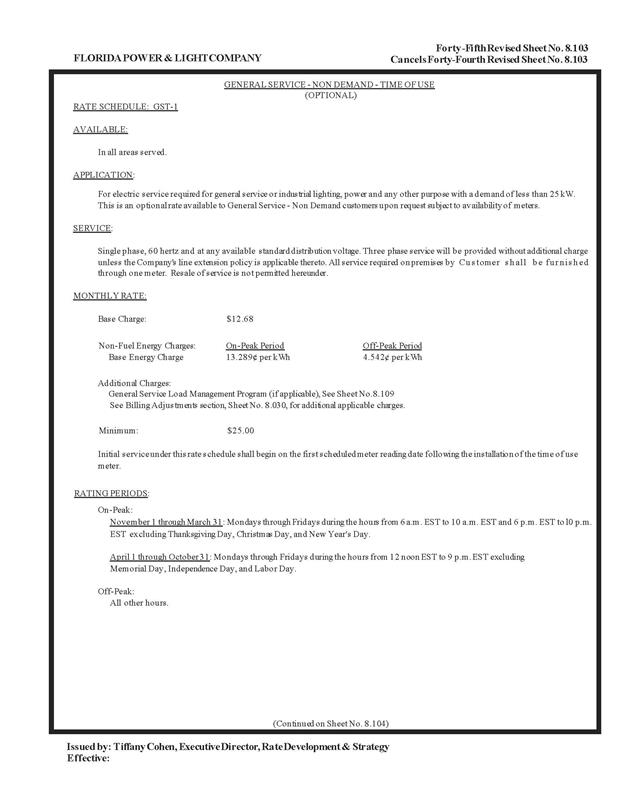

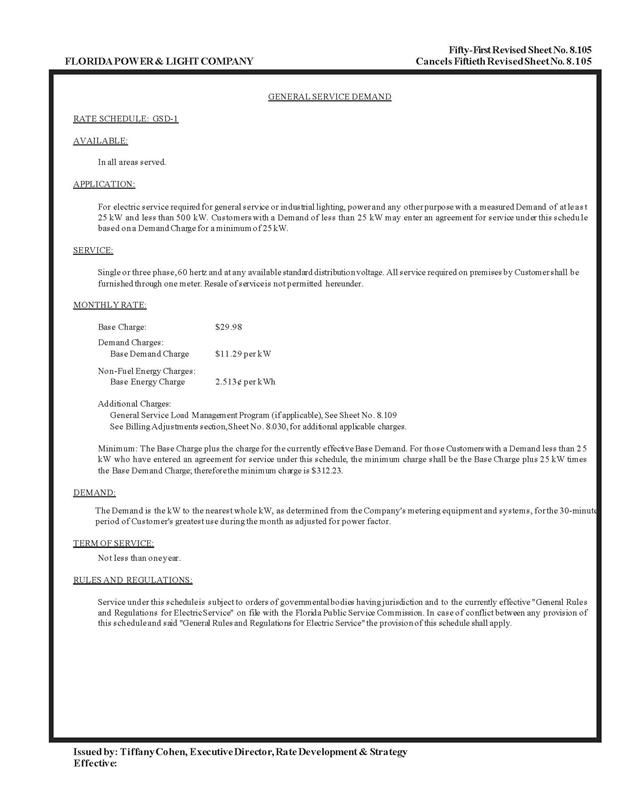

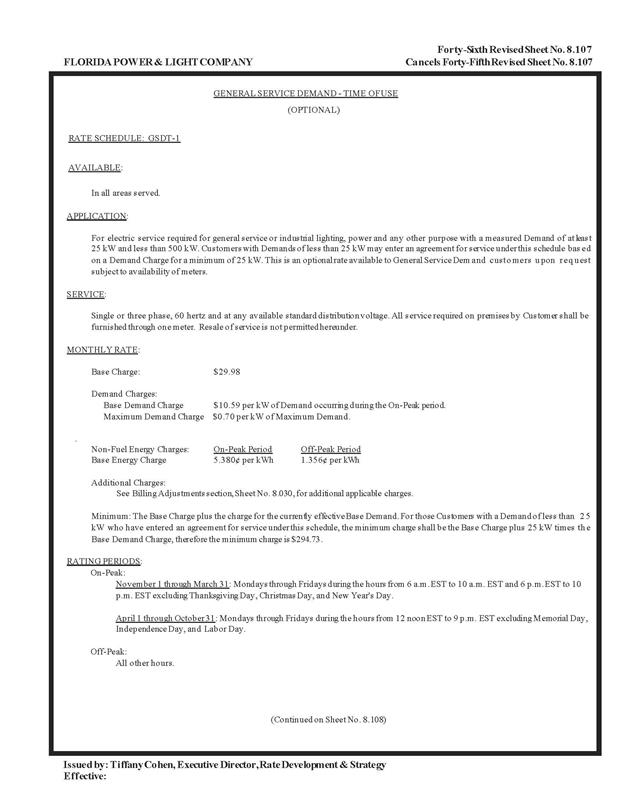

Should the Commission approve FPLís revised tariffs

to implement the IRA base revenue decrease effective January 2023?

Recommendation:

Yes. The Commission should approve FPLís revised

tariffs to implement the IRA base revenue decrease effective January 2023. The

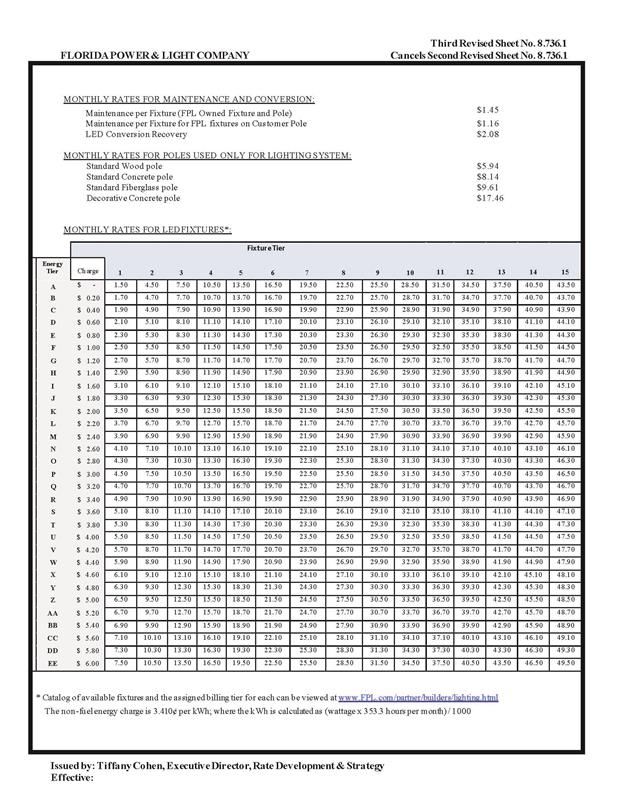

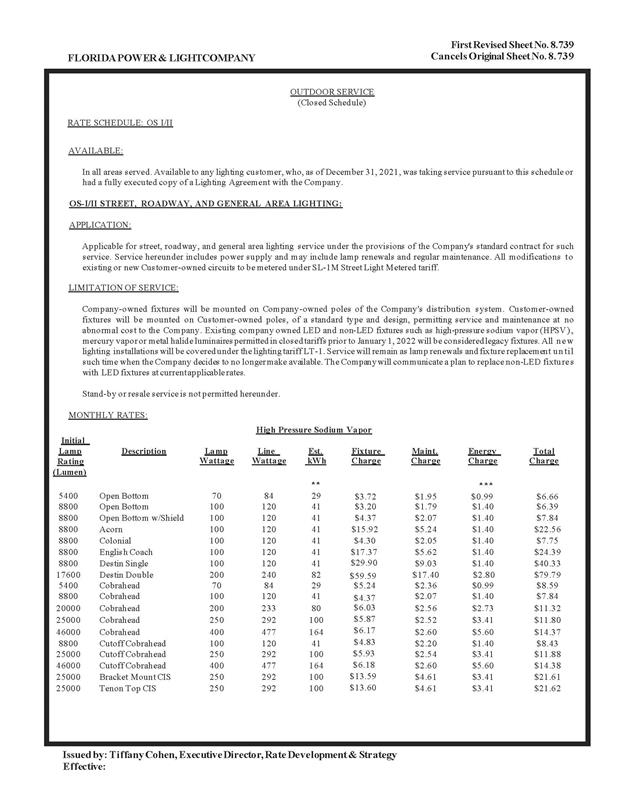

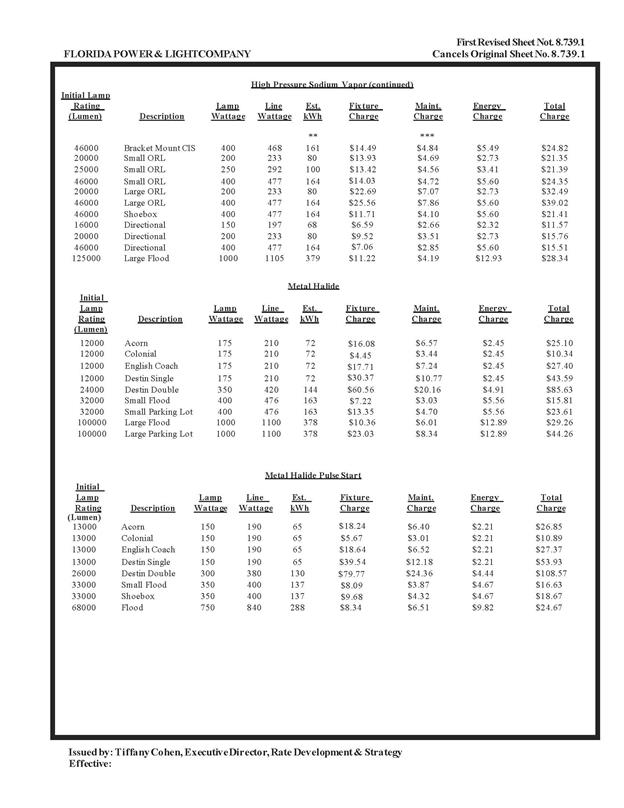

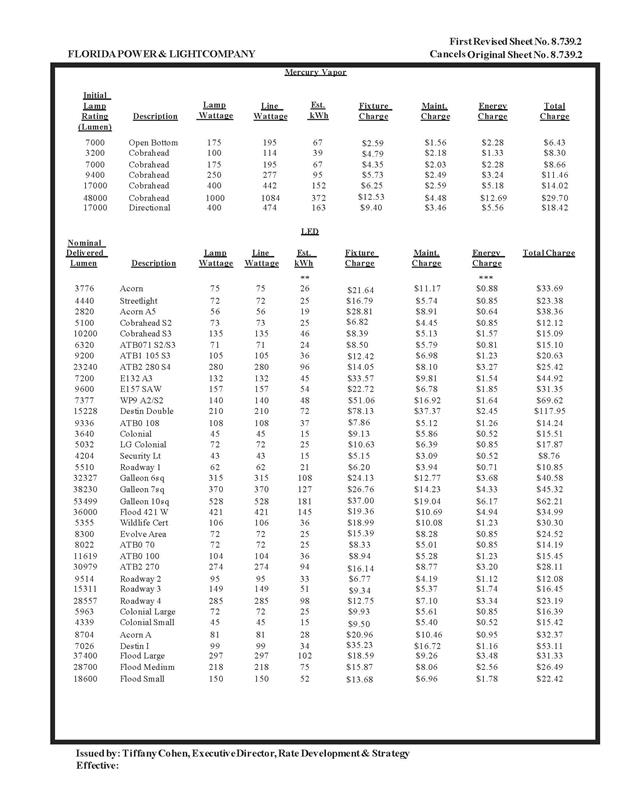

revised tariffs are shown in Attachment A to the recommendation. (Draper)

Staff Analysis:

FPLís petition includes the proposed tariff sheets

(Exhibit B-4 to the amended petition) and the calculation of the IRA adjustment

factor of (0.775) percent (Exhibit B-3, Part 2 †at page 1 of 48, of the amended petition).† The IRA adjustment factor was calculated by

dividing the $69.7 million reduction to the 2023 base revenue requirement by

the 2023 projected retail base revenue from sales of electricity ($8,999.9

million). The IRA adjustment factor was applied to the base rates for all rate

classes (Exhibit B-3, Part 2 pages 3-48 to the amended petition).

In Order No. PSC-2021-0446-S-EI, the Commission approved

an increase of $560 million in FPLís base rates effective January 2023. This

Commission-approved increase is also reflected in the revised tariffs, as both

the previously approved $560 million base rate increase and the proposed IRA

base revenue decrease are effective January 2023.

A residential customer who uses 1,000 kWh per month

currently pays $75.82 on the base rate portion of their monthly bill. Without

the IRA adjustment, the base rate portion on the 1,000 kWh residential bill

would be $80.73 effective January 2023. As a result of the IRA adjustment, the

base rate portion of the 1,000 kWh residential bill will be $80.11 effective

January 2023, an increase of $4.29 from the current $75.82.†

Staff has reviewed FPLís tariff sheets and supporting

documentation. The calculations are accurate.†

The Commission should approve FPLís revised tariffs to implement the IRA

base revenue decrease effective January 2023. The revised tariffs are shown in

Attachment A to the recommendation.

Issue 6:

Should this docket be closed?

Recommendation:

Yes. At the conclusion of the protest period, if no

protest is filed this docket should be closed upon the issuance of a

consummating order. If a protest is filed within 21 days of the issuance of the

order, the tariffs should remain in effect, subject to adjustment, pending the

resolution of the protest. (Brownless)

Staff Analysis:

At the conclusion of the protest period, if no

protest is filed this docket should be closed upon the issuance of a

consummating order. If a protest is filed within 21 days of the issuance of the

order, the tariffs should remain in effect, subject to adjustment, pending the

resolution of the protest.